| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Vegan Fast Food Market Size 2024 |

USD 1,621.72 Million |

| UK Vegan Fast Food Market, CAGR |

6.80% |

| UK Vegan Fast Food Market Size 2032 |

USD 2,745.01Million |

Market Overview

The UK Vegan Fast Food Market is projected to grow from USD 1,621.72 million in 2024 to an estimated USD 2,745.01 million by 2032, with a compound annual growth rate (CAGR) of 6.80% from 2025 to 2032. This growth reflects the increasing consumer demand for plant-based food options, driven by health-conscious, environmentally aware, and ethical considerations.

Key drivers of this market include the rising awareness of the health benefits associated with plant-based diets and the environmental impact of animal agriculture. Additionally, technological advancements in food innovation have made plant-based fast foods more accessible and appealing. The growing influence of social media, vegan activism, and increased availability of vegan products in mainstream fast food outlets have also significantly contributed to market growth. Moreover, evolving consumer preferences for convenience, affordability, and sustainability are shaping the market landscape, creating a robust foundation for continued expansion.

Geographically, the UK stands as a significant hub for the vegan fast food industry in Europe, driven by a large population of environmentally and health-conscious consumers. Major players in the market, such as Beyond Meat, Impossible Foods, and local brands like Greggs, are leading the charge by introducing vegan alternatives to popular fast-food items. These companies, alongside a strong network of independent vegan outlets, are shaping the competitive landscape of the UK vegan fast food market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Vegan Fast Food Market is projected to grow from USD 1,621.72 million in 2024 to USD 2,745.01 million by 2032, with a CAGR of 6.80% from 2025 to 2032.

- Increasing consumer demand for health-conscious, sustainable, and ethical food choices is fueling market growth. Technological advancements are improving the quality and accessibility of plant-based fast food options.

- High production costs of plant-based ingredients and the price sensitivity of consumers present challenges to the market’s widespread adoption, limiting growth potential.

- The market is heavily concentrated in urban areas such as London, with increasing demand spreading across the UK, including regions like the Midlands, Scotland, and Wales.

- Rising awareness of the health benefits of plant-based diets and the environmental impact of animal agriculture are central to the market’s expansion.

- Continuous innovation in plant-based meat and dairy substitutes is enhancing product quality and broadening consumer appeal, including among non-vegan customers.

- Major fast food chains like McDonald’s and KFC are integrating plant-based menu options, signaling greater acceptance of vegan fast food in mainstream outlets.

Market Drivers

Technological Innovations and Improved Product Quality

Technological advancements in food science and innovation have played a key role in improving the taste, texture, and overall quality of vegan fast food products. The development of plant-based substitutes that closely resemble meat, dairy, and other animal products has been a game-changer in the vegan fast food market. Companies like Beyond Meat and Impossible Foods have pioneered plant-based products that replicate the taste and texture of traditional meat, making vegan fast food options more appealing to mainstream consumers, including meat-eaters who may not typically consider plant-based alternatives.These innovations have also expanded the variety of vegan fast food offerings available in the market, ensuring that consumers have access to a wide range of delicious and satisfying meals. From vegan burgers and sausages to dairy-free milkshakes and plant-based cheese, technological advancements are enabling the creation of fast food items that deliver familiar tastes and experiences without the use of animal products. This not only enhances the appeal of vegan fast food to existing plant-based consumers but also entices a broader audience, including those who are interested in trying plant-based meals without compromising on taste or texture. As food innovation continues, it is expected that the availability of high-quality, vegan-friendly fast food options will increase, further accelerating the market’s growth.

