Market Overview

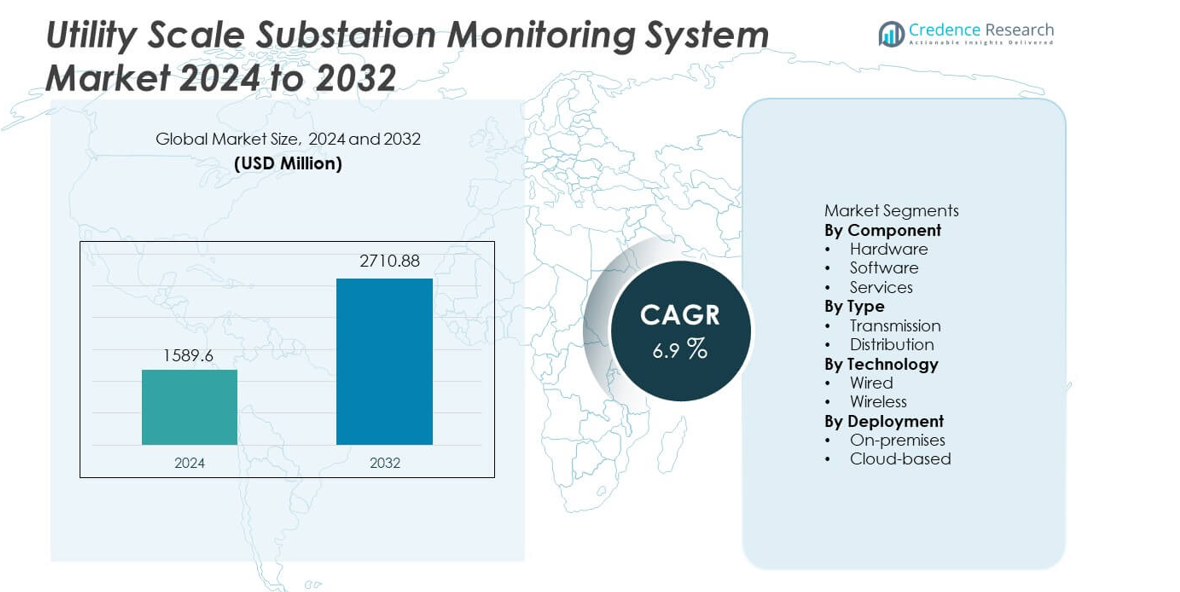

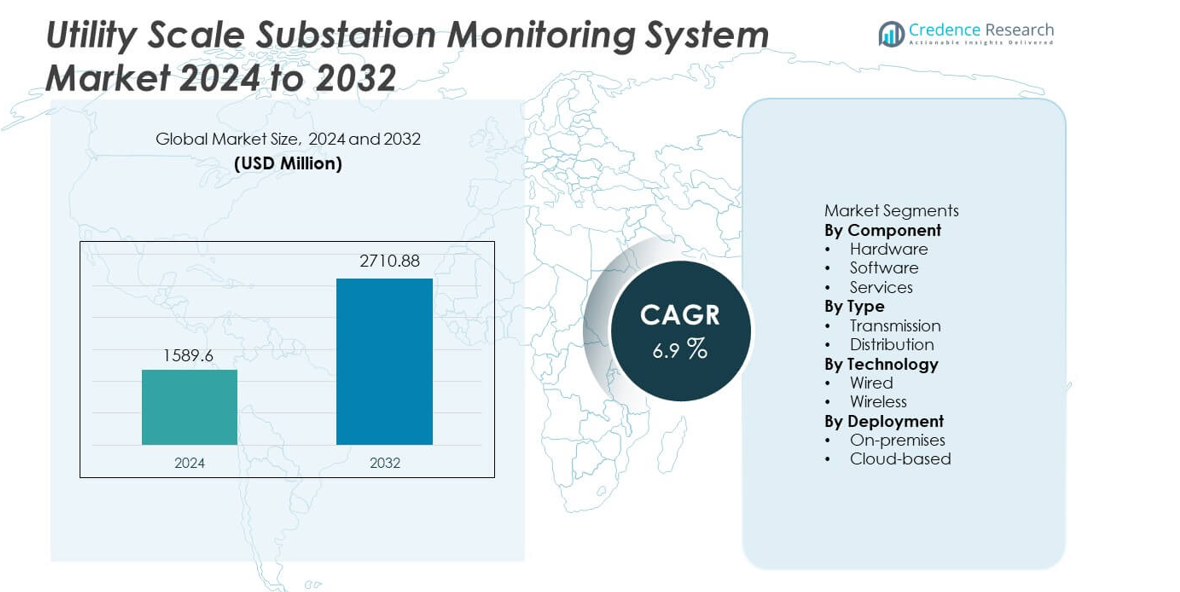

The Utility Scale Substation Monitoring System market was valued at USD 1,589.6 million in 2024 and is projected to reach USD 2,710.88 million by 2032, registering a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Utility Scale Substation Monitoring System Market Size 2024 |

