Market Overview

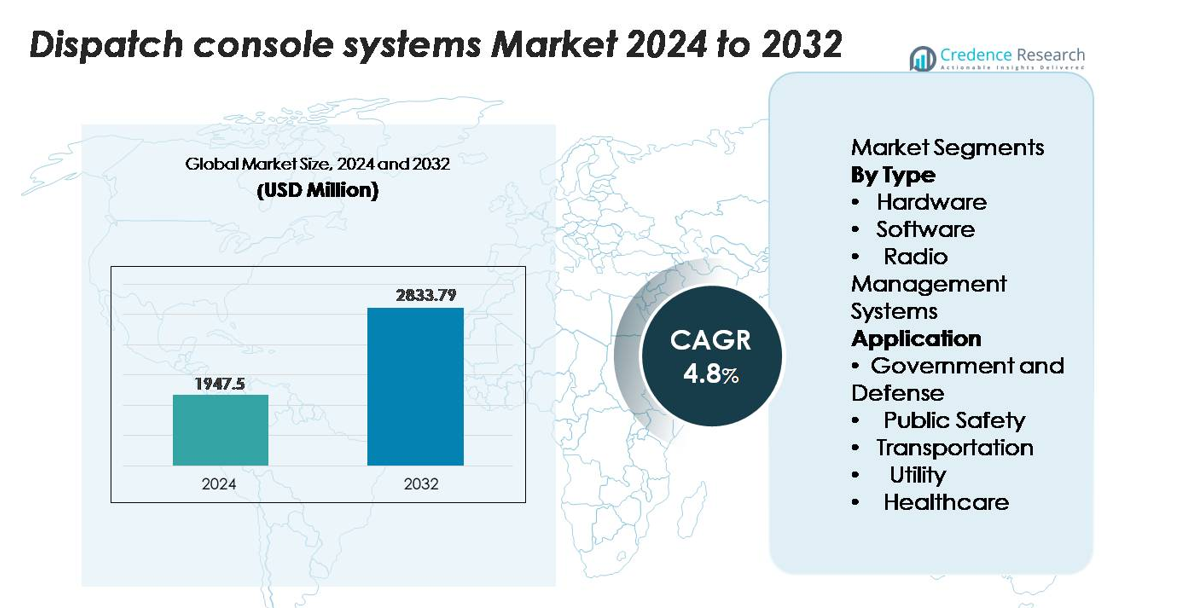

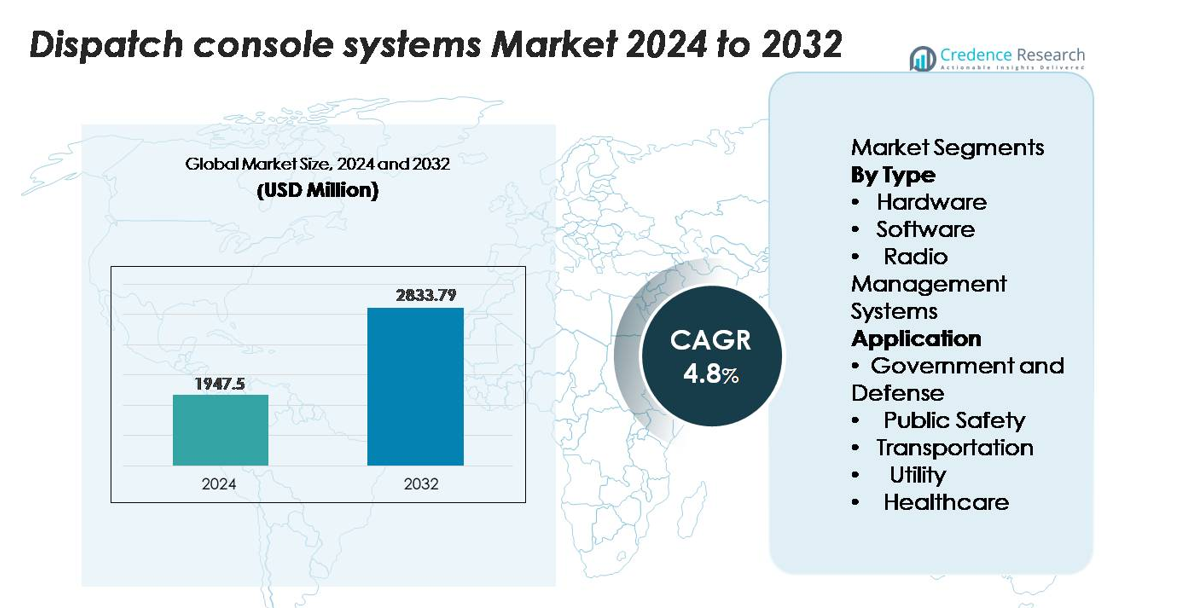

The global Dispatch Console Systems market was valued at USD 1,947.5 million in 2024 and is projected to reach USD 2,833.79 million by 2032, expanding at a CAGR of 4.8% over the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dispatch Console Systems Market Size 2024 |

USD 1,947.5 million |

| Dispatch Console Systems Market, CAGR |

4.8% |

| Dispatch Console Systems Market Size 2032 |

USD 2,833.79 million |

In the global market for dispatch console systems, top players such as Motorola Solutions, Inc., Harris Corporation, Bosch Sicherheitssysteme GmbH, Zetron, Inc. (Kenwood), Avtec Inc, Omnitronics, L.L.C., Siemens Convergence Creators GmbH (AtoS), Catalyst Communications Technologies, Inc., EF Johnson Technologies and Cisco Systems, Inc. lead with strong product portfolios, global footprints and strategic partnerships. These firms dominate innovation in hardware, software and radio-management systems, leveraging their scale and service networks. Regionally, North America remains the leading market with approximately 32.2% of global revenue in 2024, reflecting high public-safety investment and early technology adoption in the U.S. market.

Market Insights

- The global dispatch console systems market reached USD 1,947.5 million in 2024 and is projected to hit USD 2,833.79 million by 2032, expanding at a CAGR of 4.8% during the forecast period.

- Market growth is driven by increasing modernization of mission-critical communication networks, rising adoption of IP-based dispatch platforms, and greater investment in integrated command-and-control centers across public safety, transportation, utilities, and healthcare sectors.

- Emerging trends include cloud-enabled remote dispatching, AI-assisted incident management, and rising demand for interoperable multi-agency communication architectures supporting radio, telephony, and broadband networks.

- Competitive intensity is shaped by leading players such as Motorola Solutions, Harris Corporation, Zetron, Avtec, Cisco, and Bosch, focusing on advanced software consoles, resilient hardware systems, and enhanced cybersecurity capabilities.

