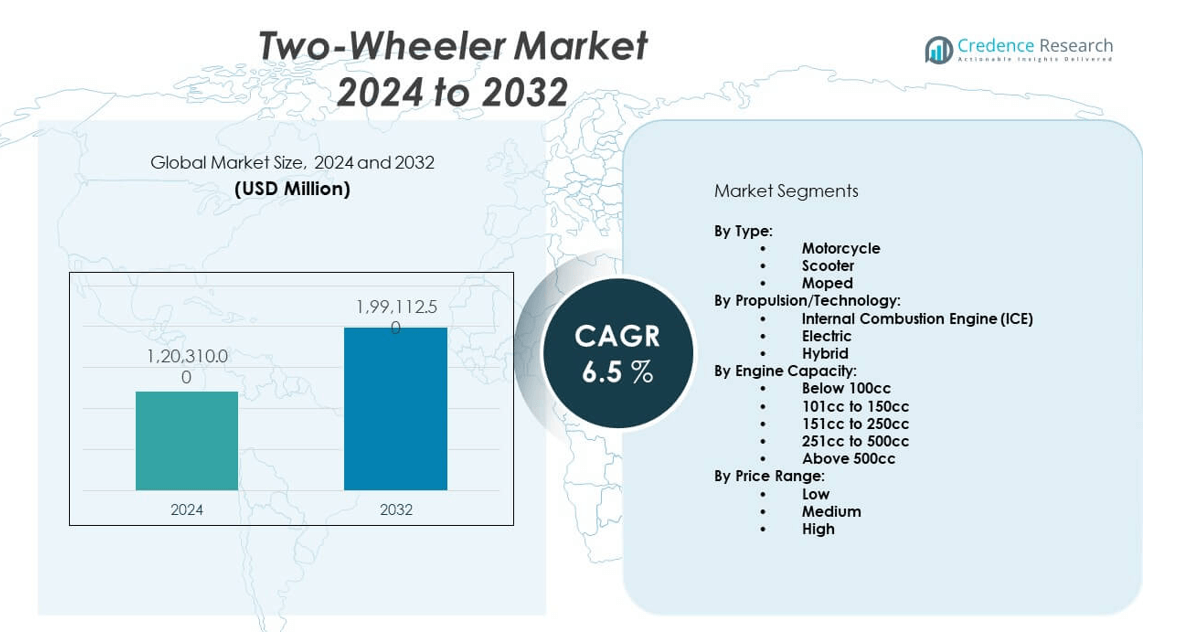

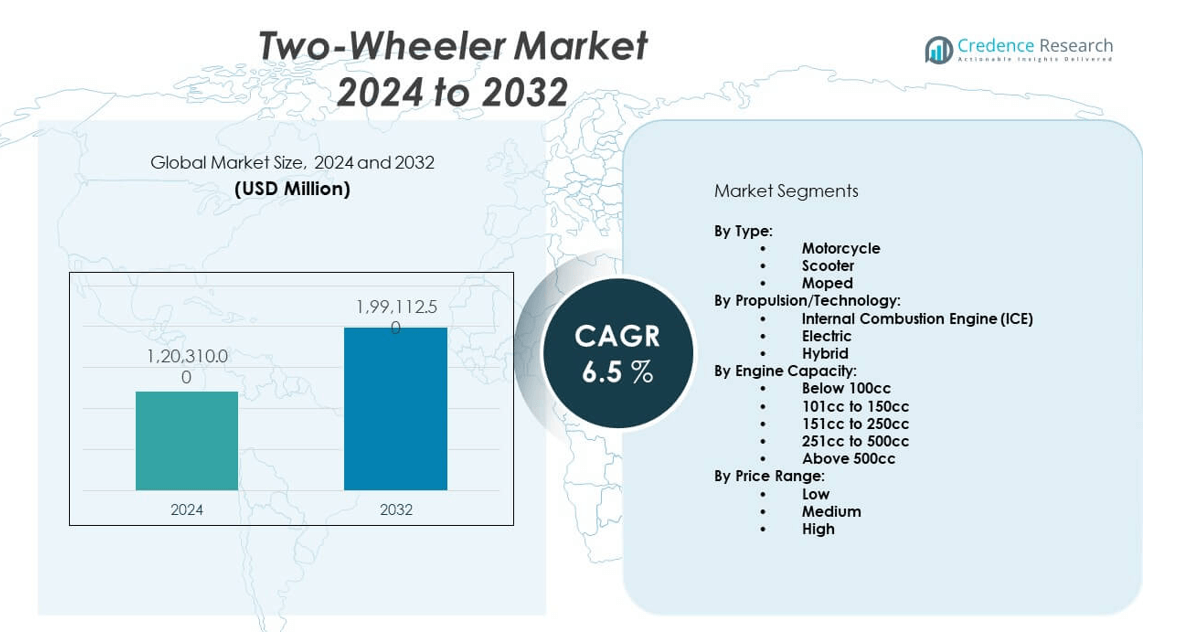

Market Overview:

The Two-wheeler market is projected to grow from USD 120,310 million in 2024 to an estimated USD 199,112.5 million by 2032, with a compound annual growth rate (CAGR) of 6.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Two-wheeler market Size 2024 |

USD 120,310 million |

| Two-wheeler market, CAGR |

6.5% |

| Two-wheeler market Size 2032 |

USD 199,112.5 million |

The global two-wheeler market is advancing due to rapid urbanization, increasing fuel efficiency awareness, and the affordability of motorcycles and scooters compared to four-wheel vehicles. Manufacturers continue to introduce technologically enhanced models, including electric variants, to meet environmental and regulatory demands. The market benefits from expanding demand in both commuter and leisure segments, supported by changing consumer lifestyles and improved financing options that make two-wheelers more accessible across income groups.

Asia-Pacific leads the two-wheeler market, driven by high population density, congested traffic conditions, and lower-income mobility needs in countries such as India, Indonesia, Vietnam, and China. These markets benefit from strong domestic manufacturing and rising rural demand. Latin America and Africa are emerging regions where economic growth, limited public transport, and increasing urban migration create favorable conditions for two-wheeler adoption. Europe and North America show slower but steady growth in the premium and electric segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Two-wheeler market is projected to grow from USD 120,310 million in 2024 to USD 199,112.5 million by 2032, registering a CAGR of 6.5% during the forecast period.

