Market Overview

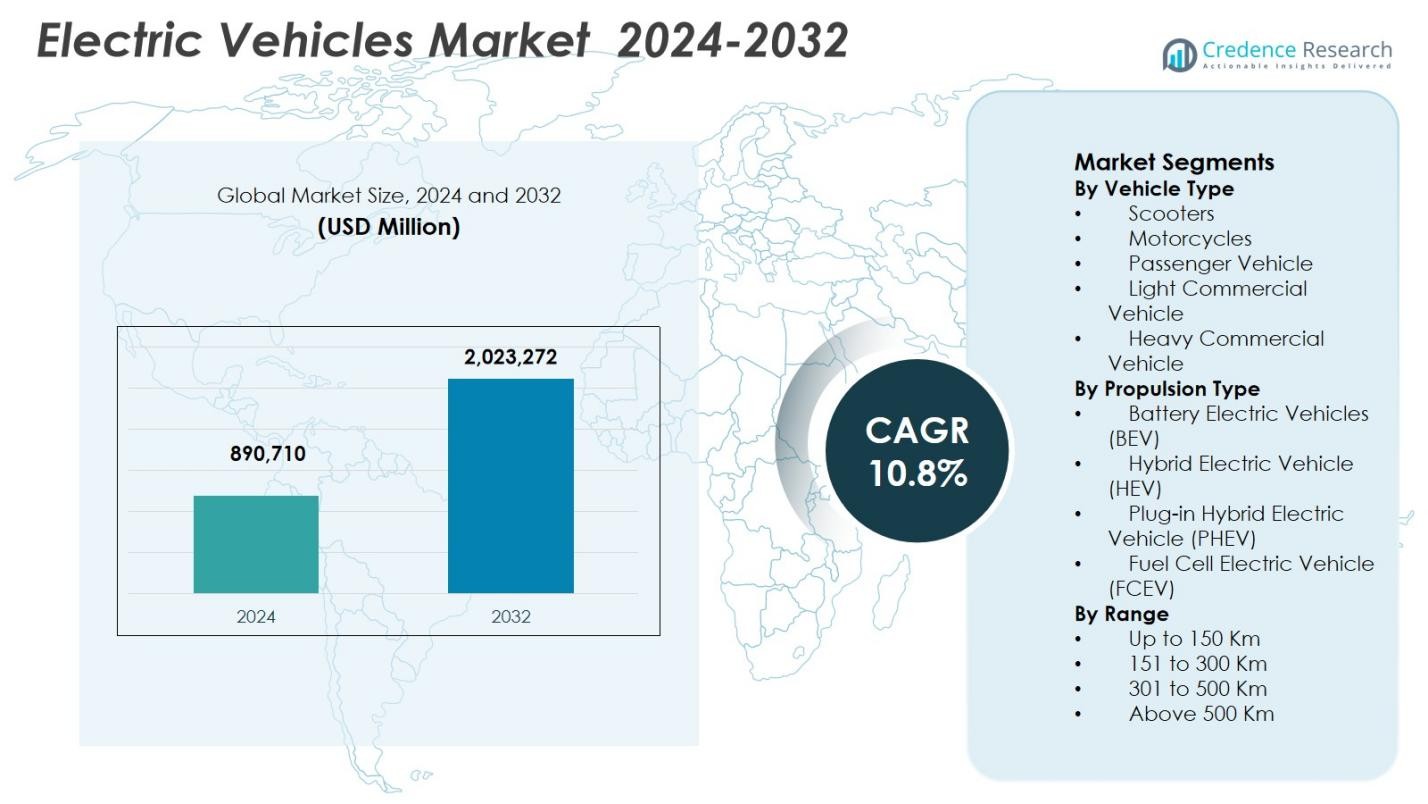

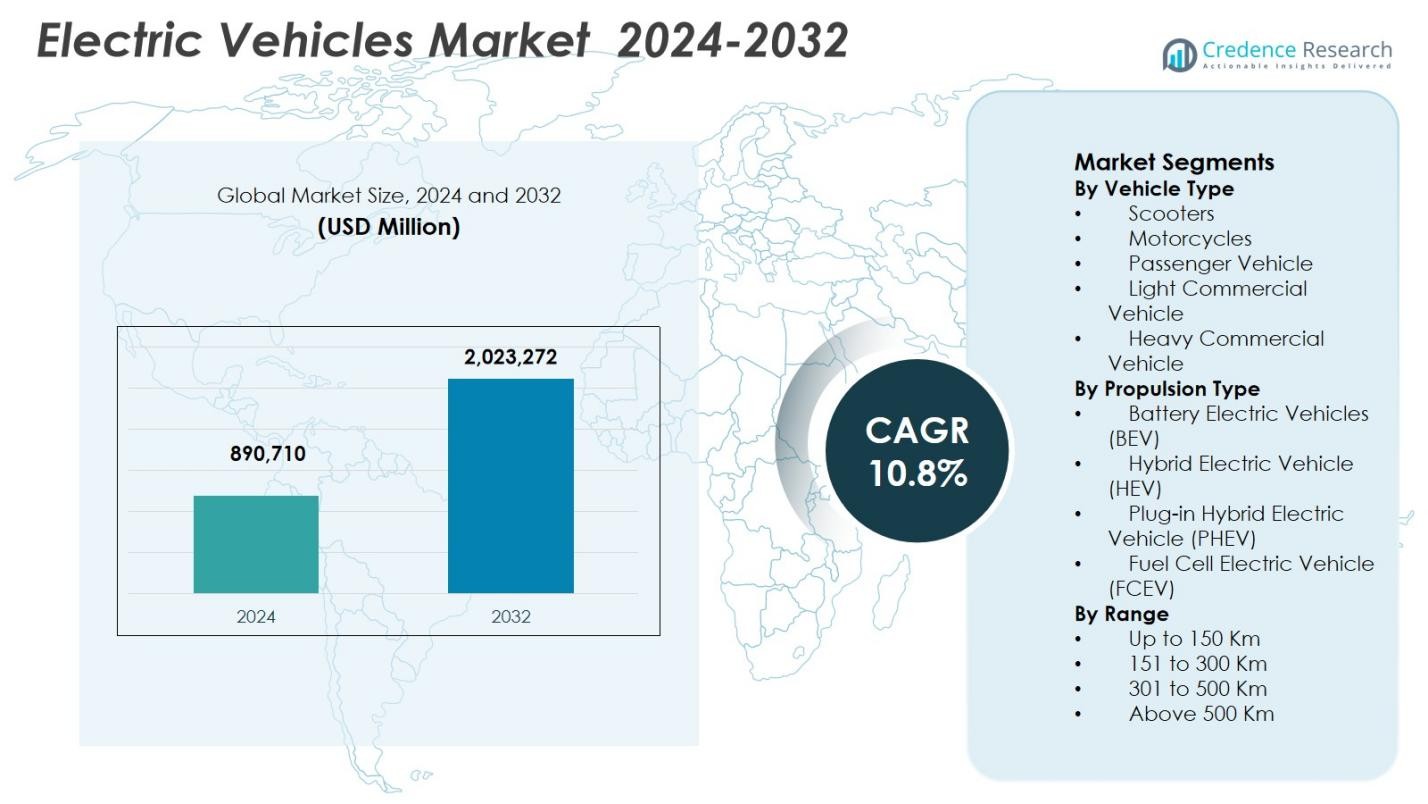

The Electric Vehicles Market size was valued at USD 890,710 million in 2024 and is anticipated to reach USD 2,023,272 million by 2032, growing at a CAGR of 10.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicles Market Size 2024 |

USD 890,710 Million |

| Electric Vehicles Market, CAGR |

10.8% |

| Electric Vehicles Market Size 2032 |

USD 2,023,272 Million |

Electric Vehicles Market is driven by strong participation from major automakers such as Tesla, Volkswagen Group, Toyota Motor Corporation, Hyundai Motor Group, BYD Auto, Mercedes-Benz Group, Tata Motors, Renault Group, General Motors, and BMW Group, which continue to expand electric model portfolios across passenger and commercial segments. These players focus on battery innovation, platform electrification, and software integration to enhance range, performance, and cost efficiency. Asia-Pacific leads the market with a 36.8% share, supported by large-scale production capacity, strong policy support, and high adoption of electric two-wheelers and passenger vehicles, particularly in China and India. Europe and North America follow, driven by stringent emission norms, advanced charging infrastructure, and rising consumer demand for sustainable mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Electric Vehicles Market was valued at USD 890,710 million in 2024 and is projected to grow at a CAGR of 10.8% through 2032, supported by accelerating electrification across passenger and commercial transportation.

