Market Overview:

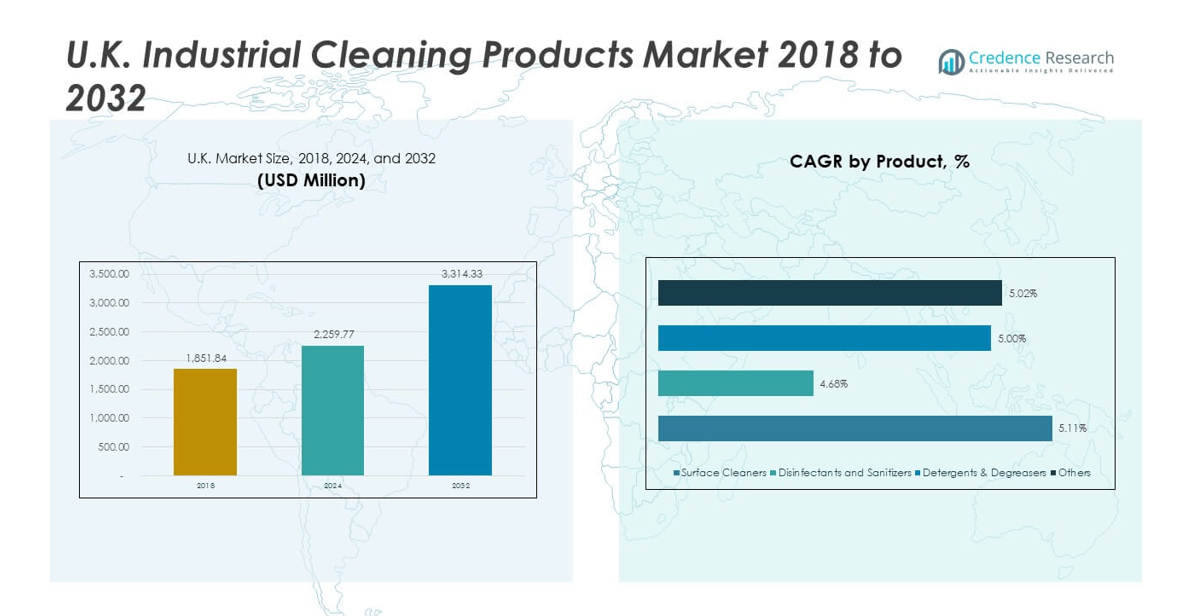

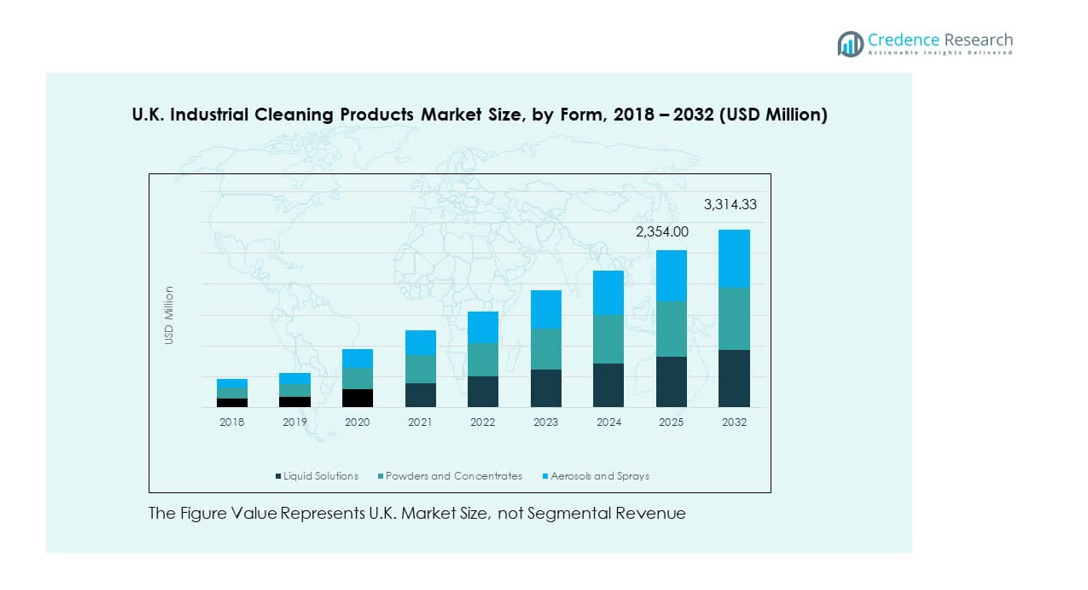

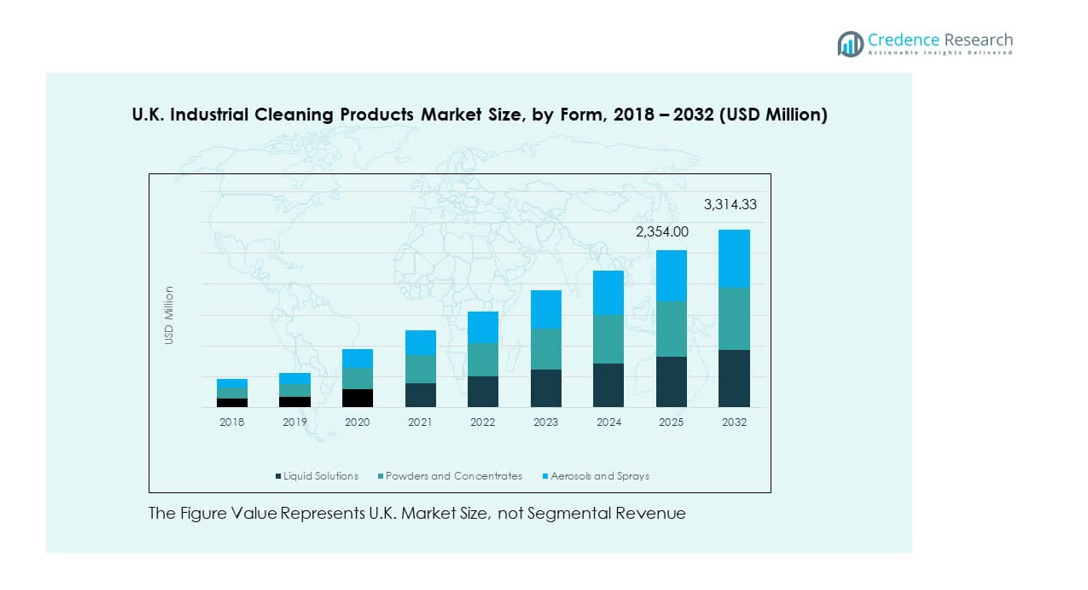

The U.K. Industrial Cleaning Products Market size was valued at USD 1,851.84 million in 2018 to USD 2,259.77 million in 2024 and is anticipated to reach USD 3,314.33 million by 2032, at a CAGR of 4.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Industrial Cleaning Products Market Size 2024 |

USD 2,259.77 million |

| U.K. Industrial Cleaning Products Market, CAGR |

4.90% |

| U.K. Industrial Cleaning Products Market Size 2032 |

USD 3,314.33 million |

The growth of the U.K. Industrial Cleaning Products Market is driven by the increasing demand for hygiene and safety across various industrial sectors. Stricter regulations and a focus on workplace cleanliness are pushing industries, particularly in manufacturing and food processing, to adopt advanced cleaning solutions. Additionally, technological innovations and the rising preference for eco-friendly cleaning products are further driving market growth.

In terms of regional dynamics, England and Wales lead the U.K. Industrial Cleaning Products Market, driven by their large industrial base, particularly in manufacturing and food sectors. Scotland and Northern Ireland are emerging markets, with increased demand driven by the expansion of industries such as energy, manufacturing, and food processing. The growing emphasis on sustainability and regulatory compliance in these regions is further contributing to their market relevance.

