| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Healthcare Supply Chain Management Market Size 2023 |

USD 723.37 Million |

| U.S. Healthcare Supply Chain Management Market, CAGR |

12.3% |

| U.S. Healthcare Supply Chain Management Market Size 2032 |

USD 2,056.09 Million |

Market Overview

U.S. Healthcare Supply Chain Management Market size was valued at USD 723.37 million in 2023 and is anticipated to reach USD 2,056.09 million by 2032, at a CAGR of 12.3% during the forecast period (2023-2032).

The U.S. healthcare supply chain management market is primarily driven by the increasing need to reduce operational costs and improve efficiency across healthcare systems. Rising pressure on hospitals and healthcare providers to enhance patient care while maintaining budget constraints has accelerated the adoption of advanced supply chain solutions. Additionally, the growing demand for real-time data analytics, inventory optimization, and automation tools contributes to market growth. The transition towards value-based care and the integration of cloud-based technologies further support streamlined operations and decision-making. Key trends include the rising implementation of RFID and IoT technologies to track medical supplies and equipment accurately, along with growing investments in AI and blockchain to improve transparency, traceability, and risk management in the supply chain. Moreover, post-pandemic emphasis on supply chain resilience and regulatory compliance has spurred the adoption of more agile and technology-driven systems, positioning supply chain management as a strategic function within the healthcare sector.

The U.S. healthcare supply chain management market demonstrates strong regional variation, with the Western and Midwestern states leading innovation due to their advanced healthcare infrastructure and early adoption of digital solutions. Southern states are witnessing rapid growth driven by expanding healthcare networks and increased investments in modernization, while the Northeastern region remains focused on integrating compliance and ESG practices into supply chain operations. Across the country, healthcare providers are increasingly turning to technology to improve efficiency, reduce costs, and enhance patient care outcomes. Key players shaping the competitive landscape include IBM Corporation, Oracle Corporation, McKesson Corporation, SAP SE, and Infor, all of which offer integrated platforms and scalable cloud-based solutions. Additional contributors such as Tecsys Inc., Blue Yonder Group, Corcentric, Epicor, and Cardinal Health are also actively advancing innovation in inventory optimization, predictive analytics, and automation. These companies collectively drive the market forward by enabling smarter, more resilient healthcare supply chains.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. healthcare supply chain management market was valued at USD 723.37 million in 2023 and is projected to reach USD 2,056.09 million by 2032, growing at a CAGR of 12.3%.

- The global healthcare supply chain management market was valued at USD 2,480.91 million in 2023 and is projected to reach USD 6,991.12 million by 2032, growing at a CAGR of 12.2% during the forecast period.

- Increasing demand for cost reduction, improved efficiency, and real-time visibility in supply chain processes is driving market growth.

- Rising adoption of advanced technologies such as AI, IoT, and blockchain is transforming supply chain operations in the healthcare sector.

- Key players like IBM, SAP, Oracle, McKesson, and Infor are actively expanding their portfolios through cloud-based and AI-powered solutions.

- High implementation costs, integration issues with legacy systems, and data security concerns are restraining market expansion.

- The Western U.S. leads in technology adoption and infrastructure, while the South is experiencing rapid digital growth in rural healthcare facilities.

- Growing emphasis on supply chain resilience and sustainability is encouraging innovation and regional investments in smart logistics systems.

