Market Overview

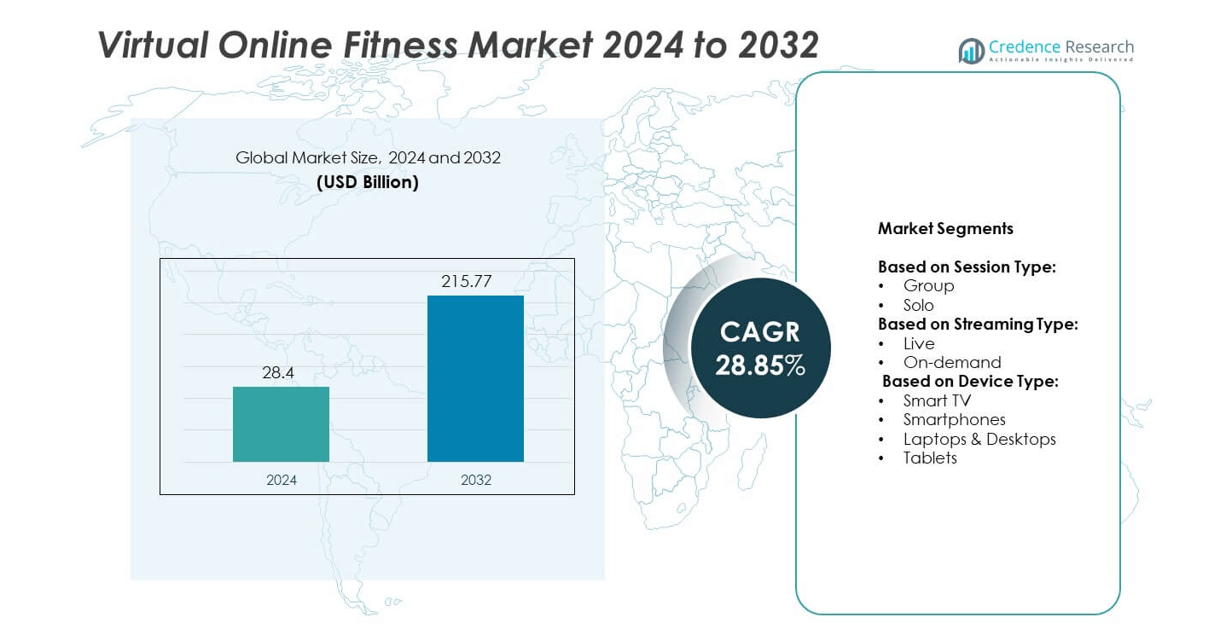

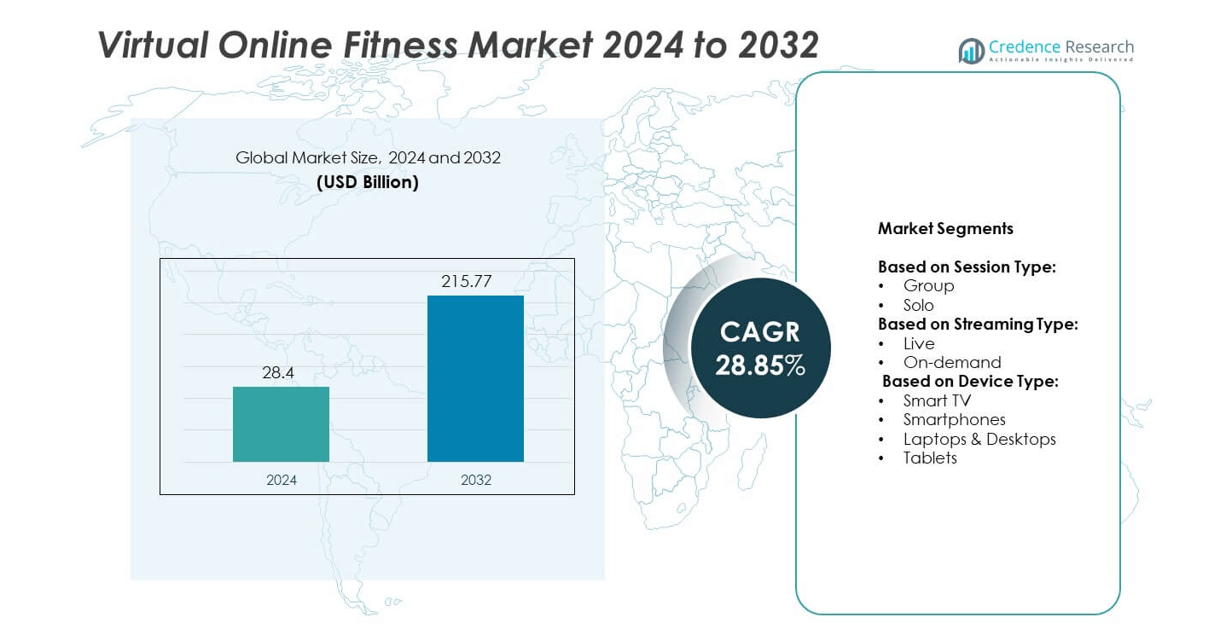

The Virtual Online Fitness Market size was valued at USD 28.4 billion in 2024 and is projected to reach USD 215.77 billion by 2032, growing at a CAGR of 28.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Virtual Online Fitness Market Size 2024 |

USD 28.4 billion |

| Virtual Online Fitness Market, CAGR |

28.85% |

| Virtual Online Fitness Market Size 2032 |

USD 215.77 billion |

The Virtual Online Fitness market grows through strong demand for flexible, accessible, and technology-driven fitness solutions. Rising adoption of hybrid models combining online and in-person workouts strengthens market expansion. AI-driven personalization, wearable integration, and interactive platforms enhance user engagement and retention. Growing health awareness and lifestyle changes support consistent adoption across demographics. Social and community-based virtual classes further boost participation. Continuous innovation in specialized fitness programs ensures inclusivity, while emerging markets with improving digital access present new growth opportunities.

North America leads the Virtual Online Fitness market, supported by advanced digital infrastructure and high consumer adoption of hybrid fitness models. Europe follows with strong demand for specialized training formats such as yoga and pilates, while Asia-Pacific shows rapid growth through expanding smartphone penetration and middle-class adoption. Latin America and the Middle East & Africa record steady uptake driven by mobile fitness apps and wellness awareness. Key players shaping this landscape include MINDBODY, Inc., ClassPass, Les Mills International Ltd., and Wexer.

Market Insights

- The Virtual Online Fitness market was valued at USD 28.4 billion in 2024 and is projected to reach USD 215.77 billion by 2032, growing at a CAGR of 28.85% from 2025 to 2032.

