Market Overview

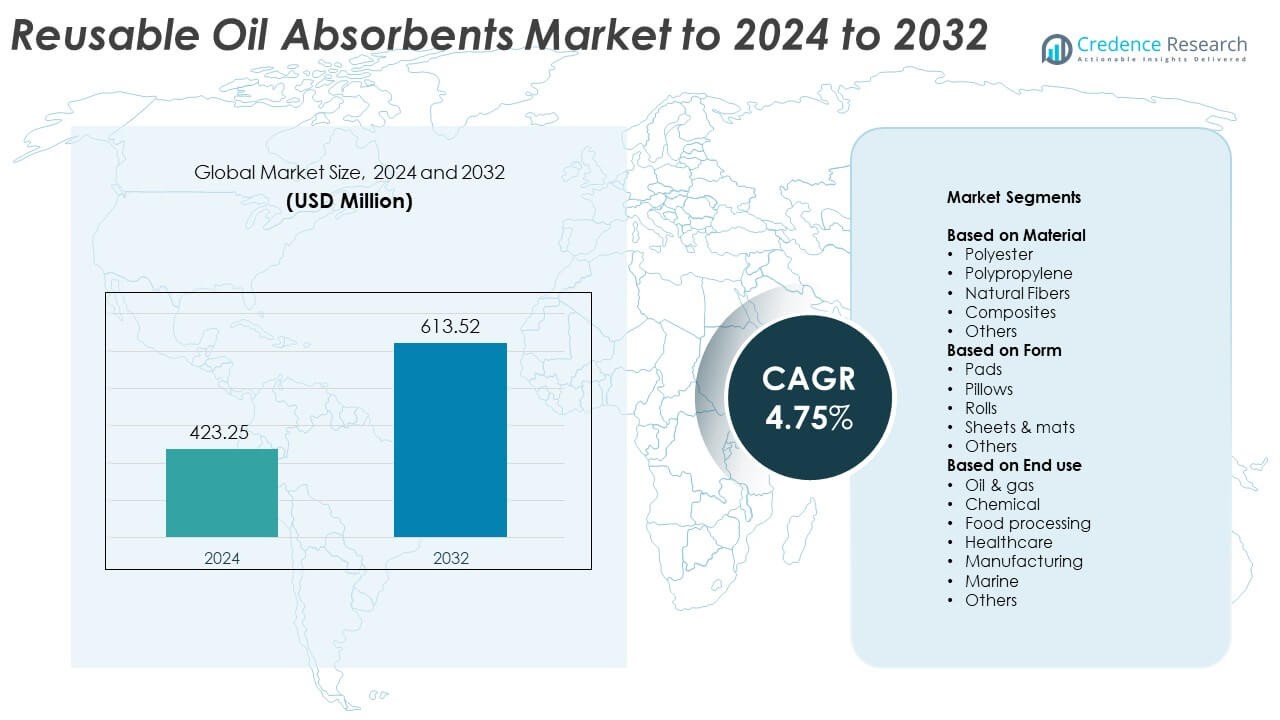

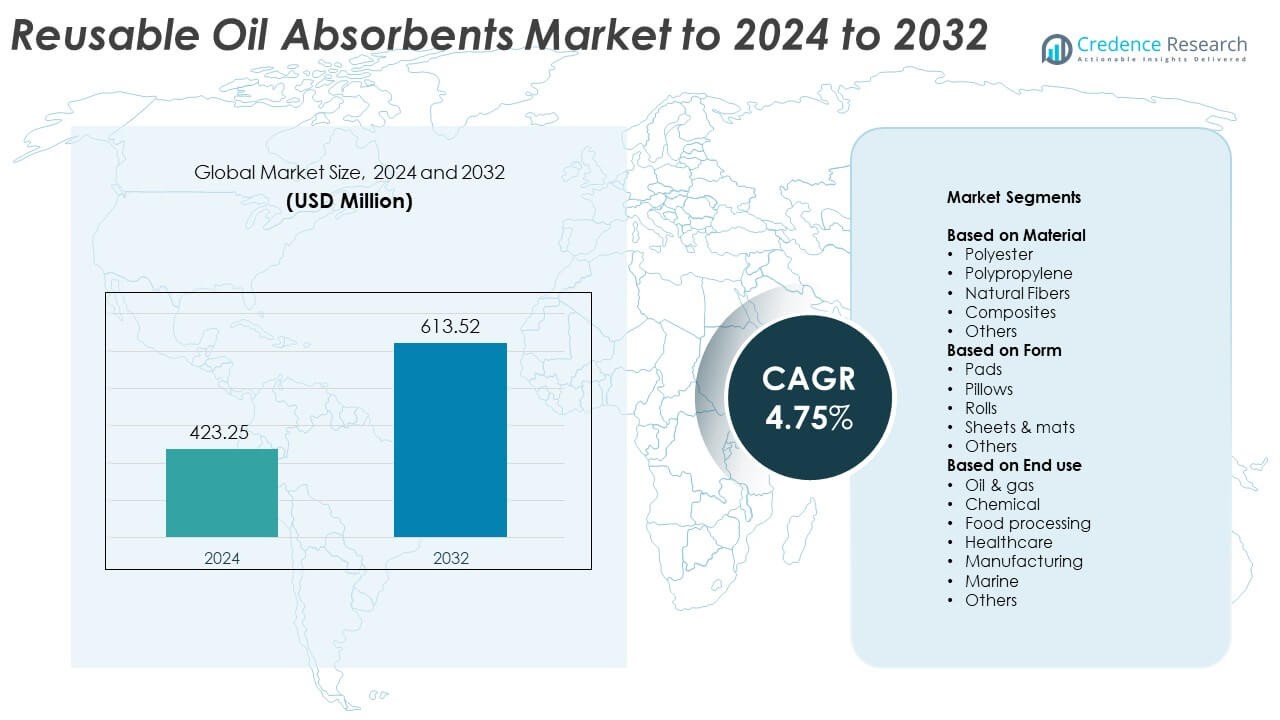

Reusable Oil Absorbents Market size was valued at USD 423.25 Million in 2024 and is anticipated to reach USD 613.52 Million by 2032, at a CAGR of 4.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reusable Oil Absorbents Market Size 2024 |

USD 423.25 Million |

| Reusable Oil Absorbents Market, CAGR |

4.75% |

| Reusable Oil Absorbents Market Size 2032 |

USD 613.52 Million |

The reusable oil absorbents market is shaped by leading companies such as Fentex Ltd., ACME, Sorbent Green LLC, New Pig Corporation, ITU AbsorbTech, Inc, Darcy Spillcare Manufacturing, Closed Loop Recycling, Park Industries, Oil-Dri Corporation of America, and 3M. These players compete through durable multi-use absorbent pads, rolls, and mats designed for industrial spill control and waste-reduction needs. North America remained the leading regional market in 2024 with about 38% share, driven by strong adoption in oil and gas, chemical processing, and large manufacturing facilities. Europe followed with nearly 27% share due to strict environmental compliance and high industrial safety standards.

Market Insights

- The reusable oil absorbents market was valued at USD 423.25 Million in 2024 and is projected to reach USD 613.52 Million by 2032 at a CAGR of 4.75%.

- Demand grows as industries adopt reusable products to lower waste and improve spill-management efficiency, with polypropylene holding 46% share due to strong absorption and durability.

- Key trends include rising adoption of eco-friendly fiber composites and advanced multi-layer absorbent designs, along with higher use of pads, which led the form segment with 49% share.

- Competition focuses on durability, extended reuse cycles, and integrated cleaning services, while restraints include high upfront costs and performance limits in harsh industrial environments.

