Market Overview

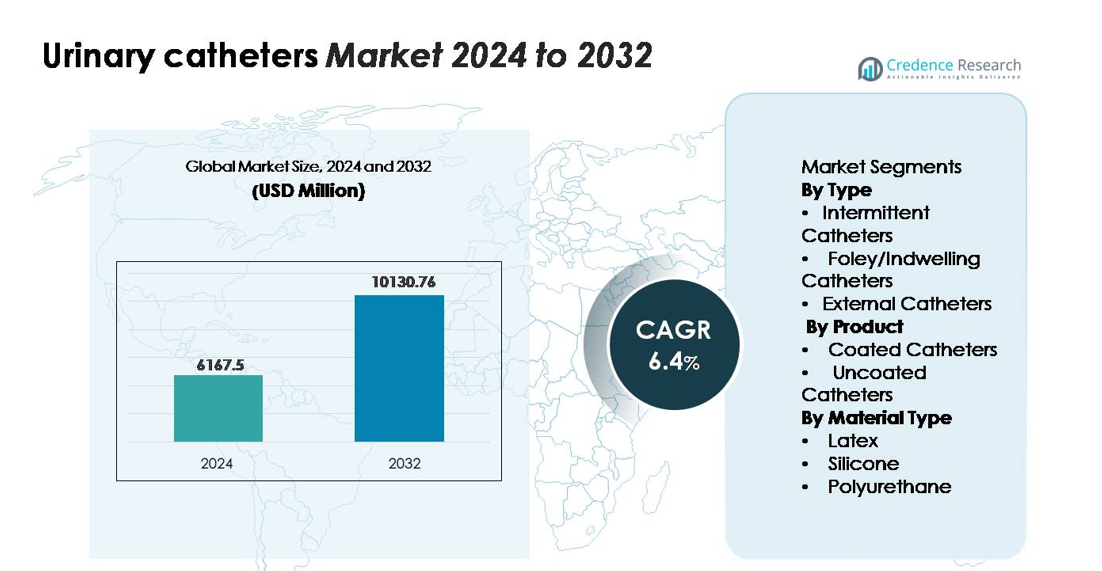

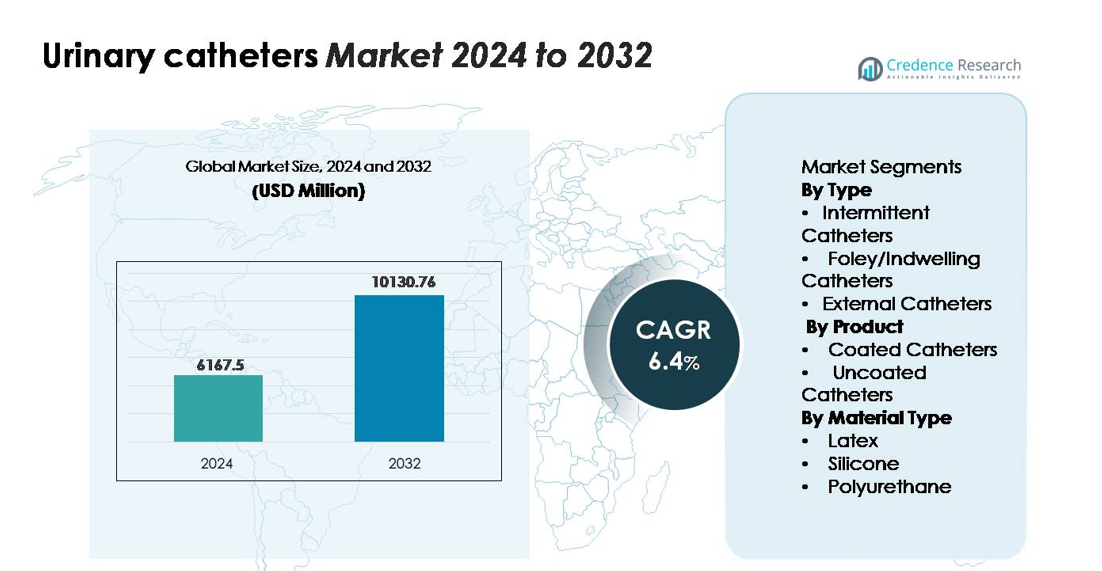

The urinary catheters market was valued at USD 6,167.5 million in 2024 and is projected to reach USD 10,130.76 million by 2032, expanding at a CAGR of 6.4% over the forecast period (2024–2032).”

