Market Overview

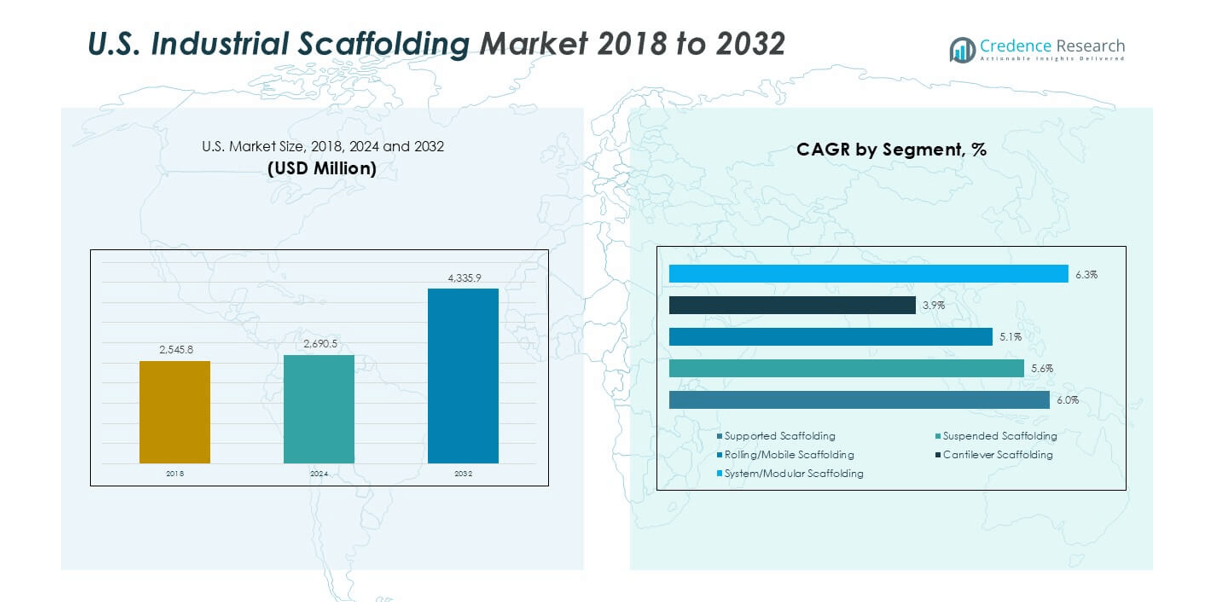

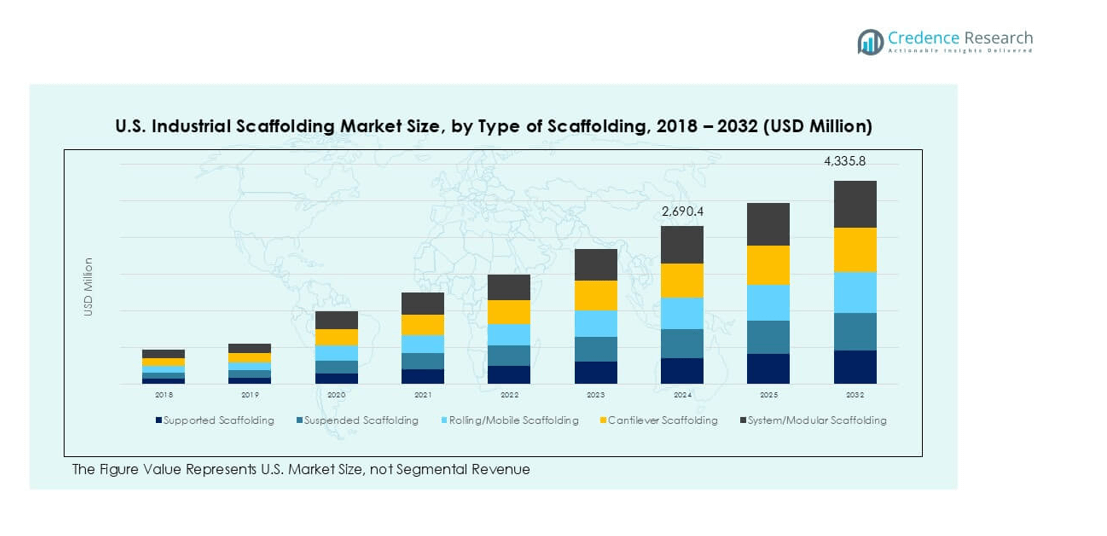

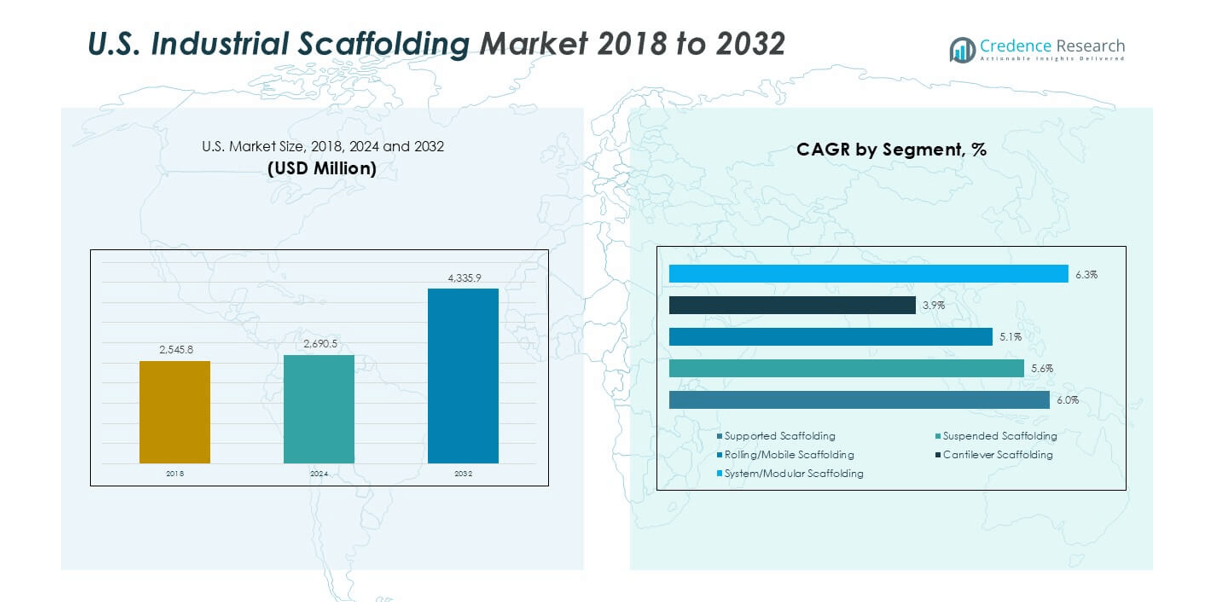

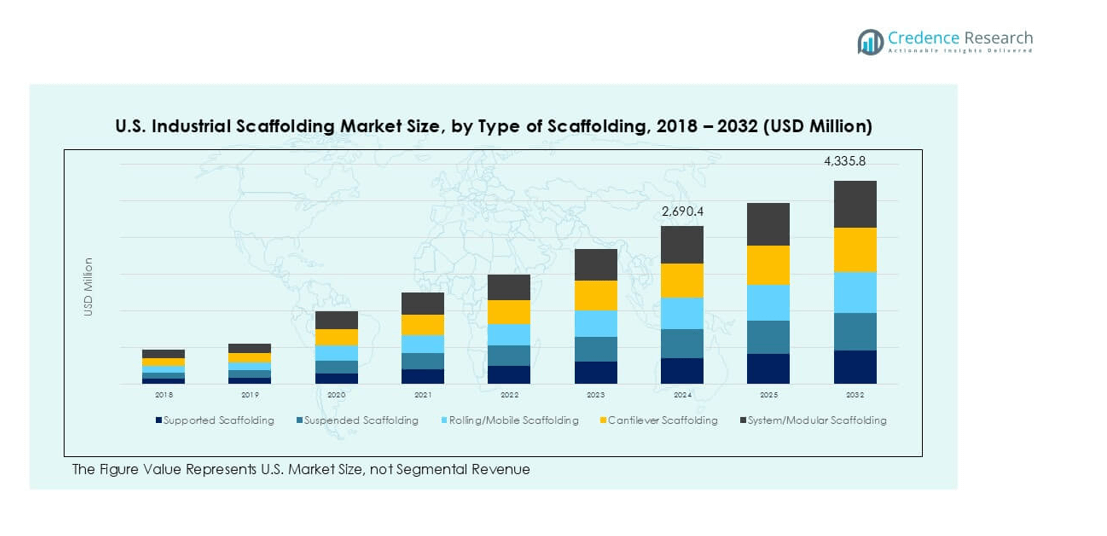

U.S. Industrial Scaffolding market size was valued at USD 2,545.84 million in 2018, reached USD 2,690.48 million in 2024, and is anticipated to reach USD 4,335.87 million by 2032, at a CAGR of 6.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Industrial Scaffolding Market Size 2024 |

USD 2,690.48 million |

| U.S. Industrial Scaffolding Market , CAGR |

6.15% |

| U.S. Industrial Scaffolding Market Size 2032 |

USD 4,335.87 million |

The U.S. industrial scaffolding market is led by key players such as BrandSafway, SafwayAtlantic, Universal Manufacturing Corp, Granite Industries, Bil-Jax (Haulotte Group), Bee Access Products, Doka USA Ltd., Matakana Scaffolding, and Northern Scaffold Access Inc. These companies dominate through extensive service networks, turnkey solutions, and strong compliance with OSHA safety standards. The South region holds the largest share at 35.0%, driven by refinery expansions, LNG terminals, and petrochemical projects, followed by the West at 27.0%, supported by energy infrastructure upgrades and mining activities. Competitive strategies focus on modular scaffolding innovations, skilled labor deployment, and partnerships to expand capacity and meet growing demand for safe, efficient access solutions in industrial maintenance and construction projects.

