Market Overview

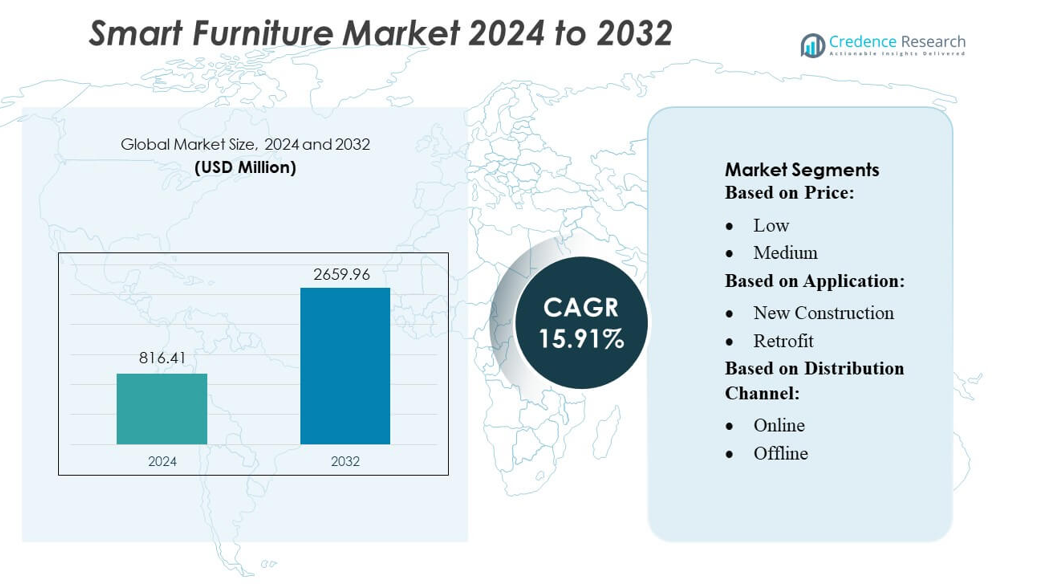

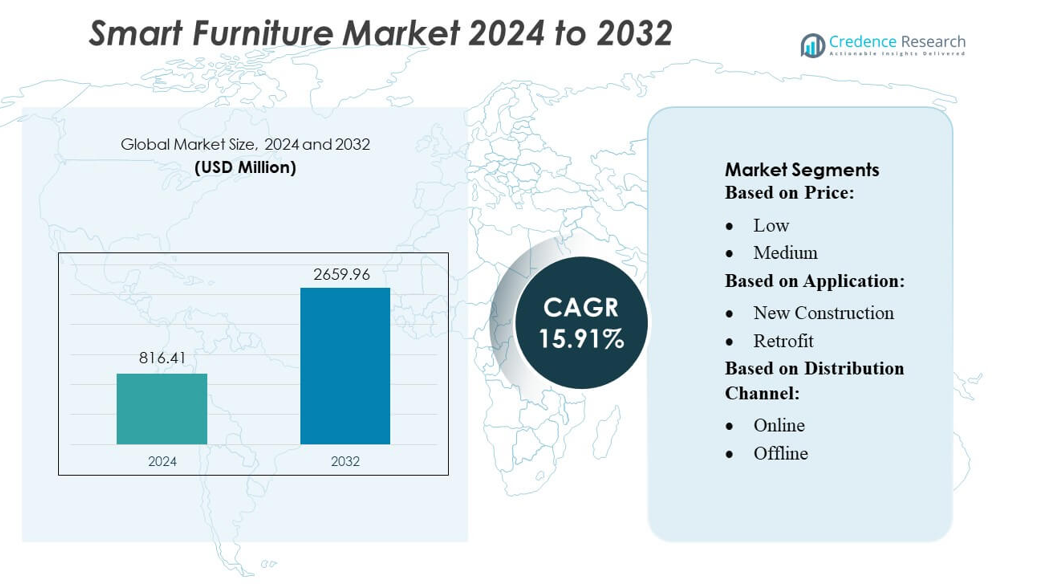

Smart Furniture Market size was valued USD 816.41 million in 2024 and is anticipated to reach USD 2659.96 million by 2032, at a CAGR of 15.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Furniture Market Size 2024 |

USD 816.41 million |

| Smart Furniture Market, CAGR |

15.91% |

| Smart Furniture Market Size 2032 |

USD 2659.96 million |

The Smart Furniture Market features strong competition from global technology and automation leaders, including Honeywell International Inc., Haier Group, Google LLC, Nice Polska Sp. z o.o., ABB, Johnson Controls, Apple Inc., Crestron Electronics, Inc., Gira, and Emerson Electric Co. These companies strengthen their presence by integrating IoT, AI, and sensor-based technologies into residential and commercial furniture solutions. Among all regions, North America leads the market with an exact market share of 32%, driven by high adoption of smart home ecosystems, advanced workspace automation, and strong consumer demand for connected and ergonomic furniture innovations.

