Market Overview

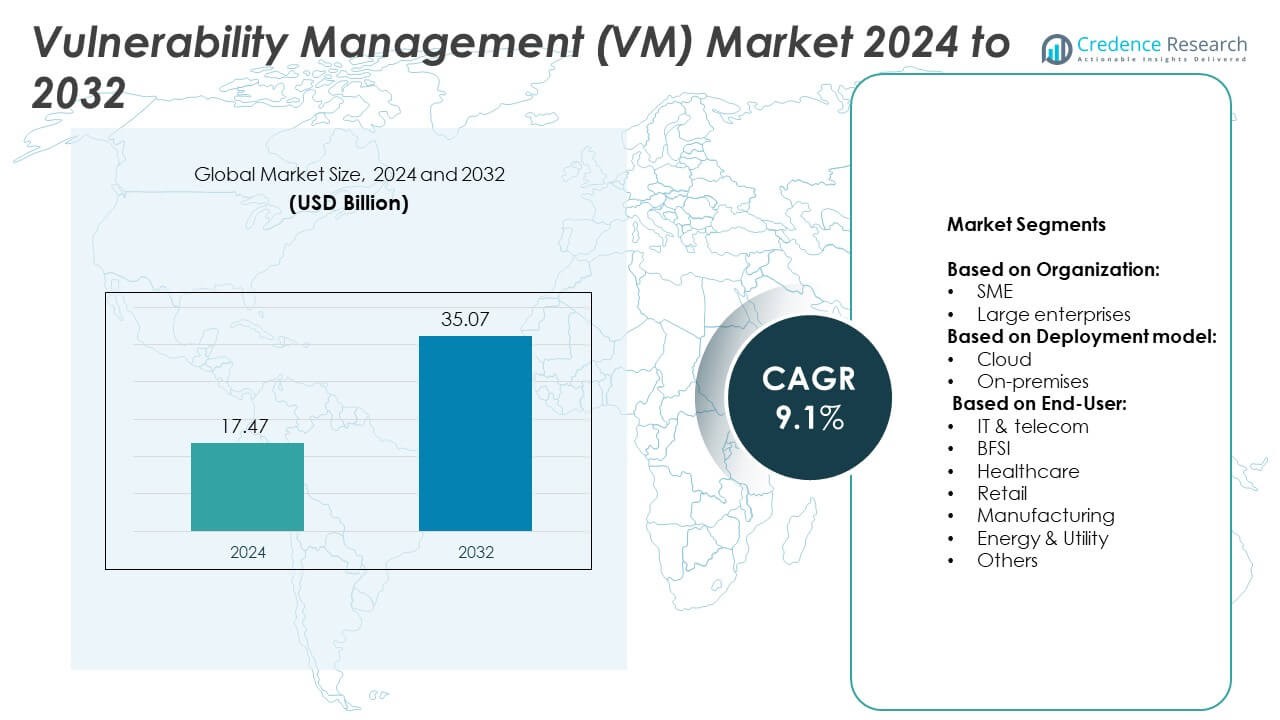

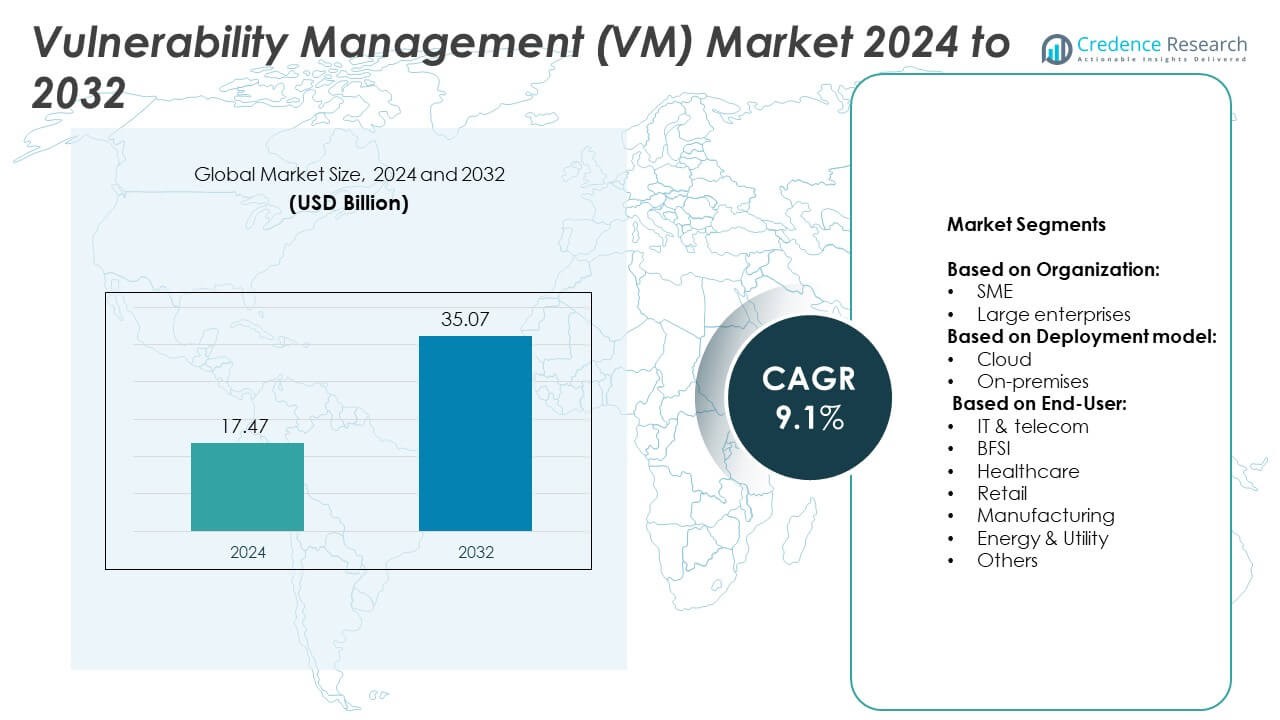

Vulnerability Management (VM) Market size was valued at USD 17.47 billion in 2024 and is anticipated to reach USD 35.07 billion by 2032, at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vulnerability Management (VM) Market Size 2024 |

USD 17.47 Billion |

| Vulnerability Management (VM) Market, CAGR |

9.1% |

| Vulnerability Management (VM) Market Size 2032 |

USD 35.07 Billion |

The Vulnerability Management (VM) market grows through rising cyber threats, strict compliance mandates, and rapid cloud adoption. Enterprises invest in real-time monitoring and automation to address evolving risks across hybrid infrastructures. AI and machine learning enhance predictive analytics, enabling risk-based prioritization and faster remediation. Demand from sectors such as BFSI, healthcare, and IT & telecom strengthens adoption. Vendors develop scalable, cloud-native solutions that support distributed environments, positioning vulnerability management as a key enabler of business resilience and cybersecurity strategy.

North America leads adoption of Vulnerability Management (VM) solutions, supported by advanced digital infrastructure and strict regulatory frameworks, while Europe emphasizes compliance with data protection standards and Asia Pacific records strong growth from rapid digitalization and expanding cyber risks. Latin America and the Middle East & Africa show steady adoption driven by rising cybercrime and national security initiatives. Key