Expansion of Vegan Fast Food Chains and Increased Availability

The expansion of both independent and major fast food chains offering vegan options is one of the most significant drivers of growth in the UK vegan fast food market. In recent years, numerous fast food outlets, including household names such as McDonald’s, KFC, and Burger King, have introduced plant-based alternatives to cater to the rising demand for vegan options. This trend has significantly increased the visibility and accessibility of vegan fast food, allowing consumers to enjoy their favorite fast food items in plant-based versions.In addition to the inclusion of vegan items on mainstream menus, the emergence of fully vegan fast food chains has further boosted the market. Chains like Leon, which offer entirely plant-based menus, are gaining popularity among consumers who prioritize vegan or plant-based dining. These businesses are capitalizing on the growing interest in veganism and are creating dedicated spaces where consumers can enjoy vegan fast food in an environment that aligns with their values. Furthermore, the increased availability of vegan fast food at convenience stores, supermarkets, and online platforms has made it easier for consumers to find and purchase vegan options. The increased reach and expansion of vegan fast food outlets are making plant-based eating more accessible to a wider range of consumers across the UK, driving the market forward.

Growing Consumer Demand for Health-Conscious and Ethical Eating Habits

The increasing awareness of the health benefits associated with plant-based diets is a key driver for the growth of the UK vegan fast food market. Consumers are increasingly prioritizing healthier food options that promote long-term wellness and mitigate the risks of chronic diseases such as obesity, diabetes, and heart disease. Vegan fast food offers a cleaner, lower-calorie alternative to traditional fast food, which is often high in saturated fats, cholesterol, and additives. Many consumers are opting for vegan options to manage their weight and improve their overall health, aligning with broader wellness trends.Moreover, ethical concerns regarding the treatment of animals in the food production industry are also playing a pivotal role. Animal welfare issues have become more prominent, with consumers seeking food options that do not contribute to the exploitation of animals. For instance, the UK vegan fast food market has seen a significant transformation with major fast-food chains like Burger King and McDonald’s introducing plant-based options, reflecting the growing consumer demand for healthier and ethical eating habits. These initiatives align with broader trends of sustainability and wellness, as consumers increasingly prioritize diets that reduce their environmental impact and promote animal welfare.

Environmental Awareness and Sustainability Concerns

Another significant factor driving the UK vegan fast food market is growing environmental awareness. The impact of animal agriculture on the environment—specifically its contribution to greenhouse gas emissions, deforestation, and water usage—has become a central concern for both consumers and businesses alike. Research and advocacy from environmental organizations and climate change experts have highlighted the unsustainable nature of traditional animal farming, prompting many consumers to adopt more sustainable diets.The vegan diet is seen as one of the most effective ways to reduce one’s ecological footprint. The production of plant-based foods generally requires fewer natural resources, generates lower carbon emissions, and contributes less to habitat destruction. As more people recognize the environmental impact of their food choices, many are turning to vegan fast food as a more eco-friendly alternative. Additionally, studies have shown that plant-based diets contribute to lower greenhouse gas emissions and reduced land and water use, making them a more sustainable alternative to traditional diets. This awareness has encouraged consumers to opt for vegan fast food as a practical way to align their dietary choices with environmental goals.

Market Trends

Focus on Nutritional Transparency and Clean Labels

As consumers become more knowledgeable about their food choices, there is a growing trend towards nutritional transparency in the vegan fast food market. UK consumers are increasingly interested in understanding the nutritional profile of the food they are eating, especially with the rise of health-conscious individuals looking for nutrient-dense meals. Vegan fast food chains are responding to this demand by offering clear, accessible information about the ingredients and nutritional content of their menu items.Clean labeling has gained significant traction, as consumers prefer food products that are free from artificial additives, preservatives, and excessive sugars. Vegan fast food chains are aligning with this trend by prioritizing natural, minimally processed ingredients, and ensuring that their products are both health-conscious and environmentally sustainable. In particular, there is a growing emphasis on providing high-protein, low-sugar options, along with clear labeling for allergens such as soy or gluten, to cater to a wide range of dietary preferences. As awareness of the importance of clean eating continues to rise, UK vegan fast food brands are likely to expand their offerings with an increasing focus on nutritious, whole-food ingredients that meet the needs of modern, health-oriented consumers.