- Regionally, North America holds ~32.2% of the market, followed by Europe at ~22–25% and Asia Pacific at ~22%. By type, hardware remains the dominant segment, while public safety leads applications due to high emergency-response deployment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Hardware remains the dominant segment in dispatch console systems, holding the largest market share due to its critical role in enabling resilient, low-latency communication across mission-critical environments. Dispatch centers continue to invest heavily in reliable operator consoles, ruggedized communication terminals, and multi-screen workstation infrastructure to maintain uninterrupted operations. Growth is further accelerated by modernization programs in emergency response networks and the replacement of legacy analog infrastructures. Software solutions and radio management systems are expanding steadily, driven by cloud integration, enhanced interoperability, and centralized control capabilities that support multi-agency coordination.

- For instance, Motorola Solutions’ MCC 7500 IP Dispatch Console part of the ASTRO® 25 system supports up to 100 console positions and provides control for more than 2,000 radio channels across multi-site trunked networks while operating with end-to-end AES-256 encryption and sub-80-millisecond audio processing latency, demonstrating the advanced hardware performance required for mission-critical dispatch operations.

By Application

Public safety represents the leading application segment, accounting for the highest share due to its essential function in emergency response, law enforcement coordination, and real-time field communication. Increasing deployment of integrated command-and-control platforms and Next-Generation 911 upgrades continues to strengthen investment in advanced dispatch consoles. Government and defense agencies also maintain strong adoption, supported by secure communication requirements and tactical incident-management needs. Transportation, utilities, and healthcare sectors exhibit rising demand as organizations prioritize operational continuity, workforce safety, and centralized monitoring across distributed assets and service networks.

