Market Overview

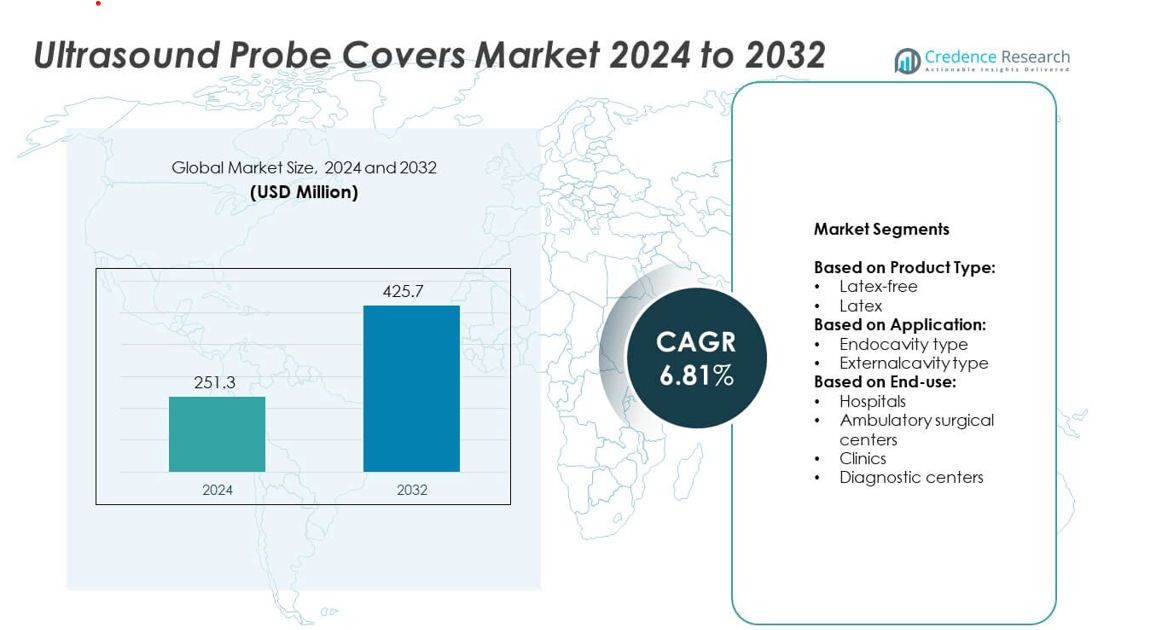

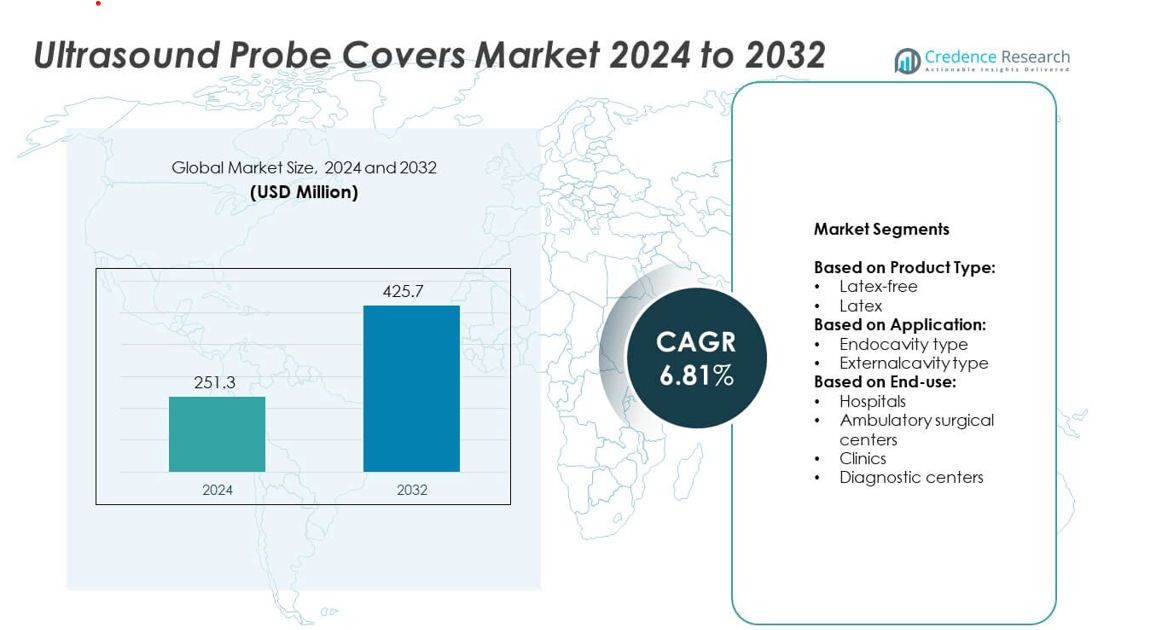

The Ultrasound Probe Covers Market size was valued at USD 251.3 million in 2024 and is anticipated to reach USD 425.7 million by 2032, at a CAGR of 6.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultrasound Probe Covers Market Size 2024 |