Market Insights

- The Smart Furniture Market reached USD 816.41 million in 2024 and is expected to attain USD 2659.96 million by 2032, registering a CAGR of 15.91%, supported by increasing adoption of connected and automated furniture solutions.

- Rising demand for IoT-enabled, sensor-integrated, and ergonomically advanced furniture drives market expansion across residential and commercial segments, with smart office furniture emerging as the fastest-growing segment due to workspace digitalization.

- Technological innovation remains a core trend, as leading companies integrate AI-driven personalization, wireless charging, and voice-controlled features to enhance productivity and user comfort.

- High upfront costs, limited interoperability across platforms, and data security concerns continue to restrain wider adoption, particularly in price-sensitive markets.

- North America leads with 32% market share, while Europe and Asia-Pacific show strong growth momentum; the smart office segment holds a dominant share due to increasing hybrid work models and corporate investment in connected workspace optimization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Price

The smart furniture market segmented by price reveals that the medium-priced segment dominates, accounting for the largest market share due to its balance between affordability and advanced functionality. Medium-range products appeal to a broad consumer base, including urban households and small offices seeking smart desks, adjustable beds, and modular seating with integrated IoT features. Market growth is driven by increasing awareness of ergonomic and connected home solutions, coupled with technological advancements such as app-controlled adjustments and energy-efficient sensors, making mid-tier smart furniture highly attractive to cost-conscious yet quality-focused buyers.

- For instance, Honeywell’s HPM Series PM2.5 sensor delivers a detection range up to 1,000 µg/m³. The sensor provides high accuracy of ±15% (for PM2.5 concentrations over 100 µg/m³) and is engineered for a long life of up to 10 years of continuous use.

By Application

In the application-based segmentation, new construction projects hold the dominant share, reflecting rising demand in residential and commercial developments incorporating smart furniture from the outset. Builders and interior designers prefer integrating connected desks, smart storage, and automated seating systems into modern layouts, enhancing convenience and space efficiency. Growth is fueled by increasing smart home adoption, regulatory incentives for energy-efficient building interiors, and rising consumer interest in multifunctional furniture. Retrofit applications are expanding but remain secondary due to the higher costs and installation complexity associated with upgrading existing furniture.

- For instance, Haier’s U+ Smart Life Platform—documented in Haier’s official ecosystem reports—supports integrations with more than 20,000 IoT device models and connects with over 1,000 certified service partners, enabling seamless incorporation of smart furniture into new construction environments.

By Distribution Channel

Within the distribution channel segment, offline retail maintains dominance, driven by the tactile nature of furniture purchases where consumers prefer in-person assessment for comfort, build quality, and functionality. Showrooms and specialty stores provide experiential demonstrations of IoT-enabled desks, smart beds, and seating solutions, reinforcing buyer confidence. Market drivers include the expansion of experiential retail outlets, brand-focused marketing strategies, and professional guidance on furniture integration. Online sales are growing rapidly due to convenience and direct-to-consumer models, but offline channels continue to lead due to high-value purchase behavior and hands-on product evaluation.

Key Growth Drivers

Rising Adoption of Smart Homes and IoT Integration

The increasing integration of IoT devices and smart home ecosystems drives demand for connected furniture solutions. Consumers seek furniture that enhances convenience, energy efficiency, and home automation, such as app-controlled desks, smart beds, and modular storage systems. Businesses are also adopting intelligent furniture to optimize workspace ergonomics and productivity. Growth is supported by technological advancements in sensors, AI-based adjustments, and voice-controlled interfaces, which enable seamless interaction and increased user satisfaction, making smart furniture an essential component of modern residential and commercial spaces.

For instance, Google Home’s platform now supports over 50,000 devices from more than 10,000 different brands and integrates with a global network of smart-home products via its Cloud-to-Cloud and Matter infrastructures, enabling manufacturers to embed desk-mounted sensors, automated storage systems, or voice-controlled lighting into smart furniture.

Growing Focus on Ergonomics and Wellness

Rising awareness of health and wellness is influencing furniture design and consumer preferences. Smart furniture with ergonomic features, such as posture-correcting chairs, height-adjustable desks, and sleep-monitoring beds, addresses physical well-being in homes and offices. The market benefits from increased sedentary lifestyle concerns, corporate wellness initiatives, and consumer willingness to invest in comfort-enhancing technology. Continuous innovation in ergonomics-driven designs and integrated monitoring systems ensures that smart furniture not only improves lifestyle quality but also encourages long-term adoption in both residential and professional settings.

For instance, ABB enhances ergonomics-focused environments through its ABB i-bus® KNX platform, which integrates certified high-frequency (HF) presence detectors capable of detecting micro-movements (like breathing) at distances up to approximately 6 to 8 meters.