- Strong drivers include rising demand for flexible fitness options, AI-driven personalization, and wearable integration that improve engagement and long-term retention.

- Key trends highlight the rapid expansion of hybrid fitness models, dominance of on-demand streaming, and growth of social and community-based platforms enhancing user participation.

- Competitive activity is shaped by global players such as MINDBODY, Inc., ClassPass, Les Mills International Ltd., Wexer, and others focusing on technology innovation, niche content development, and corporate wellness partnerships.

- Restraints include high competition, content saturation, and challenges in user retention due to short-term subscription drop-offs, along with technical barriers in regions with poor connectivity.

- Regionally, North America leads with advanced infrastructure and hybrid adoption, Europe follows with strong demand for specialized programs, Asia-Pacific grows fastest with digital penetration, while Latin America and Middle East & Africa record gradual but steady uptake.

- Future growth will depend on expansion into emerging markets, development of specialized segments such as senior-focused and rehabilitation programs, and continuous integration of immersive technologies including virtual reality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Flexible and Accessible Fitness Options

The Virtual Online Fitness market grows on the increasing demand for flexible fitness solutions. Consumers want workouts that fit into busy schedules without location restrictions. Online classes deliver this convenience through smartphones, tablets, and smart TVs. It provides both live and on-demand sessions tailored to individual preferences. Rising remote work culture strengthens the appeal of virtual classes. Consumers benefit from access to expert trainers regardless of geography, driving market growth.

