Market Overview

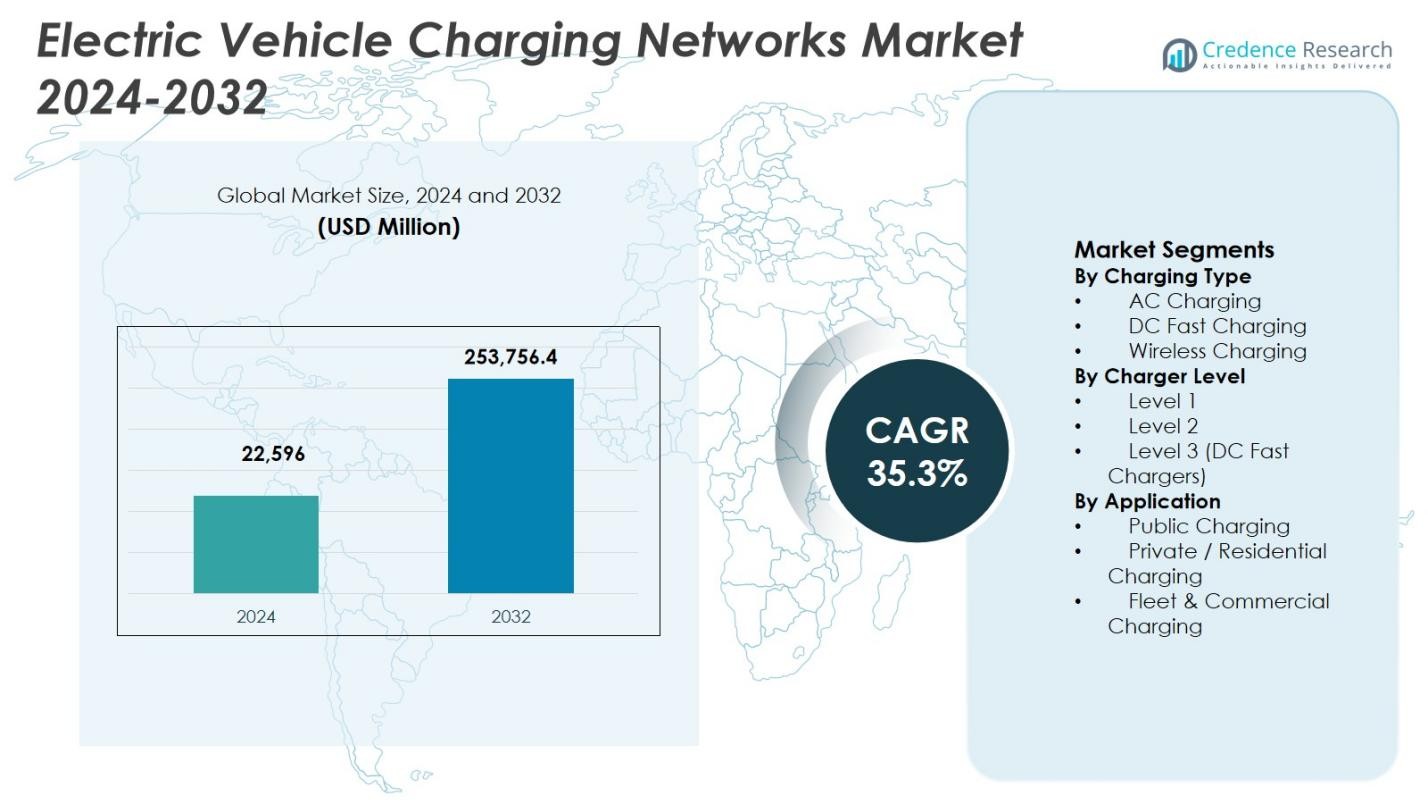

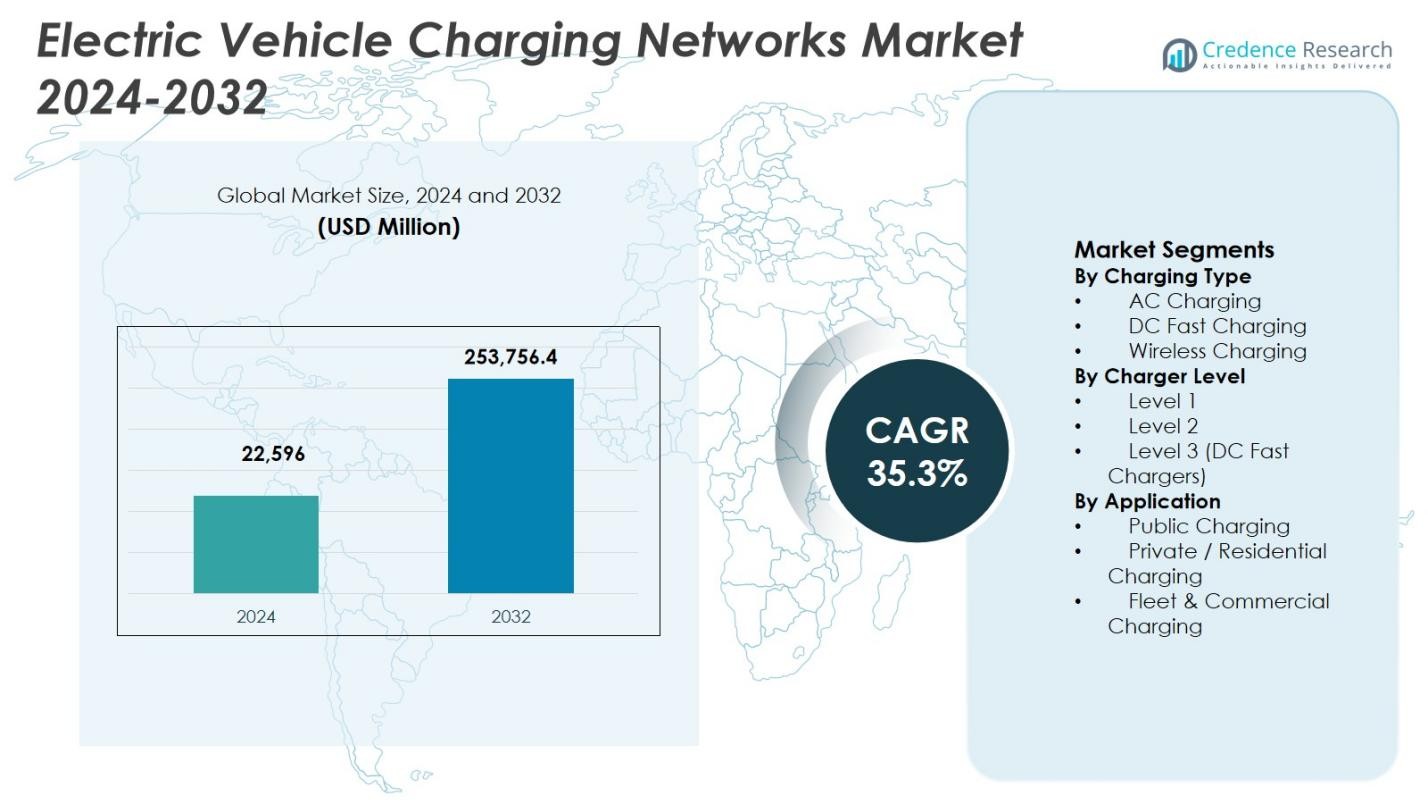

Electric Vehicle Charging Networks Market size was valued at USD 22,596 million in 2024 and is anticipated to reach USD 253,756.4 million by 2032, at a CAGR of 35.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Charging Networks Market Size 2024 |

USD 22,596 Million |

| Electric Vehicle Charging Networks Market, CAGR |

35.3% |

| Electric Vehicle Charging Networks Market Size 2032 |

USD 253,756.4 Million |

Electric Vehicle Charging Networks Market is characterized by strong participation from leading players such as Tesla, ChargePoint, EVgo, Blink Charging, ABB, Siemens, Schneider Electric, Eaton, BP Pulse, and Shell Recharge, which focus on expanding charging networks, deploying high-power DC fast chargers, and enhancing digital network management capabilities. These companies actively invest in interoperability, smart charging software, and partnerships with utilities, automakers, and commercial property owners to improve network accessibility and reliability. Regionally, North America leads the market with a 34.6% share, driven by large-scale public charging deployments and supportive federal initiatives. Europe follows with a 29.8% share, supported by stringent emission regulations and dense urban charging networks, while Asia-Pacific accounts for 27.4%, reflecting rapid EV adoption and infrastructure expansion led by China and emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Electric Vehicle Charging Networks Market was valued at USD 22,596 million in 2024 and is projected to grow at a CAGR of 35.3% through 2032, driven by rapid electrification of transport and large-scale infrastructure rollout.