- Rising urbanization, cost-sensitive mobility demand, and greater fuel efficiency awareness are key drivers of sustained market growth.

- Growing adoption of electric two-wheelers aligns with environmental regulations and the push for sustainable urban transport.

- High dependency on ICE models in developing regions may slow EV adoption due to infrastructure and battery cost challenges.

- Asia-Pacific leads the global market with a dominant share, driven by countries like India, China, Indonesia, and Vietnam.

- Latin America and Africa are emerging growth zones, supported by poor public transport systems and increasing urban migration.

- Europe and North America show moderate growth, focusing on premium bikes and electric scooter adoption in urban segments.

Market Drivers:

Surging Urbanization and Traffic Congestion Encourage Two-Wheeler Adoption:

The Two-wheeler market benefits from rapid urbanization, especially in developing regions where city populations are rising. Urban congestion creates demand for compact and fuel-efficient vehicles that can navigate through tight spaces. Two-wheelers provide a practical solution for daily commuting in cities lacking efficient public transport. It supports high mobility at low cost, making it attractive for middle- and low-income segments. Governments are under pressure to manage growing traffic volumes, which accelerates interest in two-wheeler-friendly infrastructure. Consumers prefer motorcycles and scooters for their affordability, ease of parking, and shorter travel times. These advantages strengthen demand, particularly in Southeast Asia, Africa, and Latin America. It positions two-wheelers as indispensable in city transportation systems.