Plant-Based Innovation and Collaboration with Non-Vegan Brands

Another noteworthy trend in the UK vegan fast food market is the increasing innovation in plant-based alternatives, particularly through strategic collaborations between vegan brands and traditional food companies. This trend is particularly evident in the partnerships between plant-based food producers and established food chains. Collaborations such as that between McDonald’s and Beyond Meat and the tie-up between KFC and Quorn have enabled fast food chains to offer plant-based alternatives that align with the growing consumer demand for vegan products. These partnerships allow traditional fast food giants to tap into the vegan food market without having to create entirely new product lines in-house.Additionally, plant-based food companies are developing new products with improved taste, texture, and nutritional value, which are increasingly available in mainstream supermarkets and restaurants. For example, innovations in plant-based meat alternatives, like lab-grown meats or more sophisticated soy- and pea protein-based products, are gaining traction. These products offer more than just a vegan-friendly alternative—they are becoming more competitive with traditional meat in terms of taste and consumer preference. As the technology behind plant-based food continues to advance, it is expected that the UK vegan fast food market will see an increase in the variety of offerings, with new and innovative products appealing to both vegan and non-vegan customers alike.

Increasing Menu Diversification by Mainstream Fast Food Chains

One of the most prominent trends in the UK vegan fast food market is the increasing inclusion of plant-based items in the menus of mainstream fast food chains. Traditionally known for serving meat-heavy dishes, leading fast food brands like McDonald’s, KFC, and Burger King have embraced plant-based alternatives to cater to the growing vegan and flexitarian customer base. For instance, McDonald’s UK introduced the McPlant burger, developed in collaboration with Beyond Meat, as a permanent menu item in 2022. This plant-based option features a Beyond Meat patty, vegan cheese, and vegan sauce, offering a familiar fast food experience without animal products. Similarly, Burger King UK has been expanding its vegan menu, with offerings like the Vegan Royale Bakon King, which includes plant-based bacon from La Vie. KFC UK has also joined the trend with its vegan burger, using Quorn as a meat replacement and coating it in their signature blend of herbs and spices.This trend is part of a broader shift in the food service industry towards accommodating diverse dietary preferences. The demand for plant-based options is not limited to strictly vegan consumers but also includes flexitarians—individuals who reduce their meat consumption without fully committing to a vegan lifestyle. This growing consumer segment is increasingly influencing fast food menus, prompting brands to innovate with plant-based dishes that replicate the taste and texture of traditional meat-based fast food items. As the vegan fast food market continues to grow, the industry can expect even more fast food giants to experiment with plant-based alternatives, making vegan food mainstream.

Rise in Convenience and Delivery Services for Vegan Fast Food

With the growing demand for vegan fast food, convenience has become a key factor in driving market expansion. The trend of delivery services, such as Uber Eats, Deliveroo, and Just Eat, has rapidly transformed how consumers access vegan fast food, especially in urban areas. As consumers increasingly value the convenience of ordering food from the comfort of their homes or workplaces, vegan fast food brands are capitalizing on this trend by offering fast, convenient, and easily accessible meals. For instance, Uber Eats in London offers a wide range of vegan food options from various restaurants, making it easy for consumers to access plant-based fast food. Just Eat, another popular delivery platform, has been actively promoting vegan options, with its Swiss subsidiary scoring high in terms of plant-based food availability. These delivery services have made vegan fast food more accessible, especially during events like Veganuary, when many platforms offer special discounts and promotions on plant-based dishes.This trend is particularly evident during the COVID-19 pandemic, where the demand for delivery services skyrocketed, and plant-based food options became an integral part of online menus. Vegan fast food chains and restaurants are not only expanding their presence on these delivery platforms but are also fine-tuning their offerings to ensure they are both easy to deliver and maintain high quality. The efficiency of delivery models is crucial for the success of vegan fast food, as consumers expect food to arrive fresh and hot. The incorporation of vegan-friendly delivery packaging that is environmentally sustainable has also emerged as a key selling point for eco-conscious consumers, aligning with their desire to minimize their carbon footprint. This shift towards online food delivery and at-home dining options is likely to continue shaping the vegan fast food landscape in the UK, particularly as convenience continues to be a primary driver of consumer behavior.