USD 251.3 million |

| Ultrasound Probe Covers Market, CAGR |

6.81% |

| Ultrasound Probe Covers Market Size 2032 |

USD 425.7 million |

The Ultrasound Probe Covers market grows due to rising demand for infection control and patient safety across hospitals, clinics, and diagnostic centers. Increasing ultrasound procedures in cardiology, gynecology, and minimally invasive surgeries strengthen product adoption. Latex-free and antimicrobial-coated covers gain preference for reducing allergy risks and improving sterility. Expanding outpatient and ambulatory care settings further boost demand. Technological improvements in material design enhance durability and imaging clarity, positioning probe covers as essential tools in modern diagnostic and surgical practices.

North America leads the Ultrasound Probe Covers market with advanced healthcare infrastructure and strong adoption across hospitals and surgical centers. Europe follows with high demand supported by strict hygiene regulations and widespread use of disposable products. Asia-Pacific records the fastest growth driven by expanding healthcare access and rising medical tourism. Key players shaping the market include General Electric Company, CIVCO Medical Solutions, Cardinal Health, and B. Braun Melsungen AG, focusing on innovation, partnerships, and global distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ultrasound Probe Covers market was valued at USD 251.3 million in 2024 and is projected to reach USD 425.7 million by 2032, growing at a CAGR of 6.81%.

- Rising demand for infection prevention and patient safety fuels market expansion across hospitals and diagnostic centers.

- Disposable and latex-free probe covers dominate trends, with antimicrobial-coated designs gaining traction for improved hygiene standards.

- Competition remains strong among leading players focusing on material innovation, distribution partnerships, and compliance with global regulatory standards.

- Cost pressures and limited reimbursement policies in several regions act as key restraints, particularly affecting adoption in smaller clinics and emerging economies.

- North America leads due to advanced healthcare infrastructure, Europe shows strong adoption driven by regulations, while Asia-Pacific records the fastest growth supported by expanding healthcare access.

- Market outlook highlights increasing opportunities in outpatient facilities, ambulatory care centers, and developing regions with growing medical tourism and healthcare modernization initiatives.

Market Drivers

Rising Demand for Infection Control and Patient Safety

The Ultrasound Probe Covers market expands strongly due to growing focus on infection control. Hospitals and clinics emphasize preventing cross-contamination during diagnostic and surgical procedures. Probe covers act as a protective barrier, ensuring sterility in sensitive applications. Rising hospital-acquired infections highlight the need for disposable and sterile probe covers. Regulatory authorities enforce strict hygiene standards, accelerating adoption across healthcare facilities. The market benefits from increasing awareness of patient safety measures.

- For instance, During 2023, GE HealthCare, a major and leading provider in the Indian ultrasound market, continued its operations by introducing new products, such as AI-enabled imaging solutions. This was done in a market that was estimated by ADI Media Research to include 10,600 new ultrasound systems sold in 2023.

Growth in Diagnostic Imaging Procedures

The increasing number of diagnostic imaging procedures strengthens market demand. Rising prevalence of chronic diseases requires frequent ultrasound examinations. Hospitals and diagnostic centers invest in ultrasound systems, driving parallel growth in probe cover usage. It supports diverse applications, including cardiology, gynecology, and urology. Demand also rises from interventional and minimally invasive procedures requiring sterile environments. Growing healthcare access in emerging economies further fuels market expansion.

- For instance, During 2022, CIVCO Medical Solutions, a provider of infection control products, continued its operations by manufacturing and distributing a variety of ultrasound probe covers for use in infection-sensitive medical procedures. This activity occurred with a strong market presence, including partnerships where CIVCO’s products are packaged in over 1 million kits annually.

Technological Advancements in Probe Covers

Innovation in probe covers drives wider adoption in advanced healthcare settings. Manufacturers develop latex-free and biocompatible materials to reduce allergy risks. Products now feature improved elasticity and durability, ensuring secure fit and high image clarity. It supports complex procedures requiring precision in ultrasound imaging. Integration of probe covers with antimicrobial coatings strengthens their role in infection prevention. Technological upgrades improve both safety and clinical efficiency, creating stronger market acceptance.

