Market Overview:

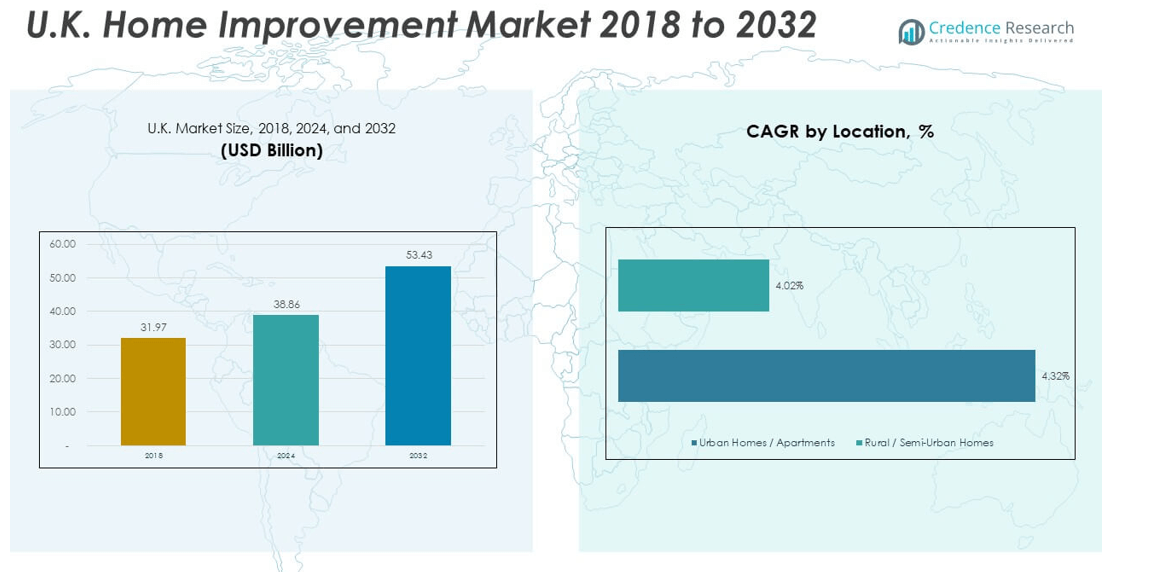

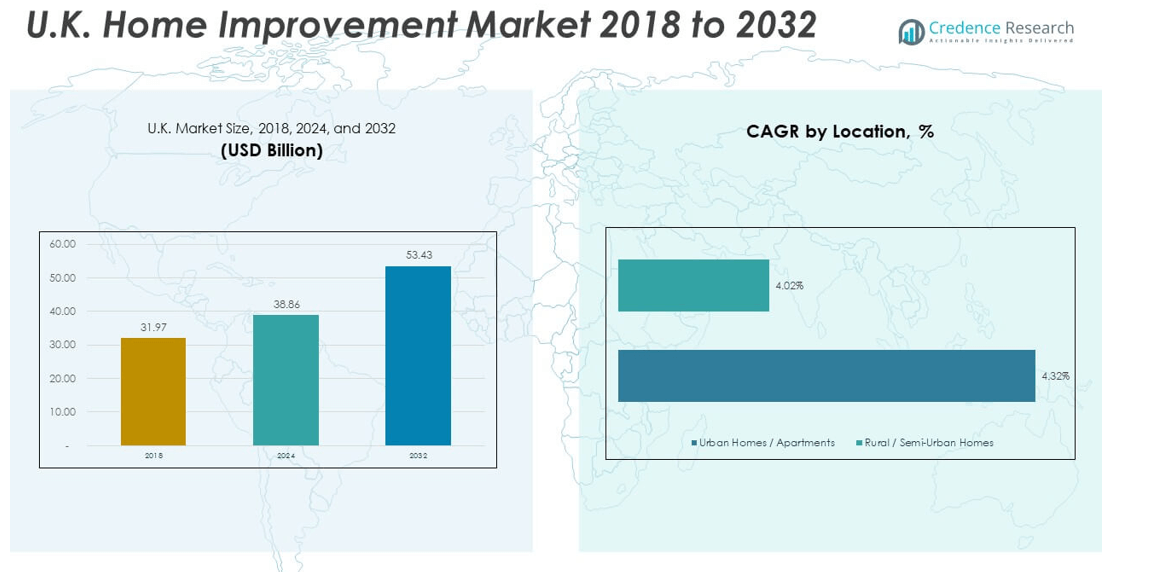

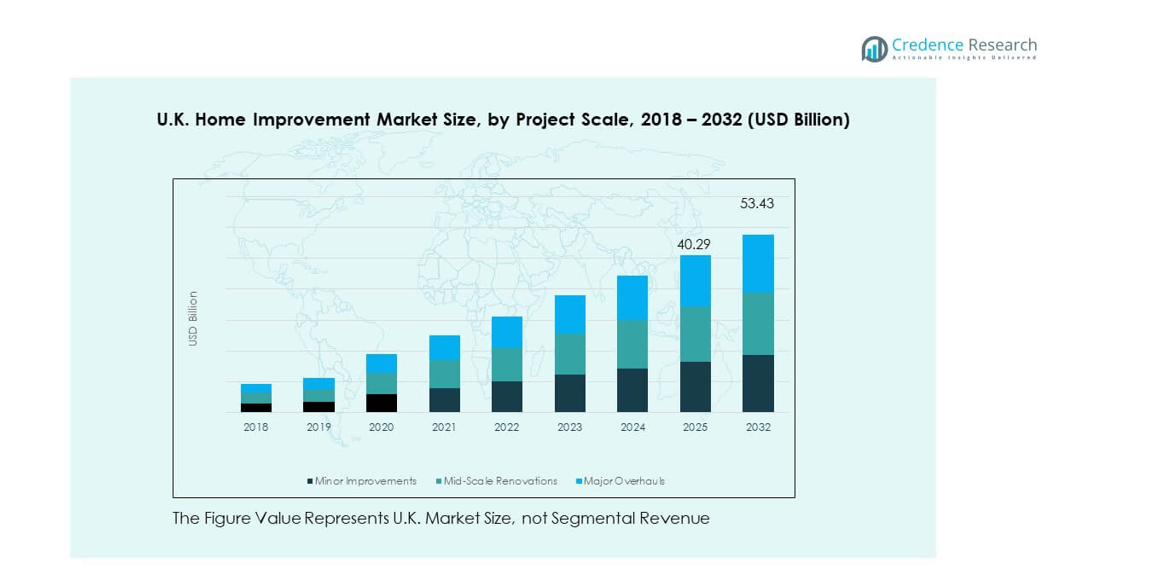

The U.K. Home Improvement Market size was valued at USD 31.97 billion in 2018, rose to USD 38.86 billion in 2024, and is anticipated to reach USD 53.43 billion by 2032, at a CAGR of 4.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Home Improvement Market Size 2024 |

USD 38.86 billion |

| U.K. Home Improvement Market CAGR |

4.04% |

| U.K. Home Improvement Market Size 2032 |

USD 53.43 billion |

Strong home‑renovation sentiment in the U.K. is fuelled by homeowners choosing to upgrade rather than relocate, especially as existing housing stock ages and interest rates remain high. Energy‑efficiency upgrades, smart‑home systems and interior redesigns are now central spending areas, with consumers actively investing in their living environments. The momentum is also driven by broader lifestyle shifts — remote working, increased time at home and rising preference for personalised spaces.

Geographically, the market is led by England’s major regions—London and the South East are dominant due to higher property values and renovation budgets. In contrast, Scotland, Wales and the North West are emerging segments, gaining traction as affordability improves and regional investment increases. As property‑age issues and upgrade demand extend beyond urban pockets, smaller towns and suburban areas across the U.K. are becoming growth hotspots.

Market Insights:

- The U.K. Home Improvement Market was valued at USD 31.97 billion in 2018 and is projected to reach USD 53.43 billion by 2032, growing at a CAGR of 4.04%.

- South England holds the largest share in the U.K. Home Improvement Market, contributing to its premium demand for luxury home improvements. North England and the Midlands follow with notable shares, driven by urbanization and regional property upgrades.

- The fastest-growing region is North England, with its significant demand for mid-scale renovations and residential expansions, driven by rising property prices and increased homeownership.

