| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Water Pump Market Size 2023 |

USD 124.14 Million |

| UAE Water Pump Market, CAGR |

1.83% |

| UAE Water Pump Market Size 2032 |

USD 146.50 Million |

Market Overview:

UAE Water Pump Market size was valued at USD 124.14 million in 2023 and is anticipated to reach USD 146.50 million by 2032, at a CAGR of 1.83% during the forecast period (2023-2032).

Several key factors are propelling the growth of the UAE water pump market. Foremost is the country’s commitment to infrastructure development, exemplified by mega-projects such as airports, hotels, and theme parks, which necessitate advanced water pumping solutions. Additionally, the UAE’s arid climate and limited freshwater resources have intensified the need for desalination and wastewater treatment facilities, thereby increasing the demand for robust and reliable water pumps. Government initiatives promoting water conservation and the adoption of energy-efficient technologies are also encouraging the integration of smart and solar-powered pumps. Furthermore, the agricultural sector’s expansion, aimed at enhancing food security, is driving the requirement for efficient irrigation systems, thus contributing to the market’s growth. Rising investments in smart city projects and the growing preference for automated water pumping systems are further accelerating market development. The demand for water pumps in oil and gas operations—particularly in offshore platforms—also remains a significant contributor.

Within the Middle East and North Africa (MENA) region, the UAE stands out as a significant contributor to the water pump market’s growth. The country’s proactive approach to infrastructure development and its relatively lower dependence on crude oil revenues enable quicker approval and execution of greenfield investment projects. This agility positions the UAE favorably compared to regional peers. Moreover, the government’s substantial investments in municipal water treatment and desalination plants are creating a conducive environment for market expansion. The UAE’s strategic location and its role as a trading hub further amplify its influence in the regional water pump market. Urban centers such as Dubai and Abu Dhabi are witnessing increased deployment of high-capacity pumps in utility and commercial infrastructure. In addition, free zones and industrial clusters are increasingly integrating advanced pumping technologies to meet sustainability and efficiency targets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UAE Water Pump Market was valued at USD 124.14 million in 2023 and is projected to reach USD 146.50 million by 2032, growing at a CAGR of 1.83%.

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Infrastructure expansion, including airports, metro systems, and hospitality projects, continues to drive strong demand for advanced water pumping systems.

- Desalination and wastewater treatment remain vital applications, fueled by the UAE’s arid climate and growing urban population.

- Technological advancements, such as smart, IoT-enabled, and solar-powered pumps, are transforming operational efficiency and reducing long-term costs.

- Diversification into sectors like agriculture, manufacturing, and logistics is increasing the demand for specialized and sustainable pumping solutions.

- Market challenges include high initial investment costs, harsh environmental conditions, and reliance on imported pump components.

- Dubai and Abu Dhabi collectively dominate the market, but northern emirates are rapidly adopting advanced pumping technologies to support industrial growth and sustainability goals.

Market Drivers:

Infrastructure Development and Urban Expansion

The UAE’s aggressive infrastructure development strategy remains a central driver for the water pump market. Mega projects such as the Dubai Expo legacy developments, Abu Dhabi’s Vision 2030 urban plan, and ongoing construction of airports, metro systems, and luxury hospitality venues require highly efficient water management systems. For instance, during Expo 2020 Dubai, advanced water management solutions were deployed to achieve significant water conservation, with some structures reducing water consumption by over 50% compared to the Dubai Electricity and Water Authority (DEWA) baseline. These projects demand advanced pumping technologies for water distribution, HVAC systems, fire safety solutions, and drainage applications. Additionally, urban expansion across emirates such as Sharjah and Ras Al Khaimah is increasing the installation of residential water pumps, thus creating sustained demand across both commercial and domestic segments.