Expansion of Outpatient and Ambulatory Care Settings

The shift toward outpatient and ambulatory care facilities boosts probe cover usage. Growing demand for cost-effective and safe diagnostic services increases reliance on ultrasound. It reduces hospital stays and supports quick turnaround in patient care. Ambulatory surgical centers adopt probe covers to maintain strict hygiene during minor procedures. Clinics and diagnostic centers expand their services, further fueling product demand. This trend ensures continuous growth opportunities for manufacturers in diverse healthcare environments.

Market Trends

Shift Toward Disposable and Single-Use Covers

The Ultrasound Probe Covers market witnesses a clear shift toward disposable products. Healthcare facilities prioritize single-use covers to reduce contamination risks and meet infection control standards. Growing awareness of hospital-acquired infections accelerates this trend across both developed and emerging regions. Disposable covers ensure safety during sensitive procedures such as biopsies and endocavity examinations. Manufacturers expand product portfolios to offer sterile, ready-to-use options for hospitals and diagnostic centers. It strengthens confidence in patient safety protocols while supporting regulatory compliance.

- For instance, During its 2022/23 fiscal year, Ambu A/S, a manufacturer of single-use medical devices, reported an organic revenue growth of 7.6%, driven by strong performance in its Endoscopy Solutions segment, which saw a 15% organic growth.

Increasing Use in Minimally Invasive and Interventional Procedures

Rising adoption of minimally invasive procedures drives strong demand for probe covers. Interventional radiology, gynecology, and cardiology rely on ultrasound guidance for accurate outcomes. Probe covers provide essential protection during procedures that require sterile environments. This trend expands with higher patient preference for less invasive treatments. Growth in outpatient surgical centers reinforces steady adoption in this segment. It establishes probe covers as vital tools in advanced clinical practices.

- For instance, During 2023, Parker Laboratories continued to manufacture and distribute its line of infection control products, including the Eclipse brand of pre-gelled, latex-free probe covers, which are made from polyethylene. The company maintained its strong market position as a supplier of ultrasound accessories, with the global ultrasound probe cover market being valued at approximately $213 million in 2022

Advancements in Material Innovation and Design

Material innovation remains a defining trend shaping the market. Latex-free, biocompatible, and antimicrobial-coated probe covers gain preference across hospitals and clinics. Manufacturers focus on designs that improve elasticity and minimize interference with image quality. Product improvements align with growing demand for comfort, durability, and safety in use. It encourages broader acceptance among clinicians handling complex diagnostic procedures. Continuous design advancements strengthen product reliability and clinical outcomes.

Rising Adoption in Emerging Healthcare Systems

Healthcare expansion in emerging economies accelerates probe cover adoption. Rising government investments in healthcare infrastructure increase ultrasound system installations. Diagnostic centers and hospitals in these regions demand cost-effective and sterile probe covers. Growing medical tourism across Asia-Pacific further supports widespread use in clinical applications. It enhances opportunities for manufacturers targeting low-cost, high-volume segments. Expanding healthcare access ensures long-term demand growth in developing regions.

Market Challenges Analysis

High Cost Pressures and Reimbursement Limitations

The Ultrasound Probe Covers market faces cost-related challenges that restrict widespread adoption. Hospitals and clinics in developing regions struggle to balance budgets with rising demand for disposable products. Reimbursement policies in many countries do not cover probe covers, adding financial strain on healthcare providers. Limited reimbursement support slows procurement decisions, particularly in small diagnostic centers. It creates dependency on low-cost alternatives that may compromise quality and sterility. Manufacturers face constant pressure to offer competitive pricing while maintaining compliance with strict standards.

Supply Chain Disruptions and Quality Concerns

Supply chain instability poses a major challenge for probe cover manufacturers. Raw material shortages and logistics delays affect production timelines and delivery schedules. Smaller healthcare facilities often encounter inconsistent product availability, limiting adoption in critical procedures. Quality concerns also arise from low-grade imports that fail to meet regulatory requirements. It affects clinician trust and reduces willingness to adopt new product lines. Addressing these supply and quality issues remains essential for long-term market stability.

Market Opportunities

Rising Focus on Infection Prevention and Sterile Practices

The Ultrasound Probe Covers market benefits from increasing emphasis on infection control measures. Hospitals and clinics prioritize sterile, single-use solutions to reduce cross-contamination risks. Demand grows across high-risk procedures such as obstetrics, gynecology, and cardiology. It supports stronger adoption of disposable probe covers in both advanced and developing healthcare systems. Manufacturers introducing latex-free, biocompatible, and antimicrobial-coated products gain wider acceptance among clinicians. Expanding regulatory focus on hygiene standards creates long-term opportunities for sustained market growth.