- For instance, in 2025, Peloton’s Q3 earnings reported 2.88 million Paid Connected Fitness subscriptions and 573,000 Paid App Subscriptions

Rising Popularity of Personalized Fitness Programs

Personalization drives strong adoption across the Virtual Online Fitness market. Consumers prefer programs customized to fitness levels, goals, and health conditions. It integrates AI-driven recommendations, wearable data, and progress tracking. Such technology makes workouts more engaging and effective. Demand for specialized sessions, including yoga, HIIT, and strength training, continues to expand. Tailored approaches encourage higher retention and long-term participation.

- For instance, Magic AI Mirror can recognize 400 distinct exercises, combining them into hundreds of customized classes. It features over 25 holographic trainers to guide users with real-time form feedback.

Integration of Technology and Interactive Platforms

Advances in digital platforms enhance the appeal of virtual fitness. High-definition video, AI coaching, and real-time feedback boost user satisfaction. It provides immersive experiences through interactive classes and gamification elements. Platforms combine social features, leaderboards, and community support to improve engagement. Partnerships with wearable device makers strengthen monitoring accuracy. Consumers value the ability to measure progress instantly and adjust training.

Cost-Effective and Scalable Fitness Solutions

The Virtual Online Fitness market benefits from being cost-effective for consumers and providers. Subscriptions often cost less than traditional gym memberships. It reduces overhead costs for trainers while increasing global reach. Scalability allows providers to serve thousands of users simultaneously. Affordable pricing attracts a broad user base across demographics. This cost advantage continues to support market expansion worldwide.

Market Trends

Expansion of Hybrid Fitness Models

The Virtual Online Fitness market shows a strong shift toward hybrid models. Consumers combine online sessions with in-person training to gain flexibility. It enables users to maintain consistency while enjoying community interaction. Gyms and studios integrate digital platforms to retain memberships. Hybrid offerings support varied schedules and diverse fitness needs. This model broadens revenue opportunities and strengthens brand loyalty.

- For instance, WHOOP launched WHOOP Coach, powered by OpenAI’s GPT-4 technology, enabling users to ask conversational questions about training, recovery, and sleep using their biometric data. This feature pulls insights from 24/7 data and prompts based on individual health metrics

Adoption of AI and Wearable Integration

Technology-driven personalization defines current trends in virtual fitness. Platforms use AI and wearable integration to create adaptive workout plans. It allows real-time performance tracking and progress updates. Consumers receive feedback that improves engagement and long-term commitment. Companies invest in smart features such as biometric monitoring and virtual coaching. The integration of AI continues to raise user expectations.

- For instance, iFIT Inc. has rolled out its AI Coach (beta) to 19 countries as of June 2, 2025. This expansion enables personalized fitness guidance for a growing global user base of more than 6 million athletes, enhancing real-time workout recommendations across its mobile app and smart-connected equipment.

Growth of Social and Community-Based Fitness Platforms

Community engagement drives participation in virtual classes. Platforms promote leaderboards, group challenges, and shared goals to increase motivation. It creates a sense of belonging that boosts user retention. Social media integration supports peer encouragement and trainer visibility. Community-driven content influences program popularity and subscription growth. This trend reshapes digital fitness into a collaborative experience.

Focus on Specialized Fitness Segments

The Virtual Online Fitness market sees growth in specialized training formats. Programs focus on yoga, pilates, strength, or senior-friendly routines. It meets specific lifestyle and health demands across demographics. Demand rises for condition-focused workouts such as postnatal or rehabilitation fitness. Providers develop niche content to differentiate offerings and attract loyal users. Specialized formats enhance accessibility and inclusivity in the sector.

Market Challenges Analysis

High Competition and Content Saturation

The Virtual Online Fitness market faces rising competition from global and regional players. Consumers encounter a wide range of platforms offering similar content, making differentiation difficult. It pressures providers to invest heavily in unique programs and advanced technology. High marketing costs are required to attract and retain users in a crowded space. Smaller firms often struggle against established brands with larger budgets. Content saturation can lead to reduced user engagement and declining subscription renewals.