Market Insights

- The U.K. Industrial Cleaning Products Market was valued at USD 1,851.84 million in 2018, is projected to reach USD 2,259.77 million in 2024, and is expected to grow to USD 3,314.33 million by 2032, with a CAGR of 4.90% during the forecast period.

- England and Wales dominate the U.K. Industrial Cleaning Products Market, accounting for the largest share, driven by a robust industrial base and manufacturing sectors. Scotland and Northern Ireland are also key regions, with emerging demand fueled by sectors like energy and food processing.

- The fastest-growing region in the U.K. Industrial Cleaning Products Market is Northern Ireland, driven by its expanding food processing industry and increasing focus on sustainability and regulatory compliance.

- Liquid solutions hold the largest share of the market at approximately 60%, followed by powders and concentrates at around 25%, and aerosols and sprays, which make up the remaining 15%. This distribution highlights the wide adoption of liquid-based solutions in industrial cleaning.

- The U.K. Industrial Cleaning Products Market sees strong demand across multiple sectors, with surface cleaners holding the largest segment share at around 40%, followed by disinfectants and sanitizers, which account for approximately 35%. These categories are critical for maintaining hygiene and regulatory compliance in industrial environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Demand for Cleaner and Safer Work Environments

The increasing emphasis on safety and hygiene in industrial workplaces drives the U.K. Industrial Cleaning Products Market. Industries are focusing more on maintaining clean and sanitary environments to meet health and safety regulations. This trend is particularly strong in manufacturing and food processing sectors, where stringent hygiene standards must be upheld. It pushes demand for effective cleaning products designed to handle heavy-duty tasks and meet specific industry needs. With these regulations becoming stricter, businesses are compelled to invest in industrial cleaning solutions that can deliver superior results.

Technological Advancements in Cleaning Solutions

The introduction of advanced cleaning technologies also boosts the market. Companies in the U.K. are increasingly using automated cleaning equipment and high-efficiency detergents. These innovations help improve cleaning efficiency while reducing manual labor and associated costs. For instance, automated floor scrubbers and smart disinfecting systems are gaining popularity for their ability to cover large areas quickly. The continuous development of products designed for specific industrial tasks also ensures that the U.K. Industrial Cleaning Products Market remains dynamic and adaptable.

- For instance, Kärcher’s B 250 R ride-on scrubber drier is validated by technical and field data to deliver a maximum theoretical cleaning capacity of 8,000 square meters per hour with a 1000 mm brush width and 250-liter water tank. The model is used by U.K. facilities for routine cleaning where performance figures are confirmed by manufacturer specifications and customer records.

Growth in Industrial and Manufacturing Sectors

Growth in the industrial and manufacturing sectors fuels the demand for industrial cleaning products. As industries expand their operations, the need for cleaning solutions to manage machinery, workspaces, and production lines grows. Industrial cleaning products are crucial in preventing downtime, ensuring smooth operations, and extending the lifespan of equipment. The expansion of these sectors, particularly in the automotive, pharmaceuticals, and construction industries, results in higher consumption of cleaning products.

- For instance, Taski’s Diversey cleaning solutions, such as the Taski R7, are referenced as standard choices in maintenance protocols across U.K. industrial contracts, with official tender documents and railway maintenance records directly citing Taski-branded chemical concentrates and daily usage rates as industry benchmarks for downtime prevention and workspace hygiene.

Increasing Focus on Sustainability and Eco-Friendly Solutions

There is a growing shift towards eco-friendly and sustainable cleaning products in the U.K. Industrial Cleaning Products Market. Businesses are becoming more conscious of the environmental impact of their operations, including the cleaning agents they use. Consumers and regulatory bodies are demanding more sustainable alternatives, prompting companies to formulate products that are biodegradable, non-toxic, and reduce harmful emissions. This trend aligns with the broader push for corporate social responsibility and is likely to accelerate in the coming years.

