Market Overview

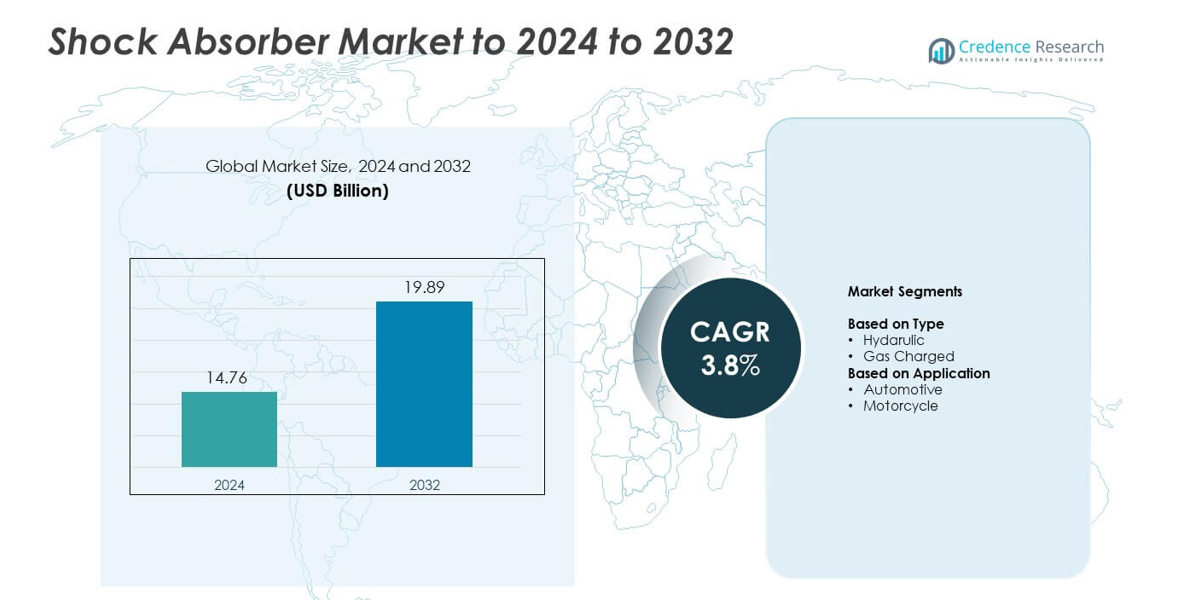

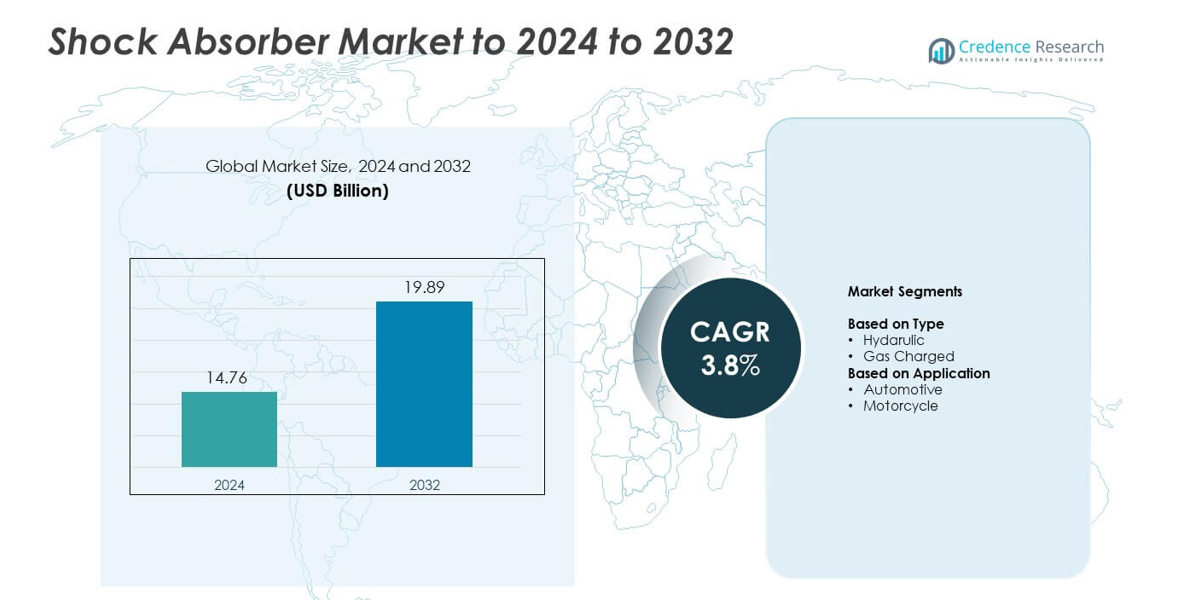

Shock Absorber Market size was valued at USD 14.76 Billion in 2024 and is anticipated to reach USD 19.89 Billion by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shock Absorber Market Size 2024 |

