Market Overview:

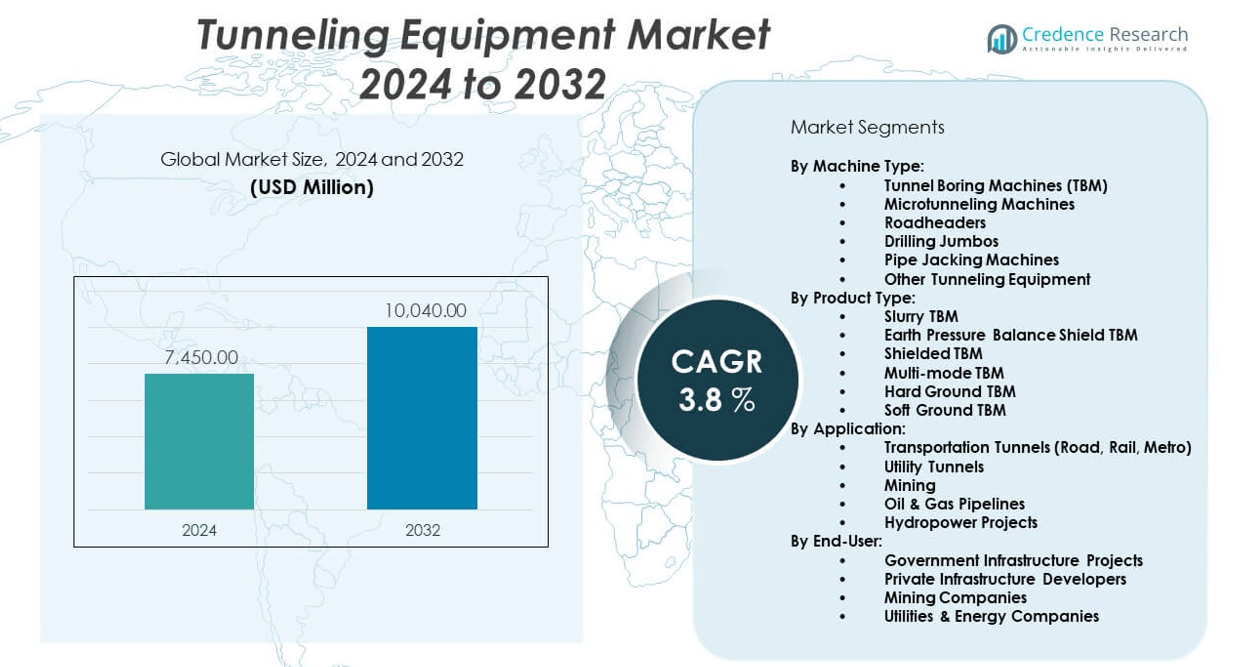

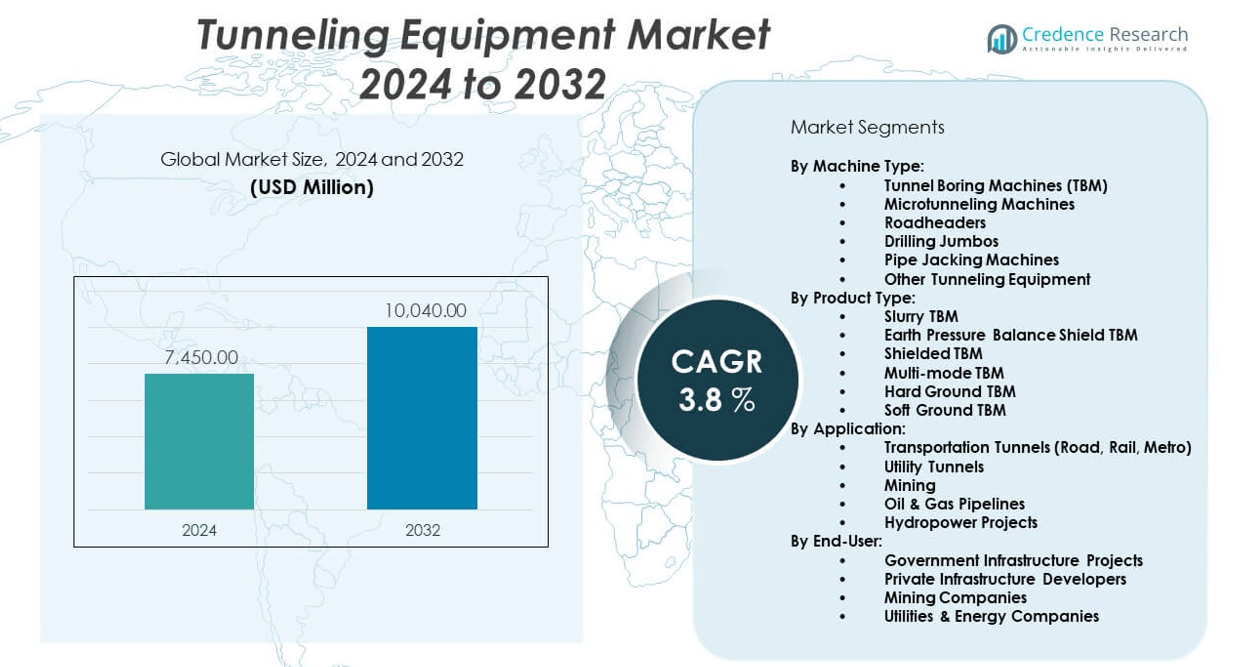

The Tunneling equipment market is projected to grow from USD 7,450 million in 2024 to an estimated USD 10,040 million by 2032, with a compound annual growth rate (CAGR) of 3.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tunneling Equipment Market Size 2024 |

USD 7,450 million |

| Tunneling Equipment Market, CAGR |

3.8% |

| Tunneling Equipment Market Size 2032 |

USD 10,040 million |

The market is expanding due to the rising demand for underground infrastructure development across urban transportation, utilities, and mining sectors. Governments and private players invest heavily in metro rail expansions, water management tunnels, and cross-border transport routes. Technological advancements in tunnel boring machines (TBMs) improve efficiency and safety, accelerating adoption. Environmental concerns and space limitations in cities further drive the shift toward subsurface construction. Increasing automation and digitization in excavation processes also contribute to the market’s steady growth.

Asia-Pacific dominates the tunneling equipment market due to rapid urbanization, large-scale metro rail and hydropower projects, and government infrastructure investments, particularly in China and India. Europe follows, driven by cross-border rail and utility tunnels in countries like Germany and the UK. North America remains a stable market with consistent investments in urban transit. Emerging markets in Latin America and the Middle East are witnessing growth due to rising infrastructure demand, supported by economic diversification and population expansion.

Market Insights:

- The tunneling equipment market was valued at USD 7,450 million in 2024 and is projected to reach USD 10,040 million by 2032, growing at a CAGR of 8%.

- Strong demand for underground transportation infrastructure, such as metro and rail tunnels, continues to drive market expansion globally.

