Market Overview

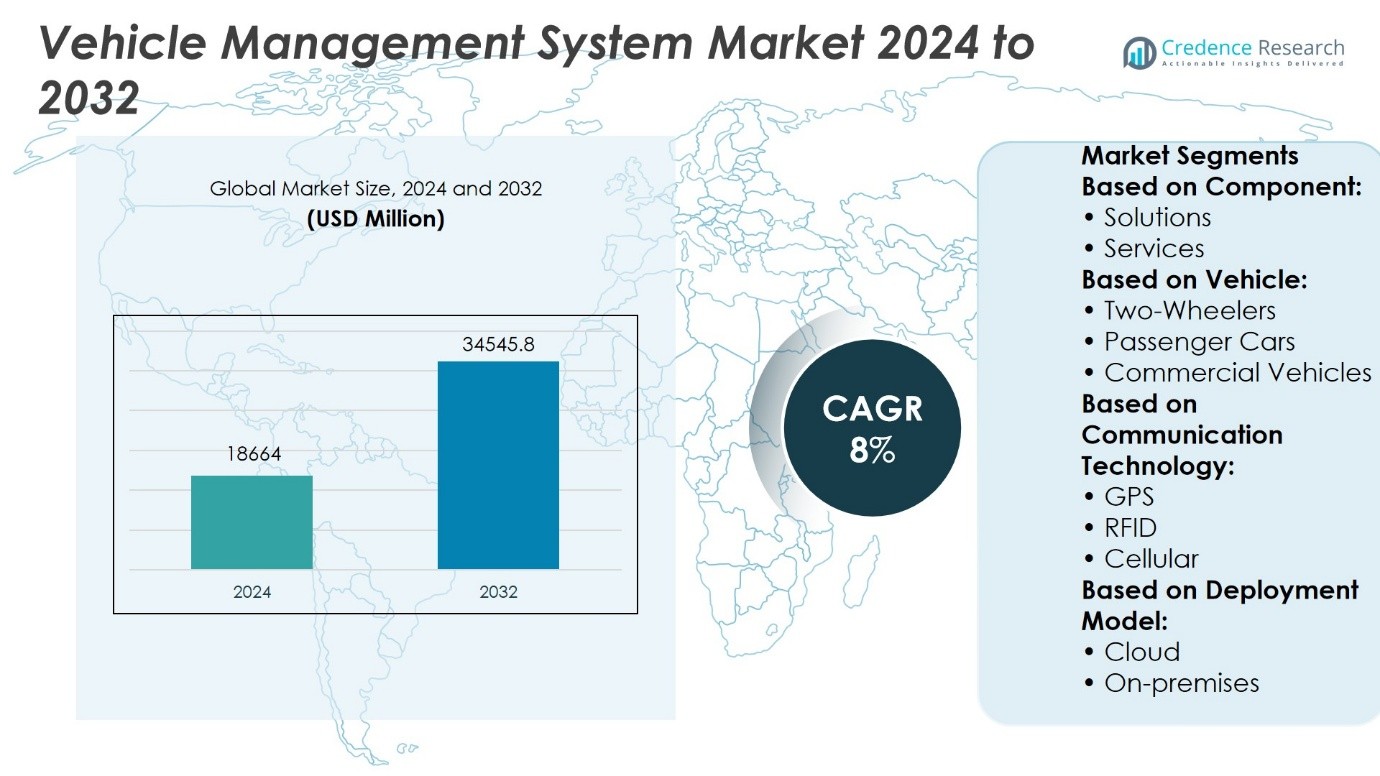

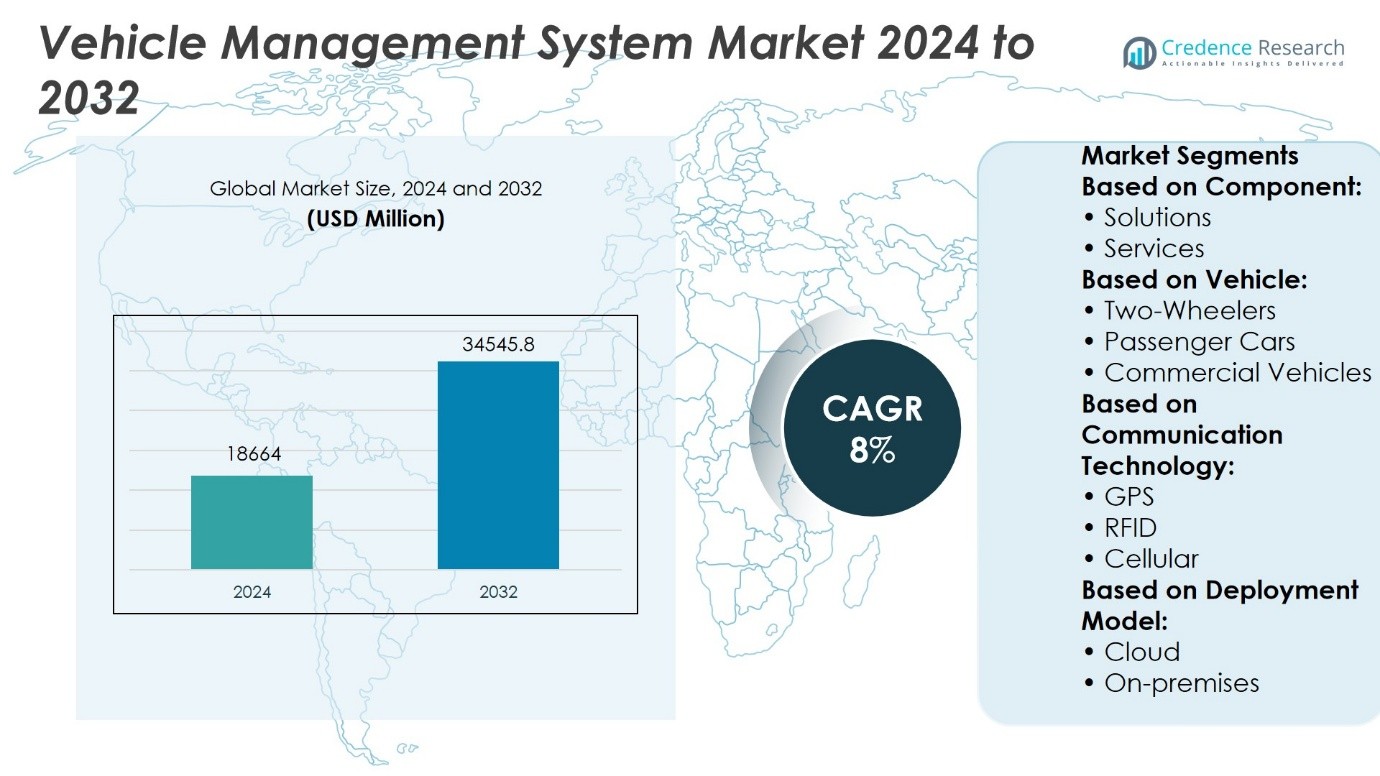

Vehicle Management System Market size was valued at USD 18664 million in 2024 and is anticipated to reach USD 34545.8 million by 2032, at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle Management System Market Size 2024 |

USD 18664 Million |

| Vehicle Management System Market, CAGR |

8% |

| Vehicle Management System Market Size 2032 |

USD 34545.8 Million |

The Vehicle Management System Market advances through strong drivers such as rising demand for fleet optimization, cost efficiency, and compliance with safety regulations. Companies adopt these platforms to reduce fuel consumption, extend vehicle lifecycles, and ensure real-time visibility across operations. It gains momentum from trends in AI-powered predictive maintenance, IoT-enabled telematics, and cloud-based deployment models that improve decision-making and scalability. Growing focus on sustainability and integration with electric mobility further enhances adoption, while smart city initiatives strengthen system relevance. The market reflects a shift toward data-driven, connected, and sustainable fleet management solutions tailored for diverse industry needs.

