Market Overview:

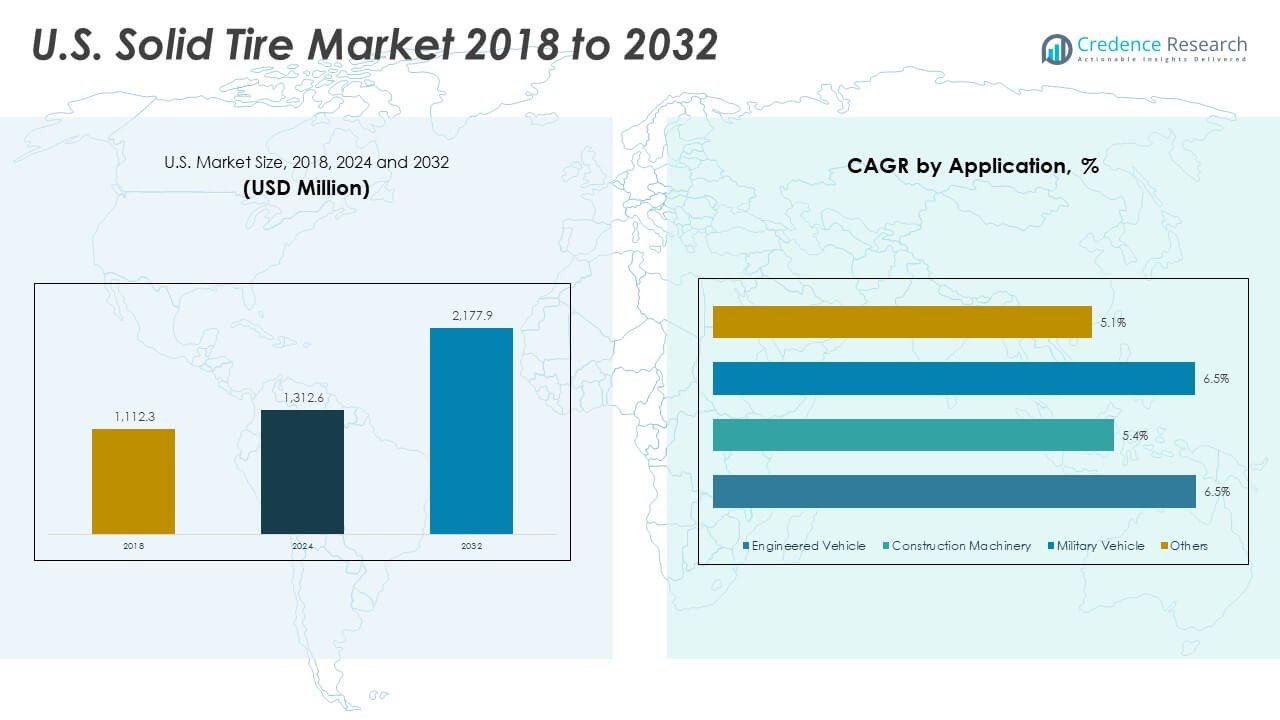

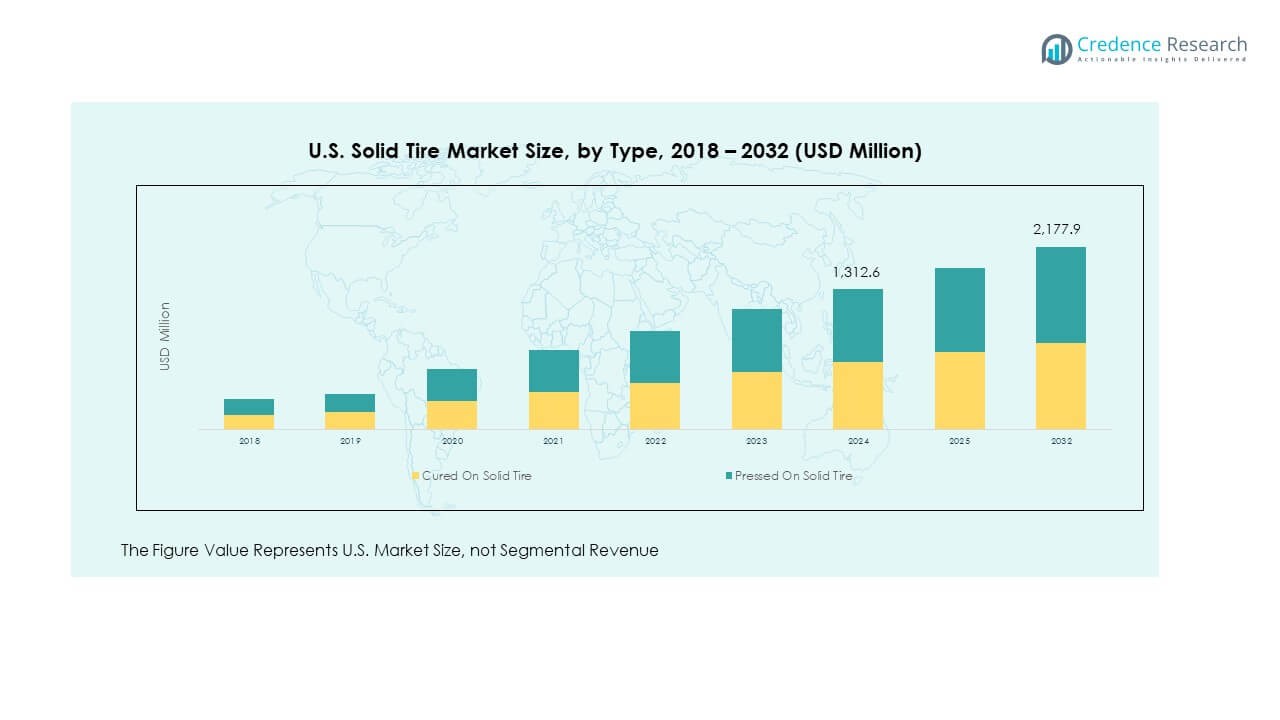

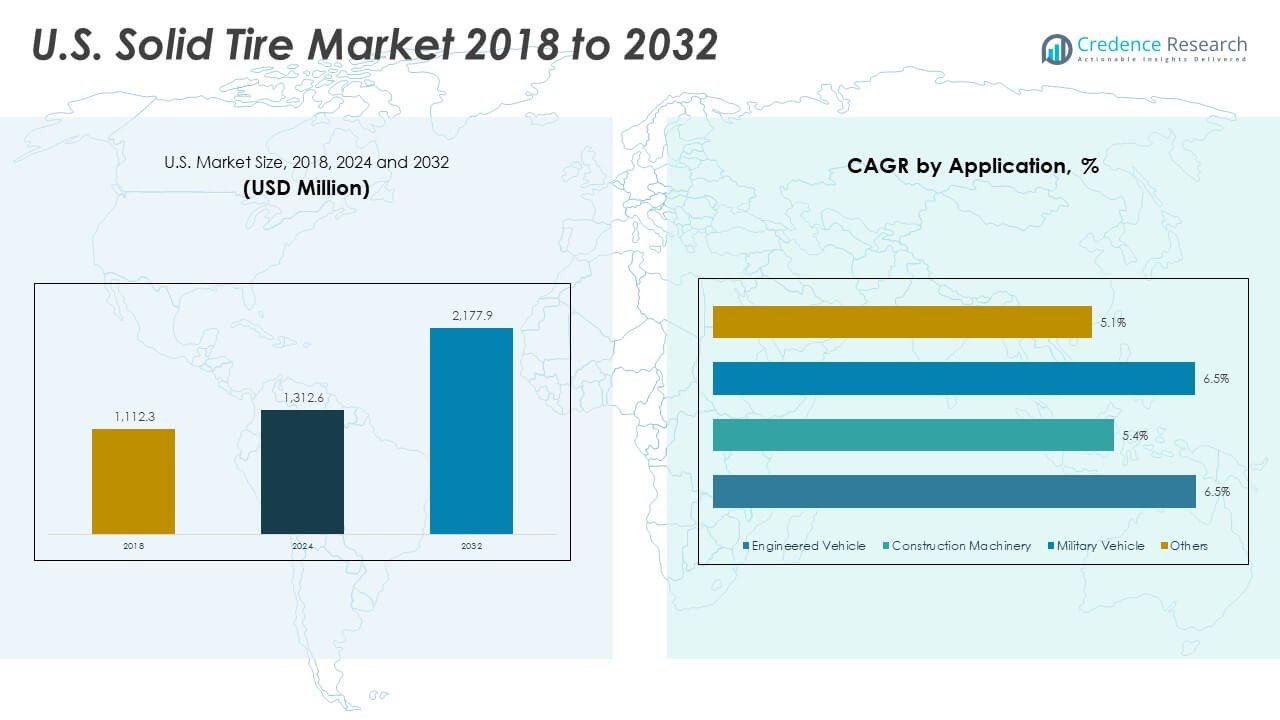

