| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Liqueurs Market Size 2024 |

USD 6,964.10 Million |

| UK Liqueurs Market, CAGR |

3.60% |

| UK Liqueurs Market Size 2032 |

USD 9,234.37 Million |

Market Overview

UK Liqueurs Market size was valued at USD 6,964.10 million in 2024 and is anticipated to reach USD 9,234.37 million by 2032, at a CAGR of 3.60% during the forecast period (2024-2032).

The UK liqueurs market is driven by a growing consumer preference for premium and craft alcoholic beverages, supported by rising disposable incomes and a shift towards experiential drinking. The increasing popularity of cocktail culture, particularly among younger demographics, has fueled demand for flavored and versatile liqueurs. Health-conscious consumers are also influencing the market, prompting innovation in low-sugar and low-alcohol variants. Additionally, seasonal and limited-edition product launches are capturing consumer interest and enhancing brand engagement. E-commerce platforms and digital marketing strategies are playing a pivotal role in expanding product reach and boosting online sales. Key market trends include a resurgence of classic liqueur recipes with modern twists and the adoption of sustainable packaging solutions, reflecting growing environmental awareness. Moreover, collaborations between liqueur brands and hospitality businesses are enhancing visibility and customer loyalty, while social media platforms continue to influence purchasing behavior by promoting mixology content and lifestyle-oriented branding.

The geographical landscape of the UK liqueurs market is shaped by diverse consumer preferences across key regions such as London, Manchester, Birmingham, and Scotland. London leads in demand due to its dynamic nightlife, premium dining culture, and a high concentration of cosmopolitan consumers who favor artisanal and luxury liqueurs. Manchester and Birmingham are emerging as vibrant hubs for flavored and low-alcohol variants, driven by a younger demographic and growing interest in mixology. Meanwhile, Scotland, traditionally known for whisky, is experiencing a steady rise in liqueur consumption, particularly in urban centers. Key players actively shaping the competitive environment include Diageo PLC, Pernod Ricard, Bacardi Limited, Anheuser-Busch InBev SA/NV, and Heineken Holding NV. These companies continue to invest in product innovation, sustainable packaging, and strategic collaborations to strengthen their foothold. Through both retail and digital channels, these brands are capitalizing on evolving consumer trends and expanding their reach across the UK market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK liqueurs market was valued at USD 6,964.10 million in 2024 and is projected to reach USD 9,234.37 million by 2032, growing at a CAGR of 3.60% during the forecast period.

- Rising consumer preference for premium and craft liqueurs is a key driver fueling market growth.

- Increasing demand for low-ABV and flavored liqueurs supports evolving lifestyle trends and moderation habits.

- Key players such as Diageo PLC, Pernod Ricard, and Bacardi Limited are expanding portfolios to capture diverse consumer segments.

- Stringent advertising regulations and rising health consciousness pose challenges to consistent market expansion.

- London dominates the regional landscape with a 34.5% share, followed by Manchester, Birmingham, and Scotland.

- Innovative packaging formats like PET bottles and metal cans are gaining traction, especially among younger consumers.

Report Scope

This report segments the UK Liqueurs Market as follows:

Market Drivers

Rising Demand for Premium and Craft Liqueurs

One of the primary drivers of the UK liqueurs market is the growing consumer inclination toward premium and craft alcoholic beverages. With increasing disposable incomes and a heightened interest in high-quality, artisanal products, consumers are seeking unique flavor profiles and sophisticated drinking experiences. For instance, a survey conducted by the Wine and Spirit Trade Association (WSTA) revealed that UK consumers are increasingly willing to pay a premium for craft liqueurs made with locally sourced ingredients and heritage recipes. Additionally, the UK Department for Environment, Food & Rural Affairs (DEFRA) has supported initiatives to promote artisanal beverage production, emphasizing the importance of authenticity and sustainability in attracting discerning buyers.

