Market Overview

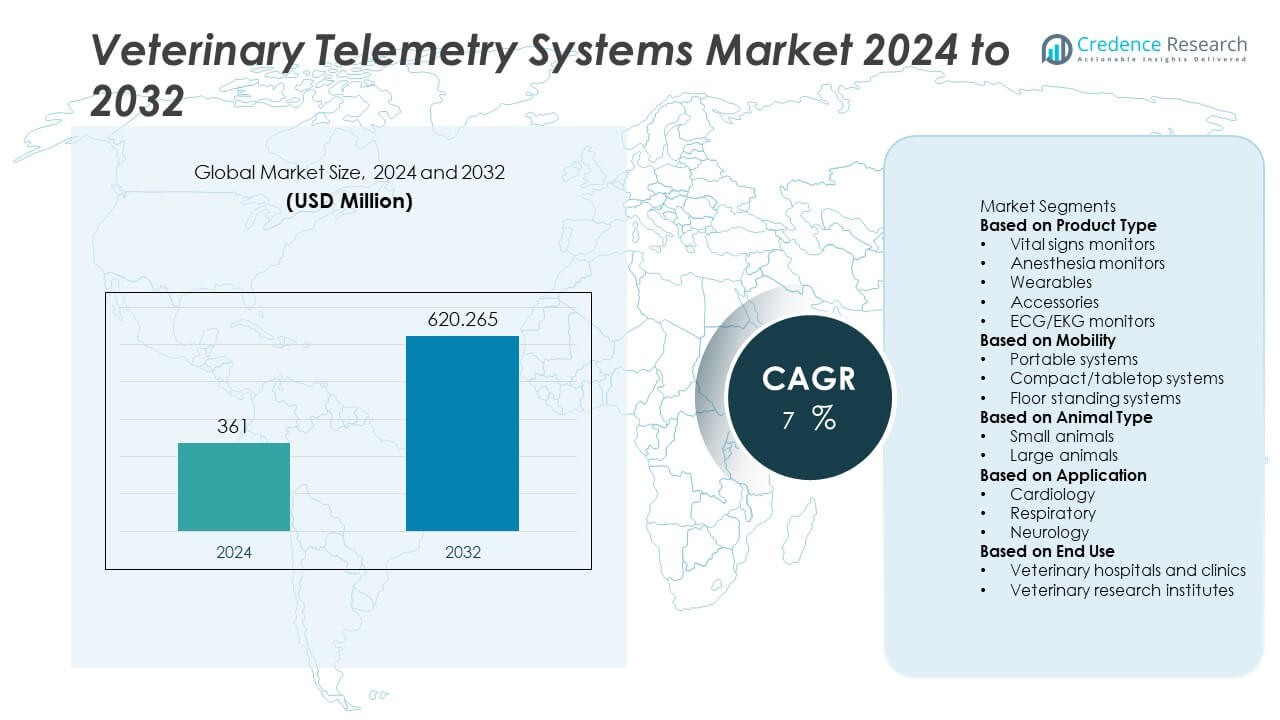

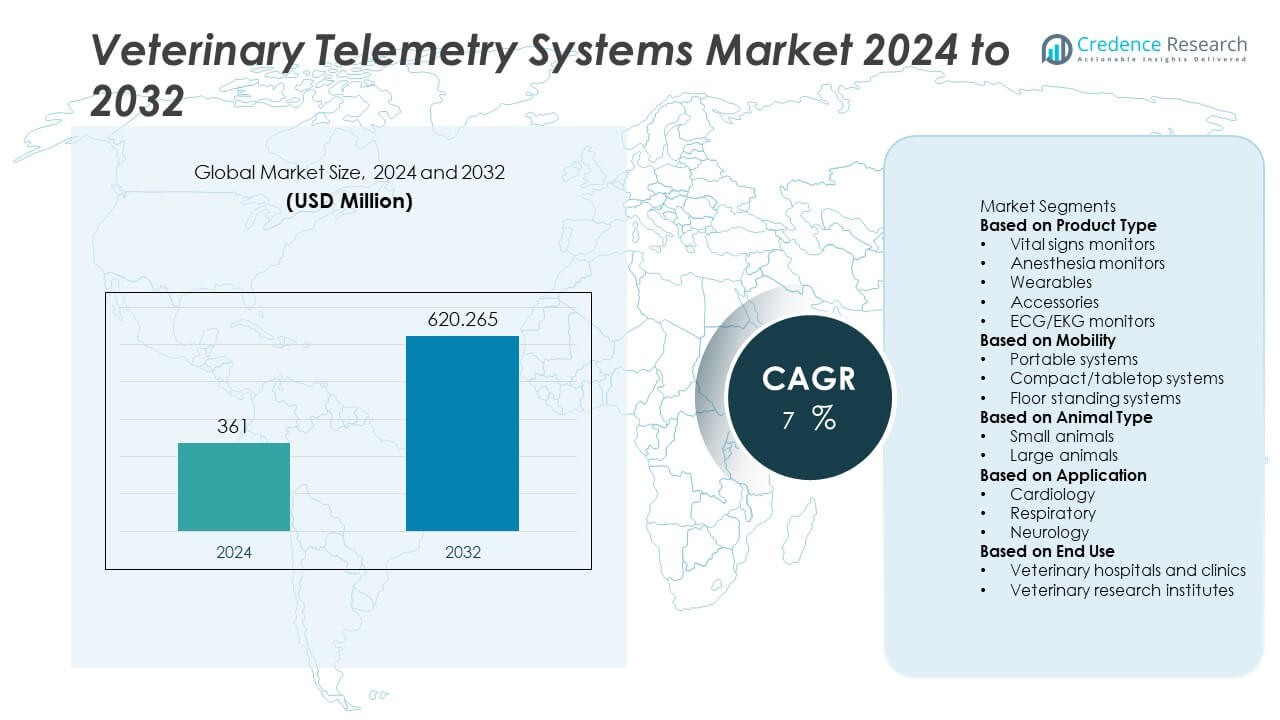

The Veterinary Telemetry Systems Market was valued at USD 361 million in 2024 and is projected to reach approximately USD 620.265 million by 2032, growing at a compound annual growth rate (CAGR) of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Telemetry Systems Market Size 2024 |

USD 361 Million |

| Veterinary Telemetry Systems Market, CAGR |

7% |

| Veterinary Telemetry Systems Market Size 2032 |

USD 620.265 Million |

The Veterinary Telemetry Systems Market is driven by the rising demand for real-time animal health monitoring, growing pet ownership, and increased spending on advanced veterinary care. Integration of wireless and cloud-based technologies enhances diagnostic capabilities and enables remote monitoring, supporting both companion and livestock applications. Trends such as the adoption of wearable telemetry devices and the expansion of telemedicine are reshaping veterinary practices. Increased regulatory focus on animal welfare and the shift toward preventive healthcare further accelerate market adoption.

Geographically, the Veterinary Telemetry Systems Market demonstrates strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to advanced veterinary infrastructure and high pet healthcare spending. Europe follows with strong regulatory support and rising adoption in livestock monitoring. Asia-Pacific is emerging rapidly, fueled by increasing pet ownership, urbanization, and government-backed animal health programs. Latin America and the Middle East & Africa are witnessing gradual adoption, particularly in livestock-centric regions where real-time monitoring improves farm productivity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Veterinary Telemetry Systems Market was valued at USD 361 million in 2024 and is expected to reach USD 620.27 million by 2032, growing at a CAGR of 7% during the forecast period.

- Rising demand for real-time animal health monitoring, preventive care, and remote diagnostics is driving the market forward, especially in companion animal and livestock applications.

