Market Overview

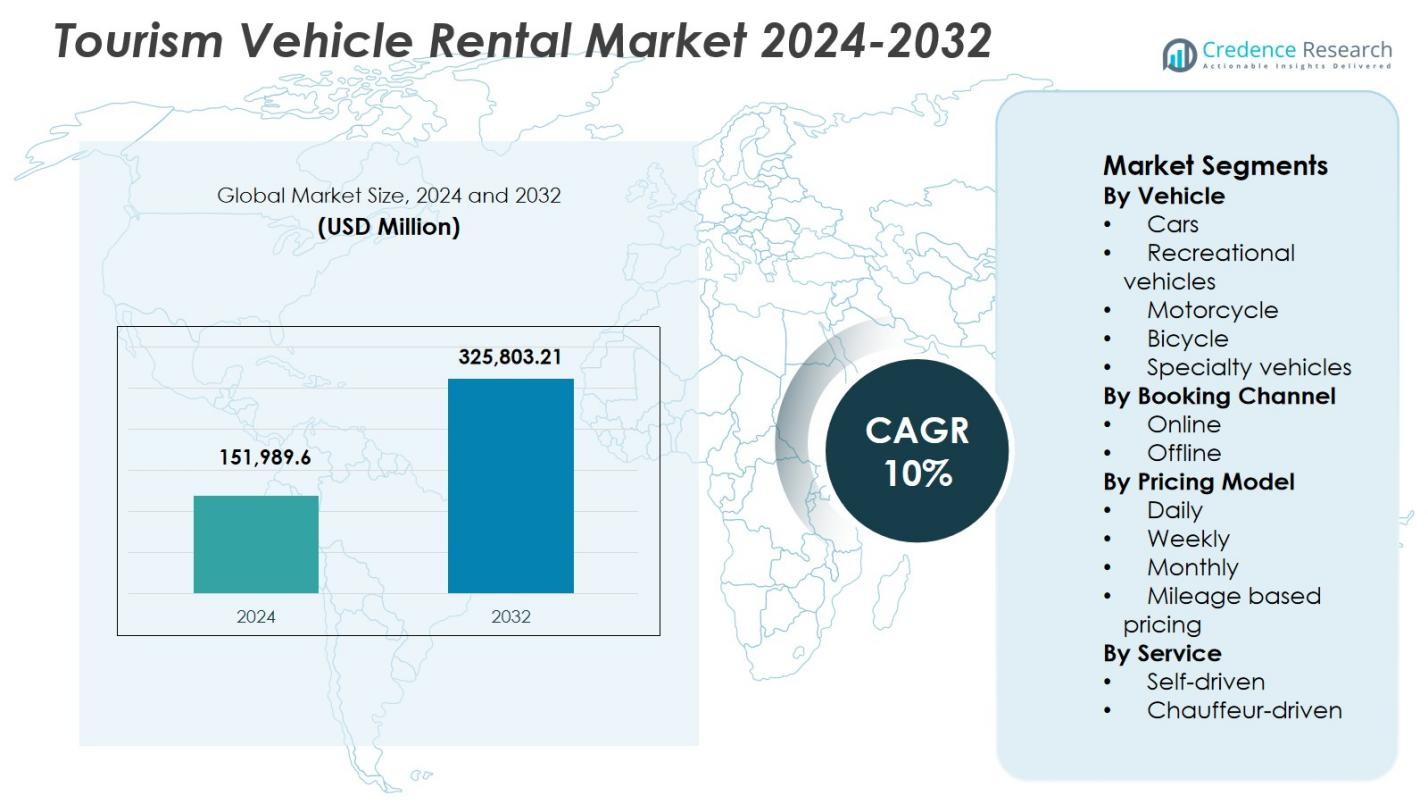

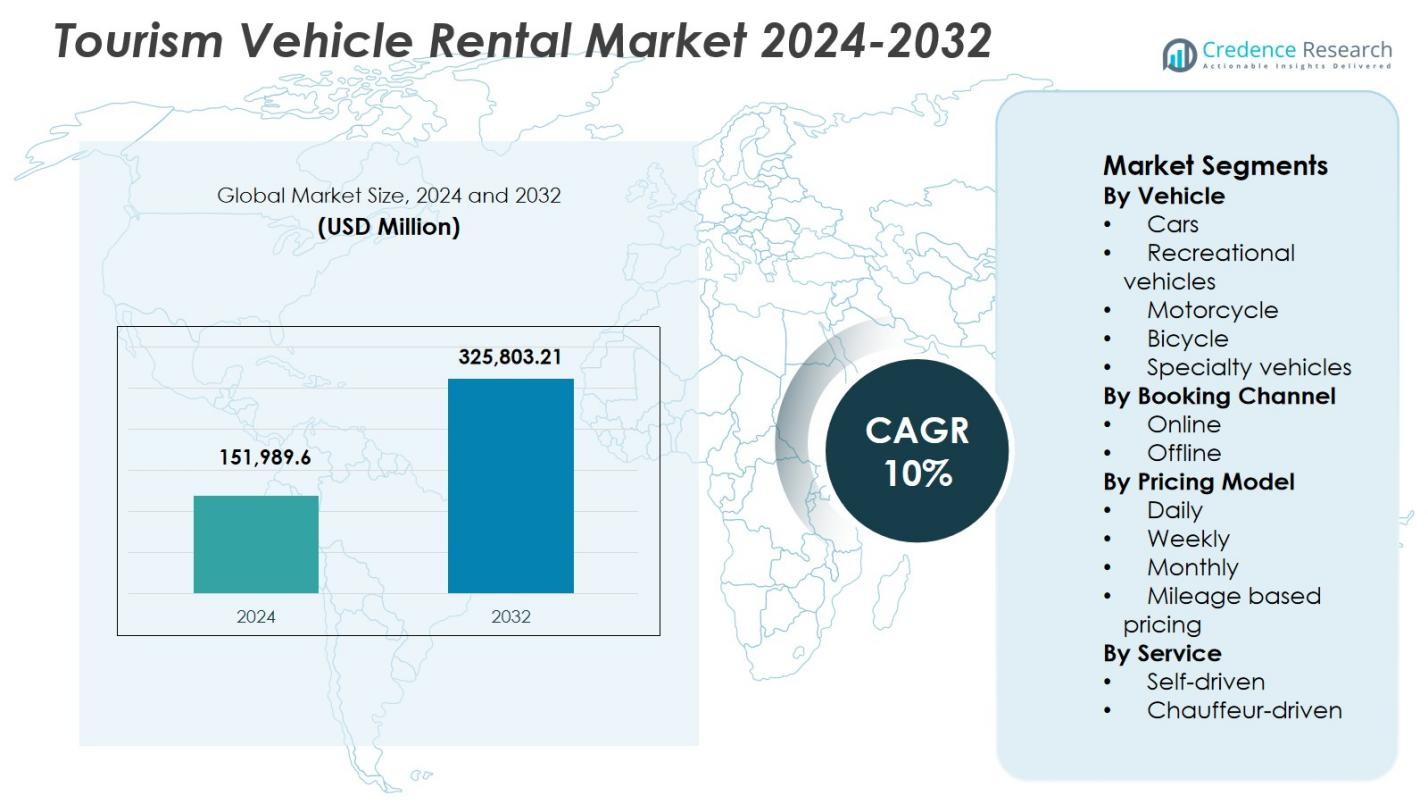

Tourism Vehicle Rental Market size was valued at USD 151,989.6 million in 2024 and is anticipated to reach USD 325,803.21 million by 2032, growing at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tourism Vehicle Rental Market Size 2024 |

USD 151,989.6 Million |

| Tourism Vehicle Rental Market, CAGR |

10% |

| Tourism Vehicle Rental Market Size 2032 |

USD 325,803.21 Million |

Tourism Vehicle Rental Market is driven by the strong presence of established global rental operators and digital travel platforms that focus on fleet scale, geographic reach, and technology-enabled services. Key players such as Enterprise Rent-A-Car, Avis Budget Group, Hertz Global Holdings, Europcar Mobility Group, Sixt SE, Booking.com, Expedia, and CarTrawler strengthen market expansion through extensive airport networks, online booking integration, and diversified vehicle offerings. These companies emphasize self-drive rentals, flexible pricing models, and digital customer engagement to capture rising tourism demand. Regionally, North America leads the Tourism Vehicle Rental Market with 34.8% market share, supported by high travel volumes, mature road infrastructure, and strong adoption of online rentals, followed by Europe and Asia-Pacific, which benefit from cross-border tourism and rapid growth in domestic travel demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Tourism Vehicle Rental Market was valued at USD 151,989.6 million in 2024 and is projected to grow at a CAGR of 10% through the forecast period, driven by rising global tourism and increasing preference for flexible mobility solutions.

