Market Overview

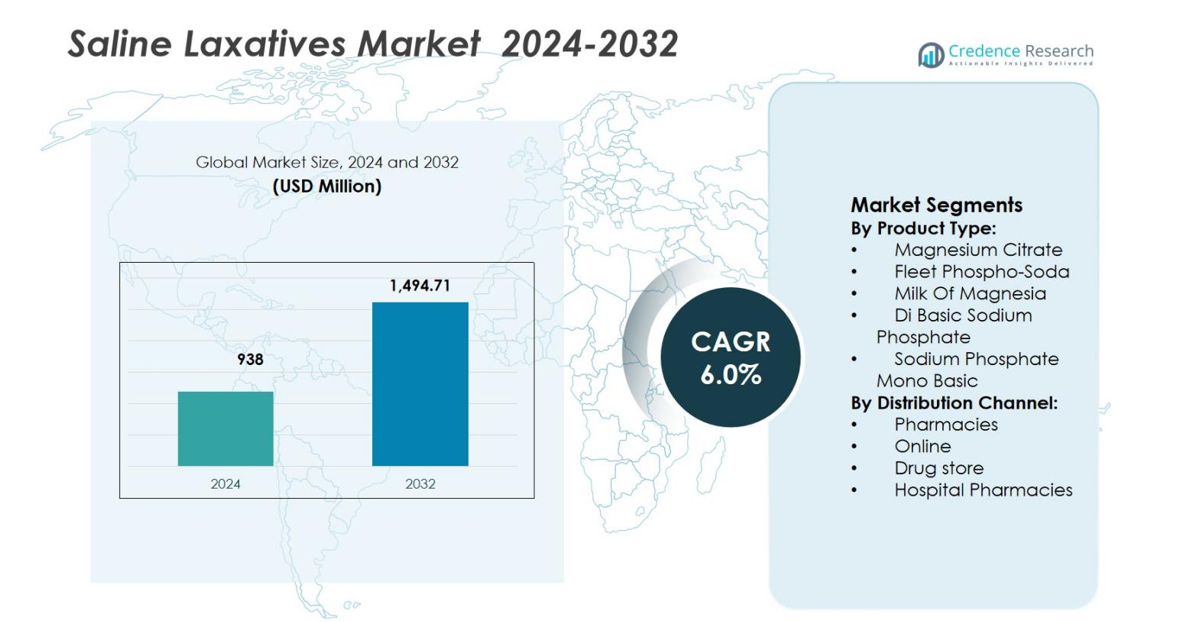

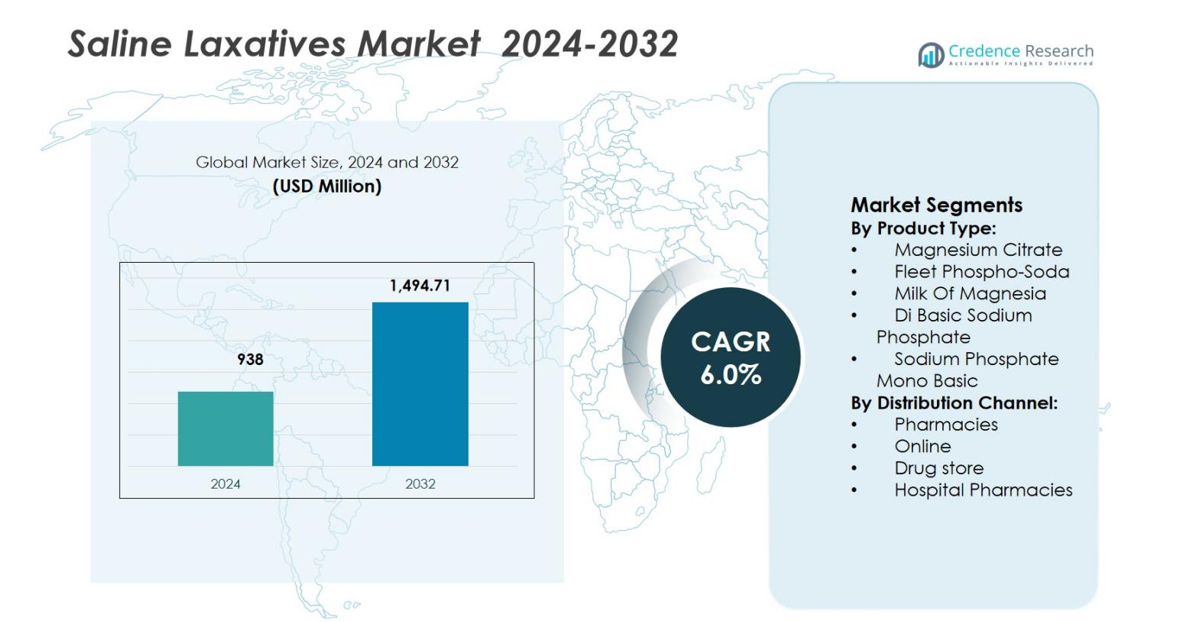

Saline Laxatives Market size was valued at USD 938 million in 2024 and is anticipated to reach USD 1,494.71 million by 2032, at a CAGR of 6.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saline Laxatives Market Size 2024 |

USD 938 million |

| Saline Laxatives Market, CAGR |

6.0% |

| Saline Laxatives Market Size 2032 |

USD 1,494.71 million |

Saline Laxatives Market is shaped by the strong presence of established pharmaceutical manufacturers and large retail pharmacy chains, including Bayer AG, Cardinal Health, Salix Pharmaceuticals, McKesson Corporation, The Kroger Company, Safeway Inc., Family Dollar Stores, Supervalu Inc., Beutlich Pharmaceuticals, and Walgreens Company. These players benefit from extensive distribution networks, brand recognition, and wide over-the-counter availability, supporting consistent product adoption across retail and institutional settings. Strategic focus on formulation reliability, regulatory compliance, and pharmacy-led visibility strengthens their market positioning. Regionally, North America leads the Saline Laxatives Market with a 36.4% market share, driven by high constipation prevalence, advanced healthcare infrastructure, and strong utilization of bowel preparation products in diagnostic procedures, followed by sustained demand across Europe and Asia Pacific.

Market Insights

- Saline Laxatives Market was valued at USD 938 million in 2024 and is projected to reach USD 1,494.71 million by 2032, expanding at a CAGR of 6.0% during the forecast period, supported by steady demand across OTC and institutional healthcare settings.