- For instance, Zetron’s MAX Dispatch system widely used in public-safety operations supports up to 128 fully assignable channels per console position, integrates P25, DMR, and LTE networks through native interfaces, and processes audio with sub-50-millisecond latency across redundant IP paths, enabling dispatchers to coordinate high-volume emergency incidents with real-time communication precision.

Key Growth Drivers

Expansion of Mission-Critical Communication Networks

The rapid modernization of mission-critical communication infrastructures remains a primary driver for dispatch console system adoption. Governments, public safety agencies, and utilities continue to upgrade from legacy analog systems to IP-based, interoperable communication platforms capable of supporting real-time voice, data, and incident-management workflows. These upgrades require next-generation dispatch consoles equipped with multi-channel processing, dynamic talk-group configuration, and resilient failover capabilities. Investments in nationwide public safety broadband networks further strengthen demand by enabling seamless coordination across agencies and enhancing emergency response times. As operational continuity becomes increasingly essential for homeland security, disaster management, and critical infrastructure protection, organizations prioritize centralized, high-availability dispatch interfaces that enhance situational awareness and reduce communication latency. The shift toward unified communication environments ensures sustained momentum for advanced dispatch console solutions.

- For instance, L3Harris’ VIDA® P25 platform supports up to 128 trunked RF channels per zone and delivers fully encrypted AES-256 IP traffic. The network maintains audio latency below 40 milliseconds across redundant paths, forming a reliable base for next-generation dispatch console integration.

Rising Deployment of Integrated Command-and-Control Centers

The growing adoption of integrated command-and-control environments is fueling demand for sophisticated dispatch console systems. Agencies across transportation, defense, emergency medical services, and utilities are consolidating their operations into centralized control rooms equipped with multi-modal communication tools and data-rich visualization platforms. Modern dispatch consoles serve as the core interface for managing cross-functional teams, digital evidence, sensor feeds, and automated alerts. Strong emphasis on coordinated emergency response, infrastructure monitoring, and proactive incident prevention drives agencies to implement consoles with interoperable radio, telephony, and IP communication modules. The increasing volume of field data from IoT devices, GPS units, and mobile responders further underscores the need for consoles that can consolidate, prioritize, and route critical information efficiently. As agencies pursue operational standardization and improved response accuracy, adoption of high-performance dispatch interfaces continues to accelerate.

- For instance, Siemens’ Siveillance Control Pro is a scalable command-and-control platform built for large campuses and critical infrastructure. The system integrates access control, fire safety, and video surveillance through open interfaces such as OPC and a dedicated SDK, allowing unified monitoring across complex sites.

Shift Toward IP-Based and Cloud-Native Dispatch Architecture

Transitioning from traditional hardware-heavy communication systems to IP-based and cloud-native dispatch platforms is reshaping market growth. Organizations are increasingly adopting software-centric consoles that support remote operations, browser-based access, and centralized configuration. Cloud migration allows dispatch centers to reduce infrastructure costs, enhance scalability, and use elastic computing resources during peak emergency events. Remote dispatching capabilities particularly valuable for distributed teams and disaster scenarios further accelerate adoption. The flexibility to update features through over-the-air upgrades and integrate with AI-assisted routing, automated call distribution, and real-time analytics enhances operational efficiency. As digital transformation initiatives accelerate across public safety, defense, and industrial sectors, the shift toward virtualized dispatch ecosystems emerges as a structural growth catalyst across global markets.

Key Trends & Opportunities

Integration of AI, Automation, and Predictive Analytics

AI-driven functionalities are rapidly transforming dispatch console capabilities, creating major opportunities for more intelligent and efficient emergency operations. Modern systems increasingly incorporate automated call triage, intelligent incident prioritization, and predictive workload modeling, which significantly reduce dispatcher burden. Machine learning algorithms can analyze historical communication patterns, geospatial data, and sensor feeds to anticipate resource needs and enhance decision accuracy. Integrating computer-aided dispatch (CAD) with AI-powered analytics also improves routing efficiency, identifies communication bottlenecks, and supports faster incident closure times. As agencies seek operational precision, automated alert classification, voice-to-text transcription, and anomaly detection strengthen console usability. The demand for intelligent consoles creates a strong innovation path for manufacturers focused on edge analytics, augmented decision support, and advanced event correlation technologies.