- North America led with 38% share, followed by Europe at 27% and Asia Pacific at 24%, while oil and gas remained the largest end-use segment with 39% share due to frequent maintenance and stricter compliance norms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Polypropylene held the dominant position in 2024 with about 46% share. This synthetic fiber gained strong traction because it offers high absorption, low weight, and reliable reuse cycles in industrial settings. Companies prefer polypropylene absorbents for oil spill response and routine maintenance due to fast uptake and chemical resistance. Polyester followed with moderate demand in automated facilities where durability matters. Natural fibers and composites expanded slowly as buyers explored eco-friendly options, but polypropylene stayed ahead because it supports cost-effective handling and consistent field performance across oil and gas, marine, and manufacturing sites.

- For instance, New Pig Corporation confirms through its official product sheets and technical specifications that a single PIG Oil-Only Polypropylene Mat (MAT403) absorbs up to 28.16 fluid ounces of oil per pad. This volume is equivalent to approximately 832.7 milliliters (mL) or 0.83 liters, as documented in some metric versions of the product specifications and technical data sheets.

By Form

Pads led the market in 2024 with nearly 49% share. Pads remained popular because they are easy to deploy, fit standard maintenance routines, and support multiple reuse cycles without major performance loss. Industrial plants favored pads for rapid spill control during equipment leaks and pipeline servicing. Rolls showed steady use in large surface coverage tasks, while pillows served targeted containment needs around machinery. Sheets and mats found adoption in workshops and transport hubs, but pads stayed dominant due to flexible sizing, strong absorption, and simple storage across diverse operational environments.

- For instance, Brady’s SPC300 oil-only pad package lists capacity of 30 gallons.

By End Use

Oil and gas dominated the end-use segment in 2024 with around 39% share. The sector relied heavily on reusable absorbents to manage drilling fluid spills, rig maintenance tasks, and pipeline leak control. Operators selected reusable products to reduce waste volumes and lower long-term disposal costs under tightening environmental compliance norms. Manufacturing units used absorbents for machine lubrication leaks, while chemical and marine sectors applied them for routine containment tasks. Food processing and healthcare showed smaller but rising uptake, yet oil and gas retained leadership due to high-frequency spill events and strict operational safety demands.

Key Growth Drivers

Rising Industrial Spill Management Needs

Industries increased the use of reusable absorbents because routine equipment leaks, lubrication spills, and pipeline maintenance created steady demand. Companies in oil and gas, chemical processing, and manufacturing sought materials that handle repeated use without losing absorption strength. Compliance with safety norms pushed firms to replace single-use absorbents with reusable variants that cut operational waste. This shift supported long-term cost savings and improved workplace efficiency. The rising frequency of maintenance cycles made spill control a key growth driver for the reusable oil absorbents market.

- For instance, ITU AbsorbTech reports SorbIts reusable pads absorb 2 to 3 times more than disposable mats.

Shift Toward Sustainable Waste Reduction

Growing emphasis on environmental protection encouraged businesses to adopt reusable absorbents that reduce landfill waste. Regulations on hazardous waste disposal pushed industries to select products that last longer and deliver lower lifetime footprint. Sustainability programs in large manufacturing and energy companies supported procurement of reusable materials with strong durability. Many facilities redesigned maintenance practices to reduce single-use supplies. These factors positioned waste reduction as a key growth driver in the reusable oil absorbents market.

- For instance, Wesba Clean’s standard single-weight oil absorbent pads hold up to 12 times their own fabric weight in absorbed oil when measured for a single, disposable use.

Cost Efficiency in High-Volume Operations

Large facilities focused on total cost benefits as reusable absorbents reduce frequent replacement and waste handling expenses. Maintenance teams favored products that maintain absorption capacity over multiple cycles, lowering long-term material spending. Organizations managing wide plant areas or high-risk operations gained measurable savings from reuse. This financial advantage aligned well with procurement strategies prioritizing value over volume. Cost efficiency therefore emerged as a key growth driver in the reusable oil absorbents market.

Key Trends & Opportunities

Adoption of Eco-Friendly Fiber Composites

Manufacturers explored natural fibers, blends, and biodegradable composites to meet rising sustainability needs. Buyers showed interest in greener options that offer strong performance while lowering environmental impact. Governments encouraged eco-friendly product adoption through stricter rules on industrial waste. These materials opened opportunities for suppliers offering durable, reusable absorbents with reduced carbon footprint. This movement formed a major trend and opportunity within the reusable oil absorbents market.