USD 1,589.6 million |

| Utility Scale Substation Monitoring System Market, CAGR |

6.9% |

| Utility Scale Substation Monitoring System MarketSize 2032 |

USD 2,710.88 million |

The Utility Scale Substation Monitoring System market features strong participation from Siemens Energy, ABB Ltd., Schneider Electric, General Electric, Hitachi Energy, Mitsubishi Electric Corporation, Eaton Corporation, Larsen & Toubro, Toshiba Energy Systems & Solutions, and Hyundai Electric & Energy Systems. These players focus on integrated monitoring platforms, digital substations, and predictive maintenance capabilities to support grid reliability. Their strength lies in end-to-end solutions, EPC expertise, and long-term utility contracts. North America leads the global market with a market share of 34%, supported by extensive grid modernization programs, high adoption of digital substations, and strict reliability regulations. Strong investment capacity and early technology adoption reinforce regional leadership and sustain competitive advantage.

Market Insights

- The Utility Scale Substation Monitoring System market was valued at USD 1,589.6 million in 2024 and is projected to reach USD 2,710.88 million by 2032, growing at a CAGR of 6.9% during the forecast period.

- Market growth is driven by grid modernization programs, aging substation infrastructure, and rising demand for real-time asset visibility to reduce outages and extend equipment life.

- Hardware remains the leading segment with a 46% market share, supported by strong demand for sensors, intelligent electronic devices, and monitoring relays across transmission substations.

- Competitive activity centers on digital substations, predictive analytics, and condition-based maintenance, with leading players strengthening EPC capabilities and lifecycle service offerings.

- North America leads with a 34% market share, followed by Asia Pacific at 28% and Europe at 26%, while Latin America and the Middle East & Africa show steady adoption driven by targeted grid upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component:

The component segment includes hardware, software, and services, with hardware holding a dominant market share of 46%. Utilities prioritize hardware such as intelligent electronic devices, sensors, and monitoring relays to ensure real-time asset visibility. Aging grid infrastructure and rising grid loads drive strong investment in physical monitoring equipment. Hardware delivers direct fault detection, temperature tracking, and condition monitoring at the substation level. Utilities favor hardware-led deployments because these systems support long operating lifecycles and high reliability. Integration of advanced sensors and digital relays strengthens asset protection strategies. Rising capital spending on grid modernization programs further supports hardware dominance across utility-scale substations.

- For instance, ABB deployed its Relion 670 series IEDs with sampling rates of 4,800 samples per second for real-time fault analysis.

By Type:

The type segment covers transmission and distribution substations, where transmission substations account for a leading market share of 58%. High-voltage transmission assets carry greater operational risk and financial impact during failures. Utilities focus monitoring investments on transmission substations to avoid large-scale outages and cascading grid disruptions. Transmission networks also require continuous monitoring due to long-distance power flows and complex load balancing. Growth in cross-border interconnections and renewable power evacuation increases monitoring needs at transmission levels. Regulatory pressure for grid reliability further accelerates adoption. Advanced monitoring improves fault localization, asset lifespan, and operational efficiency across transmission substations.

- For instance, Hitachi Energy deployed Lumada APM systems processing over 10,000 sensor data points per second on transmission assets.

By Technology:

The technology segment consists of wired and wireless systems, with wired technology dominating with a market share of 63%. Utilities prefer wired solutions due to stable data transmission, lower latency, and higher cybersecurity control. Wired networks support high data volumes from sensors, relays, and protection systems. These systems ensure uninterrupted monitoring in harsh electromagnetic environments. Utilities deploy wired technology extensively in critical substations where reliability remains non-negotiable. Long-term infrastructure compatibility also supports wired adoption. Although wireless solutions gain interest, wired technology remains the primary choice for mission-critical utility-scale substation monitoring deployments.

Key Growth Driver

Grid Modernization and Aging Infrastructure

Utilities invest heavily in monitoring systems to upgrade aging substation infrastructure. Many transmission and distribution assets exceed designed operational lifecycles. Monitoring systems provide real-time visibility into asset condition, thermal stress, and fault behavior. Utilities use these insights to prevent failures and extend equipment life. Government-led grid modernization programs further accelerate adoption. Expansion of renewable integration also increases monitoring needs at substations. Digital substations require continuous data flows for stable operation. This combination of asset replacement pressure and modernization initiatives strongly drives demand for utility-scale substation monitoring systems.