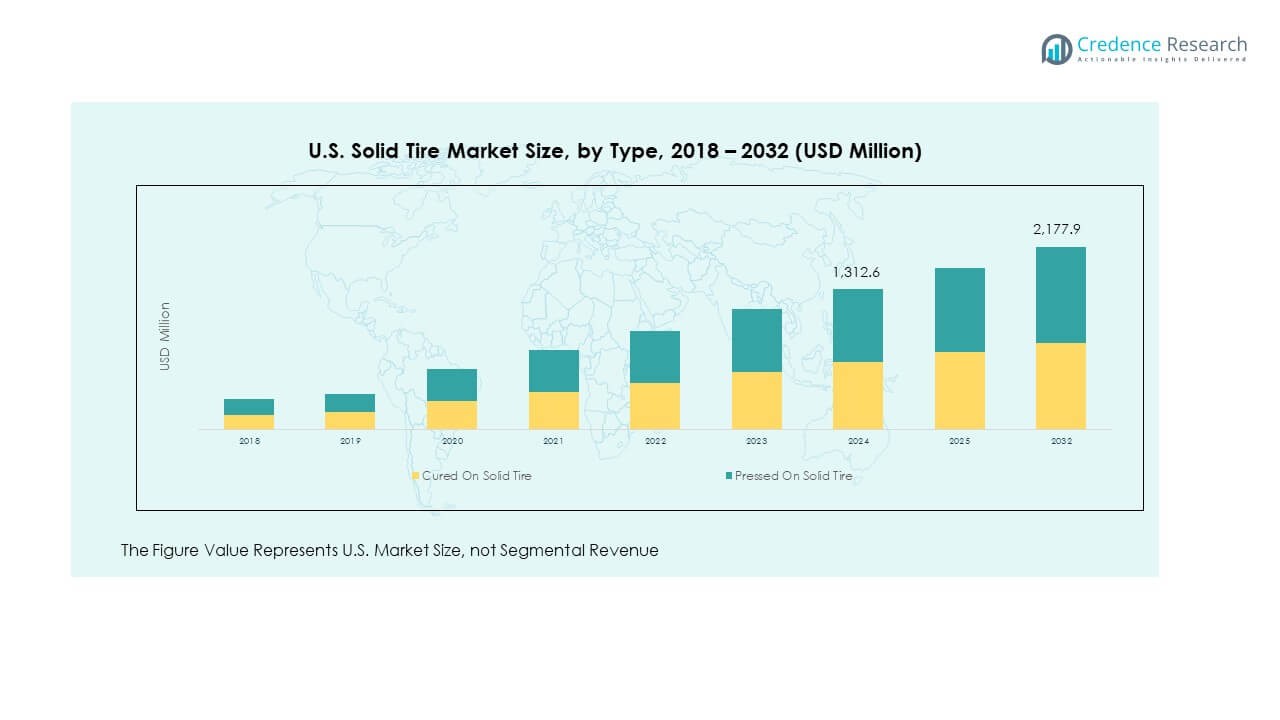

The U.S. Solid Tire Market size was valued at USD 1,112.3 million in 2018 to USD 1,312.6 million in 2024 and is anticipated to reach USD 2,177.9 million by 2032, at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Solid Tire Market Size 2024 |