Market Trends:

Rise of Green and Sustainable Cleaning Products

The shift toward environmentally friendly cleaning solutions is a key trend in the U.K. Industrial Cleaning Products Market. Consumers and businesses are prioritizing products made with natural or biodegradable ingredients that minimize environmental damage. These eco-friendly alternatives are becoming a must-have in the industrial sector, driven by heightened awareness of sustainability. Innovations in plant-based and non-toxic ingredients allow for the creation of effective cleaning products that do not compromise safety or performance, attracting a growing customer base.

- For instance, Biovate Hygienics became the first UK manufacturer to achieve Ecocert Ecodetergent certification for its range of commercial natural cleaning products in September 2024, meeting one of the world’s most stringent criteria for organic and sustainable cleaning solutions.

Integration of Smart Cleaning Technologies

Smart cleaning technologies are revolutionizing the U.K. Industrial Cleaning Products Market. The integration of Internet of Things (IoT) systems and AI-driven cleaning solutions helps businesses improve efficiency and optimize their cleaning schedules. These technologies provide real-time monitoring, automated adjustments, and predictive maintenance to reduce manual intervention. Industrial robots and automated cleaning systems are also increasingly common in large facilities, further boosting productivity while maintaining high cleaning standards.

- For instance, ISS Facility Services in the UK deployed Internet of Things (IoT) sensors and robotic floor cleaning machines at large client facilities (over 300,000 square feet), using software to tie performance data together and optimize cleaning schedules, which is now a standard service model for major contracts as of 2024.

Personalized Cleaning Solutions

The U.K. Industrial Cleaning Products Market is seeing an increasing demand for tailored cleaning products to meet the specific needs of different industries. Businesses are looking for solutions that address their unique operational challenges, such as high-traffic areas, contamination risks, and sensitive machinery. Companies are offering specialized formulations designed to cater to the diverse needs of various sectors, from food processing to pharmaceuticals, enhancing market growth. This trend is expected to lead to more customizable and industry-specific cleaning solutions.

Adoption of Digital Sales Channels

Digital platforms are reshaping the way businesses in the U.K. purchase industrial cleaning products. E-commerce has become a significant sales channel, providing convenience and accessibility for companies to order supplies online. The ease of access to product information, reviews, and comparison tools online is contributing to this shift. Many businesses now prefer buying cleaning products from e-commerce platforms due to the fast delivery and often better pricing. This trend is expected to continue, with more manufacturers and retailers focusing on online sales strategies.

Market Challenges Analysis:

High Cost of Specialized Cleaning Products

The U.K. Industrial Cleaning Products Market faces the challenge of the high cost associated with specialized cleaning products. These solutions often require advanced ingredients or technology, making them more expensive than conventional options. Small and medium-sized enterprises (SMEs) may struggle with the high upfront costs, limiting their ability to invest in premium cleaning solutions. The high cost of sustainable and eco-friendly cleaning products also contributes to this challenge, particularly for businesses operating on tight budgets.

Regulatory Compliance and Industry Standards

Strict regulatory compliance and industry standards present a significant challenge in the U.K. Industrial Cleaning Products Market. Businesses are under constant pressure to meet stringent environmental and safety regulations, which can lead to high costs in terms of product development and certification. Products must comply with a range of regulations, including chemical safety, environmental impact, and worker safety standards. These requirements can be cumbersome and costly for manufacturers, limiting the market’s ability to rapidly introduce new products.

Market Opportunities:

Growth in Food Processing Industry

The food processing sector offers significant growth opportunities for the U.K. Industrial Cleaning Products Market. With stringent hygiene standards and safety regulations in food manufacturing plants, the demand for specialized cleaning products continues to rise. These products play a crucial role in ensuring food safety, preventing contamination, and maintaining hygiene in processing environments. As the food industry in the U.K. grows, so will the need for effective and reliable cleaning solutions that meet regulatory requirements.