Report Scope

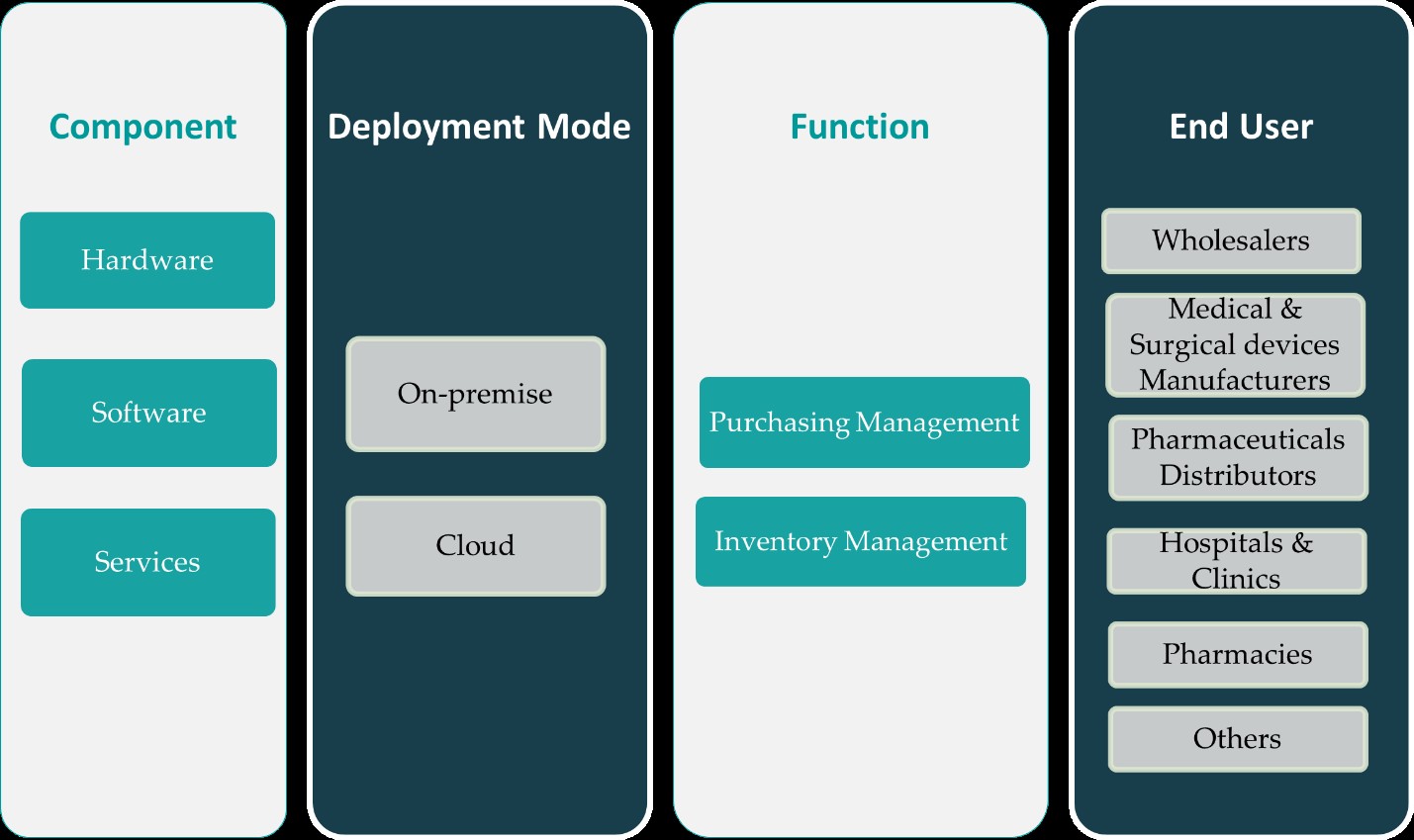

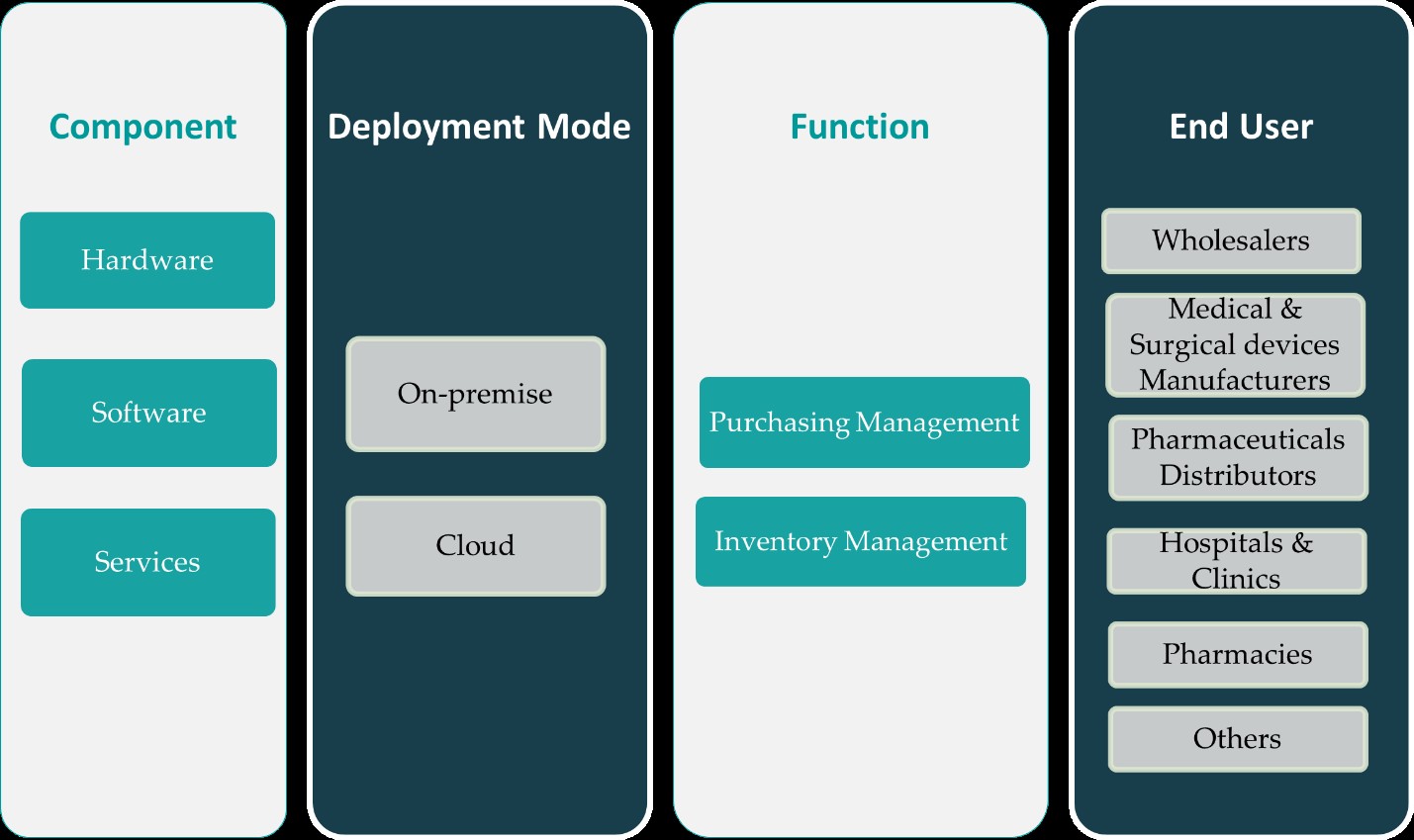

This report segments the U.S. Healthcare Supply Chain Management Market as follows:

Market Drivers

Increasing Demand for Cost Reduction and Operational Efficiency

One of the primary drivers propelling the U.S. healthcare supply chain management market is the pressing need to reduce operational costs while maintaining high-quality patient care. Healthcare organizations face mounting pressure to manage resources efficiently, particularly in light of rising treatment costs, staffing shortages, and financial constraints. For instance, a survey conducted by the American Hospital Association revealed that hospitals implementing automated inventory management systems significantly reduced stockouts and improved resource utilization. Additionally, healthcare providers in Texas have adopted AI-driven platforms to optimize procurement processes, ensuring the timely availability of critical medical supplies while minimizing waste.

Growing Emphasis on Regulatory Compliance and Risk Mitigation

The evolving regulatory landscape in the U.S. healthcare sector is another significant driver fueling the adoption of robust supply chain management systems. Healthcare organizations must adhere to strict regulations from agencies such as the FDA, HIPAA, and CDC, particularly regarding the safe storage, distribution, and handling of medical products and pharmaceuticals. For instance, pharmaceutical companies in California have implemented blockchain-based traceability systems to comply with FDA guidelines, ensuring the authenticity and safety of medical products. Additionally, hospitals in Florida have adopted real-time monitoring tools to identify supply chain disruptions early, enabling contingency planning and enhancing resilience against future crises.

