Market Overview:

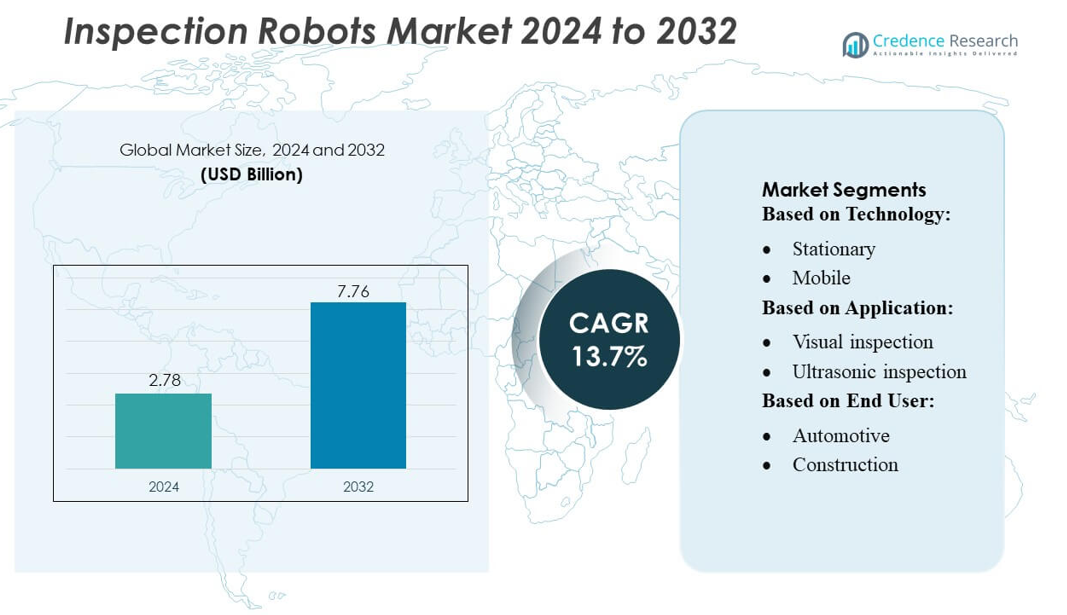

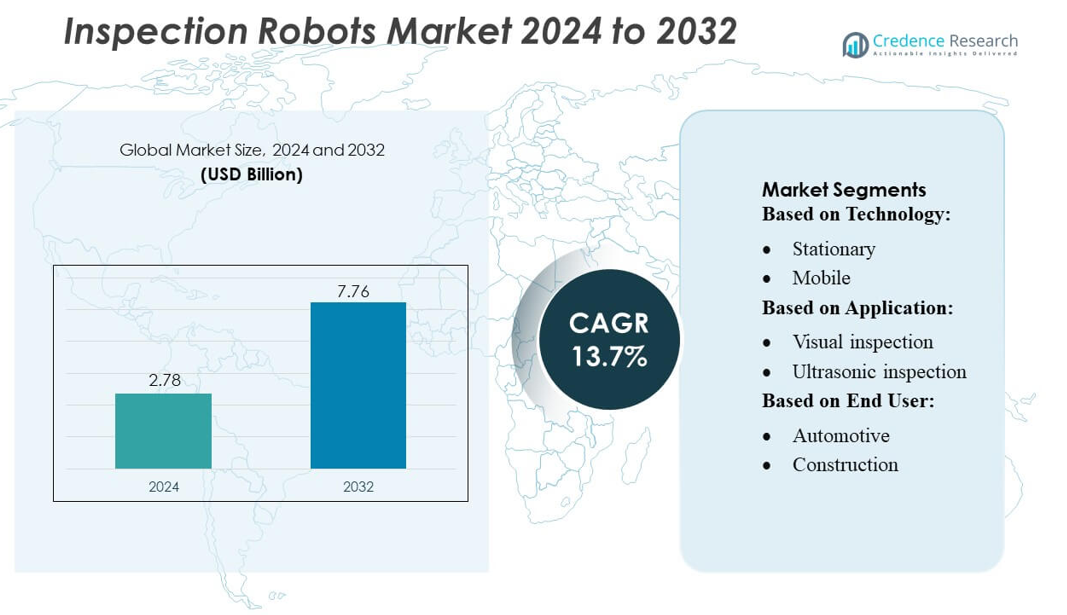

Inspection Robots Market size was valued USD 2.78 billion in 2024 and is anticipated to reach USD 7.76 billion by 2032, at a CAGR of 13.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Inspection Robots Market Size 2024 |