Expansion in Emerging Economies and Outpatient Facilities

Growth in emerging economies presents strong opportunities for probe cover manufacturers. Rapid healthcare infrastructure development across Asia-Pacific, Latin America, and the Middle East increases ultrasound installations. Rising patient preference for outpatient and ambulatory care strengthens probe cover demand in these facilities. It enables manufacturers to target cost-effective, high-volume markets with localized solutions. Medical tourism in developing regions further accelerates adoption of sterile ultrasound practices. Increasing access to healthcare ensures wider market penetration and consistent demand growth.

Market Segmentation Analysis:

By Product Type:

Latex-free probe covers dominate demand due to their hypoallergenic properties and compatibility with sensitive patients. Hospitals and diagnostic centers increasingly prefer latex-free options to meet infection control standards and avoid allergic reactions. Latex probe covers maintain a presence in certain cost-sensitive regions but face declining use in advanced healthcare settings. It highlights a steady market shift toward safer, biocompatible alternatives supported by strict regulatory guidelines.

- For instance, In 2022, Philips Healthcare, a major provider of ultrasound and image-guided therapy systems, continued to supply its technology to hospitals and clinics for a wide variety of diagnostic and interventional procedures. As a significant participant in the market, the company’s activities contributed to the overall demand for related accessories like sterile probe barriers. During fiscal year 2022, Philips reported 1.8 billion people benefited from their products and solutions globally.

By Application:

The endocavity type segment records strong growth. These covers are essential in gynecology, obstetrics, and urology procedures, where sterility is critical. Rising demand for high-precision diagnostic imaging strengthens adoption across hospitals and clinics. The externalcavity type segment retains steady growth supported by use in cardiology and general imaging applications. It benefits from rising diagnostic procedures and growing emphasis on infection prevention in outpatient care. Both segments continue to expand with wider ultrasound integration across healthcare specialties.

- For instance, In 2023, Medline Industries continued its operations as a significant manufacturer and distributor of a variety of medical supplies, including single-use ultrasound probe covers, to help healthcare facilities meet strict hygiene mandates. Medline’s ReNewal program reprocessed 2,564,389 single-use medical devices in 2023.

By End-Use:

Large patient volumes, complex surgical needs, and strong infection control protocols drive their dominance. Ambulatory surgical centers show rapid growth due to rising preference for minimally invasive procedures. Clinics adopt probe covers at a steady pace, supported by expansion of primary healthcare services. Diagnostic centers strengthen uptake as demand for preventive imaging grows worldwide. It positions all end-user categories as vital contributors to overall market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Product Type:

Based on Application:

- Endocavity type

- Externalcavity type

Based on End-use:

- Hospitals

- Ambulatory surgical centers

- Clinics

- Diagnostic centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Ultrasound Probe Covers market with 37% of global revenue. Strong adoption is driven by advanced healthcare infrastructure, high procedure volumes, and strict infection control protocols across hospitals and diagnostic centers. The region benefits from strong regulatory enforcement by agencies such as the FDA, ensuring consistent demand for sterile, disposable covers. Increasing prevalence of chronic diseases such as cardiovascular and gynecological disorders requires regular ultrasound imaging, further pushing product adoption. Hospitals across the United States and Canada invest heavily in latex-free and antimicrobial-coated probe covers to meet patient safety goals. It also benefits from growing outpatient and ambulatory surgical centers, where demand for cost-effective and sterile solutions continues to rise. Widespread use of minimally invasive procedures strengthens the preference for disposable probe covers, positioning the region as a global leader in both innovation and usage.

Europe

Europe accounts for 28% of the Ultrasound Probe Covers market, supported by a strong base of public healthcare systems and high patient awareness. Countries such as Germany, France, and the United Kingdom prioritize infection control measures, driving demand for disposable probe covers. Hospitals and clinics in the region widely adopt latex-free products due to increasing allergy concerns and compliance with EU safety standards. Rising investments in diagnostic imaging equipment across Eastern Europe expand adoption further. It is also supported by rising surgical volumes in gynecology, cardiology, and radiology segments. Growing emphasis on patient safety protocols and cross-border healthcare strengthens the use of probe covers across both private and public facilities. Regulatory frameworks and sustainability measures continue to shape product preferences, enhancing demand for eco-friendly and biocompatible materials.