The Vehicle Management System Market shows strong adoption in North America and Europe, driven by regulatory mandates and advanced telematics infrastructure, while Asia-Pacific grows rapidly with expanding logistics and urban mobility needs. Latin America and Middle East & Africa display gradual progress supported by infrastructure development. Key players such as Verizon Connect, Geotab, Bosch Automotive Service Solutions, Lytx, Mobileye, LoJack Corporation, Autel, Azuga, Launch Tech, and Snap-on strengthen the market through innovations in fleet management, diagnostics, telematics, and connected mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Vehicle Management System Market size was valued at USD 18,664 million in 2024 and is projected to reach USD 34,545.8 million by 2032, at a CAGR of 8%.

- Rising demand for fleet optimization, cost efficiency, and compliance with safety regulations drives steady adoption across industries.

- AI-powered predictive maintenance, IoT-enabled telematics, and cloud deployment models shape major trends in system adoption.

- Strong competition emerges with players focusing on telematics, diagnostics, video analytics, and connected mobility solutions.

- High implementation costs, integration complexities, and cybersecurity concerns act as key restraints.

- North America and Europe dominate market share, Asia-Pacific records rapid growth, while Latin America and Middle East & Africa display gradual adoption.

- Key players strengthen market positioning through innovations in fleet management, connectivity, and safety-focused platforms.

Market Drivers

Rising Demand for Fleet Optimization and Cost Efficiency

The Vehicle Management System Market grows steadily as organizations seek tools that optimize fleet utilization and reduce operating expenses. Rising fuel costs and pressure to improve productivity drive investments in systems that provide real-time monitoring of vehicle performance and driver behavior. Businesses rely on these platforms to reduce idle time, prevent unnecessary wear, and extend asset lifecycles. It strengthens operational control by integrating route planning and predictive maintenance, ensuring lower downtime. Companies adopt such solutions to achieve measurable savings while meeting sustainability goals. The push for efficiency across logistics, public transportation, and corporate fleets sustains strong momentum.

- For instance, Geotab telematics platform processed over 75 billion data points per day in 2024 across more than 4.5 million connected vehicles worldwide, enabling fleet operators to achieve average reductions of 900 liters of fuel per vehicle annually through predictive maintenance and optimized routing.

Integration of Advanced Telematics and Connectivity Solutions

The expansion of telematics capabilities supports rapid adoption of vehicle management platforms across industries. It enables real-time location tracking, driver performance evaluation, and remote diagnostics, creating a comprehensive view of fleet activity. Advancements in IoT sensors and cloud-based analytics enhance the precision and usability of these systems. The Vehicle Management System Market benefits from the convergence of AI-driven insights, connectivity, and automation to deliver improved decision-making. Enterprises leverage these features to boost service quality, ensure regulatory compliance, and mitigate risks. Growing reliance on digital ecosystems in mobility operations secures ongoing demand.

- For instance, Verizon Connect reported that its Reveal platform analyzed over 60 million vehicle trips daily in 2024, providing AI-based driver scorecards and predictive diagnostics that reduced unscheduled maintenance incidents by more than 25,000 across its customer fleets.

Heightened Emphasis on Safety and Regulatory Compliance

Government regulations and corporate safety mandates strengthen the importance of reliable vehicle management technologies. It ensures adherence to emission standards, driver safety norms, and transport regulations through automated reporting and alerts. Rising concerns about road safety accelerate deployment of monitoring tools that detect fatigue, speeding, and unsafe driving practices. Industries with high regulatory scrutiny, such as public transport and freight logistics, find significant value in these solutions. The Vehicle Management System Market aligns with safety-driven investment strategies that protect assets and human resources. Compliance enforcement combined with risk management creates sustained growth opportunities.