- Growth in the Electric Vehicles Market is driven by stringent emission regulations, government incentives, expanding charging infrastructure, and rapid advancements in battery technology that improve range, safety, and cost efficiency.

- A key trend in the Electric Vehicles Market is the dominance of Battery Electric Vehicles with a 71.8% share, alongside rising adoption of software-defined vehicles, connected technologies, and fleet electrification across logistics and mobility services.

- The Electric Vehicles Market faces restraints from high upfront vehicle costs, raw material price volatility, and supply chain dependencies, which continue to impact affordability and production scalability in emerging economies.

- Regionally, Asia-Pacific leads with a 36.8% share, followed by Europe at 31.9% and North America at 27.6%, while the Passenger Vehicle segment dominates with a 62.4% share, reflecting strong consumer adoption and infrastructure readiness.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Vehicle Type:

By vehicle type, the Passenger Vehicle segment dominated the Electric Vehicles Market with a 62.4% market share in 2024. This leadership is driven by rising consumer adoption of electric cars for daily commuting, favorable government incentives, expanding charging infrastructure, and rapid model launches across mass and premium categories. Automakers continue to invest heavily in improving driving range, safety features, and connected technologies, strengthening consumer confidence. Growth in urbanization, higher disposable incomes, and stricter emission regulations further support passenger EV demand, while expanding fleet electrification programs add incremental volume to this dominant segment.

- For instance, BYD’s Atto 3 includes ADAS with adaptive cruise control, lane keep assist, and forward collision warning for safer urban driving. A rotating touchscreen and 360-degree camera enhance connectivity and visibility.

By Propulsion Type:

By propulsion type, Battery Electric Vehicles (BEV) accounted for the largest share at 71.8% of the Electric Vehicles Market in 2024. BEV dominance is supported by zero tailpipe emissions, lower total cost of ownership, and strong policy support such as purchase subsidies and tax benefits. Continuous advancements in lithium-ion battery energy density, declining battery costs, and fast-charging technologies enhance vehicle affordability and usability. OEM focus on dedicated BEV platforms and large-scale investments in gigafactories further reinforce BEV adoption across passenger and commercial vehicle categories globally.

- For instance, BYD commercialized its Blade Battery (LFP chemistry), which demonstrated enhanced thermal stability in nail-penetration tests and enabled longer cycle life without cobalt, supporting cost efficiency and safety.

By Range:

By range, the 301 to 500 Km segment led the Electric Vehicles Market with a 44.6% share in 2024. This range category balances affordability, battery size, and practical driving needs, making it suitable for both urban and intercity usage. Improvements in battery efficiency and power management systems allow manufacturers to deliver extended range without significant cost escalation. Consumers increasingly prefer vehicles offering reduced range anxiety, while fleet operators favor this segment for predictable operating costs and charging flexibility, driving sustained demand across developed and emerging electric vehicle markets.

Key Growth Drivers

Government Policies and Regulatory Support

Strong government policies and regulatory frameworks significantly drive growth in the Electric Vehicles Market. Mandates targeting carbon emission reduction, fuel economy standards, and internal combustion engine phase-out plans accelerate EV adoption. Financial incentives such as purchase subsidies, tax exemptions, and reduced registration fees improve affordability for consumers and fleets. Public investments in charging infrastructure and battery manufacturing ecosystems further support market expansion. Consistent policy alignment across national and regional levels encourages long-term investments by automakers and technology providers, reinforcing sustained electric vehicle penetration.

- For instance, Telangana offers a 100% exemption from registration charges and road tax for all EV categories (private and commercial two-wheelers, four-wheelers, etc.) until December 31, 2026.

Advancements in Battery Technology

Continuous improvements in battery technology are a major growth driver in the Electric Vehicles Market. Higher energy density, faster charging capability, and extended battery lifespan enhance vehicle performance and user convenience. Declining lithium-ion battery costs reduce overall vehicle prices, improving mass-market accessibility. Innovations in solid-state batteries, battery management systems, and thermal control technologies further strengthen safety and reliability. These advancements support broader adoption across passenger and commercial segments while enabling manufacturers to introduce longer-range and cost-competitive electric models.

- For instance, CATL’s second-generation Shenxing LFP battery achieves a 12C peak charging rate with 1.3 MW power, delivering 520 km range in 5 minutes while offering up to 800 km total range.