USD 1,312.6 Million |

| U.S. Solid Tire Market, CAGR |

6.53% |

| U.S. Solid Tire Market Size 2032 |

USD 2,177.9 Million |

Market growth is strongly driven by the expansion of warehouse operations, rising adoption of automated material handling equipment, and the construction industry’s reliance on heavy machinery. Solid tires provide longer operational life, which reduces downtime and maintenance costs for fleet operators. The military and defense sector is also embracing these tires due to their ability to withstand extreme terrains. Increasing safety standards and workplace efficiency expectations are further pushing adoption. Sustainability practices are influencing the use of eco-friendly materials in solid tire production, creating opportunities for innovation.

Geographically, the U.S. market is highly concentrated across industrialized regions such as the Midwest and South, where manufacturing and logistics hubs are strong. The Northeast shows steady adoption driven by port operations and urban logistics needs. Emerging demand is visible in western states, where infrastructure development and construction activities are increasing. The strong presence of global and domestic players in the U.S. enhances competitiveness and accelerates innovation. Regional market variations highlight the influence of industrial density, logistics expansion, and government-backed infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Solid Tire Market size was USD 1,112.3 million in 2018, USD 1,312.6 million in 2024, and is projected to reach USD 2,177.9 million by 2032, reflecting a CAGR of 6.53%.

- North America held the largest share at 38% in 2024, driven by industrial hubs and logistics activity. Europe followed with 28% share due to advanced technologies and strong construction equipment demand. Asia Pacific accounted for 24%, supported by its growing manufacturing base.

- Asia Pacific is expected to be the fastest-growing region, with its share expanding on the back of large-scale industrialization, rising infrastructure projects, and automation in logistics.

- Cured On Solid Tire held around 42% of the market share in 2024, driven by its durability and adoption in high-intensity industrial operations.

- Pressed On Solid Tire accounted for nearly 58% in 2024, favored for forklifts and vehicles requiring easy installation and quick replacement cycles.

Market Drivers:

Industrial Expansion and Growth of Warehousing Operations:

The U.S. Solid Tire Market benefits from expanding industrial activities and logistics operations nationwide. Warehousing demand has surged due to e-commerce growth, pushing companies to enhance productivity. Solid tires offer durability, ensuring forklifts, tow tractors, and yard vehicles operate without frequent replacements. It creates measurable cost savings for fleet operators managing continuous operations. Safety concerns also boost reliance on solid tires, which reduce blowout risks in warehouses. Companies prefer solid tires to minimize disruptions caused by punctures in high-intensity environments. Their resilience supports long shifts under heavy loads, maximizing equipment uptime. This operational advantage makes them the preferred choice in modern distribution centers.

- For instance, the forklifts segment sees rapid adoption of solid tires with enhanced puncture resistance and longer lifespans, supported by companies like Continental AG and Trelleborg offering solid tires with load capacities exceeding 1,500 kg and improved wear resistance in high-intensity warehouse environments.

Strong Adoption Across Construction and Infrastructure Development:

The construction industry continues to strengthen demand for solid tires due to their ability to handle rugged terrains. Infrastructure expansion across highways, airports, and urban projects requires machines equipped with durable solutions. Solid tires enhance the reliability of loaders, cranes, and construction vehicles that face heavy workloads. Their puncture-proof design prevents delays on construction sites, where downtime can be costly. The resilience of solid tires supports continuous projects even in challenging conditions. Government investments in infrastructure projects further push equipment demand. Contractors favor cost-efficient, long-lasting tires to optimize machine operations. This makes solid tires a critical component in project execution efficiency.

- For instance, Maxam Tire produces solid tires that endure harsh construction conditions with significantly enhanced abrasion resistance and high load-bearing capacity, supporting continuous operation of loaders and cranes. This puncture-proof design minimizes costly downtime, allowing contractors to optimize operations during demanding infrastructure projects.