USD 2.78 billion |

| Inspection Robots Market, CAGR |

13.7% |

| Inspection Robots Market Size 2032 |

USD 7.76 billion |

The Inspection Robots Market is led by prominent players including Comau SpA, KUKA AG, ABB Ltd., Omron Corporation, Kawasaki Heavy Industries, Ltd., Denso Corporation, Nachi-Fujikoshi Corp., Fanuc Corporation, Mitsubishi Electric Corporation, and Yaskawa Electric Corporation. These companies maintain a competitive edge through continuous investment in R&D, development of AI-enabled and multi-sensor inspection robots, and expansion into emerging markets. They focus on creating mobile and modular solutions that enhance operational efficiency, predictive maintenance, and safety across industries such as manufacturing, oil & gas, automotive, and power. North America emerges as the leading region, commanding approximately 32% of the global market share, driven by early adoption of advanced robotics, strong industrial automation infrastructure, and supportive regulatory frameworks. The combination of technological innovation and strategic market penetration ensures sustained leadership and sets the pace for global industry growth.

Market Insights

- The Inspection Robots Market size was valued at USD 2.78 billion in 2024 and is projected to reach USD 7.76 billion by 2032, growing at a CAGR of 13.7% during the forecast period.

- Growth is driven by increasing industrial automation, demand for operational efficiency, predictive maintenance, and safety in manufacturing, automotive, oil & gas, and power sectors.

- Key trends include adoption of AI-enabled, multi-sensor, and modular mobile inspection robots, integration with IoT, and the rise of smart factories across industries.

- North America leads the market with approximately 32% share due to early robotics adoption and advanced industrial infrastructure, followed by Europe and Asia-Pacific, while mobile inspection robots dominate the technology segment and visual inspection holds the largest application share.

- The market faces challenges from high initial investment, technical complexity, and limited skilled workforce, while competitive strategies include continuous R&D, strategic partnerships, and expansion into emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The mobile inspection robots segment dominates the market with a share of approximately 62%, driven by their versatility in navigating complex industrial environments and accessing confined or hazardous areas. Mobile robots equipped with advanced navigation systems, LiDAR, and AI-based mapping capabilities are increasingly adopted for continuous monitoring and remote inspections. In contrast, stationary robots are preferred in controlled settings but see limited deployment due to spatial constraints. The growth of mobile robots is propelled by increasing automation in manufacturing, oil and gas facilities, and the need for real-time data collection to minimize downtime and improve operational safety.

- For instance, Comau SpA recently launched its “MyMR” family of autonomous mobile robots offering payload capabilities of 300 kg, 500 kg and 1,500 kg, enabling flexible material handling and inspection tasks across manufacturing and logistics environments.

By Application

Within applications, visual inspection holds the largest market share, accounting for nearly 45%, owing to its broad utility in defect detection, surface quality assessment, and assembly verification. High-resolution cameras, machine vision algorithms, and AI-enabled pattern recognition enhance the accuracy and speed of inspections across industries. Thermal and ultrasonic inspections are growing, particularly in predictive maintenance and structural analysis, but adoption remains niche due to higher equipment costs. The visual inspection segment benefits from increasing demand for process efficiency, regulatory compliance, and integration with Industry 4.0 frameworks in automated production environments.

- For instance, KUKA AG supports advanced visual inspection through its KR AGILUS robot series, which delivers a verified repeatability of ±0.01 mm, enabling high-precision detection of micro-defects in electronics and automotive components.

By End User

The manufacturing sector leads adoption of inspection robots, representing around 38% of the market, fueled by the need for consistent quality control, reduced human error, and faster production cycles. Automotive and oil & gas industries are significant contributors, leveraging robots for precision inspection in high-risk or repetitive processes. Drivers include rising labor costs, stringent quality standards, and advancements in AI and sensor technologies that enable predictive maintenance and real-time defect detection. Smaller sectors, such as food & beverages and construction, are gradually increasing adoption, focusing on hygiene, safety compliance, and structural integrity verification.