Growing Role of Data-Driven Insights in Mobility Decisions

Data analytics capabilities embedded in vehicle management platforms create powerful advantages for operators. It transforms raw telematics inputs into actionable intelligence on vehicle health, operational costs, and driver efficiency. Predictive maintenance powered by machine learning prevents costly breakdowns and enhances reliability. The Vehicle Management System Market capitalizes on this shift toward evidence-based fleet management, where data informs every aspect of planning and resource allocation. Businesses integrate such insights into wider enterprise systems to strengthen strategic decision-making. The emphasis on analytics-driven mobility solutions cements the role of these platforms as essential infrastructure.

Market Trends

Expansion of AI and Predictive Analytics in Fleet Operations

The Vehicle Management System Market witnesses a strong shift toward AI-powered tools that predict vehicle failures and optimize routes. Predictive analytics enables operators to identify maintenance needs before breakdowns occur, minimizing service disruptions. It supports improved asset performance through real-time condition monitoring and automated alerts. Companies deploy AI-driven scheduling tools to reduce fuel consumption and optimize driver allocation. The integration of advanced analytics also helps enterprises manage large fleets with precision. This trend redefines operational efficiency and builds long-term reliability.

- For instance, Trimble’s AI-powered TMT Fleet Maintenance platform processed over 500 million diagnostic trouble code (DTC) records in 2024, enabling fleet managers to predict component failures up to 30 days in advance and reduce unplanned downtime across more than 1.3 million connected trucks.

Rising Adoption of IoT-Enabled Telematics Platforms

The integration of IoT sensors continues to reshape fleet visibility and control. It allows continuous data flow on fuel usage, tire pressure, driver habits, and environmental conditions. The Vehicle Management System Market leverages these capabilities to enhance transparency across logistics and passenger transport. IoT-enabled telematics platforms help companies strengthen safety and compliance through automated data collection. They also provide actionable intelligence that streamlines insurance claims and accident investigations. The increasing dependence on connected systems drives long-term industry adoption.

- For instance, Samsara reported in 2024 that its IoT telematics platform connected over 5.7 million devices globally, generating more than 5 trillion sensor data points annually, which enabled customers to cut harsh driving incidents by over 200,000 across monitored fleets.

Growing Focus on Sustainability and Green Mobility

Fleet operators adopt vehicle management technologies to meet sustainability mandates and reduce carbon emissions. It promotes route optimization, load efficiency, and eco-driving practices that cut fuel usage. The Vehicle Management System Market reflects this environmental focus through integration with electric vehicle fleets and renewable energy charging infrastructure. Companies track emission levels and use data to comply with climate regulations. Sustainability-linked reporting becomes a core feature that aligns with corporate responsibility goals. The trend positions vehicle management platforms as enablers of green mobility transitions.

Integration with Smart Infrastructure and Mobility Ecosystems

Smart city initiatives create demand for vehicle management platforms that interact seamlessly with urban infrastructure. It connects vehicles with intelligent traffic signals, toll systems, and parking networks to improve efficiency. The Vehicle Management System Market evolves through partnerships with mobility service providers and government agencies. Real-time data sharing supports traffic decongestion, optimized delivery schedules, and improved passenger experience. The shift toward integrated ecosystems enhances system value beyond individual fleet operations. This trend strengthens the role of vehicle management solutions in next-generation mobility frameworks.

Market Challenges Analysis

High Implementation Costs and Integration Complexities

The Vehicle Management System Market faces challenges due to high upfront investment and complex integration requirements. Small and medium enterprises struggle to justify expenses related to hardware, software, and ongoing maintenance. It becomes difficult when systems must align with existing enterprise resource planning and legacy telematics platforms. Many operators encounter delays during deployment caused by compatibility issues and the need for skilled technicians. The lack of standardized protocols across vendors further complicates interoperability. These barriers restrict adoption, especially in cost-sensitive markets where margins remain thin.

