Market Overview

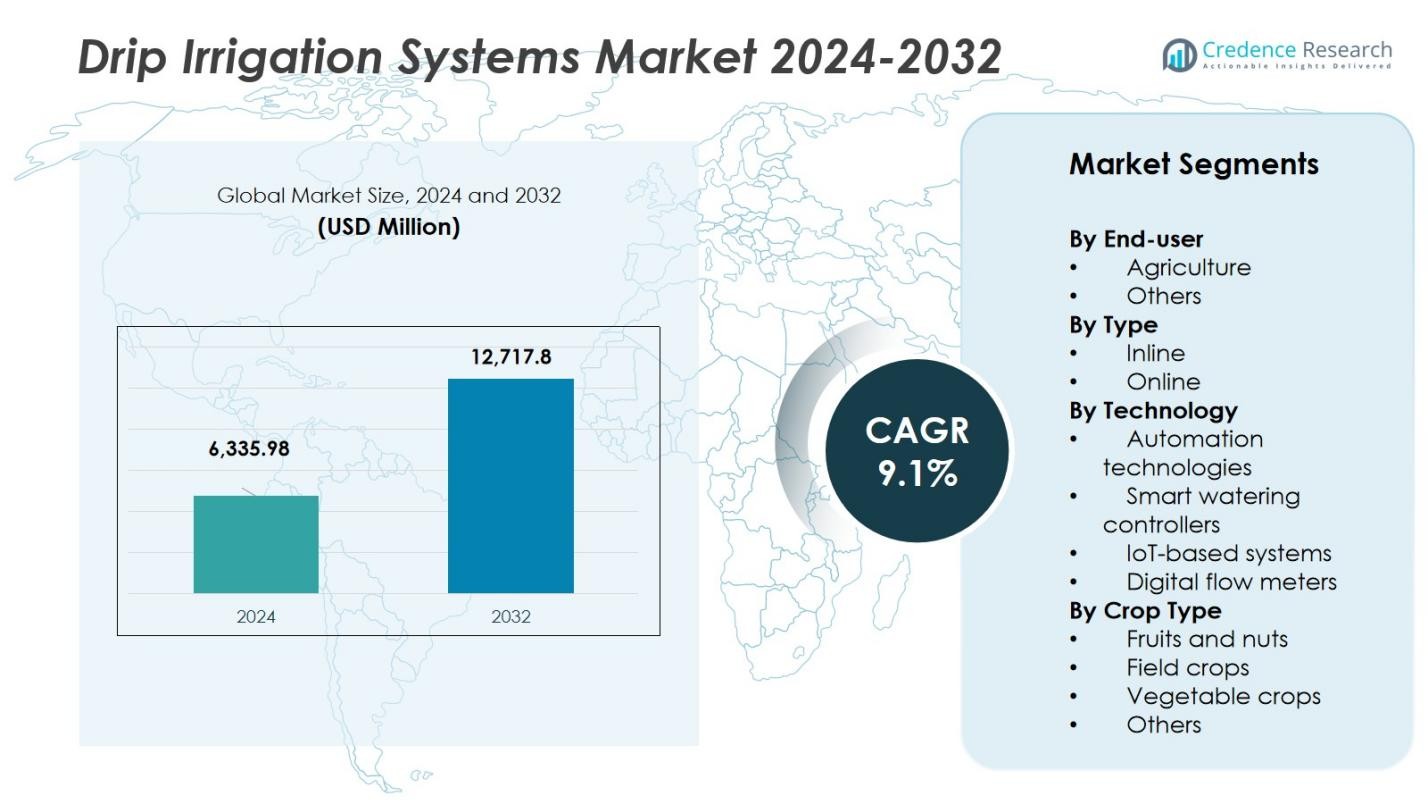

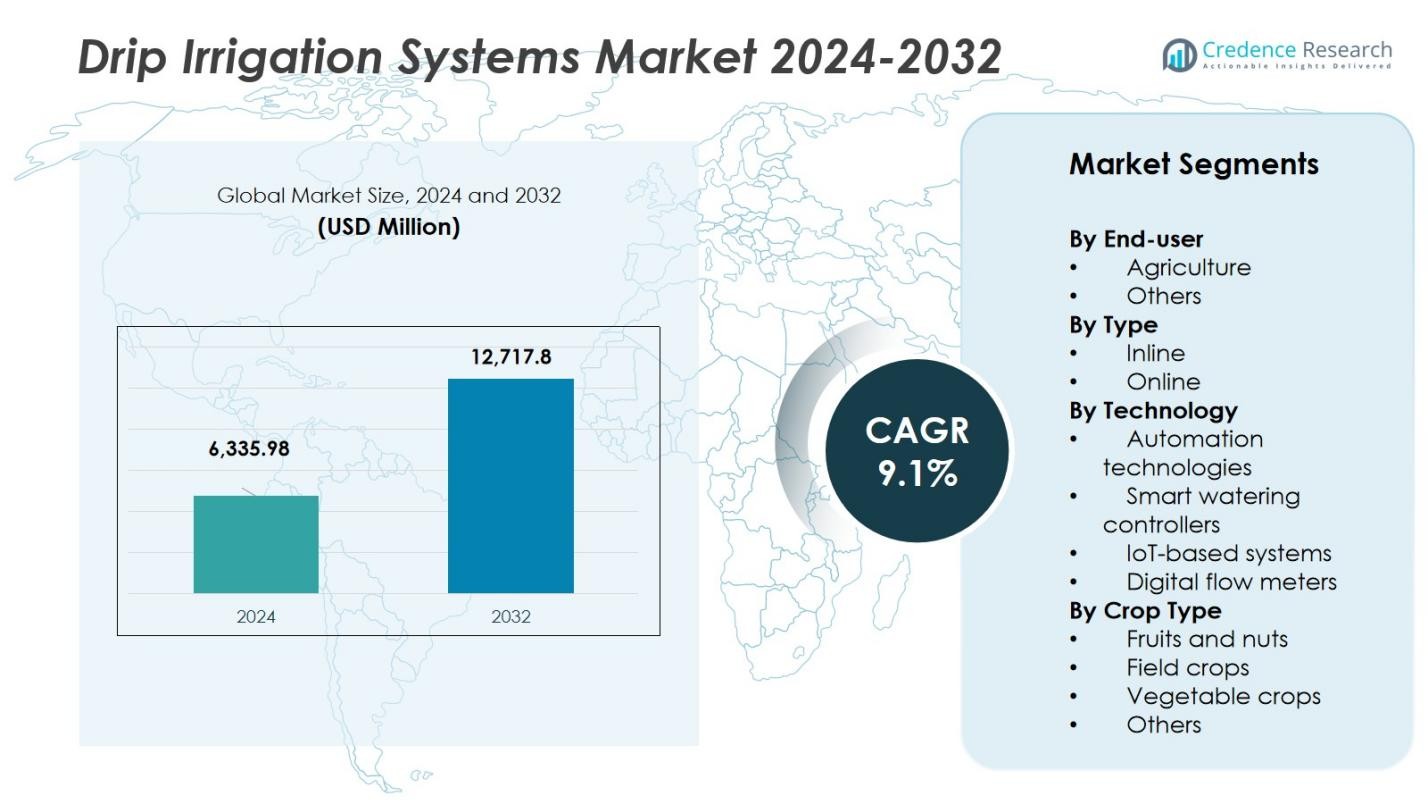

The Drip Irrigation Systems Market size was valued at USD 6,335.98 million in 2024 and is anticipated to reach USD 12,717.8 million by 2032, growing at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drip Irrigation Systems Market Size 2024 |

USD 6,335.98 Million |

| Drip Irrigation Systems Market, CAGR |

9.1% |

| Drip Irrigation Systems Market Size 2032 |

USD 12,717.8 Million |

The Drip Irrigation Systems Market features leading players such as AGRODRIP S.A., Astha Polymers Pvt. Ltd., BC Hardscapes LLC, DIG Corp., DripWorks Inc., Golden Key Middle East FZE, Hunter Industries Inc., Husqvarna AB, Irritec SpA and Jain Irrigation Systems Ltd. These companies leverage global distribution networks and technology partnerships to gain foothold across key regions. The Asia Pacific region dominates the market with a 33.0 % share in 2024, driven by large agricultural areas and strong water‑efficiency mandates. North America follows with a 26.9 % share, reflecting high investment in precision irrigation and smart technologies. Together these regions represent nearly 60 % of global revenue and act as strategic hubs for product innovation and regional expansion.