Market Insights

- The U.S. industrial scaffolding market was valued at USD 2,690.48 million in 2024 and is projected to reach USD 4,335.87 million by 2032, growing at a 6.15% CAGR.

- Infrastructure upgrades, refinery turnarounds, and strict OSHA safety standards drive steady demand for supported and modular scaffolding systems across industries.

- Trends include rising adoption of modular and mobile scaffolding for faster assembly, use of lightweight materials, and integration of digital planning and safety monitoring tools.

- The market is moderately consolidated, with players such as BrandSafway, SafwayAtlantic, and Granite Industries focusing on turnkey solutions, trained labor, and compliance-driven services.

- Regionally, the South leads with 35.0% share, followed by the West at 27.0%, while supported scaffolding dominates with 45% share, driven by its stability and suitability for large-scale industrial projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type of Scaffolding

Supported scaffolding dominates the U.S. industrial scaffolding market, accounting for over 45% share due to its versatility and ease of assembly in large-scale projects. It is widely preferred for construction, maintenance, and industrial shutdown activities because of its high load-bearing capacity and safety. The demand is driven by expansion projects in refineries, power plants, and manufacturing facilities. Rolling or mobile scaffolding is gaining traction in maintenance projects requiring frequent movement, while system/modular scaffolding is increasingly used for complex industrial sites where quick assembly and dismantling reduce downtime.

- For instance, Layher’s Lightweight system increases truck payload by 12% while reducing erection time of birdcage structures by up to 10% vs standard Allround system.

By Application

The oil and gas industry hold the largest share, exceeding 40%, as regular maintenance, turnarounds, and expansions in refineries and petrochemical facilities create consistent scaffolding demand. Scaffolding is critical for accessing elevated structures and ensuring worker safety in hazardous environments. Power generation facilities, including thermal and nuclear plants, represent the second-largest application segment, supported by ongoing upgrades and compliance with safety standards. Mining, metallurgy, and chemical industries also contribute steadily, with demand linked to periodic inspection, shutdown, and repair cycles in large industrial plants.

- For example, the LOBO System used in Valero refinery operations saved over US$8 million in seven years by cutting scaffold hire costs and enabling faster assembly.