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Urinary Catheters Market Size 2024 |

USD 6,167.5 million |

| Urinary Catheters Market, CAGR |

6.4% |

| Urinary Catheters Market Size 2032 |

USD 10,130.76 million |

The urinary catheters market is led by established global manufacturers such as Coloplast, ConvaTec, Teleflex, B. Braun Melsungen, C. R. Bard, Hollister Incorporated, Medline Industries, Cook Medical, Well Lead Medical, and Manfred Sauer, each competing through innovations in coated, silicone-based, and single-use intermittent catheter solutions. These companies focus on infection-control technologies, patient-centric designs, and expansion of home-care-friendly product lines. North America remains the leading regional market with an estimated 34% share, driven by strong reimbursement systems, high adoption of intermittent catheters, and advanced urological care infrastructure. Europe follows closely with substantial demand supported by mature clinical practices and wide availability of premium catheter products.

Market Insights

- The urinary catheters market was valued at USD 6,167.5 million in 2024 and is projected to reach USD 10,130.76 million by 2032, registering a CAGR of 6.4% during the forecast period.

- Market growth is driven by the rising prevalence of urinary retention, neurogenic bladder disorders, and post-surgical complications, alongside increasing adoption of intermittent catheters, which currently hold the largest segment share due to lower infection risk and suitability for self-catheterization.

- Key trends include rapid transition toward hydrophilic-coated and silicone-based catheters, expansion of home healthcare, and advancements in antimicrobial coatings aimed at reducing CAUTIs across long-term care settings.

- Competitive intensity remains high, with leading players—Coloplast, ConvaTec, Teleflex, B. Braun, Hollister, and C. R. Bard—focusing on product innovation, sterilization technologies, and expanded availability of single-use catheters, while cost pressures and infection risks act as major restraints.

- Regionally, North America leads with 34% share, followed by Europe at 30%, while Asia-Pacific holds 24%, supported by expanding healthcare infrastructure and rising urological disease burden.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

Intermittent catheters remain the dominant segment, capturing the largest market share due to their widespread use in managing chronic urinary retention and neurogenic bladder disorders. Their preference is driven by lower infection risk, reduced hospitalization rates, and the increasing availability of single-use sterile formats that enhance patient safety. Rising self-catheterization adoption among individuals with spinal cord injuries and multiple sclerosis further boosts demand. Foley/indwelling catheters continue to play a critical role in long-term care settings, while external catheters gain traction for male incontinence management, supported by improvements in skin-friendly adhesive technologies.

- For instance, Coloplast’s Luja™ catheter, introduced in February 2023, incorporates over 80 micro-holes—compared to the conventional 2 eyelets—and demonstrated complete bladder emptying in 90% of catheterisations (residual volume <10 mL) in the CP353 crossover study involving 42 participants, showing significantly improved drainage efficiency.

By Product:

Coated catheters hold the dominant share in this segment, supported by growing clinical preference for hydrophilic and antimicrobial coatings that minimize urethral trauma and reduce catheter-associated urinary tract infections (CAUTIs). Their ease of insertion, lubricious surfaces, and compliance with infection-control protocols strengthen adoption across hospitals and home-care environments. Uncoated catheters remain relevant due to their lower cost and continued demand in low-resource settings, but the shift toward coated variants accelerates as healthcare systems prioritize patient comfort, procedural efficiency, and reduced complication rates.

- For instance, GentleCath™ Glide by ConvaTec Group plc leverages its “FeelClean Technology™”—a hydrophilic surface integrated into the catheter material rather than applied as a coating—to offer “minimal mess and residue” and quicker readiness via a water sachet; the product is available in sizes 12 Fr-18 Fr and lengths corresponding to standard 20 cm and 40 cm formats for women and men respectively.