Technological Advancements and Product Innovation

Rapid innovations in AI, robotics, and sensor technologies are expanding the capabilities of smart furniture. Companies are introducing features like automated adjustments, IoT-enabled storage solutions, and multifunctional modular furniture that adapts to user behavior. Continuous research and development reduce manufacturing costs while increasing functionality, making products more accessible to a wider audience. These advancements also support personalized experiences, energy efficiency, and seamless integration with home automation systems, strengthening market growth and establishing smart furniture as a critical element of future-ready residential and commercial interiors.

Key Trends & Opportunities

Customization and Modular Designs

Consumers increasingly demand customizable smart furniture to suit individual aesthetics, space requirements, and functional needs. Modular systems and interchangeable components allow for flexibility in home and office setups, creating opportunities for brands to offer tailored solutions. Integration of smart technology into modular furniture enables adaptive use, enhancing convenience and space utilization. Rising interest in personalized design combined with IoT-enabled automation presents opportunities for market players to differentiate their offerings and expand into premium and mid-tier segments.

For instance, Johnson Controls supports modular interior ecosystems through its OpenBlue suite, which connects smart furniture to building automation networks using more than 2,000 interoperable APIs.

Expansion of Online and Omnichannel Retail

E-commerce and omnichannel distribution provide significant opportunities for smart furniture manufacturers. Online platforms allow consumers to explore a wide range of designs, compare features, and make informed purchases without geographical constraints. Brands leveraging virtual showrooms, AR-enabled previews, and direct-to-consumer models can enhance customer engagement and reduce dependency on traditional retail channels. Growth in digital adoption and increased comfort with high-value online purchases further positions online sales as a key opportunity to expand market reach and drive revenue growth.

For instance, Apple’s ARKit, available on more than 1 billion active devices, enables highly accurate product visualization, allowing shoppers to preview furniture scale and placement at home.

Integration with Sustainability and Eco-Friendly Materials

The shift toward sustainable living presents an opportunity to develop eco-friendly smart furniture. Manufacturers are increasingly using recycled materials, energy-efficient components, and low-impact production techniques. Products combining smart technology with sustainable practices appeal to environmentally conscious consumers and corporate clients, driving differentiation in a competitive market. This trend allows companies to align with global sustainability goals, enhance brand image, and tap into a growing segment seeking innovative yet responsible furniture solutions.

Key Challenges

High Product Costs and Affordability Barriers

Smart furniture often commands premium pricing due to embedded technology, advanced materials, and research-intensive design. High costs can limit adoption among price-sensitive consumers, particularly in emerging markets. This affordability barrier may slow market penetration despite growing interest in connected and ergonomic solutions. Companies face the challenge of balancing innovation with cost-effective production while ensuring sufficient features and quality to meet consumer expectations, requiring strategic pricing and scalable manufacturing processes to broaden market accessibility.

Technological Complexity and Maintenance Issues

Integration of sensors, AI, and IoT components increases product complexity, potentially leading to usability challenges, technical glitches, and higher maintenance requirements. Consumers may encounter difficulties in installation, connectivity, or software updates, affecting user experience and brand perception. Additionally, after-sales support and service infrastructure are critical to ensuring long-term functionality. Addressing these challenges requires robust design, intuitive interfaces, and reliable customer support systems to maintain trust, reduce friction, and foster sustained adoption in both residential and commercial segments.

Regional Analysis

North America

North America holds a leading position in the smart furniture market, accounting for approximately 32% of the global share. Growth is driven by high adoption of IoT-enabled furniture, integration with smart home and office systems, and a strong preference for ergonomic designs. The U.S. dominates, supported by advanced technology infrastructure and rising disposable income. For instance, Steelcase reported a 15% increase in smart desk installations across corporate offices in 2024. Canada also shows growing demand for connected home furniture. The region benefits from a combination of corporate investments, consumer awareness, and innovation from established players like Herman Miller.

Europe

Europe contributes roughly 28% of the global smart furniture market, led by Germany, the U.K., and France. The region emphasizes sustainability, smart workspace solutions, and technologically advanced furniture designs. Corporates and co-working spaces are increasingly investing in sensor-integrated desks and chairs to enhance productivity and well-being. For instance, Sedus Stoll GmbH deployed smart desks capable of posture tracking across 120 European offices in 2024. Strong regulatory support for energy-efficient and ergonomic office infrastructure, combined with growing home automation trends, underpins market expansion. Continuous innovation in connected furniture and rising digital integration in residential and commercial spaces maintain Europe’s strong market presence.