By Material

Steel scaffolding leads the market with over 60% share, driven by its superior strength, durability, and ability to withstand heavy loads in industrial settings. Steel’s reusability and compatibility with modular designs make it the preferred material for long-term projects in oil, gas, and power plants. Aluminum scaffolding is gaining adoption in projects requiring lightweight, corrosion-resistant structures, particularly in chemical facilities. Fiberglass/composite scaffolding serves niche applications where electrical insulation and chemical resistance are crucial, such as in power and petrochemical environments, though its higher cost limits widespread use.

Market Overview

Infrastructure Modernization and Industrial Expansion

Infrastructure upgrades and expansions across refineries, power plants, and manufacturing facilities drive scaffolding demand. Federal investments in energy infrastructure and industrial plant maintenance projects boost construction and maintenance activities. Large-scale turnarounds and shutdowns in oil and gas facilities require extensive scaffolding for safe access and inspection. The growing number of industrial capital projects, including LNG terminals and chemical plants, continues to generate recurring scaffolding requirements. These factors collectively ensure strong demand from both new construction and ongoing maintenance, supporting long-term growth for scaffolding service providers.

- For instance, Global Site Solutions (GSS) supported the Corpus Christi LNG project with over 18,000 scaffold requests, logging more than 2,250,000 man-hours and supplying upwards of 6,500 tonnes of scaffold material.

Focus on Worker Safety and Regulatory Compliance

Stringent OSHA safety standards and regulatory compliance requirements encourage industries to adopt reliable scaffolding systems. Companies invest in high-quality supported and modular scaffolding solutions to minimize accidents and improve site safety. The rising emphasis on workplace safety training and use of advanced scaffolding systems with guardrails, toe boards, and fall-protection features supports market growth. Compliance with evolving regulations also drives demand for certified scaffolding services and regular inspections, creating steady opportunities for suppliers to offer safer, innovative systems for hazardous industrial environments.

- For instance, OSHA regulation 29 CFR 1926.451(a)(1) mandates that every scaffold and scaffold component be capable of supporting, without failure, its own weight plus four times the maximum intended load applied or transmitted to

Rising Demand from Energy and Utility Sector

The energy sector remains a major driver, with consistent demand from power generation, oil, and gas industries. Aging infrastructure and the shift toward cleaner energy projects create significant scaffolding needs for retrofits, maintenance, and construction. Nuclear facility upgrades and renewable energy installations also require extensive scaffolding for complex structural work. Growth in shale gas and refinery capacity expansions further strengthen the need for reliable scaffolding solutions. This sustained demand from critical energy facilities supports recurring revenue streams for scaffolding manufacturers and service contractors.

Key Trends and Opportunities

Adoption of Modular and Mobile Scaffolding Systems

Industries are rapidly shifting toward modular scaffolding systems for faster assembly, reduced labor costs, and improved site efficiency. Mobile scaffolding solutions are increasingly used for maintenance projects that require frequent repositioning. These systems minimize downtime during plant operations and support lean project execution. Manufacturers focus on developing lightweight, easy-to-transport scaffolding with enhanced safety features. This trend creates opportunities for suppliers offering customized, flexible systems suited for industrial turnarounds, shutdowns, and high-frequency maintenance activities, particularly in oil, gas, and power generation facilities.

- For instance, in a test at a university construction site, wireless strain sensors were used on a modular scaffold frame; data from those sensors fed into a finite element method (FEM) model to adapt to changing loads in real time.

Integration of Digital and Smart Safety Solutions

The market is witnessing the adoption of digital tools for scaffolding management, including 3D modeling and design software for planning layouts. IoT-enabled sensors are being used for real-time load monitoring and safety compliance checks. Digital tracking systems help reduce assembly errors and improve efficiency during large-scale projects. This digital transformation creates opportunities for companies offering integrated solutions combining scaffolding hardware with software platforms. Contractors leveraging data analytics and remote monitoring can deliver safer, faster, and cost-effective services, gaining a competitive edge.

- For instance, in a study combining point cloud data from a 3D laser scanner with IoT sensors on scaffold components, real-time modulus of deformation was tracked during a simulated wind load, improving detection of deformation from millimetres up to several centimetres.