By Material Type:

Silicone catheters lead the material segment, accounting for the highest market share owing to their biocompatibility, non-reactive properties, and suitability for long-term catheterization. Their resistance to encrustation and ability to maintain lumen patency make them essential for patients prone to mineral buildup or chronic catheter use. Latex catheters continue to serve short-term applications but face limitations due to allergy concerns, while polyurethane catheters gain gradual acceptance for their thin-wall strength and flexibility. The expanding focus on hypoallergenic and long-duration catheter solutions reinforces silicone’s position as the dominant material choice.

Key Growth Drivers

Rising Prevalence of Urological Disorders and Chronic Conditions

The increasing global burden of urological disorders—including benign prostatic hyperplasia, urinary retention, spinal cord injuries, and neurogenic bladder—continues to propel long-term demand for urinary catheters. Aging populations, particularly in Asia-Pacific, Europe, and North America, significantly contribute to higher catheter utilization as elderly individuals face a greater incidence of bladder dysfunction and post-surgical urinary complications. Growth is further supported by the expanding number of surgeries requiring perioperative catheterization across urology, orthopedics, and general care settings. Improvements in home-based care solutions also enable patients with chronic urinary conditions to adopt intermittent self-catheterization, reducing dependence on institutional care. These clinical factors strengthen the market’s foundation, ensuring sustained demand across hospitals, ambulatory surgical centers, and home-care environments.

- For instance, Coloplast’s CP353 clinical study on its Luja™ intermittent catheter demonstrated that among 42 participants with chronic urinary retention, Luja facilitated complete bladder emptying in 90% of catheterisations (residual volume <10 mL), compared with 52% when using a conventional 2-eyelet catheter—highlighting measurable advantages for patients with neurogenic bladder and spinal cord injuries.

Expansion of Home Healthcare and Self-Catheterization Practices

The rising acceptance of self-catheterization, especially among individuals with long-term urinary dysfunction, serves as a major growth catalyst. Intermittent catheters, particularly user-friendly coated variants, support safe at-home usage with lower infection risk and greater comfort. Governments and healthcare providers encourage self-management practices to reduce hospital readmissions, optimize treatment costs, and improve patient mobility. Manufacturers contribute to this shift by developing compact, pre-lubricated, and discreet single-use catheters designed for portability and easier handling. The growing emphasis on patient independence and decentralized care systems further accelerates the transition toward home-based catheterization solutions. As healthcare infrastructure evolves—especially in developed regions—the demand for convenient, sterile-ready catheter products is expected to strengthen consistently.

- For instance, ConvaTec’s GentleCath™ Air for Women, launched in May 2024, weighs under 7 grams and uses an integrated hydrophilic matrix that requires no external lubricant, enabling faster self-catheterization in non-clinical settings; internal bench testing confirmed a 41% reduction in insertion force compared with conventional PVP-coated female catheters.

Advancements in Coating Technologies and Biocompatible Materials

Innovations in catheter materials and surface coatings continue to drive adoption of premium products in clinical and home-care settings. Hydrophilic-coated catheters reduce urethral friction and improve insertion comfort, while antimicrobial coatings help lower the incidence of catheter-associated urinary tract infections (CAUTIs), a major complication in long-term catheter use. Silicone-based designs further support extended placement durations due to their biocompatibility, thermal stability, and resistance to encrustation. Manufacturers increasingly invest in developing latex-free, hypoallergenic materials to address rising allergy concerns. Additionally, the focus on advanced surface treatments and precision-controlled manufacturing enhances product reliability, sterility integrity, and patient safety. These technological upgrades continue to shift market preference toward higher-value coated and silicone-based catheter solutions.

Key Trends & Opportunities

Growing Shift Toward Single-Use and Infection-Control Compliant Solutions

The global healthcare industry is witnessing a strong shift toward single-use urinary catheters that comply with strict infection-prevention protocols. This transition is reinforced by increasing regulatory focus on reducing CAUTIs—a priority for hospitals and long-term care facilities worldwide. As providers adopt stricter hygiene standards, disposable catheters with pre-lubricated, sterile-ready, and hydrophilic-coated designs gain substantial traction. Manufacturers are leveraging this trend by expanding their portfolios of single-use catheters that offer improved comfort, ease of handling, and reduced contamination risk. Reimbursement support for intermittent catheters in North America and parts of Europe further strengthens adoption. This movement represents a significant revenue opportunity for companies developing cost-effective, high-performance disposable systems.