Market Challenges

Consumer Perception and Skepticism

Despite the increasing popularity of vegan diets, a significant challenge for the UK vegan fast food market is the persistence of consumer skepticism regarding the taste, texture, and nutritional value of plant-based alternatives. While vegan fast food has come a long way in replicating the sensory experience of traditional meat-based dishes, many consumers, particularly meat-eaters, still harbor doubts about the authenticity and satisfaction of plant-based options. This skepticism can hinder the broader acceptance of vegan fast food among a wider audience, limiting market growth.Additionally, some consumers remain concerned about the nutritional profile of vegan fast food, questioning whether these alternatives are truly healthier than their meat counterparts. While vegan fast food options are often marketed as being healthier, the perception that they are overly processed or high in carbohydrates and fats can deter health-conscious individuals from embracing them fully. Educating consumers about the nutritional benefits and quality of plant-based ingredients, as well as improving the flavor profiles and textures of vegan products, will be crucial in overcoming this challenge and increasing mainstream acceptance.

High Production Costs and Price Sensitivity in UK Vegan Fast Food Market

One of the major challenges facing the UK vegan fast food market is the high production costs associated with plant-based ingredients and the sourcing of quality alternatives to traditional meat products. Many plant-based meat substitutes, such as those made from pea protein or soy, require advanced technology and specialized production processes, which can increase manufacturing costs. These higher production costs often translate into higher menu prices for consumers, making vegan fast food less accessible to price-sensitive segments of the population.For instance, research from the Good Food Institute revealed that the cost of plant-based meat was significantly higher than that of animal meat in 2022, with even the least expensive plant-based meat substitutes costing more than meat generated from animals. This price disparity highlights the challenge vegan fast food faces in competing with traditional options on cost, potentially limiting market growth and consumer adoption.While demand for vegan fast food is growing, the price point remains a significant barrier for many potential customers, particularly when compared to traditional fast food options that often benefit from economies of scale and lower ingredient costs. As vegan food brands strive to maintain competitive pricing, the challenge lies in balancing cost-effectiveness with the desire to provide high-quality, nutritious, and ethically sourced products. Overcoming this challenge requires continued investment in supply chain efficiency, technological innovations in food production, and strategic partnerships to reduce the costs of plant-based ingredients. Until these cost structures improve, price sensitivity will continue to limit the growth potential of vegan fast food, particularly in lower-income demographics or regions where cost considerations are paramount.

Market Opportunities

Expansion of Product Offerings and Innovation

One of the most significant opportunities in the UK vegan fast food market lies in the continuous innovation and diversification of plant-based products. As consumer preferences evolve, there is a growing demand for a broader range of vegan fast food options that replicate the taste, texture, and experience of traditional meat-based fast food. By introducing new and innovative plant-based items, such as vegan chicken nuggets, sausages, or dairy-free desserts, brands can cater to an expanding consumer base. Furthermore, developing healthier alternatives with cleaner ingredients, lower calories, and higher nutritional value presents a chance to appeal to the growing health-conscious population. Innovation in plant-based offerings not only attracts vegan and flexitarian customers but also appeals to environmentally conscious consumers looking for sustainable alternatives to animal-based fast food.

