Market Overview

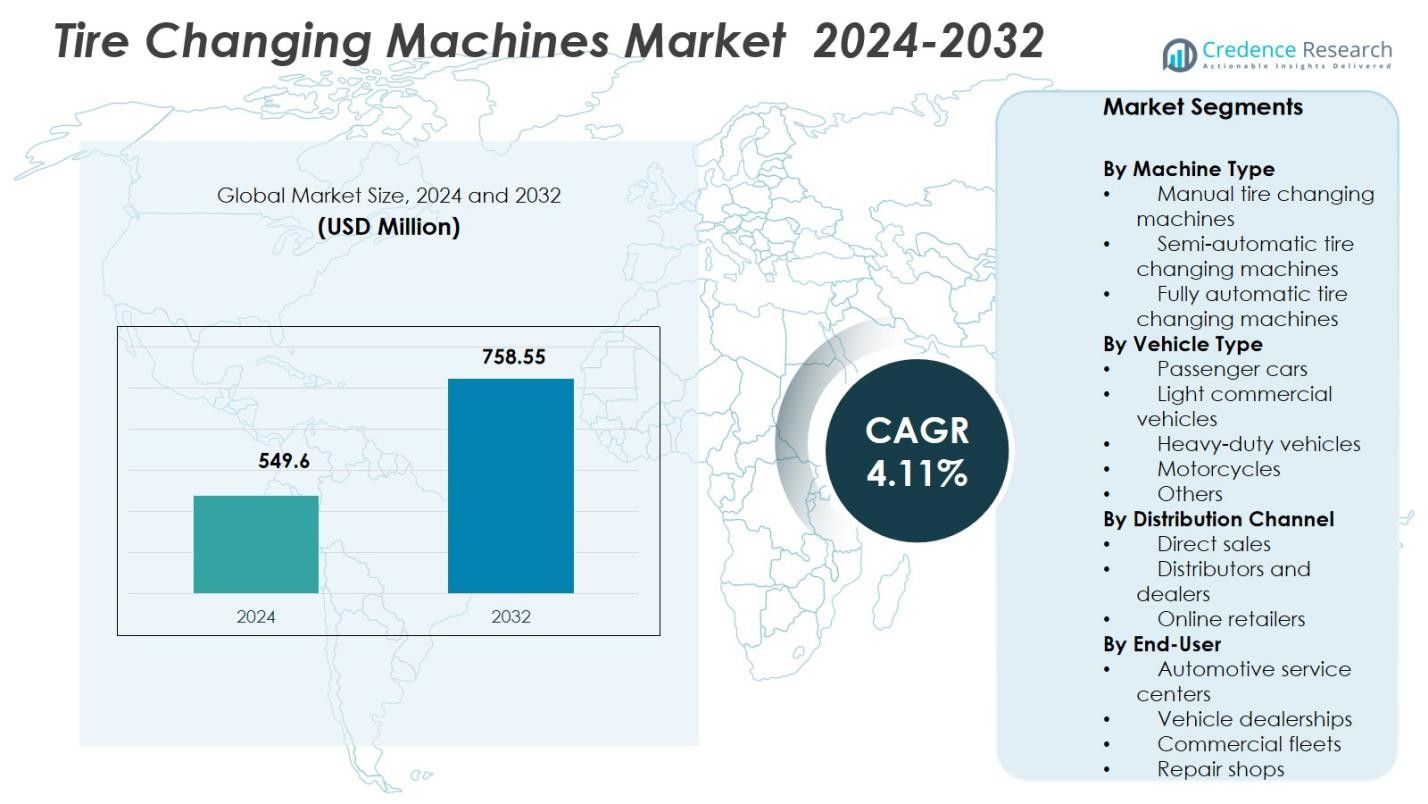

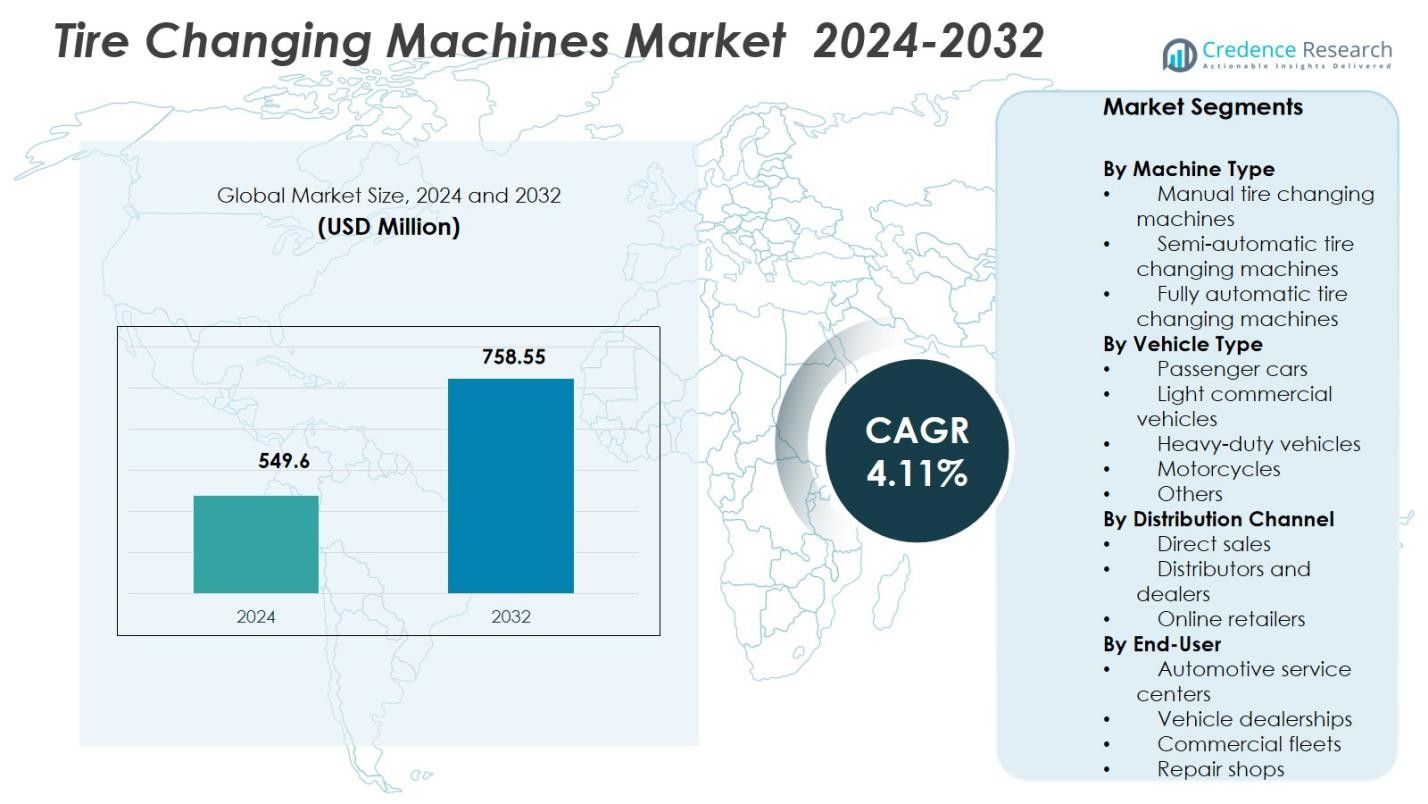

Tire Changing Machines Market size was valued at USD 549.6 million in 2024 and is anticipated to reach USD 758.55 million by 2032, expanding at a CAGR of 4.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tire Changing Machines Market Size 2024 |

USD 549.6 Million |

| Tire Changing Machines Market, CAGR |

4.11% |

| Tire Changing Machines Market Size 2032 |

USD 758.55 Million |

Tire Changing Machines Market is characterized by the strong presence of established manufacturers that focus on technology innovation, ergonomic design, and wide service networks. Key companies such as Hunter Engineering Company, Bosch Automotive Service Solutions, Snap-on Incorporated, Corghi S.p.A., Ravaglioli S.p.A., Hofmann Megaplan, Giuliano Group, SICE (SAE), Alpina Tyre Group Co., Ltd., and Twin Busch GmbH strengthen market positioning through advanced product portfolios and reliable after-sales support. These players emphasize automation, safety, and efficiency to address the evolving needs of automotive workshops. Regionally, North America leads with a 34.2% market share, supported by a mature aftermarket ecosystem and high equipment adoption, followed by Europe at 29.6% driven by regulatory compliance and service standardization, and Asia Pacific at 24.1% fueled by expanding vehicle fleets and service infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Tire Changing Machines Market was valued at USD 549.6 million in 2024 and is projected to reach USD 758.55 million by 2032, expanding at a CAGR of 4.11% driven by steady growth in automotive aftermarket services.

