Market Overview

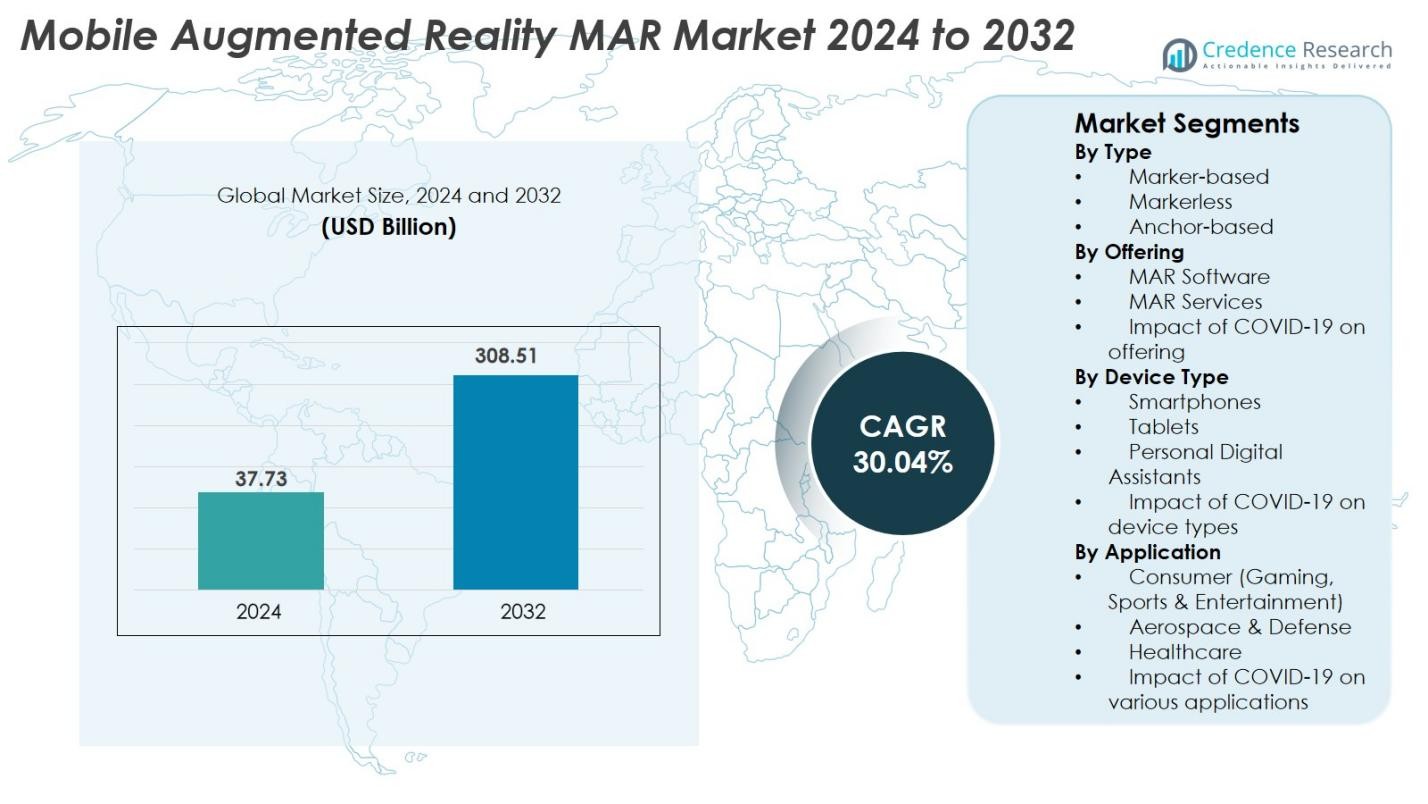

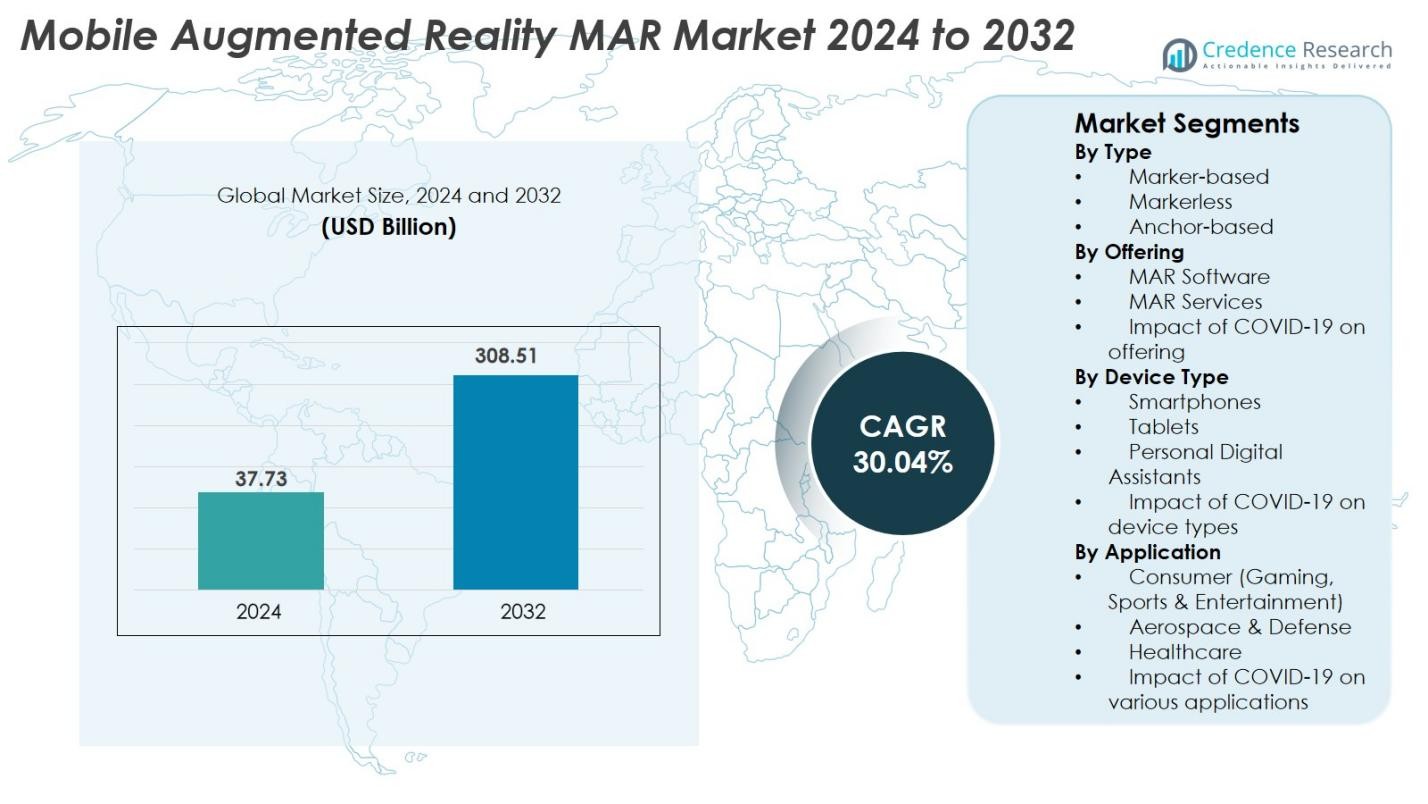

Mobile Augmented Reality (MAR) market size was valued at USD 37.73 Billion in 2024 and is anticipated to reach USD 308.51 Billion by 2032, at a CAGR of 30.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Augmented Reality (MAR) market Size 2024 |