- For instance, Coloplast’s SpeediCath® Ready-to-Use range is manufactured under a controlled hydration process that maintains the catheter’s hydrophilic surface at a measured osmolarity of 280–310 mOsm/kg, ensuring uniform lubrication and reducing epithelial shear during insertion.

Digital Monitoring and Smart Catheter Innovations

The emergence of digitally enabled urinary management systems presents new growth prospects across advanced healthcare environments. Smart catheters incorporating integrated sensors can detect urine output patterns, bladder pressure changes, and early signs of infection or catheter blockage. Such technologies support real-time monitoring in critical care units and chronic disease management, improving patient outcomes and reducing clinical workload. While adoption remains in its early stages, increased R&D funding and growing interest from medtech companies suggest strong long-term potential. As connected healthcare solutions expand, smart catheter systems may become a key differentiator for manufacturers seeking leadership in high-tech urological care products.

- For instance, Potrero Medical’s Accuryn® Smart Foley System, used widely in critical care settings, incorporates dual pressure and temperature sensors capable of delivering continuous intra-abdominal pressure (IAP) readings every 6 seconds with a validated measurement accuracy of ±1 mmHg, as confirmed in bench and clinical validation studies.

Key Challenges

High Risk of Catheter-Associated Urinary Tract Infections (CAUTIs)

CAUTIs remain one of the most significant clinical challenges associated with urinary catheters, especially for long-term Foley catheter users. These infections increase hospitalization duration, treatment costs, and patient morbidity, prompting regulatory bodies to implement stringent guidelines for catheter usage and maintenance. Despite advancements in antimicrobial coatings and improved care protocols, infection risks remain a major concern for healthcare providers. Facilities face pressure to minimize catheter usage unless medically necessary, which may limit growth in certain application areas. This challenge requires continuous innovation in materials, surface treatments, and hygiene-focused product designs to ensure safe long-term catheterization.

Limited Awareness and Training in Self-Catheterization Practices

Although self-catheterization is a preferred approach for many chronic urinary conditions, limited awareness and inadequate training among patients and caregivers pose adoption barriers. Incorrect insertion techniques increase the risk of urethral trauma, discomfort, and infection, discouraging long-term adherence. In low-resource regions, the lack of structured patient education programs, limited access to sterile supplies, and insufficient reimbursement further hinder usage. Healthcare providers and manufacturers must invest in training tools, instructional platforms, and patient-support resources to improve technique accuracy and confidence. Expanding education and accessibility remains essential for unlocking the full potential of home-based catheterization markets.

Regional Analysis

North America

North America holds the dominant share of the urinary catheters market, accounting for approximately 34% of global revenue. The region benefits from high adoption of intermittent catheters, strong reimbursement frameworks, and widespread use of coated and silicone-based catheters in clinical and home-care settings. A rising prevalence of BPH, spinal cord injuries, and urinary incontinence among the elderly further strengthens demand. Hospitals increasingly emphasize infection control protocols, boosting uptake of hydrophilic-coated and antimicrobial catheters. Advanced healthcare infrastructure, active product innovations, and strong presence of key manufacturers continue to reinforce North America’s leadership position.

Europe

Europe constitutes around 30% of the global market, driven by advanced urological care practices, strong adoption of single-use catheters, and high awareness of CAUTI prevention guidelines. Countries such as Germany, France, the U.K., and the Nordics exhibit strong utilization of intermittent self-catheterization supported by structured patient training programs. Regulatory emphasis on latex-free and biocompatible materials accelerates transition toward silicone and coated catheters. Expanding home healthcare services and favorable reimbursement policies further support sustained growth. Europe’s mature healthcare ecosystem and standardized clinical protocols ensure stable long-term demand across hospital and ambulatory care settings.

Asia-Pacific

Asia-Pacific captures roughly 24% of the urinary catheters market and represents the fastest-growing regional segment. Rising prevalence of diabetes, urinary retention, and post-surgical complications, combined with expanding access to urological care, drives substantial demand. Rapid growth in China, India, Japan, and South Korea is supported by expanding hospital infrastructure and increasing patient awareness of intermittent catheterization. Manufacturers benefit from growing adoption of coated and silicone catheters as providers shift toward infection-control–focused solutions. Government investments in aging-care services and broader health insurance coverage further accelerate market expansion across emerging economies.