- Rising global vehicle parc and increasing tire replacement frequency drive demand, with semi-automatic tire changing machines leading the market at a 44.6% share due to their cost-efficiency and operational flexibility.

- Automation, ergonomic design, and digital control integration shape market trends as workshops prioritize faster service turnaround and reduced labor dependency.

- Market participants such as Hunter Engineering Company, Bosch Automotive Service Solutions, Snap-on Incorporated, and Corghi S.p.A. strengthen positioning through product innovation, distributor expansion, and after-sales service focus.

- North America leads with a 34.2% share, followed by Europe at 29.6% and Asia Pacific at 24.1%, supported by mature service infrastructure, regulatory compliance, and expanding vehicle ownership.

Market Segmentation Analysis:

By Machine Type:

The Tire Changing Machines Market by machine type is led by semi-automatic tire changing machines, accounting for 44.6% market share in 2024. This dominance is driven by their optimal balance between affordability, efficiency, and ease of operation, making them widely preferred across small and mid-sized automotive workshops. Semi-automatic machines reduce manual effort while maintaining lower capital costs than fully automatic systems. Growing vehicle parc, rising tire replacement frequency, and increasing adoption among independent service centers continue to support demand. Manual machines retain relevance in cost-sensitive markets, while fully automatic systems gain traction in premium service environments.

- For instance, Hunter Engineering’s Revolution offers fully automatic operation with a leverless tool head, 12-30 inch rim range, and 875 ft-lbs torque for diverse wheel assemblies. It eliminates skilled operator needs in premium workshops through consistent automated processes.

By Vehicle Type:

By vehicle type, passenger cars dominate the Tire Changing Machines Market with a 52.8% share, supported by the large global passenger vehicle fleet and frequent tire replacement cycles. High urbanization rates, increasing vehicle ownership, and growing demand for routine maintenance services strongly reinforce this segment’s leadership. Service centers prioritize equipment optimized for passenger cars due to high service volumes and faster turnaround requirements. Light commercial vehicles follow, driven by logistics growth, while heavy-duty vehicles rely on specialized equipment. Motorcycles and other vehicle categories contribute steadily, supported by expanding two-wheeler ownership in emerging economies.

- For instance, Ravaglioli’s heavy-duty models like the G1190.30 use leverless tools for low-profile tires up to 24″, with servo-assisted arms and inverter motors limited to 15 rpm for safe operation on LCV wheels.

By Distribution Channel:

The distribution channel landscape is led by distributors and dealers, holding a 47.3% market share, driven by their strong regional presence, installation support, and after-sales service capabilities. Workshops prefer dealer networks for technical assistance, training, and reliable spare part availability, which directly enhances equipment uptime. Direct sales remain significant among large service chains and OEM-aligned workshops seeking customization and bulk procurement advantages. Online retailers are expanding rapidly, supported by digital procurement trends and price transparency, although their adoption remains limited to smaller machines and replacement components rather than heavy-duty systems.

Key Growth Drivers

Rising Global Vehicle Parc and Aftermarket Service Demand

The growing global vehicle parc remains a fundamental driver for the Tire Changing Machines Market, supported by increasing ownership of passenger cars and light commercial vehicles. Higher vehicle utilization results in faster tire wear and more frequent replacement cycles, directly increasing demand for tire servicing equipment. Automotive workshops and multi-brand service centers invest in advanced tire changing machines to handle rising service volumes efficiently. Expansion of organized aftermarket networks and dealership-led service models further reinforces sustained demand for reliable and high-throughput tire changing solutions.

- For instance, Corghi’s Artiglio Master FORCE employs hydraulic synchronized movements in its Smart Corghi System tool unit to eliminate tire-rim tension on low-profile and run-flat tires, allowing precise automation for faster servicing in organized aftermarket networks.

Expansion of Automotive Service Infrastructure

Rapid expansion of automotive service infrastructure significantly accelerates market growth, particularly across emerging economies. New dealership workshops, franchised service centers, and independent garages are being established to support rising vehicle populations. Tire changing machines are essential equipment in these facilities, encouraging consistent procurement and technology upgrades. Regulatory emphasis on road safety inspections and periodic vehicle maintenance further stimulates equipment demand. As service operations scale, workshops increasingly adopt semi-automatic and fully automatic systems to improve productivity and standardize service quality.

