Market Overview

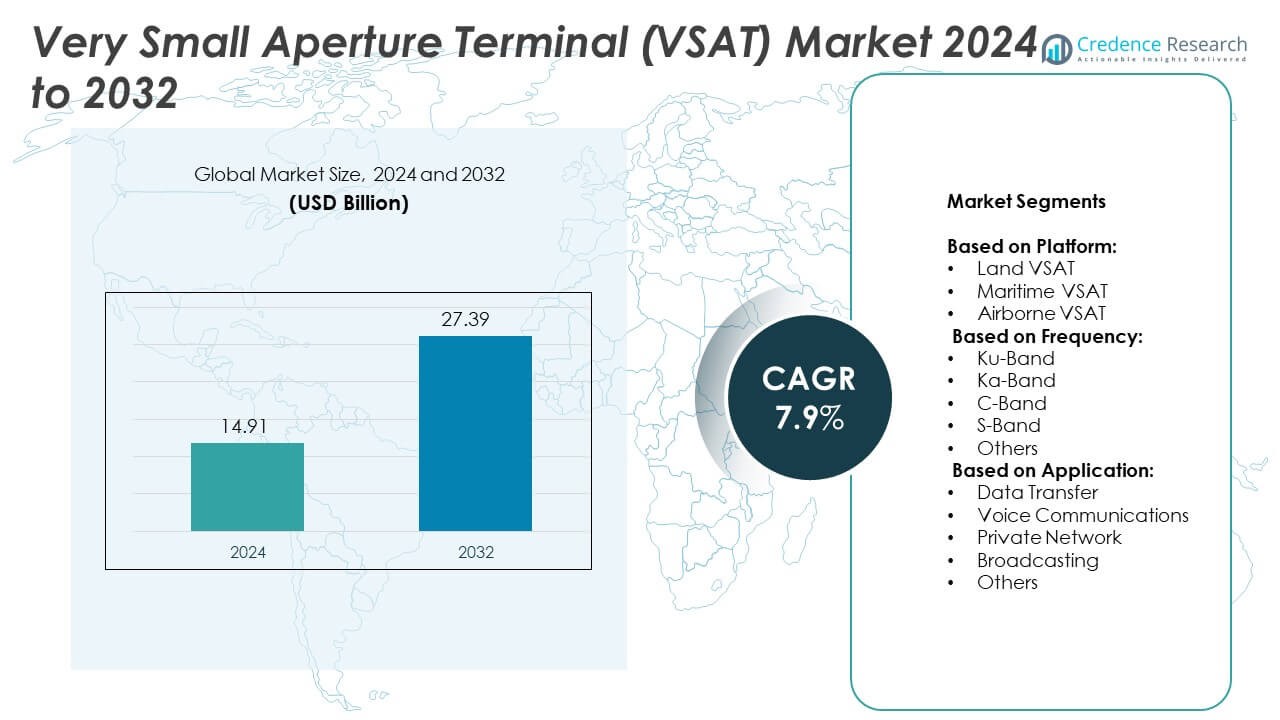

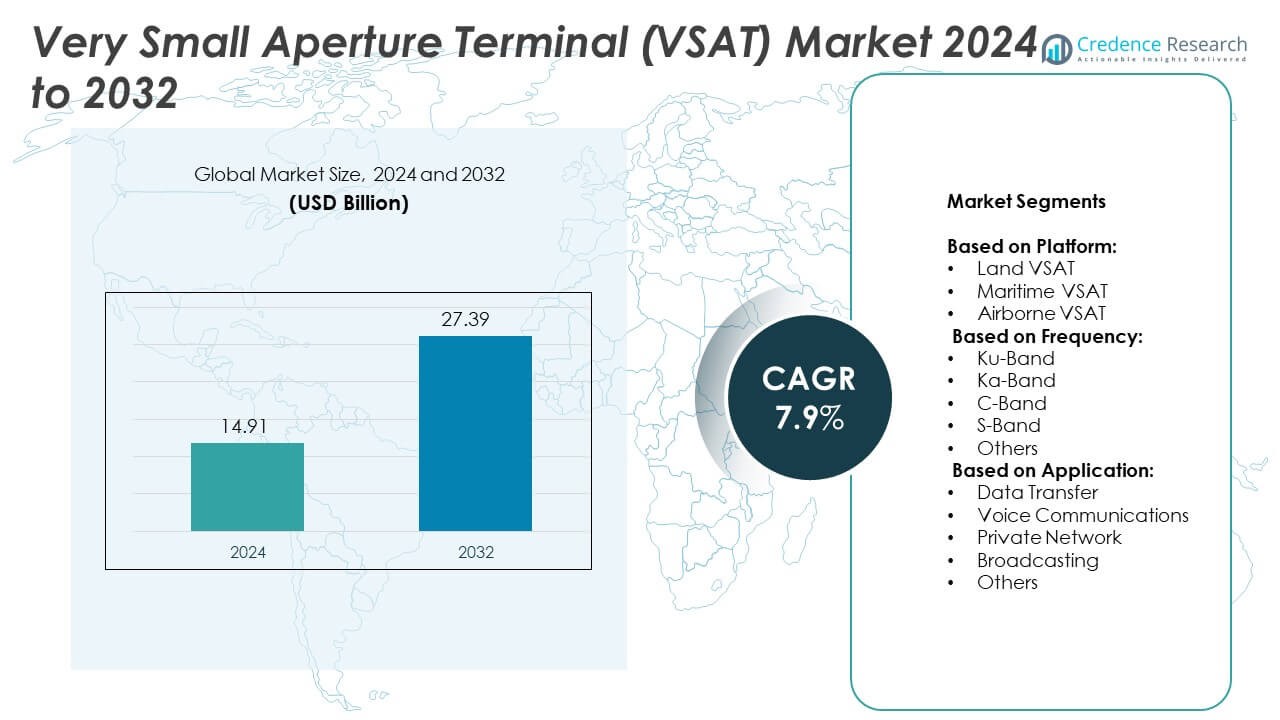

Very Small Aperture Terminal (VSAT) Market size was valued at USD 14.91 billion in 2024 and is anticipated to reach USD 27.39 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Very Small Aperture Terminal (VSAT) Market Size 2024 |

USD 14.91 Billion |

| Very Small Aperture Terminal (VSAT) Market, CAGR |

7.9% |

| Very Small Aperture Terminal (VSAT) Market Size 2032 |

USD 27.39 Billion |

The Very Small Aperture Terminal (VSAT) market grows through rising demand for reliable global connectivity and high-speed data transfer. It benefits from adoption in maritime, aviation, and defense sectors, supporting secure communication and private networks. Expansion of broadband services in rural and remote areas further drives deployment. Technological advancements in high-throughput satellites and compact terminals enhance performance and reduce latency. Integration with IoT and hybrid networks improves operational efficiency. Providers focus on scalable, flexible solutions to meet diverse enterprise and government requirements.

North America leads the Very Small Aperture Terminal (VSAT) market with extensive satellite infrastructure and advanced network adoption. Europe follows with growth driven by maritime, defense, and rural broadband projects. Asia-Pacific experiences rapid expansion through industrial, aviation, and government applications. Key players shaping the market include Orbit Communication Systems Ltd, L3Harris Technologies, Gilat Satellite Networks Ltd., and Viasat Inc. These companies focus on deploying high-throughput satellites, compact terminals, and secure communication solutions, enabling reliable connectivity across remote, offshore, and critical operational environments globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Very Small Aperture Terminal (VSAT) market was valued at USD 14.91 billion in 2024 and is expected to reach USD 27.39 billion by 2032, growing at a CAGR of 7.9%.

- Rising demand for secure and reliable connectivity across maritime, aviation, and defense sectors drives market growth.

- Expansion of rural broadband services and adoption in remote areas accelerates deployment of VSAT solutions globally.

- Key players like Orbit Communication Systems Ltd, L3Harris Technologies, Gilat Satellite Networks Ltd., and Viasat Inc. focus on high-throughput satellites, compact terminals, and private network solutions.

- High equipment costs, regulatory challenges, and dependency on satellite availability restrain widespread adoption in some regions.

- North America leads the market with advanced infrastructure and extensive government and enterprise adoption, followed by Europe and Asia-Pacific with rapid expansion in industrial and maritime applications.

- Technological advancements, IoT integration, and hybrid satellite-terrestrial networks present long-term opportunities, enabling faster data transfer, reduced latency, and scalable connectivity solutions.