- Growth of the Saline Laxatives Market is driven by rising constipation prevalence, aging populations, sedentary lifestyles, and increasing use of saline laxatives in diagnostic and surgical bowel preparation procedures.

- Product innovation and wide retail availability shape market trends, with Magnesium Citrate holding a 38.6% segment share in 2024 due to rapid action, high efficacy, and strong clinical and consumer preference.

- Market structure is influenced by established pharmaceutical brands and large retail pharmacy chains focusing on distribution reach, brand trust, private-label offerings, and consistent product efficacy across channels.

- Regionally, North America led with a 36.4% market share in 2024, followed by Europe at 28.1% and Asia Pacific at 24.3%, while Latin America and Middle East & Africa together accounted for the remaining share, reflecting developing healthcare access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The Saline Laxatives Market by product type is led by Magnesium Citrate, which accounted for 38.6% market share in 2024 due to its rapid onset of action and strong clinical preference for bowel preparation and acute constipation management. Magnesium Citrate offers predictable efficacy, high patient compliance, and widespread availability across retail and hospital settings. Fleet Phospho-Soda and Milk of Magnesia maintain steady demand, supported by established usage patterns, while Di Basic Sodium Phosphate and Sodium Phosphate Mono Basic are primarily utilized in clinical and procedural applications. Growing gastrointestinal disorder prevalence and increased diagnostic procedures continue to drive segment growth.