players shaping the market include Microsoft, Qualys, Tenable, and Rapid7, each focusing on innovation, automation, and AI-driven security frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Vulnerability Management (VM) market was valued at USD 17.47 billion in 2024 and is projected to reach USD 35.07 billion by 2032, growing at a CAGR of 9.1% during the forecast period.

- Rising cyberattacks, ransomware incidents, and zero-day vulnerabilities are driving enterprises to adopt advanced vulnerability management frameworks to safeguard critical infrastructure and ensure regulatory compliance.

- Cloud adoption, IoT expansion, and hybrid IT environments are fueling demand for scalable and cloud-native solutions, supported by continuous monitoring and predictive analytics.

- The market is competitive, with key players such as Ivanti, Microsoft, Qualys, Tenable, Rapid7, Tripwire, Symantec, and McAfee focusing on innovation, AI integration, and strategic partnerships to strengthen their global presence.

- High implementation costs, lack of skilled professionals, and complex IT environments act as restraints, creating challenges for organizations seeking streamlined vulnerability management solutions.

- North America remains the largest regional market with strong regulatory backing, Europe emphasizes data privacy and compliance standards, while Asia Pacific shows rapid growth due to digitalization and rising security risks; Latin America and the Middle East & Africa show steady adoption driven by national cybersecurity initiatives.

