Market Overview:

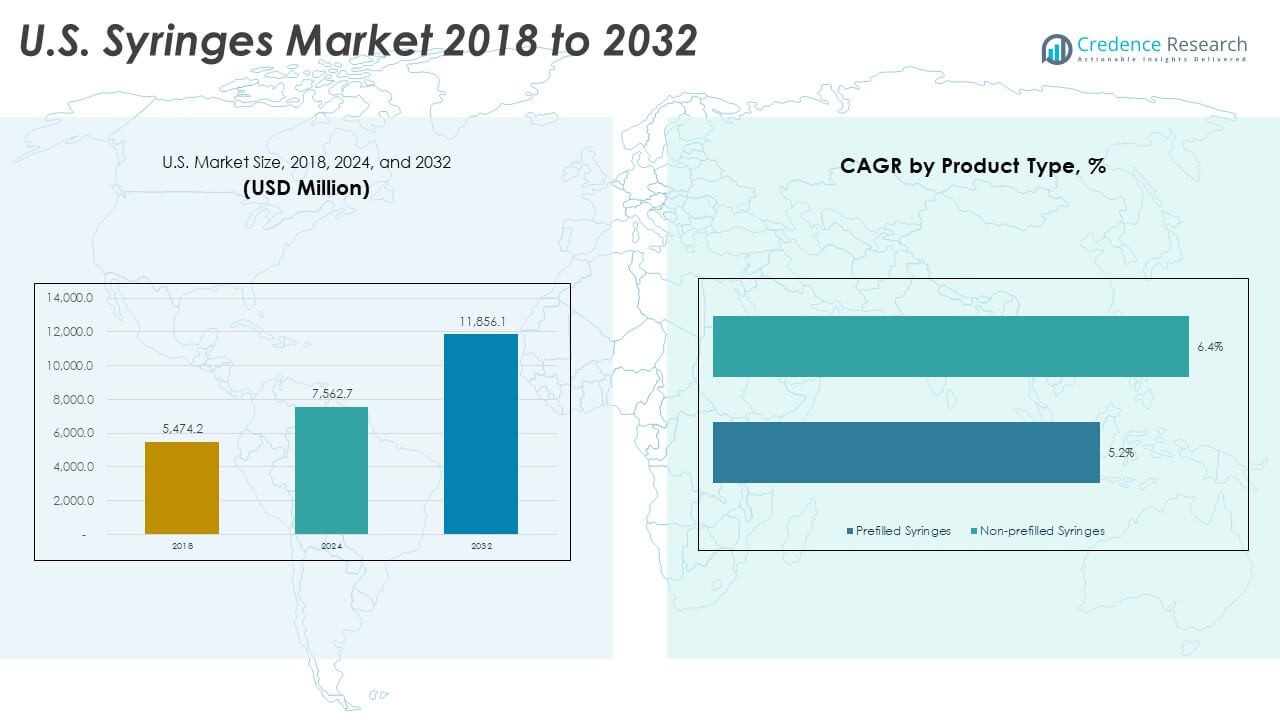

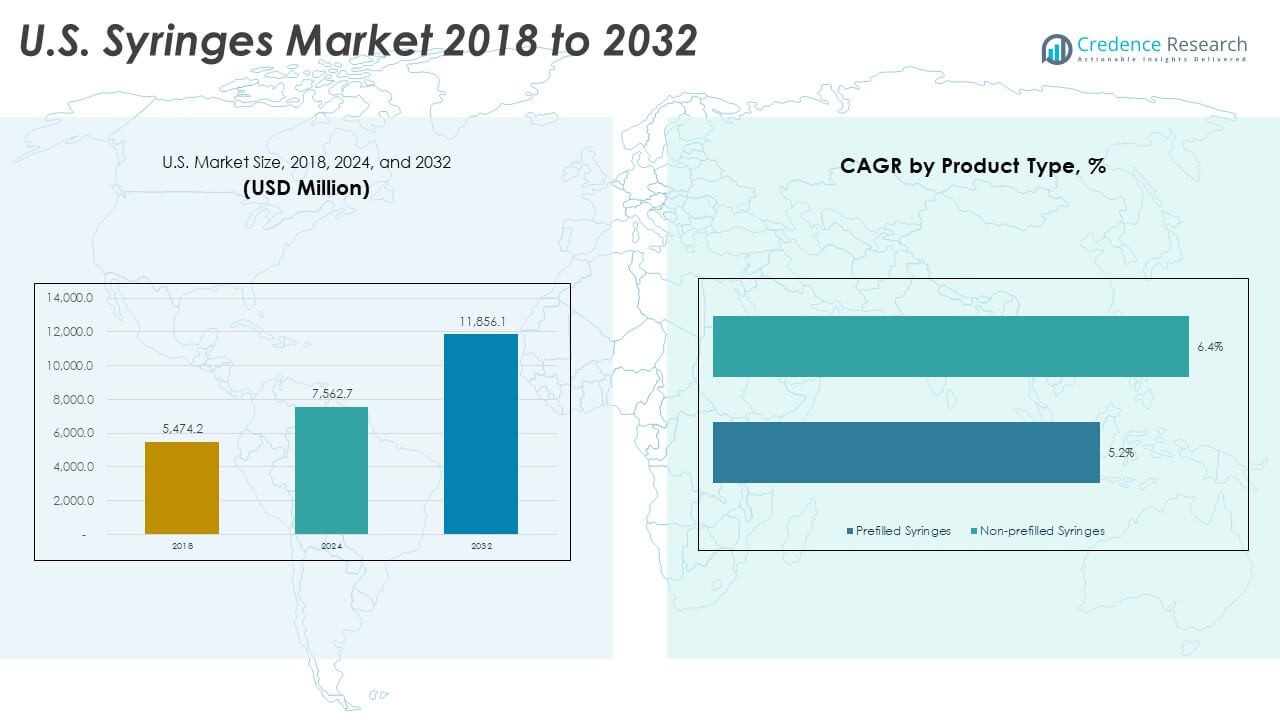

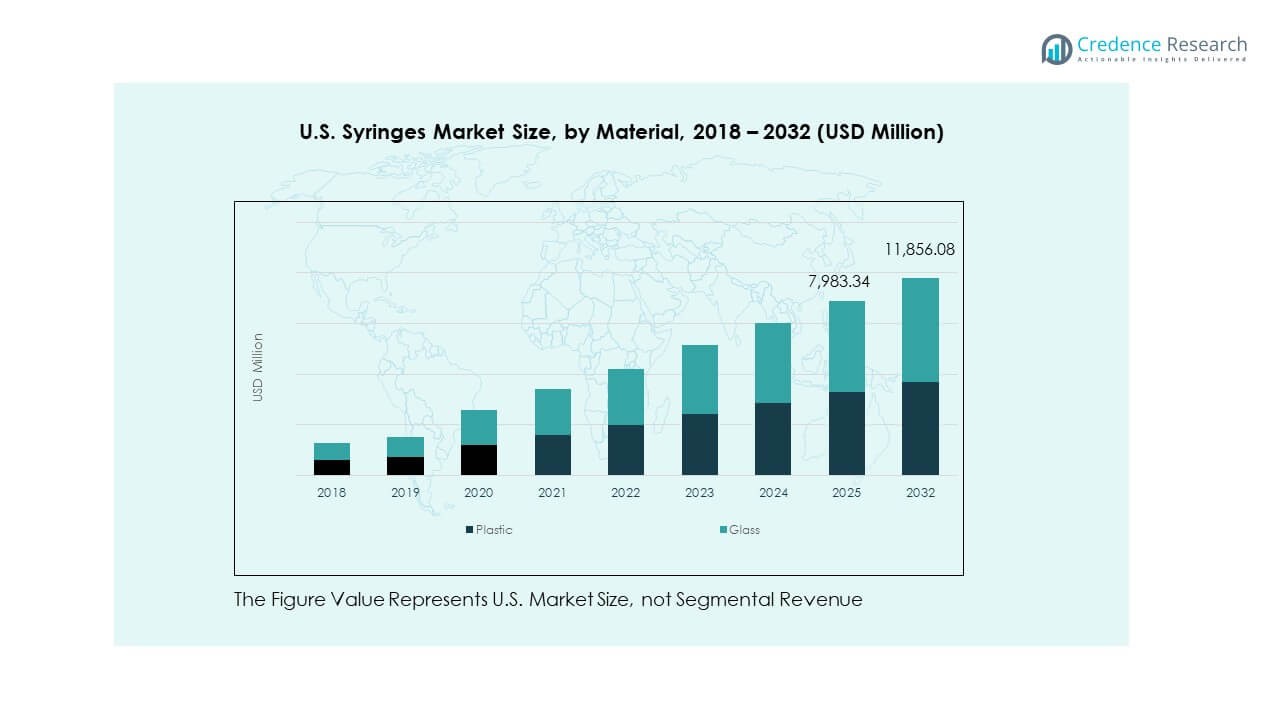

The U.S. Syringes Market size was valued at USD 5,474.20 million in 2018 to USD 7,562.70 million in 2024 and is anticipated to reach USD 11,856.10 million by 2032, at a CAGR of 5.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Syringes Market Size 2024 |

USD 7,562.70 Million |

| U.S. Syringes Market, CAGR |

5.81% |

| U.S. Syringes Market Size 2032 |

USD 11,856.10 Million |

Growing healthcare demand drives strong adoption across clinics, hospitals, and specialty centers. Chronic disease cases increase the need for regular injections, which boosts use across adult and elderly groups. Safety syringe use expands due to strict protocols that lower needle-stick risks and improve patient care. Home-based care supports higher demand for prefilled and user-friendly formats. Vaccination programs create strong volume needs across public health systems. Pharma expansion adds further support due to rising biologics and injectables. These factors push sustained growth across device categories.

Regional trends show strong presence across the U.S. due to advanced healthcare access and higher treatment penetration. Major states with large hospital networks lead adoption due to strong infrastructure, dense patient volumes, and specialist availability. High-income regions show early use of advanced safety syringes due to higher awareness and strict guidelines. Emerging regions benefit from growing ambulatory centers and wider home-care use. Continuous upgrades in care delivery and strong investments by healthcare providers support market expansion across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Syringes Market grew from USD 5,474.20 million in 2018 to USD 7,562.70 million in 2024, with projections reaching USD 11,856.10 million by 2032, advancing at a 5.81% CAGR during the forecast period.

- The South led the market with 32% share due to large healthcare networks and high treatment volumes, followed by the Northeast at 28%, supported by strong medical infrastructure and specialty care services.

- The Midwest held 22% share, while the West emerged as the fastest-growing region at 18%, driven by advanced medical practices, large health systems, and rising demand for specialty syringes.