USD 14.76 Billion |

| Shock Absorber Market, CAGR |

3.8% |

| Shock Absorber Market Size 2032 |

USD 19.89 Billion |

The shock absorber market is shaped by major global players that supply advanced damping systems to both OEM and aftermarket channels, with strong capabilities in gas charged and electronically controlled technologies. These companies compete by improving ride comfort, stability, and durability across passenger cars, SUVs, commercial vehicles, and electric models. Asia Pacific led the market in 2024 with about 35% share, driven by large-scale vehicle production in China, India, Japan, and South Korea. North America and Europe followed due to strong aftermarket demand, high vehicle ownership, and steady adoption of advanced suspension solutions across premium and mid-segment vehicles.

Market Insights

- The shock absorber market reached USD 14.76 Billion in 2024 and is projected to hit USD 19.89 Billion by 2032, expanding at a CAGR of 3.8%.

- Growing vehicle production and rising adoption of gas charged systems drive demand, supported by strong usage in passenger cars and SUVs.

- Key trends include the shift toward adaptive and semi-active suspension technologies and rising opportunities in electric vehicles requiring lightweight, high-performance dampers.

- Competition intensifies as global and regional manufacturers focus on advanced damping systems and expand aftermarket product ranges, with gas charged types holding about 59% share.

- Asia Pacific led the market with nearly 35% share, followed by North America at about 32% and Europe at around 27%, supported by strong vehicle fleets and increasing replacement demand across major countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Gas charged shock absorbers dominated the market in 2024 with about 59% share. Buyers prefer gas charged units because they reduce aeration, improve damping stability, and deliver smoother handling on uneven roads. Rising adoption in passenger cars and light commercial vehicles supports this lead, as automakers focus on ride comfort and safety. Hydraulic shock absorbers remain relevant in low-cost and heavy-duty applications, but gas charged systems expand faster due to stronger performance, better heat dissipation, and growing use in modern suspension platforms across global markets.

- For instance, Bilstein’s B6 4600 gas-pressure shock uses a nitrogen-filled 46 mm monotube design.

By Application

Automotive applications led the segment in 2024 with nearly 71% share. Strong production of passenger vehicles and steady demand for SUVs drive wider installation of advanced shock absorbers. Automakers also adopt improved damping systems to meet safety norms and comfort expectations, which strengthens the automotive category. Motorcycle applications grow at a stable pace due to rising two-wheeler sales in Asia, but the automotive segment stays ahead because it covers a larger installed base, higher replacement volume, and broader use in both OEM and aftermarket channels.

- For instance, Honda’s CRF300 Rally uses a Showa rear shock with 253 mm of rear wheel travel(10.2 inches).

Key Growth Drivers

Rising Vehicle Production and Sales

Growing demand for passenger cars, SUVs, and light commercial vehicles increases the need for high-performance shock absorbers in global markets. Automakers integrate advanced suspension systems to improve braking stability, handling quality, and ride comfort, which boosts adoption in new vehicle platforms and upgraded variants. Expanding automotive manufacturing in China, India, and Southeast Asia enhances OEM sourcing and strengthens supply chains. Rising urban mobility, growing fleet sizes, and strong replacement cycles support aftermarket expansion. Increasing preference for comfort-oriented vehicles and broader road infrastructure upgrades further reinforce long-term market growth.

- For instance, Toyota Motor sold 11,233,039 vehicles worldwide in 2023 across its group brands.

Shift Toward Advanced Suspension Technologies

Demand for smoother, safer, and more controlled driving experiences accelerates adoption of gas charged and electronically controlled shock absorbers. These systems improve damping response, reduce noise and vibration, and enhance stability across high-speed and uneven-surface driving conditions. Premium and mid-segment vehicles integrate adaptive dampers at a faster rate due to rising comfort expectations and lower technology costs. Automakers update suspension platforms to meet strict performance, comfort, and safety benchmarks. Growing electric vehicle adoption further increases demand for real-time damping control systems and advanced shock absorber technologies.