Technological Advancements and Digital Transformation

The integration of cutting-edge technologies such as cloud computing, artificial intelligence (AI), Internet of Things (IoT), and blockchain is significantly transforming healthcare supply chain operations in the U.S. Cloud-based platforms allow for centralized data management and remote access, enabling stakeholders to make real-time, informed decisions. AI and machine learning facilitate predictive analytics, helping healthcare providers forecast demand, optimize procurement schedules, and reduce waste. IoT devices such as RFID tags and smart sensors enhance asset tracking and visibility across the supply chain. Blockchain technology, though still emerging, offers secure and transparent documentation, reducing fraud and increasing traceability of products. These technological advancements not only improve the accuracy and speed of supply chain operations but also provide healthcare organizations with a strategic edge in managing resources and delivering quality patient care.

Shift Toward Value-Based Care and Patient-Centric Models

The U.S. healthcare system’s gradual transition from volume-based to value-based care models has also influenced the growth of supply chain management solutions. Value-based care emphasizes improved patient outcomes, reduced hospital readmissions, and better resource utilization. To support these goals, healthcare providers are increasingly adopting supply chain systems that align with clinical performance indicators and patient satisfaction metrics. Efficient supply chain operations contribute to timely treatment, improved diagnostics, and minimized delays in care delivery. Furthermore, a patient-centric supply chain ensures the availability of customized medical supplies and pharmaceuticals, contributing to personalized treatment plans. As healthcare providers prioritize value over volume, the need for integrated, responsive, and data-driven supply chain strategies becomes more critical, further driving market expansion in the U.S.

Market Trends

Adoption of Advanced Analytics and Predictive Modeling

One of the most notable trends in the U.S. healthcare supply chain management market is the increasing integration of advanced analytics and predictive modeling tools. Healthcare organizations are leveraging these technologies to gain deeper insights into supply chain performance, demand forecasting, and inventory optimization. Predictive analytics enables providers to anticipate future supply needs based on historical data, seasonal patterns, and patient flow, helping to minimize shortages and overstocking. These data-driven capabilities enhance strategic planning and support evidence-based decision-making, ultimately leading to improved cost-efficiency and service delivery. As healthcare institutions focus more on actionable intelligence, the demand for analytics-powered supply chain platforms is steadily growing.

Focus on Supply Chain Resilience and Diversification

The COVID-19 pandemic served as a wake-up call for healthcare organizations to prioritize supply chain resilience and diversification. For instance, healthcare systems in Pennsylvania have invested in local sourcing and multiple vendor partnerships to mitigate risks associated with global disruptions. Additionally, a study by the U.S. Department of Health and Human Services emphasized the use of supply chain mapping and risk assessment tools by hospitals in Florida to ensure preparedness against unforeseen challenges, fostering long-term resilience.

Rise in Cloud-Based and SaaS Supply Chain Solutions

The shift toward cloud-based and Software-as-a-Service (SaaS) platforms is reshaping how healthcare providers manage their supply chain operations. These solutions offer scalability, flexibility, and remote accessibility—features that have become increasingly critical in the post-pandemic healthcare environment. Cloud-based systems simplify integration with existing hospital information systems (HIS) and enterprise resource planning (ERP) platforms, facilitating real-time data exchange and coordination across departments. Moreover, SaaS models reduce upfront infrastructure costs while providing automatic updates and enhanced cybersecurity features. This trend reflects a broader digital transformation in healthcare, enabling organizations to improve agility, ensure compliance, and streamline their supply chain functions with minimal disruption.

Increasing Use of RFID, IoT, and Automation

Another significant trend is the growing use of RFID, IoT-enabled devices, and automation to enhance transparency, efficiency, and accuracy in the supply chain. For instance, healthcare providers in Illinois have deployed IoT sensors to monitor storage conditions and track temperature-sensitive pharmaceuticals in real-time, ensuring timely delivery and compliance with safety standards. Additionally, hospitals in Michigan have implemented robotics and smart dispensers to automate inventory replenishment and supply sorting, reducing manual errors and improving operational efficiency.

