| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Diabetes Drugs Market Size 2023 |

USD 176.85 Million |

| UAE Diabetes Drugs Market, CAGR |

0.85% |

| UAE Diabetes Drugs Market Size 2032 |

USD 198.02 Million |

Market Overview

UAE Diabetes Drugs Market size was valued at USD 176.85 million in 2023 and is anticipated to reach USD 198.02 million by 2032, at a CAGR of 0.85% during the forecast period (2023-2032).

The UAE Diabetes Drugs market is primarily driven by the rising prevalence of diabetes, fueled by lifestyle changes, unhealthy diets, and increasing urbanization. As the population grows older and more individuals are diagnosed with type 2 diabetes, the demand for effective treatments rises. Additionally, the market benefits from advancements in drug formulations, including oral medications and insulin alternatives, improving disease management and patient outcomes. The increasing awareness of diabetes and its complications, alongside government initiatives to promote health and wellness, further propels market growth. Additionally, the growing focus on personalized medicine and the development of innovative therapies are driving new drug introductions, contributing to a diverse treatment landscape. As a result, the market is expected to experience gradual expansion, reflecting both the increasing burden of diabetes and the continuous evolution of the pharmaceutical landscape in the UAE.

The UAE Diabetes Drugs market is influenced by the regional healthcare infrastructure and the rising prevalence of diabetes across the emirates. Dubai and Abu Dhabi, with their advanced healthcare systems and growing awareness campaigns, are central to the market’s expansion. These cities attract a diverse population, including expatriates, which increases the demand for diabetes treatments. Sharjah and other northern emirates are witnessing growing demand as well, with healthcare services gradually improving to meet the needs of diabetic patients. Key players in the UAE Diabetes Drugs market include global pharmaceutical giants such as Novo Nordisk, Eli Lilly and Company, Merck & Co., Inc., and Sanofi, which offer a broad range of diabetes medications. These companies are capitalizing on the growing need for innovative therapies, from insulin injections to oral medications and biologics, while also focusing on patient-centric solutions to address the increasing diabetes burden in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE Diabetes Drugs market was valued at USD 176.85 million in 2023 and is expected to reach USD 198.02 million by 2032, with a CAGR of 0.85%.

- The increasing prevalence of diabetes, particularly type 2, is a key driver of market growth.

- Advancements in drug formulations, including non-insulin therapies, are driving market expansion.

- Digital health solutions, including mobile apps and continuous glucose monitoring, are becoming integrated with diabetes treatments, enhancing patient outcomes.

- The market is highly competitive, with key players like Novo Nordisk, Eli Lilly, and Merck & Co. dominating the landscape.

- High treatment costs and limited public awareness remain significant market restraints.

- Dubai and Abu Dhabi lead the market, with growing demand also seen in Sharjah and northern emirates, supported by improving healthcare infrastructure.

Report Scope

This report segments the UAE Diabetes Drugs Market as follows:

Market Drivers

Rising Prevalence of Diabetes

One of the primary drivers of the UAE Diabetes Drugs market is the increasing prevalence of diabetes within the population. The UAE has seen a rapid rise in the number of individuals diagnosed with type 2 diabetes due to lifestyle changes such as poor dietary habits, sedentary behavior, and increasing urbanization. The country is witnessing a higher incidence of obesity, a major risk factor for developing diabetes, particularly among the younger population. According to the International Diabetes Federation, the UAE has one of the highest rates of diabetes in the world, prompting a growing demand for diabetes medications. This surge in diabetes cases has created a significant market opportunity for pharmaceutical companies to offer effective treatments to manage the condition.

Increasing Government Health Initiatives

Government initiatives aimed at promoting health and combating chronic diseases such as diabetes play a crucial role in driving the demand for diabetes drugs in the UAE. For instance, MoHAP launched the National Prediabetes and Diabetes Screening campaign in 2023, offering free screenings and follow-up consultations to promote early detection and management. The UAE government has implemented various national programs focusing on diabetes prevention, early detection, and management. These initiatives are coupled with awareness campaigns, screening programs, and educational efforts to inform the public about the importance of diabetes care. Moreover, the government’s active engagement in improving healthcare infrastructure, along with policies supporting the availability of affordable and accessible treatment options, is contributing to the growth of the diabetes drug market. As more individuals are diagnosed and treated, the demand for diabetes medications continues to rise.