- For instance, Honda Motor Co., Ltd. reported in 2024 that their Activa scooter surpassed 30 million units in cumulative sales in India, underscoring the model’s role as a leading urban mobility solution in a high-congestion market.

Growing Demand for Affordable Mobility Across Emerging Economies:

In regions where car ownership remains financially out of reach for many, the Two-wheeler market offers a viable alternative. Two-wheelers present lower acquisition costs, reduced maintenance expenses, and better fuel efficiency than four-wheelers. Economic volatility and rising fuel prices drive consumers toward cost-effective transportation solutions. It becomes essential for individuals in rural and peri-urban areas who rely on mobility for work and essential access. Income growth in emerging markets supports steady demand for entry-level and mid-range two-wheelers. Local manufacturers capitalize on this with mass-market models suited for price-sensitive buyers. Governments in these regions often offer subsidies or tax relief to promote vehicle accessibility. It sustains consistent volume growth across rural and semi-urban areas.

- For instance, Hero MotoCorp Ltd., the world’s largest two-wheeler manufacturer by unit volume, reported sales of over 5.2 million motorcycles in India during fiscal 2024, with over 50% of this volume categorized in the affordable, commuter-class segment (100–125cc engine capacity) that specifically targets value-focused rural and semi-urban consumers.

Expansion of Delivery Services and Last-Mile Logistics Integration:

The booming e-commerce and food delivery sectors strongly influence the Two-wheeler market’s upward trajectory. Businesses prefer motorcycles and scooters for their speed, maneuverability, and delivery efficiency in congested city zones. The rise of gig economy platforms has increased demand for personal and rented two-wheelers. It enables quick and cost-efficient last-mile delivery, particularly in densely populated urban regions. Logistics firms integrate two-wheelers to reduce delivery times and operational costs. Riders can complete multiple trips per hour, making the model highly productive. Shared fleet operators also contribute to demand by offering flexible leasing models. It aligns with delivery network optimization and supports scalable logistics infrastructure.

Favorable Government Policies and Emission Norms Influence Market Growth:

Policymakers play a crucial role in accelerating the Two-wheeler market through fiscal and regulatory measures. Incentives for electric two-wheelers, reduced registration fees, and vehicle scrappage programs improve affordability and adoption. It supports the transition toward cleaner transport by encouraging replacement of aging, polluting models. Many countries enforce stricter emission norms that push manufacturers to upgrade engines and introduce electric variants. Public-private collaborations fund charging infrastructure and battery-swapping networks to aid two-wheeler electrification. Local governments invest in dedicated two-wheeler lanes to improve rider safety and reduce congestion. These policy actions provide long-term stability and growth potential for manufacturers and suppliers. It ensures that sustainability targets align with commercial viability.

Market Trends:

Electrification of Two-Wheelers Driven by Environmental and Cost Pressures:

The Two-wheeler market is witnessing a fast-paced transition from internal combustion engines to electric powertrains. Rising fuel prices and air quality concerns compel consumers to seek cleaner mobility alternatives. Governments offer incentives for EV purchases and invest in expanding charging infrastructure. Manufacturers respond with affordable electric scooters and motorcycles tailored to city commutes. Battery-swapping technologies are gaining ground, allowing quick recharge and uninterrupted use. It helps fleet operators and logistics providers maintain uptime. Consumers increasingly favor EVs due to lower operating and maintenance costs. The shift accelerates in urban zones where environmental regulations are tightening.

- For instance, Ola Electric Mobility Limited in India achieved a manufacturing milestone by delivering over 100,000 S1 electric scooters within a single year as of April 2024, and claims battery pack longevity of up to 150 km per charge for their flagship model.

Integration of Connectivity and Smart Features in New Models:

Smart technology adoption is reshaping the Two-wheeler market by offering enhanced rider experience and operational efficiency. Manufacturers equip vehicles with GPS, mobile app integration, theft alerts, and performance analytics. Riders access real-time route suggestions, maintenance reminders, and remote diagnostics through connected dashboards. It adds value in urban mobility and fleet use cases where efficiency matters. Shared mobility platforms rely on connectivity to manage their assets and track utilization. IoT-based solutions also enable remote locking and battery monitoring in electric two-wheelers. Consumers are drawn to digital conveniences, especially in premium and mid-range models. It makes smart two-wheelers a growing segment within the overall market.