Military and Defense Applications Boost Specialized Demand:

The U.S. Solid Tire Market has witnessed rising traction in defense applications. Military vehicles often encounter rough terrains, where puncture risks compromise safety and performance. Solid tires offer reliable alternatives, ensuring armored vehicles maintain mobility under demanding conditions. Their strength against extreme environments enhances the operational capability of defense fleets. The military values these tires for missions requiring uninterrupted performance. Defense contracts continue to support manufacturers investing in rugged tire technologies. The growth of homeland security and military modernization projects provides a stable demand base. This sector’s influence strengthens the overall market’s long-term expansion potential.

Sustainability and Technological Innovation Reshape Manufacturing Practices:

Sustainability goals are encouraging manufacturers to explore eco-friendly raw materials for tire production. Recycling initiatives and green material adoption have become industry priorities. The U.S. Solid Tire Market benefits from research in lightweight compounds that enhance fuel efficiency. Companies are integrating advanced polymers and innovative curing methods to improve performance. The push toward sustainable practices aligns with regulations focused on environmental impact reduction. Customers increasingly favor suppliers offering greener products without sacrificing durability. Digital technologies in production also improve consistency and performance metrics. Together, these trends reshape the way solid tires are developed, tested, and delivered.

Market Trends:

Rising Integration of Automation in Tire Manufacturing Processes:

Manufacturers are deploying automation in tire production to achieve higher efficiency. Automated curing, mixing, and inspection technologies reduce defects and improve durability. The U.S. Solid Tire Market reflects this modernization through enhanced product quality and scalability. Automation reduces production costs, helping manufacturers stay competitive in a price-sensitive industry. Consistency in tire performance is critical for end-users, and automated lines ensure standards are met. Companies invest in smart factories to meet growing demand more effectively. The shift toward digitalized manufacturing enables rapid customization for different applications. This trend increases responsiveness to customer requirements across industries.

- For instance, UMD Automated Systems provides smart robotic solutions enabling tire manufacturers to increase throughput by 30% while maintaining strict quality control standards. This automation drives scalability and consistency in a price-sensitive U.S. market. Companies are investing in smart factories that not only optimize production but also enable rapid customization of tires for diverse industrial applications, enhancing responsiveness to customer needs.

Growing Popularity of Rental Equipment and Fleet Outsourcing:

The trend of renting equipment rather than purchasing it outright is growing. Construction firms and logistics operators increasingly use rental services for flexibility. This boosts demand for solid tires since rental fleets require durable and low-maintenance solutions. The U.S. Solid Tire Market benefits from this shift, as service providers prefer cost-effective tires. Solid tires reduce downtime for rented equipment, enhancing fleet efficiency. Rental companies also emphasize safety, where solid tires provide a clear advantage. The model encourages steady replacement cycles for solid tires across fleets. It positions them as a recurring revenue stream for suppliers and distributors.

- For instance, rental providers increasingly opt for solid tires, like those from Superior Tire & Rubber Corp., for their longevity and resistance to wear under heavy use. Solid tires enhance rental fleet productivity and safety by lowering downtime costs. However, while tire replacement contributes to revenue for suppliers, market growth in the rental equipment sector is driven by a complex mix of factors, including new equipment sales and the broader adoption of solid tire technology, not solely by the recurring replacement cycle.

Expansion of Smart Tire Monitoring Systems for Industrial Applications:

Smart tire monitoring is gaining adoption across industrial vehicles. Embedded sensors now track wear, temperature, and pressure for predictive maintenance. The U.S. Solid Tire Market is adapting to integrate these technologies, creating advanced solutions. Operators gain real-time insights, reducing unexpected failures during operations. Data-driven management ensures equipment longevity and operational safety. These systems improve transparency in large fleets managing hundreds of vehicles. Adoption is rising in warehouses and construction fleets focused on efficiency. It positions smart-enabled solid tires as a high-value option for industrial customers.

