Market Overview

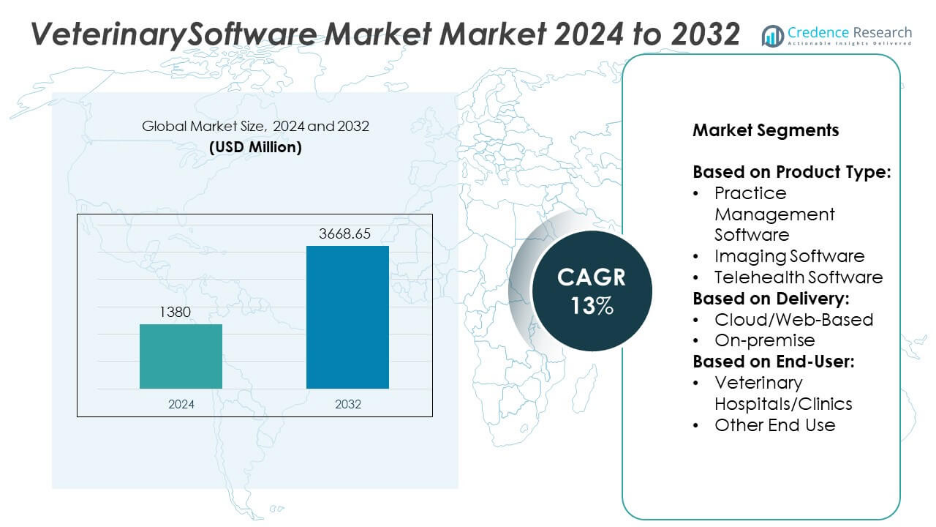

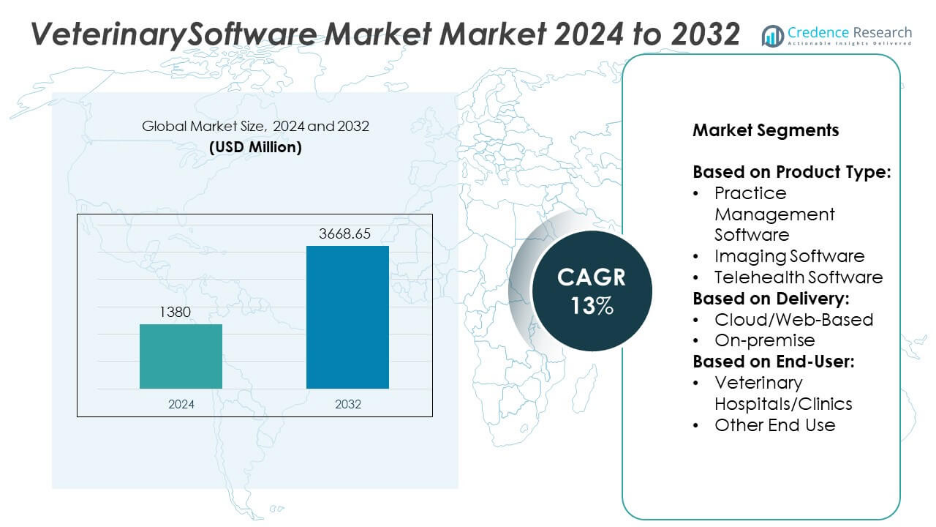

The global veterinary software market was valued at USD 1,380 million in 2024 and is projected to reach USD 3,668.65 million by 2032, growing at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Software Market Size 2024 |

USD 1,380 Million |

| Veterinary Software Market, CAGR |

13% |

| Veterinary Software Market Size 2032 |

USD 3,668.65 Million |

The veterinary software market is driven by increasing pet ownership, rising demand for efficient clinical management, and growing awareness of preventive animal care. Clinics seek digital tools to streamline operations, enhance diagnostics, and improve client communication. Cloud-based and mobile solutions are gaining popularity due to their accessibility and scalability. The trend toward personalized animal healthcare and the adoption of advanced technologies continue to shape market evolution, creating new growth opportunities for software providers and veterinary service operators.

The veterinary software market shows strong growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads in adoption due to advanced veterinary infrastructure, high pet ownership, and widespread digital integration in clinics. Europe follows closely, driven by strong animal welfare regulations and growing demand for efficient clinical management tools. The Asia Pacific region is rapidly emerging, fueled by rising companion animal populations and increasing investments in veterinary care. Latin America and the Middle East & Africa are gradually expanding due to improved awareness and developing veterinary services. which offers scalable cloud-based platforms for clinics. Companies like Hippo Manager and DaySmart Software also contribute to innovation and accessibility across a range of practice sizes and regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The veterinary software market was valued at USD 1,380 million in 2024 and is projected to reach USD 3,668.65 million by 2032, growing at a CAGR of 13% during the forecast period.