Asia-Pacific

Asia-Pacific secures 22% of the Ultrasound Probe Covers market, recording the fastest growth rate among all regions. Expanding healthcare infrastructure in China, India, and Southeast Asia drives rapid adoption of ultrasound equipment and probe covers. Rising prevalence of diabetes, cardiovascular conditions, and maternal health concerns requires consistent diagnostic support, pushing usage across hospitals and clinics. Growing medical tourism in countries such as Thailand and India boosts adoption of infection control products to meet global healthcare standards. Ambulatory care centers expand strongly in urban hubs, further creating demand for disposable probe covers. It also benefits from strong government funding toward healthcare modernization projects, enabling greater access to diagnostic technologies. Increasing local manufacturing and cost-effective production add to regional competitiveness and wider product availability.

Latin America

Latin America holds 8% of the Ultrasound Probe Covers market, driven by growing healthcare access and rising investments in diagnostic services. Brazil and Mexico remain the largest contributors due to advanced hospital networks and expanding private healthcare providers. Rising adoption of ultrasound procedures in obstetrics and gynecology strengthens steady demand for probe covers. It also gains momentum from government initiatives to expand affordable healthcare across rural areas. Increasing surgical procedures in outpatient settings accelerate usage of disposable products. However, the market faces cost-related challenges, with smaller facilities relying on low-cost alternatives. Despite this, expanding partnerships with global manufacturers help improve product penetration across the region.

Middle East & Africa

The Middle East & Africa represent 5% of the Ultrasound Probe Covers market, marking steady but limited growth. Wealthier nations such as Saudi Arabia, the UAE, and South Africa lead adoption due to strong investments in modern healthcare facilities. Rising incidence of chronic illnesses and maternal care requirements supports consistent use of ultrasound probe covers in hospitals. It is also supported by growth in private healthcare providers targeting medical tourism in Gulf countries. Access remains restricted in underdeveloped areas due to budget constraints and supply chain challenges. Nonetheless, growing collaborations with international suppliers enhance product accessibility in key urban regions. Rising emphasis on hygiene standards in leading hospitals positions the region for gradual expansion in the coming years.

Key Player Analysis

- General Electric Company

- Advance Medical Designs, Inc.

- 3M Healthcare

- FUJILATEX CO., LTD.

- CIVCO Medical Solutions

- Medline Industrie

- Ecolab

- Cardinal Health

- Fairmont Medical Products Ltd

- Parker Laboratories

- Steris Corporation

- Braun Melsungen AG

Competitive Analysis

The leading players in the Ultrasound Probe Covers market include General Electric Company, CIVCO Medical Solutions, Cardinal Health, 3M Healthcare, B. Braun Melsungen AG, FUJILATEX CO., LTD., Advance Medical Designs, Inc., Ecolab, Parker Laboratories, Steris Corporation, Fairmont Medical Products Ltd, and Medline Industrie. These companies compete through product innovation, strong distribution networks, and compliance with strict regulatory standards. The market reflects high emphasis on latex-free and antimicrobial-coated probe covers, aligning with rising demand for patient safety and infection prevention. Global leaders leverage established hospital networks and partnerships with healthcare providers to expand their presence in both advanced and emerging regions. Smaller firms strengthen their position through niche offerings, focusing on cost-effective and procedure-specific designs that appeal to mid-sized diagnostic centers and clinics. Competition also intensifies with the growing preference for disposable and single-use probe covers. Key manufacturers invest in material innovations to enhance elasticity, durability, and imaging quality, ensuring compatibility with advanced ultrasound procedures. Strategic collaborations with hospitals and distributors improve product accessibility across diverse regions. Strong brand reputation, wide product portfolios, and consistent focus on innovation remain crucial factors driving competitive advantage in this steadily expanding market.

Recent Developments

- In April 2024, Ecolab sold its global surgical solutions business, which included its Microtek ultrasound probe cover line, to Medline.

- In January 2024, Medline completed its acquisition of United Medco, a distributor of durable medical equipment and supplies.

- In 2023, Teleflex did launch new or improved kits containing standard probe covers, such as with its enhanced Arrow® VPS Rhythm® DLX device

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with stronger focus on infection prevention across healthcare facilities.

- Rising preference for disposable and latex-free products will dominate global adoption.

- Technological advances in materials will improve elasticity, durability, and image clarity.

- Growth in minimally invasive and interventional procedures will increase demand for sterile covers.

- Emerging economies will drive adoption through healthcare infrastructure expansion.

- Outpatient and ambulatory surgical centers will strengthen usage with higher procedure volumes.

- Regulatory pressure for hygiene standards will accelerate uptake of single-use probe covers.

- Medical tourism in Asia-Pacific and Middle East will boost regional adoption rates.

- Manufacturers will invest in eco-friendly and antimicrobial-coated designs to meet safety goals.

- Strategic collaborations and localized production will improve product availability worldwide.