Growth of Delivery Services and Online Platforms

With the rise of food delivery services and the increasing demand for convenience, there is a considerable opportunity for vegan fast food brands to expand their reach through online platforms like Uber Eats, Deliveroo, and Just Eat. As more consumers prioritize convenience and opt for home deliveries, vegan fast food businesses can capitalize on this trend by making their offerings easily accessible through these platforms. This trend presents an opportunity for vegan fast food chains and independent restaurants to scale their operations and reach a wider audience. Additionally, focusing on eco-friendly packaging and aligning with consumer preferences for sustainability in delivery services could enhance brand loyalty and attract environmentally conscious customers, further driving growth in the market.

Market Segmentation Analysis

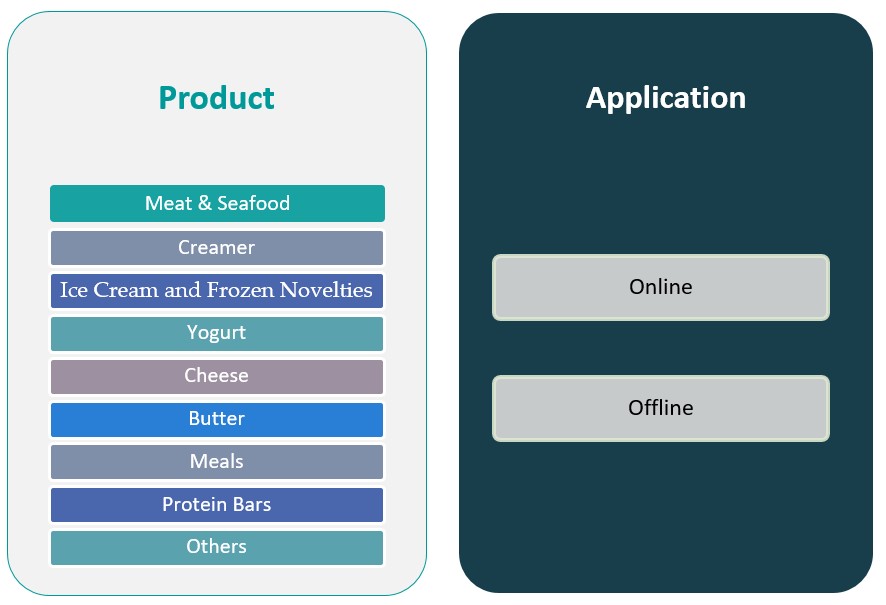

By Product

Meat and seafood alternatives hold a significant share of the vegan fast food market, with products like vegan burgers, sausages, and fishless fillets becoming more common in fast food chains. These innovations, driven by advancements in plant-based proteins, appeal to both vegans and flexitarians. Non-dairy creamers are gaining popularity as more consumers seek dairy-free alternatives for coffee and cooking, especially with the rise of vegan coffee shops and fast food chains. Vegan ice creams made from almond, soy, or coconut milk are rapidly growing, with major brands expanding their non-dairy options. Plant-based yogurt alternatives from coconut, almond, and soy are becoming a popular addition to breakfast and dessert menus in vegan fast food outlets. Vegan cheese, made from nuts, soy, or root vegetables, is widely used in burgers, sandwiches, and pizzas to cater to those avoiding dairy. The plant-based butter segment is also growing as more consumers reduce dairy consumption, with vegan butter featured in sandwiches, wraps, and pastries. Ready-to-eat vegan meals, including burgers, wraps, and pizzas, are a key segment, driven by demand for convenience and ethical eating. Vegan protein bars, made from plant-based ingredients, are increasing in popularity as on-the-go snacks for health-conscious consumers. Other vegan products, such as condiments, sauces, and snacks, further contribute to market growth.