Data Security Risks and Limited Skilled Workforce

Cybersecurity concerns emerge as a significant obstacle for widespread adoption of connected fleet solutions. The Vehicle Management System Market generates vast amounts of sensitive data, creating risks of breaches, unauthorized access, and misuse. It requires robust encryption, authentication protocols, and regulatory compliance to safeguard critical information. Many organizations face shortages of skilled professionals who can manage advanced telematics systems and interpret complex analytics. The lack of trained workforce hinders optimal utilization and slows innovation cycles. Addressing these challenges demands industry-wide investments in training, awareness, and stronger security frameworks.

Market Opportunities

Expansion into Emerging Markets and SME Adoption

The Vehicle Management System Market holds strong opportunities in emerging economies where logistics, public transport, and e-commerce sectors grow rapidly. Expanding urbanization and rising demand for efficient fleet utilization create favorable conditions for adoption. It offers scalable solutions that small and medium enterprises can deploy at lower costs through cloud-based platforms. Affordable subscription models and mobile-based applications widen accessibility in regions with limited infrastructure. Governments in developing countries invest in smart transport systems, which further accelerate market penetration. This expansion opens new revenue streams for vendors catering to diverse fleet sizes and industries.

Integration with Electric Mobility and Smart Infrastructure

The transition toward electric vehicles and connected transport ecosystems creates significant opportunities for vehicle management platforms. It enables operators to monitor battery health, charging cycles, and energy efficiency in real time. The Vehicle Management System Market benefits from integration with renewable energy charging networks and intelligent traffic systems. Collaborations with smart city projects and mobility service providers enhance system relevance beyond fleet operations. Data-driven insights improve route planning and reduce operational costs, aligning with sustainability goals. These opportunities strengthen the role of vehicle management platforms in shaping future mobility landscapes.

Market Segmentation Analysis:

By Component

The Vehicle Management System Market divides by component into solutions and services, with solutions holding a larger share due to their role in telematics, fleet monitoring, and predictive analytics. Enterprises prioritize integrated platforms that consolidate real-time data on vehicle health, driver behavior, and route optimization. It delivers immediate cost savings by reducing idle time, minimizing maintenance expenses, and improving operational visibility. Services complement these solutions through installation, training, consulting, and ongoing system support. Managed services gain traction among organizations lacking in-house expertise, while professional services cater to customization and compliance requirements. The balance between solutions and services ensures a comprehensive ecosystem for fleet operators.

- For instance, Mobileye supplied its advanced driver-assistance systems (ADAS) to more than 170 million passenger cars as of 2024, embedding real-time collision avoidance and lane-keeping features to support safer vehicle operations.

By Vehicle

Segmentation by vehicle highlights strong adoption in commercial vehicles due to the scale of logistics, public transport, and delivery operations. The Vehicle Management System Market strengthens efficiency in freight fleets through real-time tracking, driver monitoring, and fuel optimization. Passenger cars see increasing integration with advanced safety and infotainment systems, offering real-time diagnostics and driver assistance. It also supports usage-based insurance models by enabling data-driven premium calculations. Two-wheelers present growth potential in markets with dense urban mobility and last-mile delivery services, where affordable and mobile-friendly platforms prove valuable. This diversity underscores the adaptability of these systems across varied vehicle categories.

- For instance, Lytx equipped more than 2.1 million commercial vehicles globally with its video telematics system in 2024, capturing over 221 billion driving miles annually to enhance fleet safety and efficiency.

By Communication Technology

Communication technology plays a pivotal role in shaping functionality and performance. GPS dominates adoption due to its accuracy in location tracking, route planning, and navigation. The Vehicle Management System Market benefits from RFID in managing fleet inventory, automating toll payments, and enhancing access control. It gains momentum from cellular connectivity that supports real-time telematics, cloud-based analytics, and remote diagnostics. The integration of multiple communication technologies ensures comprehensive coverage across urban and remote environments. This multi-layered approach increases reliability, efficiency, and security for fleet operators.