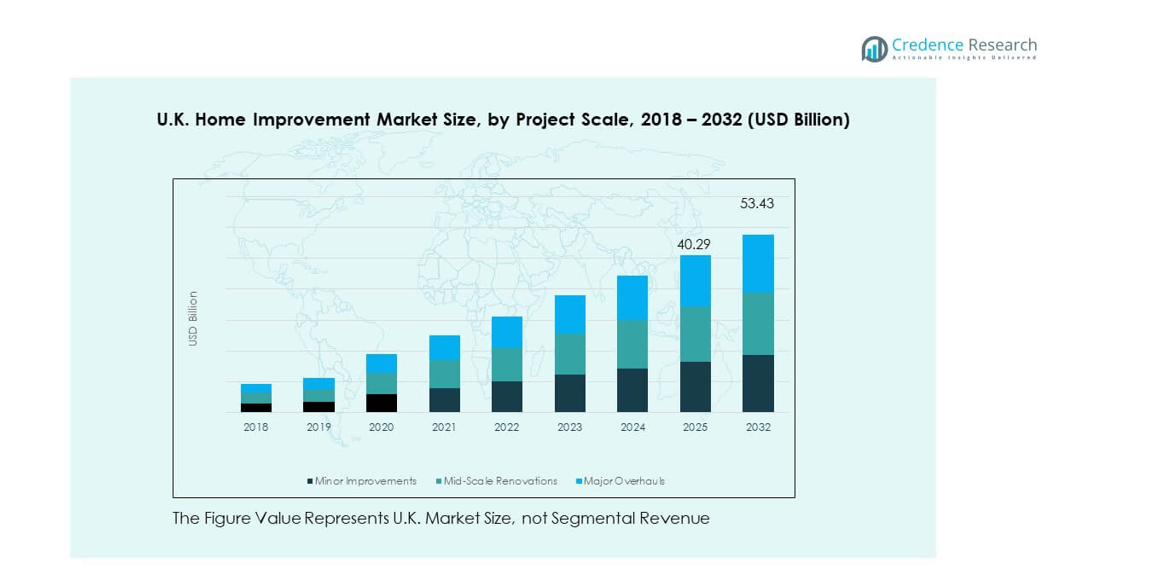

- In 2024, minor improvements held the largest share in the U.K. Home Improvement Market at 47%, followed by mid-scale renovations at 39%. Major overhauls accounted for 14%.

- By 2032, minor improvements will continue to dominate the market, making up 40%, followed by mid-scale renovations at 38% and major overhauls at 22%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increased Homeownership and Renovation Sentiment

The U.K. Home Improvement Market has been significantly driven by increased homeownership. Many homeowners are investing in improving their properties instead of moving, particularly in the face of rising property prices. Renovations, energy-efficient upgrades, and technological advancements have become central to homeowners’ decisions. With the aging housing stock and higher costs of relocation, renovation offers a cost-effective solution for property owners. Renovations also enhance property value, making it a beneficial long-term investment. This trend reflects the growing commitment to enhancing one’s home environment.

- For instance, Kingfisher — owner of B&Q and Screwfix — reported that in the U.K. and Ireland its sales growth in the quarter included a 32 % year‑on‑year rise in B&Q’s e‑commerce channel, which accounted for 12.9 % of its total revenues.

Growing Demand for Energy-Efficient Solutions

The growing focus on sustainability and energy efficiency has pushed the demand for eco-friendly home improvements. Consumers in the U.K. are increasingly opting for energy-efficient systems like insulation, solar panels, and energy-saving appliances. With rising energy costs, U.K. homeowners seek solutions that will lower utility bills and reduce their carbon footprints. The government’s initiatives, such as grants for energy-efficient home upgrades, support this shift. This focus on sustainability contributes to a growing awareness of long-term savings and environmental benefits.

- For instance, official UK government statistics show that as of February 2024 there were 1,468,652 solar PV installations across the U.K. with a capacity of approximately 15.8 GW.

Impact of Changing Lifestyles and Work-from-Home Trend

The COVID-19 pandemic has accelerated the shift towards remote working, further driving the demand for home improvements. People are spending more time at home, creating a need for multifunctional spaces that support both work and leisure. This shift has led to increased investments in home offices, soundproofing, and home entertainment systems. The U.K. Home Improvement Market has seen a rise in demand for home upgrades that accommodate these new lifestyle changes, such as enhanced connectivity and workspace optimization.

Technological Integration in Home Improvements

Smart home technologies are becoming a core component of the U.K. Home Improvement Market. Consumers are integrating smart devices for convenience, security, and energy management. The market sees an increasing adoption of home automation systems, such as smart thermostats, lighting, and security cameras. This growing demand for smart technologies is driven by the convenience they offer and the added value they bring to properties. The U.K. market is seeing a shift toward more connected homes, fostering further investment in these systems.