- The market is experiencing growth due to rising pet adoption, increasing demand for preventive animal healthcare, and the need for streamlined clinical operations across veterinary practices.

- Key trends include growing adoption of cloud-based platforms, integration of artificial intelligence for diagnostics, and rising demand for telemedicine features in veterinary care.

- Major players such as Idexx Laboratories, Covetrus Inc. (Henry Schein), and ProVet (NordHealth) dominate the market, while emerging companies like Digitail and Hippo Manager enhance competition with scalable and affordable solutions.

- High implementation costs, limited IT infrastructure in rural areas, and resistance to digital transformation among some practitioners act as key restraints in market expansion.

- North America leads the market with high digital adoption and a mature veterinary care ecosystem, followed by Europe with strong regulatory support and expanding clinic networks.

- Asia Pacific shows significant growth potential driven by increasing pet ownership and rising investment in veterinary infrastructure, while Latin America and the Middle East & Africa gradually adopt digital tools to improve service efficiency.

Market Drivers

Growing Pet Ownership and Rising Demand for Animal Health Services Fuel Market Expansion

The surge in pet adoption worldwide has significantly boosted demand for veterinary care, thereby driving the veterinary software market. Pet owners increasingly seek preventive care, early diagnosis, and treatment services, which require efficient clinical management tools. Veterinary practices are adopting digital solutions to streamline appointment scheduling, patient records, and treatment history. This shift enhances service quality and client satisfaction. The veterinary software supports these evolving needs by enabling smoother workflows and accurate data management. It plays a critical role in modernizing veterinary clinics to meet the expectations of a growing pet-owning population.

- For instance, IDEXX Laboratories reported that over 30,000 veterinary practices globally use its Cornerstone and Neo practice management software systems, enabling features such as automated patient reminders, inventory tracking, and integration with diagnostic platforms for over 250 diagnostic tests.

Increased Focus on Practice Management Efficiency Across Veterinary Clinics

Veterinary clinics and hospitals are under pressure to enhance operational efficiency and reduce administrative burden. Manual record-keeping is time-consuming and error-prone, prompting a transition toward digital solutions. Veterinary software enables clinics to manage billing, inventory, reporting, and client communication from a centralized platform. It supports improved decision-making and reduces redundant tasks. Clinics benefit from increased productivity and reduced human error by integrating software into daily operations. The growing emphasis on workflow optimization is a key driver of market demand.

- For instance, East Padden Animal Hospital in Vancouver, WA implemented PetDesk and observed 216 appointment requests and 803 appointment confirmations per month through the system.

Advancements in Cloud-Based and Mobile Technologies Support Adoption

The rapid evolution of cloud computing and mobile platforms has made veterinary software more accessible and scalable. Small to mid-sized practices now implement cloud-based solutions without the need for extensive IT infrastructure. These systems allow veterinarians to access records remotely, consult on cases, and provide timely responses to pet owners. It strengthens client engagement and supports better health outcomes. The convenience and flexibility offered by cloud-based platforms are encouraging widespread adoption in both urban and rural settings.

Rising Livestock Population and Need for Herd Health Monitoring Tools

Beyond companion animals, the livestock sector contributes significantly to the growth of the veterinary software market. Increasing livestock populations demand efficient herd management systems to monitor health, vaccination schedules, and production metrics. It assists veterinarians and farm managers in tracking herd performance and identifying potential health issues early. These tools help minimize economic losses and maintain productivity. The integration of software in large-scale animal husbandry supports the growing need for precision livestock farming solutions.

Market Trends

Cloud-Based Veterinary Solutions Gain Momentum Among Small and Mid-Sized Clinics

The shift toward cloud-based platforms is a prominent trend in the veterinary software market. These solutions reduce upfront costs and eliminate the need for on-site servers, making them ideal for small and mid-sized veterinary practices. Clinics benefit from easier data access, real-time updates, and secure backup systems. Cloud platforms also support remote consultations and mobile access to patient records. Veterinary software built on cloud infrastructure enhances operational flexibility and scalability. It enables clinics to adapt quickly to changing client demands.

- For instance, in Jul 9, 2024, Acurovet explore the cutting-edge advancements in veterinary medicine in 2025, Including telehealth, AI diagnostics to robotic surgery,3D printing and more.