Market Drivers

Rising Demand for Reliable and Remote Connectivity Across Industries

The Very Small Aperture Terminal (VSAT) market benefits from growing demand for consistent and reliable connectivity in remote areas. Industries such as oil and gas, maritime, and mining require uninterrupted communication in locations with limited terrestrial network coverage. VSAT networks provide secure voice, data, and video transmission, ensuring operational continuity. Companies adopt these solutions to maintain coordination between field sites and headquarters. It supports critical operations, reducing downtime and improving safety standards. Remote education and telemedicine services also expand VSAT deployment in underserved regions. Enterprises increasingly view it as a strategic investment to enhance operational efficiency.

- For instance, the Hughes JUPITER System is designed to deliver high throughputs, and its terminals are capable of achieving up to 300 Mbps.

Expansion of Satellite Communication Infrastructure and Technological Advancements

Technological progress in satellite systems fuels growth in the Very Small Aperture Terminal (VSAT) market. High-throughput satellites and advanced modulation techniques increase bandwidth efficiency and network capacity. It allows organizations to deploy smaller, cost-effective terminals while maintaining strong connectivity. Innovations in low-latency communication and hybrid networks enhance service reliability for enterprises and governments. Providers introduce scalable and customizable solutions to meet diverse client requirements. It supports integration with cloud platforms and IoT ecosystems, extending its utility across sectors. Continuous infrastructure upgrades strengthen global VSAT adoption.

- For instance, Viasat Inc. provides VSAT communications for mining operations globally, including in Australia, enabling connectivity for remote sites. These services support various applications, including real-time data transmission, and offer data throughputs ranging from 5 Mbps to 100 Mbps, depending on the service plan and terminal configuration

Government Initiatives and Support for Digital Inclusion and Smart Infrastructure

Government programs promoting digital inclusion drive adoption in the Very Small Aperture Terminal (VSAT) market. Initiatives targeting rural connectivity, smart grids, and emergency response systems require robust satellite communication networks. It enables quick deployment in regions lacking terrestrial broadband infrastructure. Regulatory support and spectrum allocation facilitate new satellite launches and service expansion. Governments partner with private operators to ensure nationwide coverage. It also plays a critical role in disaster management and public safety communication networks. Policies encouraging public-private collaboration boost overall market growth.

Increasing Reliance on Secure Communication for Critical Enterprises and Defense Applications

Secure communication needs propel growth in the Very Small Aperture Terminal (VSAT) market across defense and corporate sectors. Organizations require encrypted channels for transmitting sensitive data over long distances. It ensures uninterrupted command, control, and operational coordination during critical missions. Enterprises leverage VSAT networks for secure remote office connectivity and backup communication systems. It reduces vulnerability to cyber threats while maintaining operational confidentiality. Defense agencies adopt it for surveillance, reconnaissance, and tactical communication. The emphasis on security and reliability drives continuous market expansion.

Market Trends

Adoption of High-Throughput Satellite Solutions for Enhanced Network Capacity

The Very Small Aperture Terminal (VSAT) market experiences growth through the deployment of high-throughput satellite (HTS) solutions. It enables operators to deliver higher bandwidth at reduced latency, supporting critical communication demands. Enterprises increasingly adopt it for data-intensive applications, including cloud services and video conferencing. Maritime and aviation sectors benefit from consistent connectivity across global routes. It allows service providers to expand coverage in remote and underserved regions efficiently. The trend encourages the development of smaller, lightweight terminals without compromising performance. Satellite operators continue to invest in next-generation payloads to meet rising bandwidth requirements.

- For instance, In March 2025, Inmarsat announced that its bonded connectivity service, NexusWave, verified maximum download speeds of 330–340 Mbps during real-world tests.

Integration of VSAT Networks with Internet of Things (IoT) and Smart Systems

IoT deployment drives trends in the Very Small Aperture Terminal (VSAT) market by connecting remote sensors and devices. It supports data collection and real-time monitoring in industries such as agriculture, energy, and transportation. Companies leverage VSAT networks for smart grid management, predictive maintenance, and fleet tracking. It ensures secure transmission of large volumes of operational data across distant locations. Integration with cloud platforms enhances analytical capabilities and operational decision-making. Providers introduce flexible service models that allow scalable connectivity for IoT applications. This trend reinforces VSAT adoption in sectors requiring constant data exchange.