- Wearable telemetry devices and cloud-based platforms are becoming more popular, enabling seamless data collection, storage, and remote access for both clinics and pet owners.

- Key players such as Medtronic, Masimo Corporation, PetPace, and Bionet are focusing on wireless integration, multi-parameter monitoring, and species-specific designs to strengthen their market position.

- High costs of devices and limited access to skilled veterinary professionals in rural and developing regions remain key restraints, slowing adoption in budget-constrained settings.

- North America leads the market due to advanced veterinary healthcare infrastructure and pet care awareness, followed by Europe with regulatory-driven adoption and Asia-Pacific with rapid growth in urban pet ownership.

- The market shows strong potential for expansion through telemedicine, portable monitoring systems, and product customization suited for both developed and emerging regions.

Market Drivers

Rising Demand for Real-Time Animal Health Monitoring in Companion and Livestock Sectors

Veterinary Telemetry Systems Market growth is primarily driven by the increasing need for real-time health monitoring across both companion animals and livestock. Owners and veterinarians are seeking early detection tools to manage chronic diseases and post-surgical care more effectively. These systems offer continuous, non-invasive monitoring of vital parameters, enabling better diagnosis and treatment decisions. In livestock, health surveillance improves herd management, reducing disease outbreaks and improving productivity. For instance, demand for telemetry in dairy farming has grown to detect mastitis and other common ailments before visible symptoms. The market benefits from this shift toward preventive and precision veterinary care.

- For instance, Nedap’s Smarttag Neck monitored 4,345 cow lactations across eight Dutch dairy farms to track eating and rumination patterns tied to health alerts. It benefits clinics and farms transitioning to preventive and precision veterinary care.

Integration of Wireless Technologies Enhancing Veterinary Diagnostics and Care

The integration of wireless and remote sensing technologies is reshaping the capabilities of veterinary diagnostics. It allows for seamless data transmission and remote access to critical animal health metrics. The Veterinary Telemetry Systems Market benefits from these advancements, which improve workflow efficiency and reduce stress on animals during examination. Bluetooth- and Wi-Fi-enabled telemetry devices are increasingly used in small and large animal clinics. These systems contribute to faster diagnostics and enable veterinarians to monitor patients off-site, ensuring continuity of care. The reliability of data transmission has significantly improved, reinforcing the adoption rate across veterinary practices.

- For instance, Dextronix’s VET‑Scout and DexSmart2 transmitters support live ECG monitoring up to simulated 650 beats/min and store over 20,000 patient recordings in a single system database. These systems streamline diagnostics and maintain care continuity even off‑site. Improved data reliability strengthens adoption across veterinary practices.

Growing Awareness of Animal Welfare Standards and Regulatory Pressure

Animal welfare regulations and awareness initiatives are encouraging the use of advanced monitoring technologies in veterinary settings. Governments and animal health organizations are recommending or mandating monitoring solutions that align with best practices in animal care. The Veterinary Telemetry Systems Market sees rising adoption due to this regulatory momentum, especially in North America and Europe. Clinics and farms are investing in telemetry systems to ensure compliance and avoid penalties. These tools help maintain comprehensive health records, which are essential for meeting documentation standards. Awareness of ethical animal treatment is also driving demand in emerging markets.

Expanding Pet Healthcare Expenditure and Technological Innovation

Increased spending on pet healthcare services supports long-term market expansion. Pet owners are prioritizing premium veterinary care, creating a favorable environment for advanced solutions like telemetry systems. The Veterinary Telemetry Systems Market gains from this trend, particularly in urban areas where veterinary service demand is rising. Technological innovation, including wearable telemetry devices and mobile integration, makes these systems more accessible. Companies are introducing compact, cost-effective solutions tailored to pets of various sizes. This combination of rising expenditure and innovation supports broader adoption across small clinics and specialty veterinary hospitals.