- Growing domestic and international travel, higher disposable incomes, and expanding airport infrastructure continue to drive demand for rental vehicles, with self-driven services gaining strong traction among leisure and group travelers.

- Digital booking platforms dominate market trends, supported by mobile apps, real-time availability, dynamic pricing, and integration with travel and hospitality ecosystems, while electric and hybrid vehicle adoption is steadily increasing.

- The cars segment leads the market with 6% share, supported by affordability and wide availability, while online booking channels hold 68.3% share due to convenience and transparency; high fleet costs and regulatory compliance remain key restraints.

- North America leads with 8% market share, followed by Europe at 27.6% and Asia-Pacific at 24.1%, with emerging regions benefiting from tourism promotion, infrastructure development, and rising digital penetration.

Market Segmentation Analysis:

By Vehicle:

The Tourism Vehicle Rental Market by vehicle is led by Cars, which accounted for 52.6% market share in 2024. Cars dominate due to their affordability, ease of driving, and suitability for both short-distance city travel and long-distance tourism. Strong demand from leisure travelers, families, and business tourists supports segment leadership. High availability across rental fleets, fuel-efficient models, and increasing adoption of electric and hybrid cars further strengthen growth. Recreational vehicles follow, driven by road-trip tourism, while motorcycles, bicycles, and specialty vehicles cater to niche adventure, eco-tourism, and experiential travel segments.

- For instance, Enterprise Rent-A-Car introduced hybrid variants of the Toyota Corolla and RAV4 in its European fleet to support eco-friendly mobility for tourists.

By Booking Channel:

The Tourism Vehicle Rental Market by booking channel is dominated by Online booking, holding 68.3% market share in 2024. Online platforms lead due to convenience, real-time vehicle availability, transparent pricing, and integrated travel services such as flights and hotels. Mobile apps, digital payments, and loyalty programs further accelerate adoption. Strong presence of global aggregators and rental platforms enhances price comparison and customer reach. Offline booking continues to serve walk-in customers and local operators, particularly in emerging destinations, but limited scalability and manual processes constrain faster growth.

- For instance, Booking.com provides real-time car availability from over 200 suppliers at 45,000 locations in 144 countries, enabling instant bookings with filters for insurance and vehicle types.

By Pricing Model:

The Tourism Vehicle Rental Market by pricing model is led by Daily pricing, which captured 46.9% market share in 2024. Daily pricing remains dominant due to high demand for short-term rentals driven by weekend trips, city tours, and airport-based rentals. Flexibility, predictable costs, and widespread consumer familiarity support its leadership. Weekly and monthly pricing models gain traction among long-stay tourists and digital nomads, while mileage-based pricing appeals to cost-sensitive travelers seeking usage-based value, particularly in urban sightseeing and short-distance travel scenarios.

Key Growth Drivers

Expansion of Global Tourism and Travel Activity

The Tourism Vehicle Rental Market is strongly supported by the continuous expansion of global tourism. Rising disposable incomes, increasing international arrivals, and growth in domestic travel significantly increase demand for rental vehicles. Tourists seek convenient and flexible transportation to explore destinations beyond major transit hubs. Government initiatives promoting tourism, improved airport infrastructure, and development of road networks further stimulate market growth. Growth in leisure, cultural, and adventure tourism also boosts demand for diverse rental vehicle types, supporting sustained market expansion across multiple regions.

- For instance, Sixt opened a new car rental branch at Kona International Airport in Hawaii in April 2024, offering compact cars, SUVs, and luxury vehicles via a dedicated shuttle to serve the airport’s nearly 5 million annual passengers exploring the Big Island’s resorts and landmarks.

Shift Toward Flexible and Self-Driven Mobility

The growing preference for self-driven travel is a major driver for the Tourism Vehicle Rental Market. Travelers increasingly favor private vehicles to gain flexibility, control over travel schedules, and enhanced comfort. Self-drive rentals reduce dependency on public transportation and organized tours, particularly for families and group travelers. Increasing awareness of safety and hygiene standards further strengthens adoption. The availability of short-term and long-term rental options, along with diverse vehicle fleets, continues to support strong market demand.