- For instance, Intellian Technologies provides a range of VSAT terminals, including 1-meter-class antennas like the v100NX, suitable for remote applications such as telemedicine. For applications requiring low latency, Intellian also offers terminals compatible with Low Earth Orbit (LEO) satellite constellations, which typically have a latency of approximately 50 ms compared to the 500–700 ms latency of geostationary (GEO) satellite networks

Expansion of Hybrid Network Solutions Combining Satellite and Terrestrial Communication

Hybrid network models shape the Very Small Aperture Terminal (VSAT) market by combining satellite and terrestrial links. It offers uninterrupted communication during network outages or limited coverage areas. Enterprises implement it to maintain redundancy in critical operations, ensuring business continuity. Service providers optimize network efficiency by dynamically routing traffic through the best available channel. It supports applications in banking, emergency response, and government operations requiring reliable connectivity. Continuous development of hybrid network management tools enhances performance and monitoring. The trend encourages wider adoption among industries dependent on uninterrupted communication.

Focus on Compact and Mobile VSAT Terminals for Diverse Applications

Demand for portable and rapidly deployable solutions drives trends in the Very Small Aperture Terminal (VSAT) market. It allows users to establish connectivity in temporary or remote locations, including disaster zones and field operations. Compact terminals reduce installation time and operational costs while maintaining high performance. It serves sectors such as defense, media broadcasting, and humanitarian aid. Providers innovate with lightweight, energy-efficient designs suitable for harsh environments. It supports real-time communication, remote monitoring, and emergency coordination effectively. The trend promotes adoption in both commercial and strategic applications worldwide.

Market Challenges Analysis

High Infrastructure Costs and Complex Deployment Requirements Restrict Market Expansion

The Very Small Aperture Terminal (VSAT) market faces challenges due to significant infrastructure investments and complex deployment processes. It requires specialized satellite terminals, ground equipment, and network management systems. Enterprises must allocate substantial capital for installation, operation, and maintenance. It also demands skilled personnel to handle configuration, monitoring, and troubleshooting. Remote locations increase logistical difficulties and installation timelines. Smaller organizations often find these requirements cost-prohibitive, limiting adoption. Service providers continuously explore strategies to simplify deployment and reduce operational expenses.

Susceptibility to Weather Conditions and Regulatory Constraints Impede Widespread Adoption

Weather interference and strict regulations pose challenges in the Very Small Aperture Terminal (VSAT) market. Heavy rain, snow, or storms can degrade signal quality and disrupt communication. It necessitates robust system designs to maintain performance under adverse conditions. Regulatory frameworks for satellite spectrum allocation vary across regions, causing delays in approvals and network expansion. It faces limitations in frequency usage and operational coverage in certain countries. Compliance with international and national standards increases operational complexity. Providers invest in advanced technologies to enhance reliability and navigate regulatory hurdles effectively.

Market Opportunities

Growing Demand for Connectivity in Remote and Underserved Regions Presents Expansion Opportunities

The Very Small Aperture Terminal (VSAT) market benefits from rising demand for reliable communication in remote and rural areas. It enables broadband access where terrestrial networks remain limited or unavailable. Enterprises and governments adopt it for educational programs, telemedicine, and emergency response initiatives. It supports seamless voice, data, and video communication across geographically dispersed locations. Satellite operators can expand services to new regions, addressing digital inclusion and bridging connectivity gaps. Partnerships with local service providers enhance market penetration. The demand for consistent and secure connectivity creates long-term growth potential for providers.

Advancements in Satellite Technology and Integration with Emerging Digital Solutions Open New Avenues

Technological innovations drive opportunities in the Very Small Aperture Terminal (VSAT) market by enabling higher performance and broader application. It benefits from high-throughput satellites, low-latency networks, and compact terminal designs. Integration with cloud computing, IoT, and smart infrastructure solutions increases its utility across industries. It supports applications in transportation, defense, maritime, and energy sectors requiring reliable remote communication. Service providers can offer scalable and customizable solutions to meet diverse client needs. Continuous investment in satellite payloads and network management tools strengthens operational efficiency. Emerging technologies create avenues for market expansion and diversified service offerings.