Rising Need for Water Desalination and Wastewater Treatment

The UAE’s arid climate and limited natural freshwater reserves have made desalination a critical component of the national water strategy. As the country continues to rely heavily on desalination to meet potable water needs, the demand for high-capacity and energy-efficient water pumps in these plants has increased considerably. Simultaneously, growing population density and industrial activity have heightened the need for wastewater treatment facilities. Water pumps serve as essential components in all stages of wastewater processing, including sludge management and water recirculation. The government’s push for environmental sustainability, aligned with the UAE Water Security Strategy 2036, further reinforces this trend by prioritizing investments in water reuse and advanced treatment technologies.

Government Policies and Technological Advancements

Government-led initiatives supporting energy-efficient technologies are significantly influencing the market. Policies encouraging sustainable infrastructure development, alongside environmental regulations focused on water conservation, are accelerating the adoption of smart pumping systems. The integration of IoT and automation in water pump operations is gaining traction, enabling real-time monitoring, predictive maintenance, and optimized energy consumption. For example, Dubai’s Clean Energy Strategy 2050 supports the integration of solar-powered pumps into municipal and industrial applications. These technological advancements not only enhance pump efficiency but also lower operating costs, making them attractive for both municipal and industrial applications.

Sectoral Diversification and Industrial Demand

The diversification of the UAE economy beyond oil has led to increased investments in agriculture, manufacturing, and commercial real estate, all of which contribute to water pump market expansion. In agriculture, the push toward food security and local production is driving demand for pumps in irrigation systems and greenhouse operations. The industrial sector, including petrochemicals, power generation, and mining, relies on customized pumping systems for fluid handling, cooling, and water circulation. Moreover, the ongoing development of free economic zones and industrial clusters such as KIZAD and JAFZA is promoting the deployment of advanced pump technologies to meet sustainability benchmarks. As a result, the water pump market in the UAE continues to benefit from a robust pipeline of cross-sectoral projects, ensuring stable and long-term demand.

Market Trends:

Adoption of Smart and Connected Pumping Systems

One of the most prominent trends in the UAE water pump market is the growing shift toward smart and connected pumping technologies. As the UAE accelerates its digital transformation agenda, stakeholders across municipal, industrial, and commercial sectors are increasingly adopting pumps equipped with IoT sensors, automated controls, and remote monitoring capabilities. For instance, Grundfos has implemented advanced solutions such as remote monitoring systems and variable speed drives in Ras Al Khaimah’s wastewater pumping stations, resulting in a 20% reduction in energy consumption and a 12% decrease in operational costs. These systems allow for predictive maintenance, performance optimization, and reduced downtime, thereby improving operational efficiency and reducing lifecycle costs. The trend is particularly evident in utility-scale applications such as district cooling systems and municipal water supply networks, where centralized control and energy savings are critical. Leading manufacturers are responding by introducing digitally integrated pump solutions tailored for the UAE’s infrastructure and environmental conditions.

Increasing Integration of Renewable Energy Solutions

The integration of solar energy with water pumping systems is gaining significant traction in the UAE, in line with national sustainability goals. Solar-powered water pumps are becoming increasingly viable, particularly in off-grid locations and agricultural areas where conventional electricity access may be limited or expensive. The declining cost of photovoltaic panels and government incentives for clean energy adoption have made these systems more attractive to end users. In the context of water supply and irrigation, solar pumps offer a sustainable and low-maintenance solution that aligns with the country’s ambition to achieve 50% clean energy in its energy mix by 2050. This trend is also supported by pilot projects in rural areas and utility-scale initiatives aimed at reducing carbon emissions.

Focus on High-Capacity and Custom-Built Industrial Pumps

Another emerging trend is the rising demand for large-capacity and custom-engineered pumps in heavy industries such as oil and gas, desalination, and thermal power generation. These industries require high-performance pumps capable of operating under extreme pressure and temperature conditions while maintaining durability and precision. As the UAE continues to develop its downstream petrochemical sector and invest in industrial water reuse, the need for specialized pumping systems is growing. Manufacturers are increasingly offering modular and application-specific pumps designed to meet strict regulatory and performance standards. For instance, Sulzer provides corrosion-resistant centrifugal pumps for petrochemical processing and water desalination projects. The trend underscores a shift from off-the-shelf products to tailor-made solutions driven by project-specific requirements.

