Market Overview

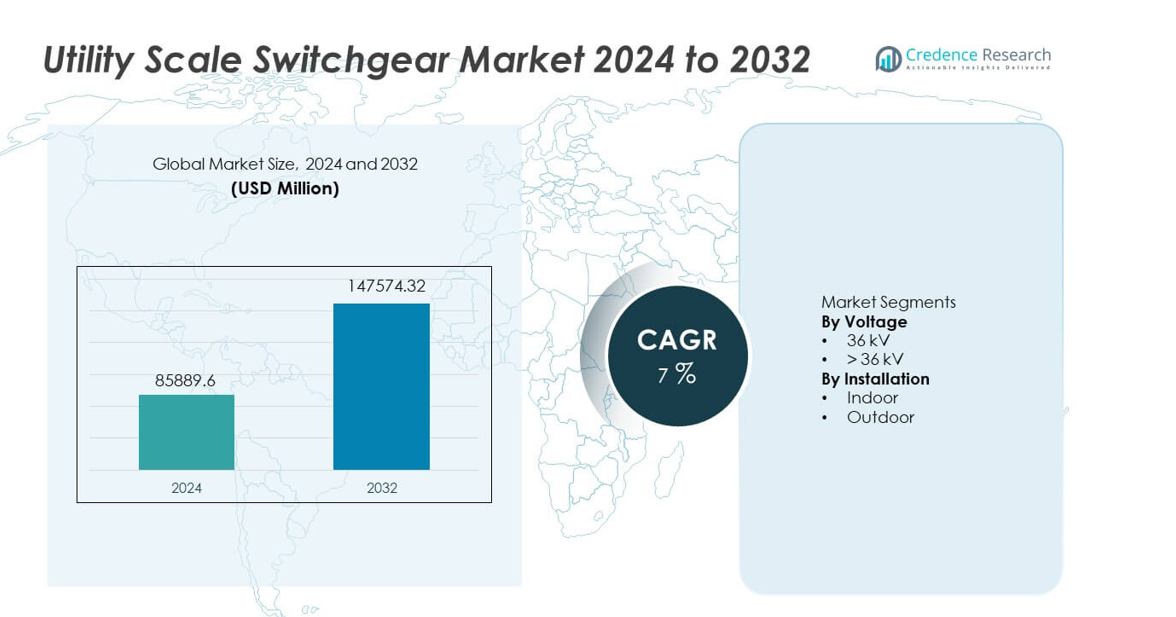

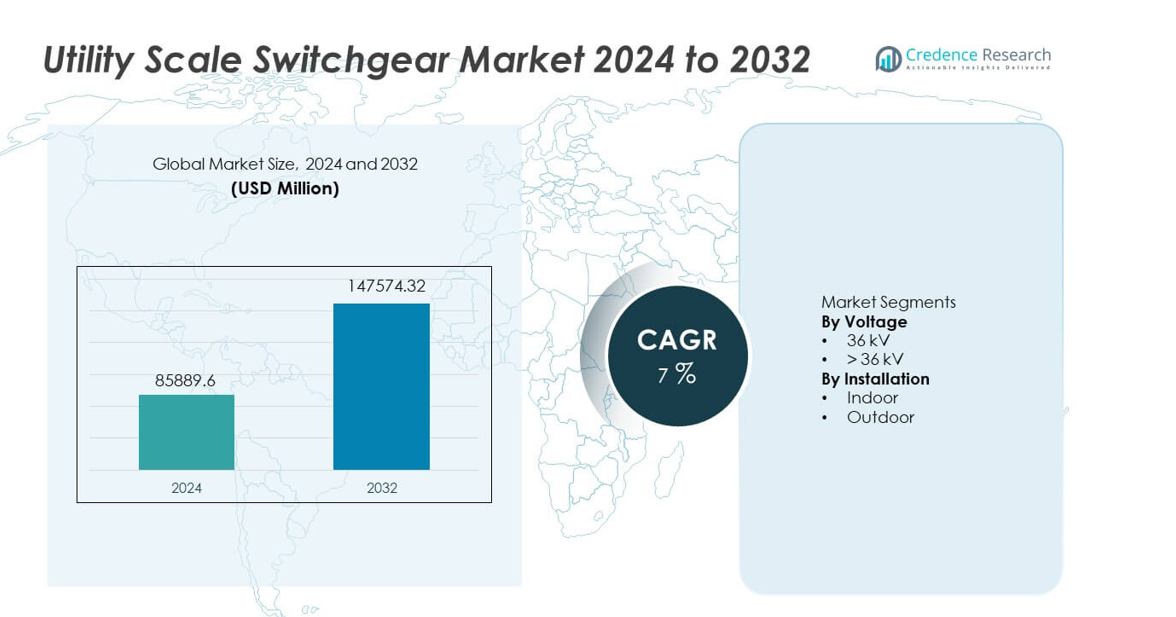

The Utility Scale Switchgear market was valued at USD 85,889.6 million in 2024 and is projected to reach USD 147,574.32 million by 2032, registering a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Utility Scale Switchgear Market Size 2024 |

USD 85,889.6 million |

| Utility Scale Switchgear Market, CAGR |

7% |

| Utility Scale Switchgear Market Size 2032 |

USD 147,574.32 million |

The Utility Scale Switchgear market features strong participation from ABB, General Electric, Eaton, Hitachi, HD Hyundai Electric, CG Power and Industrial Solutions, Bharat Heavy Electricals, Fuji Electric, Hyosung Heavy Industries, and E + I Engineering. These companies focus on high-voltage switchgear solutions, grid modernization support, and large utility transmission projects. Their competitive strength lies in manufacturing scale, EPC capabilities, and compliance with global grid standards. Asia Pacific leads the market with a market share of 35%, supported by rapid transmission expansion, rising electricity demand, and large renewable integration projects. Strong government investment in power infrastructure and continuous substation development reinforce regional dominance and sustain long-term market growth.

Market Insights

- The Utility Scale Switchgear market was valued at USD 85,889.6 million in 2024 and is projected to reach USD 147,574.32 million by 2032, growing at a CAGR of 7% during the forecast period.

- Market growth is driven by transmission expansion, grid modernization, and rising renewable energy integration that increases demand for high-voltage protection and control equipment.

- Above 36 kV switchgear leads with a 61% segment share, while outdoor installations hold a 57% share due to large-scale transmission projects and harsh operating conditions.

- Competitive activity focuses on high fault-withstand designs, digital-ready switchgear, and environmentally compliant insulation technologies, supported by strong EPC capabilities.