Market Segmentation Analysis:

By Platform:

The Very Small Aperture Terminal (VSAT) market divides into land, maritime, and airborne platforms, each catering to distinct connectivity needs. Land VSAT remains dominant due to extensive deployment in enterprises, rural broadband, and government communication networks. It provides reliable connectivity for offices, remote facilities, and critical infrastructure. Maritime VSAT supports ships, offshore platforms, and cruise liners, ensuring uninterrupted communication across oceans. It enables navigation, operational coordination, and crew welfare. Airborne VSAT serves aircraft and UAVs, offering real-time data exchange and communication during flights. It supports in-flight connectivity, surveillance, and remote monitoring applications. Each platform segment continues to grow with tailored solutions addressing unique operational challenges.

- For instance, in a 2018 managed network installation, Hughes deployed satellite and terrestrial links for over 260 sites across numerous countries. While this installation was not for U.S. rural clinics, it demonstrates Hughes’ capability to connect a large number of geographically diverse sites

By Frequency:

Frequency bands shape the Very Small Aperture Terminal (VSAT) market by determining coverage, bandwidth, and application suitability. Ku-Band dominates due to efficient bandwidth allocation and cost-effective deployment for commercial and enterprise applications. It supports high-speed data transfer and voice communication with minimal latency. Ka-Band provides higher throughput and is preferred for broadband services in dense network environments. It allows service providers to expand capacity for maritime, aviation, and corporate clients. C-Band remains essential in tropical regions due to resilience against rain fade and interference. S-Band and other frequencies support niche applications, including defense, emergency services, and specialized communication networks. It ensures diverse connectivity options for global requirements.

- For instance, in 2017, KVH supplied its mini-VSAT Broadband solution to Pacific Basin Shipping Limited for their 99-vessel fleet.

By Application:

Applications drive adoption in the Very Small Aperture Terminal (VSAT) market by addressing operational and commercial demands. Data transfer dominates, supporting internet access, cloud services, and enterprise communications. It ensures secure, high-speed transmission across remote locations. Voice communications remain crucial for mission-critical operations in maritime, aviation, and defense sectors. Private networks allow organizations to establish secure, dedicated communication channels for internal operations. Broadcasting services utilize VSAT for media transmission, live coverage, and remote reporting. Other applications include telemedicine, remote monitoring, and emergency response networks. It enables organizations to maintain reliable connectivity and enhance operational efficiency across all segments.

Segments:

Based on Platform:

- Land VSAT

- Maritime VSAT

- Airborne VSAT

Based on Frequency:

- Ku-Band

- Ka-Band

- C-Band

- S-Band

- Others

Based on Application:

- Data Transfer

- Voice Communications

- Private Network

- Broadcasting

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant 35% share of the Very Small Aperture Terminal (VSAT) market. Strong infrastructure, advanced satellite networks, and widespread adoption across enterprises and government agencies drive this dominance. It benefits from extensive investments in broadband expansion, defense communication, and remote monitoring solutions. Maritime and aviation industries increasingly rely on VSAT for secure and uninterrupted connectivity. The presence of key market players offering innovative services supports network reliability and customer confidence. It also enables real-time data transfer and private network deployment for critical applications. Growing demand for satellite-based emergency communication and disaster recovery systems strengthens its market position.

Europe

Europe commands a 25% share of the Very Small Aperture Terminal (VSAT) market. It experiences growth through the adoption of satellite connectivity for remote areas, maritime shipping routes, and industrial operations. It provides secure communication channels for enterprises, public sector applications, and defense networks. The region emphasizes compliance with strict regulatory standards, ensuring reliable service delivery. VSAT adoption accelerates in offshore energy, smart transportation, and broadband expansion projects. It supports government initiatives targeting digital inclusion in rural and hard-to-reach locations. Investment in advanced satellite infrastructure enhances bandwidth availability and service quality, encouraging further deployment across commercial and industrial sectors.

Asia-Pacific

Asia-Pacific represents 20% of the Very Small Aperture Terminal (VSAT) market and demonstrates rapid growth due to urbanization, rising maritime traffic, and expanding industrial sectors. It leverages VSAT for remote communication, data transfer, and private network requirements in countries like China, India, and Japan. It supports offshore operations, fleet management, and in-flight connectivity for commercial aviation. Increased government focus on digital infrastructure and rural connectivity boosts adoption. Providers introduce high-throughput satellite solutions to meet rising bandwidth and latency requirements. It facilitates real-time monitoring, secure data transmission, and integration with IoT applications across industries. Rising energy, transportation, and defense investments further strengthen its growth trajectory.