Expanding Charging Infrastructure

Rapid expansion of public and private charging infrastructure strongly supports Electric Vehicles Market growth. Increased deployment of fast-charging stations along highways, urban centers, and commercial hubs reduces range anxiety and improves vehicle usability. Workplace and residential charging installations further encourage daily EV usage. Utilities, governments, and private investors actively collaborate to scale charging networks and integrate renewable energy sources. Improved charging accessibility directly enhances consumer confidence and supports higher electric vehicle adoption across urban and semi-urban regions.

Key Trends & Opportunities

Electrification of Commercial and Fleet Vehicles

Electrification of commercial and fleet vehicles represents a key trend and opportunity in the Electric Vehicles Market. Logistics providers, ride-hailing platforms, and public transport operators increasingly adopt electric buses, vans, and delivery vehicles to reduce operating costs and emissions. Predictable routes and centralized charging favor fleet electrification. Corporate sustainability commitments and tightening emission regulations further accelerate this shift. This trend creates opportunities for OEMs to offer fleet-optimized EV models, charging solutions, and energy management services.

- For instance, Volvo Trucks said it has sold over 5,000 electric trucks worldwide (across its electric truck range), underscoring growing adoption in regional haul, urban distribution, and municipal duty cycles where uptime and route planning are controllable.

Integration of Advanced Software and Connectivity

The integration of advanced software and connectivity technologies is an emerging opportunity in the Electric Vehicles Market. Software-defined vehicles enable over-the-air updates, predictive maintenance, and enhanced energy optimization. Connected features improve driving efficiency, battery monitoring, and user experience. Automakers increasingly differentiate offerings through digital platforms, autonomous-ready systems, and AI-driven vehicle management. This trend supports recurring revenue models and strengthens long-term customer engagement while enhancing overall vehicle performance and safety.

- For instance, General Motors’ OnStar Proactive Alerts in models like the Chevrolet Equinox and Silverado monitor components such as the starter motor, fuel pump, and 12-volt battery for anomalies.

Key Challenges

High Upfront Costs and Affordability Concerns

High upfront costs remain a critical challenge in the Electric Vehicles Market. Despite declining battery prices, electric vehicles often carry higher initial purchase costs compared to conventional vehicles. Limited access to subsidies in some regions and fluctuating raw material prices affect affordability. Price sensitivity among consumers, particularly in emerging markets, slows adoption. Manufacturers must balance cost reduction with performance improvements to expand penetration across price-sensitive customer segments.

Supply Chain Constraints and Raw Material Dependence

Supply chain constraints pose a significant challenge to the Electric Vehicles Market. Dependence on critical raw materials such as lithium, cobalt, and nickel exposes manufacturers to price volatility and geopolitical risks. Limited mining capacity and processing bottlenecks impact battery production timelines. Supply disruptions can delay vehicle launches and affect profitability. Addressing this challenge requires diversified sourcing strategies, recycling initiatives, and investments in alternative battery chemistries to ensure long-term supply stability.

Regional Analysis

North America

North America accounted for 27.6% of the Electric Vehicles Market in 2024, driven by strong policy support, high consumer awareness, and rapid expansion of charging infrastructure. The United States leads regional adoption due to federal tax credits, state-level zero-emission vehicle mandates, and large-scale investments in domestic battery manufacturing. Automakers continue to expand electric passenger vehicles, pickup trucks, and commercial fleets, supporting volume growth. High penetration of advanced technologies, strong purchasing power, and growing corporate fleet electrification further strengthen North America’s position as a major revenue-generating region.

Europe

Europe captured 31.9% of the Electric Vehicles Market in 2024, supported by stringent emission regulations and aggressive decarbonization targets. Countries such as Germany, France, the UK, and the Nordic region drive adoption through purchase incentives, low-emission zones, and extensive public charging networks. Strong consumer preference for sustainable mobility and rapid electrification of passenger cars underpin regional growth. European automakers focus on platform electrification and battery localization, while expanding charging corridors across highways and urban areas sustains demand across both private and commercial electric vehicles.

Asia-Pacific

Asia-Pacific dominated the Electric Vehicles Market with a 36.8% share in 2024, led by China, Japan, South Korea, and India. China remains the primary growth engine due to large-scale EV production, strong government subsidies, and extensive charging infrastructure deployment. High adoption of electric two-wheelers and affordable passenger EVs significantly boosts volumes. Rapid urbanization, rising fuel costs, and expanding domestic manufacturing capabilities further accelerate market growth. Government-backed localization of battery supply chains strengthens Asia-Pacific’s leadership across both passenger and commercial electric vehicle segments.