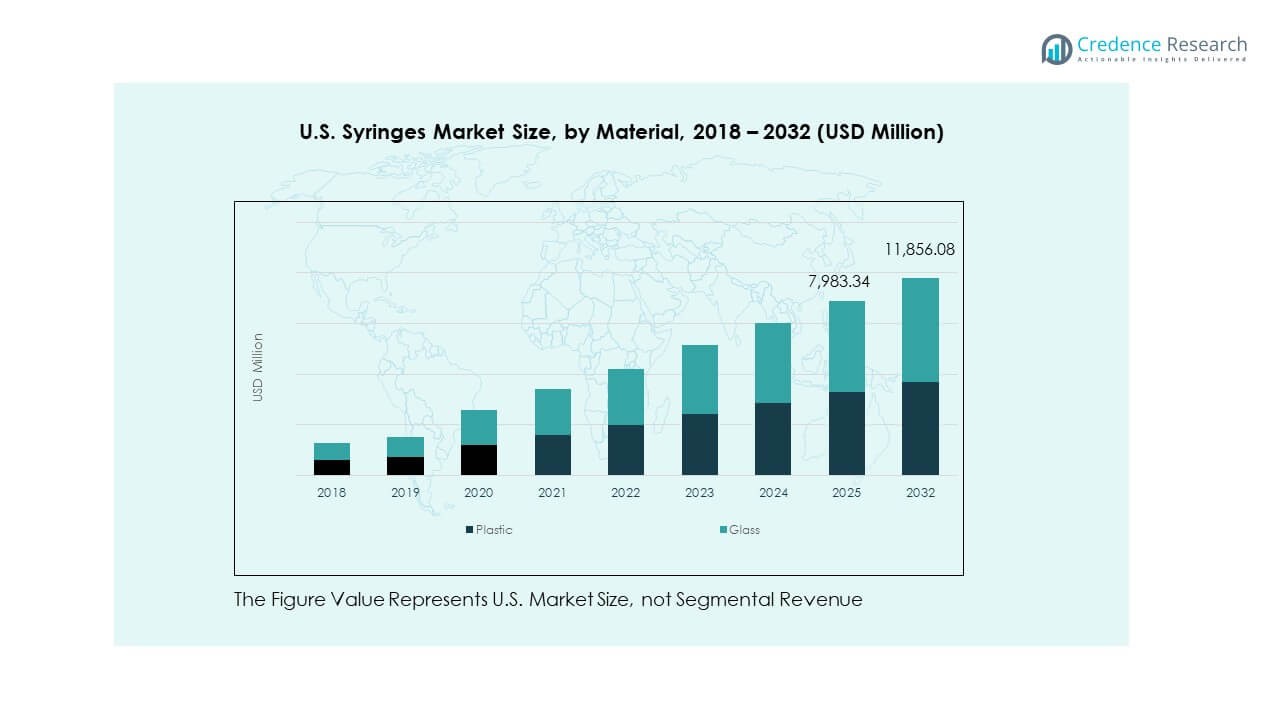

- Plastic syringes accounted for about 60% of total material use, reflecting strong preference for low-cost, high-availability, and disposable formats in clinical settings.

- Glass syringes represented roughly 40% share, supported by growing use in biologics, high-stability formulations, and premium injectable therapies.

Market Drivers:

Rising Demand from Chronic Disease Management

Growing treatment needs support steady expansion of the U.S. Syringes Market and reinforce continuous use across healthcare settings. Chronic conditions require frequent injections that raise routine consumption across hospitals and clinics. Patients with diabetes, arthritis, and hormonal disorders depend on reliable devices for regular dosing. Home-care adoption strengthens due to patient preference for convenient and controlled delivery. Pharma companies launch new injectable therapies that increase demand for diverse syringe formats. Safety-driven protocols increase the shift toward prefilled and easy-use options. Strong treatment penetration keeps demand stable across large patient groups.

- For instance, BD produces more than 2 billion insulin syringes every year globally, supporting millions of diabetes patients who rely on daily injections. Pharma companies launch new injectable therapies that increase demand for diverse syringe formats.

Expansion of Vaccination and Immunization Programs

Immunization efforts drive consistent need for high-volume applications and strengthen national demand for syringes. Public health systems require reliable supplies for seasonal vaccination cycles. Emergency vaccination campaigns require rapid scaling of injection devices. It supports wider population coverage across adult and pediatric groups. Single-use safety designs gain acceptance due to strict medical guidelines. Pharma partnerships strengthen supply chain flow during peak periods. Large-scale procurements continue to influence long-term consumption patterns.

- For instance, BD supplied 1 billion safety syringes to global immunization programs during COVID-19, marking one of the largest medical-device mobilizations.

Growing Shift Toward Safety and Needlestick Prevention Technologies

Healthcare standards push adoption of engineered safety devices that reduce clinical risks. Hospitals use automatic retractable formats to protect workers during high-volume procedures. Strong awareness among clinical teams accelerates the shift toward advanced solutions. Government guidelines reinforce strict compliance for all high-risk environments. It drives producers to launch new safety-engineered innovations. Procurement teams prioritize certified products to maintain compliance and risk reduction. Broad acceptance strengthens the transition across public and private facilities.

Rising Use of Prefilled and Ready-to-Use Syringe Formats

Demand for ready solutions increases due to growth in biologics and precision therapies. Prefilled devices simplify handling steps for clinical teams. It improves dose accuracy in high-risk therapeutic areas. Home-care programs support the use of prefilled formats for self-administration. Pharma companies expand prefilled lines to support injectable drug launches. Strong compliance needs push adoption due to reduced contamination risks. This shift supports long-term growth of advanced delivery formats.