- Future growth will be supported by AI-driven predictive tools, risk-based vulnerability frameworks, and growing demand from BFSI, healthcare, manufacturing, and telecom sectors that rely on continuous protection against evolving threats.

Market Drivers

Growing Cybersecurity Threat Landscape Driving Demand for Proactive Defense

The Vulnerability Management (VM) market expands due to rising cyberattacks across industries. Organizations face advanced threats such as ransomware, phishing, and zero-day vulnerabilities. It increases the urgency for continuous scanning and remediation tools. Companies need solutions that provide real-time visibility into assets and risks. Governments and regulators enforce strict compliance mandates, raising adoption rates further. The pressure to safeguard digital operations drives enterprises toward robust vulnerability management platforms.

- For instance, Tenable’s Cloud Risk Report 2024, analyzing millions of cloud resources, noted that even 40 days after publication, over 80% of workloads contained a severe container escape vulnerability (CVE-2024-21626). The company serves over 44,000 customers globally.

Integration of Cloud Infrastructure Creating Need for Scalable Solutions

Rapid cloud adoption drives the need for scalable security frameworks. The Vulnerability Management (VM) market responds by offering platforms that adapt to hybrid and multi-cloud environments. It ensures monitoring across distributed assets without gaps in coverage. Businesses seek tools capable of managing vulnerabilities in dynamic, containerized, and virtualized systems. Vendors integrate automation to streamline updates and patching cycles. The shift to digital-first operations highlights the necessity of continuous vulnerability management for cloud-native systems.

- For instance, the Qualys Enterprise TruRisk™ Platform is now FedRAMP High authorized for government use, and its Policy Compliance app supports over 900 policies and 100 regulations, helping clients streamline compliance.

Regulatory Compliance and Industry Standards Encouraging Stronger Adoption

Organizations face growing pressure to meet global compliance requirements. The Vulnerability Management (VM) market supports enterprises by ensuring adherence to standards such as GDPR, HIPAA, and PCI DSS. It offers reporting features that demonstrate security readiness during audits. Non-compliance risks financial penalties, reputational damage, and business disruption. Enterprises prioritize tools that simplify governance and audit processes. Regulatory demands act as strong catalysts for embedding vulnerability management into business strategies.

Shift Toward Automation and Artificial Intelligence Enhancing Efficiency

Automation and artificial intelligence reshape vulnerability assessment practices. The Vulnerability Management (VM) market leverages AI-driven analytics for faster threat detection. It enables predictive insights that prioritize vulnerabilities based on potential impact. Automation reduces manual workloads and speeds patch management cycles. Companies benefit from reduced downtime and higher operational efficiency. Advanced technologies strengthen the ability to manage vulnerabilities at scale across complex IT ecosystems.

Market Trends

Expansion of Cloud-Native Vulnerability Management Solutions Supporting Hybrid Environments

The Vulnerability Management (VM) market is shifting toward cloud-native platforms tailored for hybrid IT infrastructures. Enterprises adopt solutions that secure workloads across public, private, and multi-cloud models. It addresses visibility gaps caused by distributed assets and complex architectures. Cloud-native tools integrate seamlessly with DevOps pipelines, supporting agile development cycles. Vendors design platforms that adapt to containerized applications and virtual networks. This trend reflects the increasing importance of security strategies aligned with digital transformation.

- For instance, Rapid7 provides cybersecurity solutions for enterprise clients, including continuous vulnerability assessments across multi-cloud environments like AWS, Azure, and GCP, using its InsightCloudSec platform. The platform is designed to handle the scale of large, modern cloud environments, and integrations are available for major cloud providers. Rapid7 serves a global customer base of over 11,000 clients, helping them manage multi-cloud risk and protect their entire attack surface.

Growing Focus on Continuous and Real-Time Vulnerability Assessment

Organizations move beyond periodic scanning models to embrace continuous monitoring frameworks. The Vulnerability Management (VM) market aligns with this demand by offering real-time detection and remediation tools. It ensures risks are identified immediately rather than during scheduled audits. Continuous assessment reduces the window of exposure to critical threats. Businesses value tools that provide live dashboards and instant alerts. The emphasis on ongoing visibility reflects the need for resilient defense strategies against fast-evolving cyber risks.