Latin America

Latin America accounts for a 12% share of the Very Small Aperture Terminal (VSAT) market. Remote and rural regions drive demand for satellite communication to bridge connectivity gaps. It provides reliable networks for maritime shipping, oil and gas operations, and disaster response. The region sees increasing adoption in government initiatives for telemedicine, education, and digital inclusion. Providers focus on affordable, scalable solutions to address limited terrestrial infrastructure. It ensures secure voice, data, and broadcasting services across commercial and industrial applications. Growing interest in maritime VSAT and private networks further strengthens its market potential.

Middle East & Africa

Middle East & Africa holds an 8% share of the Very Small Aperture Terminal (VSAT) market. Harsh terrain, limited terrestrial network penetration, and offshore oil and gas operations drive adoption. It enables reliable communication for defense, energy, and transportation sectors. Providers deploy VSAT solutions for private networks, voice communication, and data transfer in critical infrastructure projects. It also supports emergency response and disaster management initiatives. Investments in satellite infrastructure and government-backed programs enhance market penetration. Rising industrialization, urbanization, and maritime connectivity needs continue to create growth opportunities for VSAT solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Echostar Corporation

- Cobham Satcom

- Orbit Communication Systems Ltd

- Viasat Inc.

- Thuraya Telecommunications Company

- L3Harris Technologies, Inc.

- Singtel

- Gilat Satellite Networks Ltd.

- ODN, Inc.

Competitive Analysis

Key players operating in the Very Small Aperture Terminal (VSAT) market include Orbit Communication Systems Ltd, L3Harris Technologies, Inc., Gilat Satellite Networks Ltd., AsiaSatellite.co, Cobham Satcom, Echostar Corporation, ODN, Inc., Singtel, Thuraya Telecommunications Company, and Viasat Inc. These companies focus on expanding their satellite network coverage and enhancing service quality to meet growing global demand. They invest in high-throughput satellite solutions and low-latency communication systems to provide reliable connectivity across land, maritime, and airborne platforms. Continuous research and development allow these providers to introduce compact, mobile, and energy-efficient terminals suitable for remote or temporary installations. Strategic partnerships and collaborations help them penetrate new regional markets and serve enterprise, government, and defense sectors effectively. They emphasize integration with emerging technologies such as IoT, cloud platforms, and hybrid network solutions, enhancing data transfer, voice communication, and private network capabilities. The competitive landscape is also shaped by mergers, acquisitions, and technology-sharing agreements that strengthen operational capacity and infrastructure. Focus on customer-centric solutions, scalable service offerings, and advanced satellite payloads positions these players to capitalize on growth opportunities in underserved and high-demand regions globally. The market remains highly dynamic, with continuous innovation and strategic expansion driving competitive advantage.

Recent Developments

- In Aug 2025, L3Harris announced it achieved the Critical Design Review and Production Readiness Review for the Space Development Agency’s (SDA) Tranche 2 Tracking Layer program, advancing this missile defense program to the production stage

- In 2024, Viasat Inc. launched a new high-throughput satellite service to enhance maritime and aviation connectivity

- In September 2024, Cobham Satcom introduced two new terminals for the Global Maritime Distress and Safety System (GMDSS): the SAILOR Fleet C and the SAILOR 7200 GMDSS

Report Coverage

The research report offers an in-depth analysis based on Platform, Frequency, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Very Small Aperture Terminal (VSAT) market will expand with rising demand for global connectivity.

- High-throughput satellite deployment will enable faster and more reliable communication.

- Adoption in maritime, aviation, and defense sectors will increase steadily.

- Integration with IoT and smart infrastructure will enhance operational efficiency.

- Hybrid satellite-terrestrial networks will provide uninterrupted and resilient communication.

- Compact and mobile VSAT terminals will gain popularity for remote and temporary setups.

- Growth in rural and underserved regions will drive market expansion.

- Private networks and secure communication solutions will attract enterprise adoption.

- Technological advancements will reduce latency and improve bandwidth efficiency.

- Continuous investment in satellite infrastructure will create long-term market opportunities