Technical Barriers and Limited User Retention

Technology-driven platforms depend on stable internet and reliable devices, which remain barriers in some regions. The Virtual Online Fitness market suffers when users face poor connectivity or limited access to advanced gadgets. It creates gaps in accessibility and restricts adoption in rural areas. User retention also poses challenges, as many subscribers drop off after short-term use. Maintaining engagement requires constant updates, live interactions, and new features. High churn rates continue to impact long-term growth and profitability for providers.

Market Opportunities

Expansion into Emerging Markets and Untapped Demographics

The Virtual Online Fitness market holds strong opportunities in emerging economies. Growing smartphone penetration and affordable internet access support expansion into new regions. It allows providers to reach younger populations and underserved communities. Demand is also increasing among seniors seeking low-impact and home-based fitness solutions. Companies can create tailored programs to address these demographic shifts. Broadening global reach strengthens revenue streams and establishes long-term market presence.

Integration with Corporate Wellness and Healthcare Programs

Partnerships with employers and healthcare providers present major growth opportunities. The Virtual Online Fitness market aligns well with corporate wellness initiatives focused on employee health and productivity. It supports preventative healthcare by encouraging regular activity and lifestyle management. Integration with telehealth platforms enhances personalized care and fitness tracking. Companies offering customized wellness packages gain a competitive advantage. Expansion in this area strengthens adoption across industries and improves overall market sustainability.

Market Segmentation Analysis:

By Session Type:

The Virtual Online Fitness market divides into group and solo formats. Group sessions attract users seeking motivation, community support, and real-time interaction. These classes create a sense of accountability that improves long-term participation. Solo sessions appeal to individuals preferring privacy, flexibility, and self-paced learning. It allows users to choose workouts aligned with personal fitness goals. Both session types remain essential in broadening the consumer base and supporting platform diversity.

- For instance, Apple Fitness+ group workouts via SharePlay support up to 32 participants on a FaceTime call.

By Streaming Type:

The market features live and on-demand formats. Live sessions gain traction for their interactive features, offering real-time trainer feedback and engagement. Users value the immediacy and dynamic environment that simulate in-person classes. On-demand content dominates due to its convenience, allowing users to access workouts anytime. It supports varied schedules and accommodates global time zones. Platforms balance both streaming models to maximize reach and consumer satisfaction.

- For instance, LES MILLS+ provides over 2,500 on-demand workouts across programs.

By Device Type:

The Virtual Online Fitness market segments into smart TVs, smartphones, laptops and desktops, and tablets. Smart TVs provide an immersive experience with large-screen visibility, suitable for family participation. Smartphones dominate usage due to portability, ease of access, and growing app integration. Laptops and desktops remain important for users who prefer structured sessions with better screen size than mobile devices. Tablets offer flexibility, blending mobility with larger displays for home-based fitness. It reflects the importance of multi-device compatibility to support varied consumer preferences. Together, these device categories strengthen accessibility and expand adoption across demographics.

Segments:

Based on Session Type:

Based on Streaming Type:

Based on Device Type:

- Smart TV

- Smartphones

- Laptops & Desktops

- Tablets

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Virtual Online Fitness market with 38% in 2024. The region benefits from strong digital infrastructure, high awareness about fitness, and early adoption of online training platforms. It also leads in integrating wearable technology with digital fitness applications, making workouts more interactive and measurable. Consumers in the United States and Canada show preference for hybrid fitness models that combine online and offline experiences. The presence of leading providers offering live and on-demand sessions also supports growth. High health awareness and the rising focus on personalized programs continue to make North America the most dominant region. It is expected to maintain leadership through consistent investment in technology-driven platforms.

Europe

Europe accounts for 27% of the Virtual Online Fitness market in 2024. Demand grows from increasing focus on wellness and government initiatives encouraging active lifestyles. The region shows high adoption of specialized training formats, such as yoga and pilates, in virtual environments. Consumers in countries like Germany, the United Kingdom, and France prefer both live-streamed and on-demand workouts. It benefits from strong broadband connectivity and the presence of fitness-focused startups. Hybrid subscription models combining gyms with online platforms gain popularity across urban centers. This regional share highlights Europe’s position as the second-largest market with strong growth potential.