- For instance, in its 2025 Microsoft Vulnerabilities Report, based on 2024 data, BeyondTrust documented 1,360 total Microsoft vulnerabilities, highlighting the volume of risks that automation helps manage.

Integration of Artificial Intelligence and Machine Learning for Predictive Analytics

Artificial intelligence and machine learning increasingly shape the direction of security solutions. The Vulnerability Management (VM) market incorporates predictive analytics that ranks vulnerabilities by risk potential. It empowers teams to prioritize remediation efforts more effectively. AI-driven insights shorten response times by automating detection processes. Machine learning models evolve with new data, improving accuracy in identifying threats. This trend accelerates the industry’s transition toward intelligent and proactive security measures.

Rising Demand for Risk-Based Vulnerability Management Frameworks

Risk-based approaches gain traction across enterprise environments. The Vulnerability Management (VM) market embraces frameworks that assess threats by business impact rather than volume. It allows organizations to focus on vulnerabilities posing the highest risk to operations. Security teams adopt tools that combine contextual analysis with asset value mapping. Vendors enhance platforms with customizable risk scoring models. This trend positions vulnerability management as a business enabler rather than only a compliance-driven requirement.

Market Challenges Analysis

Complexity of IT Environments Limiting Effective Vulnerability Management Implementation

The Vulnerability Management (VM) market faces challenges due to highly fragmented IT landscapes. Enterprises operate across hybrid infrastructures, legacy systems, and diverse endpoints. It creates difficulties in achieving unified visibility and consistent risk assessment. Many organizations lack integration between vulnerability tools and broader security frameworks. This gap delays remediation processes and leaves critical weaknesses exposed. Vendors must address interoperability issues to ensure scalability and efficiency across complex environments.

Shortage of Skilled Professionals Hindering Adoption and Optimization Efforts

A global shortage of cybersecurity expertise impacts the growth of the Vulnerability Management (VM) market. Security teams often lack the skills to analyze large volumes of vulnerability data. It increases reliance on automation while still requiring human oversight for decision-making. Smaller enterprises face difficulties hiring and retaining trained personnel. The skills gap leads to delayed patch cycles and unaddressed security risks. Overcoming this challenge requires investment in training programs and user-friendly platforms that reduce operational complexity.

Market Opportunities

Rising Adoption of Cloud and IoT Ecosystems Creating New Growth Prospects

The Vulnerability Management (VM) market benefits from the rapid expansion of cloud platforms and IoT ecosystems. Enterprises demand solutions that secure interconnected devices, virtual networks, and distributed workloads. It creates opportunities for vendors to deliver scalable and adaptive platforms. The growing complexity of digital ecosystems requires tools capable of providing unified visibility and control. Companies seek platforms that address vulnerabilities across both traditional IT and emerging technologies. This opens avenues for specialized solutions targeting cloud-native applications and IoT-driven infrastructures.

Increased Demand for Risk-Based and AI-Driven Security Frameworks Expanding Market Potential

Organizations prioritize risk-based approaches to strengthen cyber resilience. The Vulnerability Management (VM) market responds with AI-powered solutions that automate detection and prioritize threats. It positions platforms as strategic assets supporting business continuity. Enterprises value predictive analytics that identify critical risks before exploitation. Vendors investing in machine learning and automation gain competitive advantage. Expanding capabilities in predictive security creates strong opportunities for long-term adoption across industries.

Market Segmentation Analysis:

By Organization:

The Vulnerability Management (VM) market divides into SMEs and large enterprises. Large enterprises dominate due to their complex IT networks and regulatory compliance demands. It drives adoption of advanced platforms with automation, analytics, and integration capabilities. SMEs show rising adoption as they face targeted cyberattacks despite having smaller budgets. Vendors focus on delivering cost-effective, simplified solutions that address SME needs without high infrastructure costs. Both segments emphasize continuous monitoring and proactive threat detection, though adoption speed varies with organizational scale.

- For instance, Fortinet provides automated vulnerability scanning and security solutions for multinational clients’ networks, utilizing products like FortiAnalyzer for SecOps automation and FortiClient for endpoint protection. The company’s capabilities are demonstrated by data from its 2025 Global Threat Landscape Report, which notes that over 40,000 new vulnerabilities were added to the National Vulnerability Database in 2024, a 39% rise from 2023.