Market Challenges Analysis

Complexity of Regulatory Compliance and Data Security

One of the most pressing challenges facing the U.S. healthcare supply chain management market is the complexity of navigating stringent regulatory requirements while ensuring data security. Healthcare providers must comply with a wide range of federal and state regulations, including HIPAA, the FDA’s Drug Supply Chain Security Act (DSCSA), and various cybersecurity standards. For instance, hospitals in California have implemented blockchain-based systems to ensure compliance with DSCSA requirements, enabling end-to-end traceability of pharmaceuticals and reducing the risk of counterfeit drugs. Additionally, a report by the U.S. Department of Health and Human Services highlighted that healthcare organizations in Texas have adopted advanced encryption protocols and real-time monitoring tools to safeguard sensitive patient and supply chain data, addressing the growing threat of cyberattacks.

Integration Barriers and High Implementation Costs

Another significant challenge is the difficulty in integrating supply chain management solutions with existing healthcare IT infrastructure. Many hospitals and clinics operate with legacy systems that lack interoperability, making it difficult to implement advanced digital supply chain tools without extensive customization. This results in fragmented workflows, data silos, and delayed decision-making, undermining the potential benefits of automation and real-time visibility. Furthermore, the high cost of implementing advanced supply chain technologies such as AI-driven analytics, RFID systems, and IoT devices can deter adoption, particularly among mid-sized and rural healthcare providers. Budget constraints and the long return on investment period make it challenging for many institutions to justify these expenditures. As the demand for more responsive and integrated supply chain systems increases, overcoming these integration and cost-related barriers will be essential to ensuring broader market growth and technology adoption across the healthcare sector.

Market Opportunities

The U.S. healthcare supply chain management market presents significant opportunities driven by the ongoing digital transformation of the healthcare sector. As healthcare organizations increasingly prioritize value-based care, there is a growing demand for supply chain systems that align with clinical outcomes, cost efficiency, and patient satisfaction. This shift opens opportunities for solution providers to offer integrated platforms that combine procurement, inventory management, and data analytics. Moreover, the adoption of technologies such as AI, machine learning, and blockchain is creating space for innovation in predictive analytics, real-time monitoring, and secure data sharing. Companies that can deliver scalable, cloud-based, and interoperable systems tailored to various healthcare settings stand to benefit from this evolving demand. The push for automation and intelligent supply chain management also creates potential for startups and tech firms entering the healthcare space with specialized solutions.

Another promising opportunity lies in addressing the needs of underserved and rural healthcare facilities, which often face challenges in supply chain modernization due to limited resources and infrastructure. Vendors that offer cost-effective, modular, and easy-to-deploy solutions can tap into this segment by enabling smaller providers to optimize their operations without large capital investments. Additionally, the increasing focus on supply chain resilience post-pandemic has encouraged healthcare providers to diversify suppliers, enhance local sourcing, and invest in risk mitigation tools. This creates a fertile ground for consultancy firms, logistics providers, and technology developers to offer services and solutions tailored to these strategic shifts. As federal and state governments introduce funding initiatives and policies to improve healthcare infrastructure and emergency preparedness, stakeholders in the healthcare supply chain ecosystem have an opportunity to align their offerings with these objectives and capture a growing share of this dynamic market.

Market Segmentation Analysis:

By Component:

The U.S. healthcare supply chain management market, when segmented by component, includes hardware, software, and services. Among these, the software segment holds the largest market share and is expected to continue its dominance during the forecast period. This growth is primarily driven by the increasing adoption of advanced supply chain management platforms that offer real-time analytics, demand forecasting, inventory tracking, and regulatory compliance tools. Healthcare providers are investing in software solutions that integrate seamlessly with hospital information systems (HIS) and enterprise resource planning (ERP) platforms to enhance visibility and decision-making across the supply chain. While hardware components such as RFID readers, barcode scanners, and IoT-enabled tracking devices are essential for improving operational accuracy and asset management, they serve as complementary tools to software platforms. Additionally, the services segment—including system integration, maintenance, training, and support—is gaining traction as healthcare organizations seek expert guidance for deploying and managing complex supply chain solutions. Collectively, these components form a comprehensive ecosystem that supports efficient, technology-driven supply chain operations.