Asia-Pacific

Asia-Pacific accounts for approximately 25% of the global smart furniture market, driven by rapid urbanization, rising disposable income, and increasing IoT adoption. China, Japan, and India are key markets, with growing demand for multifunctional, sensor-enabled, and connected furniture in homes and offices. For instance, Xiaomi’s smart desk with integrated wireless charging and IoT features sold over 50,000 units in 2024. Government-led smart city initiatives and technology-friendly policies further accelerate adoption. Expansion of e-commerce platforms enables wider market reach. Strong manufacturing capabilities in the region also support cost-effective production, making APAC a critical growth hub for smart furniture solutions.

Latin America:

Latin America contributes around 8% of the global smart furniture market, with Brazil and Mexico driving regional demand. Growth is fueled by rising awareness of ergonomic furniture, digital office integration, and corporate adoption of productivity-enhancing solutions. For instance, Flexform launched sensor-enabled office chairs in São Paulo, adopted by 60 corporate clients in 2024. While economic volatility and limited technological infrastructure pose challenges, increasing penetration of IoT devices and smart home systems is supporting gradual market growth. Emerging interest in connected residential furniture and government-backed urban modernization projects are expected to create new opportunities, positioning Latin America as a niche but steadily expanding market.

Middle East & Africa

MEA accounts for approximately 7% of the global smart furniture market, led by the UAE and Saudi Arabia. Growth is driven by the adoption of smart office solutions, luxury residential projects, and government-backed smart city initiatives. For instance, Haworth deployed AI-enabled office seating across 20 corporate locations in Dubai in 2024 to enhance workforce comfort and efficiency. Rising investments in digital infrastructure and technology-integrated furniture are driving adoption, although limited consumer awareness and higher costs constrain rapid growth. Strategic partnerships, smart urban development initiatives, and the expansion of IoT-enabled products are expected to strengthen MEA’s market presence over the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Price:

By Application:

- New Construction

- Retrofit

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Smart Furniture Market features leading global players such as Honeywell International Inc., Haier Group, Google LLC, Nice Polska Sp. z o.o., ABB, Johnson Control, Apple Inc., Crestron Electronics, Inc., Gira, and Emerson Electric Co. The Smart Furniture Market is characterized by rapid technological advancement, continuous innovation, and a strong focus on integrating IoT, AI, and automation into everyday furniture applications. Companies in the market increasingly prioritize smart connectivity, energy efficiency, and ergonomic design to meet evolving consumer and corporate needs. Competition intensifies as manufacturers expand their portfolios with multifunctional, sensor-enabled solutions that enhance comfort, space utilization, and productivity in both residential and commercial settings. Strategic collaborations, investments in R&D, and the adoption of cloud-based platforms strengthen market positions. Additionally, growing emphasis on seamless interoperability with smart home ecosystems and workplace management systems drives differentiation, pushing the industry toward highly personalized and intuitive furniture solutions.

Key Player Analysis

Recent Developments

- In June 2024, ABB launched the ReliaHome Smart Panel, a smart home energy management system for the U.S. and Canada, in partnership with Lumin. The system coordinates home energy assets like solar inverters, EV chargers, and batteries to optimize energy usage, allow circuit scheduling, and provide real-time control via a user-friendly app.

- In June of 2024, Bosch Smart Home updated its Controller II to act as a Matter Bridge, allowing its own devices to connect to other brands’ ecosystems through the new universal Matter standard. This update provides greater flexibility for users to create a mixed smart home system, where Bosch products can be controlled within a larger, multi-brand network.

- In May 2024, Haier announced the launch of Haier Smart Home UK & Ireland with the goal of becoming the UK and Ireland’s leading smart home provider.

- In April 2024, Samsung introduced new connected bespoke AI-powered home appliances to enhances the performance of appliances. With built-in Wi-Fi, internal cameras, AI chips and compatibility with the SmartThings application, Samsung’s latest Bespoke AI appliances come with enhanced features and connectivity to lay the foundation for a truly smart home.

Report Coverage

The research report offers an in-depth analysis based on Price, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly integrate AI-driven personalization to enhance user comfort and automate routine adjustments.

- IoT connectivity will expand, enabling smart furniture to interact seamlessly with broader home and office ecosystems.

- Demand for ergonomic, health-monitoring furniture will rise as wellness-focused workplaces become more common.

- Smart office furniture adoption will accelerate with growth in hybrid work environments and digital collaboration tools.

- Energy-efficient and sustainable materials will gain prominence as manufacturers prioritize eco-friendly designs.

- Voice control, gesture recognition, and app-based management will become standard features in premium furniture.

- Modular and multifunctional smart furniture will see higher demand in compact urban living spaces.

- Cloud-based analytics will support real-time usage monitoring to optimize workspace layouts and employee productivity.

- Partnerships between furniture manufacturers and tech companies will intensify to deliver integrated smart solutions.

- Advancements in wireless charging and embedded sensors will drive innovation across residential and commercial segments.