- For instance, Ather Energy Limited’s Ather 450X electric scooter, launched in 2023, features a 7-inch touchscreen dashboard running on an Android Open Source Platform, integrated with Bluetooth and 4G LTE connectivity. It provides live navigation, remote diagnostics, and over-the-air (OTA) updates, with more than 50,000 scooters featuring these capabilities on Indian roads as of early 2024.

Growth of Subscription-Based and Shared Mobility Business Models:

The rise of subscription and rental-based mobility services is influencing how consumers access two-wheelers. Urban users, particularly younger demographics, opt for monthly or pay-per-use plans over ownership. It reduces financial burden while providing access to well-maintained, modern vehicles. Startups and fleet operators offer tailored plans for commuters, delivery personnel, and business users. The Two-wheeler market benefits from this demand shift, encouraging volume procurement and fleet expansion. Shared electric scooters and app-based rentals are growing across metro cities. It introduces flexibility and convenience without long-term commitment. Subscription models also appeal to gig workers seeking short-term transportation for delivery roles.

Focus on Lightweight Design and Enhanced Safety Features:

Manufacturers are investing in lightweight frames, composite materials, and compact engine configurations to boost performance and fuel economy. The Two-wheeler market reflects growing demand for maneuverability without compromising rider comfort. Models are engineered for smoother handling in congested areas and varied road conditions. Safety enhancements such as ABS, traction control, and integrated braking systems are now common, even in entry-level models. It meets regulatory requirements and improves consumer trust. Advanced lighting systems, anti-theft locks, and smartphone-enabled controls further strengthen value propositions. The focus on design also targets aesthetic appeal to attract younger consumers. It reinforces brand differentiation in competitive urban markets.

Market Challenges Analysis:

Limited Charging Infrastructure and Range Concerns for Electric Variants:

The Two-wheeler market faces key challenges in expanding electric vehicle penetration due to infrastructure gaps. Charging stations remain sparse in many cities, limiting range confidence for daily riders. It impacts both private users and fleet operators seeking to electrify logistics vehicles. High battery replacement costs and limited lifecycle of affordable models create hesitation. Many regions lack consistent EV policies and subsidies, delaying large-scale adoption. Technical issues such as battery overheating and inconsistent charging standards affect performance. Manufacturers must invest in R&D and partnerships to address these gaps. It slows the transition despite growing consumer interest in sustainable mobility options.

Road Safety, Licensing Barriers, and Unorganized Market Segments:

Safety remains a major concern due to inconsistent rider behavior, poor road infrastructure, and lack of protective regulations. In several regions, a large portion of the Two-wheeler market operates informally with limited licensing and oversight. This creates road hazards and affects public perception of two-wheelers as reliable transport. Accident rates involving motorcycles and scooters remain high, particularly in low- and middle-income countries. It leads to regulatory scrutiny and higher insurance premiums. Manufacturers face difficulty in standardizing safety features across price tiers. Rider training and awareness programs remain underfunded or inaccessible. These issues create friction in market formalization and scalability.

Market Opportunities:

Expansion of Electric Two-Wheelers in Cost-Sensitive Urban Corridors:

The Two-wheeler market has significant room to grow in cost-sensitive urban regions through electric models. EV two-wheelers offer compelling savings on fuel and maintenance, attracting delivery platforms and daily commuters. Battery technology improvements are reducing charging time and increasing range. It enables broader adoption in metro cities with rising environmental consciousness and policy support. Affordable financing options and micro-leasing models also open the market to low-income groups.