- For instance, Maruti Suzuki opened its 5,000th Arena Service outlet in Coimbatore, Tamil Nadu, expanding the nationwide network to over 5,640 touchpoints across 2,818 cities.

Increasing Focus on Operational Efficiency and Labor Optimization

Automotive service providers are increasingly focused on improving operational efficiency and reducing labor dependency. Rising labor costs and skilled technician shortages push workshops toward mechanized tire changing solutions. Modern machines reduce manual effort, minimize errors, and ensure faster service turnaround. These advantages directly enhance workshop profitability and customer satisfaction. High-volume service centers prioritize equipment upgrades to maintain consistent service output, making tire changing machines a strategic investment rather than a discretionary purchase.

Key Trends & Opportunities

Integration of Automation and Smart Technologies

Automation and smart technology integration represent a major trend shaping the Tire Changing Machines Market. Manufacturers are introducing digitally controlled systems, automated clamping, precision bead-breaking, and user-friendly interfaces. These features improve operational accuracy, reduce operator training time, and enhance safety. Smart diagnostics and connectivity enable predictive maintenance and higher equipment uptime. As workshops modernize and align with digital service models, demand for technologically advanced tire changing machines continues to strengthen.

- For instance, Giuliano Automotive’s T-REC tire changer features intelligent software that automatically manages complete tire bead loosening and demounting cycles without operator intervention.

Expansion of Digital Sales and Equipment Accessibility

The growing use of digital sales platforms creates new opportunities by improving equipment accessibility for small and independent workshops. Online channels offer product transparency, competitive pricing, and faster procurement, particularly in regions with limited dealer presence. Manufacturers leveraging e-commerce benefit from broader market reach and direct customer engagement. Virtual demonstrations, remote technical support, and digital catalogs further support adoption, especially for compact and mid-range tire changing machines.

- For instance, Snap-on provides digital catalogs and remote product consultations for workshop equipment, allowing customers to compare machine features and service requirements without in-person visits.

Key Challenges

High Capital Investment and Cost Constraints

High capital investment requirements remain a critical challenge, especially for small and price-sensitive workshops. Advanced tire changing machines involve significant upfront costs, limiting adoption in developing markets. Budget-constrained service providers often rely on manual or refurbished equipment to manage expenses. Volatility in raw material prices also affects equipment pricing, influencing purchasing decisions. Longer return-on-investment cycles continue to restrict rapid penetration of high-end systems.

Technical Complexity and Maintenance Dependence

Technical complexity and maintenance dependency pose additional challenges for market growth. Advanced tire changing machines require skilled operators, routine servicing, and timely calibration to maintain performance. Limited availability of trained technicians and spare parts in certain regions increases downtime risks. Maintenance costs add to total ownership expenses, discouraging adoption among smaller workshops. These operational challenges slow penetration of automated systems, particularly in rural and emerging service markets.

Regional Analysis

North America

North America holds 34.2% market share in the Tire Changing Machines Market, driven by a mature automotive aftermarket and strong presence of organized service chains. High vehicle ownership rates, frequent tire replacement cycles, and widespread adoption of advanced workshop equipment support sustained demand. Service centers prioritize semi-automatic and fully automatic machines to improve throughput and ensure consistent service quality. Strong dealer networks, availability of skilled technicians, and early adoption of automation further strengthen the regional market. The United States remains the primary contributor, supported by a large passenger vehicle fleet and continuous investments in service infrastructure modernization.

Europe

Europe accounts for 29.6% market share, supported by stringent vehicle inspection regulations and a well-established automotive service ecosystem. High penetration of dealership workshops and multi-brand garages drives consistent demand for efficient tire changing equipment. European service providers emphasize safety, precision, and ergonomic solutions, supporting adoption of technologically advanced machines. Growth is further reinforced by a strong passenger car base, increasing seasonal tire change requirements, and rising replacement demand. Countries such as Germany, France, and Italy play a central role, supported by the presence of leading equipment manufacturers and robust distributor networks.

Asia Pacific

Asia Pacific represents 24.1% market share, driven by rapid growth in vehicle ownership and expanding automotive service infrastructure. Rising disposable incomes, urbanization, and increasing passenger car and two-wheeler populations significantly boost tire servicing demand. Independent garages and emerging organized service chains are investing in semi-automatic machines to balance cost and efficiency. China and India remain key growth engines due to large vehicle fleets and expanding aftermarket services. Increasing adoption of modern workshop equipment and gradual shift toward automation continue to strengthen long-term market potential across the region.