Market Trends

Rising Adoption of Wearable Telemetry Devices Across Veterinary Practices

Veterinary clinics and hospitals are increasingly adopting wearable telemetry devices to monitor animals more efficiently. These devices allow continuous tracking of heart rate, temperature, and respiration in real-time, reducing the need for manual checks. The Veterinary Telemetry Systems Market is advancing due to the convenience and precision offered by such tools in post-operative care and chronic disease management. Wearables improve patient outcomes and reduce clinical visits, especially for aging pets. Demand for smart collars and implantable sensors is expanding among both pet owners and veterinary professionals. This trend reflects a shift toward personalized and data-driven veterinary care.

- For instance, PetPace has developed an AI-powered smart collar that monitors eight health metrics including pulse, temperature, respiration, activity, and heart rate variability. The device samples vital signs once every 2 minutes and transmits data via Bluetooth and cellular networks to veterinary dashboards, supporting remote monitoring for over 15,000 dogs and cats worldwide.

Cloud-Based Data Platforms Supporting Remote Monitoring and Diagnostics

Cloud integration has emerged as a key trend, allowing remote access and storage of telemetry data for animals under observation. It enhances collaboration between veterinary staff and pet owners while enabling better long-term care planning. The Veterinary Telemetry Systems Market is evolving with platforms that allow real-time alerts, historical data review, and AI-assisted diagnostics. It simplifies veterinary workflow, supports mobile applications, and increases scalability for clinics managing multiple cases. Secure, compliant data handling is now a priority, driving investment in cloud-based infrastructure. This trend is particularly strong in developed economies with advanced veterinary IT systems.

- For instance, Antech Diagnostics, a Mars Petcare company, implemented Reference Lab Cloud, enabling more than 16 million diagnostic test results annually to be securely uploaded and accessed by over 2,000 veterinary clinics across North America. Additionally, IDEXX Laboratories offers VetConnect PLUS, which processes over 80,000 diagnostic reports daily, integrating real-time data and predictive analytics across cloud platforms for improved clinical decision-making.

Growing Preference for Minimally Invasive Monitoring Technologies

Veterinarians are preferring minimally invasive telemetry solutions that reduce animal stress and improve clinical efficiency. New devices are being designed with animal comfort and handler safety in mind, leading to broader acceptance in clinical and field settings. The Veterinary Telemetry Systems Market benefits from innovations such as skin-adhered sensors and non-restrictive harnesses. These technologies help monitor vital signs without sedation or restraint, making them suitable for both routine exams and emergency care. The reduced need for human intervention allows clinics to optimize resources and improve patient turnaround. It reflects a clear movement toward humane and practical solutions in animal health.

Expansion of Veterinary Services in Emerging Economies Fueling System Demand

Emerging economies are witnessing growth in veterinary infrastructure and awareness, leading to greater demand for advanced monitoring systems. Rising disposable income and increasing pet ownership support market expansion in regions like Asia-Pacific and Latin America. The Veterinary Telemetry Systems Market is responding with tailored solutions that address local needs and economic constraints. Companies are offering scalable, portable systems suitable for mixed animal practices and remote clinics. Government initiatives to strengthen animal healthcare are reinforcing this trend. The global market is becoming more diverse, with strong potential in underserved veterinary segments.

Market Challenges Analysis

High Cost of Telemetry Devices Limiting Adoption in Budget-Constrained Settings

The high cost of veterinary telemetry systems continues to pose a major barrier, particularly for small clinics and animal shelters operating on limited budgets. These systems require upfront investment in equipment, software, and sometimes subscription-based data platforms. The Veterinary Telemetry Systems Market faces resistance in price-sensitive regions where veterinary services remain underfunded. Many clinics prioritize basic diagnostics over advanced technologies due to financial constraints. It becomes difficult for practitioners in rural or underserved areas to justify the expense, despite the long-term benefits. Limited access to financing options and low insurance penetration for animal care further restrict widespread adoption.