- Mechanized tunneling methods are preferred for their efficiency, safety, and ability to handle complex geological conditions.

- High capital investment and maintenance costs pose challenges for small and mid-sized contractors, limiting equipment accessibility.

- Asia-Pacific leads the market due to large-scale infrastructure projects in China, India, and Southeast Asia.

- Europe and North America show steady demand, backed by aging infrastructure upgrades and urban redevelopment projects.

- The market faces slowdowns in regions with regulatory delays, limited funding, or complex environmental approvals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Global Investment in Underground Infrastructure Projects Across Urban and Transportation Sectors:

Urban expansion and transportation congestion have pushed governments to invest in large-scale underground infrastructure. Projects such as metro railways, subways, utility tunnels, and road tunnels require robust and specialized tunneling equipment. Governments in Asia-Pacific and Europe prioritize underground development to optimize land usage. The tunneling equipment market gains momentum from public-private partnerships and urban redevelopment schemes. It supports rapid tunneling in high-density zones where surface disruption must remain minimal. Tunnel boring machines (TBMs), roadheaders, and microtunneling units find high demand in these scenarios. Equipment providers benefit from long project cycles that ensure consistent procurement. It continues to gain attention due to its role in enabling complex below-ground engineering feats.

- For instance, Herrenknecht AG supplied a 15.01 meter diameter TBM—the largest ever used—for the Shanghai Yangtze River Tunnel project, which achieved a peak advance rate of 22 meters per day, demonstrating high-performance tunneling under urban constraints with minimal surface disturbance.