Expansion of the Healthcare and Pharmaceutical Sectors

The U.K. Industrial Cleaning Products Market is also seeing opportunities in the healthcare and pharmaceutical sectors. These industries require high levels of cleanliness to maintain sterile environments and ensure the safety of their products. Cleaning products that meet the rigorous standards of hospitals, laboratories, and pharmaceutical facilities are in high demand. As these sectors continue to expand and innovate, there will be growing opportunities for industrial cleaning companies to provide tailored solutions that cater to these specialized needs.

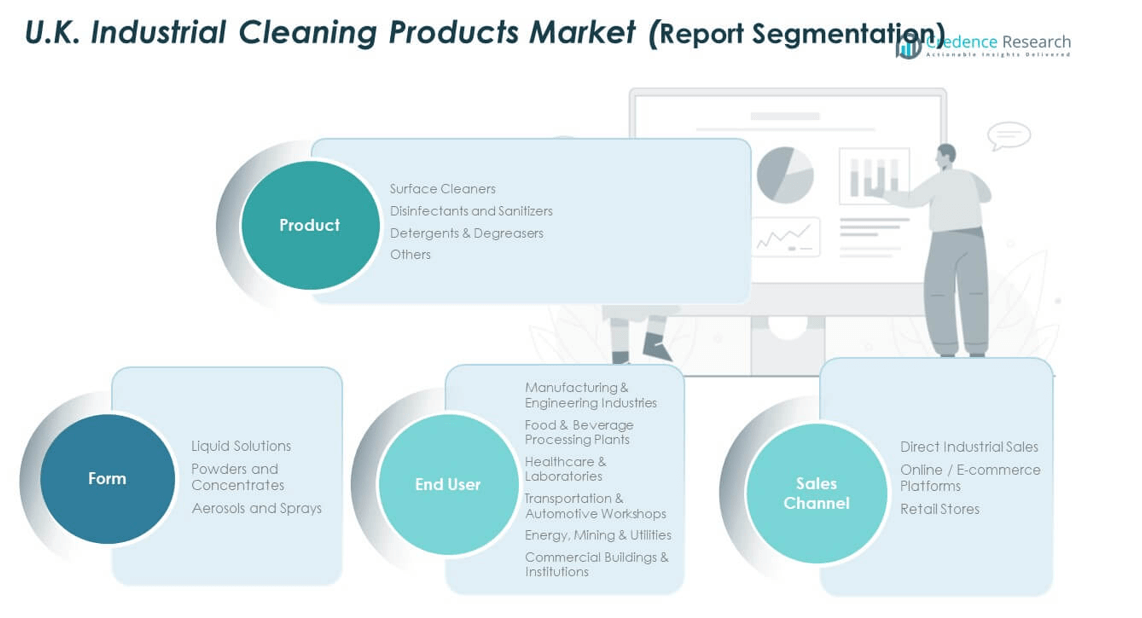

Market Segmentation Analysis:

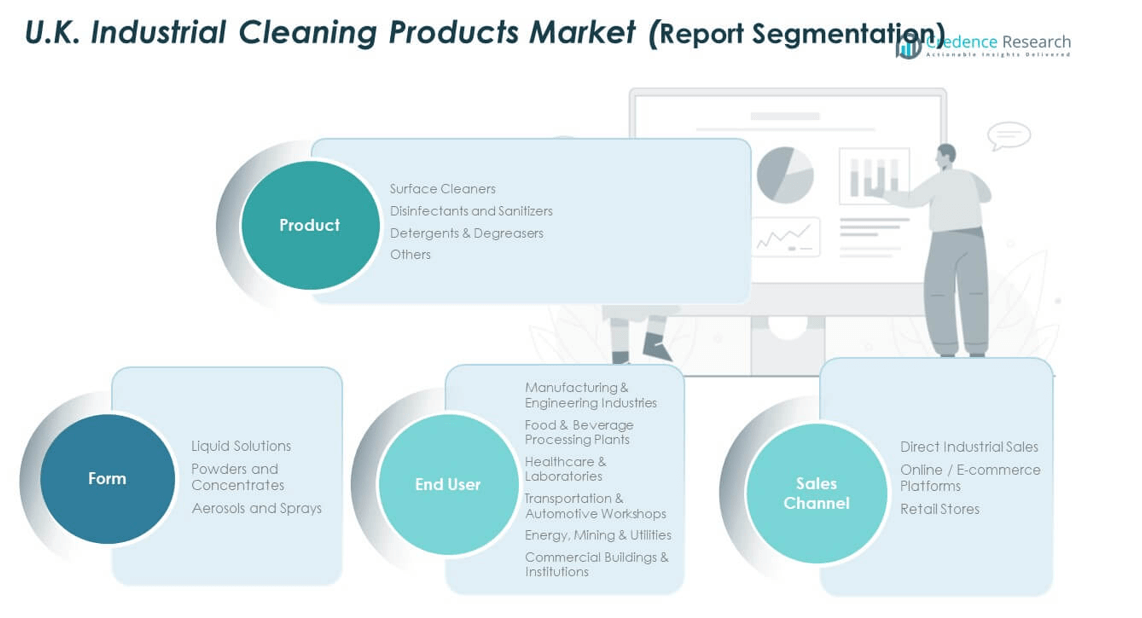

By Product Type

The U.K. Industrial Cleaning Products Market is divided into several product categories, each catering to specific industrial cleaning needs. Surface cleaners dominate the market as they are essential for maintaining cleanliness in all types of industrial settings. Disinfectants and sanitizers also see high demand, especially in food processing and healthcare industries where hygiene is critical. Detergents and degreasers are used primarily in the manufacturing sector to remove oils and other residues. Other products such as polishes and deodorizers contribute to market growth, addressing niche cleaning needs.

- For example, Scott Bader UK’s Ambimization® polishes have been recognized for their significant environmental impact, achieving a substantial reduction in VOC emissions and production waste, as confirmed by the company’s official technical documentation and industry awards.

By Form

In terms of product form, the U.K. Industrial Cleaning Products Market features liquid solutions, powders and concentrates, and aerosols and sprays. Liquid solutions are the most commonly used due to their versatility and ease of application across various sectors. Powders and concentrates are gaining popularity for their cost-effectiveness, allowing businesses to dilute the product according to their needs. Aerosols and sprays are also increasingly used in applications requiring precision and easy handling, such as in small machinery or hard-to-reach areas.

By End User

The market serves a diverse range of end-users, including manufacturing and engineering industries, food and beverage processing plants, healthcare and laboratories, transportation and automotive workshops, energy, mining, and utilities, and commercial buildings and institutions. Manufacturing industries are the largest consumers, requiring industrial cleaning products to maintain equipment and production lines. The food and beverage sector follows closely, driven by the need to comply with strict hygiene regulations. Healthcare and laboratory settings also require specialized cleaning solutions to maintain sterile environments.

- For instance, Bunzl Cleaning & Hygiene’s implementation of smart flow-meter dispensers across “260 NHS Trust sites resulted in concentrate overspend cuts totaling approximately US$1.4 million annually,” according to NHS Trust procurement audits and Bunzl’s publicly available case studies and sustainability reports for 2024-2025.

By Sales Channel

The sales channels for industrial cleaning products in the U.K. include direct industrial sales, online platforms, and retail stores. Direct industrial sales remain the most common method for large-scale procurement, especially for manufacturing plants and large facilities. Online platforms are growing rapidly, offering businesses the convenience of purchasing products quickly and at competitive prices. Retail stores also play a role, particularly for smaller businesses and institutions that require smaller quantities or more frequent purchases. These diverse sales channels ensure widespread availability and accessibility of cleaning products across the market.