- For instance, New Pig Heavyweight Absorbent Mat Pad (MAT240) is officially rated by the manufacturer to absorb up to 28.16 fluid ounces of oil per pad

Integration of Advanced Absorption Technologies

Producers invested in multilayer structures, improved wicking patterns, and stronger fiber bonding to increase reuse cycles. Enhanced durability supported wider use in harsh industrial settings, including offshore platforms and heavy machinery zones. Companies tested heat-resistant and chemical-resistant designs to extend service life. These innovations gave manufacturers a strong opportunity to differentiate products. Technology enhancements therefore served as a key trend and opportunity in the reusable oil absorbents market.

- For instance, New Pig Corporation’s technical specifications for various oil-only pads show different total absorbency values. The total capacity for a 100-pad bag of a common heavyweight oil-only pad (e.g., MAT214) is listed as 83.6 liters per bag.

Expansion Across Marine and Logistics Applications

Ports, shipping yards, and transport hubs showed greater adoption due to rising environmental audits and stricter spill rules. Reusable absorbents helped reduce supply turnover during frequent loading and refueling operations. Marine operators preferred reusable options that withstand moisture and repeated cleaning. This broadened the market base and created new opportunities for vendors. Adoption across these sectors stood out as a key trend and opportunity in the reusable oil absorbents market.

Key Challenges

Performance Limitations Under Harsh Conditions

Some reusable absorbents lose efficiency when exposed to extreme heat, heavy chemicals, or abrasive surfaces. Industries handling corrosive fluids require higher-grade materials, raising procurement complexity and cost. Repeated washing can also reduce absorption capacity over time, affecting reliability. These issues create barriers for widespread adoption in high-risk environments. Material durability constraints therefore represent a key challenge in the reusable oil absorbents market.

High Upfront Costs and Maintenance Requirements

Reusable absorbents demand higher initial investment compared to disposable versions, which slows adoption in small facilities. Cleaning, drying, and handling routines add ongoing labor and operational costs. Some plants struggle to maintain consistent reuse cycles, leading to irregular performance outcomes. Budget-limited sites prefer low-cost disposables, affecting market penetration. These financial and operational pressures form a key challenge in the reusable oil absorbents market.

Regional Analysis

North America

North America held the largest share of the reusable oil absorbents market in 2024 with about 38% share. Strong demand came from oil and gas facilities, chemical plants, and large manufacturing units that rely on reusable absorbents for routine maintenance and spill control. Regulatory pressure from environmental bodies encouraged industries to adopt low-waste solutions, boosting the use of reusable pads and rolls. The region also benefited from advanced industrial practices and high adoption of safety standards. Marine and logistics operations added consistent demand due to strict spill prevention norms across ports and transport hubs.

Europe

Europe accounted for nearly 27% share in 2024, supported by strong environmental regulations and rising industrial sustainability goals. Companies across chemicals, automotive, aerospace, and marine sectors shifted to reusable absorbents to reduce waste and comply with EU waste-reduction frameworks. High awareness of green maintenance practices strengthened the adoption of reusable pads, mats, and composite-based absorbents. The region’s advanced manufacturing landscape created steady demand from machinery maintenance and routine operational safety tasks. Ports and shipyards also contributed to market expansion as maritime operators focused on minimizing spill-related penalties and improving environmental performance.

Asia Pacific

Asia Pacific captured about 24% share in 2024, driven by rapid industrial expansion across China, India, Japan, and Southeast Asia. Strong growth in oil refining, chemical manufacturing, marine logistics, and heavy equipment industries increased the need for durable and reusable absorbents. Rising compliance with safety and environmental policies pushed industries to replace disposable absorbents with long-life alternatives. Growing port activities and ship maintenance operations added further demand. Cost efficiency also supported adoption among large plants that handle frequent maintenance cycles, helping the region emerge as a fast-growing market for reusable oil absorbents.