Digitalization of Rental Platforms and Booking Systems

Rapid digital transformation across the travel ecosystem significantly drives the Tourism Vehicle Rental Market. Online booking platforms enable seamless vehicle selection, real-time availability, and transparent pricing, enhancing customer experience. Integration with travel apps, digital payments, and loyalty programs increases booking efficiency and repeat usage. Advanced data analytics and dynamic pricing tools allow operators to optimize fleet utilization and revenue. The widespread adoption of smartphones and mobile apps further accelerates digital bookings, strengthening market growth.

- For instance, Turo rolled out its Book Instantly feature platform-wide starting in early 2024, automatically approving trips without manual host intervention.

Key Trends & Opportunities

Growth of Electric and Sustainable Rental Vehicles

Sustainability trends create strong opportunities within the Tourism Vehicle Rental Market. Rental companies increasingly incorporate electric and hybrid vehicles to meet environmental regulations and changing traveler preferences. Tourists show growing interest in low-emission transportation options, particularly in environmentally conscious destinations. Government incentives for electric vehicles and expanding charging infrastructure further support adoption. Sustainable fleets enhance brand positioning while reducing operating costs, creating long-term growth opportunities for rental operators.

- For instance, Green Circle Experience provides fully electric SUVs with at least 400 km range for tourists exploring Costa Rica, charged free at member hotels using 100% renewable energy. Each personalized vehicle supports local social or environmental projects through rental profits.

Rising Demand for Long-Term and Subscription-Based Rentals

Long-term rentals and subscription-based pricing models represent a key opportunity in the Tourism Vehicle Rental Market. Digital nomads, extended-stay tourists, and remote workers increasingly seek flexible monthly rental options. These models provide predictable revenue streams for operators and cost advantages for customers. Customizable packages, bundled services, and mileage-inclusive plans improve customer retention. The shift toward longer travel durations supports expansion beyond traditional short-term rental demand.

- For instance, Mahindra offers SUV subscription and leasing plans with flexible tenures from one to four years, including insurance, maintenance, and the option to upgrade models or buy back at a pre-determined price after the minimum period.

Key Challenges

High Fleet Management and Maintenance Costs

Fleet acquisition, maintenance, and depreciation present significant challenges for the Tourism Vehicle Rental Market. Rising vehicle prices, fuel costs, and maintenance expenses increase operational burdens for rental providers. Managing diverse fleets across multiple locations adds logistical complexity. Fluctuating demand patterns can lead to underutilization during off-peak seasons, impacting profitability. Effective fleet optimization and cost control remain critical to maintaining sustainable margins.

Regulatory Compliance and Intense Competitive Pressure

Regulatory requirements and competitive intensity pose challenges for the Tourism Vehicle Rental Market. Compliance with local licensing, insurance mandates, and environmental regulations increases operational complexity. Regulations vary across regions, creating barriers for expansion. Additionally, strong competition from global rental brands, local operators, and peer-to-peer platforms pressures pricing and margins. Differentiation through service quality, technology adoption, and fleet innovation is essential to sustain competitive positioning.

Regional Analysis

North America

North America holds a leading position in the Tourism Vehicle Rental Market, accounting for 34.8% market share in 2024. Strong tourism inflows, high vehicle ownership familiarity, and well-developed road infrastructure drive sustained demand. The region benefits from a high penetration of online booking platforms, extensive airport-based rental networks, and strong preference for self-driven travel. Demand for cars and recreational vehicles remains high, supported by road trips, national park tourism, and cross-state travel. Favorable insurance frameworks and a strong presence of organized rental operators further reinforce regional market leadership.

Europe

Europe represents a significant share of the Tourism Vehicle Rental Market with 27.6% market share in 2024. High international tourist arrivals, cross-border travel, and dense urban connectivity support consistent rental demand. Strong adoption of compact cars, electric vehicles, and short-term rentals reflects regional sustainability priorities and regulatory frameworks. Well-established rail and air networks complement vehicle rentals for last-mile and regional mobility. Growth in leisure travel, cultural tourism, and scenic road trips across Western and Southern Europe continues to support steady market expansion.