Latin America

Latin America accounts for about 7% of global market share, driven by increasing healthcare expenditure, growth in private hospitals, and rising diagnoses of urinary incontinence and post-surgical urinary retention. Brazil, Mexico, and Argentina lead regional demand, with a growing shift toward coated intermittent catheters in urban healthcare systems. Budget constraints and varied reimbursement structures limit widespread adoption of premium catheters, although gradual improvements in urological care are supporting steady growth. Efforts to enhance clinical training and infection-prevention protocols are also helping increase utilization of higher-quality catheter solutions across major healthcare facilities.

Middle East & Africa

The Middle East & Africa region represents approximately 5% of the global market, with growth driven by expanding hospital capacity, increasing urological disease burden, and rising investment in modern medical technologies. Gulf nations—particularly Saudi Arabia and the UAE—lead adoption with growing demand for silicone and coated catheters in tertiary care centers. In Africa, unmet clinical needs, limited access to high-quality catheter supplies, and infrastructure gaps constrain market penetration; however, international health programs and improved procurement frameworks support gradual uptake. The region continues to transition toward safer, sterile single-use catheter products.

Market Segmentations:

By Type

- Intermittent Catheters

- Foley/Indwelling Catheters

- External Catheters

By Product

- Coated Catheters

- Uncoated Catheters

By Material Type

- Latex

- Silicone

- Polyurethane

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Lands

The urinary catheters market is characterized by strong competition among global manufacturers focused on expanding portfolios, improving material biocompatibility, and enhancing infection-control performance. Leading companies continuously invest in hydrophilic and antimicrobial coating technologies, silicone-based long-term catheters, and user-friendly intermittent catheter designs tailored for home-care use. Strategic initiatives include product approvals, manufacturing capacity expansions, and collaborations with healthcare institutions to strengthen clinical adoption. Players increasingly prioritize latex-free, pre-lubricated, and sterile single-use solutions to meet evolving regulatory and patient safety requirements. Rising emphasis on sustainability and compact packaging formats also shapes differentiation strategies. In emerging markets, competitive intensity grows as regional manufacturers introduce cost-effective catheter options that appeal to public hospitals and low-resource settings. Overall, the landscape is defined by innovation-driven competition, with companies focusing on advanced materials, infection prevention, and patient comfort to secure long-term market positioning.Top of Form

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coloplast

- ConvaTec

- Teleflex

- B. Braun Melsungen

- C. R. Bard

- Hollister Incorporated

- Medline Industries

- Cook Medical

- Well Lead Medical

- Manfred Sauer

Recent Developments

- In May 2024, ConvaTec Group plc Launched in Europe the GentleCath Air™ for Women — a compact intermittent catheter using next-gen FeelClean Technology™ (hydrophilic integrated into material) for female users.

- In Nov 2023, Coloplast announced a new manufacturing site in Portugal for its intermittent catheter products (for people with urinary retention such as SCI/spina bifida) to meet rising global demand.

- In Feb 2023, Coloplast A/S Launched a male catheter (“Luja”) designed with 80+ micro-holes to reduce urinary tract infection (UTI) risk

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Material type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for intermittent self-catheterization will continue to rise as patients increasingly shift toward home-based urinary management.

- Adoption of hydrophilic-coated and antimicrobial catheters will accelerate as infection-prevention standards tighten globally.

- Silicone-based catheters will strengthen their lead due to improved biocompatibility and reduced risk of encrustation.

- Smart catheter technologies with integrated sensors will gain traction in critical care and chronic monitoring applications.

- Manufacturers will expand portfolios of single-use, ready-to-use catheters to meet hygiene and convenience expectations.

- Regulatory agencies will enforce stricter CAUTI reduction protocols, reshaping hospital procurement priorities.

- Emerging markets in Asia-Pacific and Latin America will see rapid demand growth as urology care infrastructure improves.

- Sustainability-focused catheter designs and recyclable materials will gain importance in procurement decisions.

- Training and education programs for self-catheterization will expand, improving patient adoption and compliance.

- Strategic collaborations between device makers and healthcare systems will grow to support clinical integration of next-generation catheter solutions.