- For instance, Phillips’ Milk of Magnesia by Bayer provides magnesium hydroxide (typically 1.2 g per 15 mL) for cramp-free constipation relief, working within 30 minutes to 6 hours by softening stool, with over 140 years of established use as the leading brand.

By Distribution Channel:

Within the distribution channel segment of the Saline Laxatives Market, Pharmacies dominated with a 41.2% market share in 2024, supported by strong consumer trust, pharmacist recommendations, and easy accessibility of over-the-counter laxatives. Retail pharmacies serve as the primary point of purchase for self-medication and routine constipation management. Drug stores and hospital pharmacies contribute significantly through prescription-based and inpatient usage, while online channels are expanding due to convenience and discreet purchasing. Rising OTC drug consumption, expanding pharmacy networks, and increasing awareness of digestive health are key drivers supporting channel dominance.

- For instance, Prestige Consumer Healthcare’s Fleet Saline Enema, with its pre-lubricated Comfortip and ultra-pure saline formula, delivers relief in 1-5 minutes and ranks as the top enema brand available OTC at pharmacies like Walgreens.

Key Growth Drivers

Rising Prevalence of Constipation and Gastrointestinal Disorders

The Saline Laxatives Market is strongly driven by the rising prevalence of constipation and gastrointestinal disorders linked to aging populations, sedentary lifestyles, low dietary fiber intake, and increased consumption of processed foods. Chronic constipation is particularly common among elderly patients and individuals with metabolic or neurological conditions, increasing routine dependence on laxative therapies. Saline laxatives provide fast relief and predictable outcomes, making them a preferred option for acute and episodic treatment. Growing awareness of digestive health and proactive symptom management further accelerates adoption across both prescription and over-the-counter channels.

- For instance, C.B. Fleet Company’s Fleet Phospho-Soda, an oral sodium phosphate saline laxative, was widely used for short-term constipation relief and bowel preparation but faced a voluntary recall in 2008 due to risks of acute phosphate nephropathy in certain patients.

Increasing Use in Diagnostic and Surgical Procedures

The expanding volume of diagnostic and surgical procedures significantly drives growth in the Saline Laxatives Market. Saline laxatives are widely used for bowel cleansing prior to colonoscopies, endoscopic examinations, and abdominal surgeries due to their rapid action and high efficacy. Rising colorectal cancer screening programs and hospital-based diagnostic testing increase institutional demand for bowel preparation products. Healthcare providers favor saline formulations for their reliability and standardized dosing, strengthening their role in clinical settings. The steady expansion of hospital infrastructure and preventive screening initiatives continues to support this driver.

- For instance, Suprep Bowel Prep Kit delivered 97% success in overall colon cleansing efficacy in a split-dose trial involving 180 adults preparing for colonoscopy with a light breakfast.

Strong Availability and Acceptance of Over-the-Counter Products

Widespread availability of saline laxatives as over-the-counter products plays a key role in market expansion. Consumers increasingly prefer self-medication for mild to moderate constipation, driving demand through retail pharmacies and drug stores. Clear labeling, pharmacist guidance, and established brand recognition enhance consumer confidence in saline formulations. The ease of access eliminates the need for physician consultations, supporting frequent usage. This accessibility, combined with cost-effectiveness and rapid symptom relief, positions saline laxatives as a first-line choice for short-term constipation management.

Key Trends & Opportunities

Shift Toward Patient-Friendly and Low-Sodium Formulations

A major trend shaping the Saline Laxatives Market is the development of patient-friendly formulations with improved taste profiles and controlled sodium content. Manufacturers are investing in reformulations to reduce side effects such as electrolyte imbalance and dehydration while maintaining clinical efficacy. These advancements address safety concerns among elderly and cardiovascular patients, expanding the eligible user base. Opportunities exist for brands offering balanced formulations that improve tolerability and adherence, especially in chronic-use scenarios and institutional settings focused on patient safety.

