Market Overview:

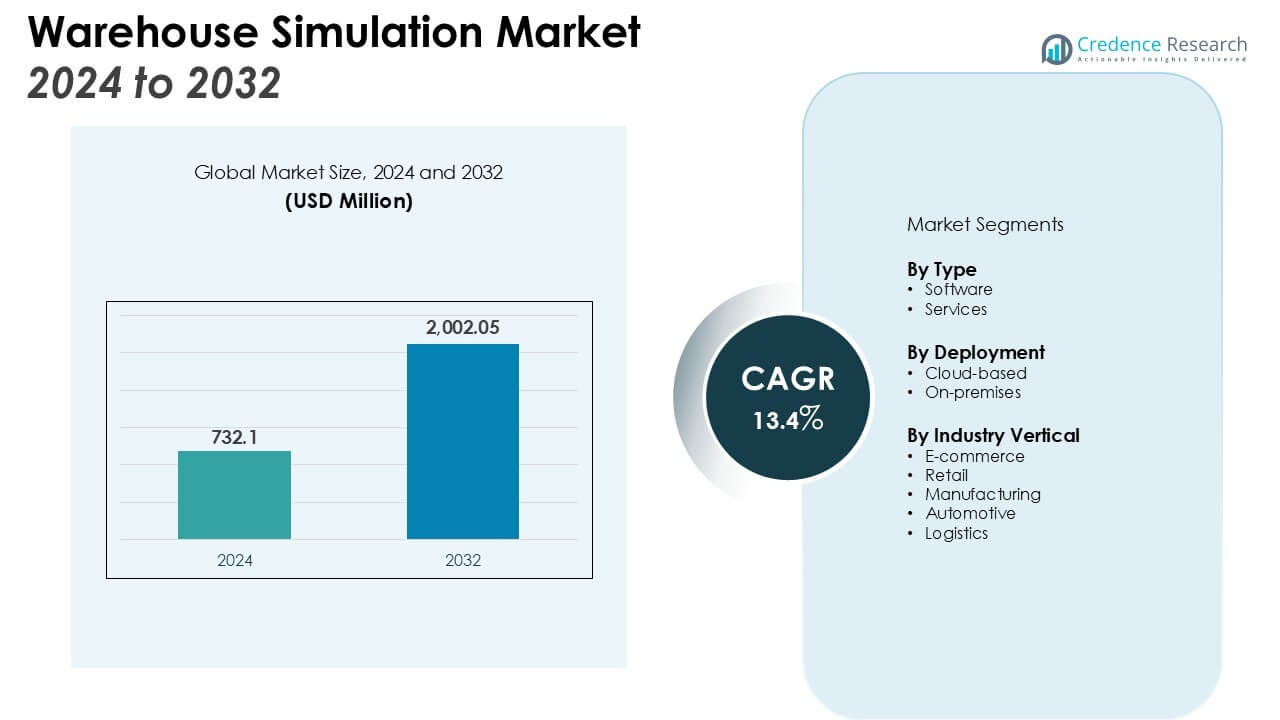

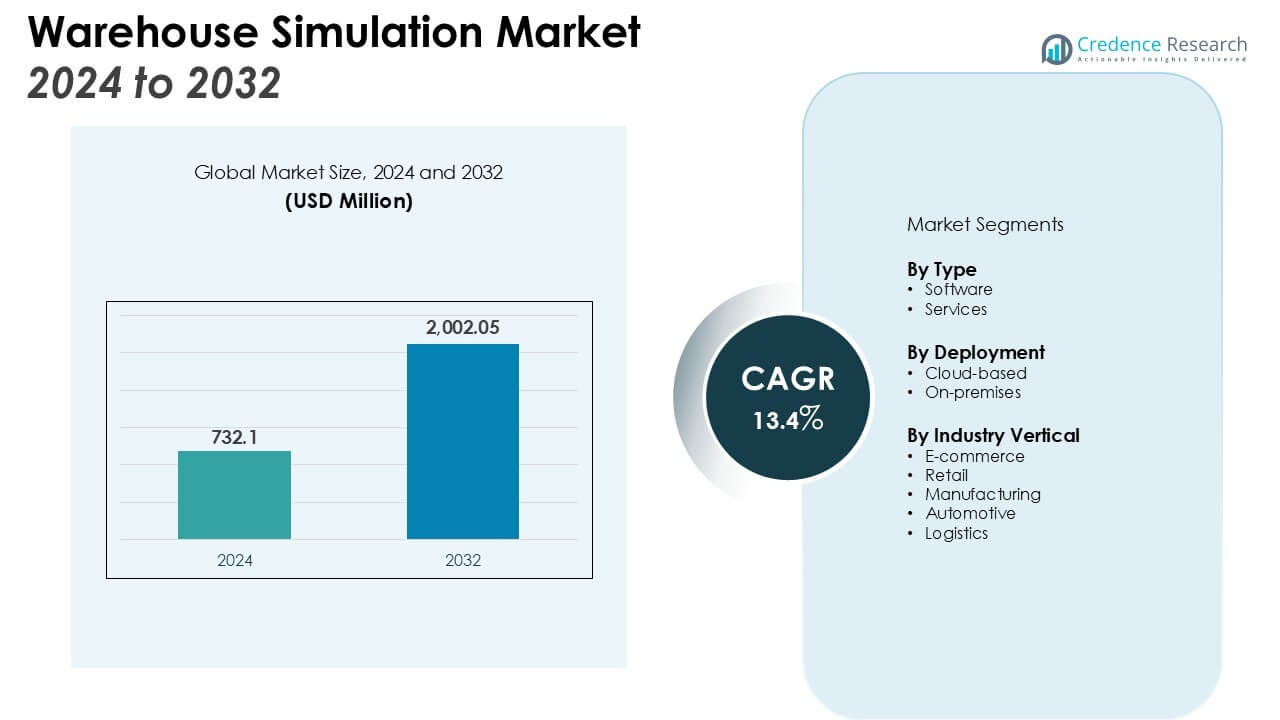

The Warehouse Simulation Market size was valued at USD 732.1 million in 2024 and is anticipated to reach USD 2,002.05 million by 2032, at a CAGR of 13.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Warehouse Simulation Market Size 2024 |

USD 732.1 Million |

| Warehouse Simulation Market, CAGR |

13.4% |

| Warehouse Simulation Market Size 2032 |

USD 2,002.05 Million |

The warehouse simulation market is expanding as companies face increasing pressure from the growth of e-commerce, which drives the need to optimize layouts, inventory flows, and picking operations. Rising labor costs and skill shortages are further encouraging businesses to adopt simulation-based automation planning to improve efficiency. In addition, advances in artificial intelligence, cloud computing, and digital twin technologies are strengthening the role of simulation by enabling real-time predictive modeling and more effective scenario planning.

The market shows strong adoption across key regions. Asia Pacific leads with significant investment in industrial expansion, e-commerce growth, and smart warehousing initiatives in major economies. North America maintains steady momentum supported by advanced e-commerce infrastructure, rising automation deployment, and demand for digitally integrated supply chains. Europe continues to grow as companies focus on operational efficiency, sustainability measures, and Industry 4.0-driven modernization of warehousing operations. Growing demand for resilient and flexible supply chains is further accelerating the adoption of warehouse simulation worldwide.

Market Insights:

- The Warehouse Simulation Market reached USD 732.1 million in 2024 and is forecasted to hit USD 2,002.05 million by 2032, growing at a CAGR of 13.4%.

- Expansion of global e-commerce is increasing demand for optimized layouts, inventory flows, and accurate picking operations.

- Rising labor costs and workforce shortages are encouraging companies to adopt simulation-based automation to improve efficiency.

- Artificial intelligence, digital twins, and cloud platforms are strengthening predictive modeling and real-time warehouse planning.

- High upfront costs, integration complexities, and cybersecurity risks remain key barriers to wider adoption.

- Asia Pacific leads with 39% share, followed by North America at 31% and Europe at 22%, reflecting strong regional adoption.

- Growing emphasis on sustainability, resilient supply chains, and digital transformation continues to drive simulation adoption worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Growth of E-commerce Driving Operational Efficiency Needs

The Warehouse Simulation Automation Market is benefiting from the surge in global e-commerce. Companies are under constant pressure to handle larger volumes, faster delivery timelines, and higher accuracy rates. Simulation tools allow firms to test different warehouse layouts, order flows, and automation strategies before physical implementation. This reduces costly trial-and-error in live operations. It strengthens decision-making and enables smoother adoption of advanced fulfillment systems.