Segments:

Based on Component:

Based on Vehicle:

- Two-Wheelers

- Passenger Cars

- Commercial Vehicles

Based on Communication Technology:

Based on Deployment Model:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis

North America

North America accounts for the largest share of the Vehicle Management System Market with 35%, supported by strong adoption across logistics, public transportation, and corporate fleets. The United States leads regional growth with extensive investment in telematics platforms, predictive analytics, and IoT-enabled solutions. It benefits from strict government regulations on vehicle safety, emission standards, and electronic logging requirements that drive mandatory adoption among commercial fleet operators. Canada follows with growing reliance on fleet optimization tools in transportation and mining sectors. The presence of leading technology providers and continuous R&D initiatives ensures ongoing innovation in cloud-based systems and AI-powered analytics. Enterprises across the region prioritize efficiency, safety, and compliance, which creates consistent demand for advanced vehicle management platforms.

Europe

Europe secures 30% of the global share, driven by regulatory frameworks such as the EU’s road safety directives and carbon reduction targets. Countries including Germany, France, and the United Kingdom adopt vehicle management systems to enhance fleet performance, comply with emission standards, and support sustainable mobility. It gains momentum from the region’s emphasis on electric vehicle integration and smart city initiatives, where data-driven platforms ensure optimal resource use. Public transport operators deploy real-time tracking, passenger safety monitoring, and predictive maintenance solutions to improve efficiency. Europe also benefits from strong collaboration between automakers, telematics firms, and government agencies, which accelerates innovation. The region’s focus on digital transformation across mobility ecosystems underpins steady adoption across both commercial and passenger vehicle segments.

Asia-Pacific

Asia-Pacific holds 25% of the Vehicle Management System Market, reflecting rapid adoption in China, India, Japan, and Southeast Asian nations. Expanding logistics networks, booming e-commerce, and urban mobility challenges create strong demand for advanced fleet management solutions. China leads the region with widespread implementation of telematics, RFID, and GPS-based platforms across passenger cars, taxis, and commercial fleets. It also benefits from government initiatives promoting connected vehicle technologies and smart transportation systems. India experiences growth through adoption among last-mile delivery operators, public bus fleets, and corporate car rental services. Japan and South Korea leverage advanced telematics integration in electric vehicles and connected car ecosystems. The region’s growing digital infrastructure, coupled with cost-sensitive demand for mobile-friendly and cloud-based solutions, supports significant expansion.

Latin America

Latin America contributes 6% to the global share, with Brazil and Mexico leading adoption in freight, logistics, and public transportation. It gains momentum from rising investments in infrastructure modernization and increased awareness of safety and fuel efficiency. Governments promote digital transformation in transport systems, creating opportunities for telematics integration. However, high upfront costs and limited technological infrastructure in rural areas restrain adoption. Brazil demonstrates strong adoption of real-time tracking in urban fleets, while Mexico emphasizes compliance with cross-border transport regulations. The Vehicle Management System Market in this region reflects gradual progress, with cloud-based models and mobile platforms gaining popularity among small and medium enterprises.

Middle East & Africa

The Middle East & Africa region accounts for 4%, reflecting steady but gradual adoption influenced by infrastructure development and diversification of economies. Gulf countries such as the UAE and Saudi Arabia invest in smart city initiatives and digital fleet optimization systems to enhance public mobility and logistics. It benefits from government-backed programs supporting connected vehicles, particularly in urban hubs. Africa experiences slower adoption due to cost barriers, limited connectivity, and lack of awareness, but urban centers such as South Africa and Nigeria show growing interest. Regional logistics and oilfield service companies integrate telematics platforms to improve asset utilization and driver safety. Although its current share remains small, increasing investment in transportation modernization is expected to expand long-term opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LoJack Corporation

