Market Overview:

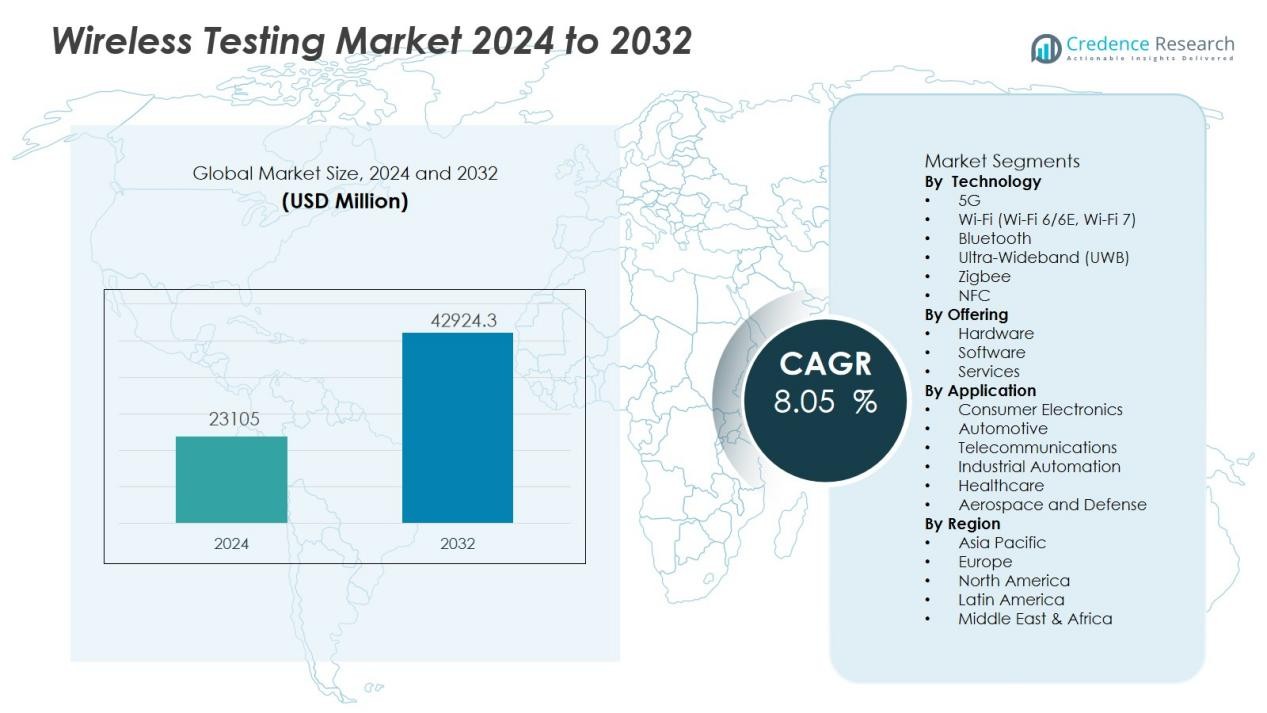

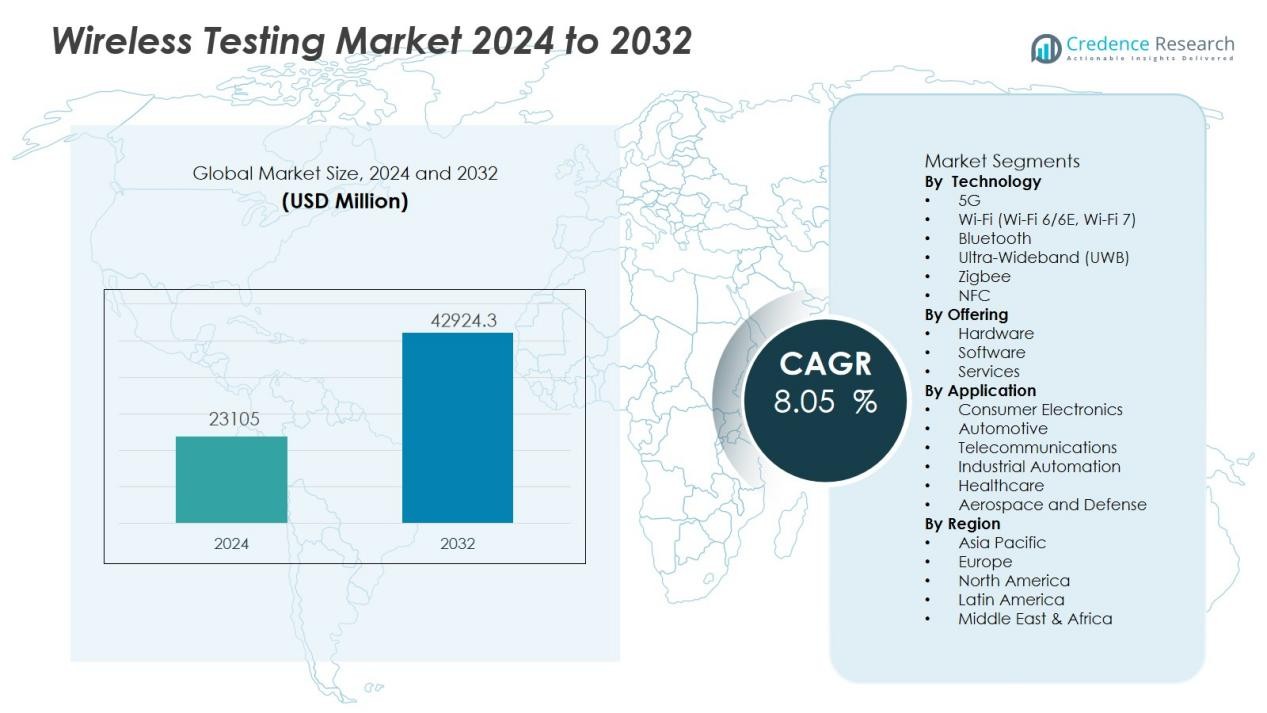

The Wireless testing market size was valued at USD 23105 million in 2024 and is anticipated to reach USD 42924.3 million by 2032, at a CAGR of 8.05 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless testing market Size 2024 |

USD 23105 Million |

| Wireless testing market , CAGR |

8.05 % |

| Wireless testing market Size 2032 |

USD 42924.3 Million |

Key drivers of the wireless testing market include rapid technological advancements in wireless communication standards, such as Wi-Fi 6/6E, Bluetooth 5.x, and ultra-wideband (UWB), which require rigorous testing for performance, security, and compliance. The rising adoption of Internet of Things (IoT) devices and smart home applications has created new opportunities for test solution providers. In addition, the ongoing digital transformation in industrial sectors and the emergence of Industry 4.0 concepts are accelerating investments in wireless testing to ensure reliability and safety.

Regionally, North America commands the largest share of the wireless testing market, supported by early adoption of cutting-edge technologies and robust R&D activities. Asia-Pacific is expected to witness the fastest growth due to expanding manufacturing capabilities, rapid urbanization, and increased investments in 5G networks and IoT infrastructure. Europe maintains steady market momentum, driven by strong regulatory frameworks and a focus on technological innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The wireless testing market reached USD 23,105 million in 2024 and is projected to rise to USD 42,924.3 million by 2032, at a CAGR of 8.05% during 2024–2032.

- Rapid advancements in wireless standards such as 5G, Wi-Fi 6/6E, Bluetooth 5.x, and UWB drive strong demand for rigorous performance, security, and compliance testing.

- Widespread adoption of IoT devices and smart home technologies increases the need for reliable and comprehensive wireless testing across industries.

- Strict regulatory frameworks and certification requirements compel manufacturers to invest in advanced testing labs and automated solutions.

- Digital transformation and Industry 4.0 initiatives in manufacturing and industrial sectors accelerate the demand for robust wireless testing to ensure reliability and safety.

- Complexity of evolving wireless standards and high operational costs present challenges, especially for smaller market participants.

- North America leads with 36% market share, Asia-Pacific emerges as the fastest-growing region with 31%, and Europe maintains a stable position at 24% share, each driven by technology adoption, regulatory strength, and industrial focus.

Market Drivers:

Rapid Evolution of Wireless Communication Standards Demands Rigorous Testing:

The wireless testing market experiences significant growth due to continual advances in wireless communication protocols, including 5G, Wi-Fi 6/6E, Bluetooth 5.x, and ultra-wideband (UWB). Manufacturers must rigorously validate device interoperability, data speed, and signal reliability to comply with evolving standards. Each new generation of wireless technology introduces complex frequency bands and advanced modulation schemes, making precise testing essential for performance and safety. This environment creates robust demand for cutting-edge testing solutions across device development cycles.

- For instance, in 2023, Qualcomm achieved the world’s fastest 5G sub-6 GHz downlink with a peak speed record of 7.5 Gbps using the Snapdragon X75, demonstrating the exceptional performance metrics now possible through advanced wireless testing

Proliferation of IoT Devices and Connected Ecosystems Fuels Demand:

Rapid adoption of Internet of Things (IoT) devices across consumer, industrial, and healthcare sectors heightens the need for comprehensive wireless testing. IoT devices require seamless connectivity and stringent security, pushing manufacturers to invest in advanced test procedures to guarantee functionality and compliance. The expanding smart home and smart city markets further drive testing requirements, ensuring device reliability and interoperability within increasingly complex ecosystems. These factors position wireless testing as a foundational requirement for innovation.

- For instance, Qualcomm conducted 3,500 interoperability and security validation tests on its Snapdragon X IoT platform in 2024 to ensure seamless device connectivity across diverse use cases.

Regulatory Compliance and Certification Requirements Intensify Testing Needs:

Stringent regulatory frameworks across global markets necessitate thorough wireless device testing before products reach the market. Regulatory bodies such as the FCC, ETSI, and other national agencies enforce strict guidelines for electromagnetic compatibility, spectrum allocation, and safety. Companies rely on advanced test labs and automated solutions to navigate certification processes efficiently. Compliance-driven testing protects consumers and strengthens market access for manufacturers.

Digital Transformation and Industrial Automation Accelerate Investment:

Widespread digital transformation initiatives and the rise of Industry 4.0 increase the need for reliable wireless connectivity in industrial settings. Wireless networks support automation, predictive maintenance, and real-time data analytics on the factory floor. It ensures mission-critical applications remain robust against interference and signal degradation. This shift drives continuous investment in wireless testing solutions to maintain performance, uptime, and safety standards.

Market Trends:

Integration of Artificial Intelligence and Automation Enhances Wireless Testing Efficiency:

Artificial intelligence (AI) and automation now play a pivotal role in transforming wireless testing workflows. Leading manufacturers and test labs implement AI-powered analytics and automated test scripts to improve speed, accuracy, and scalability of test cycles. It reduces manual intervention, accelerates fault detection, and enables predictive maintenance across wireless devices and infrastructure. Advanced automation supports simultaneous multi-standard testing, which is critical for devices operating on several wireless protocols. AI-driven platforms also streamline certification and regulatory compliance by rapidly identifying issues that could delay product launches. These advancements drive efficiency and responsiveness throughout the wireless testing market.

- For instance, Rohde & Schwarz’s R&S MXO 4 oscilloscope delivers a real-time update rate of over 4.5 million acquisitions per second, enabling engineers to capture and analyze intermittent signal anomalies within microseconds.

Expansion of 5G and IoT Ecosystems Spurs Multi-Protocol and End-to-End Testing:

The global roll-out of 5G networks and the exponential increase in IoT deployments set new requirements for wireless testing capabilities. Manufacturers and service providers now demand test solutions that cover multi-protocol compatibility, massive device densities, and ultra-low latency scenarios. It becomes essential to validate device performance in real-world environments, including interoperability with legacy systems and other network technologies. The wireless testing market sees growing adoption of over-the-air (OTA) and end-to-end testing methodologies, ensuring robust connectivity and minimal signal interference. Test equipment suppliers continue to invest in scalable platforms that support evolving 5G and IoT standards, addressing the dynamic needs of industries embracing digital transformation.

- Tektronix’s Vector Signal Analyzers support frequency testing up to 50 GHz, enabling characterization and calibration of high-frequency millimeter-wave 5G components essential for ensuring ultra-high-speed network performance in both FR1 and FR2 bands.

Market Challenges Analysis:

Complexity of Evolving Wireless Standards Increases Testing Difficulties:

Frequent updates to wireless standards create significant hurdles for manufacturers and testing service providers. Each new protocol introduces additional frequency bands, complex modulation schemes, and stricter performance requirements. It raises the technical expertise and investment needed for accurate and comprehensive wireless testing. Keeping pace with these changes demands ongoing training, upgraded equipment, and software updates. Smaller players in the wireless testing market often struggle to match the capabilities and resources of larger competitors. This complexity can delay product development cycles and elevate operational costs.

High Costs and Time-Intensive Nature of Comprehensive Wireless Testing:

Extensive wireless testing requires sophisticated equipment, skilled personnel, and purpose-built facilities, which contribute to high operational expenses. The need for end-to-end validation, multi-protocol compatibility, and regulatory compliance extends the time required to bring products to market. It poses a challenge for companies aiming to innovate quickly in a competitive environment. Unforeseen technical issues or failed compliance tests may necessitate repeated testing, further straining budgets and timelines. The wireless testing market must address these barriers to enable faster, cost-effective product launches.

Market Opportunities:

Emergence of 5G, Wi-Fi 7, and Next-Generation Technologies Unlocks New Growth Potential:

Widespread deployment of 5G, Wi-Fi 7, and ultra-wideband (UWB) networks generates strong demand for advanced wireless testing solutions. Manufacturers and service providers require new test methodologies to validate the performance, reliability, and security of next-generation devices. The wireless testing market benefits from opportunities to deliver solutions that address massive device densities, ultra-low latency, and network slicing requirements. It supports the introduction of innovative products across autonomous vehicles, smart cities, and healthcare applications. Test providers who invest in evolving protocols and scalable testing platforms are well-positioned to capitalize on this ongoing transformation.

Growth of IoT Ecosystems and Smart Infrastructure Expands Testing Applications:

Rapid proliferation of IoT devices and connected infrastructure opens new avenues for wireless testing companies. Smart factories, intelligent transportation systems, and digital healthcare all require robust wireless connectivity and stringent security validation. It creates opportunities for test solution providers to develop specialized services for interoperability, cybersecurity, and over-the-air (OTA) performance. Demand for lifecycle testing and remote diagnostics grows as enterprises seek to minimize downtime and ensure reliable operations. The wireless testing market stands to benefit by addressing these evolving needs with flexible, future-ready solutions.

Market Segmentation Analysis:

By Technology:

The wireless testing market covers a range of technologies, with 5G, Wi-Fi (including Wi-Fi 6/6E and Wi-Fi 7), Bluetooth, and ultra-wideband (UWB) representing the most prominent segments. 5G technology holds the largest share due to global investments in infrastructure and rapid device proliferation. Wi-Fi and Bluetooth segments remain vital, driven by widespread adoption in consumer electronics, smart home devices, and industrial automation. UWB technology gains momentum for precise location tracking and secure short-range communication, fueling demand for specialized testing.

By Application:

Wireless testing solutions support diverse applications, including consumer electronics, automotive, telecommunications, industrial automation, healthcare, and aerospace. Consumer electronics represent the largest application segment, driven by high demand for smartphones, wearables, and connected home devices. The automotive sector witnesses robust growth due to increasing deployment of advanced driver assistance systems (ADAS), connected vehicles, and in-car infotainment systems. Telecommunications operators prioritize wireless testing for network reliability and seamless service delivery, while healthcare and industrial automation sectors demand high standards for safety and interoperability.

- For instance, Qualcomm’s Snapdragon X65 modem achieved a peak downlink throughput of 10 Gbps in lab-based 5G NR mmWave validation tests.

By Offering:

The wireless testing market is segmented by offering into hardware, software, and services. Hardware holds the dominant share, encompassing signal generators, spectrum analyzers, and network testers. Software solutions enable automated testing, analytics, and compliance reporting. Services—including consulting, certification, and managed testing—are gaining traction, especially as organizations seek to streamline product launches and ensure regulatory compliance across regions. It continues to evolve, driven by innovation in both product and service offerings.

- For instance, Keysight Technologies introduced the E7515W UXM Wireless Connectivity Test Platform in 2024, which enables Wi-Fi 7 device makers to simulate traffic based on the latest IEEE 802.11be standards, achieving fast test setup and supporting high-bandwidth performance for accelerated time to market.

Segmentations:

By Technology:

- 5G

- Wi-Fi (Wi-Fi 6/6E, Wi-Fi 7)

- Bluetooth

- Ultra-Wideband (UWB)

- Zigbee

- NFC

By Application:

- Consumer Electronics

- Automotive

- Telecommunications

- Industrial Automation

- Healthcare

- Aerospace and Defense

By Offering:

- Hardware

- Software

- Services

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America commands 36% share of the wireless testing market, supported by early adoption of advanced wireless technologies and strong R&D investments. The region leads in 5G deployment, IoT integration, and adoption of Wi-Fi 6/6E standards across consumer and industrial sectors. Major technology hubs in the United States and Canada drive continuous innovation, pushing demand for comprehensive testing services. Leading manufacturers, telecommunications providers, and certification labs are concentrated in this region, ensuring steady revenue streams for testing solution providers. It benefits from robust regulatory frameworks and active participation in international standardization bodies. These factors reinforce North America’s leadership and sustain long-term growth prospects for wireless testing.