Evolving Cocktail Culture and Mixology Trends

The widespread popularity of cocktails and mixology in the UK is significantly fueling liqueur consumption. Consumers, particularly in urban areas and younger demographics, are increasingly experimenting with at-home cocktails and favor liqueurs for their versatility in mixing drinks. For instance, the Wine and Spirit Trade Association (WSTA) reported that social media platforms have played a pivotal role in driving cocktail trends, with influencers showcasing creative recipes that prominently feature liqueurs. Similarly, the UK Hospitality Association has highlighted the growing demand for liqueurs in bars and restaurants, driven by the cultural shift toward experiential drinking. This cultural shift towards experiential drinking continues to encourage the adoption of new and diverse liqueur offerings.

Innovation in Flavors and Health-Conscious Alternatives

Product innovation, particularly in flavor profiles and health-conscious formulations, is another important driver of market growth. UK consumers are increasingly health-aware, prompting demand for low-alcohol, low-sugar, and organic liqueur options. In response, producers are expanding their portfolios with innovative flavors such as botanical infusions, exotic fruits, and dessert-inspired blends while also reducing artificial additives. Brands are also capitalizing on seasonal launches and limited-edition variants to maintain consumer interest and encourage repeat purchases. This focus on product differentiation is enabling brands to capture a broader audience and stay relevant in a highly competitive and trend-sensitive marketplace.

Expansion of E-commerce and Digital Marketing Channels

The growth of online retail channels and targeted digital marketing has significantly contributed to the accessibility and visibility of liqueur products across the UK. E-commerce platforms allow consumers to conveniently browse and purchase a wide variety of liqueurs, including exclusive or limited-stock items not typically available in physical stores. Additionally, digital marketing campaigns, influencer partnerships, and branded content on social media have become effective tools for engaging audiences and promoting brand loyalty. Virtual tastings and online mixology tutorials have further enhanced consumer engagement, particularly during and after the pandemic era. These digital strategies continue to reshape consumer behavior and play a crucial role in driving sales growth across the UK liqueurs market.

Market Trends

Growth in Flavored and Low-ABV Liqueurs

A prominent trend in the UK liqueurs market is the increasing demand for flavored and low-alcohol-by-volume (ABV) options. Consumers are gravitating towards unique and exotic flavor combinations such as salted caramel, blood orange, passion fruit, and herbaceous infusions, which enhance the overall sensory experience. This shift is particularly strong among millennials and Gen Z, who prefer lighter, approachable drinks with bold and adventurous profiles. Simultaneously, the growing focus on moderation and wellness has led to rising popularity of low-ABV and alcohol-free liqueurs, enabling consumers to enjoy the indulgence of liqueurs without compromising on their health-conscious lifestyle. This trend is encouraging manufacturers to diversify their offerings and experiment with new formulations that meet evolving consumer preferences.

Sustainability and Eco-Friendly Packaging Initiatives

Sustainability is becoming a defining factor in consumer purchasing decisions within the UK liqueurs market. Brands are increasingly adopting environmentally friendly practices, such as using recyclable glass bottles, biodegradable labels, and eco-conscious packaging materials. For instance, the UK Department for Environment, Food & Rural Affairs (DEFRA) has supported initiatives to promote sustainable sourcing and energy-efficient production processes in the beverage industry. Similarly, the Wine and Spirit Trade Association (WSTA) has highlighted the growing consumer preference for brands that prioritize ethical values and environmental responsibility.

Surge in Online Sales and Digital Engagement

The digital transformation of the alcohol industry is strongly reflected in the UK liqueurs segment. The convenience of online shopping and the growing preference for doorstep delivery have led to a significant increase in e-commerce sales. For instance, the UK Department for Digital, Culture, Media & Sport (DCMS) has emphasized the role of e-commerce platforms in expanding consumer access to domestic and imported liqueurs. Additionally, virtual tastings and interactive content, supported by the Wine and Spirit Trade Association (WSTA), have enhanced digital engagement and reshaped purchasing behavior in the post-pandemic era.