By Deployment Model:

Deployment divides between cloud and on-premises models. Cloud deployment records stronger momentum, driven by its scalability and flexibility in supporting distributed workforces. It allows real-time updates and reduces dependence on in-house infrastructure. On-premises models remain relevant in industries with strict data sovereignty and compliance needs. Companies in defense, government, and banking rely on on-premises systems for control and security assurance. Vendors enhance offerings in both models to meet diverse compliance and operational requirements.

- For instance, Acunetix, a web application security scanner by Invicti, provides cloud-based vulnerability assessments designed for mid-sized firms. The scanner is capable of detecting over 7,000 web vulnerabilities, including common attacks like SQL Injections and Cross-site Scripting (XSS).

By End-User:

The market covers IT & telecom, BFSI, healthcare, retail, manufacturing, energy & utility, and others. The Vulnerability Management (VM) market witnesses high demand from IT & telecom due to large-scale data handling and cloud reliance. BFSI invests heavily to protect sensitive financial information from breaches and regulatory fines. Healthcare grows rapidly as electronic health records and connected devices expand exposure points. Retail focuses on securing e-commerce platforms and customer data. Manufacturing emphasizes protection of operational technologies and industrial systems against disruptions. Energy & utility requires robust frameworks to secure grids and critical infrastructure. Other industries adopt tools tailored to specific regulatory and operational needs.

Segments:

Based on Organization:

Based on Deployment model:

Based on End-User:

- IT & telecom

- BFSI

- Healthcare

- Retail

- Manufacturing

- Energy & Utility

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a share of 38% in the Vulnerability Management (VM) market, making it the leading regional segment. The region benefits from strong cybersecurity regulations, advanced digital infrastructure, and early adoption of security technologies. It shows high penetration across industries such as BFSI, IT & telecom, and healthcare, where data protection remains a top priority. Enterprises in the United States and Canada invest heavily in automated platforms that integrate vulnerability detection, patch management, and compliance reporting. It also experiences consistent demand due to the rise in ransomware and targeted attacks, pushing organizations to strengthen their defense mechanisms. Cloud adoption across enterprises further accelerates the implementation of vulnerability management frameworks. Vendors in the region leverage partnerships and mergers to expand portfolios, focusing on integrating AI-driven analytics and automation into their platforms. Strong government mandates and the presence of major security providers ensure North America retains a dominant position in global adoption.

Europe

Europe accounts for 27% of the Vulnerability Management (VM) market, supported by stringent data protection regulations such as GDPR and NIS2 directives. Regional enterprises adopt comprehensive frameworks to ensure compliance and maintain consumer trust. It records strong adoption across critical sectors including finance, utilities, and healthcare, where data sensitivity and infrastructure security remain key priorities. Germany, the United Kingdom, and France emerge as major contributors, with enterprises investing in real-time monitoring and risk-based prioritization. The region faces increasing threats from cross-border cyberattacks, making vulnerability management a critical part of security strategies. Cloud migration in Europe, supported by strict privacy regulations, drives demand for secure hybrid and multi-cloud platforms. Vendors expand offerings with tailored compliance reporting features to meet the diverse requirements of European enterprises. Europe’s mature regulatory ecosystem and focus on advanced defense frameworks secure its strong position within the global market.

Asia Pacific

Asia Pacific secures a 22% share of the Vulnerability Management (VM) market, demonstrating the fastest growth potential among regions. Rapid digitalization across China, India, Japan, and Southeast Asian economies drives large-scale adoption of security frameworks. It records heightened demand from BFSI, manufacturing, and telecom industries that face increased risks with expanding digital ecosystems. Governments in the region implement strict cybersecurity laws, reinforcing the need for proactive risk management. Cloud adoption grows significantly, with enterprises requiring platforms capable of managing vulnerabilities in dynamic, distributed environments. Vendors focus on offering scalable and cost-effective solutions suitable for enterprises of different sizes, particularly SMEs seeking affordable yet comprehensive frameworks. Asia Pacific also sees rising investment in AI-driven security tools that provide predictive insights, supporting the region’s shift toward modern, automated approaches. Expanding digital infrastructure and growing attack surfaces position the region as a key driver of long-term global growth.