Key Challenges

High Labor and Installation Costs

Labor-intensive assembly and dismantling processes significantly impact overall project costs. Shortage of skilled scaffolders in the U.S. further raises wage rates and project expenses. This cost pressure can delay projects or lead to reduced scaffolding budgets in some industrial sites. Companies are exploring automation, modular systems, and prefabricated designs to optimize labor use, but adoption remains gradual due to upfront investment costs. Managing costs while maintaining safety and compliance remains a critical challenge for contractors and service providers in this market.

Stringent Regulatory and Safety Compliance

Strict safety regulations impose additional costs for inspections, certifications, and employee training. Non-compliance can result in penalties, project delays, and reputational risks. Constantly evolving OSHA standards require companies to regularly update equipment and processes. Small and mid-sized service providers face challenges meeting these requirements while staying cost-competitive. Ensuring continuous compliance while managing project timelines and budgets adds complexity for contractors. This challenge encourages partnerships with certified scaffolding providers and investment in standardized, regulation-compliant systems.

Regional Analysis

Northeast

The Northeast accounts for 17.0% of the U.S. industrial scaffolding market in 2024, highlighting its importance in urban and industrial maintenance projects. Strong demand comes from chemical plants, pharmaceutical facilities, and port infrastructure upgrades that require safe, reliable access solutions. Supported scaffolding dominates usage due to its stability in dense construction zones. The region’s aging bridges, water systems, and manufacturing sites continue to require frequent overhauls and retrofits. High safety standards and strict regulatory compliance drive the use of certified scaffolding systems, supporting steady growth in this mature but maintenance-intensive market.

Midwest

The Midwest holds 21.0% market share, supported by its concentration of heavy industries and power generation facilities. The region’s demand is driven by refinery turnarounds, grid modernization, and upgrades to steel mills and automotive plants. Supported and modular scaffolding systems are widely adopted for complex industrial projects requiring high load capacity. Industrial maintenance cycles create recurring business opportunities, ensuring a stable demand base. Continued investment in manufacturing infrastructure and renewable energy projects further boosts market growth, making the Midwest a key region for scaffolding service providers and equipment suppliers.

South

The South leads with 35.0% market share, making it the largest regional contributor to the U.S. industrial scaffolding market. Growth is propelled by extensive oil and gas operations, LNG terminals, and petrochemical projects along the Gulf Coast. Regular maintenance shutdowns and large-scale capital expansion projects fuel consistent demand for scaffolding services. Power generation projects, including thermal and renewable energy plants, add to the region’s requirements. High construction activity and industrial investments position the South as the most dynamic market, attracting key players offering turnkey scaffolding solutions and specialized manpower.

West

The West represents 27.0% of the U.S. industrial scaffolding market, with strong activity in energy infrastructure, mining, and water treatment projects. The region’s demand is driven by refinery upgrades, renewable energy installations, and large-scale construction in urban centers. Modular scaffolding systems are increasingly used due to complex site layouts and strict safety regulations. The presence of major ports and manufacturing hubs also supports recurring demand for scaffolding during maintenance cycles. Growth is reinforced by state-level sustainability initiatives and investments in green energy infrastructure, which create opportunities for innovative scaffolding solutions.

