Market Overview

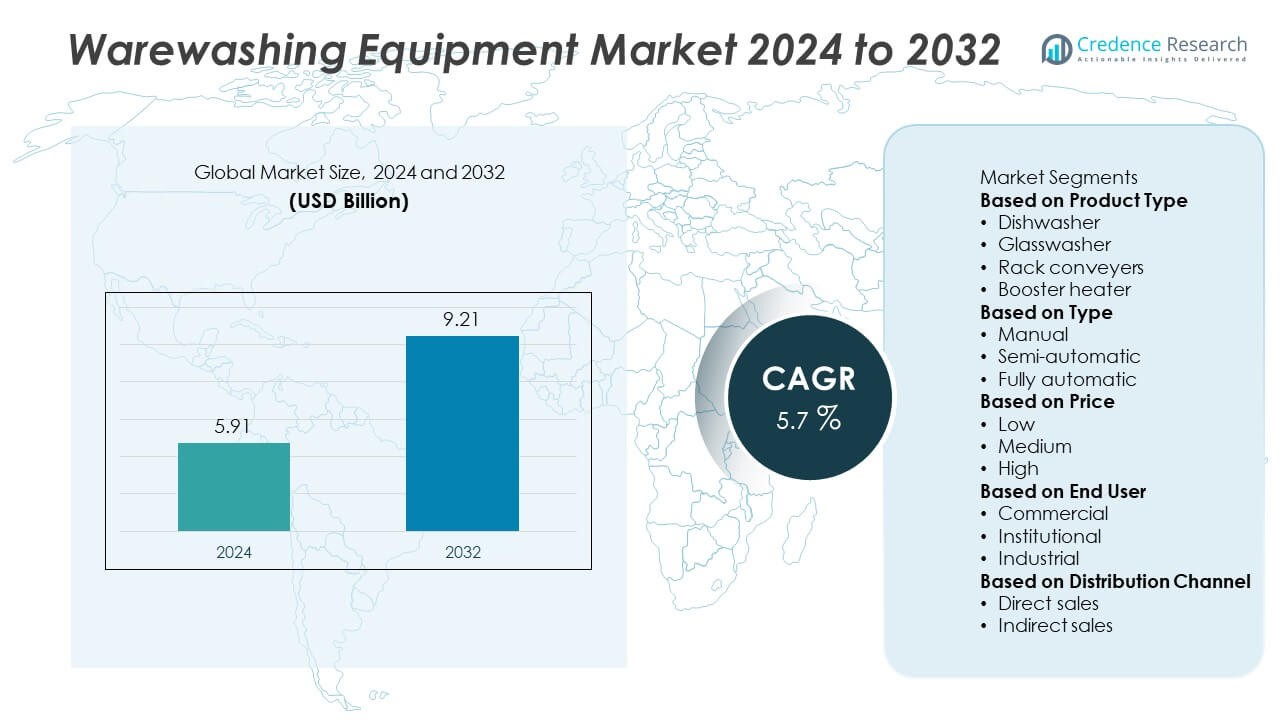

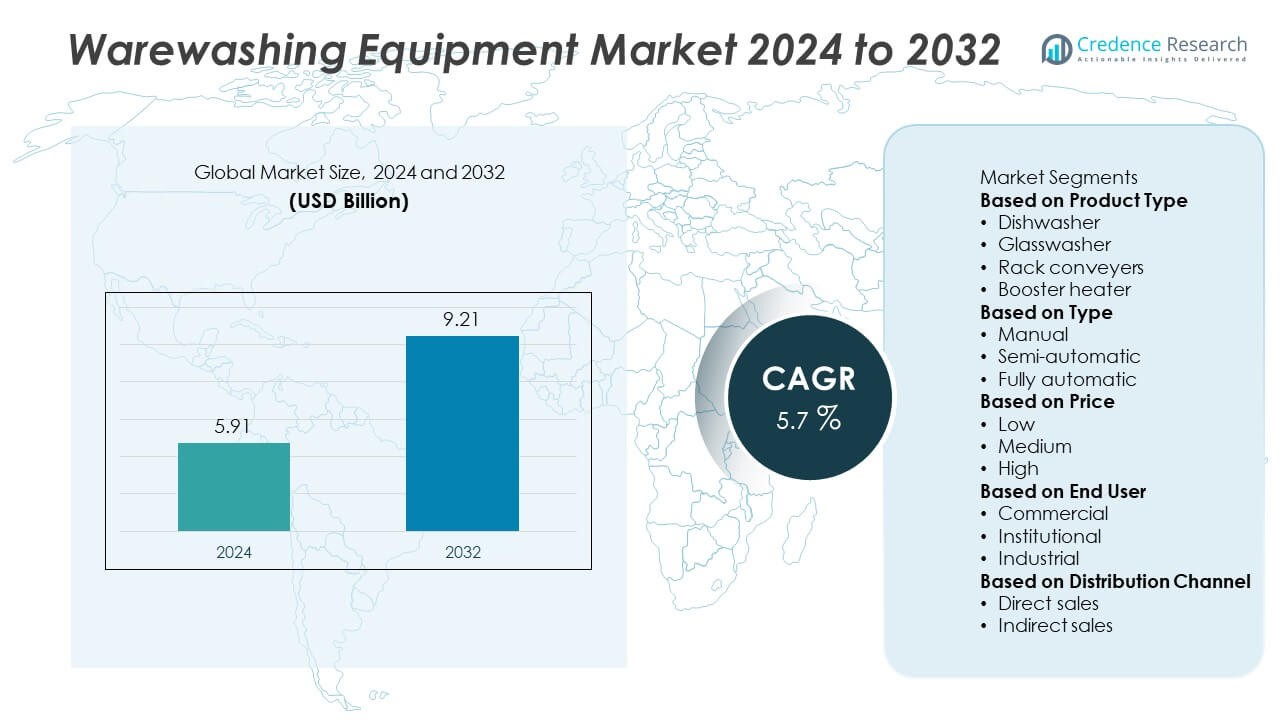

The Warewashing Equipment Market size was valued at USD 5.91 billion in 2024 and is anticipated to reach USD 9.21 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Warewashing Equipment Market Size 2024 |

USD 5.91 Billion |

| Warewashing Equipment Market, CAGR |

5.7% |

| Warewashing Equipment Market Size 2032 |

USD 9.21 Billion |

The Warewashing Equipment Market grows through rising demand from hospitality, foodservice, and institutional kitchens worldwide. Increasing hygiene regulations and food safety standards drive adoption of advanced dishwashers, glasswashers, and utensil washers. It supports efficiency, reduces labor dependency, and ensures consistent cleaning performance.

The Warewashing Equipment Market demonstrates strong global adoption, with distinct growth drivers across regions. North America leads with advanced adoption in restaurants, quick-service outlets, and institutional kitchens supported by strict hygiene standards. Europe emphasizes sustainability and energy-efficient solutions, with countries such as Germany, Italy, and the UK investing heavily in eco-friendly warewashing technologies. Asia-Pacific grows rapidly with China, Japan, and India driving demand from expanding hospitality, foodservice, and healthcare sectors. Latin America and the Middle East & Africa show steady uptake fueled by tourism, retail expansion, and modernization of foodservice operations. Key players including Electrolux, Ali Group, Ecolab, and Jackson WWS strengthen the market by focusing on innovation, automation, and sustainability. Their strategies involve offering high-capacity dishwashers, glasswashers, and modular systems tailored for diverse customer needs. By combining advanced technology with compliance-focused designs, these companies enhance competitiveness and support widespread adoption across developed and emerging markets.

Market Insights

- The Warewashing Equipment Market was valued at USD 5.91 billion in 2024 and is projected to reach USD 9.21 billion by 2032, growing at a CAGR of 5.7%.

- Rising demand from restaurants, hotels, and institutional kitchens drives adoption of efficient dishwashers, glasswashers, and utensil washers.

- Energy-efficient, eco-friendly, and water-saving models are gaining traction as sustainability becomes a priority in foodservice operations.

- Leading companies such as Electrolux, Ali Group, Ecolab, and Jackson WWS compete by focusing on automation, compact modular designs, and compliance with hygiene standards.

- High initial investment and ongoing maintenance costs act as restraints, slowing adoption among small and medium-sized operators in cost-sensitive regions.