USD 37.73 Billion |

| Mobile Augmented Reality (MAR) market , CAGR |

30.04% |

| Mobile Augmented Reality (MAR) market Size 2032 |

USD 308.51 Billion |

Mobile Augmented Reality (MAR) Market is driven by leading players such as Google, Apple, Samsung Electronics, PTC, MAXST, Wikitude, Blippar, Magic Leap, Atheer, and Upskill, all of whom advance AR software frameworks, 3D visualization tools, and device innovations to expand adoption across consumer and enterprise applications. These companies focus on enhancing mobile AR experiences through improved computer vision, spatial mapping, and cloud-based rendering. Regionally, North America leads the MAR market with a 38% share, supported by strong technological infrastructure and early adoption. Asia-Pacific follows with a 29% share due to high smartphone penetration and strong AR engagement, while Europe holds a 27% share driven by enterprise and industrial AR deployments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mobile Augmented Reality (MAR) Market was valued at USD 37.73 Billion in 2024 and is projected to reach USD 308.51 Billion by 2032, expanding at a CAGR of 30.04%.

- Market growth is driven by rising AR-enabled smartphone adoption, expanding enterprise usage in training and maintenance, and increasing demand for immersive retail and e-commerce experiences.

- Key trends include rapid integration of AI and cloud rendering, growth in location-based AR applications, and rising adoption of markerless AR, which holds the largest segment share at 55% in 2024.

- The competitive landscape features strong innovation from Google, Apple, Samsung Electronics, PTC, MAXST, Wikitude, Blippar, Magic Leap, Atheer, and Upskill, focusing on AR platforms, SDKs, and mobile device enhancements.

- Regionally, North America leads with 38% share, followed by Asia-Pacific at 29% driven by gaming and social AR, and Europe at 27% due to strong enterprise adoption.

Market Segmentation Analysis

By Type

The Mobile Augmented Reality (MAR) market is primarily dominated by the markerless segment, holding 55% market share in 2024, driven by its flexibility, real-time scene recognition, and broad adoption across gaming, retail, and navigation applications. Marker-based AR continues to support training and industrial workflows, while anchor-based AR is gaining momentum for persistent overlays used in smart city and enterprise environments. The strong growth of markerless AR is propelled by rapid advancements in computer vision, spatial mapping, and mobile sensor technologies.

- For instance, markerless AR is widely used in gaming applications, where real-time spatial mapping enhances immersive experiences on smartphones.

By Offering

The MAR software segment leads the market with 62% share in 2024, supported by increasing demand for AR development platforms, 3D rendering engines, and immersive content creation tools across consumer and enterprise applications. Services are expanding as organizations adopt customized AR solutions for remote assistance, digital training, and interactive marketing. COVID-19 accelerated reliance on AR technologies for remote work and virtual engagement, further boosting software adoption. Growing investment in cloud-based AR authoring tools and XR SDKs continues to strengthen the segment’s dominance.

- For instance, Unity Technologies remains a key player with its AR Foundation platform, widely used for developing cross-platform AR applications that power games, retail, and education solutions.

By Device Type

Smartphones dominate the MAR market with 70% market share in 2024, driven by their global penetration, high-quality cameras, advanced processors, and native AR development support through ARCore and ARKit. Tablets hold a steady share as preferred devices in education, retail visualization, and enterprise training due to larger displays. Personal Digital Assistants remain limited to industrial and field service applications. COVID-19 significantly boosted smartphone-based AR usage as consumers increasingly adopted AR gaming, virtual try-ons, and remote shopping experiences.

Key Growth Driver

Rising Adoption of AR-Enabled Smartphones

The rapid penetration of AR-compatible smartphones remains a primary growth catalyst for the Mobile Augmented Reality (MAR) market, enabling widespread access to immersive digital experiences. Major phone manufacturers have integrated advanced processors, depth sensors, LiDAR scanners, and high-resolution cameras, enhancing AR rendering and real-time scene understanding. Platforms such as ARCore and ARKit have further democratized AR development, enabling developers to create high-quality mobile AR applications across gaming, retail, education, and navigation. Consumer demand for interactive content, virtual try-ons, indoor mapping, and social media filters continues to surge, making mobile devices the most accessible AR gateway. The shift toward 5G connectivity significantly accelerates AR adoption by lowering latency and enabling cloud-based rendering for complex environments. This combination of hardware evolution, global smartphone affordability, and rising AR-ready user bases continues to anchor sustained market expansion.