Emphasis on Water Efficiency and Circular Water Management

With rising awareness of water scarcity and environmental preservation, the UAE is witnessing a steady move toward circular water management practices. This approach focuses on reducing water waste, recycling treated water, and improving overall water use efficiency. In this context, variable frequency drive (VFD) pumps and energy-efficient centrifugal pumps are gaining popularity due to their ability to adjust output based on demand, thus conserving water and power. These technologies are increasingly incorporated in residential developments, commercial buildings, and industrial parks to meet green building certifications and government efficiency targets. As the country enhances its water governance framework, demand for precision-engineered, environmentally compliant pump systems continues to rise.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the primary restraints impacting the UAE water pump market is the high initial cost associated with advanced pumping systems. While smart, solar-powered, and energy-efficient pumps offer long-term operational benefits, their upfront procurement and installation costs can be prohibitive for small- to mid-sized enterprises and residential users. For instance, dewatering pumps equipped with high-efficiency motors and automatic control systems require substantial capital outlay, making them less accessible to smaller players in industries such as construction and mining. Additionally, the need for specialized technicians and periodic maintenance further elevates the total cost of ownership. These financial constraints can delay adoption, particularly in sectors with limited budget flexibility, thereby slowing the overall market growth.

Dependence on Imported Technologies and Components

The UAE’s limited domestic manufacturing capabilities for high-grade water pump components present a challenge to market scalability and supply chain stability. Most technologically advanced pumping systems, especially those used in desalination and oil & gas industries, rely heavily on imports from Europe, North America, and East Asia. This dependence makes the market vulnerable to global supply chain disruptions, fluctuating foreign exchange rates, and extended lead times. Such constraints can hinder the timely execution of large-scale infrastructure projects and affect long-term equipment reliability.

Operational Challenges in Harsh Environments

The UAE’s extreme climatic conditions, characterized by high temperatures, saline groundwater, and sandy terrain, pose operational challenges for water pump systems. Equipment deployed in remote or coastal regions often suffers from accelerated wear and corrosion, leading to frequent breakdowns and shortened service life. This necessitates the use of corrosion-resistant materials and advanced sealing technologies, which further increase the product cost. Ensuring pump reliability under these environmental stresses remains a critical technical hurdle for manufacturers and service providers.

Regulatory and Technical Compliance Complexity

Navigating the evolving regulatory landscape related to water conservation, energy efficiency, and emissions standards adds complexity for manufacturers and end users. Compliance with these standards often requires continuous upgrades in technology and documentation, adding to operational and administrative burdens.

Market Opportunities:

The UAE water pump market presents substantial growth opportunities, driven by the country’s strategic focus on sustainable development, infrastructure expansion, and water security. As urbanization accelerates and new smart city projects take shape across the Emirates, demand for efficient water management systems continues to rise. Water pumps are integral to residential, commercial, and industrial developments, including utilities, transportation networks, and high-rise buildings. With the government investing heavily in large-scale projects such as the Etihad Rail, Dubai South, and Expo City Dubai, the need for reliable and high-performance pumping solutions is expected to increase significantly over the next few years.

Additionally, the UAE’s national sustainability agendas, including the UAE Water Security Strategy 2036 and the Dubai Clean Energy Strategy 2050, are opening new avenues for solar-powered and energy-efficient pump technologies. The growing emphasis on renewable energy integration in rural water supply, agriculture, and remote area development presents a promising market for solar-driven pump systems. Furthermore, increasing investments in desalination and wastewater recycling facilities offer opportunities for high-capacity, corrosion-resistant, and digitally integrated pumps. As the country continues to diversify its economy and reduce its reliance on oil revenues, sectors such as agriculture, manufacturing, and logistics are projected to grow—further boosting the demand for advanced water pumping solutions. Market players that focus on innovation, customization, and sustainability are well-positioned to capitalize on these evolving opportunities.