Increasing Preference for Mechanized Tunneling to Enhance Safety and Project Timelines:

Project owners prefer mechanized tunneling due to its ability to improve operational safety and reduce worker exposure to hazardous conditions. Manual excavation methods face limitations in consistency and speed, especially in rocky or unstable terrains. Tunneling equipment such as earth pressure balance TBMs and slurry TBMs provide better control in variable geologies. These machines reduce delays by handling ground pressure changes and water ingress efficiently. The tunneling equipment market responds to this shift with advanced automation features. It supports faster project completion and fewer occupational hazards. Construction firms invest in high-efficiency machines to meet aggressive timelines. Automated steering and monitoring systems further boost equipment appeal in risk-prone zones.

- For instance, The Robbins Company’s Earth Pressure Balance TBM used in Mumbai Metro Line 3 operated at up to 105 millimeters per minute and completed a 12.2 km drive with less than 1% deviation from planned alignment, directly improving worker safety by minimizing manual tunnel face interventions.

Rising Demand for Utility Infrastructure Tunnels to Meet Urban Service Needs:

The surge in demand for underground utility corridors supports market growth. Cities require reliable networks for sewage, water, electricity, and telecommunications without disrupting surface operations. Microtunneling and pipe jacking technologies enable precise underground installations. The tunneling equipment market aligns with this trend by offering compact and remotely operated units. It ensures less surface excavation, faster execution, and lower urban disruption. These advantages appeal to contractors working in congested urban zones. Demand for trenchless methods grows across Europe, North America, and fast-urbanizing Asian cities. Government sustainability goals also promote utility tunnel development over open-cut trenching.

Infrastructure Modernization in Emerging Markets Drives Equipment Procurement:

Emerging economies invest in long-term infrastructure development to stimulate economic growth and improve logistics. Countries such as India, Brazil, and Indonesia fund metro, road, and irrigation tunnel projects to support industrial activity. The tunneling equipment market expands with increased capital allocation in construction sectors. It sees higher adoption due to local governments’ push to complete infrastructure backlogs. Domestic and international contractors compete for large-scale underground projects, driving up machinery demand. Financing support from multilateral development banks further accelerates project execution. It benefits from bulk procurement schemes and government leasing models. Equipment suppliers scale operations to meet rising demand in these regions.

Market Trends:

Integration of Smart Technologies and IoT Sensors for Real-Time Equipment Monitoring:

Manufacturers integrate smart technologies to improve equipment efficiency and reduce downtime. IoT sensors embedded in tunneling machines collect real-time data on cutter head torque, temperature, and vibrations. These inputs allow predictive maintenance and avoid unplanned stoppages. The tunneling equipment market incorporates digital interfaces for remote diagnostics. It improves decision-making during operations in high-risk environments. Data analytics help optimize machine performance based on ground conditions. Construction firms use these insights to lower repair costs and extend machine life. Automation-enabled controls improve precision and operator safety. The market moves toward smarter machines with minimal manual intervention.

- For instance, Sandvik AB’s AutoMine® system enables real-time monitoring and autonomous operation for drill jumbos and loaders; at the Kiruna mine in Sweden, the system led to a 30% improvement in equipment utilization and reduced unscheduled maintenance events by 20%, according to operator records.

Growing Use of Hybrid and Electric-Powered Tunneling Machines to Lower Emissions:

Environmental regulations push the industry toward eco-friendly solutions. Equipment manufacturers develop hybrid and electric-powered tunneling machines to reduce carbon footprints. These machines operate with lower fuel consumption and emissions, especially in enclosed environments. The tunneling equipment market adopts electric propulsion in TBMs for metro and utility tunnels. It aligns with global goals to transition construction fleets to cleaner alternatives. Construction companies prefer machines that comply with green certification standards. Reduced noise and vibration levels further make electric machines ideal for urban deployments. Battery and motor innovations support extended operation cycles without sacrificing performance. It paves the way for sustainable tunneling solutions globally.

- For instance, TERRATEC supplied an all-electric 6.61-meter TBM for the Istanbul Metro, which reduced scope 1 site emissions and achieved a 43 dB(A) reduction in noise levels inside launch shafts per onsite acoustic monitoring, while delivering an advance rate averaging 250 meters per month in urban tunneling.