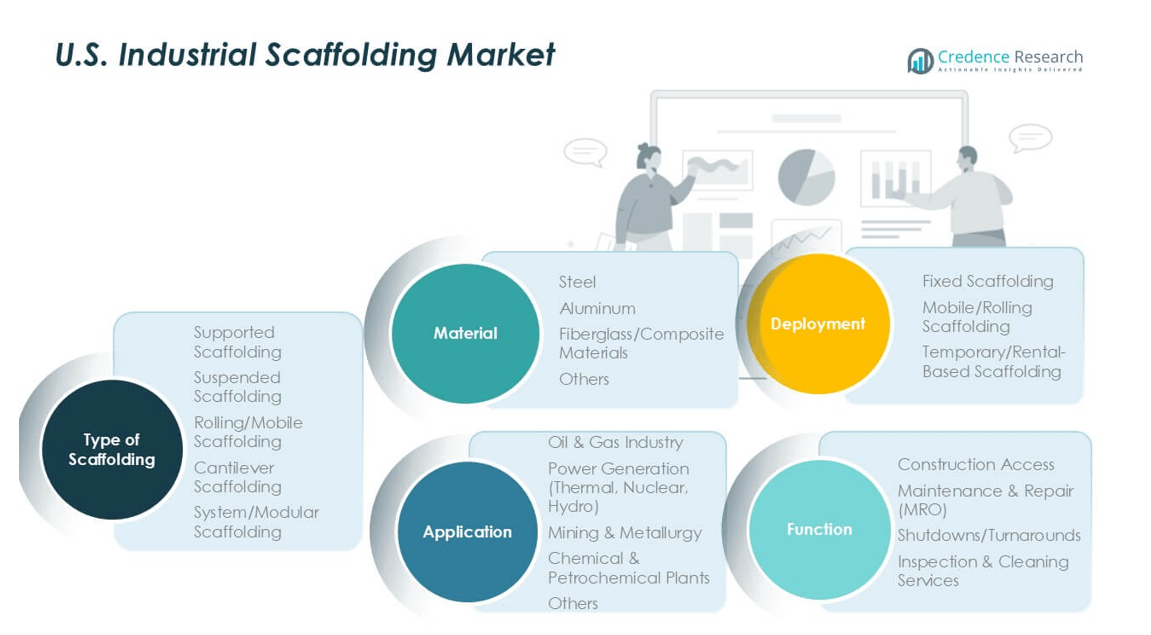

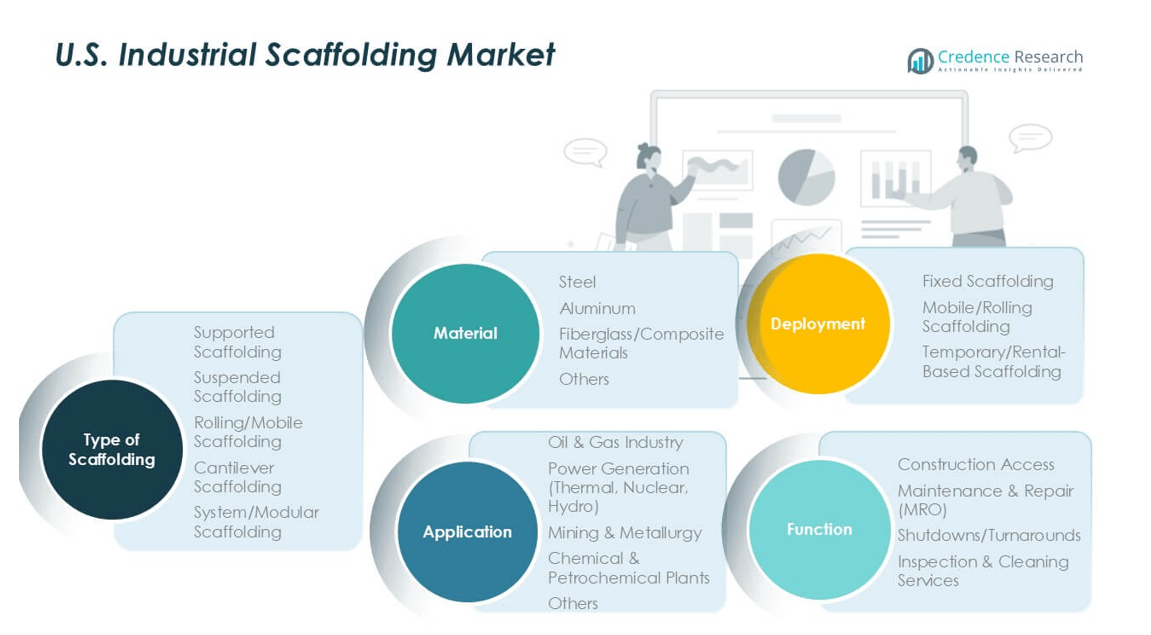

Market Segmentations:

By Type of Scaffolding

- Supported Scaffolding

- Suspended Scaffolding

- Rolling/Mobile Scaffolding

- Cantilever Scaffolding

- System/Modular Scaffolding

By Application

- Oil & Gas Industry

- Power Generation (Thermal, Nuclear, Hydro)

- Mining & Metallurgy

- Chemical & Petrochemical Plants

- Others

By Material

- Steel

- Aluminum

- Fiberglass/Composite Materials

- Others

By Deployment

- Fixed Scaffolding

- Mobile/Rolling Scaffolding

- Temporary/Rental-Based Scaffolding

By Function

- Construction Access

- Maintenance & Repair (MRO)

- Shutdowns/Turnarounds

- Inspection & Cleaning Services

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. industrial scaffolding market is moderately consolidated, with leading players such as BrandSafway, SafwayAtlantic, Universal Manufacturing Corp, and Granite Industries holding a significant share. These companies focus on delivering turnkey scaffolding solutions, including supported, modular, and mobile systems, to serve industries such as oil and gas, power generation, and manufacturing. Strategic partnerships, mergers, and acquisitions strengthen their service capabilities and geographic reach. Players invest in safety-certified equipment, skilled labor training, and digital planning tools to meet stringent OSHA regulations and improve project efficiency. Mid-sized and regional players like Northern Scaffold Access Inc. and Bee Access Products cater to specialized projects, offering customized systems and competitive pricing. Innovation in lightweight materials and modular designs helps companies differentiate and reduce installation time. Overall, competition is driven by safety compliance, cost efficiency, rapid project execution, and the ability to handle large-scale shutdowns and maintenance turnarounds across multiple industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BrandSafway

- SafwayAtlantic

- Universal Manufacturing Corp

- Granite Industries

- Bil-Jax (a Haulotte Group brand)

- Bee Access Products, Inc.

- Doka USA Ltd.

- Matakana Scaffolding

- Northern Scaffold Access Inc.

Recent Developments

- In July 2022, A major developer and provider of formwork and scaffolding systems, PERI Formwork Systems, Inc., has developed what would become a new industry standard for bridge construction. VPS ensures a safety and efficiency gap through a highly versatile system that is adjustable, rentable, and productive in forming bridge columns and caps.

- In July 2022, Doka, a key player in formwork solutions and services to the construction industry has taken its collaboration with the well-known American scaffolding company AT-PAC to the next level by making a significant investment in the US-based firm. The two companies first teamed up in 2020 to offer comprehensive solutions for building sites, and their partnership has only grown stronger since then.

- In July 2022, A Glasgow subsidiary named StepUp Scaffold UK from StepUp Scaffold Group in Memphis has completed the purchase of MP House ApS located near Copenhagen during July 2022. The company MP House stands as the dominant supplier of tools and equipment along with accessories to scaffolding operators based in Denmark.

- In April 2022, Layher Holding GmbH Co KG has introduced the Allround Scaffold, a name that reflects the company and perhaps represents the pinnacle of modular scaffolding solutions. The Modular Scaffolding System is essentially the Layher Allround Scaffolding. This system is comparable to Allround Performance, as it serves multiple purposes within a single framework. No matter how complex the designs, architectural styles, or strict safety standards may be, Allround Scaffolding consistently proves to be the quicker, safer, and more economical choice

Report Coverage

The research report offers an in-depth analysis based on Type of Scaffolding, Application, Material, Deployment, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increasing demand from oil, gas, and power industries.

- Infrastructure modernization projects will boost scaffolding requirements across industrial and construction sectors.

- Adoption of modular scaffolding will rise for faster assembly and reduced project downtime.

- Digital tools and 3D modeling will improve planning, safety, and project efficiency.

- Skilled labor training will remain a focus to meet OSHA safety compliance requirements.

- Investment in lightweight and corrosion-resistant materials will expand for harsh industrial environments.

- Maintenance shutdowns and turnarounds will create recurring demand for scaffolding services.

- Regional demand will remain highest in the South, driven by refinery and petrochemical projects.

- Competition will intensify as players offer turnkey solutions and integrated digital services.

- Sustainability initiatives will drive use of reusable systems and eco-friendly materials.