Market Overview

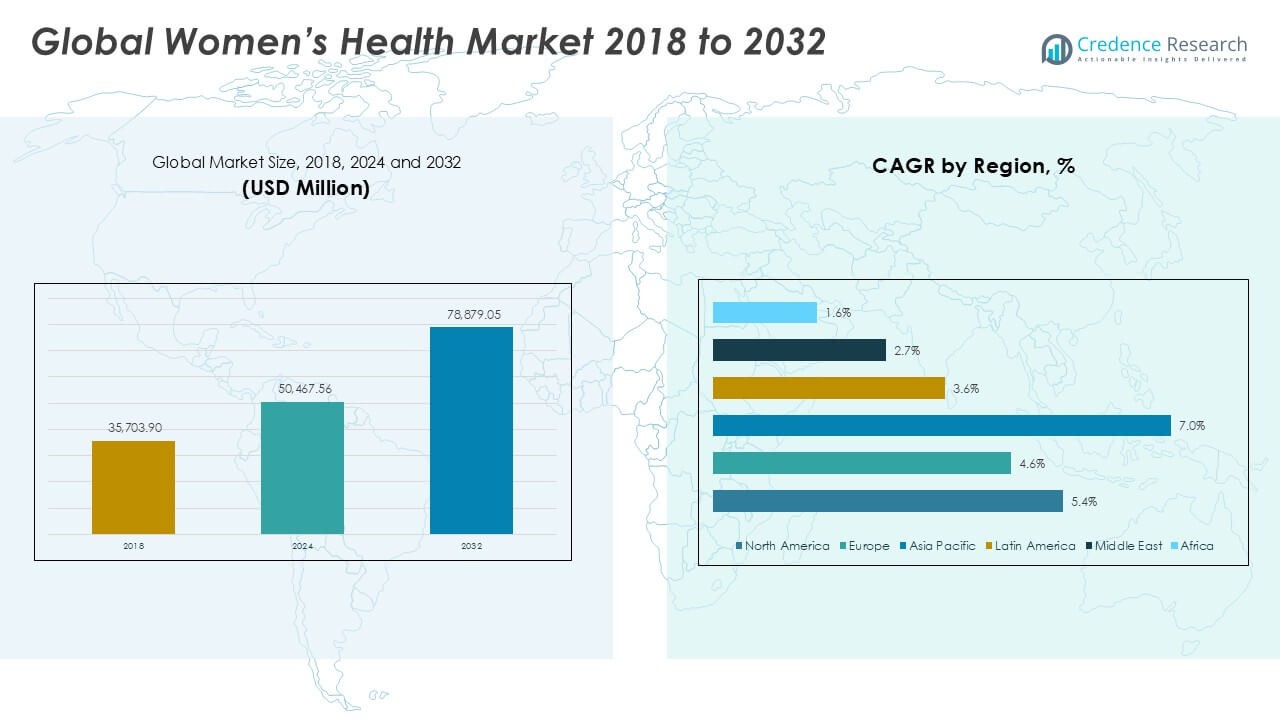

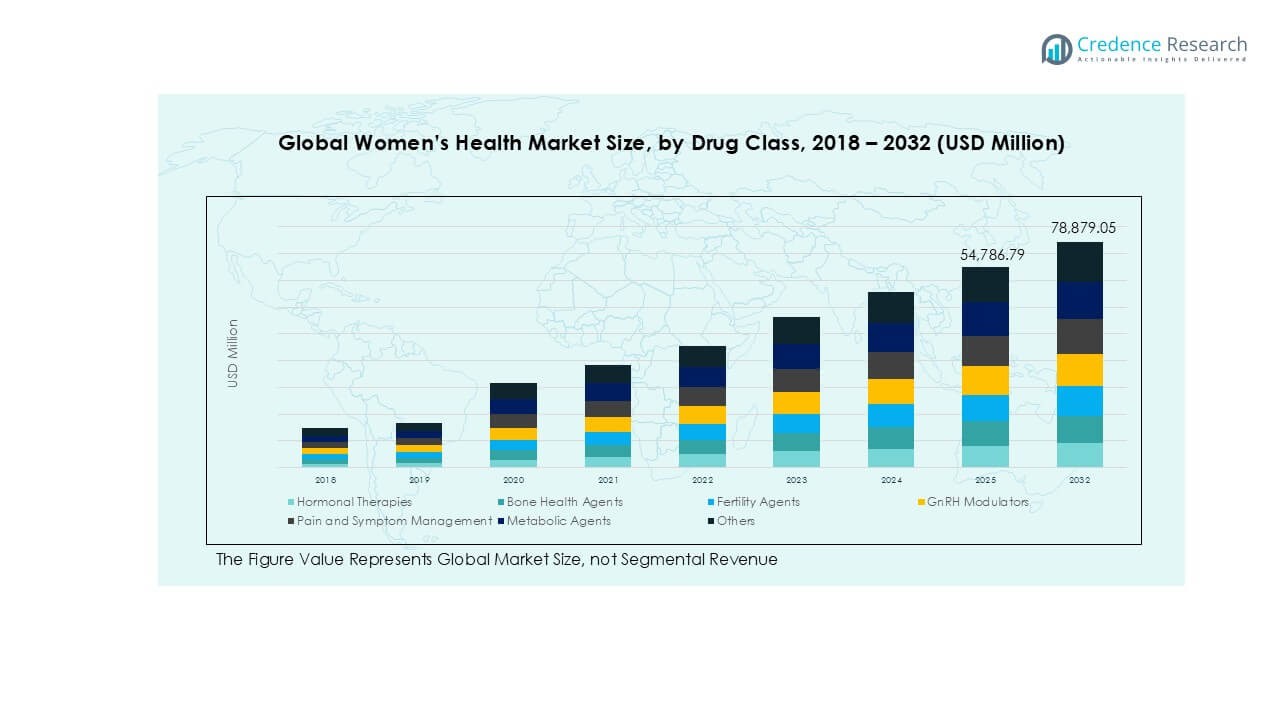

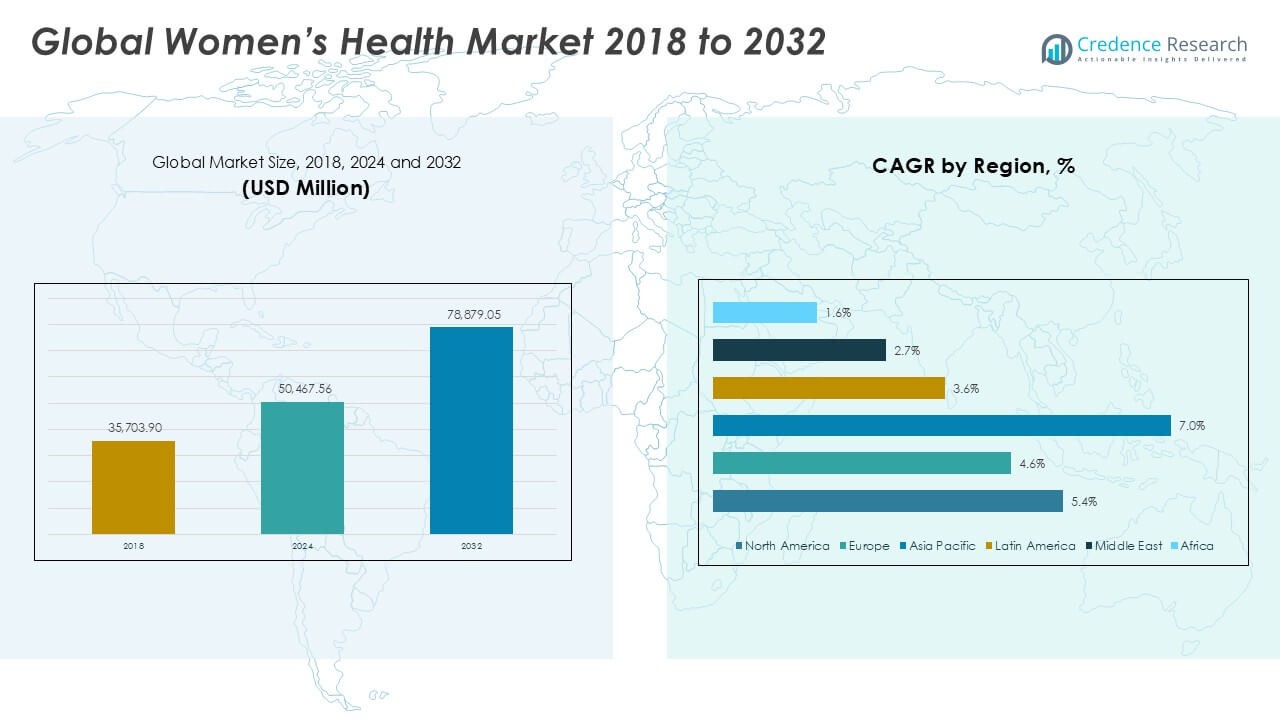

