Market Insights

-

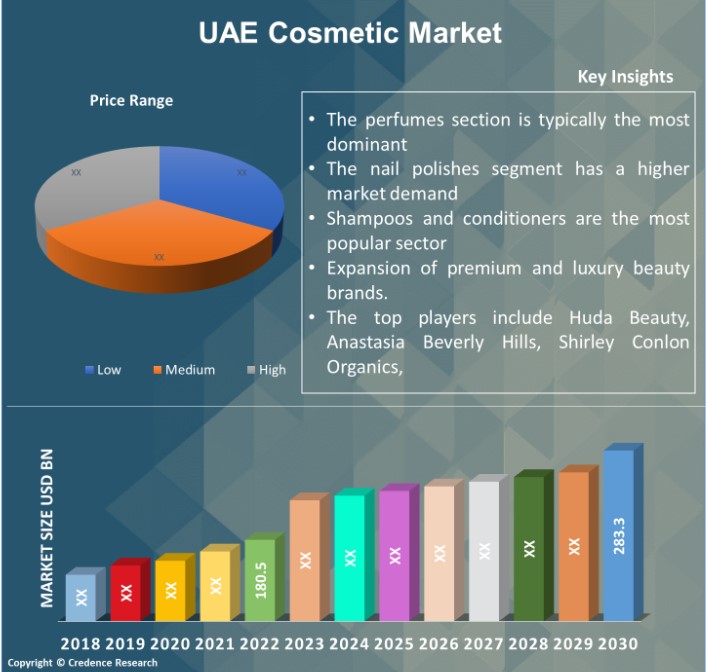

The UAE cosmetic market is projected to expand from USD 190.97 million in 2023 to USD 317.20 million by 2032, achieving a compound annual growth rate (CAGR) of 5.80%.

- The most popular segment of the cosmetics market is facial care, and the second largest area is body care.

- Shampoos and conditioners are the most popular category, while hair styling products are the second most important category in the cosmetics industry.

- The most popular makeup component is facial makeup, while the eye makeup section is the second largest in the cosmetics market.

- Perfumes are often the most dominating segment of the cosmetics business, followed by body sprays and deodorants.

- The nail polish section has a higher market demand, whereas the nail care products business adds to the cosmetics market.

- The oral care market is well-known and popular, and the Hygiene Products sector is equally important.

- The Natural and organic sector maintained the largest share of the market in 2022.

- The ethnic cosmetics business has expanded tremendously, and the Halal cosmetics market is another key component.

- Online retail category has grown significantly in recent years, and it remains the market’s second most important area.

- Demand for personal care products will drive market growth.

- Counterfeiting in cosmetics and personal care products is a major impediment to market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Executive Summary

Market Definition

The UAE cosmetic market refers to the UAE’s beauty and personal care Market. It contains skincare, makeup, haircare, fragrances, and other items. It’s a vibrant market with a diverse choice of local and international brands.

Market Overview

The UAE cosmetic market is projected to expand from USD 190.97 million in 2023 to USD 317.20 million by 2032, achieving a compound annual growth rate (CAGR) of 5.80%. The UAE cosmetics sector is a vibrant and fast expanding industry. Factors such as rising population, rising disposable income, and increased knowledge of beauty and personal care goods are driving this trend. The market provides a diverse selection of options, including both domestic and foreign brands. Some of the most popular categories in the UAE cosmetic market are skincare, cosmetics, haircare, and fragrances. The market is well-known for its premium retail options, which draw both residents and tourists.

Segmentation by Skin Care

- Facial care is the most popular segment of the cosmetics market. Individuals seek for facial care products such as cleansers, moisturizers, serums, and masks for their regular skincare routine.

- Body care is the second largest segment of the cosmetics market. Body care products, such as lotions, washes, scrubs, and oils, are commonly used to hydrate and nurture the skin on the body. Body care is an essential component of general skincare since it keeps the skin nourished and smooth.

- Men’s skin care is likewise growing in popularity and has emerged as a significant market niche in the cosmetics industry.

Segmentation by Hair Care

- Shampoos and conditioners are the most popular sector. Shampoos and conditioners are necessary for the care and nourishment of our hair. They aid in the cleansing of the scalp, the removal of impurities and excess oil, and the provision of moisture and nutrients to maintain our hair healthy and beautiful.

- The hair styling products area is the second most important segment in the cosmetics market.