- For instance, ZF’s Continuous Damping Control (CDC) shock adjusts damping within milliseconds (often cited as 10 milliseconds or a fraction of a second) using an electronically controlled proportional valve

Growing Aftermarket Replacement Demand

Aging vehicle fleets and deteriorating road surfaces increase the frequency of shock absorber replacement, reinforcing strong aftermarket demand across global markets. Drivers replace worn suspension parts to maintain braking efficiency, steering stability, and cabin comfort, making shock absorbers a recurring maintenance need. Wider availability of branded and mid-range replacement options supports broader adoption. The growth of service centers, independent garages, and e-commerce auto parts platforms improves accessibility. Heavy usage in commercial vehicles and motorcycles adds additional replacement cycles, keeping the aftermarket a major contributor to overall market growth.

Key Trends & Opportunities

Expansion of Semi-Active and Adaptive Suspension Systems

Semi-active and adaptive shock absorbers gain momentum as automakers integrate electronic damping for real-time handling improvements. These systems adjust within milliseconds to driving conditions, delivering enhanced cornering stability, braking control, and ride comfort. Once limited to luxury models, they now expand into mid-segment vehicles as technological costs decline. Electric vehicles also benefit from adaptive systems that manage battery weight more effectively. Investments in smart suspension, sensor integration, and actuator-based technology create new opportunities for suppliers developing advanced damping and electronic control solutions.

- For instance, Audi’s A8 adaptive air suspension, when in “automatic” mode, automatically lowers the body by 25 mm (approximately 1 inch) if the vehicle is driven at speeds of 120 km/h (75 mph) or more for over 30 seconds to optimize aerodynamic properties.

Increasing Use of Lightweight Materials

Manufacturers shift toward aluminum, composites, and advanced alloys to produce lightweight shock absorbers that improve fuel efficiency and dynamic performance. Reduced component weight enhances handling, agility, and overall ride responsiveness in both ICE vehicles and EVs. With global emission standards tightening, automakers prioritize weight-optimized suspension systems that maintain durability while improving efficiency. Suppliers develop thin-wall tubes, advanced piston rods, and low-friction finishes to meet performance expectations. This trend supports continuous innovation across OEM and aftermarket categories, aligning with long-term goals for sustainability and vehicle lightweighting.

- For instance, BMW’s 2016 7 Series uses a carbon-fiber-reinforced and aluminum-intensive body that cuts vehicle weight by up to 130 kg compared with the previous generation.

Growing Demand in Electric Vehicles

Rising EV adoption increases demand for specialized shock absorbers designed to manage heavier battery loads and deliver quieter, smoother rides. EV manufacturers incorporate advanced damping systems to reduce vibration, enhance cabin comfort, and support regenerative braking behavior. Suppliers respond with EV-specific shock absorber designs featuring improved thermal resistance, lightweight construction, and optimized damping curves for range efficiency. Strong global EV production growth, government incentives, and expanding charging infrastructure create significant opportunities for suspension upgrades. This trend accelerates the shift toward adaptive and electronically controlled damping technologies.

Key Challenges

Fluctuating Raw Material Costs

Manufacturers depend on steel, aluminum, rubber, and specialized coatings, all of which face volatile pricing due to supply chain disruptions, geopolitical tensions, and rising energy costs. Sudden increases in raw material prices elevate production expenses and squeeze margins, especially for suppliers operating under strict OEM contract pricing. Companies adopt strategies like hedging, supplier diversification, and alternative materials, but planning remains difficult. Mid-sized manufacturers face the most pressure as cost instability delays capacity expansion and reduces R&D spending. Persistent fluctuations continue to hinder predictable cost management and profitability.

Intense Competitive Pressure in OEM and Aftermarket

The market faces heavy competition across global and regional players, creating pressure on pricing, product quality, and technological differentiation. OEM contracts enforce strict performance, safety, and durability standards, making it difficult for suppliers to stand out without increasing costs. In the aftermarket, buyers compare premium, mid-range, and low-cost brands, pushing prices downward. Manufacturers are forced to innovate, optimize supply chains, and strengthen brand positioning to maintain share. Competitive intensity limits premium pricing opportunities and requires continuous product development to meet evolving customer expectations.