- Launch Tech

- Lytx

- Bosch Automotive Service Solutions

- Verizon Connect

- Geotab

- Autel

- Mobileye

- Azuga

- Snap-on

Competitive Analysis

The Vehicle Management System Market players include Autel, Azuga, Bosch Automotive Service Solutions, Geotab, Launch Tech, LoJack Corporation, Lytx, Mobileye, Snap-on, and Verizon Connect. The Vehicle Management System Market demonstrates intense competition driven by rapid technological advancements and growing demand for connected mobility solutions. Companies differentiate through innovation in telematics, AI-based analytics, and IoT-enabled platforms that enhance fleet visibility and performance. Market dynamics highlight strong emphasis on cloud deployment, predictive maintenance, and driver safety monitoring, which create measurable value for operators. Strategic collaborations with automotive manufacturers, logistics providers, and government agencies strengthen industry positioning. Continuous investment in research and development accelerates the integration of electric mobility, sustainability features, and compliance-driven solutions. The competitive environment reflects a balance between established firms with broad global reach and emerging players offering niche, cost-effective, and mobile-friendly platforms.

Recent Developments

- In June 2025, Market growth is fueled by demand from transportation, logistics, and government fleets; increasing digitalization and urbanization in Asia-Pacific and Latin America regions; and ongoing mergers and acquisitions aimed at expanding capabilities and geographical reach.

- In February 2024, Geotab and Daimler Truck North America partnered to simplify fleet management. By integrating data from Freightliner trucks through Geotab’s fleet management platform, MyGeotab, with DTNA’s data-as-a-service technology, fleets can now access a seamless solution combining technology and convenience. This integration streamlines mixed-fleet management, allowing data from various OEMs and Geotab’s GO devices to be available on a single platform.

- In December 2023, TomTom and Microsoft collaborated with each other to leverage generative AI capabilities in the automotive industry. Through the collaboration, the companies will be developing an end-to-end AI-based conversational assistant that improves voice-based interaction with location search, infotainment, and vehicle command systems.

- In March 2023, Revolv, an electric medium-to-heavy commercial fleet provider, secured USD 15 million in a Series A funding round led by Greenbacker. With this funding, the company intends to expand its operations across North America to support the increasing adoption of decarbonized commercial fleets with medium, light, and heavy-duty trucks.

Market Concentration & Characteristics

The Vehicle Management System Market reflects a moderately concentrated structure where a mix of global technology leaders and specialized telematics providers compete to capture share. It is characterized by steady innovation in AI, IoT, and cloud-based platforms that enhance fleet efficiency, safety, and compliance. Established vendors maintain dominance through broad product portfolios, advanced analytics, and strong distribution networks, while smaller firms compete with agile, cost-effective, and sector-specific solutions. The market shows high barriers to entry due to integration complexities, cybersecurity requirements, and the need for regulatory compliance across different regions. It evolves through partnerships with automakers, logistics operators, and government agencies, which expand system adoption and drive ecosystem integration. The Vehicle Management System Market continues to mature with increasing emphasis on predictive maintenance, sustainability-linked reporting, and smart infrastructure connectivity, making it essential for fleet optimization and next-generation mobility strategies.

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle, Communication Technology, Deployment Model and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven predictive maintenance will expand to reduce downtime and extend vehicle life cycles.

- Cloud-based deployment will dominate due to scalability, cost efficiency, and real-time accessibility.

- Integration with electric vehicle fleets will grow as operators seek optimized charging and energy management.

- Advanced telematics and IoT platforms will enhance real-time tracking, safety monitoring, and compliance reporting.

- Data security and cybersecurity investments will intensify to protect sensitive fleet information.

- Mobile-based applications will see wider use among small and medium enterprises for affordable fleet solutions.

- Collaboration with smart city initiatives will strengthen the role of vehicle management systems in urban mobility.

- Video telematics and driver behavior analytics will gain traction for improving safety standards.

- Sustainability-linked features will expand to help fleets meet emission reduction and regulatory targets.

- Global competition will push continuous innovation in analytics, automation, and connected infrastructure integration.