Expansion of Tunneling Applications in Mining and Hydroelectric Projects:

Mining companies and hydroelectric developers invest in tunneling to reach deeper resources and construct underground conduits. The tunneling equipment market diversifies into these sectors beyond urban transit. It supports the creation of access tunnels, pressure shafts, and ventilation passages. Equipment must withstand abrasive geological conditions and deliver consistent cutting performance. Customized TBMs and roadheaders improve productivity in mining zones. Hydroelectric tunneling projects demand long tunnel drives, prompting suppliers to offer high-reliability machines. Equipment leasing for short-term mining contracts has also increased. It continues to play a critical role in infrastructure development in energy and resource sectors.

Collaborative R&D and Customization Initiatives by Equipment Manufacturers:

Manufacturers collaborate with project developers to co-design equipment tailored to specific tunnel profiles. These partnerships help overcome geological challenges such as fault zones, mixed grounds, and underwater alignments. The tunneling equipment market encourages joint development programs to enhance machine reliability. It supports modular designs that allow configuration based on tunnel size and drive length. Regional customization addresses transport logistics and power compatibility. Software upgrades improve ground condition adaptability. Construction firms benefit from machines optimized for local site demands. This customization strategy strengthens supplier-client relationships and improves project outcomes across complex tunneling sites.

Market Challenges Analysis:

High Capital Investment and Maintenance Costs Limit Equipment Accessibility for Smaller Contractors:

The initial purchase cost of advanced tunneling machines remains a barrier for small and mid-sized contractors. Equipment such as TBMs require substantial upfront capital along with logistical support for assembly and transport. Maintenance, spare parts, and operator training add to total ownership costs. The tunneling equipment market experiences slow adoption in price-sensitive regions. It challenges newer entrants who cannot compete with larger firms owning advanced fleets. Rental options exist but often come with long lead times and limited customization. It may limit growth opportunities for localized tunnel development in rural or emerging areas. Equipment standardization across suppliers remains inconsistent, adding operational complexity.

Geotechnical Uncertainties and Site-Specific Risks Delay Equipment Deployment and Project Progress:

Unpredictable geological formations pose major challenges in tunneling operations. Soil instability, water ingress, or mixed-ground conditions can halt equipment or damage components. The tunneling equipment market faces delays due to the need for specialized ground treatment or redesign. TBMs must often be customized or reinforced for high-pressure zones or abrasive materials. These uncertainties affect project timelines and budget allocations. Construction delays lead to lower equipment utilization rates. It results in project overruns that affect profitability. Equipment providers must invest in robust R&D to develop machines capable of adapting to varied ground conditions rapidly.

Market Opportunities:

Rising Demand for Sustainable Underground Transport Projects in Urban Economies:

Urbanization and climate policy support underground metro and road tunneling projects worldwide. Governments invest in low-emission mobility solutions to reduce traffic congestion and pollution. The tunneling equipment market benefits from demand for cleaner and space-efficient transportation modes. It plays a role in enabling city infrastructure that meets sustainability targets. Manufacturers have opportunities to supply compact, low-emission machines tailored for inner-city use. Public transit expansion plans in global cities continue to drive tender activity and long-term equipment contracts.

Emerging Markets Creating Demand for Mid-Sized and Cost-Efficient Equipment Solutions:

Developing regions seek cost-effective tunneling technologies to meet infrastructure expansion goals. Equipment providers have opportunities to introduce mid-range machines with strong durability and lower operational costs. The tunneling equipment market expands with financing programs and build-operate-transfer (BOT) models. It can gain market share by serving urban and utility tunnel projects in Africa, Southeast Asia, and Latin America. Standardized, modular tunneling machines that reduce setup time can appeal to new contractors in these regions.Top of Form

Market Segmentation Analysis:

Machine Type: Diversification Supports Sector-Specific Excavation Needs

The tunneling equipment market includes several core machine types that address varied construction challenges. Tunnel Boring Machines (TBMs) dominate large-scale urban infrastructure projects due to their ability to excavate long tunnels with minimal surface impact. Microtunneling Machines and Pipe Jacking Machines suit trenchless applications in dense urban areas. Roadheaders are preferred in irregular or soft formations, particularly in mining and civil tunneling. Drilling Jumbos serve hard rock tunneling, especially in hydro and mining sectors. Other tunneling equipment includes ventilation, dewatering, and conveyor systems essential to maintaining safety and workflow.