Resurgence of Heritage Brands and Classic Recipes

There is a renewed appreciation for heritage liqueur brands and traditional recipes in the UK market. Consumers are showing interest in nostalgic flavors and time-honored production methods, often associated with authenticity and craftsmanship. This revival is being supported by storytelling-focused branding, where producers highlight their historical legacy and artisanal processes. At the same time, some brands are modernizing these classic liqueurs by infusing them with contemporary twists or repositioning them for cocktail use. The blend of tradition and innovation is allowing heritage labels to connect with both long-standing customers and a new generation of consumers seeking a refined and culturally rich drinking experience.

Market Challenges Analysis

Stringent Regulatory Environment and Taxation Policies

The UK liqueurs market faces significant challenges stemming from stringent government regulations and evolving alcohol taxation policies. The industry operates under strict advertising standards, labelling requirements, and legal limitations on alcohol content and marketing practices, which can restrict brand visibility and innovation. For instance, the UK Advertising Standards Authority (ASA) enforces rigorous guidelines on alcohol marketing to ensure responsible advertising practices, limiting promotional flexibility for brands. Additionally, the UK Treasury’s recent increases in alcohol duties have been highlighted by the Wine and Spirit Trade Association (WSTA) as a significant factor driving up retail prices and reducing consumer spending, particularly among price-sensitive buyers.

Changing Consumer Preferences and Market Saturation

Another key challenge impacting the UK liqueurs market is the rapid shift in consumer preferences coupled with growing market saturation. As consumers increasingly adopt healthier lifestyles, there is a noticeable decline in demand for high-sugar, high-calorie liqueur options. Brands that fail to adapt to these evolving tastes risk losing market share to competitors offering low-alcohol, low-sugar, or plant-based alternatives. In addition, the influx of both domestic and international brands has intensified competition, making it difficult for smaller or newer entrants to establish a strong foothold. With a wide variety of flavors and products already available, brands must constantly innovate and differentiate themselves to capture consumer interest. This highly competitive environment, combined with changing consumption patterns, creates substantial barriers to sustained market growth and long-term brand loyalty.

Market Opportunities

The UK liqueurs market presents promising opportunities driven by shifting consumer behavior, evolving lifestyle preferences, and an increasing appetite for premium, low-alcohol, and artisanal offerings. As consumers seek more diverse and personalized drinking experiences, there is a growing opportunity for brands to expand their portfolios with unique flavor profiles, seasonal variants, and limited-edition releases. The trend toward moderation and wellness also opens doors for low-ABV and alcohol-free liqueur options, which are gaining momentum among health-conscious individuals. Brands that can successfully innovate while maintaining product authenticity are well-positioned to capture a broader customer base. Additionally, the demand for premium liqueurs made with natural ingredients and sustainable practices continues to grow, enabling manufacturers to align their offerings with ethical and environmental values, thus enhancing brand loyalty and appeal.

Another significant opportunity lies in the digital transformation of the liqueurs market. The rise of e-commerce, coupled with increased consumer engagement on social media and digital platforms, allows brands to reach target audiences more effectively and expand their online footprint. Direct-to-consumer sales channels enable brands to personalize marketing, offer exclusive products, and foster deeper customer relationships. Furthermore, collaborations with mixologists, influencers, and hospitality businesses can enhance brand visibility and drive experiential consumption. Expanding into niche segments, such as dessert-inspired liqueurs or those designed for specific cocktail pairings, can also differentiate offerings in an increasingly saturated market. With the right blend of innovation, sustainability, and digital engagement, companies in the UK liqueurs market have ample room to strengthen their position and capture emerging growth opportunities.