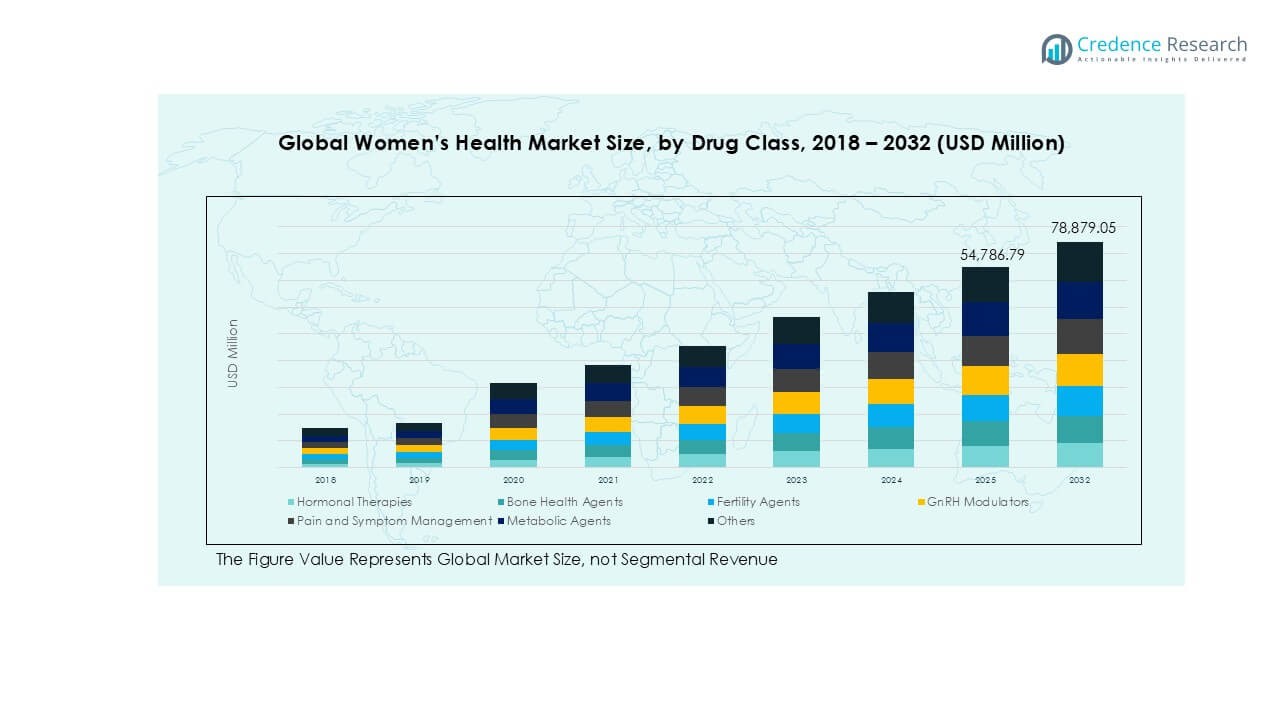

Global Women’s Health Market size was valued at USD 35,703.90 million in 2018 to USD 50,467.56 million in 2024 and is anticipated to reach USD 78,879.05 million by 2032, at a CAGR of 5.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Women’s Health Market Size 2024 |

USD 50,467.56 Million |

| Women’s Health Market, CAGR |

5.34% |

| Women’s Health Market Size 2032 |

USD 78,879.05 Million |

The global women’s health market is shaped by major players such as Abbott Laboratories, Bayer AG, Merck & Co., Inc., Pfizer, Inc., Teva Pharmaceuticals, Ferring B.V., Agile Therapeutics, Amgen, Inc., AstraZeneca PLC, Bristol-Myers Squibb Company, and F. Hoffmann-La Roche Ltd. These companies lead with strong portfolios in hormonal therapies, contraceptives, fertility treatments, and bone health agents. North America dominates the market with a 44.2% share in 2018, driven by advanced healthcare infrastructure and high adoption of women’s health products. Europe follows with 29.3% share, supported by robust regulatory frameworks, while Asia Pacific, with 18.5% share, emerges as the fastest-growing region due to rising healthcare investments and increasing demand for reproductive care solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global women’s health market was valued at USD 35,703.90 million in 2018, reached USD 50,467.56 million in 2024, and is projected to attain USD 78,879.05 million by 2032, registering a CAGR of 5.34%.

- Key drivers include the rising prevalence of reproductive disorders, growing cases of postmenopausal osteoporosis, and increasing demand for contraceptives and fertility agents.

- Market trends highlight the shift toward non-hormonal therapies, adoption of digital health platforms, and growing demand for long-acting contraceptives and advanced fertility treatments.

- Competition remains strong with leading players such as Abbott, Bayer, Merck, Pfizer, Teva, Amgen, and Ferring focusing on product launches, clinical trials, and strategic partnerships to strengthen market presence.

- Regional analysis shows North America held 44.2% share in 2018, followed by Europe at 29.3%, while Asia Pacific with 18.5% share is the fastest-growing region. By segment, contraceptives and hormonal therapies remain dominant revenue contributors globally.

Market Segmentation Analysis:

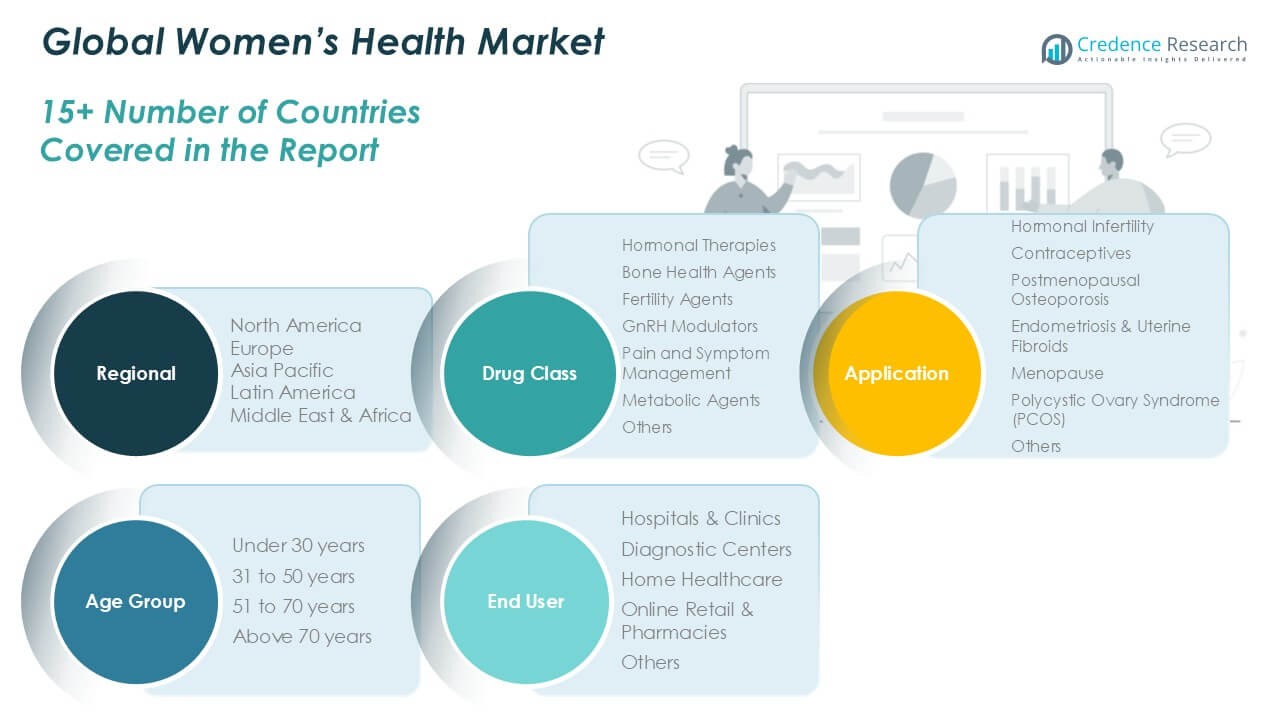

By Drug Class

Hormonal therapies hold the largest share in the women’s health market due to their broad use in contraceptives, menopause management, and infertility treatments. Strong demand arises from their effectiveness in regulating reproductive health and addressing hormonal imbalances. Bone health agents follow as a key sub-segment driven by rising cases of osteoporosis in aging women. Fertility agents and GnRH modulators are gaining traction with growing awareness of infertility treatments, while pain and symptom management solutions expand with rising endometriosis and menstrual disorder cases. Metabolic agents and others continue to support niche therapeutic needs.

- For instance, once a top-selling product for Bayer with combined annual sales exceeding $1 billion, prescriptions for the contraceptives Yasmin and Yaz have significantly declined over the past decade due to safety concerns, extensive litigation, and competition from generic alternatives.

By Application and Age Group

Contraceptives dominate the application segment, accounting for the largest revenue share. Their use is driven by rising awareness of family planning, favorable government programs, and availability of hormonal and non-hormonal options. Postmenopausal osteoporosis treatment also shows steady growth due to aging populations. Within age group segmentation, women aged 31 to 50 years represent the dominant sub-segment, supported by higher usage of contraceptives, fertility treatments, and preventive healthcare services. Demand in the 51–70 years group is also significant, largely influenced by menopausal care and osteoporosis management.

- For instance, NuvaRing, initially developed by Organon and now manufactured by Organon & Co. (after a series of acquisitions and spin-offs), was a highly popular non-oral contraceptive for many years.

By End User

Hospitals and clinics remain the largest end-user segment, holding a dominant share owing to their wide service coverage, specialized physicians, and advanced infrastructure for women’s healthcare. Diagnostic centers are expanding rapidly with increased adoption of preventive health checkups and fertility screenings. Home healthcare grows steadily, supported by remote monitoring tools and personalized care models. Online retail and pharmacies are emerging as strong channels, driven by consumer preference for convenience and discreet access to contraceptives and hormonal therapies. Other end users add incremental growth through community health programs and non-traditional care models.

Key Growth Drivers

Rising Prevalence of Chronic and Reproductive Health Disorders

The increasing burden of conditions such as osteoporosis, endometriosis, and polycystic ovary syndrome significantly drives the women’s health market. Rising infertility cases and hormonal imbalances further create consistent demand for advanced therapies. Aging populations amplify risks of postmenopausal osteoporosis and related complications. Pharmaceutical companies continue to introduce innovative drugs addressing these unmet needs. This growing prevalence ensures continuous adoption of treatment solutions, making chronic and reproductive health disorders a primary factor boosting market growth globally.

- For instance, Amgen’s Prolia (denosumab) has been administered to more than 26 million women with osteoporosis worldwide since its initial launch in June 2010. The medication addresses postmenopausal bone loss, as well as osteoporosis in men and other at-risk patient populations.

Advancements in Hormonal and Non-Hormonal Therapies

Therapeutic innovation is a key growth driver as companies expand their portfolios of hormonal and non-hormonal treatments. Hormonal contraceptives and fertility drugs dominate the space, while newer non-hormonal products appeal to women seeking safer alternatives. Advancements in drug delivery, such as long-acting injectables and transdermal patches, enhance compliance and efficacy. Ongoing clinical trials aim to improve safety profiles, expanding treatment adoption across different age groups. These innovations strengthen accessibility and choice in healthcare, accelerating market growth.

- For instance, Bayer’s Mirena intrauterine system is one of the most widely used hormonal intrauterine devices (IUDs) and is a highly effective, long-acting reversible contraceptive. Mirena is available in over 120 countries and is an important component of the overall market for intrauterine contraception, which is used by approximately 160 million women globally.

Government Initiatives and Awareness Programs

Supportive government policies and global awareness campaigns continue to drive adoption of women’s health products. Family planning initiatives, subsidies for contraceptives, and national osteoporosis screening programs boost early adoption. Public and private organizations actively promote awareness of infertility and reproductive health, increasing demand for specialized care. Programs in emerging economies play a critical role in bridging healthcare gaps for women. Combined, these efforts enhance healthcare infrastructure, expand coverage, and accelerate the growth of the women’s health market.

Key Trends & Opportunities

Rising Demand for Fertility and Reproductive Care Solutions

Fertility agents and assisted reproductive technologies are gaining strong momentum as infertility rates climb worldwide. Growing societal acceptance of IVF and related treatments expands the market scope. Advanced fertility drugs and diagnostics support success rates, attracting more women seeking parenthood later in life. Increasing medical tourism for affordable fertility care in Asia-Pacific creates cross-border opportunities. This trend strengthens demand for innovative therapies and positions reproductive care as a high-potential growth area in women’s healthcare.

- For instance, Merck’s Gonal-f is a prominent fertility treatment, and the company reports that it has supported the birth of over 6 million babies worldwide.

Expansion of Digital Health and Online Pharmacies

Digital health platforms and online retail channels create new opportunities for women’s health solutions. Telemedicine offers easy access to gynecological consultations, while mobile apps track fertility and menopausal symptoms. Online pharmacies enhance access to contraceptives and hormonal therapies, particularly in regions with limited physical infrastructure. These channels provide privacy and convenience, encouraging wider adoption. Integration of digital tools with traditional care expands market reach, creating a strong opportunity for companies investing in technology-driven healthcare solutions.

Key Challenges

High Treatment Costs and Limited Accessibility

The cost of advanced therapies, fertility treatments, and long-term hormonal care limits adoption, especially in low- and middle-income regions. Despite government subsidies, affordability remains a major barrier for women in rural and underserved areas. Limited healthcare infrastructure and uneven availability of diagnostic facilities further reduce access to timely treatment. This challenge constrains overall market penetration and requires focused investments in affordable and inclusive healthcare delivery systems.

Safety Concerns and Regulatory Hurdles

Concerns around side effects of hormonal therapies and fertility agents act as barriers to wider adoption. Regulatory authorities enforce strict approval standards for women’s health drugs, often delaying product launches. Adverse effects such as cardiovascular risks or bone loss linked with certain treatments create hesitation among patients and providers. Meeting stringent clinical safety requirements increases costs and development timelines for companies. These regulatory and safety challenges continue to affect innovation speed and adoption in the global women’s health market.

Regional Analysis

North America

North America accounted for the largest share of the global women’s health market, representing 44.2% in 2018 with a market size of USD 15,793.44 million. The market grew to USD 22,095.20 million in 2024 and is projected to reach USD 34,628.69 million by 2032 at a CAGR of 5.4%. Growth is driven by strong healthcare infrastructure, high adoption of hormonal therapies, and supportive government programs in reproductive and menopausal care. Rising awareness of osteoporosis and fertility treatments further supports market dominance across the region.

Europe

Europe held a significant share of 29.3% in 2018, with market size at USD 10,477.31 million, advancing to USD 14,293.56 million in 2024. By 2032, it is expected to reach USD 21,078.27 million, growing at a CAGR of 4.6%. The region’s market expansion is supported by strict regulatory frameworks, rising healthcare spending, and strong demand for contraceptives and infertility treatments. Postmenopausal osteoporosis and PCOS therapies contribute to consistent revenue growth. High awareness and government-backed women’s health programs position Europe as the second-largest market globally.

Asia Pacific

Asia Pacific is the fastest-growing region, holding 18.5% share in 2018 with a market size of USD 6,589.51 million. It expanded to USD 10,128.59 million in 2024 and is forecasted to reach USD 18,010.85 million by 2032 at a CAGR of 7.0%. Rapid urbanization, rising infertility rates, and increasing adoption of modern contraceptives are major growth drivers. Expanding healthcare infrastructure in China, India, and Southeast Asia fosters accessibility to advanced treatments. Growing medical tourism for reproductive care further strengthens the region’s market outlook, making it the key growth engine globally.

Latin America

Latin America represented 4.3% of the global share in 2018, valued at USD 1,539.66 million. The market rose to USD 2,146.68 million in 2024 and is projected to reach USD 2,932.39 million by 2032 at a CAGR of 3.6%. Increasing government investments in healthcare and awareness campaigns on contraception and infertility management support gradual market growth. Brazil and Mexico drive the majority of regional demand due to expanding access to diagnostic services and reproductive health facilities. However, limited healthcare access in rural areas slightly constrains growth potential across the region.

Middle East

The Middle East accounted for 2.4% share in 2018, with market value of USD 861.29 million, rising to USD 1,095.98 million in 2024. It is anticipated to reach USD 1,397.46 million by 2032 at a CAGR of 2.7%. Growing adoption of contraceptives, coupled with gradual improvements in healthcare access, drives demand. Fertility treatments are witnessing increased adoption in Gulf countries due to rising infertility cases. However, cultural and social barriers to women’s health treatments restrain rapid expansion. Market growth remains steady but slower compared to other developing regions.

Africa

Africa contributed 1.2% share in 2018, with market size of USD 442.69 million. It reached USD 707.56 million in 2024 and is projected to grow to USD 831.39 million by 2032 at a CAGR of 1.6%, the slowest globally. Limited healthcare infrastructure, affordability challenges, and low access to modern therapies hinder widespread adoption. However, increasing initiatives by international organizations and gradual improvements in urban healthcare access provide opportunities for growth. Contraceptives and maternal care programs drive most of the demand, though penetration remains limited compared to other global regions.

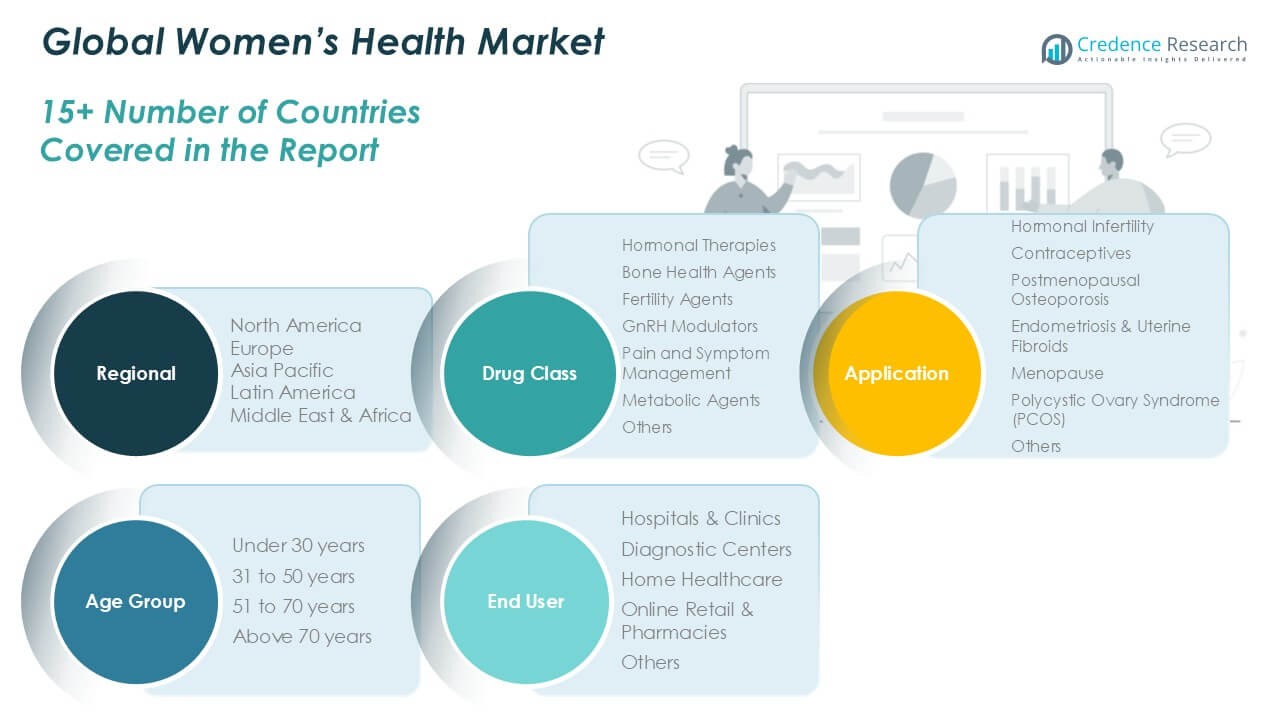

Market Segmentations:

By Drug Class

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

By Application

- Hormonal Infertility

- Contraceptives

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Polycystic Ovary Syndrome (PCOS)

- Others

By Age Group

- Under 30 years

- 31 to 50 years

- 51 to 70 years

- Above 70 years

By End User

- Hospitals & Clinics

- Diagnostic Centers

- Home Healthcare

- Online Retail & Pharmacies

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The global women’s health market is highly competitive, with leading pharmaceutical and biotechnology companies driving innovation across therapeutic areas. Key players include Abbott Laboratories, Bayer AG, Merck & Co., Inc., Pfizer, Inc., Teva Pharmaceuticals, Ferring B.V., Agile Therapeutics, Amgen, Inc., AstraZeneca PLC, Bristol-Myers Squibb Company, and F. Hoffmann-La Roche Ltd. These companies hold strong portfolios spanning hormonal therapies, fertility treatments, contraceptives, and osteoporosis management solutions. Strategic priorities include expanding product pipelines, securing regulatory approvals, and enhancing global distribution networks. Recent developments emphasize partnerships, acquisitions, and the introduction of advanced non-hormonal therapies aimed at reducing side effects and improving patient compliance. Companies also focus on digital health integration and online pharmacy collaborations to strengthen consumer outreach. Intense competition encourages continuous investment in research and development, with players striving to capture demand from emerging regions while maintaining leadership in mature markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Abbott Laboratories

- Bayer AG

- Merck & Co., Inc.

- Pfizer, Inc.

- Teva Pharmaceuticals

- Ferring B.V.

- Agile Therapeutics

- Amgen, Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Hoffmann-La Roche Ltd

Recent Developments

- In September 2024, Organon announced acquisition of Dermavant, a subsidiary of Roivant focused on developing and commercializing novel treatments in immuno-dermatology.

- In March 2024, Insud Pharma announced the successful acquisition of Viatris’ Women’s Healthcare division, which focuses on oral and injectable contraceptives. This strategic move strengthens Insud Pharma’s industrial footprint in India by adding two manufacturing facilities located in Sarigam and Ahmedabad.

- In March 2024, The U.S. FDA granted approval to ELAHERE, developed by AbbVie Inc., for the treatment of adult patients with folate receptor alpha (FRα)-positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer, who have previously undergone up to three lines of therapy.

- In December 2023, Theramex completed the acquisition of the Femoston and Duphaston in Europe from Viatris. The company acquired these products for the consolidation of its menopause portfolio.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Application, Age Group, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The women’s health market will expand steadily with rising focus on reproductive care.

- Demand for contraceptives will remain dominant due to increasing family planning awareness.

- Fertility treatments will grow strongly as infertility rates rise across developed and emerging regions.

- Advancements in non-hormonal therapies will gain traction for safer treatment alternatives.

- Digital health platforms will play a larger role in diagnosis and remote consultations.

- North America will maintain leadership while Asia Pacific emerges as the fastest-growing region.

- Aging populations will drive higher adoption of osteoporosis and menopause-related therapies.

- Strategic collaborations and acquisitions will shape competition among global pharmaceutical leaders.

- Online pharmacies will expand access to women’s health products and therapies.

- Increasing government initiatives will support wider availability of preventive and specialized care.