Market Trends:

Adoption of Smart Syringes and Digital-Enabled Injection Systems

Technology adoption rises as healthcare providers seek precise tracking and improved workflow control. Smart solutions integrate identifiers that support authentication and patient safety. It helps clinicians monitor dosage history with greater clarity. Automated features support better compliance across care teams. Hospitals deploy connected systems that enhance monitoring across high-volume units. Digital features improve record accuracy for sensitive treatments. This trend strengthens the shift toward more advanced delivery ecosystems.

- For instance, Terumo’s digital syringe pump systems support dose accuracy to within ±2%, helping clinicians achieve greater precision during critical medication delivery.

Growth of Eco-Friendly and Sustainable Syringe Materials

Manufacturers explore low-impact materials to reduce waste across healthcare operations. Biodegradable components gain interest due to sustainability mandates. It encourages producers to redesign devices with reduced environmental load. Healthcare groups seek greener options that support long-term sustainability goals. Recycling programs expand across major facilities to reduce plastic volume. Regulatory bodies study frameworks that support responsible waste handling. Market preference slowly shifts toward more eco-conscious device categories.

- For instance, Gerresheimer’s glass plants operate with cullet recycling rates reaching up to 50% in select facilities, reducing energy demand and emissions during production.

Customization of Syringe Designs for Specialized Therapies

Innovative therapies require precise dosing tools that support sensitive delivery needs. Specialty syringes gain traction across oncology and immunology segments. It pushes companies to develop customized designs for targeted dosing. Clinics rely on specialized solutions for complex biologics. Growth in niche therapies increases the need for tailored configurations. Manufacturers expand portfolios to support rising clinical specifications. This trend enhances product differentiation in competitive environments.

Automation and High-Speed Production Adoption in Manufacturing Plants

Producers invest in automated lines to increase output and maintain sterile handling standards. Automation reduces risk of manufacturing errors and strengthens product consistency. It supports higher throughput during peak demand periods. Robotic assembly enables faster turnaround times for large orders. Quality-control systems integrate sensors that improve defect detection. Large companies upgrade plants to manage diverse product mixes efficiently. Automation helps stabilize supply reliability across domestic channels.

Market Challenges Analysis:

Rising Pressure on Supply Chain Stability and Raw Material Availability

Supply chain disruptions influence the stability of the U.S. Syringes Market and challenge production volume planning. Resin shortages cause delays that affect high-demand categories. It forces manufacturers to adjust sourcing strategies across multiple regions. Transportation constraints increase delivery timelines for medical facilities. Hospitals maintain higher inventory levels to reduce operational risks. Producers face difficulty scaling during sudden demand spikes. These pressures influence cost structures across the ecosystem. Firms continue seeking diversified sourcing to reduce vulnerability.

Stringent Compliance Requirements and High Cost of Advanced Safety Technologies

Regulations demand strict adherence to safety norms that raise operational responsibilities for producers. Advanced retractable and shielded formats require costly engineering processes. It increases manufacturing expenses for companies scaling safety-driven lines. Hospitals prefer advanced devices but face cost pressures during large procurements. Smaller facilities struggle to transition fully toward premium categories. Certification processes lengthen product launch timelines. Compliance enforcement raises workload across supply and quality teams. These factors limit rapid adoption across cost-sensitive settings.

Market Opportunities:

Expansion of Home-Care Delivery and Self-Administration Devices

Growing preference for home-care raises new opportunities for the U.S. Syringes Market and opens demand for user-friendly formats. Self-administration increases adoption of prefilled devices across chronic care. It encourages pharma companies to grow companion delivery systems. Simplified designs support adherence in long-term therapies. Demand rises for compact and portable solutions. Telehealth growth pushes stronger interest in at-home procedures. These opportunities expand device penetration across wider patient groups.

Rising Investment in Specialty Syringes for Emerging Drug Classes

Biologics and gene-based therapies open strong growth windows for specialized devices. Producers invest in advanced materials for stable handling of sensitive formulations. It encourages development of precision-oriented syringe formats. Specialty care centers require devices built for complex dosing. Pharma players seek partnerships for co-developed delivery tools. Growth in advanced therapies expands long-term volume prospects. These trends create strong opportunities for innovation-focused manufacturers.