Integration of Artificial Intelligence for Enhanced Diagnostics and Decision Support

Veterinary software is evolving with the integration of artificial intelligence to support faster and more accurate clinical decisions. AI-powered tools assist in diagnosing complex conditions, analyzing medical images, and recommending treatment plans. This trend helps improve diagnostic accuracy while reducing time spent on manual evaluations. Clinics gain the ability to manage larger case volumes without compromising care quality. It supports veterinarians in offering data-driven insights and personalized care. The demand for AI-enabled systems reflects the growing emphasis on precision medicine in animal health.

- For instance, Antech Imaging Services’ AIS RapidRead Radiology tool was trained on a database of 16 million labeled companion-animal radiographs drawn from a library exceeding 8 billion stored images, and delivers detailed diagnostic reports in 10 minutes or less per study.

Client Communication Tools Become Central to Practice Management

Veterinary practices are placing greater focus on client engagement through integrated communication tools. Software platforms now include automated appointment reminders, vaccination alerts, and follow-up messaging features. These tools strengthen the relationship between pet owners and veterinary professionals. It improves client retention and drives repeat visits. Veterinary software with built-in communication functions also reduces staff workload and minimizes missed appointments. This trend highlights the shift toward a more connected and client-focused approach to animal care.

Mobile Applications Transform the Way Veterinarians Deliver Services

Mobile-enabled veterinary software is redefining service delivery by offering flexibility and real-time access to clinical data. Veterinarians use mobile apps during house calls, farm visits, or emergency situations to record observations and update medical records instantly. This mobility improves efficiency and ensures accurate data capture. It enhances service quality in both urban and rural settings. Mobile platforms support faster decision-making and better coordination among team members. The growing adoption of mobile technology is shaping the future of veterinary care delivery.

Market Challenges Analysis

High Implementation Costs and Limited IT Infrastructure in Smaller Clinics

Many veterinary practices, particularly in rural or low-resource areas, face challenges related to the high cost of implementing digital systems. Initial investments in software licenses, hardware upgrades, and staff training can strain the budgets of small clinics. Limited access to IT infrastructure further complicates adoption, especially for cloud-based platforms that require stable internet connectivity. Veterinary software may remain underutilized in such settings due to financial and technical constraints. It creates a gap in digital transformation between urban and rural veterinary services. This disparity hinders broader market penetration and slows the pace of industry modernization.

Data Security Concerns and Resistance to Technological Change

Handling sensitive patient and client information digitally raises concerns over data privacy and cybersecurity. Veterinary clinics must comply with data protection regulations and ensure secure handling of electronic health records. Breaches or data loss can damage trust and disrupt clinic operations. Resistance to adopting new technologies also presents a challenge, particularly among practitioners accustomed to traditional record-keeping methods. Veterinary software, despite its efficiency benefits, often encounters hesitation from users unfamiliar with digital tools. It limits operational improvements and delays full integration of advanced systems.

Market Opportunities

Rising Demand for Telemedicine Services in Animal Healthcar

The growing interest in remote veterinary consultations presents a strong opportunity for digital solution providers. Pet owners seek convenient and timely access to care, especially in underserved or remote areas. Veterinary software that supports telemedicine features, including video consultations and digital prescriptions, meets this demand effectively. It helps clinics expand their reach without investing in physical infrastructure. The integration of telehealth tools within existing practice management systems can drive software adoption. This trend opens new revenue streams for providers and enhances client satisfaction.

Expanding Role of Data Analytics in Preventive Animal Care

Veterinary professionals increasingly rely on data to monitor trends in animal health, manage chronic conditions, and personalize treatment plans. Software platforms with built-in analytics and reporting tools can support evidence-based decision-making. It allows clinics to identify early warning signs, track outcomes, and improve overall care quality. The demand for predictive tools and health monitoring systems creates a significant growth avenue. Veterinary software that enables better data utilization can position itself as a strategic asset in modern veterinary care. This shift toward proactive healthcare models supports long-term market expansion.

Market Segmentation Analysis:

By Product Type:

Practice management software holds the largest share due to its essential role in streamlining clinical operations. It helps veterinary professionals manage appointments, billing, inventory, and patient records from a centralized platform. The demand for such software continues to rise as clinics prioritize operational efficiency and client satisfaction. Imaging software is also gaining traction, driven by advancements in diagnostic imaging and increased use of digital radiography. Telehealth software is emerging as a fast-growing segment due to the rising demand for remote consultations and virtual care. Veterinary software supports all three categories by integrating features into unified platforms to meet varying clinical needs.