- For instance, platforms like Google ARCore and Apple ARKit have democratized AR development, allowing millions of users worldwide to access immersive applications such as virtual try-ons and social media filters via their smartphones.

Increasing Enterprise Adoption for Training and Remote Assistance

Enterprises across manufacturing, logistics, healthcare, and field services increasingly adopt mobile AR solutions to enhance workforce efficiency, accuracy, and operational safety. Mobile AR provides real-time overlays, guided workflows, and remote collaboration tools that reduce operational downtime and improve productivity. Training applications using AR-driven step-by-step instructions help organizations minimize training costs and accelerate employee onboarding. In field operations, technicians benefit from remote expert guidance via mobile AR, reducing service errors and enabling faster problem resolution. The growing focus on automation, digital transformation, and Industry 4.0 encourages enterprises to integrate AR into inspection, maintenance, and quality control processes. The scalability and lower cost of smartphone-based AR, compared to specialized headsets, make it more attractive for large-scale deployments. As industries prioritize operational efficiency and augmented workforce capabilities, enterprise-driven demand continues to elevate the growth trajectory of the MAR market.

- For instance, DHL incorporates AR-powered guided workflows and remote assistance in its logistics operations, helping technicians resolve issues faster and reducing operational downtime.

Expanding Use Cases in Retail, E-commerce, and Advertising

Mobile AR is transforming consumer engagement across retail and e-commerce by enabling virtual product try-ons, immersive catalogs, and in-store navigation. Retailers leverage AR to offer realistic visualization of products such as apparel, furniture, cosmetics, and accessories, improving purchase confidence and reducing return rates. Brands increasingly integrate AR into marketing campaigns through interactive advertisements, gamified experiences, and location-based activations that enhance customer engagement and conversion rates. The rise of social commerce platforms that embed AR filters and try-on features drives further adoption among digitally active consumers. E-commerce players benefit from AR-powered personalization, where mobile devices enable consumers to experience products at home before purchasing. As shoppers increasingly demand interactive and immersive digital experiences, mobile AR becomes a strategic tool for customer retention and brand differentiation, fueling growth across retail and marketing ecosystems.

Key Trend & Opportunity

Growth of Location-Based and Geo-AR Experiences

Location-based AR applications powered by GPS, visual positioning systems (VPS), and spatial anchors are emerging as a significant opportunity within the MAR market. These applications enable users to access AR overlays tied to real-world locations, supporting use cases in tourism, navigation, retail mapping, gaming, and urban planning. Advancements in 5G and cloud-edge architectures allow real-time rendering of large-scale AR environments, supporting multi-user interactions and persistent AR objects across cities. Retailers and advertisers increasingly use geo-AR for targeted promotions and personalized outdoor campaigns. Tourism boards and cultural institutions deploy AR storytelling to enhance visitor engagement with landmarks and historical sites. As urban infrastructures become digitally mapped, location-based AR opens a new frontier for smart cities and immersive consumer experiences. This trend creates broad commercial and public-sector opportunities while expanding the long-term ecosystem of mobile AR.

- For instance, Niantic’s Pokémon GO continues to popularize location-based AR gaming with persistent geospatial overlays enhancing user engagement worldwide.