Asia-Pacific

Asia-Pacific accounts for 24.1% market share in 2024, driven by rapid tourism growth and expanding middle-class populations. Rising domestic travel in countries such as China, India, Japan, and Southeast Asia fuels strong demand for affordable rental vehicles. Improving road infrastructure, digital payment adoption, and increasing smartphone penetration accelerate online bookings. Tourists increasingly prefer self-drive options for flexibility in emerging destinations. The region also benefits from growing low-cost airline connectivity and government initiatives promoting tourism, supporting long-term market growth.

Latin America

Latin America holds 8.2% market share in 2024 within the Tourism Vehicle Rental Market. Growth is supported by increasing international tourism, especially in destinations such as Mexico, Brazil, and the Caribbean. Demand is driven by airport-based rentals, leisure travel, and expanding urban tourism. Improving digital booking platforms and partnerships with travel aggregators enhance accessibility. However, market growth remains influenced by infrastructure development and economic stability. Rising interest in regional road travel and adventure tourism continues to create opportunities for rental providers.

Middle East & Africa

The Middle East & Africa region accounts for 5.3% market share in 2024. Growth is driven by rising tourism investments, large-scale events, and luxury travel demand, particularly in the Gulf countries. Strong airport infrastructure and high demand for premium and specialty vehicles support market expansion. In Africa, growing eco-tourism and safari travel increase demand for specialty and off-road rentals. Government-led tourism diversification strategies and infrastructure upgrades continue to strengthen the region’s role in the global market.

Market Segmentations:

By Vehicle

- Cars

- Recreational vehicles

- Motorcycle

- Bicycle

- Specialty vehicles

By Booking Channel

By Pricing Model

- Daily

- Weekly

- Monthly

- Mileage based pricing

By Service

- Self-driven

- Chauffeur-driven

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Tourism Vehicle Rental Market features a diverse mix of global brands, regional operators, and digital travel platforms, including Enterprise Rent-A-Car, Avis Budget Group, Hertz Global Holdings, Europcar Mobility Group, Sixt SE, Booking Holdings, Expedia Group, and CarTrawler. The market emphasizes scale, fleet diversity, geographic reach, and digital capabilities as core differentiators. Leading players focus on expanding airport and urban presence, strengthening online booking ecosystems, and optimizing fleet utilization through data-driven pricing and demand forecasting. Strategic partnerships with airlines, hotels, and travel aggregators enhance customer acquisition and cross-selling opportunities. Operators increasingly invest in electric and hybrid vehicles to meet regulatory and sustainability requirements while improving brand positioning. Technology-driven enhancements such as mobile apps, contactless rentals, and subscription-based models further intensify competition. Smaller regional players compete through localized services, flexible pricing, and niche vehicle offerings, sustaining a dynamic and highly fragmented market structure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2025, Ryde announced a strategic expansion into the electric vehicle rental market through partnerships with Guan Chao Holdings and Singapore Electric Vehicles, targeting a fleet of up to 400 EVs over the next six months.

- In October 2025, AMP launched India’s first premium electric vehicle subscription platform, offering access to luxury EVs from BMW, Mercedes, BYD, Audi, and Volvo for salaried professionals without ownership commitments.

- In December 2025, Enterprise Mobility completed the acquisition of Hogan, a well-established U.S. commercial transportation services provider, expanding its mobility portfolio and service reach in the Tourism Vehicle Rental Market.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Booking Channel, Pricing Model, Service and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Tourism Vehicle Rental Market will expand steadily with rising domestic and international tourism activity across key regions.

- Digital booking platforms will continue to dominate as travelers prioritize convenience, transparency, and real-time availability.

- Demand for self-drive rentals will strengthen as travelers seek flexibility, privacy, and personalized travel experiences.

- Electric and hybrid vehicles will gain wider adoption driven by sustainability goals and regulatory support.

- Long-term and subscription-based rental models will grow with increasing extended stays and remote work travel.

- Fleet diversification will increase to address demand for recreational, specialty, and adventure-oriented vehicles.

- Integration with airlines, hotels, and travel platforms will enhance customer reach and booking efficiency.

- Advanced analytics and dynamic pricing will improve fleet utilization and revenue management.

- Emerging markets will contribute higher growth supported by infrastructure development and tourism promotion.

- Service differentiation through contactless rentals and enhanced customer experience will shape competitive positioning.