Segmentation by Makeup

- The facial makeup component is the most popular. Face makeup consists of materials such as foundation, concealer, powder, and blush that are intended to enhance and level out the complexion.

- The eye makeup segment is the second largest in the cosmetics market. Eye cosmetics, such as eyeshadow, eyeliner, and mascara, are used to highlight and define the eyes.

- Lip products, such as lipsticks, lip glosses, and lip balms, are also popular in the cosmetics industry. They come in a variety of colours and finishes, allowing people to express their particular style while also adding a pop of colour to their lips.

Segmentation by Fragrances

- The perfumes section is typically the most dominant. Perfumes are in high demand due to their capacity to enhance personal aroma and leave a lasting impression. They are available in a wide range of scents, from floral and fruity to woody and oriental, to suit a variety of tastes and moods.

- Body sprays and deodorants are another key section of the cosmetics market.

Segmentation by Nail Care

- The nail polishes segment has a higher market demand. Individuals who appreciate expressing themselves through unique and colourful nail colours are fans of nail paints. They provide a diverse choice of colours, finishes, and effects, allowing individuals to experiment with various appearances and styles.

- The nail care products industry, on the other hand, contributes to the cosmetics market.

Key Highlights of the Report

The UAE Cosmetic Market is segmented by Skin Care, Hair Care, Makeup, Fragrances, Nail Care, Personal Care, Feminine Hygiene Products, Luxury Cosmetics, Online and Offline Channels and region. In 2022, the organic sector accounted for the most share of the market. In addition, the nail polish category has a bigger market demand, and the perfumes area is usually the most dominant. Also, shampoos and conditioners are the most popular industry, with eye makeup ranking second in the cosmetics market.

The primary drivers of the market include rising beauty consciousness and demand for personal care products, as well as the influence of social media and digital marketing in promoting beauty trends. Furthermore, the primary market limitations are counterfeit and low-quality product competition, stringent regulations and compliance requirements, and fluctuations in raw material prices impacting product costs.

What Elements Are Driving the Market for UAE Cosmetic?

Several variables influence the UAE cosmetic market. Beauty and personal care goods are in high demand due to a growing population and rising disposable income. People with more disposable income are more likely to invest in skincare, cosmetics, haircare, and fragrances. Second, there is a noteworthy growth in beauty consciousness among UAE residents. People are becoming more conscious of the value of self-care and are actively looking for goods to improve their beauty habits.

What Are The Main Obstacles That The UAE Cosmetic MarketFaces?

While the UAE cosmetic sector is thriving, it is not without challenges. One significant difficulty is competition from counterfeit and low-quality products. Because of the market’s prominence, there is an increased possibility of counterfeit products entering the market, which can be harmful to both consumers and real brands. Another impediment is the presence of severe regulations and compliance requirements. The UAE has rigorous restrictions addressing the safety and efficacy of cosmetic products, which can provide hurdles for firms looking to enter or expand in the market.

What Market Development Prospects Are There For UAE Cosmetic ly?

The UAE cosmetic sector offers a number of fascinating options. The growth of e-commerce platforms and online beauty purchasing creates new opportunities for firms to reach a larger customer base. Consumers may browse and purchase a variety of beauty goods from the comfort of their own homes thanks to the ease of internet shopping. In addition, there is a growing demand in the UAE for natural and organic beauty products. Consumers are becoming more aware of the materials used in skincare and cosmetic products, opening up potential for firms that provide natural and sustainable alternatives.

Market Drivers

The UAE Cosmetic Market is driven by several factors. The following are the key drivers of the UAE Cosmetic Market:

Personal Care Product Demand

Changes in people’s lives, shifting weather patterns, and consumers’ growing concern for their skin and sun protection all have an impact on cosmetics manufacturing.

Men and women are both utilizing more skincare products. Women between the ages of 45 and 65 are far more likely to use anti-aging products than men.

The market for personal care product components will expand due to rising demand for skin care products among consumers of all ages. As people ly grow more health-conscious, there has been an increase in demand for multipurpose skin care products. Because of the increased demand and awareness, manufacturers in the personal care industry have devised extremely effective and environmentally friendly products using cosmetic chemicals.

Furthermore, a movement in consumer behaviour toward healthier lifestyles is a major driver driving the need for personal care products, which is expected to raise demand for cosmetic chemicals over the forecast period.