- For instance, BMW Group uses advanced simulation for its factory logistics, allowing its production line to manufacture one car every 56 seconds.

Rising Labor Costs and Workforce Shortages Creating Automation Demand

Labor shortages and escalating wages are pushing organizations to seek alternatives that improve productivity. The Warehouse Simulation Automation Market provides solutions for modeling automated workflows, which reduce reliance on manual processes. Companies can evaluate the integration of robotics, automated guided vehicles, and conveyor systems in a simulated environment. This minimizes risks tied to workforce disruptions and ensures higher throughput. It also supports long-term cost control and operational consistency.

- For instance, Amazon has deployed over 1 million robots across its warehouse operations to handle repetitive tasks and improve fulfillment efficiency.

Integration of Artificial Intelligence and Digital Twins Enhancing Predictive Capabilities

Artificial intelligence and digital twin technology are reshaping warehouse planning strategies. The Warehouse Simulation Automation Market leverages these technologies to create accurate, real-time models of complex logistics systems. Businesses can forecast demand fluctuations, identify process bottlenecks, and optimize asset utilization. It delivers actionable insights that improve adaptability to market volatility. Such predictive modeling strengthens resilience and enhances overall warehouse performance.

Growing Focus on Sustainability and Energy Efficiency Encouraging Technology Adoption

Environmental regulations and corporate sustainability goals are driving investments in efficient warehouse operations. The Warehouse Simulation Automation Market supports this shift by enabling organizations to simulate energy usage, material handling flows, and space optimization strategies. Companies can assess greener alternatives and reduce resource wastage while maintaining service levels. It empowers enterprises to align operational efficiency with environmental responsibility. This focus on sustainable practices adds further momentum to simulation-based automation adoption.

Market Trends:

Advancements in AI, Cloud Platforms, and Digital Integration Reshaping Warehouse Operations

The Warehouse Simulation Automation Market is experiencing strong momentum from the integration of AI, cloud platforms, and digital technologies. These tools allow businesses to build accurate virtual models of warehouse environments, enabling them to test workflows before physical deployment. It provides visibility across inventory, workforce allocation, and equipment utilization, reducing inefficiencies and downtime. Cloud-enabled simulation ensures scalability and remote access, which supports global operations and multi-site coordination. Digital integration with enterprise resource planning and supply chain management systems strengthens real-time decision-making. This trend enhances agility, allowing companies to respond quickly to fluctuations in demand and supply chain disruptions.

- For instance, when automotive supplier BOOSTER Precision Components implemented the KUKA iiQoT platform for a transparent overview of its robot fleet, the integration for each robot took only about 10 minutes on average.

Rising Adoption of Robotics, IoT, and Data-Driven Optimization in Modern Warehousing

Robotics and IoT are driving a significant transformation in warehouse operations worldwide. The Warehouse Simulation Automation Market supports this trend by enabling firms to simulate robotic systems, automated guided vehicles, and sensor-enabled equipment before investments are made. It reduces risks linked to capital-intensive automation while ensuring alignment with operational goals. IoT-enabled data streams from sensors and connected devices are used to refine warehouse models, improving accuracy in planning and execution. Simulation platforms also allow enterprises to analyze large datasets and identify process improvements, which supports efficiency and cost reduction. This growing reliance on robotics and data-driven insights highlights a shift toward highly automated, intelligent, and connected warehouse ecosystems.

- For instance, an internal project at KUKA using its iiQoT software platform, built on Microsoft Azure IoT, demonstrated that data-driven optimization saved 25 hours of machine downtime and administrative work in a single year of production.

Market Challenges Analysis:

High Implementation Costs and Integration Complexities Limiting Wider Adoption

The Warehouse Simulation Automation Market faces challenges due to high upfront costs and integration complexities. Deploying advanced simulation platforms requires significant capital investment, which limits adoption among small and mid-sized enterprises. It also demands skilled professionals who can design, configure, and manage simulation models. Integration with existing warehouse management systems, robotics, and IoT platforms often requires customization, leading to delays and higher expenses. Businesses may hesitate to commit resources without clear short-term returns. These factors create barriers that slow market expansion in cost-sensitive industries.