- For instance, RapidSOS integrated into leading CAD and dispatch platforms processes more than 250 million emergency data transactions per year and delivers real-time device-level location updates at intervals as low as five seconds, enabling AI-driven dispatch systems to perform faster triage and predictive incident modeling with high data fidelity.

Growing Adoption of Cloud-Based Remote Dispatching

Remote and hybrid dispatching models are emerging as a major trend, driven by the need for workforce flexibility, continuity planning, and distributed command structures. Cloud-based consoles enable dispatchers to operate from secure remote workstations without compromising communication quality or system redundancy. This model enhances resilience during natural disasters, pandemics, and infrastructure failures by enabling rapid reallocation of dispatch capabilities across regions. Additionally, cloud-native solutions offer seamless software upgrades, stronger cybersecurity frameworks, and cost-efficient scalability. As more agencies modernize their communication infrastructure, remote dispatching becomes an attractive operational strategy, opening opportunities for platform vendors to deliver browser-based consoles, encrypted cloud communication layers, and subscription-driven service models.

- For instance, Motorola Solutions’ CommandCentral Cloud platform operates across more than 20 global AWS Availability Zones and supports end-to-end AES-256 encryption, while enabling dispatchers to handle up to 300 concurrent remote call-handling sessions through its web-based interface capabilities that directly enable large-scale remote dispatch operations.

Increasing Interoperability Across Multi-Agency Communication Networks

Interoperability is becoming a top priority for agencies requiring seamless communication across police, fire, EMS, transportation, and public works departments. Next-generation dispatch consoles support cross-network bridging, multi-band radio control, and unified talk-group management, allowing diverse agencies to coordinate efficiently during emergencies. The rise of national broadband safety networks and cross-border security collaborations further strengthens the need for interoperable console architectures. Vendors that offer flexible APIs, standards-based interfaces, and multi-protocol radio integration are positioned to capture significant opportunities as agencies replace siloed systems with unified communication environments.

Key Challenges

Cybersecurity Vulnerabilities in Connected Dispatch Environments

As dispatch systems transition to IP-based and cloud-connected architectures, cybersecurity risks emerge as a critical challenge. Centralized console platforms handle sensitive incident data, real-time communication logs, and operational workflows that are highly vulnerable to ransomware, intrusions, and data interception. Ensuring end-to-end encryption, secure authentication, and multi-layer network protection requires significant investment and continuous monitoring. Public safety agencies and utilities often operate with constrained IT resources, making it difficult to maintain robust security hygiene. Attack surfaces expand further as consoles integrate CAD platforms, IoT sensors, and field devices. The growing complexity of digital communication ecosystems demands advanced cybersecurity frameworks, but adoption remains uneven across regions, creating operational and regulatory challenges for dispatch operators.

High Cost of System Modernization and Integration Complexity

Upgrading dispatch consoles from legacy analog or proprietary systems to IP-enabled, interoperable platforms involves substantial capital expenditure and complex integration processes. Many agencies operate long-standing communication infrastructures that lack compatibility with modern systems, necessitating extensive hardware replacement, network redesign, and workforce retraining. Integration with radio networks, telephony protocols, CAD software, and data management platforms increases deployment time and requires specialized technical expertise. Budget constraints especially in smaller municipalities and developing regions slow modernization efforts. Ongoing maintenance costs, software licensing fees, and periodic hardware refresh cycles further add to the financial burden, limiting the pace of adoption despite the clear operational benefits of next-generation dispatch consoles.

Regional Analysis

North America

North America leads the dispatch console market, capturing approximately 32.2 % of global revenue in 2024. The region benefits from high public-safety investment, early adoption of IP-based infrastructure and well-funded defence and emergency-response networks. Established players and strong regulatory frameworks promote upgrades of legacy systems to integrated digital dispatch environments. Sustained funding for first-responder communications and coordinated multi-agency systems drive growth. Cost pressures and the saturation of mature markets temper expansion, but replacement cycles and technology refresh programmes remain key revenue streams in North America.