Key Growth Drivers

Rising Demand for Automation and Operational Efficiency

Industries are increasingly adopting inspection robots to enhance productivity, reduce human error, and ensure consistent quality. Automated inspections in manufacturing, oil & gas, and power plants minimize downtime and accelerate maintenance processes. Advanced sensors, AI-based analytics, and robotic mobility allow real-time monitoring of complex systems, driving operational efficiency. The push toward Industry 4.0 and smart factories has further reinforced the adoption of robotic inspection solutions, positioning automation as a critical growth driver in optimizing cost, safety, and overall operational performance.

- For instance, ABB Ltd. has strengthened automation efficiency through its ABB Ability™ Condition Monitoring platform, which processes data from more than 180 distinct sensor parameters in real time to detect anomalies and optimize asset performance.

Safety and Hazard Mitigation in Industrial Environments

Inspection robots play a pivotal role in reducing human exposure to hazardous environments such as chemical plants, oil refineries, and nuclear facilities. Equipped with cameras, ultrasonic sensors, and thermal scanners, robots can perform inspections in confined or high-risk areas where manual intervention is unsafe. Increasing regulatory compliance requirements for workplace safety, coupled with the demand for predictive maintenance to prevent accidents, drive adoption. Companies are prioritizing robotic solutions to safeguard employees while maintaining uninterrupted monitoring and data collection in dangerous operational zones.

- For instance, Omron’s LD-series Autonomous Mobile Robots (AMRs) like the LD-90 navigate factory floors using safety-rated laser scanners with 240° field of view, plus rear sonar sensors and front bumper detectors, enabling reliable obstacle detection and safe autonomous motion.

Technological Advancements in Robotics and AI

Rapid innovations in AI, machine learning, and sensor technologies are enhancing the accuracy, speed, and autonomy of inspection robots. Mobile robots with LiDAR, 3D mapping, and advanced navigation can perform complex inspections across diverse terrains. Integration with cloud platforms and predictive analytics enables real-time reporting and data-driven maintenance decisions. These technological improvements are expanding use cases across industries, increasing adoption rates. Continuous investment in R&D by leading robotics manufacturers ensures that inspection robots evolve to meet growing industrial demands, driving sustained market growth.

Key Trends & Opportunities

Integration with Industry 4.0 and IoT

Inspection robots are increasingly being integrated with IoT-enabled devices and Industry 4.0 frameworks. Real-time data collection and cloud-based analytics allow predictive maintenance, anomaly detection, and workflow optimization. The trend of connected robotics enhances decision-making capabilities and operational transparency. Opportunities lie in deploying robots that communicate with factory systems, machinery, and enterprise software, creating seamless inspection processes. Industries are leveraging these advancements to improve asset management, reduce downtime, and gain actionable insights, positioning inspection robots as essential tools in smart manufacturing ecosystems.

- For instance, Kawasaki Heavy Industries supports connected inspection automation through its RS007N/RS007L robots, which achieve a repeatability of ±0.02 mm and operate at speeds up to 11,000 mm/s, ensuring high-precision, data-rich inspection tasks suitable for smart factories.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East offer significant growth opportunities due to rapid industrialization and increasing adoption of automation technologies. Cost-effective labor alternatives are being supplemented with inspection robots to enhance efficiency, particularly in oil & gas, automotive, and manufacturing sectors. Governments in these regions are incentivizing Industry 4.0 adoption and industrial modernization, accelerating demand. The growing awareness of safety standards and quality compliance further fuels market potential, presenting companies with opportunities to introduce innovative, affordable robotic inspection solutions tailored to these high-growth markets.

- For instance, Denso Corporation supports deployment in these regions through its COBOTTA collaborative robot, which provides a compact 0.5 kg payload capacity, a 342.5 mm reach, and a repeatability of ±0.05 mm, enabling precision inspection tasks in space-constrained facilities.