- For instance, ezyVet, a cloud-based solution by IDEXX, reported handling over 100 million patient records and supporting 1,800+ veterinary hospitals globally, with built-in modules for imaging integration, teleconsultation, and inventory automation.

By Delivery:

The cloud/web-based segment dominates the market, supported by its scalability, remote accessibility, and lower upfront costs. Clinics prefer web-based solutions for their ease of deployment and ability to provide real-time updates. It enables veterinary professionals to access patient data from any device, improving responsiveness and service delivery. On-premise solutions maintain relevance among larger clinics that require tighter control over data and systems. However, the shift toward cloud platforms continues to accelerate as internet infrastructure improves. Veterinary software vendors are focusing on flexible deployment models to meet different user preferences.

- For instance, Covetrus reported that its cloud-based platform Pulse is used by over 13,000 veterinary practices, offering integrated access to medical records, diagnostics, and prescription management via secure web interfaces accessible on desktop and mobile devices.

By End-User:

Veterinary hospitals and clinics represent the primary consumers of veterinary software due to their high patient volumes and need for structured workflows. These facilities depend on software to enhance clinical performance, reduce administrative tasks, and improve client communication. Other end users, including research centers and academic institutions, contribute to market growth through specialized applications. It provides customized modules to support data management, teaching, and case tracking in non-clinical settings. The expanding scope of veterinary services broadens the application of software across multiple sectors.

Segments:

Based on Product Type:

- Practice Management Software

- Imaging Software

- Telehealth Software

Based on Delivery:

- Cloud/Web-Based

- On-premise

Based on End-User:

- Veterinary Hospitals/Clinics

- Other End Use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held the largest share of the global veterinary software market in 2024, accounting for approximately 45% of the total revenue. The region’s dominance is driven by a high level of pet ownership, advanced veterinary infrastructure, and widespread adoption of digital technologies among clinics. The presence of well-established software vendors, supportive healthcare IT policies, and growing awareness of preventive animal care contribute to sustained growth. The United States leads in terms of revenue, supported by strong investments in cloud-based veterinary platforms and telehealth solutions. High disposable income and willingness to spend on pet health services continue to drive market expansion. It remains a key region where software solutions are widely used for both companion and livestock animal healthcare.

Europe

Europe accounted for nearly 25% of the global market share in 2024, making it the second-largest regional contributor. The region shows consistent growth due to increased demand for efficient clinical management tools across veterinary hospitals and clinics. Countries like Germany, the United Kingdom, and France are leading adopters of veterinary software, supported by advanced healthcare systems and strong regulatory frameworks for animal welfare. Cloud adoption and the integration of AI-based diagnostic tools are rising across European markets. The growing trend of pet humanization and preventive healthcare fuels the demand for digital practice management solutions. It continues to benefit from increasing investments in veterinary education and infrastructure.

The Asia Pacific

The Asia Pacific region captured around 18% of the global veterinary software market in 2024. Rapid urbanization, rising income levels, and an expanding companion animal population are contributing to growth across emerging economies like China, India, and Southeast Asian countries. Veterinary practices in the region are gradually transitioning from manual to digital systems, with increasing interest in telehealth and mobile platforms. The livestock sector, particularly in countries with large agricultural bases, drives the need for herd management and health monitoring software. It plays a growing role in enabling animal traceability and disease control. Local governments and private stakeholders are beginning to invest in veterinary IT systems, although adoption rates vary by country.

Latin America

Latin America accounted for approximately 7% of the market share in 2024. The region is witnessing steady growth driven by rising awareness of animal health, growing pet ownership, and a shift toward organized veterinary services. Brazil and Mexico represent major markets where veterinary clinics are exploring cloud-based software to improve patient recordkeeping and service efficiency. The market remains in a developing stage, with limited infrastructure and budget constraints posing challenges. It sees potential for expansion as more clinics adopt technology to streamline operations and enhance client communication. Veterinary software in the region supports the evolving needs of urban clinics and rural animal health providers.