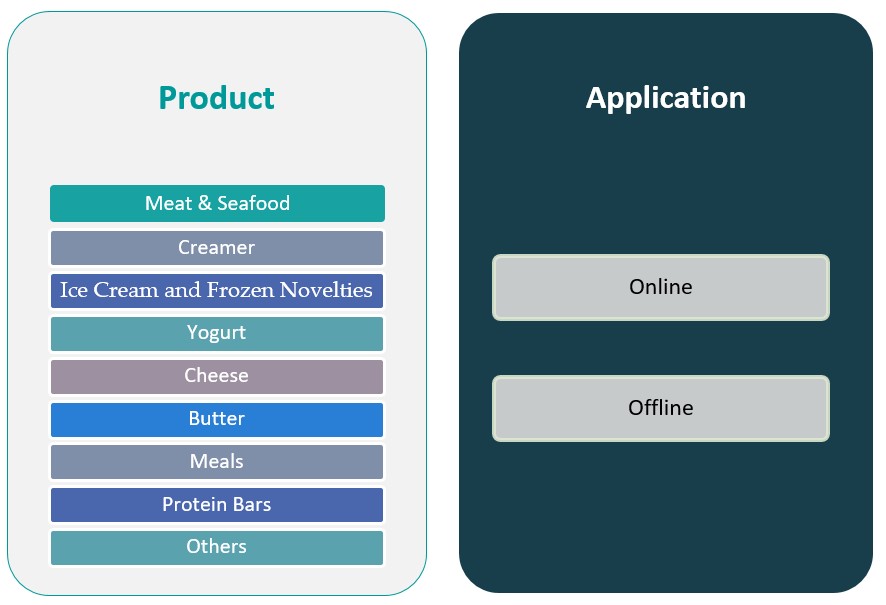

By Distribution Channel

The online channel has become increasingly important as consumers seek convenience and the ability to order vegan fast food directly to their homes. Online platforms, including food delivery services like Uber Eats, Deliveroo, and Just Eat, play a crucial role in reaching a wider audience. As more consumers prefer the convenience of online ordering, especially in urban areas, this channel is expected to continue growing, providing a significant opportunity for vegan fast food brands to expand their customer base.Traditional brick-and-mortar fast food restaurants, as well as dedicated vegan outlets, remain an essential part of the market. These establishments are often located in high-traffic areas, such as shopping centers and food courts, providing direct access to customers. Many consumers still prefer the experience of dining out, especially in locations where vegan options are increasingly popular. Offline channels are expected to remain important, though the growing trend toward online food delivery may reduce foot traffic in physical locations.

Segments

Based on Product

- Meat & Seafood

- Creamer

- Ice Cream and Frozen Novelties

- Yogurt

- Cheese

- Butter

- Meals

- Protein Bars

- Others

Based on Distribution Channel

Based on Region

- London and Southeast England

- Midlands and North England

- Scotland and Wales

Regional Analysis

London and Southeast England (40%)

London, the capital, and the surrounding Southeast region hold the largest market share in the UK vegan fast food sector, accounting for approximately 40% of the total market. The high concentration of vegan-friendly fast food outlets, including both independent vegan restaurants and fast food chains offering plant-based options, has made London a hub for vegan dining. This area benefits from a large, diverse population, high levels of awareness about health and environmental issues, and a strong culture of ethical consumption. The abundance of vegan fast food options and delivery services in urban centers like London drives significant demand, making it the primary region for vegan fast food consumption in the UK. The increased adoption of plant-based products by major fast food brands, including McDonald’s and Burger King, has further bolstered growth in this region.

Midlands and North England (30%)

The Midlands and North regions of the UK, which include cities such as Birmingham, Manchester, and Leeds, hold a combined market share of approximately 30%. These regions are witnessing a rapid increase in the popularity of vegan fast food, though they still lag behind London and Southeast England in terms of market size. However, the growing awareness of veganism and health-conscious eating is gradually driving change. Major cities in the North are seeing a rise in the number of vegan restaurants, with both independent businesses and national fast food chains offering plant-based menus. The demand for convenient vegan fast food is particularly strong in urban centers with a younger, more diverse population. Additionally, the growing number of delivery services in these regions has made vegan fast food more accessible, further contributing to market growth.