Multi-functional and Modular Robotics Solutions

The trend toward multi-functional robots capable of performing visual, ultrasonic, thermal, and laser inspections is gaining momentum. Modular designs allow customization for diverse industrial requirements, reducing deployment costs and improving scalability. Companies can retrofit robots with new sensors or upgrade software for different applications without replacing hardware. This flexibility creates opportunities for broader adoption across multiple sectors. Industries seeking versatile solutions benefit from reduced capital expenditure and faster ROI, making modular, multi-functional robots an attractive proposition in evolving industrial inspection landscapes.

Key Challenges

High Initial Investment and Maintenance Costs

The adoption of inspection robots involves substantial upfront capital, including hardware, software, and integration expenses. Small and medium enterprises often face budget constraints, limiting deployment despite operational benefits. Additionally, ongoing maintenance, sensor calibration, and software updates add to the total cost of ownership. Industries with tight operational margins may hesitate to invest in high-end robotic solutions, slowing market penetration. Balancing cost with technological benefits remains a critical challenge, requiring manufacturers to offer scalable, cost-efficient models and financing solutions to enhance accessibility.

Technical Complexity and Workforce Adaptation

Deploying inspection robots demands skilled personnel for operation, programming, and data analysis, creating a workforce adaptation challenge. Industries with limited technical expertise may struggle to integrate robots into existing processes effectively. Complex systems, sensor calibration, and AI-based analytics require continuous training and knowledge development. Resistance to change and the need for human oversight in certain inspections further hinder adoption. Addressing these challenges requires comprehensive training programs, user-friendly interfaces, and robust technical support to ensure smooth deployment and maximize the benefits of robotic inspection systems.

Regional Analysis

North America

North America dominates the inspection robots market with a share of around 32%, driven by advanced industrial automation, high adoption of AI-enabled technologies, and strong R&D investments. The U.S. leads deployment across manufacturing, oil & gas, and power sectors due to stringent safety regulations and emphasis on predictive maintenance. Canada also contributes to growth through industrial modernization initiatives. Adoption of mobile and multi-functional robots is accelerating, supported by government incentives and corporate investment in smart factory solutions. The region benefits from well-established supply chains, skilled labor, and early adoption of Industry 4.0 technologies.

Europe

Europe holds approximately 28% of the inspection robots market, fueled by industrial automation in automotive, aerospace, and energy sectors. Germany, France, and the U.K. are key contributors, leveraging robotics for quality control and safety compliance. The European market emphasizes sustainable operations and predictive maintenance, integrating IoT and AI solutions in inspections. Investment in modular and mobile robots is rising, addressing challenges in confined or hazardous environments. Strong regulatory frameworks and government initiatives supporting robotics R&D further drive adoption. Europe’s mature industrial base, coupled with innovation in sensor and AI technologies, positions the region as a significant market hub.

Asia-Pacific

Asia-Pacific is the fastest-growing market, accounting for roughly 25% of global inspection robot adoption. Rapid industrialization, especially in China, Japan, and India, and increasing automation in manufacturing, oil & gas, and construction sectors drive growth. Emerging economies are investing in smart factories and predictive maintenance systems, with mobile robots gaining prominence due to cost-effectiveness and flexibility. Rising labor costs and demand for operational safety accelerate adoption. Government incentives for Industry 4.0 integration and technological collaborations with global robotics providers further boost market expansion, positioning Asia-Pacific as a key region for long-term growth in inspection robotics.

Latin America

Latin America represents around 8% of the global inspection robots market, driven by industrial modernization in Brazil and Mexico. Adoption focuses on the oil & gas, manufacturing, and power sectors, with mobile and visual inspection robots increasingly deployed to optimize efficiency and minimize risks. Economic constraints and limited infrastructure in some countries pose challenges but are offset by gradual investments in smart factory initiatives. Regulatory frameworks for workplace safety and increasing awareness of automation benefits stimulate demand. Opportunities exist for cost-effective, modular robotic solutions tailored to regional industrial needs, creating potential for steady growth in Latin America.