Asia-Pacific

Asia-Pacific represents 22% of the Virtual Online Fitness market in 2024. Rising smartphone penetration and affordable internet access fuel rapid adoption across China, India, Japan, and Southeast Asia. The growing middle-class population invests more in health and fitness solutions that fit digital lifestyles. It also benefits from the expansion of global players partnering with regional providers. Local platforms develop affordable and localized content to cater to diverse demographics. Urban populations embrace digital workouts for their flexibility and affordability, supporting consistent growth. Asia-Pacific is expected to show the fastest expansion rate due to young demographics and expanding e-commerce reach.

Latin America

Latin America holds 7% of the Virtual Online Fitness market in 2024. The region’s growth is driven by rising health awareness and the popularity of mobile fitness applications. Countries such as Brazil and Mexico lead adoption due to improving digital ecosystems. It benefits from the growing interest in affordable fitness solutions and flexible subscription models. Partnerships with local gyms and trainers strengthen online program availability. Live-streamed group classes gain popularity among younger consumers seeking engagement and motivation. The region’s share highlights its gradual but steady contribution to the global market.

Middle East & Africa

Middle East & Africa capture 6% of the Virtual Online Fitness market in 2024. Adoption is supported by increasing smartphone usage and growing investments in digital health. Consumers in the Gulf countries, such as the UAE and Saudi Arabia, lead demand. It reflects strong interest in premium fitness programs and wellness-focused lifestyles. The region faces challenges due to uneven internet access in rural areas, but urban centers show strong uptake. Fitness influencers and digital communities drive awareness and adoption. This market share underlines Middle East & Africa’s role as a developing but promising segment of global virtual fitness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Leading players in the Virtual Online Fitness market include MINDBODY, Inc., ClassPass, Fitness On Demand, Unscreen, Navigate Wellbeing Solutions, Sworkit (Nexercise, Inc.), Les Mills International Ltd., VIXY BV, Wellbeats, Move Technologies Group Ltd., and Wexer. These companies focus on delivering diverse virtual fitness experiences, ranging from live-streamed group sessions to personalized on-demand workouts. They leverage digital platforms, apps, and smart device integration to strengthen customer reach and engagement. Competitive strategies emphasize innovation in streaming quality, AI-driven customization, and interactive features that replicate in-person training environments. Partnerships with gyms, corporations, and wellness programs expand their market presence and create long-term user value. Strong emphasis on hybrid fitness models, combining online and offline formats, supports retention and broadens user appeal. Regional expansion also plays a key role, with providers entering emerging markets through localized offerings and flexible subscription models. Intense competition pushes companies to differentiate with niche content such as yoga, strength training, or senior-focused programs. The market remains highly dynamic, with technology adoption, user experience, and scalable content libraries driving competitive advantages. Collectively, these players shape the evolution of virtual fitness by aligning digital innovation with consumer demand for accessible, affordable, and engaging wellness solutions.

Recent Developments

- In March 2025, MINDBODY partnered with Rokt to deliver highly relevant online ad experiences to its fitness and wellness members

- In 2025, ClassPass, Mindbody, and Booker merged under the parent brand Playlist, with Fritz Lanman named CEO

- In 2024, Navigate Wellbeing Solutions announced expansion of employee wellbeing platforms focused on integrating more digital fitness modules, with emphasis on hybrid and virtual formats for remote teams.

Report Coverage

The research report offers an in-depth analysis based on Session Type, Streaming Type, Device Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with stronger adoption of hybrid fitness models.

- AI-driven personalization will enhance user engagement and workout efficiency.

- Wearable integration will strengthen tracking and real-time feedback.

- On-demand content will continue to dominate due to convenience and flexibility.

- Group-based interactive classes will grow with social and community features.

- Specialized programs for seniors and niche health needs will gain traction.

- Corporate wellness partnerships will drive wider adoption across industries.

- Emerging markets will contribute significantly with rising digital penetration.

- Virtual reality and immersive technologies will reshape user experiences.

- Continuous innovation will keep the market competitive and customer-focused.