- Asia Pacific dominates with a 35% market share, followed by North America at 32% and Europe at 24%, while Latin America at 6% and the Middle East & Africa at 3% show steady growth through targeted grid upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage:

The voltage segment includes 36 kV and above 36 kV categories, with above 36 kV dominating with a market share of 61%. Utilities prioritize high-voltage switchgear to support bulk power transmission and grid stability. Expansion of transmission networks and renewable power evacuation drives strong demand for higher voltage ratings. These systems handle higher fault currents and ensure reliable operation under heavy loads. Growth in cross-border interconnections and ultra-high-voltage projects further strengthens adoption. Utilities also prefer higher voltage switchgear for reduced transmission losses and improved efficiency. Ongoing grid expansion programs continue to reinforce the dominance of the above 36 kV segment.

- For instance, Hitachi Energy supplies gas-insulated switchgear rated up to 550 kV with short-circuit withstand capability of 63 kA for 3 seconds, supporting long-distance transmission corridors.

By Installation:

The installation segment covers indoor and outdoor switchgear, where outdoor installations hold a leading market share of 57%. Utility-scale substations favor outdoor switchgear due to suitability for high-voltage applications and large-scale deployments. Outdoor systems support transmission substations and renewable integration projects. Robust designs withstand harsh weather and environmental conditions. Utilities also benefit from easier scalability and lower space constraints with outdoor installations. Expansion of transmission corridors and greenfield substations drives demand. Reduced building requirements and cost efficiency further support adoption. Outdoor switchgear remains the preferred choice for utility-scale power infrastructure projects.

- For instance, ABB delivers outdoor air-insulated switchgear designed for voltage levels up to 800 kV, operating reliably in ambient temperatures ranging from –40°C to +55°C.