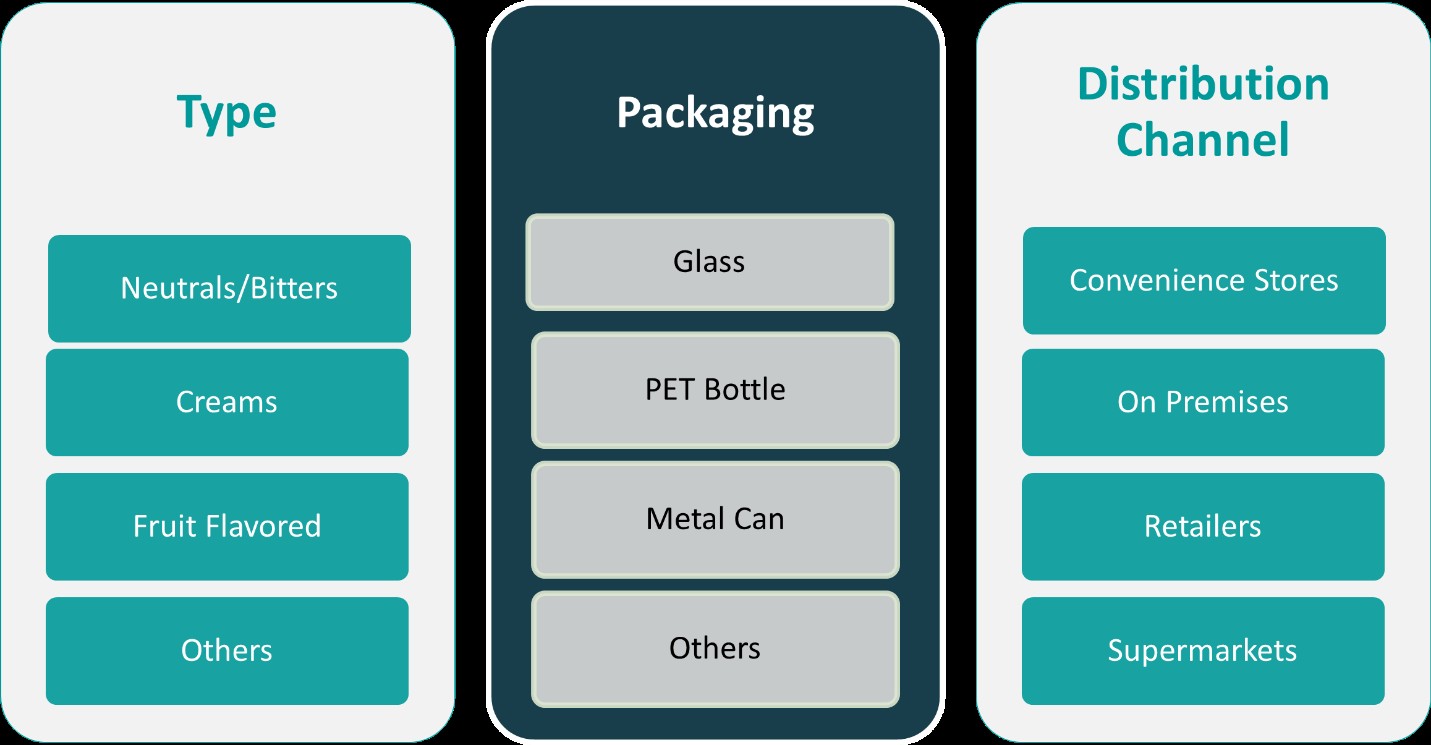

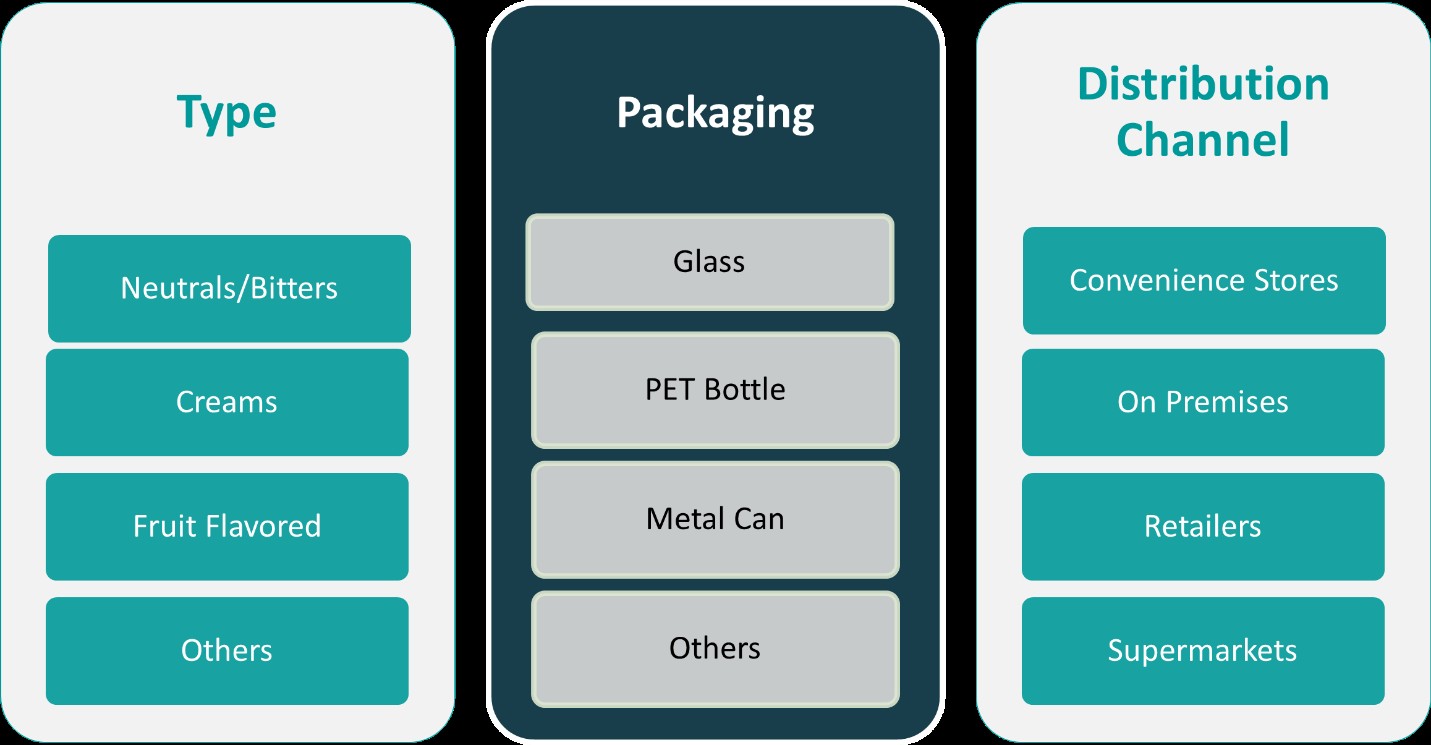

Market Segmentation Analysis:

By Type:

The UK liqueurs market is segmented by type into Neutrals/Bitters, Creams, Fruit Flavored, and Others, each catering to distinct consumer preferences. Neutrals and bitters continue to hold a solid market share due to their popularity in cocktails and their traditional association with after-dinner consumption. Cream-based liqueurs such as Irish cream enjoy strong demand, particularly during festive seasons and in the dessert beverage category, supported by their smooth texture and rich flavor profiles. Fruit-flavored liqueurs are rapidly gaining traction among younger consumers who favor sweet, vibrant, and mixable options, especially for at-home cocktails and social gatherings. This segment is witnessing innovation with tropical, berry, and citrus infusions driving consumer interest. Meanwhile, the ‘Others’ category, which includes herbal, nut-based, and specialty liqueurs, is also expanding as niche preferences and experimental mixology practices gain popularity. Together, these type-based segments reflect a diversified market where traditional preferences coexist with modern, trend-driven choices.