Advancements in Drug Formulations

The continuous advancements in diabetes drug formulations are significantly driving the market in the UAE. There has been a rise in the availability of innovative medications, including oral hypoglycemics and insulin alternatives, which cater to the diverse needs of diabetic patients. These newer drug formulations offer better efficacy, improved safety profiles, and ease of administration compared to older treatments. For instance, the introduction of GLP-1 receptor agonists, SGLT-2 inhibitors, and novel insulin therapies have provided more options for personalized treatment, enhancing patient outcomes. As the therapeutic landscape evolves, the availability of better treatment options is likely to continue driving market growth in the UAE.

Growing Focus on Personalized Medicine

The shift toward personalized medicine is another key driver for the UAE Diabetes Drugs market. Personalized medicine tailors treatment plans to individual patients based on genetic, environmental, and lifestyle factors, ensuring more effective and targeted care. For instance, research initiatives at Khalifa University are exploring pharmacogenomics to optimize diabetes treatments based on genetic profiles, paving the way for precision medicine in the UAE. With advancements in genomics and biotechnology, pharmaceutical companies are increasingly developing drugs that can address specific patient profiles, making treatment more efficient. In the UAE, this trend is gaining momentum, particularly as patients seek treatments that are better suited to their unique health conditions. As personalized treatment options expand, the demand for specialized diabetes drugs is expected to grow, driving innovation and growth within the market.

Market Trends

Shift Towards Non-Insulin Therapies

One prominent trend in the UAE Diabetes Drugs market is the growing preference for non-insulin therapies, especially for type 2 diabetes management. Oral medications such as SGLT-2 inhibitors, GLP-1 receptor agonists, and DPP-4 inhibitors are becoming increasingly popular due to their ease of use, fewer side effects, and ability to provide better glycemic control without the need for injections. For instance, the Emirates Diabetes Society has endorsed the use of GLP-1 receptor agonists for their dual benefits in glycemic control and weight management, particularly for patients with obesity-related diabetes. These non-insulin therapies are designed to manage blood glucose levels effectively, improve patient compliance, and offer additional benefits, such as weight loss and cardiovascular protection. As the demand for less invasive treatment options grows, non-insulin drugs are becoming a key component of diabetes management in the UAE.

Integration of Digital Health Solutions

Another growing trend in the UAE Diabetes Drugs market is the integration of digital health solutions in diabetes management. Digital health tools such as mobile apps, wearable devices, and continuous glucose monitoring (CGM) systems are increasingly being used to help patients manage their condition more effectively. For instance, the Dubai Health Authority (DHA) has implemented telemedicine platforms that integrate CGM data with patient records, enabling real-time monitoring and personalized treatment adjustments. These tools allow for real-time monitoring of blood glucose levels, medication adherence, and lifestyle factors, providing valuable insights for both patients and healthcare providers. The integration of these technologies with diabetes drugs offers a comprehensive approach to managing the disease, improving patient outcomes, and enhancing overall treatment efficacy. This trend is expected to continue as digital health solutions become more widespread and accessible in the UAE.

Focus on Patient-Centric Treatment Approaches

There is an increasing focus on patient-centric treatment approaches in the UAE Diabetes Drugs market. The shift towards personalized medicine, where treatment plans are tailored to individual patient needs, is gaining traction. This trend involves considering factors such as the patient’s genetic makeup, lifestyle, comorbidities, and preferences to optimize drug therapies. By adopting a more patient-centered approach, healthcare providers can ensure better treatment outcomes, minimize side effects, and improve patient satisfaction. This trend reflects the broader global movement toward precision medicine and is becoming a key factor driving the development and adoption of diabetes drugs in the UAE.