Latin America

Latin America held a 2.1% share of the Electric Vehicles Market in 2024, reflecting early-stage adoption across the region. Brazil, Mexico, and Chile lead growth through pilot electrification programs for public transport and urban fleets. Rising fuel prices and growing environmental awareness encourage gradual EV uptake. Government initiatives supporting electric buses and charging infrastructure development improve market conditions. Although infrastructure gaps and cost sensitivity remain challenges, increasing investments and policy alignment position Latin America for steady long-term electric vehicle market expansion.

Middle East & Africa

The Middle East & Africa accounted for 1.6% of the Electric Vehicles Market in 2024, driven by sustainability initiatives and diversification strategies in select countries. The UAE and Saudi Arabia lead regional adoption through smart mobility programs, charging infrastructure investments, and clean energy targets. In Africa, adoption remains limited but electric buses and two-wheelers gain traction in urban areas. High-income markets support premium electric vehicle demand, while government-led pilot projects gradually improve awareness and infrastructure, supporting incremental market growth across the region.

Market Segmentations:

By Vehicle Type

- Scooters

- Motorcycles

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Propulsion Type

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Range

- Up to 150 Km

- 151 to 300 Km

- 301 to 500 Km

- Above 500 Km

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Electric Vehicles Market highlights intense innovation, capacity expansion, and strategic positioning among leading players including Tesla, Volkswagen Group, Toyota Motor Corporation, Hyundai Motor Group, BYD Auto, Mercedes-Benz Group, Tata Motors, Renault Group, General Motors, and BMW Group. Market participants focus on expanding electric model portfolios across passenger and commercial segments while investing heavily in battery technology, software platforms, and charging ecosystems. Platform standardization and localization of battery manufacturing help companies reduce costs and improve supply chain resilience. Strategic partnerships with battery suppliers, technology firms, and energy providers support faster product development and infrastructure rollout. Automakers also emphasize vertical integration, over-the-air software capabilities, and advanced driver assistance features to enhance differentiation. Strong competition drives rapid innovation cycles, frequent model launches, and continuous improvements in range, performance, and affordability, shaping long-term market dynamics.

Key Player Analysis

- Hyundai Motor Group

- Tesla

- Tata Motors

- Renault Group

- Volkswagen Group

- Ola Electric

- Mercedes-Benz Group

- VinFast

- TVS Motor Company

- Toyota Motor Corporation

Recent Developments

- In December 2025, Ola Electric commenced mass deliveries of vehicles powered by its 4,680 Bharat Cell technology, marking a major rollout milestone for the company’s EV offerings.

- In December 2025, Ford Motor Company and Renault Group formed a strategic partnership to jointly develop two new Ford-branded electric vehicles on Renault’s Ampere platform, with the first models expected in showrooms by 2028.

- In December 2025, Perkbox agreed to acquire Loveelectric, an EV salary-sacrifice and charging solutions provider, to expand its electric mobility offerings.

- In December 2025, Nissan partnered with energy provider Pod to offer a home EV charging subscription service with reduced upfront costs for EV buyers, enhancing the EV ownership ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Propulsion Type, Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric vehicle adoption will accelerate as governments continue tightening emission regulations and phasing out internal combustion engine vehicles.

- Battery technology will advance further, enabling longer driving ranges, faster charging, and improved safety performance.

- Charging infrastructure deployment will expand rapidly across urban, highway, and rural networks, reducing range anxiety.

- Electric vehicles will gain stronger penetration in commercial fleets, logistics, and public transportation applications.

- Cost competitiveness with conventional vehicles will improve as battery prices decline and manufacturing scales increase.

- Software-defined vehicles will enhance performance optimization, connectivity, and over-the-air feature upgrades.

- Localization of battery and vehicle manufacturing will strengthen supply chain resilience and regional self-sufficiency.

- Consumer demand will grow for diverse electric models across two-wheelers, passenger cars, and commercial vehicles.

- Integration of renewable energy with charging networks will support sustainable electric mobility ecosystems.

- Strategic collaborations among automakers, technology providers, and energy companies will shape long-term market growth.

Market Segmentation Analysis:

Market Segmentation Analysis: