Market Overview:

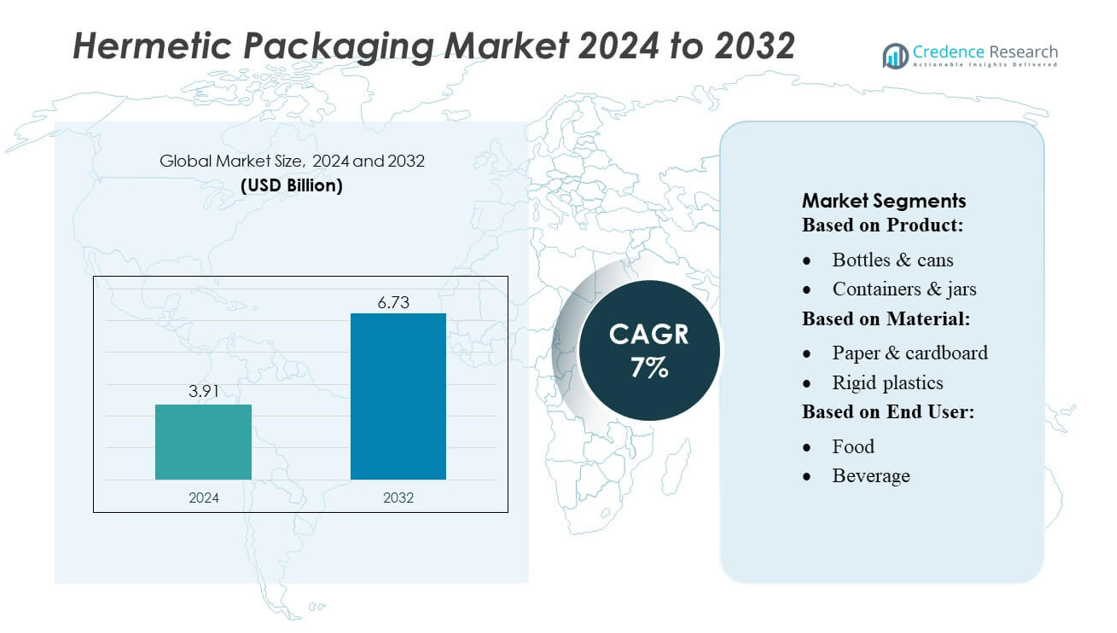

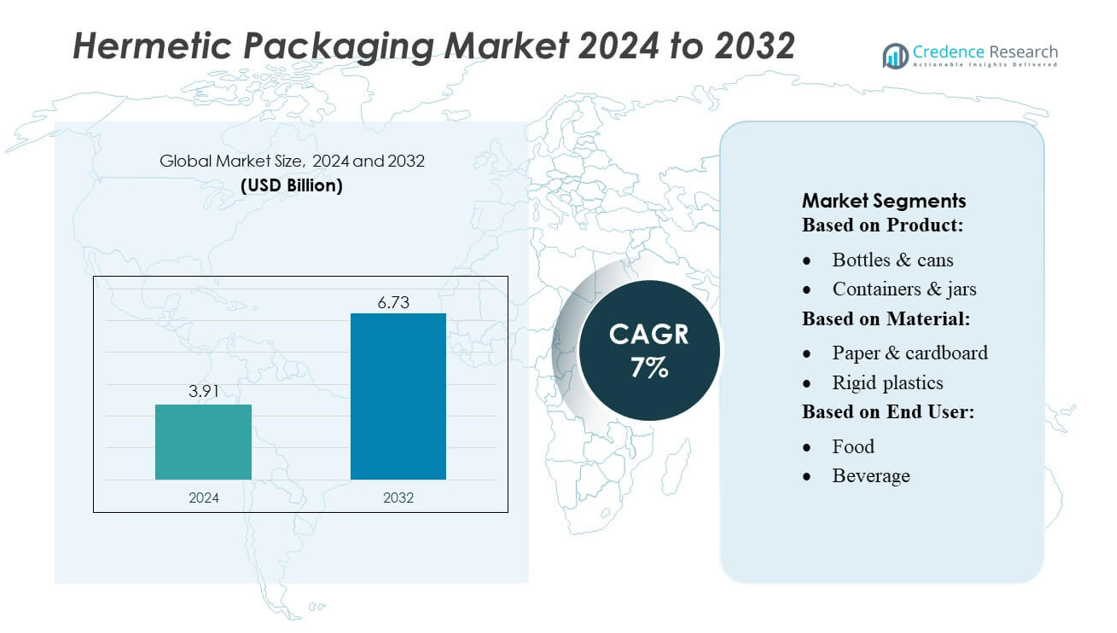

Hermetic Packaging Market size was valued USD 3.91 billion in 2024 and is anticipated to reach USD 6.73 billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hermetic Packaging Market Size 2024 |

USD 3.91 billion |

| Hermetic Packaging Market, CAGR |

7% |

| Hermetic Packaging Market Size 2032 |

USD 6.73 billion |

The hermetic packaging market is shaped by the presence of several top players that focus on advanced sealing technologies, high-reliability materials, and specialized engineering capabilities. Leading companies continually expand their product portfolios to support critical applications across semiconductors, aerospace, defense, and medical devices, strengthening competitive intensity. Asia-Pacific emerges as the leading region with an exact market share of 38%, driven by its dominant semiconductor manufacturing base, extensive electronics production, and rapid technological advancements. Strong regional investments in MEMS devices, sensors, and power electronics further reinforce Asia-Pacific’s leadership in the global hermetic packaging industry.

Market Insights

- The Hermetic Packaging Market was valued at USD 3.91 billion in 2024 and is projected to reach USD 6.73 billion by 2032, registering a 7% CAGR during the forecast period.

- Strong demand from semiconductors, medical devices, and aerospace systems drives market growth, supported by the need for airtight protection, reliability, and contamination control in high-precision applications.

- Key trends include rising adoption of miniaturized hermetic solutions for MEMS and sensors, increased use of advanced sealing materials, and growing development of smart, high-barrier packaging formats.

- Competitive intensity remains high as companies focus on technological innovation, production expansion, and material engineering, while restraints include high manufacturing costs and design limitations associated with metal and ceramic hermetic structures.

- Asia-Pacific leads the global market with 38% share, while the product segment shows bottles and cans dominating with 30–35% share, supported by extensive electronics production and expanding power electronics and automotive manufacturing ecosystems

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

In the hermetic packaging market, bottles & cans dominate the product segment, holding an estimated 30–35% share, driven by their superior barrier integrity and extended shelf-life benefits for moisture- and oxygen-sensitive products. Containers & jars follow, supported by rising applications in premium foods and healthcare. Bags, pouches & wraps gain traction due to lightweight formats, while closures & lids strengthen demand through advancements in tamper-evident sealing. Boxes & crates and drums & IBCs serve bulk and industrial needs, supported by growing chemical and pharmaceutical logistics. Other formats expand gradually with niche applications.

- For instance, Amkor maintains a portfolio of more than 3,000 different package formats and sizes, ranging from classic lead-frame ICs to high-density 3D, TSV, MEMS, wafer-level, flip-chip, and SiP packages.

By Material

Metal leads the material segment with an estimated 28–32% market share, owing to its unmatched hermeticity, corrosion resistance, and suitability for high-value food, chemical, and pharmaceutical products. Glass maintains strong demand for its inertness and premium positioning, while rigid plastics accelerate due to lower weight and improved sealing technologies. Paper & cardboard see moderate adoption in secondary hermetic packaging, whereas flexible plastics expand through multi-layer barrier films. Wood, textiles, and other materials remain limited to specialized industrial and storage applications. Demand across materials is driven by product safety, regulatory compliance, and improved barrier engineering.

- For instance, Egide S.A. manufactures over 2,500 distinct metal and ceramic hermetic package types for microelectronics, supporting applications in aerospace, defense, medical, and high-performance computing.

By End User

The food industry dominates the end-user segment with an estimated 35–40% share, fueled by the need to preserve freshness, prevent contamination, and extend shelf life in perishable and processed categories. The beverage sector follows, particularly for canned and aseptic formats. Healthcare exhibits rapid growth due to strict sterility requirements for pharmaceuticals and medical devices. Cosmetics and household products adopt hermetic formats to maintain formulation stability, while the chemicals industry relies on hermetic drums and IBCs for hazardous material containment. Other industries grow steadily as safety and quality standards intensify globally.

Key Growth Drivers

Rising Demand for Product Safety and Contamination Control

Growing emphasis on contamination-free packaging in food, pharmaceuticals, and high-value electronics drives strong demand for hermetic packaging. Manufacturers increasingly adopt airtight formats to prevent moisture ingress, oxygen exposure, and microbial contamination, ensuring longer shelf life and regulatory compliance. As global safety standards tighten, industries require packaging solutions with enhanced barrier performance, advanced sealing integrity, and traceability features, reinforcing hermetic packaging as a critical enabler of product reliability and consumer protection across sensitive end-use applications.

- For instance, Texas Instruments leverages hermetic ceramic and metal packages for high-reliability analog and mixed-signal ICs, including their Precision Analog and Data Converter devices. These packages are tested to meet rigorous standards, such as those defined by MIL-STD-883 Test Method 1014, with leak-rate requirements as low as 1×10⁻⁹ atm·cm³/s, and many devices are designed to operate reliably across a wide temperature range, such as −55°C to +150°C.

Expansion of the Electronics and Semiconductor Industry

Rapid growth in semiconductor manufacturing and miniaturized electronic components significantly boosts the need for hermetic packaging. Sensitive components such as sensors, MEMS, optoelectronics, and power devices rely on hermetic seals to safeguard against humidity, thermal variation, and particulate intrusion. Increasing adoption of 5G infrastructure, electric vehicles, and industrial automation amplifies demand for durable, high-performance hermetic enclosures. Manufacturers invest in advanced materials and sealing technologies to enhance thermal stability and long-term reliability, making hermetic packaging essential for high-precision electronics.

- For instance, Micross Components provides custom hermetic packages with leak rates below 5×10⁻¹¹ atm·cm³/s, suitable for aerospace, defense, and space-grade microelectronics.

Rising Use of High-Barrier Materials and Advanced Sealing Technologies

Innovations in high-barrier materials—including metal alloys, multi-layer films, and reinforced glass—support the market’s expansion by improving product protection in harsh environments. Advancements in laser welding, cold sealing, and composite sealing systems enhance packaging performance across diverse industries. These technologies deliver improved leak resistance, corrosion protection, and mechanical strength, meeting the needs of pharmaceuticals, chemicals, aerospace, and defense sectors. The push for lightweight, sustainable, and tamper-evident hermetic solutions further accelerates adoption across global supply chains.

Key Trends & Opportunities

Growth of Sustainable Hermetic Packaging Solutions

Market players increasingly explore eco-friendly hermetic packaging by integrating recyclable metals, bio-based films, and lightweight material combinations. Sustainability-driven regulations and corporate commitments encourage the shift toward reduced carbon footprints and improved material circularity. Opportunities emerge for manufacturers offering recyclable aluminum cans, glass-based hermetic formats, and energy-efficient sealing technologies. The trend also motivates R&D investments in low-emission coatings and biodegradable barrier layers, creating pathways for innovation while supporting long-term regulatory and environmental expectations.

- For instance, Kyocera does produce high-performance ceramic packages for MEMS and RF devices using high-purity alumina substrates (up to 99.6% content or higher) and offers hermetic sealing for these packages.

Increasing Adoption of Smart and Connected Packaging Technologies

Integration of sensors, RFID tags, and real-time monitoring components into hermetic packaging creates new opportunities, especially in pharmaceuticals, logistics, and industrial electronics. Smart hermetic packaging enables tracking of temperature, humidity, and tampering, ensuring supply chain transparency and product integrity. This trend aligns with Industry 4.0 and digital healthcare initiatives, driving manufacturers to embed data-enabled functions into sealed units. As connectivity becomes a competitive differentiator, companies offering intelligent hermetic solutions stand to capture significant market value.

- For instance, AMETEK’s Advanced Sensors and Instruments division provides highly reliable, hermetically sealed pressure and temperature sensors for aerospace and industrial applications. These components are designed to meet rigorous performance standards, with temperature sensors operating reliably up to +260°C and hermetic seals meeting leak rates as low as 1×10⁻⁹ atm·cm³/s.

Rising Demand from Defense, Aerospace, and High-Reliability Applications

Hermetic packaging is gaining traction in defense and aerospace sectors, where extreme environmental durability is critical. Growth in satellite deployment, avionics systems, and military-grade electronic components expands opportunities for highly reliable hermetic enclosures. These industries require shielding against vibration, vacuum pressure, radiation, and temperature fluctuations, creating long-term demand for metal, ceramic, and glass-to-metal sealing technologies. The increasing investment in space exploration and defense modernization further enhances growth prospects for specialized hermetic packaging providers.

Key Challenges

High Production Costs and Complex Manufacturing Requirements

Hermetic packaging involves advanced materials, precision sealing, and stringent quality control, resulting in substantially higher production costs compared to conventional packaging. Manufacturers face challenges related to specialized equipment, skilled labor, and complex fabrication processes such as laser welding or glass-to-metal sealing. These factors limit adoption among cost-sensitive industries and small-scale producers. Additionally, fluctuations in metal and specialty material prices further strain margins, making cost optimization and process automation critical challenges for market growth.

Limited Material Flexibility and Design Constraints

Despite its superior barrier protection, hermetic packaging often suffers from restricted material flexibility and design limitations. Metal, ceramic, and glass-based solutions offer high performance but may lack adaptability for lightweight or customizable applications. These rigid formats can hinder innovation in sectors seeking flexible packaging or unconventional shapes. Furthermore, compatibility challenges arise when sealing dissimilar materials, affecting durability and performance. As end-user needs evolve toward lighter and more versatile products, overcoming these material and design constraints becomes a significant market barrier.

Regional Analysis

North America

North America holds a substantial 28–32% share of the hermetic packaging market, supported by strong adoption in aerospace, defense, and advanced electronics manufacturing. High demand for hermetically sealed semiconductor components, medical devices, and pharmaceutical packaging reinforces regional growth. The U.S. leads due to extensive R&D activities, robust semiconductor fabrication capabilities, and stringent quality regulations that necessitate reliable, airtight packaging. Expanding applications in electric vehicles and optical communication systems further strengthen market presence. Continuous innovation in metal, ceramic, and glass-to-metal sealing technologies enhances the region’s competitiveness in high-reliability applications.

Europe

Europe accounts for an estimated 22–25% market share, driven by strong demand from automotive electronics, industrial equipment, and healthcare sectors. Germany, France, and the U.K. lead adoption due to mature manufacturing ecosystems and high regulatory standards for product safety and environmental sustainability. Growing investment in renewable energy systems, such as fuel cells and power electronics, increases the need for durable hermetic enclosures. The region also benefits from advancements in ceramic and glass-based sealing technologies. Sustainability-focused policies encourage the development of recyclable hermetic formats, supporting both innovation and long-term market stability.

Asia-Pacific

Asia-Pacific dominates the global market with a 35–40% share, driven by large-scale semiconductor and electronics production in China, Japan, South Korea, and Taiwan. Expanding manufacturing output in sensors, MEMS devices, and consumer electronics significantly boosts demand for high-reliability hermetic components. The region also experiences growing adoption in automotive electronics and medical device manufacturing. Increasing investments in 5G infrastructure, electric mobility, and industrial automation accelerate market expansion. Cost-effective production capabilities and rapid technological advancements position Asia-Pacific as the fastest-growing hub for hermetic packaging solutions.

Latin America

Latin America captures around 6–8% of the market, with growth primarily driven by rising pharmaceutical production, food and beverage processing, and expanding industrial operations. Brazil and Mexico lead due to increasing investments in healthcare packaging and electronics assembly. The region’s demand for moisture- and contamination-resistant packaging formats strengthens as consumer safety standards improve. Growth in chemical and agrochemical sectors further supports the adoption of hermetic drums, cans, and metal enclosures. Although the market remains price-sensitive, gradual technological modernization creates opportunities for advanced barrier and sealing solutions.