Latin America

Latin America represents 7% of the Vulnerability Management (VM) market, reflecting steady adoption across key industries. Countries such as Brazil and Mexico lead adoption efforts due to rising cybercrime rates and growing awareness of regulatory compliance. It witnesses consistent demand in BFSI and retail, where digital transactions and e-commerce expansion heighten security risks. Enterprises increasingly seek risk-based frameworks that align with limited resources yet provide effective coverage. Vendors in the region emphasize cloud-based and managed solutions to reduce infrastructure costs for enterprises. Government-led initiatives to strengthen national cybersecurity strategies further promote the adoption of vulnerability management tools. Latin America’s growing reliance on digital platforms creates opportunities for expanding security investments, even though budgetary constraints remain a limiting factor.

Middle East & Africa

The Middle East & Africa holds a 6% share of the Vulnerability Management (VM) market, reflecting emerging opportunities. The region faces rising cyberattacks targeting government, energy, and financial institutions, driving investments in advanced platforms. It emphasizes the adoption of vulnerability frameworks in sectors such as oil & gas, utilities, and telecom, where operational disruptions can cause significant impact. Gulf Cooperation Council countries, particularly the UAE and Saudi Arabia, invest in advanced digital infrastructure, fueling demand for AI-driven and cloud-native security tools. It also shows rising adoption of compliance-focused frameworks, as regulators strengthen mandates for critical industries. Vendors in the region focus on offering tailored solutions that combine affordability with advanced automation. While overall market penetration is smaller compared to other regions, increasing digital transformation initiatives and high reliance on connected infrastructure position the Middle East & Africa as an emerging growth segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The leading players in the Vulnerability Management (VM) market include Ivanti, McAfee, Microsoft, Rapid7, Symantec, Tenable, Tripwire, and Qualys. These companies shape the competitive landscape through product innovation, global presence, and industry partnerships. Vendors focus on developing platforms that integrate advanced analytics, real-time monitoring, and automated remediation features. It helps enterprises reduce risks, improve compliance, and streamline vulnerability assessment processes across complex IT infrastructures. Cloud-native platforms and AI-driven solutions remain central to their strategies, ensuring adaptability in hybrid and multi-cloud environments. Strategic acquisitions and collaborations strengthen their portfolios, allowing broader service coverage and deeper integration with security ecosystems. Each vendor aims to differentiate by offering scalable solutions suited for both SMEs and large enterprises. Growing regulatory demands and the rising sophistication of cyberattacks drive continuous updates and feature enhancements. Competition also intensifies around providing risk-based frameworks that prioritize vulnerabilities based on business impact rather than volume. With evolving threat landscapes and increasing reliance on digital infrastructures, the market remains dynamic, where leading providers invest heavily in research and development to maintain competitive advantage. This strong rivalry ensures that enterprises gain access to advanced, reliable, and efficient vulnerability management solutions.

Recent Developments

- In 2025, Tenable Introduced enhancements to its vulnerability management platform with greater integration of AI for automated threat prioritization and risk scoring.

- In 2024, Rapid7 launched Attack Surface Management—including Surface Command and Exposure Command—integrated with various third‑party tools, and expanded features across the Command Platform

- In 2024, Microsoft significantly enhanced its vulnerability scanning capabilities, particularly for multicloud and hybrid environments, as part of the broader expansion of its Microsoft Defender platform

Report Coverage

The research report offers an in-depth analysis based on Organization, Deployment Model, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Vulnerability Management (VM) market will see stronger adoption of AI-driven platforms.

- Enterprises will prioritize risk-based frameworks to improve threat prioritization and remediation.

- Cloud-native solutions will expand with hybrid and multi-cloud environments gaining traction.

- Real-time monitoring will become essential to counter advanced and fast-evolving cyber threats.

- SMEs will adopt cost-effective platforms as cyberattacks target smaller organizations more frequently.

- Regulatory requirements will continue to drive higher investments in compliance-focused tools.

- Healthcare and BFSI sectors will remain major adopters due to sensitive data protection needs.

- Vendors will integrate automation to reduce manual workloads and shorten patch cycles.

- Demand for predictive analytics will rise to identify vulnerabilities before exploitation.

- Emerging markets in Asia Pacific and Middle East & Africa will drive significant growth opportunities.