- For instance, Komatsu Ltd. has supplied over 2,300 TBMs to the market since its first rock-excavation model in 1963, with recent advancements introducing electric mining TBMs for sustainable hard rock operations. Komatsu’s latest TBMs feature adaptability for tight curves and intersections in mines and operate without diesel, aligning with stricter underground environmental requirements. These innovations were trialed in partnership with Codelco at the Chuquicamata mine to further validate energy and productivity gains

Product Type: Selection Aligns with Geological and Pressure Conditions

By product type, Slurry TBMs and Earth Pressure Balance Shield TBMs are widely used in soft, water-bearing grounds, offering control over face pressure and settlement. Shielded TBMs provide extra structural integrity during excavation, while Multi-mode TBMs allow switching between drive modes in mixed conditions. Hard Ground TBMs are designed to cut through abrasive rock formations with reinforced cutterheads, whereas Soft Ground TBMs focus on soil-based alignments with optimized thrust and torque features. This variety enables users to match equipment to the site’s geological profile.

- For instance, China Railway Construction Heavy Industry Co., Ltd. (CRCHI) manufactured a 13.46-meter multi-mode TBM for the Chengdu Metro that switched between earth pressure balance and open mode on site, successfully driving through both water-bearing clay and weathered granite with cutterhead change intervals exceeding 800 meters per drive.

Application: Scope Extends from Urban Mobility to Resource Extraction

Transportation Tunnels remain the primary application segment, driven by rapid metro, rail, and road expansion. Utility Tunnels support underground placement of power, water, and communication infrastructure in urban developments. Mining projects require tunneling systems for shaft access, ventilation, and mineral extraction. Oil & Gas Pipelines rely on trenchless tunneling to protect surface ecosystems. Hydropower Projects use specialized machines for pressure tunnels and penstocks to move water efficiently through mountainous terrain.

End-User: Segments Drive Equipment Demand Through Infrastructure Investments

Government Infrastructure Projects lead equipment demand due to public investment in transport and urban development. Private Infrastructure Developers support commercial projects including underground parking and service tunnels. Mining Companies use tunneling machines to access and develop ore bodies. Utilities & Energy Companies apply tunneling for laying underground grids, fluid conduits, and cables. The tunneling equipment market serves these stakeholders by offering specialized, durable, and high-performance machinery tailored to unique operational goals.

Segmentation:

By Machine Type:

- Tunnel Boring Machines (TBM)

- Microtunneling Machines

- Roadheaders

- Drilling Jumbos

- Pipe Jacking Machines

- Other Tunneling Equipment

By Product Type:

- Slurry TBM

- Earth Pressure Balance Shield TBM

- Shielded TBM

- Multi-mode TBM

- Hard Ground TBM

- Soft Ground TBM

By Application:

- Transportation Tunnels (Road, Rail, Metro)

- Utility Tunnels

- Mining

- Oil & Gas Pipelines

- Hydropower Projects

By End-User:

- Government Infrastructure Projects

- Private Infrastructure Developers

- Mining Companies

- Utilities & Energy Companies

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Strong Demand from Infrastructure Renewal and Urban Projects

North America leads the tunneling equipment market with a market share of 32.6%. The region benefits from significant investments in urban transit expansion, utility tunneling, and transportation infrastructure upgrades. The U.S. government’s infrastructure plans prioritize tunnel boring for subways, highways, and sewer systems, which stimulates consistent equipment demand. Canada also contributes through projects focused on water conveyance and mining development. Leading manufacturers operate in this region, supporting equipment availability, service contracts, and technological innovation. It maintains steady demand for advanced machinery, automation systems, and environmentally controlled boring units tailored to urban construction standards.

Asia-Pacific: Rapid Urbanization, Metro Rail Expansion, and Mining Sector Growth

Asia-Pacific holds a market share of 28.5% in the tunneling equipment market. It experiences robust growth due to rising infrastructure needs in densely populated economies like China and India. Massive metro rail expansions, smart city developments, and underground utilities projects create demand for specialized tunnel boring machines. China drives large-scale adoption through national infrastructure programs and mining operations. India and Southeast Asian nations invest in transit corridors and energy tunnels to address urban congestion. Equipment manufacturers in Japan and South Korea support technological exports and regional collaborations, enhancing local capacity and operational efficiency.