Key Growth Driver

Expansion of Transmission and Distribution Infrastructure

Utilities continue to invest in large-scale transmission and distribution expansion to meet rising electricity demand. Utility scale switchgear plays a critical role in managing high-voltage power flows and ensuring grid stability. Rapid urbanization and industrial growth increase the need for new substations and network upgrades. Governments support grid expansion through national electrification and infrastructure programs. Integration of renewable energy also requires additional switchgear capacity. Utilities prioritize reliable and high-performance equipment to reduce outage risks. These infrastructure investments remain a primary driver of sustained growth in the utility scale switchgear market.

- For instance, Siemens Energy deploys air-insulated and gas-insulated switchgear rated up to 420 kV with short-circuit withstand capability of 63 kA, supporting new transmission substations and grid reinforcement projects.

Integration of Renewable Energy and Grid Interconnections

Renewable energy integration increases demand for advanced switchgear across utility networks. Wind and solar projects require high-voltage switching equipment for grid connection and power evacuation. Intermittent generation places higher stress on grid assets. Switchgear ensures safe isolation, protection, and control under fluctuating loads. Cross-border and interregional power interconnections further drive deployment. Utilities adopt higher voltage ratings to support long-distance transmission. As renewable capacity continues to expand, switchgear demand remains strong across both transmission and distribution substations.

- For instance, GE Vernova supplies gas-insulated switchgear designed for renewable evacuation substations, supporting voltage levels up to 550 kV and continuous current ratings of 5,000 A for large solar and wind integration hubs.

Grid Modernization and Replacement of Aging Assets

Aging grid infrastructure drives replacement of outdated switchgear across utility networks. Many installed systems exceed their operational life and face higher failure risks. Utilities invest in modern switchgear to improve reliability and safety. Advanced designs support higher fault ratings and improved insulation. Digital monitoring compatibility further enhances asset performance. Modernization programs also focus on reducing maintenance and downtime. These replacement cycles create continuous demand for utility scale switchgear across developed and emerging markets.

Key Trend & Opportunity

Adoption of Gas-Insulated and Compact Switchgear Designs

Utilities increasingly adopt gas-insulated and compact switchgear to optimize substation footprint. These designs support high-voltage applications in space-constrained environments. Compact systems offer higher reliability and lower maintenance needs. Urban substations and offshore renewable projects drive adoption. Improved insulation performance enhances operational safety. Vendors offering compact solutions gain competitive advantage. Growth in urban power infrastructure creates long-term opportunities for advanced switchgear technologies.

- For instance, ABB delivers gas-insulated switchgear rated up to 800 kV with a short-circuit withstand capacity of 63 kA for 3 seconds, enabling compact transmission substations in dense urban zones.

Integration of Digital Monitoring and Smart Switchgear

Smart switchgear with embedded sensors gains traction across utility networks. Digital monitoring enables real-time condition assessment and predictive maintenance. Utilities reduce outage risks through early fault detection. Integration with digital substations enhances operational efficiency. Data-driven insights support asset optimization strategies. Vendors investing in intelligent switchgear solutions capture new growth opportunities. Digital transformation strengthens long-term demand in the utility scale switchgear market.

- For instance, Eaton equips high-voltage switchgear with digital sensors capable of monitoring temperature, humidity, and partial discharge, recording up to 10,000 operational events for detailed asset diagnostics.

Key Challenge

High Capital Costs and Long Procurement Cycles

Utility scale switchgear involves high capital investment. Manufacturing, installation, and commissioning add to project costs. Long procurement and approval cycles delay deployment. Budget constraints impact utility spending decisions. Customization requirements further increase lead times. These factors slow adoption, especially in cost-sensitive regions. Vendors must balance cost efficiency with performance to address this challenge.

Environmental and Regulatory Compliance Pressure

Environmental regulations impact switchgear design and material selection. Restrictions on insulating gases increase compliance complexity. Utilities face challenges in transitioning to alternative technologies. Regulatory approvals extend project timelines. Compliance costs affect overall project economics. Vendors must invest in sustainable and compliant solutions. Meeting regulatory standards remains a key challenge in the utility scale switchgear market.

Regional Analysis

North America

North America holds a market share of 32% in the Utility Scale Switchgear market, supported by strong transmission upgrades and grid reliability mandates. Utilities invest in high-voltage switchgear to replace aging assets and support renewable integration. Expansion of cross-state transmission corridors increases demand for outdoor and above 36 kV systems. Digital substations and smart grid initiatives further strengthen adoption. Utilities also prioritize safety, fault tolerance, and compliance with strict standards. Strong capital spending capacity and long-term infrastructure programs continue to sustain steady demand across utility-scale projects in the region.