Europe

Europe accounts for an estimated 22-25 % of the global dispatch console systems market. The region is characterized by rising cross-border cooperation in emergency services, increasing interoperability standards, and growing demand from transport and utility sectors. EU-level initiatives push for modernisation of public-safety communications, while legacy TETRA systems are gradually upgraded to IP-enabled dispatch platforms. Challenges include budget constraints across smaller countries and slower procurement cycles in public agencies. Nevertheless, the transition to unified command-centre architectures presents a stable growth path for the European segment.

Asia Pacific

In the Asia Pacific region the market share hovers around 22 % in 2024, with China and India together representing more than half of that regional demand. Rapid urbanisation, growing transportation and utility networks, and expanding public-safety infrastructure underpin growth. Governments are investing in smart-city initiatives and integrated dispatch consoles to support emergency services, transport hubs and large industrial facilities. While growth rates are higher than mature regions, challenges include interoperability of legacy systems, fragmentary procurement practices, and differing regulatory regimes across countries. The Asia Pacific market offers strong upside for console system vendors.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for roughly 8-10 % of the global dispatch console market. Growth is driven by enhanced investment in public-safety communications, critical-infrastructure protection and energy-sector monitoring systems. Large-scale programmes in GCC countries and increasing urban-infrastructure spending boost uptake of dispatch console solutions. However, slower adoption in many African nations due to budget constraints, infrastructure gaps and low awareness limits overall share. The region remains an emerging frontier, with significant opportunities for vendors that offer cost-effective, scalable and interoperable dispatch platforms adapted to diverse local conditions.

Latin America

Latin America’s share stands at around 5–6 % of the global dispatch console systems market. Policymakers in large regional markets are increasingly allocating budgets to modernise emergency-response, transportation and utility communication systems. However, economic volatility, public-sector budgetary constraints and extended procurement timelines slow the pace of investment. Vendors that can offer modular solutions, local support and flexible financing stand to gain. While absolute growth is moderate, the region’s push toward infrastructure modernization especially in transportation corridors and smart-grid initiatives marks Latin America as a developing but actionable market.

Market Segmentations:

By Type

- Hardware

- Software

- Radio Management Systems

Application

- Government and Defense

- Public Safety

- Transportation

- Utility

- Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dispatch console systems market is characterized by a mix of global technology leaders, specialized communication solution providers, and emerging software-centric vendors focusing on interoperable, IP-based architectures. Companies compete on system reliability, integration flexibility, cybersecurity enhancements, and multi-network support across radio, telephony, and broadband platforms. Leading players emphasize developing scalable console solutions that support cross-agency communication, visual incident management, and seamless migration from legacy systems to cloud-enabled environments. Strategic partnerships with public-safety agencies, transportation networks, and utility operators play a pivotal role in strengthening market presence. Vendors are also expanding their portfolios with AI-powered analytics, remote dispatching capabilities, and unified command-center interfaces to meet evolving operational demands. Continual investment in R&D, along with mergers and acquisitions, enables key manufacturers to enhance product performance, accelerate deployment speed, and offer long-term lifecycle support, reinforcing their competitive advantage in the globally expanding dispatch console ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Avtec Inc

- Harris Corporation

- EF Johnson Technologies

- Zetron, Inc. (Kenwood)

- Omnitronics, L.L.C.

- Motorola Solutions, Inc.

- Catalyst Communications Technologies, Inc.

- Siemens Convergence Creators GmbH (AtoS

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift further toward cloud-native dispatch platforms supporting remote and distributed operational models.

- AI-driven incident prioritization and automated call handling will become standard features across next-generation consoles.

- Integration of broadband, LTE, 5G, and radio networks will enhance multi-agency interoperability and real-time data sharing.

- Software-defined consoles will gain prominence as agencies migrate away from hardware-heavy legacy systems.

- Cybersecurity enhancements will remain a top priority as dispatch environments adopt more IP-based and connected architectures.

- Command centers will increasingly adopt unified interfaces that consolidate video, GIS, telemetry, and communication feeds.

- Public safety digital transformation initiatives will accelerate system replacements and large-scale fleet modernization.

- Vendors will expand modular, scalable console solutions to address diverse needs across utilities, healthcare, and transportation.

- Global smart-city programs will boost demand for integrated dispatch systems supporting urban safety and mobility operations.

- Strategic collaborations between technology providers and public-safety agencies will strengthen ecosystem innovation and long-term service models.