Market Segmentation Analysis:

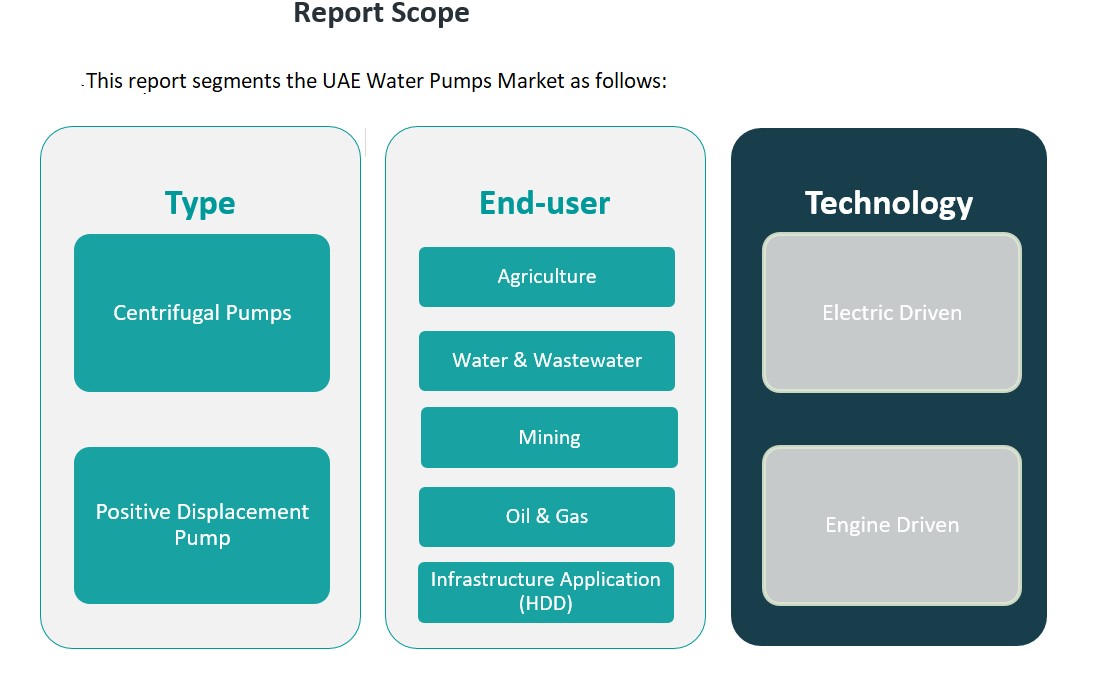

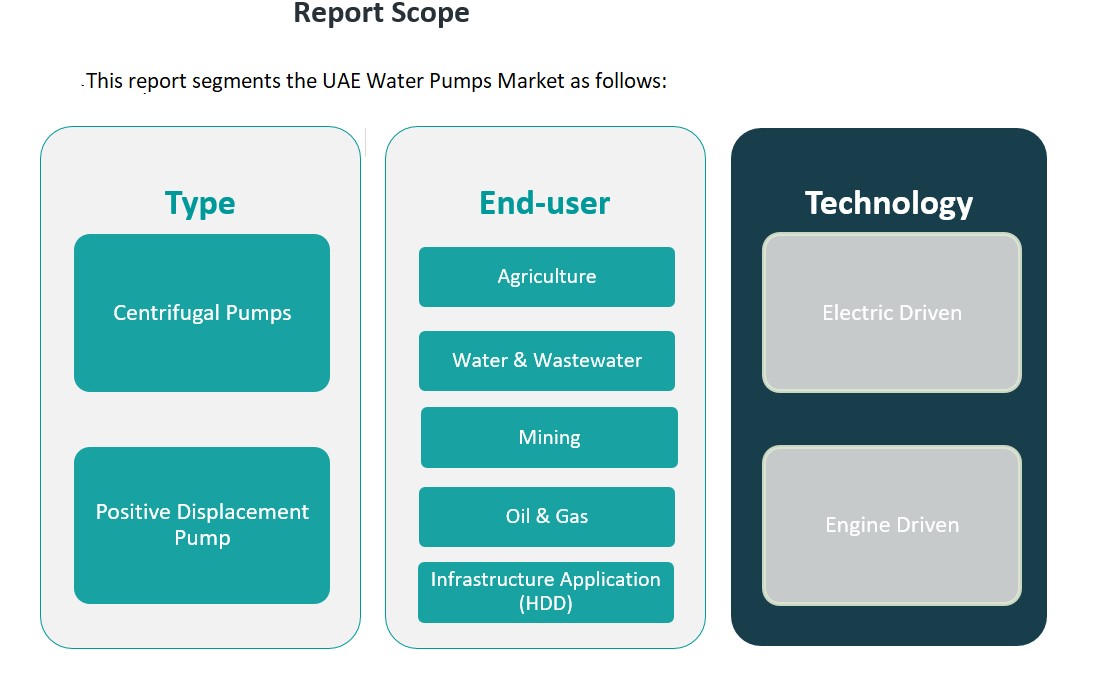

The UAE water pump market is segmented by type, end-user, and technology, each offering unique growth dynamics influenced by national development priorities and industrial demands.

By type segment, centrifugal pumps hold a dominant position due to their high efficiency, relatively low maintenance, and versatility in handling various fluids. These pumps are widely used in municipal water supply, HVAC systems, and commercial infrastructure. Positive displacement pumps, while accounting for a smaller share, are increasingly utilized in high-viscosity and high-pressure applications, particularly in the oil and gas and chemical processing industries, where precise fluid handling is essential.

By end-user, the infrastructure application and water & wastewater segments lead market demand. The infrastructure segment, particularly horizontal directional drilling (HDD) applications, is experiencing steady growth due to ongoing construction and utilities expansion. The water and wastewater sector is also a key consumer, driven by the UAE’s extensive investments in desalination and sewage treatment facilities. The oil and gas industry continues to require advanced pump solutions for fluid transfer and drilling operations, while the agriculture segment is witnessing increased adoption of irrigation pumps aligned with national food security objectives.

By technology segment, electric-driven pumps account for the majority share, favored for their energy efficiency and compatibility with automation systems. However, engine-driven pumps maintain relevance in remote and off-grid locations, particularly in agricultural and emergency scenarios. Together, these segments illustrate the UAE’s diversified demand for water pumping systems tailored to specific industrial, environmental, and energy requirements.