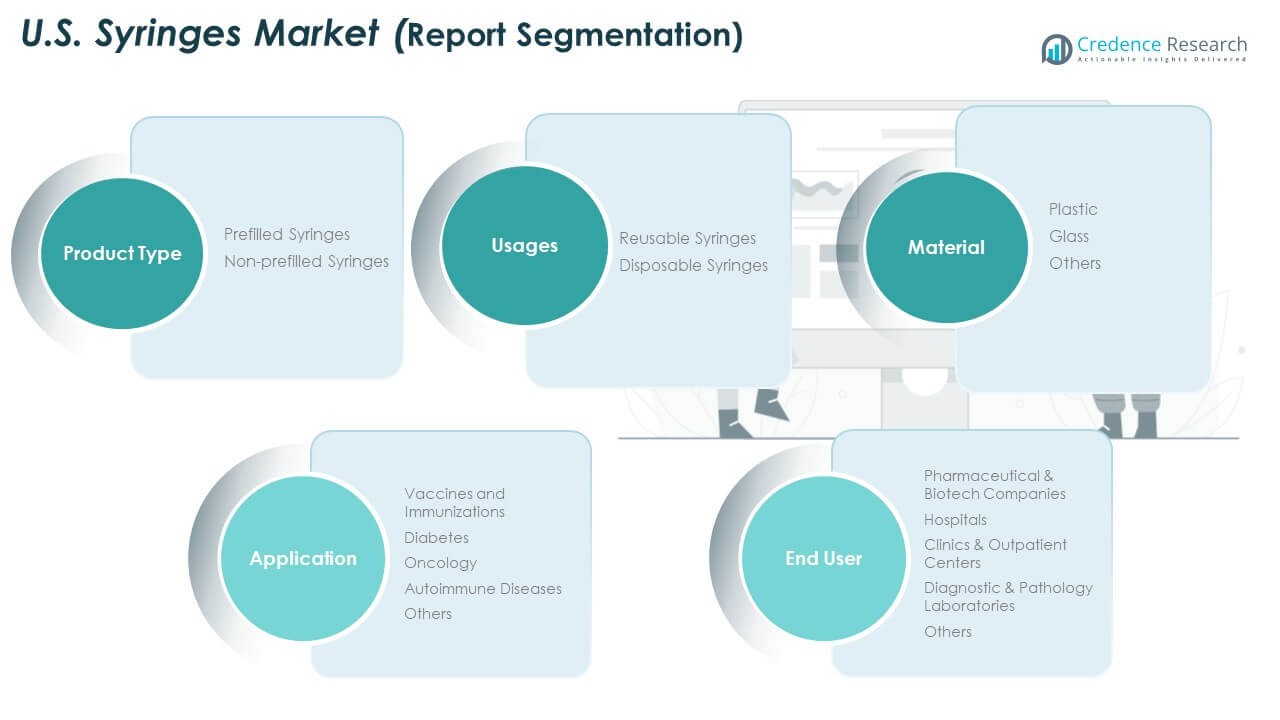

Market Segmentation Analysis:

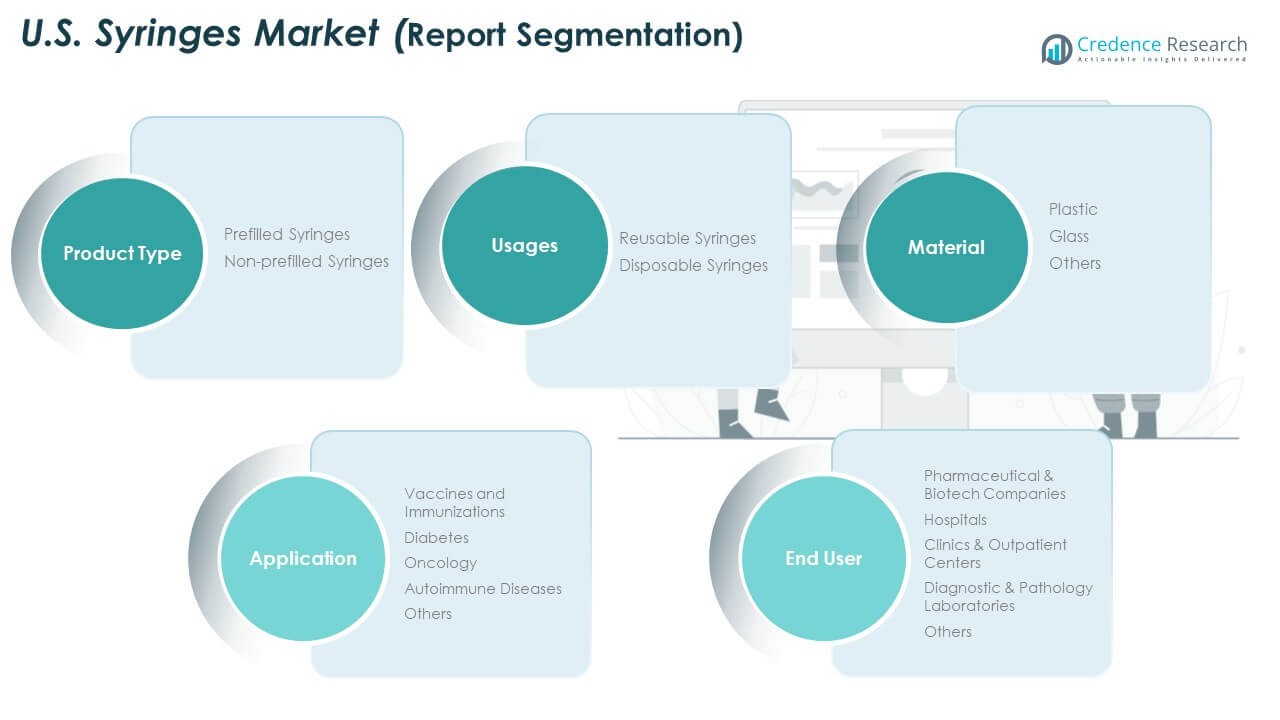

By Product Type

The U.S. Syringes Market displays strong demand across prefilled and non-prefilled formats. Prefilled syringes gain traction due to their safety, accuracy, and ease of use. It supports wider adoption in biologics, vaccines, and specialty injections. Non-prefilled types maintain relevance across routine hospital procedures and high-volume applications. Hospitals prefer flexibility in procurement for non-prefilled devices. Growth across both types reflects expanding therapeutic needs. The mix of convenience and affordability shapes adoption patterns across care settings.

- For instance, Gerresheimer produces several hundred million ready-to-fill syringes annually (both glass and plastic) and is expanding its capacity to double production by 2027 to support the expanding biologics pipelines. Growth across both types reflects expanding therapeutic needs, while convenience and affordability shape adoption patterns across care settings.

By Application

Vaccination drives significant usage due to seasonal programs and preventive care needs. Diabetes supports steady consumption through regular insulin administration. Oncology requires specialized syringes for precise dosing of sensitive drugs. Autoimmune therapies increase adoption due to injectable biologics. It strengthens recurring demand across long-term treatment cycles. Other applications handle general medical, diagnostic, and emergency uses. Broad medical coverage ensures stable growth across key therapeutic areas.

- For instance, Terumo supplies high-quality, specialty syringes, such as their PLAJEX polymer prefillable syringes, which are designed with advanced material technology to ensure compatibility and stability with sensitive drugs, including biopharmaceuticals and some chemotherapeutic agents.

By Material

Plastic syringes dominate due to low cost, high availability, and disposable nature. Glass variants remain important for sensitive formulations that need stability and compatibility. It ensures safe handling of biologics and premium injectables. Other materials cater to niche applications with unique performance needs. Healthcare providers prioritize reliability across all formats. Material selection aligns with safety standards. The mix supports diverse clinical demands.

By End User and Usages

Hospitals lead consumption due to high patient volume and broad procedural coverage. Pharmaceutical and biotech companies drive demand for prefilled and specialty types. Clinics and outpatient centers expand use through routine care cycles. Diagnostic laboratories maintain steady need for sample collection. It supports consistent procurement across settings. Disposable syringes dominate due to infection control priorities. Reusable formats hold limited but stable demand.