Regional Analysis

North America

North America held about 32% share in 2024, driven by strong demand for passenger cars, SUVs, and pickup trucks. Automakers in the US and Canada continue to adopt advanced suspension systems that enhance comfort and handling. Replacement demand remains high due to aging vehicles and widespread aftermarket service networks. Growth also benefits from rising sales of premium models that use gas charged and electronically controlled shock absorbers. Expanding EV production encourages suppliers to introduce lighter and more efficient damping systems, supporting steady regional growth across both OEM and aftermarket channels.

Europe

Europe accounted for nearly 27% share in 2024, supported by strong automotive manufacturing in Germany, France, Italy, and the UK. Strict safety and comfort standards push automakers to integrate high-performance damping systems across vehicle categories. Rising adoption of luxury and performance cars strengthens demand for advanced suspension technologies. The region also benefits from strong aftermarket activity driven by long vehicle lifespans. Efforts to expand electric vehicle production increase the need for optimized shock absorbers that manage heavier battery loads while improving ride stability across diverse road conditions.

Asia Pacific

Asia Pacific dominated the global market with about 35% share in 2024, led by large-scale vehicle production in China, India, Japan, and South Korea. Rapid urbanization and rising disposable incomes boost demand for passenger cars and two-wheelers, strengthening both OEM and aftermarket channels. Manufacturers expand gas charged and lightweight shock absorber offerings to meet growing expectations for comfort and durability. The region’s expanding EV production base further drives innovation in suspension engineering. Strong local supply chains and competitive manufacturing costs keep Asia Pacific the fastest-growing regional market.

Latin America

Latin America held close to 4% share in 2024, supported by moderate growth in vehicle production across Brazil, Mexico, and Argentina. The region shows stable demand for replacement shock absorbers due to aging car fleets and challenging road conditions. Economic recovery in key markets helps lift new vehicle sales, especially in entry-level and mid-range models. Manufacturers introduce durable and cost-efficient damping solutions that address local driving needs. Opportunities grow as OEMs expand regional assembly operations, increasing demand for both hydraulic and gas charged shock absorbers across varied vehicle categories.

Middle East and Africa

Middle East and Africa captured about 2% share in 2024, driven by steady demand for SUVs, light commercial vehicles, and off-road models. Hot climates and rough terrain increase wear on suspension components, supporting a strong aftermarket. Growth remains linked to expanding construction activity, tourism mobility, and rising vehicle imports. Markets like the UAE, Saudi Arabia, and South Africa adopt more advanced suspension systems as consumers prefer higher comfort levels. Limited local manufacturing keeps reliance on imported components high, but regional modernization efforts support gradual growth in shock absorber adoption.

Market Segmentations:

By Type

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Bilstein, Mando, Hitachi, ZF, Showa, KONI, KYB, Magneti Marelli, Anand, and Tenneco lead the competitive landscape of the shock absorber market. These companies compete through advanced damping technologies, strong partnerships with global automakers, and continuous product innovation tailored to evolving vehicle platforms. The market shows steady movement toward gas charged, adaptive, and electronically controlled systems, pushing manufacturers to upgrade designs focused on performance, stability, and comfort. Firms strengthen their positions by expanding regional production, improving supply chain efficiency, and investing in lightweight materials to support electric and hybrid vehicle growth. Increasing aftermarket demand also drives competition, encouraging brands to offer durable, cost-effective, and easy-to-install solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Tenneco expanded its Monroe Intelligent Suspension (MIS) portfolio with new semi-active suspension solutions tailored for electric and high-performance vehicles.

- In 2024, ZF showcased new advancements in adaptive damping technology, emphasizing integrated chassis control systems where shock absorbers are a critical component, highlighted by the serial production start of their sMOTION fully active suspension system and the expansion of the cubiX software platform.

- In 2023, KYB made significant investments in R&D focused on advanced electronic suspension systems, particularly targeting electric vehicles.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as automakers adopt more advanced suspension technologies.

- Gas charged and adaptive shock absorbers will see wider use in passenger vehicles.

- Electric vehicle expansion will increase demand for lightweight and high-performance dampers.

- Aftermarket replacement will rise due to aging fleets and challenging road conditions.

- Smart suspension systems with real-time damping control will gain broader adoption.

- Manufacturers will invest in lightweight materials to improve efficiency and ride comfort.

- Premium and mid-segment vehicles will drive adoption of electronically controlled dampers.

- Global suppliers will expand production networks to meet rising OEM demand.

- Digital retail and e-commerce channels will boost aftermarket shock absorber sales.

- Sustainability goals will push development of durable, energy-efficient suspension components.