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The UAE water pump market exhibits regional variations influenced by each emirate’s economic activities, infrastructure development, and industrial focus. Dubai leads the market, accounting for approximately 35% of the total share. This dominance is driven by its rapid urbanization, numerous high-rise developments, and significant investments in smart city initiatives. The emirate’s extensive construction projects and emphasis on sustainable infrastructure have heightened the demand for advanced water pumping solutions. Abu Dhabi follows closely, contributing around 30% to the market. As the capital, it hosts major desalination plants and oil & gas operations, necessitating robust and high-capacity pumping systems. The government’s focus on water security and infrastructure expansion further bolsters the market in this region.

Sharjah holds a market share of about 15%, with growth propelled by its burgeoning industrial sector and residential developments. The emirate’s initiatives to enhance water treatment facilities and expand its manufacturing base have increased the adoption of efficient water pumps. The northern emirates—Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain—collectively represent the remaining 20% of the market. These regions are witnessing gradual growth due to ongoing infrastructure projects and efforts to improve water management systems. Their strategic focus on tourism and industrial diversification is expected to drive further demand for water pumping solutions. Overall, while Dubai and Abu Dhabi dominate the market, the collective contribution of the other emirates underscores a nationwide emphasis on enhancing water infrastructure and sustainability.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT Inc.