Growing Popularity of Biologic Drugs

Biologic drugs are becoming increasingly popular in the UAE Diabetes Drugs market, especially as treatments for type 1 diabetes and severe cases of type 2 diabetes. These biologic agents, such as biosimilar insulins and GLP-1 receptor agonists, offer more targeted and effective solutions for controlling blood sugar levels. Biologics are often preferred by patients who have not responded well to traditional oral therapies, as they can offer more effective glycemic control and additional health benefits. The growing acceptance and use of biologic drugs in the UAE reflects a broader trend toward innovative treatments that offer enhanced precision and improved quality of life for diabetic patients. As research and development in biologic therapies continue, their market presence is expected to grow significantly.

Market Challenges Analysis

High Cost of Diabetes Drugs

A significant challenge in the UAE Diabetes Drugs market is the high cost of diabetes medications, particularly for advanced therapies such as biologic drugs and newer insulin alternatives. These treatments often come with substantial price tags, which can be a barrier to access for a large portion of the population. For instance, a study published in the International Journal of Diabetes in Developing Countries estimated that the direct annual cost of diabetes treatment in the UAE averages USD 2,968 per person, with biologic drugs and insulin alternatives accounting for a significant portion. While the UAE has a relatively advanced healthcare system, the affordability of these medications remains a concern, especially for individuals without comprehensive health insurance coverage. The high cost of treatment may limit patient adherence to prescribed regimens and create financial strain for both healthcare providers and patients. Addressing this issue will be crucial for ensuring that effective diabetes care remains accessible to all segments of the population.

Limited Public Awareness and Education

Another challenge faced by the UAE Diabetes Drugs market is the limited public awareness and education surrounding diabetes management. Despite the growing prevalence of the disease, many individuals still lack adequate knowledge about proper diabetes care, medication adherence, and the long-term implications of poorly managed diabetes. This lack of awareness can result in delayed diagnoses, improper medication usage, and a higher burden on the healthcare system. Although government initiatives are addressing this issue through health campaigns, the challenge remains in ensuring that the population fully understands the importance of diabetes treatment and the range of available medications. Increased education efforts are needed to bridge this gap and promote better disease management.

Market Opportunities

The UAE Diabetes Drugs market presents several key opportunities driven by the growing prevalence of diabetes and the evolving treatment landscape. As the number of diabetes cases continues to rise, there is an increasing demand for both established and innovative drug therapies. This provides pharmaceutical companies with an opportunity to expand their portfolios by introducing advanced drug formulations that offer better efficacy and improved patient outcomes. The market is particularly poised for growth in non-insulin therapies, such as GLP-1 receptor agonists, SGLT-2 inhibitors, and DPP-4 inhibitors, which are gaining popularity due to their ease of use, lower side-effect profiles, and potential benefits for comorbid conditions like cardiovascular diseases. As healthcare providers look to offer more personalized treatment options, companies can capitalize on this trend by developing tailored solutions that cater to individual patient needs.

Furthermore, the increasing integration of digital health solutions presents a significant market opportunity. The adoption of mobile apps, wearable devices, and continuous glucose monitoring (CGM) systems is helping patients better manage their diabetes by providing real-time data and improving medication adherence. The growing trend of combining drug therapies with digital health tools creates a comprehensive approach to diabetes care, which is expected to enhance patient outcomes and drive market growth. Additionally, the UAE government’s efforts to improve public health awareness and accessibility to healthcare services create a favorable environment for the growth of the diabetes drug market. With a focus on prevention, early detection, and management, there are numerous opportunities for both local and international companies to introduce innovative treatments and support the healthcare infrastructure.