Latin America

Latin America holds 7.1% market share, supported by steady growth in vehicle parc and expanding independent automotive workshops. Demand is primarily driven by passenger cars and light commercial vehicles, with service centers favoring cost-effective semi-automatic and manual tire changing machines. Brazil and Mexico lead regional adoption due to higher vehicle density and improving service infrastructure. Growing awareness of preventive vehicle maintenance and gradual expansion of organized service formats contribute to equipment demand. However, price sensitivity and limited access to advanced systems moderate adoption of fully automated machines.

Middle East & Africa

The Middle East & Africa region accounts for 5.0% market share, driven by increasing vehicle imports and gradual expansion of automotive service facilities. Demand is supported by rising passenger car ownership and growth in commercial fleets, particularly in Gulf countries. Service centers focus on durable and easy-to-maintain tire changing machines suited to harsh operating environments. The presence of independent garages dominates the market, encouraging demand for semi-automatic solutions. While adoption of advanced systems remains limited, infrastructure development and growing automotive aftermarket activity continue to support steady regional growth.

Market Segmentations:

By Machine Type

- Manual tire changing machines

- Semi-automatic tire changing machines

- Fully automatic tire changing machines

By Vehicle Type

- Passenger cars

- Light commercial vehicles

- Heavy-duty vehicles

- Motorcycles

- Others

By Distribution Channel

- Direct sales

- Distributors and dealers

- Online retailers

By End-User

- Automotive service centers

- Vehicle dealerships

- Commercial fleets

- Repair shops

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Tire Changing Machines Market highlights a moderately consolidated structure characterized by strong brand presence, technological differentiation, and extensive distribution networks. Hunter Engineering Company, Bosch Automotive Service Solutions, Snap-on Incorporated, Corghi S.p.A., Ravaglioli S.p.A., Hofmann Megaplan, Giuliano Group, and SICE (SAE) dominate the market through continuous product innovation and global dealer coverage. Leading players focus on automation, ergonomic design, and digital controls to improve operational efficiency and reduce labor dependency for workshops. Strategic initiatives include product portfolio expansion, regional distributor partnerships, and enhanced after-sales service capabilities. Manufacturers increasingly target emerging markets by offering cost-optimized semi-automatic models while maintaining premium automated solutions for high-volume service centers. Competitive intensity is further shaped by investments in training, technical support, and customization, enabling key players to strengthen customer loyalty and sustain long-term market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Corghi S.p.A.

- Giuliano Group

- Hofmann Megaplan

- Alpina Tyre Group Co., Ltd.

- Snap-on Incorporated

- Twin Busch GmbH

- Bosch Automotive Service Solutions

- Hunter Engineering Company

- Ravaglioli S.p.A.

- SICE (SAE)

Recent Developments

- In November 2025, Hunter Engineering launched the TCX51C Pro tire changer at SEMA 2025, featuring a hybrid leverless mount head for handling large tires, a lower locking disc for bottom bead demounting, and the FastBlast inflation system for challenging fitments.

- In November 2025, Rotary Solutions demonstrated the R1250 tire changer at SEMA 2025, equipped with dual bead rollers, front-loading wheel lift, and variable speed control for challenging wheels.

- In February 2024, Rabaconda introduced its All-New Mini Tire Changers designed to quickly and easily change motorcycle tires from 10 to 17 inches, enhancing workshop versatility and service efficiency.

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Vehicle Type, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will benefit from sustained growth in global vehicle ownership and expanding automotive aftermarket services.

- Demand will increasingly shift toward semi-automatic and fully automatic machines to improve service speed and consistency.

- Workshops will prioritize equipment that reduces labor dependency and enhances operator safety and ergonomics.

- Automation and digital control features will gain wider adoption across organized service centers and dealerships.

- Manufacturers will focus on cost-optimized models to address price-sensitive independent workshops.

- Emerging economies will remain key growth engines due to expanding service infrastructure and vehicle fleets.

- Distributor and dealer networks will continue to play a critical role in market penetration and customer support.

- Equipment customization for different vehicle types will strengthen supplier differentiation.

- After-sales service, training, and technical support will become decisive factors in purchase decisions.

- Continuous product innovation will remain essential to sustain long-term competitiveness in the market.