Asia-Pacific :

Asia-Pacific holds 31% share of the wireless testing market, demonstrating the fastest growth rate worldwide. Rapid industrialization, urbanization, and expansion of digital infrastructure fuel strong demand for wireless testing across China, Japan, South Korea, and India. Regional governments support large-scale investments in 5G, smart cities, and connected manufacturing initiatives, creating favorable conditions for market expansion. Leading electronics manufacturers in this region drive new product development cycles and require robust testing capabilities. It experiences increasing collaboration between public and private sectors to promote technology adoption and workforce training. These dynamics position Asia-Pacific as a critical growth engine for wireless testing in the years ahead.

Europe :

Europe accounts for 24% share of the wireless testing market, driven by a combination of stringent regulatory standards and a mature industrial base. Leading economies such as Germany, the United Kingdom, and France emphasize technological innovation, supporting market demand for advanced wireless testing solutions. The region hosts prominent test laboratories, certification bodies, and wireless technology providers. It maintains active participation in global standard-setting organizations, which shapes industry best practices. Commitment to data privacy, security, and sustainability further elevates testing requirements for new wireless products and systems. Europe’s regulatory-driven approach and focus on quality assurance ensure stable market growth and ongoing innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- GGS Group

- DEKRA com

- Alifecom Technology

- Anritsun

- Bureau Veritas

- Intertek Group PLC

- Keysight Technologies

- TUV Nord Group

- Viavi Solutions Inc

- EXFO Inc.

- Rohde & Schwarz

Competitive Analysis:

The wireless testing market features a highly competitive landscape, dominated by established global players and specialized testing providers. Leading companies such as GGS Group, DEKRA com, Alifecom Technology, Anritsun, Bureau Veritas, Intertek Group PLC, Keysight Technologies, and TUV Nord Group maintain strong market presence through comprehensive service portfolios and advanced technological capabilities. It emphasizes continuous innovation, investment in R&D, and rapid adaptation to evolving wireless standards. Leading firms focus on partnerships, acquisitions, and expanding global testing facilities to serve a diverse client base across multiple industries. Rigorous regulatory requirements and growing demand for interoperability drive ongoing investment in state-of-the-art equipment and integrated solutions. Companies differentiate through expertise in multi-protocol testing, regulatory compliance, and tailored services for sectors such as telecommunications, automotive, and consumer electronics. Competitive intensity will remain high as wireless technologies advance and customer requirements evolve.

Recent Developments:

- In Feb 2025, GGS India (GUS Global Services India Pvt. Ltd.) announced a strategic partnership with the University of Surrey to support the launch of an International Branch Campus (IBC) in GIFT City, India.

- In April 2025, DEKRA launched the “Digital Trust Service,” offering integrated testing and certification for functional safety, cybersecurity, and AI.

- In March 2024, Alifecom Technology launched its Non-Terrestrial Networks (NTN) IoT Platform (NE6000 IoT-NTN Network Emulator) for satellite communication UE testing at the SATELLITE 2024 event in Washington, D.C.

Market Concentration & Characteristics:

The wireless testing market exhibits moderate to high concentration, with leading global players such as Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, and National Instruments holding significant shares. It features strong barriers to entry due to high capital requirements, complex technical expertise, and the need for continuous innovation to meet evolving wireless standards. Major companies invest heavily in R&D, advanced automation, and integrated testing platforms to maintain competitive advantage. The market is characterized by long-term partnerships with OEMs, strong focus on regulatory compliance, and increasing demand for end-to-end testing solutions. It continues to evolve in response to rapid advancements in 5G, IoT, and multi-protocol wireless technologies.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application, Offering and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for advanced wireless testing solutions will rise with global expansion of 5G, Wi-Fi 7, and IoT deployments.

- AI and automation will become integral to testing processes, driving efficiency and reducing manual intervention.

- Test providers will develop multi-protocol platforms to support device interoperability across diverse wireless standards.

- Growth in autonomous vehicles, smart cities, and healthcare technology will increase requirements for robust wireless testing.

- Regulatory agencies will tighten compliance standards, leading to higher investments in certification and validation.

- Over-the-air (OTA) and end-to-end testing will gain prominence to address complex, real-world connectivity scenarios.

- Partnerships between manufacturers, telecom providers, and test labs will strengthen to accelerate product launches.

- Test equipment suppliers will invest in remote diagnostics and lifecycle testing services for enterprise clients.

- Emerging markets in Asia-Pacific and Latin America will offer new growth opportunities as wireless infrastructure expands.

- Sustainability initiatives and energy-efficient wireless systems will influence future testing requirements and methodologies.