Data Accuracy, Cybersecurity, and Resistance to Change Hindering Growth

Accurate data is critical for warehouse simulation models to deliver actionable insights, yet many companies struggle with incomplete or outdated datasets. The Warehouse Simulation Automation Market also faces risks related to cybersecurity, as cloud-enabled platforms must safeguard sensitive operational data. It raises concerns about data breaches and unauthorized access, which can deter adoption. Resistance to change within organizations further complicates implementation, as employees may view automation tools as a threat to existing roles. This cultural barrier slows digital transformation and reduces the potential benefits of simulation systems. Addressing these concerns is essential for the market to sustain long-term growth.

Market Opportunities:

Expansion of E-commerce, Automation Demand, and Digital Supply Chain Transformation

The Warehouse Simulation Automation Market has strong opportunities supported by the expansion of global e-commerce and rising demand for faster fulfillment. Companies are under pressure to manage large order volumes, optimize picking accuracy, and reduce delivery times. It allows businesses to design efficient layouts, test automated workflows, and improve order management before investing in physical infrastructure. Digital transformation of supply chains further enhances the role of simulation by enabling predictive planning and real-time visibility. Adoption of robotics, automated guided vehicles, and AI-driven platforms strengthens these opportunities. Growing investments in modern distribution centers create a favorable environment for simulation adoption.

Rising Focus on Sustainability, Cost Optimization, and Risk Mitigation Strategies

Sustainability goals and stricter environmental regulations are opening new growth avenues for the Warehouse Simulation Automation Market. Enterprises are seeking ways to minimize energy usage, reduce material wastage, and align operations with green standards. It enables organizations to evaluate energy-efficient systems, resource-saving layouts, and environmentally responsible automation models. Cost optimization is another major opportunity, as simulation helps reduce capital risks tied to automation investments. Businesses can test scenarios for labor allocation, equipment usage, and process efficiency without disrupting live operations. The growing need to build resilient and risk-proof supply chains further expands opportunities for simulation-driven automation.

Market Segmentation Analysis:

By Type

The Warehouse Simulation Automation Market by type includes software and services. Software holds a leading share due to its ability to model workflows, optimize layouts, and integrate predictive analytics into planning. Services play a vital role by offering customization, training, and ongoing maintenance to ensure operational efficiency. It allows enterprises to align simulation outcomes with specific warehouse needs while minimizing risks tied to implementation. The combined demand for both software and services is driving consistent market expansion.

- For instance, by using AnyLogic’s simulation software to model its operations, DHL Supply Chain identified optimizations that reduced its staffing needs by 66 employees for a large-scale warehouse.

By Deployment

By deployment, the Warehouse Simulation Automation Market is segmented into cloud-based and on-premises solutions. Cloud-based models are expanding quickly due to scalability, remote accessibility, and smooth integration with supply chain systems. On-premises deployment remains relevant for industries prioritizing data control and regulatory compliance. It enables businesses to select deployment strategies aligned with security and infrastructure requirements. This balanced demand supports adoption across multiple industry groups.

- For instance, in a warehouse with 500,000 SKUs, logistics provider DHL Supply Chain used simulation to test new picking strategies, which identified optimizations that reduced the required staff by 66 people.

By Industry Vertical

The Warehouse Simulation Automation Market serves e-commerce, retail, manufacturing, automotive, and logistics. E-commerce and retail dominate adoption, driven by growing order volumes and rapid delivery expectations. Manufacturing and automotive sectors are using simulation to optimize production-linked warehousing and material flows. Logistics providers leverage it to streamline distribution networks, cut delays, and reduce costs. This wide applicability highlights the versatility of simulation automation across consumer and industrial domains.

Segmentations:

By Type

By Deployment

By Industry Vertical

- E-commerce

- Retail

- Manufacturing

- Automotive

- Logistics

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Strong Growth Across Asia Pacific Driven by Industrial Expansion and E-commerce Boom

Asia Pacific holds 39% share of the Warehouse Simulation Automation Market, making it the leading regional market. Rapid industrial expansion and strong e-commerce activity are fueling this dominance. Countries such as China, India, Japan, and South Korea are investing heavily in smart warehousing and logistics automation. It is enabling businesses to manage rising demand for faster fulfillment and large-scale distribution. Government-backed digitalization programs and Industry 4.0 policies are further strengthening adoption. This robust growth positions Asia Pacific as the key hub for simulation-driven automation solutions.