Middle East & Africa

The Middle East & Africa region holds an estimated 4–6% market share, supported by increasing applications in oil & gas, chemicals, healthcare, and industrial electronics. The Gulf countries drive demand for hermetic enclosures used in harsh environments where temperature, humidity, and dust resistance are critical. Growing investments in defense technologies and energy infrastructure contribute to steady adoption. In Africa, the expanding pharmaceutical and food processing sectors stimulate need for contamination-resistant packaging formats. While adoption of advanced hermetic technologies is still emerging, rising industrialization supports gradual market growth.

Market Segmentations:

By Product:

- Bottles & cans

- Containers & jars

By Material:

- Paper & cardboard

- Rigid plastics

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hermetic packaging market features leading players such as Materion Corporation, Amkor Technology, Egide S.A., Texas Instruments Incorporated, Micross Components, Inc., Kyocera Corporation, AMETEK, Inc., Teledyne Microelectronic Technology, Schott AG, and NGK Spark Plug Co., Ltd. the hermetic packaging market is characterized by strong technological specialization, with companies focusing on advanced sealing techniques, high-barrier materials, and precision engineering to meet the needs of mission-critical applications. Competition intensifies as manufacturers expand capabilities in metal, ceramic, and glass-to-metal hermetic solutions to support the growing demand from aerospace, defense, semiconductors, and medical device industries. Firms emphasize improving reliability, thermal performance, and moisture resistance, while also pursuing innovations in miniaturized and high-density packaging. Strategic initiatives such as global manufacturing expansion, supply chain strengthening, and application-specific customization further shape competitive positioning across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Materion Corporation

- Amkor Technology

- Egide S.A.

- Texas Instruments Incorporated

- Micross Components, Inc.

- Kyocera Corporation

- AMETEK, Inc.

- Teledyne Microelectronic Technology

- Schott AG

- NGK Spark Plug Co., Ltd.

Recent Developments

- In May 2025, Metsä Group and Amcor announced a collaboration to create 3D molded fiber packaging for food applications by combining Metsä’s wood-based Muoto™ packaging with Amcor’s high-barrier film liner and lidding.

- In April 2025, SÜDPACK, BASF Gastronomy, and Werz partnered to launch a new meat and sausage packaging for the hotel, restaurant, and catering (Horeca) sector that uses BASF’s chemically recycled material, Ultramid Ccycled polyamide.

- In April 2025, Amcor and Riverside Natural Foods launched MadeGood Trail Mix bars using Amcor’s AmFiber paper-based packaging to create a curbside-recyclable snack bar wrapper. This collaboration is a “category first” and features an FSC-certified, paper-based material that is recyclable without sacrificing performance, a development praised by both companies and consumer studies.

- In January 2025, Ardagh Glass Packaging-North America expanded its 12oz (355ml) Heritage glass beer bottle range by introducing new color and closure options. The new additions provide craft brewers and beverage producers with more packaging choices

Report Coverage

The research report offers an in-depth analysis based on Product, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained demand as industries prioritize airtight protection for sensitive electronic and medical components.

- Adoption of advanced sealing technologies will increase to support high-reliability applications in aerospace, defense, and automotive electronics.

- Growth in semiconductor manufacturing will continue to accelerate the need for durable hermetic enclosures.

- Miniaturization trends in sensors, MEMS devices, and microelectronics will drive innovation in compact hermetic designs.

- Manufacturers will expand the use of high-barrier materials to improve performance under extreme environmental conditions.

- Sustainability initiatives will encourage development of recyclable and energy-efficient hermetic packaging solutions.

- Smart and connected packaging features will gain traction, particularly in healthcare and industrial monitoring.

- Global supply chain diversification will influence production footprints and localization strategies.

- Increased investment in electric mobility and power electronics will boost demand for robust hermetic components.

- Companies will strengthen customization capabilities to meet the diverse requirements of specialized end-use industries.