- For instance, Siemens Energy deployed Sensformer units that capture transformer temperature data every 1 second for continuous condition tracking.

Rising Demand for Grid Reliability and Outage Prevention

Grid reliability remains a top priority for utilities facing growing power demand. Substation failures cause large-scale outages with high economic impact. Monitoring systems enable early fault detection and predictive maintenance. Utilities reduce unplanned downtime by acting on real-time alerts. Increased electrification of transport and industry adds further stress to substations. Regulators enforce stricter reliability standards across regions. Utilities respond by deploying advanced monitoring platforms. These systems improve fault localization, load management, and response time. Reliability-focused investments therefore remain a core growth driver for the market.

- For instance, GE Grid Solutions deployed Phasor Measurement Units operating at 60 frames per second to detect voltage instability in transmission substations.

Integration of Renewable Energy and Distributed Generation

Rapid growth of renewable energy changes power flow patterns across grids. Substations now manage variable loads from solar and wind sources. Monitoring systems help utilities maintain voltage stability and grid balance. Real-time analytics support faster operational decisions under fluctuating conditions. Distributed energy resources increase network complexity at both transmission and distribution levels. Utilities require continuous monitoring to avoid congestion and equipment overload. Monitoring platforms also support grid automation strategies. The shift toward renewable-heavy grids strongly drives demand for advanced substation monitoring solutions.

Key Trend & Opportunity

Adoption of Digital Substations and Advanced Analytics

Utilities increasingly deploy digital substations with intelligent sensors and automation systems. Monitoring platforms integrate with digital relays and control systems. Advanced analytics convert raw data into actionable insights. Utilities use analytics to predict failures and optimize maintenance schedules. This trend reduces operational costs and manual inspections. Vendors offering integrated analytics gain strong competitive advantage. Cloud-enabled platforms further enhance scalability and remote access. Digital substation adoption creates long-term opportunities for monitoring system providers across both new installations and retrofit projects.

- For instance, Mitsubishi Electric’s MELPRO digital protection relays process sampled values at 4,800 samples per second to support real-time analytics in digital substations.

Growth of Condition-Based and Predictive Maintenance Models

Utilities shift from time-based maintenance to condition-based strategies. Monitoring systems provide continuous asset health data. Predictive models identify early signs of insulation degradation or thermal stress. This approach lowers maintenance costs and improves asset utilization. Utilities extend equipment life while maintaining safety standards. The trend supports demand for advanced sensors and software platforms. Vendors offering predictive capabilities gain stronger adoption rates. Expansion of predictive maintenance programs creates sustained growth opportunities in the substation monitoring system market.

- For instance, Schneider Electric’s EcoStruxure™ Transformer Expert analyzes sensor inputs with data refresh cycles below one hour to support predictive maintenance decisions.

Key Challenge

High Initial Investment and Integration Complexity

Substation monitoring systems require significant upfront investment. Hardware, communication infrastructure, and software add to project costs. Integration with legacy substations remains technically complex. Utilities must manage compatibility across different equipment generations. Skilled workforce shortages further slow deployment. Budget constraints delay adoption in cost-sensitive regions. Utilities also face long approval cycles for capital projects. These financial and technical barriers limit faster market penetration. Vendors must address cost efficiency and integration simplicity to overcome this challenge.

Cybersecurity Risks and Data Management Issues

Increasing digitalization exposes substations to cybersecurity threats. Monitoring systems generate large volumes of sensitive operational data. Utilities must secure communication networks against cyberattacks. Compliance with cybersecurity regulations increases system complexity. Data overload also challenges utility teams lacking advanced analytics skills. Poor data management reduces system effectiveness. Concerns over remote access vulnerabilities slow cloud adoption. Cybersecurity risks and data handling issues therefore restrain deployment. Addressing security and data governance remains critical for long-term market growth.

Regional Analysis

North America

North America accounts for a market share of 34% in the Utility Scale Substation Monitoring System market, driven by strong grid modernization investments and strict reliability standards. Utilities focus on monitoring systems to manage aging transmission assets and prevent large-scale outages. High penetration of digital substations and advanced analytics supports steady adoption. The region benefits from early deployment of condition-based maintenance practices. Growing renewable integration further increases monitoring demand across transmission substations. Strong regulatory oversight and high utility spending capacity continue to sustain North America’s leading position in the global market.