Market Insights

- The Drip Irrigation Systems Market was valued at USD 6,335.98 million in 2024 and is projected to reach USD 12,717.8 million by 2032, growing at a CAGR of 9.1% during the forecast period.

- Increasing demand for water-efficient solutions, government subsidies, and technological advancements are driving market growth.

- Smart irrigation systems and IoT-based technologies are gaining traction, particularly in large-scale farms, enhancing precision and water conservation.

- The Asia Pacific region leads the market with a 33.0% share in 2024, followed by North America at 26.9%, and Europe at 15.2%.

- High initial setup costs and lack of awareness in developing regions remain challenges, limiting faster adoption of drip irrigation systems in some markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By End-User

The agriculture segment leads the Drip Irrigation Systems Market, commanding approximately 75% of the market share. This dominance is driven by the growing need for efficient water usage in farming, especially in regions facing water scarcity. Drip irrigation offers targeted water delivery, improving crop yield and reducing water waste. As sustainable farming practices gain importance globally, the demand for drip irrigation systems in agriculture is projected to increase, with farmers seeking to optimize productivity while conserving water resources.

- For instance, Netafim’s advanced drip irrigation technology has enabled farmers in Israel to increase crop yields by up to 30% while reducing water consumption by 50%.

By Type

Inline drip irrigation systems hold the largest share at around 60%, owing to their efficiency in delivering consistent water over large areas, making them ideal for agricultural applications like field crops and orchards. On the other hand, online systems make up about 40% of the market, offering greater flexibility for smaller areas or specialized crops. These systems allow for targeted irrigation in gardens, landscaping, and niche crop production, making them attractive for use in residential and commercial applications where precise water control is critical.

- For instance, Rivulis Irrigation’s online drip systems are widely adopted for vineyards and high-value crops, with their precision irrigation improving water savings by 40% and increasing yield consistency.

By Technology

Automation technologies dominate the technology segment of the Drip Irrigation Systems Market, capturing roughly 40% of the share. These systems, which include smart controllers and IoT-based solutions, enable farms to optimize water usage by adjusting irrigation based on real-time environmental conditions. The adoption of digital flow meters, weather-based controllers, and soil moisture sensors is growing, as they help reduce labor costs and improve water efficiency. These advancements are particularly popular in large-scale agricultural operations seeking to automate irrigation for better resource management.

Key Growth Drivers

Increasing Demand for Water-Efficient Solutions

The growing demand for water-efficient solutions is a major driver for the Drip Irrigation Systems Market. As water scarcity becomes a global concern, especially in arid and semi-arid regions, farmers are increasingly adopting drip irrigation systems to optimize water usage. These systems provide targeted water application directly to plant roots, minimizing evaporation and runoff. With governments and environmental organizations emphasizing sustainability, the need for efficient irrigation systems that conserve water while maximizing agricultural productivity is rising, driving market growth.

- For instance, Jain Irrigation Systems Ltd. reports their drip‑irrigation systems have saved up to 70 % of water compared to flood irrigation and increased crop yield by up to 230 %

Government Support and Subsidies

Government initiatives and subsidies for sustainable farming practices are significantly driving the adoption of drip irrigation systems. In many countries, subsidies for water-efficient technologies and incentives for farmers to reduce water consumption are helping to lower the upfront costs of installing drip irrigation systems. Such support is particularly beneficial for small-scale and developing region farmers, enabling them to transition to more water-efficient practices. This push for modernization and sustainability in the agricultural sector is accelerating the market’s expansion.

- For instance, under the Pradhan Mantri Krishi Sinchai Yojana (PMKSY) in India, small and marginal farmers receive subsidies covering 55 % of the indicative unit cost for drip‑irrigation systems.