North America Advancing with Automation, Digital Integration, and Strong E-commerce Infrastructure

North America accounts for 31% share of the Warehouse Simulation Automation Market, supported by its advanced logistics infrastructure. The region benefits from mature e-commerce ecosystems and high levels of automation adoption. Companies in the United States and Canada are using simulation with robotics, IoT, and digital supply chain tools to drive efficiency. It allows faster adaptation to shifting consumer demands and market dynamics. Investments in sustainable warehouse designs and predictive modeling are rising steadily. This focus on technology integration ensures North America remains a major contributor to global market growth.

Steady Growth in Europe Supported by Efficiency, Sustainability, and Industry 4.0 Initiatives

Europe represents 22% share of the Warehouse Simulation Automation Market, reflecting steady regional expansion. Demand is growing as companies invest in modernized warehouse systems focused on energy efficiency and sustainability. It is also supported by Industry 4.0 initiatives that encourage adoption of digital technologies across warehousing. Countries including Germany, the United Kingdom, and France are leading implementation with advanced automation strategies. Predictive analytics and real-time modeling are becoming central to operational improvements. These priorities ensure Europe continues to play a strong role in driving market development.

Key Player Analysis:

- The AnyLogic Company

- Rockwell Automation

- FlexSim Software Products, Inc.

- Dassault Systèmes

- Manhattan Associates

- Simio LLC

- Autodesk Inc

- Lanner

- Siemens

- ProModel Corporation

- Honeywell International Inc

Competitive Analysis:

The Warehouse Simulation Automation Market features a competitive landscape shaped by global technology providers and specialized simulation firms. Leading players focus on software innovation, integration capabilities, and advanced modeling tools that enhance warehouse planning and execution. It is driving strategic partnerships with logistics companies, e-commerce platforms, and manufacturing firms to expand customer reach. Vendors are also investing in artificial intelligence, digital twin technology, and IoT integration to strengthen predictive modeling and real-time decision-making. Regional companies are competing by offering cost-effective solutions tailored to local industries, while global players emphasize scalability and cross-industry applicability. Competition is intensifying as enterprises seek solutions that reduce costs, improve efficiency, and support sustainability initiatives. The emphasis on end-to-end automation and data-driven insights is shaping the strategies of key market participants. This competitive environment encourages continuous innovation and supports the long-term growth trajectory of warehouse simulation automation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments:

- In April 2025, FlexSim Software Products, Inc. announced that its Answers forum will be migrated to the Autodesk Forums platform, following its acquisition by Autodesk.

- In March 2025, Siemens finalized the acquisition of Altair Engineering Inc., a move intended to create a comprehensive AI-powered portfolio of industrial software.

- In August 2025, Autodesk launched freemium access to its AI-powered visual effects tool, Autodesk Flow Studio, which included a new free tier and reduced pricing for its Lite plan.

Report Coverage:

The research report offers an in-depth analysis based on Type, Deployment, Industry Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Warehouse Simulation Automation Market will expand with rising e-commerce volumes requiring faster and accurate fulfillment.

- It will benefit from increasing adoption of robotics, automated guided vehicles, and AI-powered warehouse systems.

- Companies will integrate digital twins and predictive analytics to improve planning and operational resilience.

- Simulation will gain importance in addressing labor shortages and reducing reliance on manual processes.

- Cloud-based platforms will continue to grow as enterprises demand scalability and remote accessibility.

- Sustainability goals will drive adoption of simulation to optimize energy use and reduce waste.

- Regional growth will remain strong in Asia Pacific, supported by industrial expansion and digital infrastructure.

- North America will advance with high automation adoption and demand for digitally integrated supply chains.

- Europe will see steady growth as Industry 4.0 initiatives push modernization and efficiency in warehouses.

- Continuous innovation and competitive pressure will ensure simulation platforms deliver greater adaptability and value.