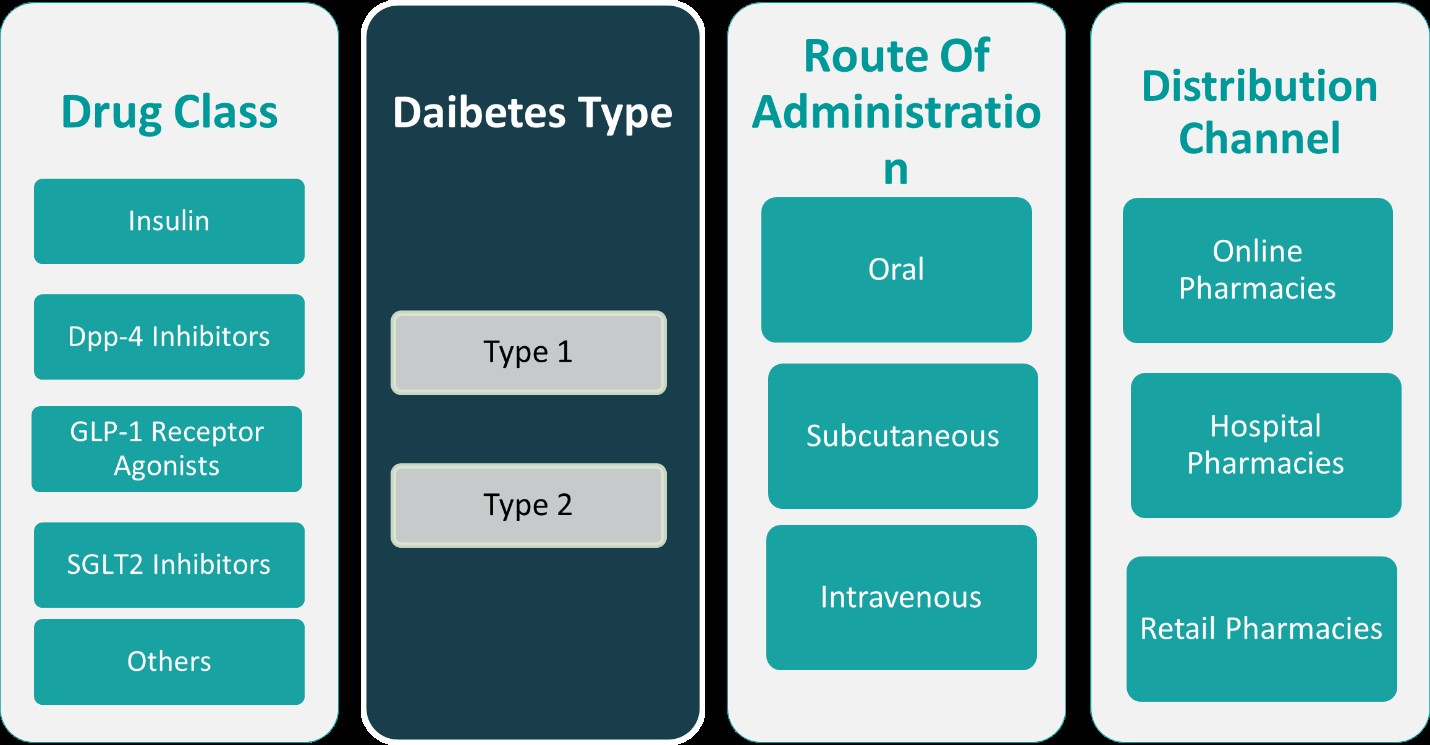

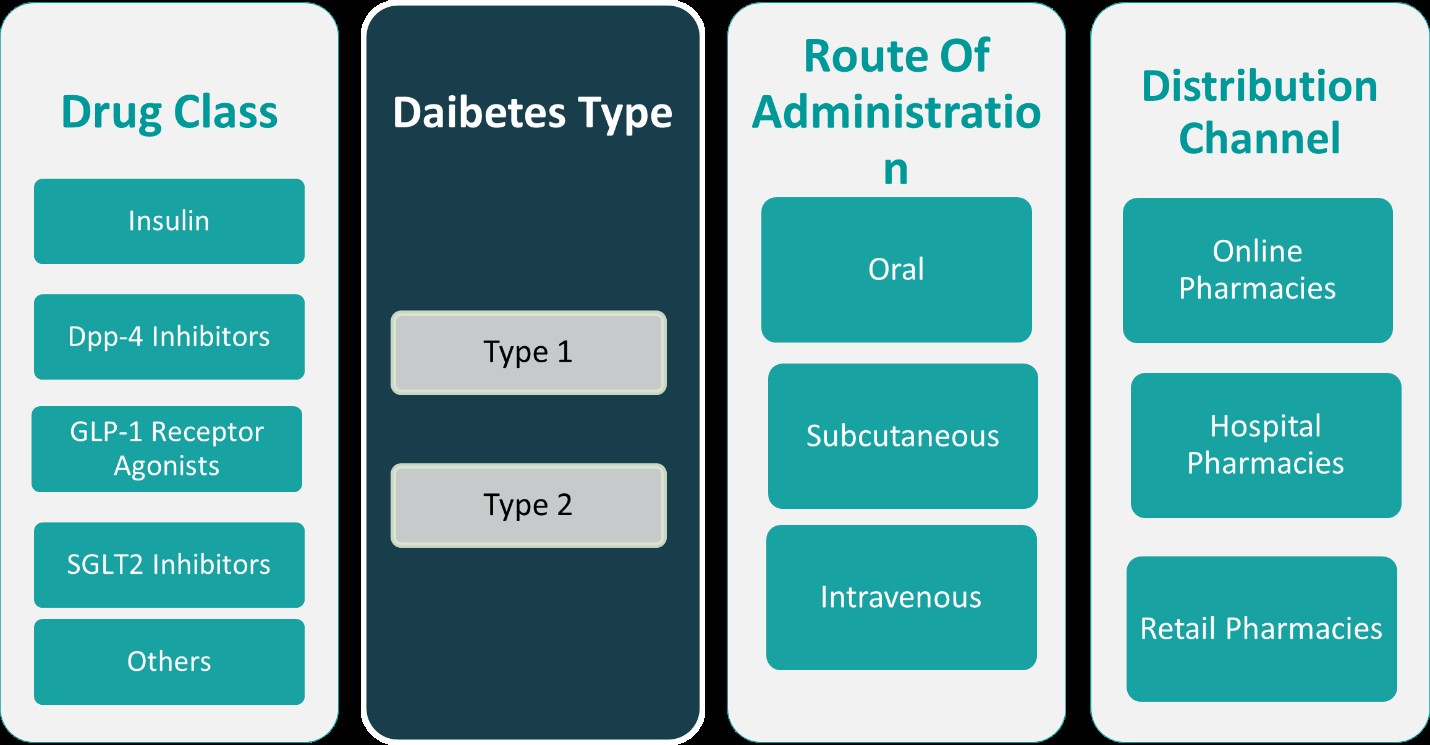

Market Segmentation Analysis:

By Drug Class:

The UAE Diabetes Drugs market is characterized by a variety of drug classes designed to meet the different needs of diabetic patients. Insulin remains the cornerstone of treatment for type 1 diabetes, and is also used for managing advanced cases of type 2 diabetes. However, the demand for non-insulin therapies has risen significantly in recent years, driven by the adoption of more patient-friendly treatments. DPP-4 inhibitors, such as sitagliptin, are increasingly used for type 2 diabetes due to their ability to enhance insulin secretion and reduce blood sugar levels with fewer side effects. GLP-1 receptor agonists, such as liraglutide, are gaining popularity for their dual benefits of improving glycemic control and promoting weight loss. SGLT2 inhibitors, like empagliflozin, offer additional advantages such as cardiovascular protection and weight reduction, making them a preferred choice for managing type 2 diabetes. Other drug classes, including sulfonylureas and thiazolidinediones, continue to play a role in diabetes management, though their market share is gradually decreasing.