Technological Advancements in Drip Irrigation

Technological innovations, including automation, IoT-based systems, and smart controllers, are fueling the growth of the Drip Irrigation Systems Market. These technologies allow farmers to monitor soil moisture levels and weather conditions in real-time, optimizing irrigation schedules and water usage. The integration of digital flow meters and smart watering controllers also improves system efficiency and reduces manual labor. As precision agriculture continues to gain popularity, these advancements are becoming increasingly essential in providing farmers with better control over their irrigation systems, driving the market forward.

Key Trends & Opportunities

Shift Toward Smart Irrigation Solutions

A notable trend in the Drip Irrigation Systems Market is the increasing shift toward smart irrigation solutions. These systems, incorporating IoT and automation technologies, allow for real-time monitoring and precise control of water usage. With rising concerns over water conservation, farmers are adopting smart controllers and digital sensors that adjust water flow based on environmental conditions. This trend presents significant opportunities for market players to innovate and offer advanced, user-friendly solutions that optimize water distribution, reducing waste and improving crop yields, particularly in large-scale agricultural operations.

- For example, Netafim’s GrowSphereCrop Advisor system captures real‑time data from sensors, hydraulic systems and weather feeds to optimise irrigation scheduling.

Rising Adoption in Non-Agricultural Applications

There is a growing trend of adopting drip irrigation systems beyond traditional agricultural applications. These systems are increasingly being used in landscaping, golf courses, and even urban residential areas. As consumers and businesses become more aware of water conservation, drip irrigation is seen as an ideal solution for efficient water use in non-agricultural environments. This trend presents new opportunities for manufacturers to expand their product offerings and cater to the growing demand for sustainable water management solutions in these sectors.

- For instance, Toro’s irrigation solutions are now widely used in golf courses and urban parks, enabling water savings of up to 50% in landscaping applications.

Key Challenges

High Initial Setup Costs

One of the main challenges in the Drip Irrigation Systems Market is the high initial investment required for system installation. While drip irrigation offers long-term savings in water usage and labor costs, the upfront expenses can be a barrier, especially for small and medium-scale farmers in developing regions. The cost of purchasing and installing the necessary components, such as pipes, emitters, and controllers, can be prohibitive without adequate financial support or government incentives. Overcoming this challenge is essential for ensuring broader adoption of drip irrigation technology.

Lack of Awareness and Technical Knowledge

Another challenge facing the Drip Irrigation Systems Market is the lack of awareness and technical knowledge among farmers, particularly in rural or less-developed regions. Many farmers are unfamiliar with the benefits and operation of drip irrigation systems and may be hesitant to adopt the technology due to perceived complexity or a lack of skilled labor to manage and maintain the systems. Educating farmers about the efficiency, cost-effectiveness, and ease of use of drip irrigation is critical to expanding its adoption, especially in regions where traditional irrigation methods are deeply ingrained.

Regional Analysis

Asia Pacific

The Asia Pacific region captured a market share of 33.0% in 2024, making it the largest regional market for drip irrigation systems. This leadership is driven by the region’s vast agricultural land, water scarcity challenges, and strong government support for sustainable irrigation. Countries like India and China are adopting drip technologies to improve crop yields while conserving water. Technological acceptance among farmers, along with subsidies and water regulatory pressures, further strengthens the region’s growth dynamics, positioning Asia Pacific as a key player in the global market.

North America

North America held a market share of 26.9% in 2024, driven by its advanced agricultural infrastructure and increasing adoption of precision irrigation techniques. The region benefits from strong government support for water-efficient technologies and a high uptake of smart drip systems, particularly on high-value crop farms. Market growth is further supported by large farms pursuing sustainability, increased water use regulations, and robust research investments in automated systems. The United States, in particular, is a major contributor to the growth in North America’s drip irrigation market.

Latin America

Latin America accounted for 10.8% of the global drip irrigation systems market in 2024. Growth in this region is driven by the expansion of irrigated farmland, particularly in horticulture and fruits, as well as efforts to address water scarcity in key agricultural zones. Countries such as Brazil, Argentina, and Peru are advancing drip systems in response to export demand and resource constraints. However, infrastructure gaps and varying subsidy programs moderate adoption rates, limiting faster growth potential compared to other regions.