Market Trends:

Rising Popularity of DIY Projects and Home Improvements

The DIY trend continues to gain momentum in the U.K. Home Improvement Market, with consumers more willing to take on home projects themselves. Many homeowners are choosing to renovate their properties rather than hire professionals for certain tasks. This trend is driven by a desire to save costs and a growing sense of confidence in tackling home improvement projects. The availability of online resources and tutorials has made it easier for people to engage in DIY projects, leading to an increase in home improvements across the country. DIY products, from tools to materials, continue to see strong demand.

- For instance, Kingfisher reported that in its financial year to 31 January 2024, its total Group e-commerce sales were up 6.4%. E-commerce sales penetration reached 17.4% for the year, supported by strong marketplace sales growth at B&Q.

Emphasis on Sustainability and Green Building Materials

The U.K. Home Improvement Market is increasingly focusing on sustainability, with more consumers choosing eco-friendly materials. There is a growing demand for sustainable building products, such as recycled materials, natural paints, and low-VOC finishes. This trend aligns with the broader global push for greener construction practices. Consumers are becoming more aware of the environmental impact of their purchases and are seeking materials that have a lower carbon footprint. This shift toward sustainability is shaping the products and services offered within the market, from energy-efficient appliances to eco-conscious home improvement materials.

- For instance, there is a growing demand for recycled materials, natural paints, and low-VOC finishes. Consumers are becoming more aware of the environmental impact of their purchases and seek materials with a lower carbon footprint. This shift towards sustainability is shaping the products and services offered within the market.

Increasing Popularity of Modular and Prefabricated Homes

Modular and prefabricated homes are gaining popularity in the U.K. Home Improvement Market due to their efficiency and cost-effectiveness. These homes, which are assembled in sections and then transported to the site, offer homeowners a faster and more affordable way to build or renovate. The flexibility of modular homes appeals to those looking for a quick housing solution or affordable expansions. The U.K. market is expected to see continued growth in the adoption of modular homes as they provide high-quality construction at a fraction of the cost and time of traditional building methods.

Home Automation and Smart Home Integration

Smart home integration is a key trend within the U.K. Home Improvement Market, with more homeowners opting for home automation systems. Smart thermostats, lighting, and security devices are transforming how people interact with their homes. These systems offer enhanced control over home environments, energy management, and security. As technological advancements continue to make these devices more affordable and accessible, the demand for smart home upgrades is expected to rise. The increasing interest in home automation highlights a significant shift toward creating more connected, efficient, and secure living spaces.

Market Challenges Analysis:

High Renovation Costs and Supply Chain Issues

The U.K. Home Improvement Market faces challenges related to rising renovation costs, partly due to inflation and disruptions in the supply chain. The cost of construction materials has risen significantly, leading to higher prices for renovation projects. This price hike makes it harder for homeowners to afford extensive improvements, especially during economic uncertainty. Additionally, supply chain disruptions have resulted in delays and shortages of key materials. The market must navigate these issues to maintain steady growth and accommodate demand for home improvements.

Skilled Labor Shortage and Project Delays

The shortage of skilled labor in the U.K. construction industry continues to challenge the home improvement sector. There is a significant gap in tradespeople such as electricians, carpenters, and builders, which results in delays and increased costs for projects. Many homeowners experience difficulties in securing qualified professionals for specialized work, leading to longer wait times. This shortage puts pressure on companies to train more workers and find solutions to mitigate delays. It also increases costs for services, making home improvements less affordable for certain consumers.

Market Opportunities:

Technological Innovation and Smart Home Solutions

The growing adoption of smart home technologies presents a key opportunity for the U.K. Home Improvement Market. As more homeowners seek to integrate automation into their living spaces, companies that specialize in smart technologies have significant growth potential. Products such as smart thermostats, lighting systems, and home security solutions are increasingly popular, driving demand for upgrades. This trend creates an opportunity for companies to innovate and offer new, cutting-edge solutions that improve convenience, efficiency, and security for homeowners across the country.

Sustainability-Driven Growth in Eco-Friendly Renovations

There is a clear market opportunity for businesses focusing on eco-friendly renovations and sustainable materials. With increasing awareness of climate change and energy efficiency, consumers are more willing to invest in green home improvements. Businesses can capitalize on this trend by offering energy-efficient products, such as solar panels, eco-friendly insulation, and green building materials. As government policies continue to promote sustainability, companies involved in providing eco-friendly solutions are well-positioned to capture the growing demand for environmentally-conscious home improvements.