Lack of Skilled Professionals and Training Hindering Operational Efficiency

Effective use of telemetry systems demands trained personnel capable of interpreting complex data and managing connected technologies. In many regions, veterinary staff lack adequate exposure to digital monitoring systems, creating a gap between device availability and clinical use. The Veterinary Telemetry Systems Market encounters challenges in implementation where professional development and training are insufficient. It reduces the potential impact of these systems on patient outcomes and care efficiency. It also increases reliance on external technical support, which can delay diagnosis and treatment. Without strategic investment in education and training, the market may struggle to reach its full potential.

Market Opportunities

Expansion of Telemedicine and Remote Veterinary Care Creating New Avenues

The growing demand for telemedicine and remote veterinary consultations is opening new growth avenues for telemetry system providers. These technologies allow veterinarians to monitor animal health outside the clinic, improving access to care in remote or rural regions. The Veterinary Telemetry Systems Market can leverage this shift by offering solutions that integrate easily with mobile and cloud-based platforms. It supports continuous monitoring and timely interventions without requiring physical clinic visits. Pet owners increasingly seek digital health tools for convenience and efficiency, which expands the customer base. This trend presents significant opportunity for scalable, home-use telemetry systems designed for both companion animals and livestock.

Product Innovation and Customization Expanding Addressable Market

Ongoing innovation in device design and customization is enabling the development of telemetry systems tailored to specific species, conditions, and clinical environments. Manufacturers are introducing compact, user-friendly devices that offer multi-parameter monitoring with high accuracy. The Veterinary Telemetry Systems Market stands to benefit by targeting specialized use cases such as equine sports medicine, neonatal monitoring, and post-surgical recovery. It creates an opportunity to serve niche segments that have previously lacked dedicated solutions. Custom-fit devices and modular platforms allow clinics to adopt systems gradually based on their needs and budget. This flexibility increases the appeal of telemetry technology across a wider range of veterinary practices.

Market Segmentation Analysis:

By Product Type

The Veterinary Telemetry Systems Market, when segmented by product type, includes cardiac monitors, respiratory monitors, temperature monitors, and multi-parameter telemetry systems. Multi-parameter systems lead the segment due to their ability to simultaneously track various physiological parameters, offering greater diagnostic value in clinical settings. Cardiac monitors hold a strong position, especially in specialty clinics and surgical centers, where real-time ECG monitoring is essential. Temperature and respiratory monitors are commonly used in post-operative care and emergency interventions. Each product type serves specific veterinary needs, and demand varies based on the clinical application and animal health condition. The trend toward integrated diagnostic systems continues to drive innovation across this segment.

- For instance, Masimo Corporation’s multi-parameter telemetry platform integrates pulse oximetry, capnography, and ECG in a single system, supporting over 10,000 active veterinary units globally.

By Mobility

Based on mobility, the market is divided into portable and stationary systems. Portable telemetry systems dominate due to their flexibility in field applications and ease of use in home-based or rural animal care. These systems support mobile veterinary services, which are growing in response to increased demand for in-home animal healthcare. The Veterinary Telemetry Systems Market benefits from this trend, as portable units help extend monitoring capabilities beyond clinic boundaries. Stationary systems still hold relevance in established animal hospitals and research institutions where continuous, high-precision data is required. The need for mobility and operational efficiency strongly influences purchasing decisions in this segment.

- For instance, VetGuardian developed a portable, contactless monitoring system that tracks heart rate and respiration in real time and is currently deployed in over 2,500 veterinary clinics across North America.

By Animal Type

The market, by animal type, includes companion animals and livestock. Companion animals, such as dogs and cats, account for a significant share due to rising pet ownership and increased willingness among pet owners to invest in advanced veterinary care. The Veterinary Telemetry Systems Market is seeing high adoption in this category due to the growing focus on pet wellness and chronic disease management. Livestock telemetry is gaining traction, particularly in large-scale farms and breeding operations, where remote monitoring reduces labor costs and improves herd health. The segment continues to grow as more farmers adopt precision livestock farming practices to boost productivity and animal welfare.