Europe

Europe held a market share of 15.2% in 2024. This region is a mature market, with demand driven by strong regulatory frameworks that focus on water conservation and agricultural productivity. Adoption is mainly in horticulture, vineyards, and greenhouse cultivation. While market growth is steady, it is slower compared to other regions, as most demand is tied to system upgrades and retrofitting rather than large new installations. European countries prioritize sustainability, making drip irrigation solutions a key part of their agricultural practices.

Middle East & Africa

The Middle East & Africa region holds a market share of 14.1% in 2024. This region is emerging as a key growth area for drip irrigation due to its high water stress levels and limited arable land. Government programs, large-scale projects, and private investments in irrigation technologies are accelerating adoption. Harsh climates, increasing food import dependency, and expanding agribusiness ventures are driving interest in drip irrigation solutions. Countries like Saudi Arabia, Israel, and South Africa are leading the charge in adopting water-efficient agricultural technologies in the region.

Market Segmentations:

By End-user

By Type

By Technology

- Automation technologies

- Smart watering controllers

- IoT-based systems

- Digital flow meters

By Crop Type

- Fruits and nuts

- Field crops

- Vegetable crops

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the drip irrigation systems market features key players such as AGRODRIP S.A., Astha Polymers Pvt. Ltd., BC Hardscapes, LLC, DIG Corp., DripWorks Inc., Golden Key Middle East FZE, Hunter Industries Inc., Husqvarna AB, Irritec SpA, and Jain Irrigation Systems Ltd. These companies actively pursue product innovation, global expansion, and strategic alliances to build market share. They invest in smart‑irrigation technologies like IoT sensors and automated controllers to differentiate their offerings. Regional partnerships and localized manufacturing allow them to serve diverse markets and reduce costs. Meanwhile, smaller regional suppliers focus on niche crops or local subsidies, keeping price competition intense. Market entry barriers are moderate due to capital requirements for technology and distribution networks. Together, these dynamics shape an evolving competitive environment aimed at water efficiency, crop yield improvement, and sustainable agriculture adoption.

Key Player Analysis

- Hunter Industries Inc.

- Jain Irrigation Systems Ltd.

- Golden Key Middle East FZ

- BC Hardscapes, LLC

- DripWorks Inc.

- DIG Corp.

- Irritec SpA

- Astha Polymers Pvt. Ltd.

- Husqvarna AB

- AGRODRIP S.A.

Recent Developments

- In September 2024, Netafim launched GrowSphere, a digital farm management suite that integrates hydraulic diagnostics with agronomic decision support.

- In February 2024, Hunter Industries Inc. partnered with Saudi Drip Irrigation Company to manufacture irrigation systems for agricultural, residential, commercial, and golf applications. This collaboration highlights their shared commitment to sustainable practices, focusing on water and energy-saving solutions, including advanced drip irrigation management.

- In January 2024, Rain Bird Corporation partnered with Pinehurst Resort to manufacture irrigation equipment and provide service and support for its system. As part of this partnership, Rain Bird was recognized as the resort’s Official Irrigation Partner.

- In October 2023, Netafim Limited introduced an innovative irrigation system in India featuring anti-clogging technology, ensuring optimal nutrient and water distribution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, End User, Technology, Crop Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as water scarcity intensifies and farmers seek efficient irrigation solutions.

- Growing global emphasis on sustainable agriculture will drive system upgrades and bigger adoption.

- Smart and IoT‑enabled drip irrigation systems will gain traction among large‑scale farms for precision and automation.

- Emerging economies will present significant growth opportunities as government subsidies and infrastructure investments increase.

- Non‑agricultural segments such as landscaping, urban farms and controlled‑environment agriculture will adopt drip irrigation at higher rates.

- Integration of solar‑powered and renewable energy driven irrigation solutions will open new market segments.

- Manufacturers will invest in innovation to reduce clogging, improve durability, and adapt products for varying crop types and terrains.

- Partnerships between technology providers and irrigation equipment firms will accelerate market penetration and regional presence.

- High initial procurement costs and lack of awareness among smallholders will remain hurdles to rapid expansion.

- Standardisation of smart irrigation protocols and data interoperability will become essential for scaling technology adoption across regions.