- For instance, USV Ltd’s Exelyte Liquid Lime provides an oral saline laxative in a 45 ml bottle with lime flavoring for better palatability. This formulation uses monobasic sodium phosphate dihydrate and disodium hydrogen orthophosphate dihydrate to draw fluid into the intestine, promoting bowel movement in 30 minutes to 6 hours while supporting electrolyte balance.

Growth of Online Pharmacies and Digital Health Platforms

The rapid expansion of online pharmacies presents a significant opportunity in the Saline Laxatives Market. Digital platforms enable discreet purchasing, home delivery, and access to product information, appealing to tech-savvy and urban consumers. E-commerce channels also support subscription models for recurring needs, enhancing customer retention. Integration of digital health tools, such as symptom trackers and pharmacist consultations, further strengthens consumer engagement. Companies that optimize online visibility and digital distribution strategies can capture incremental demand and improve market penetration.

- For instance, Instacart delivers Fleet Laxative Saline Enema (118 ml dose with 19g monobasic sodium phosphate) in as fast as 1 hour with contactless home drop-off, supporting quick fulfillment for recurring constipation relief needs.

Key Challenges

Safety Concerns and Risk of Electrolyte Imbalance

Safety concerns related to electrolyte imbalance and dehydration pose a key challenge for the Saline Laxatives Market. Excessive or prolonged use can lead to complications such as sodium overload, kidney stress, and cardiovascular issues, particularly in elderly and high-risk patients. These risks necessitate strict usage guidelines and limit long-term consumption. Healthcare providers often recommend alternative laxatives for chronic cases, restricting repeat usage. Regulatory scrutiny and warning requirements further add complexity to product positioning and consumer education efforts.

Availability of Alternative Laxative Therapies

The wide availability of alternative laxative therapies challenges growth in the Saline Laxatives Market. Bulk-forming, osmotic, stimulant, and stool softener laxatives offer gentler options for long-term management and are often preferred by physicians for chronic constipation. Natural fiber supplements and probiotic-based products also gain traction due to their perceived safety. This competitive landscape pressures saline laxatives to maintain relevance primarily for acute and procedural use, limiting expansion into broader chronic treatment segments.

Regional Analysis

North America

North America held a 36.4% market share in 2024 in the Saline Laxatives Market, driven by high constipation prevalence, strong awareness of digestive health, and widespread access to over-the-counter medications. The region benefits from advanced healthcare infrastructure, high screening rates for colorectal conditions, and routine use of bowel preparation products in diagnostic procedures. Strong presence of branded products, pharmacist-led recommendations, and insurance coverage for hospital use further support demand. An aging population and increasing adoption of preventive healthcare practices continue to reinforce market leadership across the United States and Canada.

Europe

Europe accounted for a 28.1% market share in 2024 in the Saline Laxatives Market, supported by rising gastrointestinal disorder incidence and strong regulatory acceptance of OTC laxatives. Countries such as Germany, the UK, France, and Italy drive regional demand through well-established pharmacy networks and high healthcare utilization among elderly populations. Increased colorectal cancer screening programs and hospital-based bowel preparation protocols contribute to steady consumption. Growing awareness of digestive wellness and physician-guided short-term laxative use further strengthens market penetration across both retail and institutional healthcare settings.

Asia Pacific

Asia Pacific captured a 24.3% market share in 2024 in the Saline Laxatives Market, reflecting rapid growth driven by urbanization, dietary changes, and increasing gastrointestinal health issues. Expanding middle-class populations, improving access to healthcare, and rising OTC drug consumption support strong regional momentum. Countries such as China, India, and Japan contribute significantly due to large patient pools and expanding pharmacy chains. Increased adoption of Western diagnostic practices and growing awareness of bowel health further boost demand, positioning Asia Pacific as the fastest-expanding regional market.

Latin America

Latin America represented a 6.8% market share in 2024 in the Saline Laxatives Market, supported by gradual improvements in healthcare access and increasing awareness of digestive disorders. Brazil and Mexico dominate regional demand due to expanding urban populations and growing retail pharmacy presence. Rising use of OTC medications for self-treatment and increased hospital diagnostic activity contribute to market growth. However, affordability concerns and uneven healthcare infrastructure limit faster expansion. Continued investment in healthcare services and pharmacy distribution networks is expected to support steady market development.