By Packaging:

In terms of packaging, the UK liqueurs market is segmented into Glass, PET Bottles, Metal Cans, and Others. Glass packaging dominates the segment due to its premium appeal, reusability, and consumer perception of quality. It is the preferred choice for premium and craft liqueurs, often featuring ornate or heritage designs that reinforce brand identity and product positioning. PET bottles are gaining popularity for their lightweight, cost-effectiveness, and durability, making them suitable for casual consumption and travel use. Metal cans, though a smaller segment, are emerging in ready-to-drink (RTD) formats, catering to convenience-focused and on-the-go consumers. This format is particularly appealing to younger demographics seeking portability and portion control. The ‘Others’ category includes alternative or sustainable packaging options, which are gradually gaining traction as eco-consciousness grows among UK consumers. Overall, packaging choices in the liqueurs market not only serve functional purposes but also influence purchasing decisions, brand perception, and sustainability narratives.

Segments:

Based on Type:

- Neutrals/Bitters

- Creams

- Fruit Flavored

- Others

Based on Packaging:

- Glass

- PET Bottle

- Metal Can

- Others

Based on Distribution Channel:

- Convenience Stores

- On Premises

- Retailers

- Supermarkets

Based on the Geography:

- London

- Manchester

- Birmingham

- Scotland

Regional Analysis

London

London holds the largest share of the UK liqueurs market, accounting for approximately 35% of the total revenue. The region’s dominance is largely driven by its diverse, cosmopolitan population and a high concentration of premium bars, lounges, and fine-dining establishments. London’s affluent consumer base exhibits a strong preference for premium and craft liqueurs, particularly those with unique flavors, heritage branding, or sustainable packaging. The city also benefits from significant tourist inflow, which supports demand across on-premise channels. Moreover, London’s thriving nightlife and cocktail culture fuel the popularity of both traditional and innovative liqueurs. The presence of numerous mixology events and beverage exhibitions provides a fertile ground for new product introductions, collaborations, and brand awareness campaigns. With a growing inclination toward low-ABV and artisanal variants, brands in London are innovating rapidly to keep pace with evolving tastes and lifestyle trends.

Manchester

Manchester contributes around 23% to the UK liqueurs market and remains one of the fastest-growing regional segments. Known for its vibrant youth culture and expanding hospitality sector, Manchester has witnessed rising demand for flavored liqueurs and low-alcohol options, especially among millennials and Gen Z consumers. The city’s bar and pub scene supports frequent experimentation with liqueur-based cocktails, increasing visibility and trial of niche and imported products. Local retailers and supermarkets also report consistent sales in both cream-based and fruit-infused variants. Manchester’s growing student population and a robust events calendar including music festivals and food fairs further boost liqueur consumption. Additionally, e-commerce penetration is strong in this region, allowing consumers access to a wide range of brands and product formats. This has made Manchester a key test market for emerging trends and product lines.

Birmingham

Birmingham commands a market share of approximately 20% in the UK liqueurs sector, supported by its diverse demographic and increasing preference for convenience-focused alcoholic beverages. The region has shown a steady shift from traditional high-alcohol spirits to flavored and ready-to-drink liqueurs that offer a balanced taste and moderate alcohol content. Supermarkets and retail chains in Birmingham have expanded their product assortment in response to rising consumer interest in seasonal and limited-edition variants. Furthermore, local craft distilleries are introducing regionally inspired liqueurs, tapping into the demand for artisanal and locally sourced options. With growing attention to ethical sourcing and sustainability, Birmingham consumers are also responding positively to eco-friendly packaging and organic ingredients. The combination of a multi-cultural consumer base and evolving drinking habits places Birmingham in a strong position for sustained market contribution.

Scotland

Scotland accounts for about 15% of the UK liqueurs market, showing stable yet modest growth compared to other regions. While traditionally known for its whisky heritage, Scotland has experienced a growing acceptance of liqueurs, especially those with rich, creamy textures and locally inspired flavors. The regional market benefits from tourism, particularly in cities like Edinburgh and Glasgow, where hospitality businesses are incorporating diverse liqueur selections into their offerings. The retail sector in Scotland has also expanded shelf space for innovative liqueurs, including herbal, nut-based, and dessert-style varieties. Although premium products have gained traction, affordability continues to influence purchasing behavior, with mid-range liqueurs seeing steady demand. Digital marketing and online sales channels are also expanding in the region, allowing smaller brands to reach rural consumers. As consumer awareness of global liqueur trends grows, Scotland holds potential for incremental market share gains through targeted promotions and product localization.