- EBARA Corporation

- Prakash Pump

Competitive Analysis:

The UAE water pump market features a competitive landscape marked by the presence of both international manufacturers and regional suppliers. Leading global companies such as Grundfos, Xylem Inc., Sulzer Ltd., and KSB SE & Co. KGaA dominate the market through their broad product portfolios, technological innovations, and established distribution networks. These firms cater to large-scale infrastructure, desalination, and industrial applications by offering energy-efficient and customized solutions. Regional players also play a significant role by addressing niche demands and providing cost-effective alternatives for residential and agricultural use. The competition is further intensified by growing demand for smart, IoT-enabled pumps and solar-powered technologies, prompting companies to invest in R&D and local partnerships. Additionally, the emphasis on sustainability, regulatory compliance, and after-sales service has become a key differentiator in the market. As the UAE continues to prioritize water security and infrastructure growth, companies that offer advanced, reliable, and efficient pump systems are well-positioned to lead.

Recent Developments:

- In March 2025, Xylem announced its focus on leading the digital transformation of water management in the GCC region, including the UAE. The company is driving advancements in wastewater treatment, desalination, and smart city infrastructure by offering digitally connected pumping solutions.

- Servotech Power Systems Ltd.launched solar pump controllers on October 28, 2024, designed for 2HP to 10HP water pumps. This aligns with initiatives like PM-KUSUM to promote sustainable farming practices through water-efficient solutions.

- Roto Pumps Ltd.announced the launch of its subsidiary, Roto Energy Systems Ltd., in Feb 2024. This new division focuses on solar-powered water pumping solutions, including submersible and surface pumps, catering to eco-friendly water management needs.

- Grundfos’ commitment to the Water Resilience Coalition in March 2025 aligns with the water pump market’s focus on sustainability and efficient water management. The coalition’s goals include measurable improvements in global water sustainability by 2030.

- On February 28, 2025, KSB launched the MultiTec Plus pump series, specifically optimized for drinking water transport. This product integrates energy-saving technologies and real-time monitoring capabilities, emphasizing advancements in smart and sustainable water pumping solutions.

Market Concentration & Characteristics:

The UAE water pump market exhibits moderate to high market concentration, with a few key global players controlling a significant share, particularly in industrial and municipal segments. Companies such as Grundfos, Xylem, and KSB maintain strong brand presence and customer loyalty through advanced technologies, energy-efficient solutions, and reliable service networks. These players dominate high-value projects, including desalination plants, wastewater treatment facilities, and oil & gas infrastructure. The market is also characterized by the presence of regional and niche manufacturers who compete on pricing and customization in segments like residential and agriculture. The market is technology-driven, with growing adoption of smart pumps, variable frequency drives, and solar-powered systems. Demand is strongly influenced by infrastructure development, regulatory standards, and sustainability goals. While procurement decisions are typically project-based, long-term contracts and maintenance services contribute to customer retention. The need for durable, energy-efficient, and environment-compliant solutions defines the core characteristics of the UAE water pump market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased infrastructure investments will continue to drive demand for advanced water pumping systems across residential and commercial developments.

- Adoption of smart pump technologies will expand, supported by national digital transformation initiatives.

- Renewable energy integration, particularly solar-powered pumps, will gain momentum in agricultural and off-grid applications.

- Desalination and wastewater treatment projects will generate consistent demand for high-capacity, corrosion-resistant pumps.

- Industrial growth in sectors such as oil & gas, manufacturing, and power generation will spur demand for customized and durable pump solutions.

- Government-led sustainability goals will accelerate the transition to energy-efficient and environmentally compliant pumping systems.

- The rising importance of water reuse and conservation will boost investment in intelligent water management infrastructure.

- Technological advancements will create opportunities for IoT-enabled predictive maintenance and automation in pump systems.

- Market competition will intensify as regional suppliers innovate to meet specific local requirements and price-sensitive segments.

- Continued economic diversification and urban development will ensure long-term growth across all major emirates.