By Deployment Mode:

Based on deployment mode, the market is categorized into on-premise and cloud-based solutions. Cloud-based deployment is witnessing faster growth, driven by the need for scalable, cost-effective, and accessible platforms across healthcare facilities of varying sizes. Cloud solutions allow real-time data sharing and remote access, which are critical in a healthcare environment that demands timely decision-making and collaboration across departments and locations. Additionally, cloud models reduce infrastructure costs, simplify upgrades, and improve cybersecurity through centralized updates and managed services. On-premise solutions, although preferred by some large hospitals for greater control and data security, are gradually being supplemented or replaced by cloud systems due to their limited scalability and higher maintenance costs. The flexibility and adaptability of cloud-based systems make them particularly attractive to small and mid-sized healthcare providers seeking to modernize their supply chain operations without significant capital investments. As digital transformation accelerates, cloud deployment is expected to remain a key growth driver in the U.S. healthcare supply chain management market.

Segments:

Based on Component:

- Hardware

- Software

- Services

Based on Deployment Mode:

Based on Function:

- Purchasing Management

- Inventory Management

Based on End User:

- Medical & Surgical Device Manufacturers

- Pharmaceutical Distributors

- Wholesalers

- Hospital & Clinics

- Pharmacies

- Others

Based on the Geography:

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Regional Analysis

Western United States

The Western United States holds the largest share of the U.S. healthcare supply chain management market, accounting for approximately 32% in 2023. This region’s dominance can be attributed to the presence of leading healthcare institutions, advanced health IT infrastructure, and early adoption of digital supply chain solutions in states such as California, Washington, and Oregon. The region also benefits from strong investments in health tech startups and proximity to major technology hubs like Silicon Valley, which fosters innovation in healthcare logistics and automation. Hospitals and health systems in the West are increasingly implementing AI-powered inventory tracking, RFID solutions, and cloud-based supply chain management platforms to optimize costs and improve patient outcomes. Additionally, regulatory emphasis on sustainability and carbon footprint reduction in the region is encouraging the adoption of greener supply chain practices, such as localized sourcing and smart inventory planning. These factors collectively strengthen the Western region’s leadership in the healthcare supply chain ecosystem.

Midwestern United States

The Midwestern United States follows with a significant market share of around 26%, driven by a strong network of healthcare providers and pharmaceutical manufacturers, particularly in states such as Illinois, Ohio, and Michigan. The region’s central location makes it a vital logistics hub for medical supply distribution across the country. Healthcare systems in the Midwest are increasingly investing in predictive analytics, real-time monitoring, and digital inventory solutions to improve operational efficiency and manage growing patient volumes. Furthermore, several academic medical centers and regional health systems in the Midwest are collaborating with tech providers to implement integrated supply chain systems that support value-based care. The presence of large warehouses and distribution centers further enhances the region’s role in healthcare logistics. As supply chain resilience and efficiency become a top priority post-pandemic, the Midwest continues to benefit from infrastructure investments and strategic partnerships that strengthen its role in national healthcare supply chain operations.

Southern United States

The Southern United States accounts for approximately 24% of the U.S. healthcare supply chain management market, supported by a large and diverse healthcare network across states like Texas, Florida, and Georgia. The region is witnessing accelerated adoption of cloud-based and mobile supply chain solutions, particularly in rural and community hospitals aiming to modernize outdated systems. The South’s growing population and higher chronic disease burden also drive the demand for more agile and responsive healthcare supply chains. Moreover, government and private investments in healthcare infrastructure—especially in fast-growing urban centers—are creating new opportunities for supply chain technology vendors. Many hospitals are transitioning to automated procurement systems and leveraging IoT-based tools to improve inventory accuracy and reduce waste. Although certain rural areas face challenges with IT implementation due to budget limitations, ongoing digital initiatives and training programs are gradually addressing these gaps and enhancing the region’s overall market potential.

Northeastern United States

The Northeastern United States holds a market share of about 18%, reflecting the region’s mature but relatively compact healthcare ecosystem. States like New York, Massachusetts, and Pennsylvania are home to some of the nation’s top academic medical centers and research institutions, which act as early adopters of innovative supply chain management tools. However, the region’s smaller geographic footprint and high population density can limit the scale of supply chain expansion compared to other parts of the country. Despite this, the Northeast benefits from a highly skilled workforce, strong regulatory frameworks, and advanced IT adoption across hospital networks. Supply chain solutions in this region are increasingly focused on enhancing transparency, ensuring compliance, and integrating ESG (environmental, social, and governance) principles into procurement practices. The rising emphasis on risk mitigation and data-driven decision-making is expected to fuel steady growth in supply chain modernization efforts, although at a more measured pace compared to faster-growing regions.