Latin America

Latin America held around 7% share in 2024, supported by steady utilization in oil production zones, marine terminals, and metal processing sites. Countries such as Brazil and Mexico increased the use of reusable absorbents due to rising offshore activities and stricter environmental monitoring. Industrial plants across chemicals and manufacturing adopted reusable options to reduce long-term waste handling costs. Local suppliers expanded product availability, improving market penetration. Although adoption levels remain lower compared to developed regions, growing focus on compliance and spill-prevention practices continues to support gradual market expansion.

Middle East & Africa

Middle East & Africa accounted for nearly 4% share in 2024, with demand concentrated in oil fields, petrochemical hubs, and marine operations. Large-scale extraction and refining activities increased the reliance on reusable absorbents for routine spill control and machinery maintenance. Governments promoted environmental safety guidelines, encouraging companies to adopt more durable absorbent materials. Industrial facilities in the UAE, Saudi Arabia, and South Africa used reusable pads and rolls to manage operational spills more cost-effectively. While adoption is still emerging, expanding industrial infrastructure and rising compliance efforts support continued market growth in the region.

Market Segmentations:

By Material

- Polyester

- Polypropylene

- Natural Fibers

- Composites

- Others

By Form

- Pads

- Pillows

- Rolls

- Sheets & mats

- Others

By End use

- Oil & gas

- Chemical

- Food processing

- Healthcare

- Manufacturing

- Marine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The reusable oil absorbents market features key players such as Fentex Ltd., ACME, Sorbent Green LLC, New Pig Corporation, ITU AbsorbTech, Inc, Darcy Spillcare Manufacturing, Closed Loop Recycling, Park Industries, Oil-Dri Corporation of America, and 3M. Competition centers on product durability, absorption performance, and the ability to support multiple reuse cycles. Companies focus on developing advanced materials that handle industrial spills while reducing waste generation. Many suppliers invest in sustainability-driven designs to align with rising environmental compliance requirements. Expanding distribution networks and customized solutions for oil and gas, manufacturing, and marine sectors help strengthen market presence. Firms also enhance product portfolios with pads, rolls, mats, and composite materials that support long-term operational efficiency. Integration of cleaning and reconditioning services further differentiates offerings. Continuous innovation, improved lifecycle performance, and stronger industry partnerships define the competitive momentum across global markets.

Key Player Analysis

- Fentex Ltd.

- ACME

- Sorbent Green LLC

- New Pig Corporation

- ITU AbsorbTech, Inc

- Darcy Spillcare Manufacturing

- Closed Loop Recycling

- Park Industries

- Oil-Dri Corporation of America

- 3M

Recent Developments

- In 2025, ITU AbsorbTech acquired Industrial Absorbent Solutions (IAS), expanding its service reach in South Carolina and reinforcing its leadership in sustainable spill management using launderable, reusable oil absorbents under the SorbIts brand.

- In 2025, ACME Environmental is set to launch Geo-Boom™️, a new containment boom featuring location-tracking technology to improve efficiency in oil spill containment.

- In 2024, New Pig continued its market presence by offering a variety of reusable oil absorbents made from materials like recycled fibers, emphasizing eco-friendly options.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material, Form, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as industries increase adoption of reusable absorbents for routine maintenance.

- Demand will rise due to stronger environmental regulations and waste-reduction requirements.

- Manufacturers will introduce advanced materials with higher durability and improved absorption capacity.

- Eco-friendly fiber composites will gain traction as companies shift toward sustainable operations.

- Adoption will expand in marine and logistics sectors due to tighter spill-prevention norms.

- Industrial automation will support higher use of standardized absorbent pads and rolls.

- Cost-efficient reusable products will replace disposable variants in high-volume facilities.

- Growth will accelerate in Asia Pacific as industrial activity and safety compliance increase.

- Partnerships between suppliers and large industrial clients will improve long-term product deployment.

- Innovation in cleaning and reconditioning methods will extend reuse cycles and lower operational costs.