Segmentation:

By Product Type

- Prefilled Syringes

- Non-prefilled Syringes

By Application

- Vaccines and Immunizations

- Diabetes

- Oncology

- Autoimmune Diseases

- Others

By Material

By End User

- Pharmaceutical & Biotech Companies

- Hospitals

- Clinics & Outpatient Centers

- Diagnostic & Pathology Laboratories

- Others

By Usages

- Reusable Syringes

- Disposable Syringes

Regional Analysis:

Northeast Region

The Northeast holds an estimated 28% share of the U.S. Syringes Market due to its dense hospital networks and advanced medical infrastructure. Large academic medical centers drive steady demand for safety-engineered syringes. It benefits from strong adoption of prefilled formats for specialized therapies. High vaccination rates across urban areas support recurring volume use. Regulatory compliance levels remain strict, which encourages providers to shift toward premium safety designs. Pharmaceutical clusters strengthen procurement for clinical trials and biologic therapies. These factors help the region maintain a stable leadership position.

South and Midwest Regions

The South secures roughly 32% share, supported by a large population base and rapid healthcare expansion. Growing chronic disease prevalence increases routine syringe use across diabetes and long-term therapies. It benefits from strong development of outpatient centers and community clinics. The Midwest holds close to 22% share, driven by established hospital systems and broad diagnostic activity. Preventive care programs support regular vaccination demand across both regions. Healthcare providers in these areas adopt safety solutions at a steady rate. Combined growth strengthens overall market penetration across central and southern states.

West Region

The West accounts for nearly 18% share of the U.S. Syringes Market due to a strong focus on technology-driven healthcare delivery. High adoption of prefilled and specialty syringes supports advanced treatment procedures. It benefits from a growing elderly population that requires long-term injectable therapies. Large health systems in California and Washington lead early uptake of safety devices. Preventive health initiatives support consistent volume demand across urban centers. Biotech presence strengthens demand for clinical and laboratory applications. Regional growth remains supported by strong investment in advanced medical practices.

Key Player Analysis:

- BD

- Braun

- Gerresheimer

- Terumo Corporation

- ICU Medical

- Cardinal Health

- Stevanato Group

- Ingersoll Rand

- MedXL

Competitive Analysis:

Competition in the U.S. Syringes Market remains strong, with major companies expanding product portfolios and strengthening supply capabilities. Leading players invest in safety-engineered formats to meet strict healthcare standards. It gains momentum from innovation in prefilled and specialty devices that support biologics. Large manufacturers compete through automation upgrades that increase output precision and consistency. Strategic partnerships help firms expand distribution across hospitals and clinics. Mid-sized companies focus on niche applications that need customized dosing tools. Competitive pressure remains high due to evolving clinical requirements and strong demand for safety-focused products.

Recent Developments:

- In BD , 2025 has seen significant strategic investments aimed at bolstering U.S. syringe manufacturing capacity. In August 2025, the company committed more than $35 million to expand the production of prefilled flush syringes at its Nebraska facility, subsequently adding around 50 jobs and enhancing annual output by hundreds of millions of units to meet hospital demand.

- In September 2025, B. Braun announced a $20 million expansion and modernization of its medical device manufacturing facility in the Lehigh Valley, Pennsylvania. This project will create over 200 new jobs, reinforcing the company’s commitment to IV therapy and compounding operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on product type, application, material, end user, and usage segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for safety-engineered syringes will grow as healthcare systems enforce strict compliance standards.

- Prefilled formats will expand due to the rising use of biologics and self-administration therapies.

- Hospital procurement will prioritize devices with strong safety features and clear performance certifications.

- Automation in manufacturing plants will improve production speed and strengthen supply stability.

- Pharma partnerships will expand to support advanced drug delivery requirements across therapeutic areas.

- Disposable syringes will retain dominance due to strong infection-control priorities across clinical settings.

- Growth in outpatient care and home-based treatment will increase demand for user-friendly syringe formats.

- Specialty materials for advanced injectables will gain traction in high-value therapeutic applications.

- Regional expansion in the West and South will continue due to strong healthcare infrastructure growth.

- Digital integration in syringe tracking will rise, supporting better workflow visibility and clinical safety.