Market Restraints

The UAE Cosmetic Market faces some challenges that may hinder its growth. These include the following:

Counterfeiting in Cosmetics and Personal Care

Consumers who purchase counterfeit cosmetics run a very high risk of having allergies and irritations due to the use of inexpensive/synthetic components and the lack of licensed production facilities, laboratories with the requisite workers, or specialists. Because purchasers confuse these counterfeit goods for the real thing, this diluting of genuine brands is another effect of these counterfeit goods.

As a result of the market’s increased acceptance of counterfeit goods, genuine businesses’ sales and brand awareness suffer. Unlicensed vendors are also increasingly selling luxury goods with no guarantees and no resale value. These dealers of counterfeit goods are free from paying federal excise taxes on their items. They may benefit more than the original product’s manufacturers as a result. To address this issue, established enterprises must sell their products at fair prices by cutting profit margins, which has an impact on the whole market under study’s expansion.

Opportunities

The UAE Cosmetic Market offers significant growth opportunities. These include the following:

Increasing Cosmetic Market Research and Development

Producers all around the world are beginning to use a more comprehensive and integrated strategy while making their goods. They do not divide health and beauty items into two distinct categories under the category of personal care, but rather group them together. As a result, they are becoming more open to concepts that establish a link between scientific advances in the health and biotechnology industries and the efficacy of beauty products.

Pharmaceutical, biotechnology, and food ingredient companies are increasingly interested in growing their position in the beauty market. The end result will be the installation of highly superior componentry.

Competitive Landscape

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

The UAE Cosmetic Market is highly competitive, with several key players. Some of the major players in the market and their market share are as follows:

- Huda Beauty

- Anastasia Beverly Hills

- Shirley Conlon Organics

- The Estée Lauder Companies Inc.

- Shiseido Company

- Unilever PLC

- Herbal Essentials

- Hammamii

- Reine Michi Beauty

- The Camel Soap Factory and other prominent players.

These organizations prioritize Skin Care innovation, Disease Area expansion, and mergers and acquisitions to stay competitive.

The UAE Cosmetic Market’s key players continually seek to stay ahead by offering new Skin Cares and developments.

In May 2021, Cosmo Cosmetics, an organic and natural cosmetics brand based in the UAE, has launched a new web gateway to provide simple access to their extensive array of healthy, sustainable, and cruelty-free products.

In August 2021, RAMICOS Cosmetics, a new startup, has announced the debut of a new line of products featuring clean, vegan, and freshly packaged recipes. In the next two months, the firm will launch its direct-to-consumer website, which will provide access to both RAMICOS cosmetics and skincare brands, including colour cosmetics.

In April 2022, during in-cosmetics, Ashland showcases natural, nature-derived, and biodegradable personal care solutions, as well as nature-positive STEM education programs for village farmers in India.

In May 2022, at Excipient World in Kissimmee, Florida, Ashland presented Vialose trehalose dihydrate, a high purity lyoprotectant and stabilizer for biologic medications and other parenteral formulations.

Summary of Key Findings

- Counterfeit in cosmetics and personal care products stifles industry growth.

- Market segmented by Skin Care, Hair Care, Makeup, Fragrances, Nail Care, Personal Care, Feminine Hygiene Products, Luxury Cosmetics, Online and Offline Channels and region.

- The most popular makeup component is facial makeup

- Perfumes are often the most dominating segment of the cosmetics business

- The market is highly competitive with key players including Huda Beauty, Anastasia Beverly Hills, Shirley Conlon Organics, The Estée Lauder Companies Inc., Shiseido Company

Future Outlook

- Continued expansion in the beauty and personal care industry.

- Rising interest in natural and organic products.

- Increase in e-commerce and online beauty purchasing.

- Product introductions that are new and technologically advanced.

- Emphasize sustainability and environmentally beneficial techniques.

- Men’s grooming products are becoming increasingly popular.

- Expansion of premium and luxury beauty brands.

- Personalized and tailored beauty solutions are emphasized.

Segmentation

- By Skin Care:

- Facial Care

- Body Care

- Men’s Skin Care

- By Hair Care:

- Shampoos and Conditioners

- Hair Styling Products

- Hair Coloring and Treatments

- By Makeup:

- Face Makeup

- Eye Makeup

- Lip Products

- Makeup Tools

- By Fragrances:

- Perfumes

- Body Sprays and Deodorants

- By Nail Care:

- Nail Polishes

- Nail Care Products