Segmentation

By Product Type

- Surface Cleaners

- Disinfectants and Sanitizers

- Detergents & Degreasers

- Others

By Form

- Liquid Solutions

- Powders and Concentrates

- Aerosols and Sprays

By End User

- Manufacturing & Engineering Industries

- Food & Beverage Processing Plants

- Healthcare & Laboratories

- Transportation & Automotive Workshops

- Energy, Mining & Utilities

- Commercial Buildings & Institutions

By Sales Channel

- Direct Industrial Sales

- Online / E-commerce Platforms

- Retail Stores

Regional Analysis

England and Wales

The largest market share in the U.K. Industrial Cleaning Products Market is held by England and Wales, which together account for around 75% of the total market share. The region’s strong industrial base, particularly in sectors like automotive, manufacturing, and food processing, contributes significantly to the demand for industrial cleaning products. The growing emphasis on hygiene and safety in these industries drives the market, particularly with the implementation of strict cleaning regulations. England, in particular, is a hub for manufacturing, where industrial cleaning solutions are needed to maintain operational efficiency and equipment longevity.

Scotland

Scotland holds about 15% of the U.K. Industrial Cleaning Products Market. The demand in this region is driven by industries such as oil and gas, renewable energy, and manufacturing, which require specialized cleaning solutions for machinery and production lines. The energy sector, with its focus on sustainability and environmental impact, has accelerated the adoption of eco-friendly industrial cleaning products. Scotland’s significant role in renewable energy also emphasizes the demand for cleaner, more sustainable solutions, aligning with the broader trends in the market.

Northern Ireland

Northern Ireland contributes around 10% to the U.K. Industrial Cleaning Products Market. The region’s market is fueled by its growing manufacturing and food processing industries, where maintaining cleanliness is critical to meet industry-specific regulations. The food sector in particular demands high levels of hygiene, driving demand for specialized cleaning solutions. Though the market share in Northern Ireland is smaller compared to other regions, the steady growth of its industrial and agricultural sectors continues to provide a stable demand for industrial cleaning products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the U.K. Industrial Cleaning Products Market is marked by the presence of several key players that offer a wide range of cleaning solutions across various industries. Leading companies in the market include Procter & Gamble, Reckitt Benckiser, Diversey Holdings, and SC Johnson Professional, all of which maintain strong positions due to their broad product portfolios and widespread distribution networks. These companies leverage their established brand reputations and large-scale manufacturing capabilities to serve the diverse needs of the industrial cleaning sector.Procter & Gamble, for instance, focuses on both commercial and industrial cleaning solutions, offering products that meet stringent regulatory standards. Diversey Holdings stands out with its emphasis on sustainability and eco-friendly cleaning products, appealing to businesses looking to reduce their environmental impact. SC Johnson Professional focuses on providing high-quality cleaning products for healthcare and food industries, which demand specialized solutions. Smaller players in the market, such as TanaChemie and Ecochem, are capitalizing on niche segments by offering innovative and sustainable cleaning solutions tailored to specific industries.

Recent Developments

- In October 2025, BASF SE entered a strategic collaboration with International Flavors & Fragrances (IFF) to develop new enzyme and polymer innovations for industrial cleaning, fabric, and personal care sectors. This collaboration aims to accelerate next-generation cleaning solutions for industrial and consumer domains, including the U.K

- In September 2025, Evonik Industries AG launched the Next Markets Program to tap new market opportunities adjacent to its core, including circular packaging and advanced biosurfactants, further expanding solutions for cleaning and home care.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to see consistent growth driven by increasing demand from the manufacturing and food processing sectors.

- Eco-friendly and sustainable cleaning solutions will become more integral as businesses prioritize environmental responsibility.

- Technological advancements, including automated cleaning systems and smart solutions, will shape product innovation and usage.

- Increased regulations around workplace hygiene and safety will push industries to adopt advanced cleaning products.

- The growing demand for specialized cleaning products tailored to specific industries will continue to rise.

- E-commerce and online platforms will see expanded usage as a primary sales channel for industrial cleaning solutions.

- With sustainability becoming a priority, companies will invest more in R&D to create greener and safer cleaning products.

- Regional growth in Scotland and Northern Ireland will contribute to a broader market expansion beyond England and Wales.

- Market consolidation through mergers and acquisitions will become more common as companies seek to expand their reach and offerings.

- The healthcare and laboratory sectors will continue to drive demand for high-performance cleaning products that meet stringent cleanliness standards.