- Market growth is strongly supported by rising electric vehicle adoption, government incentives, zero-emission mandates, and increasing investments from utilities and energy companies in public and fast-charging networks.

- DC Fast Charging leads the market with a 56.8% segment share, while Level 2 chargers dominate by charger level with 48.6%, supported by balanced cost, charging speed, and widespread residential and commercial deployment.

- Leading players such as Tesla, ChargePoint, ABB, Siemens, Schneider Electric, and Shell Recharge focus on network expansion, high-power charging, smart charging platforms, and partnerships to strengthen coverage and reliability.

- North America holds the largest regional share at 34.6%, followed by Europe at 29.8% and Asia-Pacific at 27.4%, reflecting strong policy support, urban charging density, and rapid EV adoption across major economies.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Charging Type:

By charging type, DC Fast Charging dominated the Electric Vehicle Charging Networks Market with a 56.8% market share in 2024, driven by rising demand for rapid charging along highways, urban hubs, and commercial corridors. DC fast chargers significantly reduce charging time, supporting long-distance travel and high vehicle utilization. Growing deployment of high-power chargers above 150 kW, expansion of ultra-fast charging stations, and strong government support for public fast-charging infrastructure reinforce this dominance. Increasing adoption of long-range battery electric vehicles further accelerates demand for DC fast charging networks.

- For instance, EVgo partnered with General Motors and Pilot Company to deploy over 200 fast charging locations across 40 states, adding 850 public DC fast charging stalls at travel centers to connect key highway corridors.