Integration of AI and Cloud Technologies in AR Processing

The convergence of artificial intelligence and cloud rendering technologies presents a transformative opportunity for mobile AR applications. AI-driven object recognition, semantic segmentation, and spatial understanding significantly enhance AR accuracy and interaction quality. Cloud and edge computing enable mobile devices to offload complex rendering tasks, supporting high-fidelity AR visuals without straining device resources. This capability accelerates the development of enterprise-grade AR applications, including digital twins, remote collaboration, and large-scale 3D visualization. AI-enhanced AR analytics also support personalized content delivery, offering context-aware recommendations and adaptive experiences across retail, education, and entertainment. As cloud-based AR platforms evolve, they facilitate multi-user shared AR sessions, improving collaboration and engagement. The integration of AI and cloud technologies expands AR’s potential far beyond simple overlays, unlocking advanced enterprise and consumer opportunities.

- For instance, cloud and edge computing enhance mobile AR experiences by processing data-intensive tasks like spatial mapping, semantic understanding, and precise localization without taxing local device hardware. Niantic’s Lightship platform leverages these cloud services extensively, particularly through its Visual Positioning System (VPS), to enable precise, multi-user shared AR experiences that anchor virtual objects accurately in real space, although the final graphics rendering typically still occurs on the mobile device.

Key Challenge

Hardware Limitations and Device Fragmentation

Despite rapid progress, hardware limitations remain a significant challenge for the MAR market. AR performance heavily depends on device capabilities such as processing power, camera quality, depth sensing, and motion tracking accuracy. Variability across smartphone models and operating systems leads to inconsistent AR experiences, complicating application development and optimization. Mid- and low-tier devices often struggle to support advanced AR features, limiting the addressable user base in emerging markets. High battery consumption, overheating, and limited field depth also hinder prolonged AR usage. While premium devices integrate advanced sensors and LiDAR, mass-market adoption still relies on smartphones with basic AR capabilities. This fragmentation slows the development of universally compatible AR applications and increases development costs. Addressing these hardware constraints is essential for scalable and seamless mobile AR experiences.

Privacy, Security, and Data Protection Concerns

Mobile AR applications rely heavily on continuous data capture through cameras, sensors, GPS, and user interactions, raising significant privacy and security concerns. AR apps often process sensitive information including facial data, location details, and real-world surroundings, increasing the risk of data breaches and unauthorized access. Regulatory frameworks such as GDPR and CCPA impose strict data protection requirements, complicating global deployment strategies for AR developers. The blending of digital and physical environments presents new cybersecurity challenges, including spoofing, deepfakes, and manipulation of AR overlays. Users also express concerns over surveillance and misuse of camera-based data collection. Ensuring transparent data practices, secure storage, and robust encryption is critical for building user trust. Without strong privacy safeguards, consumer hesitation may slow the widespread adoption of mobile AR technologies.

Regional Analysis

North America

North America holds 38% market share in the Mobile Augmented Reality (MAR) market, driven by strong technological infrastructure, high smartphone usage, and early adoption of AR for gaming, retail, and enterprise applications. Leading companies such as Google, Apple, and Magic Leap continue to advance AR capabilities through enhanced developer frameworks and device innovations. Rapid expansion of 5G supports low-latency AR experiences in navigation, entertainment, and remote collaboration. Enterprise investments in AR-based training, maintenance, and remote support further strengthen the region’s leadership, establishing North America as the most mature market for mobile AR adoption.

Europe

Europe accounts for 27% market share in the MAR market, supported by high adoption across automotive, industrial, education, tourism, and retail sectors. Countries like Germany, the UK, and France lead due to strong digital transformation programs and increasing use of AR in manufacturing workflows and workforce training. Retailers expand AR usage for immersive product visualization and virtual try-ons, while museums and tourism agencies deploy AR for enhanced visitor experiences. Growing 5G coverage and Industry 4.0 initiatives continue to elevate regional demand, positioning Europe as a major global contributor.

Asia-Pacific

Asia-Pacific holds 29% market share and remains the fastest-growing region in the MAR market due to high smartphone penetration, extensive 5G infrastructure, and rapid adoption in AR gaming, e-commerce, and social media. China, South Korea, India, and Japan dominate regional development with strong investments from companies like Samsung, MAXST, Xiaomi, and leading gaming studios. Retailers and online platforms accelerate AR-based virtual try-ons and interactive purchasing experiences. Rising digital engagement, smart city expansion, and a tech-driven youth population further strengthen MAR demand, making Asia-Pacific a major growth engine in the global market.