Market Segmentation Analysis:

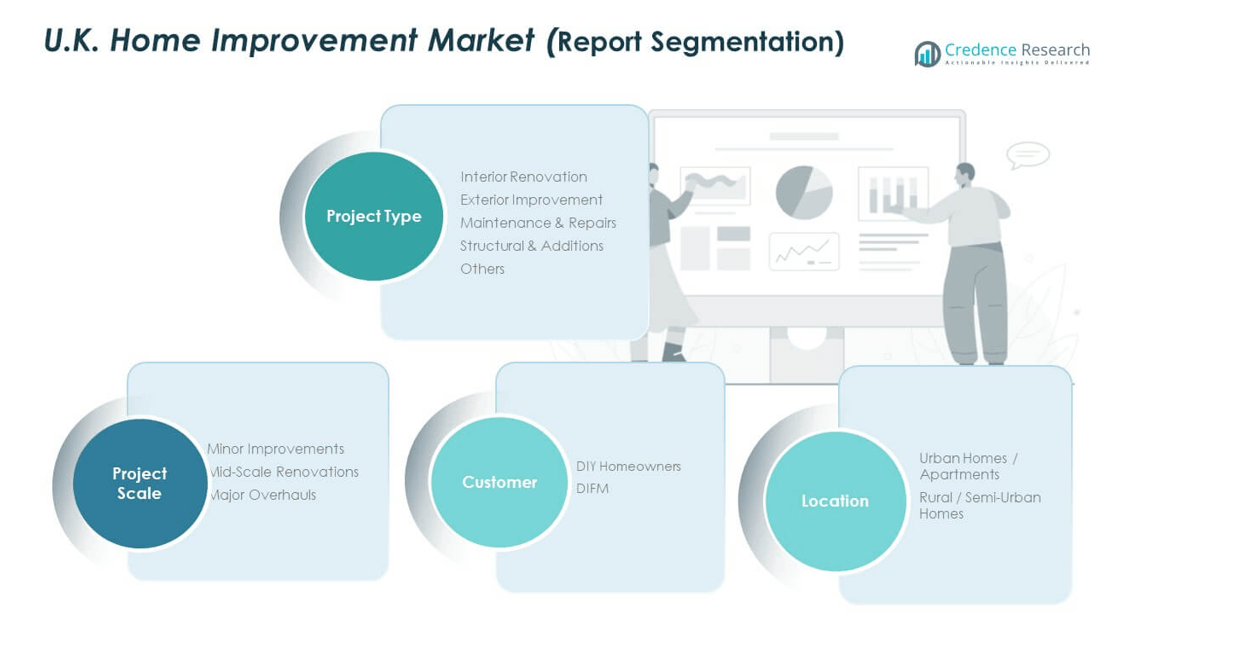

BY PROJECT TYPE

The U.K. Home Improvement Market is characterized by several key project types. Interior renovations, including kitchen and bathroom upgrades, dominate due to the growing trend of creating personalized, functional living spaces. Exterior improvements, such as roof repairs, landscaping, and façade upgrades, remain popular, driven by increasing home value expectations. Maintenance and repairs make up a significant portion as homeowners focus on preserving their properties’ structural integrity. Structural additions, like room extensions and loft conversions, cater to the demand for more space. Other types of projects include energy-efficient upgrades and eco-friendly home improvements, gaining traction among environmentally conscious consumers.

- For instance, Kingfisher said that strong demand for its seasonal ranges contributed to its performance in the UK, with the group claiming market share gains.

BY PROJECT SCALE

Project scale in the U.K. Home Improvement Market varies from minor improvements, such as painting and small repairs, to larger renovations. Mid-scale renovations, such as kitchen or bathroom makeovers, represent a substantial segment due to their ability to significantly enhance a property’s value and appeal. Major overhauls, involving complete property remodels or extensions, are typically more capital-intensive but continue to thrive as homeowners seek more substantial changes.

BY CUSTOMER TYPE

The market is divided between DIY homeowners and DIFM (Do It For Me) customers. DIY homeowners are increasingly involved in minor projects, driven by cost savings and the availability of online resources. On the other hand, DIFM customers prefer professional services for larger, more complex renovations. This segment reflects the growing demand for specialized expertise, as many consumers seek high-quality results and professional assurance in their home improvement projects.

Segmentation:

BY PROJECT TYPE

- Interior Renovation

- Exterior Improvement

- Maintenance & Repairs

- Structural & Additions

- Others

BY PROJECT SCALE

- Minor Improvements

- Mid-Scale Renovations

- Major Overhauls

BY CUSTOMER TYPE

- DIY Homeowners

- DIFM (Do It For Me)

BY LOCATION

- Urban Homes / Apartments

- Rural / Semi-Urban Homes

COMPANY PROFILES

- Refresh Renovations UK

- Company Overview

- Project Type Portfolio

- Financial Overview

- Recent Developments

- Growth Strategy

- SWOT Analysis

- Belfor

- Coit Services, Inc.