Segments:

Based on Product Type

- Vital signs monitors

- Anesthesia monitors

- Wearables

- Accessories

- ECG/EKG monitors

Based on Mobility

- Portable systems

- Compact/tabletop systems

- Floor standing systems

Based on Animal Type

- Small animals

- Large animals

Based on Application

- Cardiology

- Respiratory

- Neurology

Based on End Use

- Veterinary hospitals and clinics

- Veterinary research institutes

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share in the Veterinary Telemetry Systems Market, accounting for approximately 38% of the global market in 2024. The region’s leadership is supported by well-established veterinary healthcare infrastructure, high pet ownership, and widespread adoption of digital health solutions. The United States drives the majority of regional demand, fueled by growing expenditure on pet care, rising awareness of animal wellness, and integration of wearable monitoring systems in both clinical and home settings. Veterinary schools and research institutions in the U.S. actively use telemetry in clinical trials and academic programs, further strengthening market penetration. Canada contributes steadily, with increased adoption of remote veterinary services in rural provinces. Companies in this region focus on advanced technologies, including AI-enabled telemetry and cloud-based data platforms, which boost North America’s dominance in the global market.

Europe

Europe accounts for around 26% of the global Veterinary Telemetry Systems Market, supported by stringent animal welfare regulations and rising investments in veterinary digital health. Countries like Germany, the United Kingdom, and France are leading adopters, particularly in multi-parameter telemetry systems for companion animals. The European Union’s regulatory framework encourages preventive veterinary care and documentation, promoting the integration of telemetry systems across veterinary clinics and farms. Livestock applications are also gaining momentum in countries such as the Netherlands and Denmark, where dairy and meat production benefit from real-time animal health monitoring. The presence of several regional manufacturers and technology providers supports customization and cost-effective deployment. This growing alignment of regulation, technology, and livestock care is expanding the market footprint across Europe.

Asia-Pacific

Asia-Pacific holds a market share of 18%, with significant growth potential led by China, India, Japan, and Australia. Rapid urbanization, increasing disposable income, and rising pet ownership are key factors driving market development in this region. China and India are witnessing strong adoption of mobile and portable veterinary telemetry devices in both urban clinics and rural livestock centers. The Veterinary Telemetry Systems Market in Asia-Pacific is expanding through government-backed livestock health monitoring programs and a growing number of veterinary startups offering telehealth platforms. Japan leads in the deployment of advanced monitoring solutions for companion animals, particularly in an aging pet population. Although challenges remain in infrastructure and affordability, the region is expected to capture a larger market share in the coming years.

Latin America

Latin America accounts for approximately 10% of the global market share, with Brazil, Mexico, and Argentina being the major contributors. The region is experiencing a growing need for veterinary telemetry in livestock farming to improve productivity and reduce disease-related losses. Brazil leads the regional market due to its expansive cattle farming industry and efforts to modernize animal health management systems. Companion animal care is improving in urban centers, with clinics beginning to adopt telemetry devices for chronic disease monitoring. However, budget limitations and lack of trained professionals limit widespread deployment. The market remains in an early growth stage but holds potential through agricultural digitization and veterinary telemedicine expansion.

Middle East and Africa

The Middle East and Africa region represents around 8% of the global Veterinary Telemetry Systems Market. Growth is primarily driven by increasing attention toward livestock health, particularly in countries such as Saudi Arabia, South Africa, and the United Arab Emirates. Livestock monitoring is a priority in these regions due to the economic importance of dairy, poultry, and meat production. While adoption in companion animal care remains limited, the market is evolving through international collaborations and investments in veterinary telehealth infrastructure. Telemetry systems are being introduced in veterinary universities and government-backed animal health initiatives. Despite challenges such as inconsistent infrastructure and limited access in remote areas, the region offers long-term growth potential through improved veterinary services and mobile technology integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic

- PetPace

- Bionet

- Nonin

- DRE Medical (Avante Health Solutions)

- Dextronix

- Halo Collar

- Nedap

- Midmark

- Masimo Corporation

- Digicare Biomedical

Competitive Analysis

The Veterinary Telemetry Systems Market is highly competitive, with key players including Medtronic, Masimo Corporation, PetPace, Bionet, Dextronix, Digicare Biomedical, DRE Medical (Avante Health Solutions), Midmark, Nedap, Nonin, and Halo Collar. These companies focus on innovation in wireless connectivity, real-time monitoring, and cloud-based data integration to address growing demand for remote animal health solutions. Medtronic and Masimo leverage their expertise in human health monitoring to offer advanced, non-invasive veterinary applications. PetPace and Bionet emphasize user-friendly, wearable, and multi-parameter devices tailored for companion animals and small veterinary practices. Dextronix and Digicare provide compact and portable systems that support clinical efficiency and mobility. Across the board, leading players prioritize customization, training support, and smart data capabilities to meet evolving customer expectations and maintain a competitive edge in the global veterinary telemetry landscape.

Recent Developments

- In April 2025, Nonin continued to develop innovative veterinary pulse oximeters and capnographs, focusing on enhancing accuracy and adaptability for various animal species. They improved veterinary-specific algorithms to monitor SpO2 and heart rate, emphasizing durability and advanced sensor integration in their telemetry products.

- In January 2025, DRE Veterinary released the Vetrec VST system, a next-generation central station cardiac monitoring system for veterinary use. This system utilizes VST telemetry transmitters for wireless ECG monitoring, capable of supporting up to 16 patients concurrently. It offers both hardwired and wireless monitoring options and can be customized for various veterinary environments.

- In October 2024, PetPace enhanced its smart collar’s integration with veterinary telehealth services, offering remote outpatient programs for chronic disease management and early detection using data from its collar. This expanded integration aims to provide veterinarians with real-time insights into pet health, facilitating timely interventions and proactive care.

Market Concentration & Characteristics

The Veterinary Telemetry Systems Market shows moderate concentration, with a mix of established medical device companies and specialized veterinary technology firms competing across global regions. It is characterized by a strong emphasis on innovation, with companies focusing on wireless communication, multi-parameter tracking, and cloud integration to enhance diagnostic capabilities. Most players operate across multiple regions, targeting both high-income urban pet care segments and emerging livestock monitoring sectors. The market favors companies that offer user-friendly, scalable systems adaptable to various animal types and clinic sizes. It continues to attract new entrants, particularly startups focused on wearable telemetry and mobile-enabled platforms, which contributes to ongoing product differentiation. Customer demand centers on accuracy, real-time data access, portability, and species-specific functionality. Veterinary professionals seek solutions that improve clinical efficiency, reduce manual monitoring, and support preventive care. The Veterinary Telemetry Systems Market remains dynamic, driven by continuous product development and the growing digitalization of veterinary services worldwide.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Mobility, Animal Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with rising demand for remote and real-time animal health monitoring.

- Adoption of wearable telemetry devices will expand across both companion animal and livestock segments.

- Cloud-based platforms will gain wider use for storing and analyzing veterinary telemetry data.

- Telemedicine integration will drive demand for portable and mobile-compatible telemetry systems.

- Technological innovation will lead to more compact, multi-parameter, and species-specific devices.

- Veterinary clinics will prioritize telemetry solutions that improve workflow efficiency and diagnostic accuracy.

- Emerging markets will adopt telemetry systems as veterinary infrastructure and awareness improve.

- Regulatory focus on animal welfare will support greater use of monitoring technologies.

- Companies will invest in AI-enabled analytics to enhance decision-making in veterinary care.

- Partnerships between tech firms and veterinary service providers will shape future market development.