Key Player Analysis

- IBM Corporation

- SAP SE

- McKesson Corporation

- S. Healthcare Exchange, LLC

- Oracle Corporation

- Tecsys Inc.

- Infor

- Corcentric, Inc.

- Epicor Software Corporation

- Cardinal Health

- Blue Yonder Group, Inc.

- LogiTag Systems

- Coupa

- Medsphere Systems Corporation

- Manhattan Associates

- Others

Competitive Analysis

The competitive landscape of the U.S. healthcare supply chain management market is characterized by the presence of established technology providers and healthcare-focused solution vendors offering integrated, scalable platforms. Leading players such as IBM Corporation, SAP SE, Oracle Corporation, McKesson Corporation, Infor, Cardinal Health, Tecsys Inc., Blue Yonder Group, Epicor Software Corporation, and Corcentric, Inc. dominate the market with strong product portfolios, extensive industry expertise, and strategic partnerships with healthcare providers. These companies focus on delivering end-to-end solutions that enhance supply chain visibility, automate procurement, streamline inventory management, and support regulatory compliance. The competitive advantage lies in offering cloud-based deployment, interoperability with electronic health records (EHRs), and analytics-driven tools that improve forecasting and decision-making. Vendors also differentiate themselves by integrating AI, IoT, and blockchain technologies to address challenges related to real-time tracking and risk management. Continuous investment in R&D, innovation, and customer service further strengthens their market presence. With growing demand for cost-effective, secure, and resilient supply chain systems, these players remain well-positioned to lead the market’s digital transformation.

Recent Developments

- In March 2025, SAP unveiled its vision for autonomous supply chains embedded with AI-first strategies and launched SAP Business Data Cloud for enhanced operational visibility.

- In February 2025, GHX celebrated its Supply Chains of Distinction Award, recognizing top-performing hospitals that excelled in automation and clinical integration.

- In January 2025, McKesson’s Practice Insights was named a Qualified Clinical Data Registry by CMS, enabling oncology practices to streamline data reporting and improve patient care.

- In November 2024, IBM integrated generative AI into its cognitive control tower, enabling natural language queries for faster decision-making. This transformation saved $388 million in inventory and shipping costs.

- In September 2024, Oracle introduced RFID-powered replenishment solutions in its Cloud SCM platform to automate inventory management and improve visibility across healthcare supply chains.

Market Concentration & Characteristics

The U.S. healthcare supply chain management market exhibits a moderate to high level of market concentration, with a few dominant players controlling a significant portion of the industry. These key players possess strong technological capabilities, broad product portfolios, and long-standing relationships with major healthcare providers, enabling them to maintain a competitive edge. The market is characterized by rapid technological advancements, with increasing integration of cloud-based platforms, AI, and automation to improve operational efficiency, reduce costs, and enhance transparency across the supply chain. Moreover, the market displays high entry barriers due to regulatory compliance requirements, data security concerns, and the need for deep domain expertise. While large enterprises drive innovation, mid-sized and emerging firms are also gaining traction by offering niche solutions tailored to specific healthcare segments. Overall, the market is shaped by ongoing digital transformation, a growing emphasis on value-based care, and the critical need for resilient, scalable supply chain infrastructures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Function, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Artificial intelligence and predictive analytics will enhance demand forecasting and inventory optimization, leading to more efficient operations.

- The adoption of cloud-based solutions will increase, offering scalability and real-time data access across healthcare networks.

- Healthcare organizations will prioritize end-to-end supply chain visibility to improve decision-making and patient outcomes.

- Cybersecurity measures will become more robust to protect sensitive data amid rising digital integration.

- The shift towards non-acute care settings will necessitate adaptable supply chain models to support decentralized healthcare delivery.

- Sustainability initiatives will drive the adoption of eco-friendly practices and products within the supply chain.

- Collaborative relationships between suppliers and providers will strengthen, fostering innovation and efficiency.

- Regulatory compliance will remain a critical focus, requiring continuous adaptation to evolving standards.

- The integration of Internet of Things (IoT) devices will enable real-time tracking and management of medical assets.

- Data-driven insights will become central to strategic planning, enhancing responsiveness to market dynamics.