Rising Demand for Dual-Purpose Models in Urban and Rural Markets:

There is increasing demand for versatile two-wheelers that serve both urban commuters and rural users. The Two-wheeler market can capitalize on this with rugged, fuel-efficient models suited for mixed terrains. Delivery companies and small businesses also seek dependable vehicles for daily operations. Manufacturers have opportunities to introduce models that blend comfort, durability, and fuel economy. It encourages deeper market penetration across regions with diverse transport needs.

Market Segmentation Analysis:

By Type

The Two-wheeler market includes motorcycles, scooters, and mopeds, each catering to different mobility needs. Motorcycles lead in global volume, offering versatility across both urban and rural environments. Scooters are popular among urban commuters for their automatic transmission and storage convenience. Mopeds serve cost-sensitive consumers, mainly in developing countries with basic transportation infrastructure. It supports wide demographic usage, from daily commuting to leisure.

- For instance, in Vietnam, Yamaha—together with other VAMM association members—reported combined two-wheeler sales of 2,653,607 units in 2024. Scooters, which account for a significant and growing share of total sales, are increasingly central to urban mobility strategies in the region

By Propulsion/Technology

Internal combustion engine (ICE) vehicles currently dominate the Two-wheeler market due to affordability and fueling convenience. Electric two-wheelers are expanding, especially in cities, driven by emissions regulations and fuel cost savings. Hybrid models remain limited but represent an emerging transition technology in markets targeting low-emission transportation. It reflects the shift toward cleaner alternatives without sacrificing performance.

- For instance, Bajaj Auto Ltd. reported that in fiscal year 2024, ICE-powered motorcycles constituted over 85% of its total unit sales, but its EV division saw a 103% year-on-year growth, fueled by the Chetak electric scooter reaching 100,000 cumulative shipments since launch.

By Engine Capacity

The 101cc to 150cc segment holds the largest share, favored for daily commuting and fuel economy. Models below 100cc serve rural users and entry-level buyers seeking budget-friendly options. Mid- to high-capacity bikes (151cc to 500cc) are preferred for long-distance travel and performance. Above 500cc caters to a premium niche focused on sports, touring, and adventure categories. It supports broad segmentation based on rider needs and price sensitivity.

By Price Range

Low and medium price segments dominate due to demand across emerging markets and working-class consumers. These categories ensure accessibility and align with functional transport needs. High-price two-wheelers gain popularity in developed regions where consumers seek premium features, brand prestige, and electric performance. It demonstrates market maturity in balancing utility and aspirational value.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Type:

By Propulsion/Technology:

- Internal Combustion Engine (ICE)

- Electric

- Hybrid

By Engine Capacity:

- Below 100cc

- 101cc to 150cc

- 151cc to 250cc

- 251cc to 500cc

- Above 500cc

By Price Range:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Commands the Largest Market Share Due to Volume and Infrastructure

Asia-Pacific holds the dominant position in the Two-wheeler market with a 62% market share. Countries such as India, China, Indonesia, Vietnam, and Thailand drive demand due to high population density, cost-sensitive consumers, and well-established two-wheeler manufacturing ecosystems. Daily commuting needs, underdeveloped public transport, and rapid urbanization fuel consistent two-wheeler sales across both rural and urban regions. Governments support the sector through subsidies for electric two-wheelers and investments in road connectivity. Local brands hold strong market presence with mass-market and mid-range models that cater to affordability and fuel efficiency. It benefits from strong domestic demand and export capacity. The region is expected to maintain its lead with growing electrification and infrastructure improvements.

Europe Focuses on Sustainability and Urban Mobility Integration

Europe accounts for 15% of the global Two-wheeler market, driven by urban mobility initiatives, environmental regulations, and changing consumer preferences. Countries such as Italy, France, Germany, and the Netherlands promote scooters, mopeds, and electric bikes for short-distance travel in cities. Governments enforce emission standards and invest in two-wheeler lanes and EV incentives. The market sees strong demand for electric models due to zero-emission zones in major cities. Shared mobility services are widespread in Western Europe, enabling high fleet utilization. It shows stable growth, supported by technological innovation and rising adoption of premium electric scooters. The market remains attractive for urban commuters and sustainability-focused buyers.