Europe

Europe holds a market share of 26%, supported by aggressive renewable energy targets and cross-border power transmission networks. Utilities deploy monitoring systems to ensure grid stability under variable renewable loads. Aging infrastructure replacement programs across Western and Northern Europe drive sustained investment. Emphasis on grid automation and digital substations accelerates technology adoption. Regulatory mandates on grid reliability and energy efficiency further support deployment. Utilities also prioritize cybersecurity-compliant monitoring solutions. These factors position Europe as a key contributor to global market growth.

Asia Pacific

Asia Pacific represents a market share of 28%, driven by rapid grid expansion and rising electricity demand. Large-scale investments in transmission infrastructure support strong monitoring system adoption. Countries such as China and India prioritize substation monitoring to manage grid complexity and reduce outages. Renewable capacity additions increase the need for real-time asset visibility. Utilities adopt monitoring solutions to support high-voltage network expansion. Government-backed power sector reforms further strengthen demand. Asia Pacific remains the fastest-growing regional market.

Latin America

Latin America accounts for a market share of 7%, supported by ongoing power infrastructure upgrades. Utilities invest in monitoring systems to improve grid reliability and reduce technical losses. Expansion of renewable energy projects increases monitoring requirements at transmission substations. Budget constraints limit rapid deployment, but targeted modernization programs sustain growth. Countries focus on reducing outage duration through better fault detection. International funding for grid projects also supports adoption. The region shows steady progress in monitoring system implementation.

Middle East & Africa

The Middle East & Africa region holds a market share of 5%, driven by grid expansion and energy diversification efforts. Utilities deploy monitoring systems to support high-voltage transmission networks. Growth in renewable and cross-border power projects increases demand for asset monitoring. Harsh operating environments raise the need for real-time equipment condition tracking. Investment in smart grid initiatives supports gradual adoption. While deployment remains selective, long-term infrastructure development sustains regional market growth.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Type

- Transmission

- Distribution

By Technology

By Deployment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights Siemens Energy, ABB Ltd., Schneider Electric, General Electric, Hitachi Energy, Mitsubishi Electric Corporation, Eaton Corporation, Larsen & Toubro, Toshiba Energy Systems & Solutions, and Hyundai Electric & Energy Systems as leading participants. These companies compete through comprehensive substation monitoring portfolios that combine sensors, intelligent electronic devices, analytics software, and integration services. Market leaders leverage strong EPC capabilities and long-term utility relationships to secure large transmission projects. Players focus on digital substation platforms, condition-based monitoring, and predictive analytics to strengthen differentiation. Strategic investments target grid modernization, renewable integration support, and cybersecurity-ready architectures. Companies also expand service offerings to include lifecycle management and remote monitoring. Competition remains intense as vendors balance cost efficiency with advanced functionality. Continuous innovation, system reliability, and seamless integration with legacy infrastructure define competitive advantage in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Energy

- ABB Ltd.

- Schneider Electric

- General Electric

- Hitachi Energy

- Mitsubishi Electric Corporation

- Eaton Corporation

- Larsen & Toubro

- Toshiba Energy Systems & Solutions

- Hyundai Electric & Energy Systems

Recent Developments

- In September 2024, Siemens Energy signed grid upgrade contracts with Eletrobras in Brazil. The scope included online dissolved-gas monitoring for transformer stations and substations.

- In February 2024, General Electric launched GridBeats via GE Vernova’s Grid Solutions business. GridBeats targets digital monitoring and automation for grid infrastructure.

- In March 2023, Tohoku Electric Power ordered Toshiba Energy Systems to create a STATCOM. This STATCOM will assist in the more effective powering of the grid and will enhance smooth operation during complex power transmissions, thereby increasing reliability in case of faults within the transmission systems.

Report Coverage

The research report offers an in-depth analysis based on Component, Type, Technology, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Utilities will expand monitoring deployments to support large-scale grid modernization programs.

- Digital substations will drive higher demand for integrated monitoring platforms.

- Predictive maintenance adoption will increase across transmission and distribution assets.

- Utilities will prioritize real-time asset health monitoring to reduce outage risks.

- Renewable energy integration will intensify monitoring needs at high-voltage substations.

- Wired monitoring systems will remain dominant in critical utility applications.

- Cybersecurity-ready monitoring architectures will gain stronger adoption.

- Cloud-enabled analytics will support remote substation management.

- Utilities will invest in lifecycle services to improve asset performance.

- Emerging regions will accelerate adoption through targeted transmission upgrades.