Europe

Europe accounts for a market share of 24%, driven by renewable energy targets and cross-border interconnections. Utilities deploy advanced switchgear to manage variable power flows from wind and solar assets. Replacement of legacy infrastructure supports consistent demand across transmission networks. Compact and gas-insulated switchgear gains traction in urban substations. Regulatory focus on grid efficiency and operational safety accelerates modernization efforts. Investment in offshore wind transmission further supports high-voltage switchgear adoption. These factors position Europe as a stable and technology-driven regional market.

Asia Pacific

Asia Pacific leads with a market share of 35%, supported by rapid grid expansion and rising electricity demand. Large-scale transmission projects drive strong demand for high-voltage and outdoor switchgear. Countries such as China and India invest heavily in new substations to support urbanization and industrial growth. Renewable energy integration increases switching requirements at grid connection points. Government-backed power sector reforms accelerate infrastructure development. High project volumes and continuous network expansion make Asia Pacific the largest regional contributor to market growth.

Latin America

Latin America represents a market share of 6%, driven by gradual upgrades to power transmission infrastructure. Utilities focus on improving grid reliability and reducing technical losses. Expansion of renewable energy projects increases demand for utility scale switchgear. Budget limitations slow large-scale deployment, but targeted investments support steady progress. Transmission reinforcement programs in key countries sustain demand. International financing and public-private partnerships also aid infrastructure development. The region shows consistent adoption of switchgear across new and refurbished substations.

Middle East & Africa

The Middle East & Africa region holds a market share of 3%, supported by grid expansion and energy diversification initiatives. Utilities invest in switchgear to support high-voltage transmission networks and renewable projects. Harsh operating conditions increase demand for robust outdoor systems. Power infrastructure development remains a national priority in several countries. Adoption progresses steadily through large transmission and interconnection projects. Long-term electrification and renewable goals continue to support gradual market growth across the region.

Market Segmentations:

By Voltage

By Installation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights ABB, General Electric, Eaton, Hitachi, HD Hyundai Electric, CG Power and Industrial Solutions, Bharat Heavy Electricals, Fuji Electric, Hyosung Heavy Industries, and E + I Engineering as major participants in the Utility Scale Switchgear market. These companies compete through broad high-voltage switchgear portfolios, strong manufacturing scale, and deep utility relationships. Market leaders emphasize reliability, high fault-withstand capability, and compliance with regional grid standards. Vendors invest in advanced insulation technologies, digital monitoring integration, and environmentally compliant designs to strengthen differentiation. EPC partnerships and long-term utility contracts support project wins in large transmission programs. Competition remains intense as players balance cost efficiency with performance and regulatory compliance. Continuous product innovation, supply chain resilience, and the ability to deliver turnkey solutions define competitive advantage in the utility scale switchgear market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- General Electric

- Eaton

- Hitachi

- Fuji Electric

- ABB

- HD Hyundai Electric

- CG Power and Industrial Solutions

- Hyosung Heavy Industries

- Bharat Heavy Electricals

- E + I Engineering

Recent Developments

- In September 2025, during Climate Week NYC, Schneider Electric unveiled an expansion of its sustainability initiatives aimed at accelerating Scope 3 (supply chain) decarbonization.

- In August 2025, Siemens focused on scaling its Siemens Xcelerator ecosystem, with notable adoptions such as India’s Skyroot Aerospace utilizing the platform to optimize software lifecycles.

- In August 2024, General Electric’s GE Vernova won RTE’s 245 kV SF₆-free GIS pilot.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Installation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Utilities will expand switchgear installations to support large transmission and distribution projects.

- High-voltage switchgear demand will increase with renewable energy integration.

- Grid modernization programs will drive replacement of aging switchgear assets.

- Outdoor switchgear adoption will remain strong across utility substations.

- Digital and smart switchgear solutions will gain wider utility acceptance.

- Environmentally compliant insulation technologies will see higher adoption.

- Utilities will prioritize equipment with higher fault-withstand capability.

- Long-term EPC contracts will shape supplier selection strategies.

- Emerging markets will increase investment in transmission infrastructure.

- Reliability and operational safety will remain core procurement priorities.