North America and Rest of the World Show Niche Growth Trends

North America holds 12% of the Two-wheeler market, with demand concentrated in the U.S. and Canada. While car ownership dominates, motorcycles are popular in leisure and lifestyle segments. Electric scooters and mopeds are gaining traction in urban centers through shared mobility platforms. The Rest of the World contributes the remaining 11%, led by Latin America and Africa. These regions exhibit rising adoption due to urbanization, limited public transport, and growing delivery services. It gains from affordability and ease of operation, especially in informal economies. Infrastructure gaps and regulatory fragmentation pose growth limitations, but long-term potential remains strong.

Key Player Analysis:

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Hero MotoCorp Ltd.

- Bajaj Auto Ltd.

- TVS Motor Company Ltd.

- Suzuki Motor Corporation

- Harley-Davidson, Inc.

- BMW Group

- Kawasaki Heavy Industries, Ltd.

- Piaggio Group

- Triumph Motorcycles Limited

- Royal Enfield (Eicher Motors Limited)

- Ducati Motor Holding S.p.A. (Audi AG)

- Zero Motorcycles, Inc.

- Ather Energy Limited

- Ola Electric Mobility Limited

- Niu International

- Energica Motor Company

- KYMCO (Kwang Yang Motor Co., Ltd.)

- Yadea Group Holdings Ltd.

Competitive Analysis:

The Two-wheeler market is highly competitive, with established players like Honda, Yamaha, Hero MotoCorp, and Bajaj Auto leading in volume and brand equity. These companies dominate in Asia and maintain strong dealer networks and product portfolios. European and American brands such as BMW, Harley-Davidson, and Triumph compete in the premium and leisure segments. Electric-focused firms like Ola Electric, Ather Energy, and Niu International are reshaping urban mobility in key markets. Manufacturers invest in technology, EV platforms, and rider safety features to maintain relevance. It remains innovation-driven, with differentiation achieved through fuel efficiency, design, connectivity, and performance.

Recent Developments:

- In February 2025, Bajaj Auto Ltd. introduced the “Bajaj GoGo” brand for electric three-wheelers, targeting both passenger and cargo segments, including models with a range of up to 251km and advanced tech features, reinforcing its leadership in this growing space.

- On January 24, 2025, Harley-Davidson, Inc. introduced several new and refreshed models for its 2025 lineup, including the Street Glide Ultra, Pan America 1250 ST, and six revamped cruiser models, each boasting technology and performance upgrades.

- Suzuki Motor Corporation revealed the all-new GSX-8T and GSX-8TT neo-retro street bikes on July 4, 2025, bringing modern tech to classic designs and expanding availability in Europe and North America for summer 2025.

Market Concentration & Characteristics:

The Two-wheeler market displays moderate to high concentration, with a few global players dominating in terms of volume, especially in Asia-Pacific. It is price-sensitive, technology-adaptive, and segmented across urban and rural demand. It supports both utility and leisure, with clear divides between mass-market ICE models and premium or electric offerings. Competitive dynamics are shaped by innovation, regulation, and the pace of electrification across regions.

Report Coverage:

The research report offers an in-depth analysis based on vehicle type, propulsion technology, engine capacity, and price range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Electric two-wheelers will gain market share across urban mobility sectors

- Mid-range engine capacity models will continue to dominate commuter demand

- Premium motorcycle demand will rise in Europe and North America

- Shared mobility services will adopt more connected two-wheelers

- Manufacturers will invest in lightweight materials and design innovation

- Government incentives will drive faster EV adoption in emerging markets

- Battery-swapping networks will support electric fleet scalability

- Price-sensitive markets will retain dominance of ICE models in rural areas

- Digital financing and online sales platforms will improve product accessibility

- Advanced rider assistance systems will feature in higher-end two-wheelers