Increasing Customization for Application-Specific Requirements:

Customers demand tailored solutions for vehicles operating in specialized environments. Tire customization includes different compounds, tread patterns, and sizes optimized for performance. The U.S. Solid Tire Market reflects this shift with wider product portfolios from manufacturers. Forklifts in warehouses require different specifications compared to heavy machinery in mining. Customization enables companies to align tire properties with operational needs. This approach reduces energy use and boosts safety for specific applications. Manufacturers gain customer loyalty by delivering specialized products with measurable benefits. The strategy enhances competitiveness in a growing but fragmented market.

Market Challenges Analysis:

High Raw Material Costs and Supply Chain Pressures:

The U.S. Solid Tire Market faces challenges linked to rising raw material costs. Natural rubber, synthetic rubber, and petroleum derivatives often fluctuate in price. Supply chain disruptions further increase production challenges, impacting profitability. Manufacturers struggle to maintain margins while meeting competitive pricing demands. Import dependency on raw materials exposes the market to global uncertainties. These pressures push companies to explore substitutes, which may not match performance. Price volatility creates unpredictability in long-term planning for producers. It restricts smaller players from scaling operations sustainably in the market.

Competition from Alternative Tire Technologies and Regulations:

Solid tires face competition from pneumatic tires with advanced puncture-resistant technology. These alternatives appeal to industries seeking comfort and energy efficiency. The U.S. Solid Tire Market experiences pressure to differentiate against evolving options. Stricter environmental regulations around tire disposal also create compliance challenges. Manufacturers must invest in recycling systems, adding operational costs. The need for greener practices influences procurement decisions in sensitive industries. Competitive intensity increases as domestic and international brands expand in the U.S. Smaller companies often find it difficult to keep pace with innovation. These challenges underline the importance of differentiation and compliance.

Market Opportunities:

Expansion into Advanced Material Development and Green Innovations:

The U.S. Solid Tire Market holds opportunities in advanced material development. Companies can explore recyclable polymers and lightweight compounds to improve sustainability. Innovations in green materials align with government policies promoting eco-friendly practices. Customers increasingly demand products that combine durability with lower environmental impact. Manufacturers investing in research gain competitive advantages in procurement bids. Eco-friendly innovations can also open new customer segments. It helps players expand into industries where sustainability is a purchasing factor. This focus creates long-term opportunities to balance growth and compliance.

Emerging Demand in Automation and Material Handling Solutions:

Automation in warehousing and material handling fuels demand for reliable tires. Solid tires suit automated guided vehicles and robotics requiring durable performance. The U.S. Solid Tire Market is set to benefit from these advanced applications. Tire designs optimized for AGVs enhance safety in unmanned environments. Manufacturers can create partnerships with logistics firms to strengthen adoption. Smart integration features increase compatibility with Industry 4.0 systems. This segment provides untapped opportunities for tire producers. It positions them to play a key role in future logistics automation.

Market Segmentation Analysis:

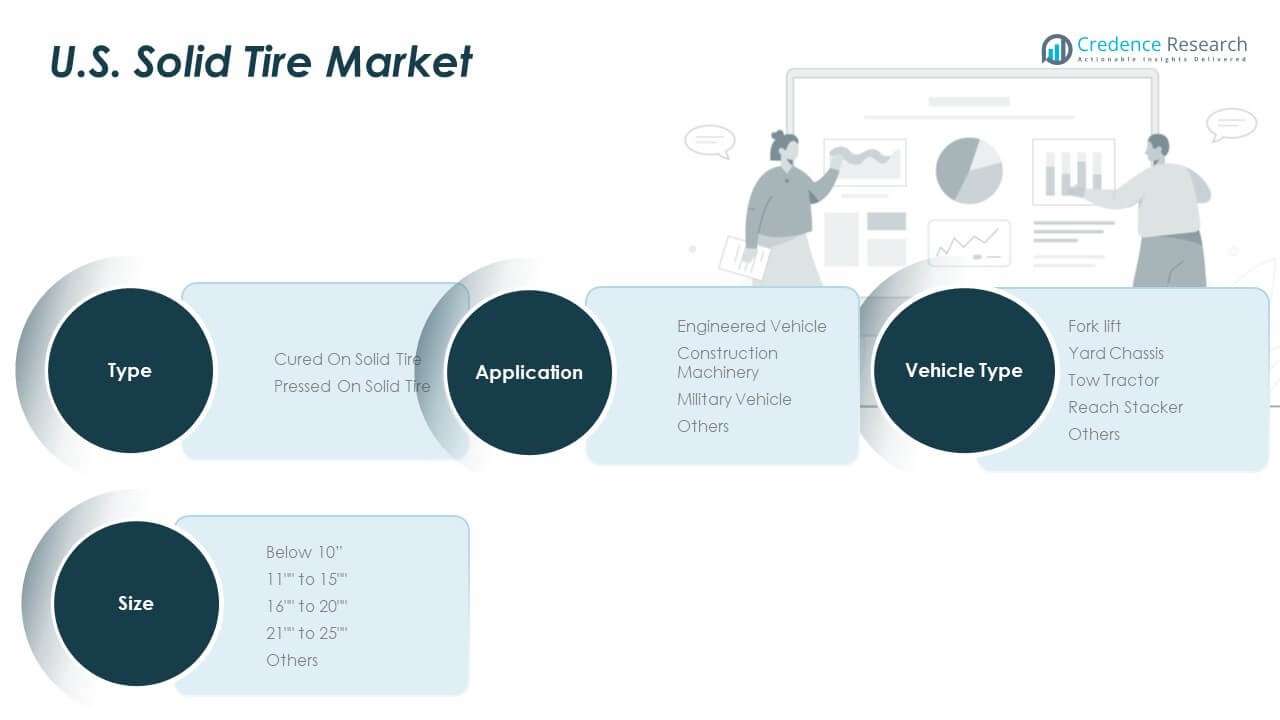

By Type

The U.S. Solid Tire Market is divided into cured on and pressed on types. Cured on tires dominate due to their durability and ability to handle high-intensity operations. Pressed on tires are gaining traction in smaller industrial vehicles due to easier installation. Both categories serve distinct applications, ensuring broad adoption across industries.

- For example, Continental’s cured-on tires feature advanced rubber composites that extend tire life in industrial and construction scenarios. Pressed-on tires are gaining traction in smaller vehicles due to their ease of installation, capturing demand in mid-sized warehouses that rely on quick maintenance solutions.

By Application

Solid tires are widely used in engineered vehicles and construction machinery. Forklifts and industrial vehicles remain the primary application drivers. Military vehicles use them for rugged terrains where puncture resistance is critical. Other applications include specialized logistics and material handling systems.

- For example, forklifts and industrial vehicles are primary application drivers for solid tires. Manufacturers like Michelin and Trelleborg supply specialized solid tires optimized for intense warehouse and industrial environments, with emphasis on puncture resistance and durability to minimize downtime. Ride comfort, however, is a common trade-off, as solid tires inherently offer less shock absorption compared to air-filled (pneumatic) tires.

By Size

Size segmentation ranges from below 10 inches to above 21 inches. Smaller sizes are popular in compact forklifts and AGVs. Mid-range sizes, particularly 11–20 inches, see the highest demand in warehouses and construction. Larger categories support heavy machinery in demanding environments.

By Vehicle Type

Forklifts form the largest segment due to their widespread use in logistics and warehousing. Yard chassis and tow tractors also contribute significantly to the market. Reach stackers rely on solid tires for safety in port operations. Other vehicles, such as specialty carriers, further diversify adoption.

Segmentation:

- By Type

- Cured On Solid Tire

- Pressed On Solid Tire

- By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

- By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

- By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

Midwest and Southern U.S.