Key players

- Greggs

- Danone SA

- Beyond Meat

- Amy’s Kitchen

- VBites

Competitive Analysis

The UK vegan fast food market is highly competitive, with key players like Greggs, Danone SA, Beyond Meat, Amy’s Kitchen, and VBites leading the charge. Greggs, a prominent high-street bakery chain, has successfully integrated vegan options into its menu, with the popular “Vegan Sausage Roll” driving significant growth. Danone SA, known for its plant-based dairy alternatives, provides vegan-friendly products like plant-based yogurts and creamers, which cater to the growing demand for dairy-free options. Beyond Meat stands out with its plant-based meat substitutes, gaining widespread distribution across fast food chains and supermarkets. Amy’s Kitchen focuses on providing organic, plant-based frozen meals, catering to health-conscious consumers seeking convenient vegan options. VBites, an established UK brand, offers a wide range of vegan products, positioning itself as a strong competitor with its broad product portfolio. Each player brings unique strengths, contributing to the rapid expansion of the vegan fast food market in the UK.

Recent Developments

- In January 2025, Greggs reintroduced the Spicy Vegetable Curry Bake for Veganuary, describing it as a “much-loved meat-free favorite”.

- In December 2024, Beyond Meat announced the launch of Beyond Smash burger at Tesco stores across the UK, set to be available from January 1, 2025.

Market Concentration and Characteristics

The UK vegan fast food market is characterized by moderate market concentration, with a mix of established players and emerging brands driving competition. Major fast food chains like Greggs, Burger King, and McDonald’s have incorporated vegan options into their menus, capitalizing on the growing consumer demand for plant-based alternatives. At the same time, independent vegan brands such as VBites and Amy’s Kitchen offer specialized, entirely plant-based products, appealing to a niche but loyal customer base. The market also sees increasing innovation, particularly in plant-based meat and dairy substitutes, with companies like Beyond Meat leading the charge in providing high-quality, vegan-friendly fast food. While large multinational corporations dominate the market share, the sector remains dynamic, with new entrants and product innovations continually reshaping the competitive landscape. This mix of both large-scale chains and independent players fosters healthy competition and drives market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Fast food chains are expected to expand their vegan offerings, introducing new plant-based alternatives to appeal to a broader customer base. This diversification will help meet the growing demand for varied vegan fast food products.

- Continued investments in food technology will lead to more realistic plant-based meat and dairy alternatives, enhancing the consumer experience and attracting a wider audience. Innovation will drive the next wave of vegan fast food products, improving taste and texture.

- As consumers become more health-conscious and environmentally aware, the demand for vegan fast food is projected to rise significantly. Education about the environmental and health benefits of plant-based diets will boost adoption.

- The popularity of online ordering and delivery platforms will further boost the market. Vegan fast food brands are expected to increase their presence on platforms like Uber Eats and Deliveroo, enhancing accessibility for consumers.

- As sustainability becomes a critical focus, vegan fast food companies will increasingly adopt eco-friendly practices in sourcing ingredients, packaging, and waste management. Consumers are likely to prefer brands with strong environmental commitments.

- Major fast food chains, including McDonald’s and KFC, will likely increase their vegan product offerings to cater to the growing vegan and flexitarian customer base. This will lead to greater mainstream acceptance of vegan fast food.

- With growing concerns about the health impacts of processed foods, vegan fast food chains will focus on offering healthier, nutrient-dense alternatives. Expect a rise in plant-based meals rich in protein and low in unhealthy fats.

- The demand for vegan fast food will spread beyond major cities like London, reaching smaller towns and regional areas. This growth will be supported by rising awareness and a broader range of vegan options becoming available.

- As the market expands, competition among brands will intensify, pushing companies to differentiate through product quality, price, and brand loyalty. Smaller independent vegan brands will continue to challenge larger fast food chains.

- As the plant-based food market grows, government policies and regulations supporting vegan products and sustainability initiatives will likely increase. This support could include incentives for plant-based food production and environmental practices.