Latin America

Latin America holds 4% market share in the MAR market, supported by rising smartphone adoption and growing e-commerce penetration across Brazil, Mexico, and Argentina. Retailers increasingly use AR for virtual product visualization in fashion, cosmetics, and home décor categories. Younger consumers drive adoption through AR-enhanced social media, gaming, and digital marketing experiences. Schools and universities begin integrating AR learning tools to improve classroom interactivity. Although connectivity gaps persist in certain areas, expanding digital infrastructure and increasing enterprise interest are gradually supporting broader adoption throughout the region.

Middle East & Africa

The Middle East & Africa region holds 2% market share in the global MAR market and is experiencing steady growth through investments in smart city initiatives, tourism enhancement, and enterprise digitalization. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption with AR-driven navigation, cultural experiences, and retail engagement. Expanding 5G networks enhance the performance of mobile AR applications, especially in urban centers. Enterprise sectors including construction, oil & gas, and utilities explore AR for remote support and workforce training. Rising digital transformation continues to unlock long-term MAR market potential.

Market Segmentations

By Type

- Marker-based

- Markerless

- Anchor-based

By Offering

- MAR Software

- MAR Services

- Impact of COVID-19 on offering

By Device Type

- Smartphones

- Tablets

- Personal Digital Assistants

- Impact of COVID-19 on device types

By Application

- Consumer (Gaming, Sports & Entertainment)

- Aerospace & Defense

- Healthcare

- Impact of COVID-19 on various applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mobile Augmented Reality (MAR) market is characterized by strong innovation, strategic partnerships, and continuous platform enhancements led by major global technology companies. Key players such as Google, Apple, Samsung Electronics, PTC, MAXST, Wikitude, Blippar, Magic Leap, Atheer, and Upskill focus on advancing AR software frameworks, cloud-based rendering, computer vision capabilities, and device-level integration to expand AR adoption across consumer and enterprise environments. Apple and Google dominate through ARKit and ARCore, enabling large developer ecosystems, while Samsung drives hardware innovation through AR-ready devices. Enterprise-focused companies like PTC, Atheer, and Upskill enhance AR use cases in training, maintenance, and remote assistance. European and Asian players, including Wikitude and MAXST, strengthen global competition with robust SDKs and scalable AR solutions. Growing investments in AI-enabled AR, spatial mapping, and 5G-driven applications continue to intensify competition, pushing companies to evolve rapidly to meet rising demand across retail, education, gaming, and industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Samsung Electronics teased its Project Moohan mixed-reality headset running Android XR, developed in collaboration with Google and Qualcomm.

- In October 2025, Magic Leap announced a prototype reference design for Android XR smart glasses in partnership with Google.

- In May 2025, Meta Platforms and Anduril Industries announced a strategic partnership to develop advanced AR and XR systems for defense applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Offering, Device Type Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The MAR market will experience accelerated adoption as smartphones gain more advanced sensors and AR processing capabilities.

- Enterprises will increasingly integrate mobile AR into training, maintenance, and remote assistance workflows.

- Location-based and geo-enabled AR applications will expand across retail, tourism, and smart city initiatives.

- AI-driven enhancements will improve object recognition, spatial understanding, and personalized AR interactions.

- Cloud and edge computing will support more realistic, large-scale AR experiences on mobile devices.

- E-commerce platforms will adopt AR try-on and visualization tools as standard features.

- Social media and entertainment apps will drive mass-market engagement with AR effects and interactive content.

- Mobile AR will play a key role in education through immersive learning environments and interactive modules.

- Improved 5G connectivity will enable smoother, low-latency AR experiences with real-time rendering.

- Collaboration between hardware manufacturers and AR software developers will intensify, driving continual innovation across the ecosystem.