The Midwest and Southern regions hold the largest share of the U.S. Solid Tire Market, supported by strong industrial and manufacturing hubs. States such as Texas, Ohio, and Michigan account for high demand due to their logistics centers and large-scale construction projects. Warehousing operations tied to e-commerce growth are further strengthening adoption in these regions. The durability of solid tires aligns with the needs of heavy-duty equipment operating in industrial zones. The presence of domestic manufacturers enhances supply reliability and lowers distribution costs. It continues to benefit from investments in regional infrastructure and supply chain modernization.

Northeastern U.S.

The Northeast represents a significant portion of the market, supported by its concentration of ports, distribution centers, and urban logistics activity. States such as New York, New Jersey, and Pennsylvania play a leading role in demand for solid tires in forklifts and port handling equipment. The region’s dense population drives consumption through retail distribution and e-commerce fulfillment centers. Safety regulations in industrial operations also increase reliance on solid tires. Companies in this area prioritize performance and reduced downtime, making puncture-proof tires a strong choice. The U.S. Solid Tire Market gains stability here due to consistent demand from logistics-intensive industries.

Western U.S.

The Western region is emerging as a high-growth area, supported by rapid construction and infrastructure projects. California leads with significant adoption in warehousing and automated material handling systems. Growth in technology-driven logistics, including robotics and automated guided vehicles, enhances the demand for solid tires. The construction boom in states like Nevada and Arizona adds further momentum. Companies focus on advanced, eco-friendly tire solutions to meet sustainability goals set by state regulations. The U.S. Solid Tire Market is seeing opportunities expand in this region as investment in ports, highways, and smart warehouses continues. It positions the West as a future growth center.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CAMSO (Michelin)

- Continental AG

- Global Rubber Industries (GRI)

- NEXEN Tire America, Inc.

- Setco Solid Tire & Rim Assembly (U.S.)

- Superior Tire & Rubber Corp. (U.S.)

- Maxam Tire North America

- TY Cushion Tire

- Tube & Solid Tire

- Yantai Balsanse Rubber Co., Ltd.

Competitive Analysis:

The U.S. Solid Tire Market features a competitive environment shaped by global leaders and regional specialists. Companies such as CAMSO (Michelin), Continental AG, and Maxam Tire North America dominate through broad product portfolios and advanced technology. Domestic firms like Setco Solid Tire & Rim Assembly and Superior Tire & Rubber Corp. enhance competitiveness with tailored solutions for local industries. It is characterized by constant innovation, with manufacturers focusing on eco-friendly materials and enhanced durability. Partnerships and mergers strengthen market positioning, while rental equipment providers increase replacement cycles. Intense competition drives continuous investment in R&D and advanced distribution networks.

Recent Developments:

- NEXEN Tire America, Inc. achieved record-high quarterly sales in Q1 2025 with revenues of KRW 771.2 billion and an operating profit of KRW 40.7 billion, driven by expanded production capacity and the launch of premium tires including 18-inch and larger sizes. Their successful growth is attributed to enhanced plant utilization and increased original equipment supply to major automakers, reflecting robust demand in North America.

- In the U.S. Solid Tire Market, Ceat anticipates a 10-15% revenue increase following the integration of Camso, which it acquired from Michelin for USD 225 million. This acquisition grants Ceat access to a global customer base including over 40 international OEMs and premium distributors, along with two manufacturing facilities in Sri Lanka. The deal strengthens Ceat’s foothold in the high-margin off-highway tyres segment and is expected to be margin accretive over time, with initial impacts on the bottom line expected within four to six quarters after full integration.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will grow from rising warehouse automation and e-commerce expansion.

- Defense and military vehicles will continue boosting specialized solid tire use.

- Construction growth will sustain long-term adoption of heavy-duty tire solutions.

- Manufacturers will invest more in eco-friendly compounds and recycling practices.

- Smart tire monitoring systems will gain traction in industrial vehicle fleets.

- Rental equipment trends will fuel recurring replacement cycles for suppliers.

- Partnerships with logistics and manufacturing companies will enhance adoption.

- Domestic firms will expand through customization and regional distribution strength.

- Consolidation through mergers and acquisitions will reshape competitive dynamics.

- Technological advancements will improve efficiency, safety, and product lifespan.