Middle East & Africa (MEA)

The MEA region accounts for approximately 7% of the inspection robots market, with growth concentrated in oil-rich nations like Saudi Arabia, UAE, and South Africa. Inspection robots are increasingly deployed for pipeline monitoring, refinery inspections, and power plant maintenance, reducing human exposure to hazardous conditions. Adoption is supported by infrastructure investments, government-backed industrial automation initiatives, and rising demand for predictive maintenance. High upfront costs and limited local technical expertise remain challenges. However, collaborations with global robotics vendors and growing awareness of safety and operational efficiency present significant opportunities for expanding the adoption of inspection robots across the MEA region.

Market Segmentations:

By Technology:

By Application:

- Visual inspection

- Ultrasonic inspection

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Inspection Robots Market is highly competitive, with leading players including Comau SpA, KUKA AG, ABB Ltd., Omron Corporation, Kawasaki Heavy Industries, Ltd., Denso Corporation, Nachi-Fujikoshi Corp., Fanuc Corporation, Mitsubishi Electric Corporation, and Yaskawa Electric Corporation. The Inspection Robots Market is characterized by intense competition driven by continuous technological innovation and increasing automation across industries. Companies focus on developing advanced mobile and modular robotic solutions equipped with AI, machine learning, and multi-sensor capabilities, including visual, thermal, ultrasonic, and laser scanning technologies. Strategic initiatives such as partnerships, mergers, and collaborations are commonly employed to expand geographic reach and enhance service offerings. The market also emphasizes customization to meet diverse industrial requirements, from manufacturing and automotive to oil & gas and power sectors. Continuous R&D investment is enhancing robot autonomy, navigation, and data analytics capabilities, enabling predictive maintenance and real-time monitoring. Competitive differentiation increasingly relies on offering integrated, high-precision solutions that improve operational efficiency, safety, and cost-effectiveness. As industries embrace Industry 4.0 and smart factory concepts, the market is expected to witness sustained innovation-driven growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Comau SpA

- KUKA AG

- ABB Ltd.

- Omron Corporation

- Kawasaki Heavy Industries, Ltd.

- Denso Corporation

- Nachi-Fujikoshi Corp.

- Fanuc Corporation

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

Recent Developments

- In February 2025, Delta has announced its participation in ELECRAMA 2025 under the theme of Smart Manufacturing with the launch of its new D-Bot series Collaborative Robots (Cobots) in the Indian market. These 6-axis cobots are made to enable sectors with more intelligent and effective manufacturing processes, including electronics assembly, packaging, material handling, and even welding with payloads of up to 30 kg and speeds of up to 200 degrees per second.

- In January 2025, RIGSA deployed the Unitree B2 robot at Panama’s Fortuna Hydroelectric Power Plant to inspect transmission tunnels, a move resulting from a partnership with Enel Panama to advance robotic inspection for energy infrastructure. This collaboration uses the Unitree B2 robot, which is equipped with advanced sensors, to conduct comprehensive mapping of structural and environmental conditions within the tunnels, enhancing safety and efficiency.

- In December 2024, Apptronik announced a partnership with Google DeepMind to develop AI-powered humanoid robots. This collaboration aims to combine Apptronik’s robotics platform with Google DeepMind’s AI expertise to create adaptable and safe robots.

- In May 2024, Neura Robotics announced a strategic partnership with OMRON aimed at integrating AI-enhanced cognitive robots into manufacturing processes. This collaboration seeks to leverage advanced artificial intelligence to boost operational efficiency and enhance safety measures within factory environments.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of mobile and autonomous inspection robots will continue to increase across industries.

- Integration of AI and machine learning will enhance real-time defect detection and predictive maintenance.

- Multi-sensor robots combining visual, thermal, ultrasonic, and laser technologies will gain traction.

- Growing industrial automation and smart factory initiatives will drive demand for inspection robots.

- Expansion in emerging markets will create new growth opportunities.

- Robots will increasingly be used in hazardous and hard-to-reach environments for safety.

- Modular and customizable robotic solutions will see higher adoption for diverse applications.

- Collaboration between robotics manufacturers and industrial enterprises will accelerate technological advancements.

- Cloud connectivity and IoT integration will improve monitoring and analytics capabilities.

- Continuous R&D will lead to more efficient, compact, and cost-effective inspection robots.