Europe and Rest of the World: Tunnel Modernization and Cross-Border Projects Drive Steady Growth

Europe represents 23.3% of the tunneling equipment market, driven by large-scale rail and roadway tunnel developments in Germany, France, Switzerland, and the UK. The region maintains demand through ongoing upgrades in transport infrastructure, cross-border connectivity, and hydroelectric tunneling projects. It emphasizes sustainability, noise control, and minimal surface disruption in tunnel operations. The Rest of the World, including Latin America, the Middle East, and Africa, collectively holds a market share of 15.6%. Emerging economies in these regions adopt tunneling equipment for water management, mining, and urban development projects. Countries like Brazil, UAE, and South Africa initiate new tunnel works, supported by foreign investment and international construction firms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Herrenknecht AG

- The Robbins Company

- Mitsubishi Heavy Industries, Ltd.

- Komatsu Ltd.

- Sandvik AB

- Caterpillar Inc.

- Hitachi Zosen Corporation

- Terratec Ltd.

- China Railway Construction Heavy Industry Co., Ltd. (CRCHI)

- Epiroc AB

Competitive Analysis:

The tunneling equipment market features a mix of global heavyweights and regionally focused manufacturers competing across machine type, technology, and service support. Key players such as Herrenknecht AG, The Robbins Company, and Mitsubishi Heavy Industries lead with advanced TBMs and customized solutions for complex tunneling projects. Komatsu Ltd., Sandvik AB, and Caterpillar Inc. strengthen competition with their expertise in rock excavation and automation. It sees increasing investment in R&D to enhance equipment performance, energy efficiency, and digital integration. Companies focus on geographic expansion, long-term project contracts, and joint ventures to increase market penetration and secure recurring revenue from aftersales services and parts supply.

Recent Developments:

- In April 2025, Herrenknecht AG was awarded the bauma Innovation Award in the Machine Technology category for its Tunnel Enlargement System (TES) at bauma 2025 in Munich. The TES enables substantial renewal and cross-sectional expansion of existing railroad tunnels while train operations continue, specifically addressing the modernization needs of over 800 aging tunnels in Germany, Austria, and Switzerland. Herrenknecht’s presentation at bauma 2025 also emphasized new advances in sustainable tunneling, including robotics for segment production and digital solutions for muck management.

- In June 2025, The Robbins Company showcased its latest developments at the Rapid Excavation and Tunneling Conference (RETC) in Dallas, TX. Robbins highlighted the application of hard rock Tunnel Boring Machines (TBMs) and Shaft Boring Machines for the increasing number of pumped power storage and small hydropower projects, demonstrating the growing feasibility and efficiency of TBMs in renewable energy infrastructure. The company also presented on technical advancements in TBMs for non-circular excavation and complex geological conditions.

- In June 2025, Komatsu Ltd. signed a major equipment delivery agreement with Barrick Mining for the Reko Diq copper/gold project in Pakistan. Under this partnership, Komatsu will deliver primary mining equipment and establish Komatsu Pakistan Mining to support the project’s long-term operations. The package includes ultra-class Komatsu 980E-5 haul trucks, with deliveries starting in 2026. This move marks Komatsu’s first major mining equipment deployment in the Middle East and is supported by new service and technical resources in the region.

- In June 2025, Mitsubishi Heavy Industries, Ltd. did not have a new tunneling equipment launch or public partnership announcement during this period according to industry sources.

Market Concentration & Characteristics:

The tunneling equipment market is moderately consolidated, with a few multinational companies holding significant shares due to their technical capabilities and global project presence. It reflects high entry barriers linked to capital requirements, technology specialization, and compliance with safety and performance standards. The market rewards players offering comprehensive equipment portfolios, project customization, and lifecycle services. Regional firms compete through cost efficiency and local partnerships. It exhibits cyclical demand aligned with public infrastructure investments, resource development cycles, and urban expansion.

Report Coverage:

The research report offers an in-depth analysis based on machine type, product type, application, end-user, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Urbanization will drive sustained demand for metro and road tunneling projects.

- Equipment automation and digital controls will gain adoption across all machine categories.

- Compact microtunneling units will see increased use in utility infrastructure upgrades.

- Manufacturers will focus on eco-friendly and electric-powered tunneling solutions.

- Emerging markets in Asia-Pacific and Africa will present new growth opportunities.

- Rental and leasing models will become more common among small contractors.

- Hybrid TBMs with mode-switching features will address mixed ground complexities.

- Aftermarket services and predictive maintenance will support long-term revenue.

- Joint ventures and local manufacturing will help global players gain regional access.

- Public-private partnerships will remain crucial in financing large tunneling projects.