Key Player Analysis

- Diageo PLC

- Pernod Ricard

- Bacardi Limited

- Anheuser-Busch InBev SA/NV

- Heineken Holding NV

Competitive Analysis

The competitive landscape of the UK liqueurs market is shaped by the strategic presence of leading players such as Diageo PLC, Pernod Ricard, Bacardi Limited, Anheuser-Busch InBev SA/NV, and Heineken Holding NV. These companies maintain a strong foothold through diverse product portfolios, well-established distribution networks, and ongoing brand development efforts. Premiumization remains a central strategy, with firms emphasizing heritage, quality, and artisanal production methods to capture the attention of discerning consumers. Strategic marketing, including collaborations with mixologists, event sponsorships, and influencer partnerships, is widely used to enhance brand visibility and consumer engagement. Additionally, the growing importance of online retail has led companies to invest in digital channels, allowing for better consumer targeting and higher brand accessibility. Retail expansion, both in supermarkets and convenience formats, supports widespread product availability. Furthermore, continuous efforts in research and development have resulted in the introduction of limited-edition releases and seasonal variants, helping brands stay relevant in a dynamic market landscape.

Recent Developments

- In February 2025, Diageo reported a 1% growth in organic net sales for the first half of fiscal 2025, driven by strong performance in brands like Don Julio and Crown Royal. Guinness also achieved double-digit growth for the eighth consecutive half-year.

- In February 2025, AB InBev reported record revenue for fiscal year 2024, with a focus on premiumization and no-alcohol beer categories. Corona Cero achieved triple-digit volume growth globally.

- In November 2024, Pernod Ricard announced a strategic shift towards premium spirits, showcasing high-end offerings like Royal Salute and Jameson Black Barrel at a Christmas event in London.

- In September 2024, Bacardi Limited announced a partnership with Coca-Cola to launch BACARDÍ Mixed with Coca-Cola ready-to-drink (RTD) cocktails, set to debut in European markets and Mexico in 2025.

Market Concentration & Characteristics

The UK liqueurs market exhibits moderate to high market concentration, characterized by the dominance of a few well-established players that hold a significant share of the overall revenue. These companies benefit from strong brand equity, extensive distribution networks, and diversified product portfolios that cater to various consumer segments. The market is further defined by premiumization trends, flavor innovation, and evolving consumer preferences, particularly among younger demographics seeking unique, low-alcohol, and craft-style beverages. While legacy brands continue to lead through consistent quality and marketing, smaller and niche producers are increasingly gaining traction by offering artisanal and locally inspired liqueurs. The market also demonstrates seasonal demand peaks, especially around festive and celebratory periods. Additionally, convenience-driven packaging and sustainability are becoming influential characteristics, as consumers show growing interest in ethical sourcing and eco-friendly solutions. Overall, the UK liqueurs market reflects a balance of brand loyalty and innovation-driven competition, making it dynamic yet concentrated.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Packaging, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for ready-to-drink (RTD) liqueur-based cocktails will rise, aligning with the convenience trend among busy consumers.

- Craft distilleries and small-batch producers will gain popularity, offering unique local flavors and authenticity.

- Augmented reality and digital labels may become tools for brands to enhance consumer interaction and storytelling.

- Seasonal and limited-edition offerings will remain effective in driving short-term sales and brand excitement.

- Retailers will focus more on exclusive collaborations with liqueur brands to create curated selections.

- Artificial intelligence and data analytics will play a growing role in consumer behavior tracking and personalized marketing.

- Urban nightlife and tourism recovery will stimulate on-premise consumption growth.

- Functional and botanical ingredients may be integrated into liqueurs to attract wellness-oriented consumers.

- The shift toward gender-neutral marketing and inclusive branding will expand the appeal of liqueur products.

- Export opportunities for UK-based liqueur brands will grow in emerging markets with evolving taste preferences.