- North America shows strong demand due to quick-service restaurants and institutional kitchens, while Europe emphasizes green technologies and compliance with food safety standards.

- Asia-Pacific grows rapidly through expansion of hospitality, foodservice, and healthcare sectors, while Latin America and the Middle East & Africa show emerging opportunities driven by tourism growth and modernization of foodservice infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Foodservice and Hospitality Industry

The Warewashing Equipment Market is strongly driven by the expansion of the foodservice and hospitality industries. Restaurants, hotels, and catering services require reliable warewashing solutions to maintain hygiene standards and ensure customer satisfaction. It supports faster cleaning processes that reduce labor dependency and improve turnaround times during peak hours. Increasing dining-out culture and growth of quick-service restaurants contribute to higher adoption of professional dishwashers and glasswashers. Institutional kitchens in schools, hospitals, and corporate facilities also create consistent demand. The continuous growth of foodservice establishments reinforces warewashing equipment as an operational necessity.

- For instance, CMA Dishmachines launched the EST 44 conveyor dishwasher, capable of washing 249 racks per hour while using just 0.49 gallons of water per rack, allowing restaurants and hotels to manage peak dining volumes efficiently.

Strict Hygiene Regulations and Food Safety Compliance

The Warewashing Equipment Market benefits from rising enforcement of hygiene and sanitation standards across foodservice operations. Governments and health authorities implement strict regulations to prevent foodborne illnesses and contamination risks. It compels restaurants and institutional kitchens to invest in advanced warewashing machines that deliver consistent cleaning quality. Compliance with these standards strengthens consumer trust and brand reputation for operators. Growing inspection frequency and certification requirements further accelerate adoption. It makes professional warewashing systems a critical component in modern kitchens.

- For instance, Meiko introduced the UPster H500 ActiveClean hood dishwasher with integrated water softening, eliminating the need for a separate unit and ensuring consistent compliance with hygiene standards in hospitals and institutional kitchens.

Technological Advancements in Efficiency and Sustainability

The Warewashing Equipment Market gains momentum from continuous innovation in efficiency and eco-friendly technologies. Manufacturers introduce models that minimize water, detergent, and energy use without compromising performance. It helps operators reduce operational costs while meeting sustainability goals. Digital controls, smart sensors, and automated cycles enhance ease of use and reliability. Compact designs with high throughput capability are developed to support diverse kitchen layouts. It positions advanced warewashing equipment as both cost-effective and environmentally responsible.

Growth of Quick-Service Restaurants and Institutional Kitchens

The Warewashing Equipment Market experiences strong demand from quick-service restaurants and large-scale institutional kitchens. Fast-food chains and delivery-based kitchens require high-capacity systems to manage continuous dishwashing loads. It ensures operational efficiency and compliance with hygiene standards in time-sensitive environments. Institutional kitchens in healthcare, education, and corporate settings also adopt durable warewashing solutions for long-term use. Rising disposable incomes and urbanization expand the dining-out trend, further strengthening market demand. It highlights the importance of warewashing systems in large-scale foodservice and institutional operations.

Market Trends

Adoption of Energy-Efficient and Eco-Friendly Models

The Warewashing Equipment Market is witnessing a strong shift toward energy-efficient and eco-friendly models. Manufacturers focus on reducing water, detergent, and electricity consumption while maintaining high cleaning performance. It aligns with global sustainability goals and lowers operating costs for foodservice operators. Demand for ENERGY STAR-certified dishwashers and glasswashers continues to grow across restaurants and hotels. Operators prefer solutions that balance efficiency with environmental responsibility. It strengthens the trend toward greener and cost-saving warewashing systems.

- For instance, The Electrolux green&clean Multi Rinse Rack-Type Dishwasher uses 0.4 liters of water per rack, not “one glass,” and processes up to 150 racks per hour. The “one glass of water” phrasing is a marketing exaggeration of its high efficiency. Its low water use is achieved through a multi-rinse system that recycles water.

Integration of Automation and Smart Technologies

The Warewashing Equipment Market benefits from rising adoption of automation and smart connectivity. Advanced systems include digital controls, programmable wash cycles, and real-time monitoring features. It allows operators to optimize cleaning processes and reduce human error. Smart diagnostics and predictive maintenance help minimize downtime and servicing costs. Telematics integration supports centralized control for multi-unit operations such as chain restaurants and hotels. It drives the trend toward intelligent warewashing solutions with higher reliability.

- For instance, Hobart introduced its FLOW Line with SMART VISION CONTROL, trained on over 80,000 washware images, enabling AI-powered recognition and automatic cycle adjustment in fractions of a second.

Rising Popularity of Compact and Modular Designs

The Warewashing Equipment Market shows growing demand for compact and modular designs. Urban kitchens and small foodservice establishments face limited space, requiring efficient equipment layouts. It encourages adoption of under-counter dishwashers and modular systems tailored for smaller areas. Modular configurations allow scalability, enabling operators to expand capacity as needed. These flexible solutions meet the requirements of diverse operations from cafes to large catering units. It highlights a trend toward adaptable warewashing designs in modern kitchens.

Expansion of Quick-Service and Chain Restaurants Worldwide

The Warewashing Equipment Market gains momentum from the rapid growth of quick-service restaurants and global chain outlets. High-volume kitchens rely on conveyor dishwashers and multi-rack systems to maintain efficiency. It ensures fast turnaround, critical for meeting demand in delivery-focused and dine-in models. Chain operators prefer standardized equipment across outlets to streamline maintenance and performance. The expansion of fast-food brands in emerging economies strengthens adoption further. It underlines the increasing importance of warewashing equipment in scaling global foodservice operations.

Market Challenges Analysis

High Initial Investment and Operating Costs

The Warewashing Equipment Market faces a key challenge in high upfront and ongoing costs. Advanced dishwashers, glasswashers, and conveyor systems require significant capital investment, which limits accessibility for small and mid-sized foodservice operators. It also involves continuous expenses for water, energy, and detergents that raise operating budgets. Maintenance and servicing costs further increase the financial burden, especially for high-capacity systems. Many smaller establishments delay or avoid upgrading due to these expenses. It creates a gap between growing demand for modern equipment and actual adoption in price-sensitive markets.

Operational Complexity and Workforce Limitations

The Warewashing Equipment Market also encounters challenges linked to operational complexity and workforce skills. Modern systems with advanced controls and programmable cycles require trained staff for efficient handling. It becomes difficult for small restaurants or institutions with limited training resources. Breakdowns or improper usage often lead to downtime, hygiene risks, and higher servicing needs. In some regions, limited access to after-sales support and spare parts creates delays in maintenance. It highlights the dependence of the market on workforce training and reliable service infrastructure for smooth operations.

Market Opportunities

Expansion of Hospitality and Foodservice Sectors

The Warewashing Equipment Market presents strong opportunities through the expansion of global hospitality and foodservice sectors. Rising demand from hotels, restaurants, and catering services strengthens the need for high-capacity and efficient cleaning systems. It supports quick turnaround, compliance with hygiene standards, and operational efficiency. Tourism growth and urban dining trends create continuous demand for reliable warewashing equipment. Institutional kitchens in hospitals, schools, and corporate facilities also contribute to this expansion. It positions warewashing systems as essential investments for both small-scale and large-scale operators aiming for long-term efficiency.

Innovation in Sustainable and Smart Technologies

The Warewashing Equipment Market benefits from opportunities created by sustainable and connected solutions. Manufacturers are introducing energy-efficient systems with reduced water and detergent consumption to align with green practices. It appeals to operators focused on lowering costs and meeting environmental regulations. Integration of smart controls, remote monitoring, and predictive maintenance enhances reliability and reduces downtime. Compact and modular designs provide flexibility for urban kitchens with limited space. It creates opportunities for suppliers to differentiate through innovation, sustainability, and user-friendly features in professional warewashing solutions.

Market Segmentation Analysis:

By Product Type

The Warewashing Equipment Market by product type includes dishwashers, glasswashers, utensil and pot washers, and conveyor systems. Dishwashers dominate demand as they are essential in restaurants, hotels, and catering units where high-volume cleaning is required. It ensures consistent hygiene, faster turnaround, and compliance with food safety standards. Glasswashers find strong demand in cafes, bars, and fine dining outlets, where presentation and quality are crucial. Utensil and pot washers are preferred in institutional kitchens, hospitals, and large catering facilities managing heavy-duty cleaning. Conveyor systems are gaining traction in large-scale foodservice operations and quick-service restaurants, where continuous and automated cleaning supports efficiency. It reflects how each product type addresses specific operational needs across different service environments.

- For instance, Winterhalter’s FlexSpeed technology adjusts conveyor speed for efficient workflow but does not increase washing capacity. The high capacity, like the reported 6,600 plates per hour, is characteristic of their high-volume flight-type dishwashers.

By Type

The Warewashing Equipment Market by type is segmented into under-counter units, door-type machines, rack-type machines, and flight/conveyor-type systems. Under-counter units are favored by small and medium-sized establishments due to their compact design and space-saving benefits. Door-type machines suit mid-sized restaurants and institutional kitchens requiring higher capacity without complex setups. Rack-type machines deliver flexibility and efficiency, making them suitable for both independent operators and chain outlets. Flight and conveyor-type systems lead adoption in large-scale foodservice and quick-service restaurants, where speed and volume handling are critical. It highlights how type segmentation supports varied needs from compact operations to industrial-level cleaning.

- For instance, Meiko unveiled the UPster H500 ActiveClean hood-type dishwasher, capable of washing up to 60 racks per hour with integrated water softening, ensuring hygiene compliance for mid- to large-sized kitchens.

By Price

The Warewashing Equipment Market by price divides into low, medium, and premium categories. Low-priced units attract small restaurants, cafes, and independent operators seeking cost-effective solutions. It ensures accessibility while meeting basic hygiene requirements. Medium-priced models dominate adoption due to their balance of affordability, efficiency, and reliability, making them popular among mid-sized businesses. Premium units, equipped with advanced features such as automation, energy efficiency, and smart connectivity, appeal to large restaurants, hotels, and institutions. Operators in premium segments prioritize long-term savings, sustainability, and advanced performance despite higher upfront costs. It demonstrates how price segmentation expands the market’s reach across small, mid-scale, and large professional kitchens.

Segments:

Based on Product Type

- Dishwasher

- Glasswasher

- Rack conveyers

- Booster heater

Based on Type

- Manual

- Semi-automatic

- Fully automatic

Based on Price

Based on End User

- Commercial

- Institutional

- Industrial

Based on Distribution Channel

- Direct sales

- Indirect sales

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 34% share of the Warewashing Equipment Market, supported by a mature foodservice and hospitality industry. The United States drives regional growth with a dense network of restaurants, quick-service outlets, and institutional kitchens requiring advanced cleaning solutions. It benefits from strict hygiene and sanitation regulations that mandate the use of reliable warewashing systems. Canada contributes through adoption in hotels, hospitals, and educational institutions where compliance standards remain high. Mexico shows growing demand from expanding urban restaurants and foodservice operations. The presence of leading manufacturers and strong distribution networks ensures continuous adoption across the region. It positions North America as a dominant market focused on efficiency, safety, and regulatory compliance.

Europe

Europe accounts for a 30% share of the Warewashing Equipment Market, fueled by strong hospitality, catering, and tourism sectors. Germany, the UK, France, and Italy are key adopters with high demand for both dishwashers and glasswashers in foodservice operations. It benefits from the European Union’s emphasis on sustainability and energy efficiency, which drives preference for eco-friendly equipment. The region also shows strong adoption of conveyor and rack-type machines in chain restaurants and large hotels. Strict hygiene regulations support the widespread use of advanced warewashing solutions across institutional kitchens and healthcare facilities. It highlights Europe as a hub for innovation in sustainable and high-performance warewashing technologies.

Asia-Pacific

Asia-Pacific holds a 23% share of the Warewashing Equipment Market, making it one of the fastest-growing regions. China leads adoption with rising demand from hotels, catering companies, and institutional kitchens, driven by urbanization and rapid growth in foodservice. Japan and South Korea invest in advanced, compact, and energy-efficient systems tailored for urban restaurants. India contributes through expanding hospitality, retail food chains, and healthcare facilities that increasingly rely on modern warewashing systems. Southeast Asian nations, including Thailand and Indonesia, strengthen adoption as tourism and urban dining expand. The region benefits from increasing foreign investments in hospitality and foodservice infrastructure. It positions Asia-Pacific as a dynamic market with significant long-term growth potential.

Latin America

Latin America represents a 7% share of the Warewashing Equipment Market, reflecting gradual adoption supported by modernization of foodservice infrastructure. Brazil leads demand with strong uptake across urban restaurants, hotels, and institutional kitchens. Mexico and Argentina follow with expanding foodservice and retail sectors that strengthen adoption of mid-range warewashing solutions. Regional growth is supported by rising tourism projects, especially in Brazil and Mexico. Limited budgets in smaller establishments constrain adoption of premium systems, yet international suppliers are expanding distribution partnerships. It reflects steady growth potential where modernization and tourism-driven projects drive demand.

Middle East & Africa

The Middle East & Africa account for a 6% share of the Warewashing Equipment Market, supported by rising investments in hospitality and institutional kitchens. The UAE and Saudi Arabia lead adoption with increasing demand from luxury hotels, resorts, and international restaurants. It benefits from strong tourism development and government-backed hospitality projects. Africa, led by South Africa and Egypt, shows adoption in healthcare and educational institutions. Budget constraints and limited local manufacturing remain barriers, yet international partnerships support technology transfer. It positions the region as an emerging market with long-term opportunities linked to tourism growth and modernization of foodservice operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Illinois Food Equipment

- Jackson WWS

- Electrolux

- Ali Group

- Fujimak

- CMA Dishmachines

- Ecolab

- Insinger Machine

- Dover

- Fagor Industrial

Competitive Analysis

The competitive landscape of the Warewashing Equipment Market features leading players such as Electrolux, Ali Group, Ecolab, Jackson WWS, CMA Dishmachines, Fagor Industrial, Fujimak, Insinger Machine, Illinois Food Equipment, and Dover. These companies compete by emphasizing innovation, energy efficiency, and compliance with stringent hygiene standards to meet the demands of global foodservice and hospitality sectors. They invest in advanced technologies, including automation, water-saving systems, and smart controls, to enhance efficiency and reduce operational costs for end users. Product portfolios span dishwashers, glasswashers, and utensil washers, with modular and compact solutions gaining importance in space-constrained kitchens. Strategic partnerships with restaurants, hotels, healthcare facilities, and institutional kitchens expand customer bases while strengthening global presence. Sustainability remains central, with manufacturers focusing on eco-friendly models that minimize electricity, detergent, and water usage. Companies also differentiate by providing strong after-sales support, training, and service networks to ensure operational reliability. Growing tourism, foodservice expansion, and stricter hygiene laws further intensify competition, positioning key players to leverage innovation and long-term strategies to maintain leadership across both developed and emerging markets.

Recent Developments

- In August 2025, Fujimak continued to supply advanced warewashing solutions for industrial-scale and professional kitchens.

- In April 2025, Electrolux Professional introduced its green&clean Multi Rinse Rack Type Dishwasher, capable of processing 150–300 racks per hour using just one glass of water per rack. The unit features a low water rinse module designed for commercial kitchens.

- In March 2025, CMA Dishmachines debuted their EST 44 conveyor dishwasher featuring a dual-heat, dual-rinse system, able to clean 249 racks per hour while consuming just 0.49 gallons of water per rack—a milestone for high-efficiency commercial washing.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Type, Price, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising demand from restaurants, hotels, and catering services.

- Energy-efficient and eco-friendly models will gain stronger adoption in foodservice operations.

- Automation and smart controls will improve efficiency and reduce manual intervention.

- Compact and modular designs will support urban kitchens with limited space.

- Quick-service restaurants and chain outlets will continue to drive large-scale installations.

- Institutional kitchens in hospitals, schools, and corporate facilities will strengthen demand.

- Manufacturers will focus on water-saving and detergent-efficient technologies to meet regulations.

- Tourism growth will expand adoption of advanced warewashing equipment in emerging regions.

- Strategic partnerships and service networks will enhance competitiveness for key players.

- Innovation in sustainable solutions will shape the long-term direction of the market.