By Diabetes Types:

The UAE Diabetes Drugs market is further segmented based on the type of diabetes being treated, with type 2 diabetes accounting for the largest share. As the most common form of diabetes in the UAE, type 2 diabetes drives the demand for a range of oral and injectable medications, including GLP-1 receptor agonists, DPP-4 inhibitors, and SGLT2 inhibitors. Type 1 diabetes, while less prevalent, still represents a significant portion of the market, primarily requiring insulin therapy for lifelong management. Emerging conditions, such as diabetes type 3, which is associated with Alzheimer’s disease, and diabetes type 4, linked to obesity, are creating a new demand for specialized therapies targeting both blood glucose control and related comorbidities. Diabetes type 5 and other newly classified forms of diabetes are also beginning to influence the market, though these are still in early stages of research and treatment development. As awareness and diagnoses of various diabetes types increase, there is growing potential for specialized treatments tailored to these distinct forms of diabetes.

Segments:

Based on Drug Class:

- Insulin

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- SGLT2 Inhibitors

- Others

Based on Diabetes Types:

- Type 1

- Type 2

- Diabetes Type 3

- Diabetes Type 4

- Diabetes Type 5

Based on Route of Administration:

- Oral

- Subcutaneous

- Intravenous

- Route of Administration 4

- Route of Administration 5

Based on Technology:

- Technology 1

- Technology 2

- Technology 3

Based on Distribution Channel:

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

- Distribution Channel 4

- Distribution Channel 5

Based on the Geography:

- Abu Dhabi

- Dubai

- Sharjah

- Ajman

- Fujairah

- Ras Al Khaimah

- Umm Al Quwain

Regional Analysis

Dubai

Dubai leads the market, holding the largest share, accounting for approximately 35% of the total market. As the commercial and healthcare hub of the UAE, Dubai has a high concentration of both diabetes cases and healthcare facilities. The city’s advanced healthcare infrastructure, coupled with its diverse population, drives the demand for a wide range of diabetes medications. Additionally, Dubai’s significant expatriate population and growing healthcare tourism contribute to the market’s expansion. The continuous efforts to enhance healthcare services in Dubai further fuel the growth of the diabetes drugs market.

Abu Dhabi

Abu Dhabi follows as the second-largest contributor to the UAE diabetes drug market, commanding around 30% of the market share. As the capital of the UAE, Abu Dhabi benefits from strong government initiatives to combat diabetes, making it a crucial region for diabetes care. The emirate’s healthcare system is well-developed, with an increasing focus on public health awareness campaigns targeting diabetes prevention and management. The high prevalence of diabetes in Abu Dhabi, coupled with its affluent population, results in a substantial demand for both traditional and advanced diabetes medications. Additionally, Abu Dhabi’s healthcare facilities and research institutions are continuously contributing to the availability of new treatment options.

Sharjah

Sharjah, with a market share of approximately 15%, represents a growing segment of the UAE Diabetes Drugs market. As the third-largest emirate, Sharjah has witnessed an increase in diabetes cases, driven by factors such as urbanization, lifestyle changes, and rising obesity rates. The government’s investment in healthcare infrastructure, alongside increasing awareness of diabetes and its management, is driving the demand for diabetes medications in Sharjah. The emirate is also home to a significant number of industrial workers, many of whom face an elevated risk of developing diabetes, contributing to the growing need for effective treatments.

Ajman, Fujairah, Ras Al Khaimah, and Umm Al Quwain

The remaining regions, including Ajman, Fujairah, Ras Al Khaimah, and Umm Al Quwain, collectively account for around 20% of the market share. Among these, Ajman and Ras Al Khaimah are seeing moderate growth, with an increasing number of diabetes cases in line with the national trend. Fujairah and Umm Al Quwain have smaller shares of the market, but their growing healthcare initiatives and increasing healthcare access are expected to boost the demand for diabetes drugs in the coming years. As these regions continue to develop their healthcare sectors, they present untapped opportunities for pharmaceutical companies to expand their reach and introduce innovative diabetes treatments.

Key Player Analysis

- Novo Nordisk A/S

- Sanofi

- Merck & Co., Inc

- Eli Lilly and Company

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Novartis AG

- Johnson & Johnson Services, Inc.