Middle East & Africa

The Middle East & Africa held a 4.4% market share in 2024 in the Saline Laxatives Market, driven by rising healthcare spending and improving access to essential medications. Urban centers in the Gulf Cooperation Council countries contribute significantly through modern hospitals and retail pharmacy expansion. Increasing awareness of gastrointestinal health and growing adoption of diagnostic procedures support demand. However, limited access in rural areas and lower healthcare penetration restrain broader growth. Ongoing healthcare infrastructure development and rising OTC drug availability are expected to gradually enhance regional market presence.

Market Segmentations:

By Product Type:

- Magnesium Citrate

- Fleet Phospho-Soda

- Milk Of Magnesia

- Di Basic Sodium Phosphate

- Sodium Phosphate Mono Basic

By Distribution Channel:

- Pharmacies

- Online

- Drug store

- Hospital Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Saline Laxatives Market includes Bayer AG, Cardinal Health, Salix Pharmaceuticals, McKesson Corporation, The Kroger Company, Safeway Inc., Family Dollar Stores, Supervalu Inc., Beutlich Pharmaceuticals, and Walgreens Company. The market remains moderately consolidated, with established pharmaceutical manufacturers and large retail pharmacy chains shaping product availability and pricing dynamics. Key players focus on brand recognition, wide distribution reach, and consistent product efficacy to maintain market position. Strong retail and pharmacy networks provide a competitive advantage by ensuring high product visibility and consumer accessibility. Companies continue to invest in packaging improvements, patient-friendly formulations, and regulatory compliance to strengthen trust among healthcare professionals and consumers. Strategic partnerships between manufacturers and distributors enhance supply chain efficiency, while private-label offerings from large retailers intensify price competition. Continuous emphasis on quality assurance and pharmacist-driven recommendations supports sustained competitiveness across both OTC and institutional segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bayer Ag

- Cardinal Health

- Salix Pharmaceuticals

- Mckesson Corporation

- The Kroger Company

- Safeway

- Family Dollar Stores

- Supervalu Inc

- Beutlich Pharmaceuticals

- Walgreen Company

Recent Developments

- In July 2025, Bausch Health’s Salix Pharmaceuticals launched a “I Wish I Knew” direct-to-consumer awareness campaign focused on its gastrointestinal portfolio (including GI health education around related therapies), signaling expanded patient engagement initiatives within the broader GI treatment space.

- In March 2025, Glenmark Pharmaceuticals announced the launch of Polyethylene Glycol 3350 Powder for Solution as an OTC laxative product in the U.S. market, addressing demand for an alternative to existing polyethylene glycol formulations.

- In November 2024, Cardinal Health announced two strategic acquisitions: the purchase of a majority stake in GI Alliance (GIA), the country’s leading gastroenterology management services organization, for approximately $2.8 billion in cash (representing 71% ownership), and the acquisition of Advanced Diabetes Supply Group, which will expand Cardinal Health’s at-Home Solutions business.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Saline Laxatives Market demand will continue to grow due to rising constipation prevalence linked to aging populations and lifestyle changes.

- Increasing colorectal screening and diagnostic procedures will sustain institutional use of saline laxatives.

- Over-the-counter availability will remain a key driver supporting self-medication and routine short-term use.

- Manufacturers will focus on improving formulation safety to reduce electrolyte imbalance risks.

- Patient-friendly formulations with better taste and tolerability will gain wider acceptance.

- Expansion of retail pharmacy networks will strengthen product accessibility across regions.

- Online pharmacy channels will contribute incremental growth through convenience and discreet purchasing.

- Regulatory emphasis on labeling and usage guidelines will shape product positioning strategies.

- Competition from alternative laxative therapies will push differentiation through efficacy and reliability.

- Emerging markets will offer long-term growth opportunities as healthcare access and awareness improve.