- Crane Renovation Group

- DKI Ventures, LLC

- Anglian Home Improvements

- Masco Corporation

- HHI

- Watsco, Inc.

- Other Key Players

Regional Analysis:

North England

North England represents a significant portion of the U.K. Home Improvement Market, contributing about 30% to the overall market share. Key cities like Manchester, Leeds, and Liverpool are driving growth, with a strong demand for both interior and exterior renovations. Property owners in this region are increasingly opting for home extensions, loft conversions, and kitchen refurbishments. The relatively lower property prices in comparison to the South make home renovations a more cost-effective option for homeowners looking to increase property value. As the region continues to urbanize, the demand for modernized homes and sustainable renovations grows steadily.

South England

South England holds the largest market share, accounting for around 40% of the U.K. Home Improvement Market. The region’s higher property values, particularly in London and the South East, contribute to the demand for luxury home improvements and premium renovations. Homeowners are focusing on high-end interior renovations, energy-efficient upgrades, and high-performance home automation systems. The trend toward investing in home improvements rather than relocating drives consistent market growth in this region. Increased demand for energy-efficient solutions and eco-friendly building materials also plays a key role in shaping market dynamics in South England.

Midlands and Wales

The Midlands and Wales region contributes approximately 20% to the U.K. Home Improvement Market share. This region experiences steady growth, with a rising preference for both minor improvements and mid-scale renovations. The market is supported by homeowners upgrading older properties and adapting homes to modern standards. The demand for maintenance and repairs is strong, particularly in rural areas where older homes require regular upkeep. In recent years, there has been a growing interest in sustainable renovations, especially in urban areas like Birmingham and Cardiff. The region’s potential for future growth is significant as local property values rise and consumer awareness of eco-friendly solutions increases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Refresh Renovations UK

- Belfor

- Coit Services, Inc.

- Crane Renovation Group

- DKI Ventures, LLC

- Anglian Home Improvements

- Masco Corporation

- HHI

- Watsco, Inc.

Competitive Analysis:

The U.K. Home Improvement Market is highly competitive, with numerous key players vying for market share across various segments. Leading companies focus on expanding their service offerings, including eco-friendly home improvements, energy-efficient solutions, and advanced home automation systems. Many players, such as Anglian Home Improvements and Refresh Renovations UK, leverage their established brands to attract homeowners seeking reliable and high-quality renovations. Strategic investments in technology, coupled with strong customer service, are key differentiators in the market. The growing demand for home extensions, energy-efficient upgrades, and smart home devices continues to intensify competition. As property values rise, more businesses enter the market, expanding the range of services and products available. Industry leaders focus on sustainability, innovation, and offering tailored solutions to meet the evolving needs of homeowners.

Recent Developments:

- In September 2025, Refresh Renovations expanded its U.K. leadership and franchise network when Reza Rad joined the company as a Renovation Consultant and Franchise Owner for Surrey. Rad brought over three decades of international expertise in construction, project management, and high-end property development to the role, demonstrating the company’s continued growth strategy in the U.K. market.

- Belfor Franchise Group completed a significant strategic acquisition in May 2024, when it acquired JUNKCO+, a junk removal and demolition service franchise. This acquisition expanded Belfor’s portfolio of residential and commercial service brands, adding junk removal and demolition services to its existing family of 14 service-based franchise opportunities.

Report Coverage:

The research report offers an in-depth analysis based on by product type, by project scale and customer type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased demand for sustainable and eco-friendly home improvements will drive market growth.

- The adoption of smart home technologies will continue to enhance home automation solutions.

- Demand for home extensions and conversions will rise as homeowners seek to maximize living space.

- Energy-efficient home improvements will remain a priority due to rising energy costs.

- More home improvement businesses will focus on personalized renovation solutions to meet specific customer needs.

- Digital platforms for home renovation services will see greater integration to facilitate customer engagement.

- DIY trends will continue to grow, especially for minor renovations and maintenance.

- Regional market expansion will occur, especially in Northern and Midlands areas.

- Competition in the market will intensify as companies invest in innovative products and services.

- Rising property values in urban areas will continue to support the demand for premium home improvements.