- Bayer AG

- NeoBiocon

- NewBridge Pharmaceuticals FZ LLC

Competitive Analysis

The UAE Diabetes Drugs market is highly competitive, with several leading global pharmaceutical companies driving the industry. Key players in the market include Novo Nordisk, Eli Lilly and Company, Merck & Co., Inc., Sanofi, AstraZeneca, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Novartis AG, Johnson & Johnson Services, Inc., Bayer AG, NeoBiocon, and NewBridge Pharmaceuticals FZ LLC. These companies offer a broad range of diabetes medications, from traditional insulin therapies to newer non-insulin treatments such as GLP-1 receptor agonists, DPP-4 inhibitors, and SGLT2 inhibitors. These therapies not only aim at controlling blood sugar but also address comorbidities like cardiovascular diseases, which are increasingly prevalent in diabetic patients. The market is also characterized by aggressive strategies including product innovation, strategic collaborations, and acquisitions to strengthen market positioning. Companies are investing heavily in research and development to bring advanced treatment options that cater to diverse patient needs. Additionally, the growing integration of digital health solutions, such as continuous glucose monitoring systems and diabetes management apps, is shaping the competitive landscape. To stay ahead, market players must also navigate challenges such as high treatment costs and regulatory hurdles while working to enhance patient access to effective diabetes care across the UAE.

Recent Developments

- In March 2025, Novo Nordisk signed a deal worth up to $2 billion for the rights to UBT251, a new obesity and diabetes drug developed by United BioTechnology. The drug combines GLP-1, GIP, and glucagon to manage blood sugar and reduce hunger.

- In February 2025, Sanofi received FDA approval for MERILOG, the first rapid-acting insulin aspart biosimilar, to improve glycemic control in adults and pediatric patients with diabetes.

- In December 2024, JD Health began offering Merck’s GLUCOPHAGE XR (Reduce Mass) online in China, enhancing access to metformin hydrochloride extended-release tablets for type 2 diabetes patients.

- In December 2024, Torrent Pharma acquired three diabetes brands from Boehringer Ingelheim, including those with Empagliflozin, to strengthen its anti-diabetes portfolio

- In November 2024, AstraZeneca presented promising early data for its obesity pipeline, including AZD5004, an oral GLP-1 receptor blocker, at ObesityWeek 2024.

Market Concentration & Characteristics

The UAE Diabetes Drugs market exhibits moderate concentration, with a mix of global pharmaceutical giants and regional players dominating the landscape. A few key multinational companies control a significant share of the market, particularly in insulin therapies and newer drug classes such as GLP-1 receptor agonists and SGLT2 inhibitors. These companies maintain a competitive edge through continuous innovation, extensive product portfolios, and strong distribution networks. However, the presence of local players and new entrants focused on developing region-specific solutions also contributes to market fragmentation. The market is characterized by a growing emphasis on patient-centric treatments, with a shift towards non-insulin therapies and integrated digital health solutions. The increasing demand for personalized medicine, which tailors treatment plans to individual patient needs, is also shaping the competitive dynamics. Despite the dominance of established players, the market remains dynamic, offering opportunities for new and emerging companies to capitalize on the evolving demand for diabetes management solutions in the UAE.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Diabetes Types, Route of Administration, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UAE Diabetes Drugs market is expected to experience steady growth due to the rising prevalence of diabetes in the region.

- Increasing demand for non-insulin therapies, such as GLP-1 receptor agonists and SGLT2 inhibitors, will drive market expansion.

- The adoption of personalized medicine tailored to individual patient profiles will shape the future of diabetes treatments.

- Digital health solutions, including continuous glucose monitoring and diabetes management apps, will become more integrated with drug therapies.

- Innovation in biologic drugs will lead to more targeted treatments, particularly for type 1 and advanced type 2 diabetes.

- The UAE government’s focus on healthcare infrastructure and public awareness will further boost market growth.

- Rising healthcare accessibility and affordability will make diabetes drugs more available to a wider population.

- There will be increased emphasis on the management of comorbidities, such as cardiovascular diseases, in diabetes treatments.

- Growing competition will foster the introduction of more affordable and effective diabetes medications.

- The market will see greater collaboration between global pharmaceutical companies and regional healthcare providers to address local needs.