The Middle East & Africa

The Middle East & Africa region held around 5% of the global market share in 2024. Market growth is supported by increasing government efforts to improve veterinary services, particularly in the Gulf Cooperation Council (GCC) countries. The livestock industry drives much of the demand for veterinary software in African countries, where herd management and disease surveillance remain top priorities. Clinics and animal health centers are gradually adopting digital solutions to enhance operational efficiency. It serves an important role in improving veterinary outcomes in resource-constrained environments. While the market is still emerging, rising investment in animal health infrastructure is expected to support long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Leading players in the veterinary software market include Idexx Laboratories, Covetrus Inc. (Henry Schein), ProVet (NordHealth), Hippo Manager, and DaySmart Software.These companies actively shape the market through continuous innovation, product expansion, and client-focused solutions.Laboratories holds a strong position by offering integrated diagnostic tools and cloud-based software that streamline clinical workflows. Operating under Henry Schein, leverages its global distribution network and robust practice management systems to maintain competitive strength. Focuses on scalable cloud platforms, gaining traction among mid-sized and large veterinary clinics across Europe and other regions. Hippo Manager targets small and independent clinics with cost-effective, user-friendly software solutions, contributing to broader digital adoption. It emphasizes customizable and mobile-enabled systems, supporting flexible clinic operations. These companies invest heavily in R&D and customer support to retain market share. Strategic partnerships, acquisitions, and geographic expansion remain central to their growth strategies, positioning them to meet evolving needs across diverse veterinary settings.

Recent Developments

- In August 2024, Digitail announced sponsorship for The Veterinary Hospital Managers Association’s (VHMA) mission to advance veterinary management and provide resources to veterinary hospital managers.

- In June 2024, Pawlicy Advisor announced integration with EzyVet practice management software (PMS) with an aim to streamline the insurance process, improve client engagement, and increase revenue for veterinary clinics.

- In May 2024, Evette, a leading company that addresses staff shortages in veterinary settings, partnered with Shepherd Software with an aim to create a platform to streamline veterinary clinic operations, improve staff efficiency, and enhance the overall work environment.

- In April 2024, Wag! launched a software solution named as Furscription which is designed to assist veterinary clinics manage pet care and improve customer engagement. By streamlining clinic operations, reducing administrative tasks, and enhancing the overall pet care experience.

- In April 2024, Weave integrated with Shepherd, enhancing its capabilities in client communication and engagement for businesses. This integration streamlined communication processes and improved customer service, benefiting businesses using Weave’s platform.

- In February 2024, IDEXX launched a novel pet parent engagement software known as Vello. Its features include; automated appointment reminders, health service reminders, online scheduling, and two-way texting, all integrated with IDEXX’s practice management software.

- In January 2024, Covetrus showcased its VetSuite solution at VMX 2024, offering integrated technology and services to improve veterinary practice efficiency and pet care. The company entered into partnership with Zoetis Diagnostics for seamless data exchange, enhancing diagnostic capabilities for veterinarians and improving patient care.

- In November 2023, a brand-new reference lab for Antech Diagnostics opened in Warwick. With its debut, Antech’s first comprehensive and adaptable portfolio-which comprises software solutions, in-house diagnostics, imaging, and reference lab-arrived in the UK.

Market Concentration & Characteristics

The veterinary software market is moderately concentrated, with a mix of established players and emerging vendors competing across global regions. Leading companies such as Idexx Laboratories, Covetrus Inc. (Henry Schein), and ProVet (NordHealth) dominate through comprehensive product offerings, strong distribution networks, and established customer bases. Smaller players like Hippo Manager and Digitail are gaining market presence by delivering agile, cloud-based solutions tailored to independent clinics and niche segments. The market is characterized by rapid technological advancement, a shift toward cloud deployment, and increasing demand for mobile accessibility and integrated features. Veterinary software must adapt to diverse clinic needs, including practice management, telehealth, imaging, and diagnostics. It often serves multi-specialty clinics, livestock operations, and academic institutions, making flexibility and scalability key characteristics. Competitive differentiation depends on ease of use, customer support, integration capabilities, and data security standards. The market continues to evolve, driven by changing client expectations, pet care trends, and regulatory requirements.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Delivery, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cloud-based veterinary software will continue to increase across clinics of all sizes

- AI-driven diagnostic tools will gain traction and support more accurate clinical decisions

- Telehealth capabilities will expand and become integral to virtual care offerings

- Data analytics and reporting tools will support proactive health management and preventive care

- Integration of mobile platforms will enable veterinarians to access patient data in real time

- Security standards and compliance features will rise in importance to protect patient records

- Practice management systems will evolve to support multi-site and franchise veterinary operations

- Software providers will collaborate with diagnostics, imaging, and pharmacy vendors for comprehensive offerings

- Global expansion will remain a focus, especially in emerging markets with growing pet care infrastructure

- Customizable modules and scalable architectures will serve diverse end-user segments and specialty practices