By Charger Level:

By charger level, Level 2 chargers held the largest share at 48.6% in 2024, supported by widespread installation across residential, workplace, and public locations. Level 2 chargers offer an optimal balance between charging speed, cost, and grid compatibility, making them suitable for daily charging needs. Their dominance is reinforced by strong adoption in multi-unit housing, commercial parking facilities, and retail locations. Incentive programs, standardized connectors, and compatibility with most electric vehicle models continue to drive sustained deployment of Level 2 charging infrastructure globally.

- For instance, Tesla’s Wall Connector, a Level 2 home and workplace solution, topped satisfaction rankings with a score of 776/1000 in the 2025 J.D. Power study due to its 11.5 kW output adding up to 44 miles of range per hour.

By Application:

By application, Public Charging accounted for the leading 52.4% market share in 2024, driven by expanding urban charging networks and rising EV penetration in densely populated regions. Public charging stations play a critical role in addressing range anxiety and supporting drivers without access to private parking. Government-funded infrastructure programs, partnerships with commercial property owners, and integration with smart city initiatives strengthen this segment. Increasing installation of fast and ultra-fast chargers at highways, transit hubs, and retail centers further supports the continued dominance of public charging applications.

Key Growth Drivers

Rapid Expansion of Electric Vehicle Adoption

Accelerating adoption of electric vehicles remains a primary growth driver for the Electric Vehicle Charging Networks Market. Rising fuel costs, tightening emission regulations, and expanding EV model availability continue to increase global EV sales across passenger and commercial segments. As vehicle density grows, demand for reliable, accessible, and fast charging infrastructure intensifies. Urbanization and higher daily travel requirements further amplify charging needs. Automakers’ electrification strategies and long-term phaseout plans for internal combustion engines continue to stimulate large-scale investments in charging networks.

- For instance, General Motors partnered with ChargePoint to deploy hundreds of ultra-fast charging ports at strategic U.S. locations by the end of 2025. These stations feature up to 500kW speeds and Omni Port technology for CCS and NACS compatibility, enhancing public access.

Strong Government Support and Policy Mandates

Government policies and financial incentives significantly support market expansion. National and regional authorities are investing heavily in public charging infrastructure through subsidies, tax credits, and infrastructure development programs. Mandates for EV charging installation in new residential and commercial buildings accelerate network density. Public–private partnerships further enhance deployment efficiency. Regulatory targets for carbon neutrality and zero-emission transportation continue to prioritize charging infrastructure as a critical enabler, strengthening long-term market growth.

- For instance, India’s PM E-DRIVE scheme allocates INR 2,000 crore specifically for public fast charging stations, supporting deployment from October 2024 to March 2026.

Increasing Investments from Energy and Infrastructure Companies

Growing investments by utilities, oil and gas companies, and infrastructure providers strongly drive market growth. Energy companies are expanding charging networks to diversify revenue streams and support energy transition goals. Utilities are integrating charging infrastructure with grid modernization initiatives, including smart metering and load management. Infrastructure developers increasingly deploy large-scale charging hubs along highways and logistics corridors. These investments improve network coverage, reliability, and scalability, supporting sustained market expansion.

Key Trends & Opportunities

Deployment of Ultra-Fast and High-Power Charging Stations

The market is witnessing rapid deployment of ultra-fast and high-power charging stations to reduce charging time and improve user convenience. Charging capacities above 150 kW enable quicker turnaround for passenger and commercial EVs, supporting long-distance travel and fleet operations. This trend creates opportunities for network operators to differentiate offerings and increase station utilization. High-power charging also supports emerging electric trucks and buses, expanding addressable market opportunities.

- For instance, ABB launched the Terra HP charger, capable of delivering up to 350 kW from two power cabinets or 175 kW from one, with dynamic DC power sharing to charge two vehicles simultaneously at 175 kW each.

Integration of Smart Charging and Digital Platforms

Integration of smart charging technologies represents a major opportunity in the Electric Vehicle Charging Networks Market. Digital platforms enable real-time monitoring, dynamic pricing, load balancing, and predictive maintenance. Smart charging improves grid stability by optimizing energy consumption during peak and off-peak hours. User-friendly mobile applications enhance customer experience through seamless payment and station availability tracking. These capabilities improve operational efficiency and support scalable network management.

- For instance, ChargePoint’s mobile app supports Tap to Charge for instant sessions using a phone over the station reader, alongside tracking charging history for energy used, miles added, and costs across public and home stations.

Key Challenges

High Infrastructure and Installation Costs

High upfront capital requirements pose a significant challenge for charging network expansion. Costs related to equipment, grid upgrades, land acquisition, and installation impact return on investment, particularly for fast and ultra-fast chargers. Rural and low-utilization areas face slower deployment due to economic constraints. Network operators must balance expansion with profitability while managing maintenance and upgrade expenses. These cost pressures can delay infrastructure rollout in certain regions.

Grid Capacity and Power Management Constraints

Grid capacity limitations present ongoing challenges for large-scale charging deployment. High-power chargers place significant demand on local electricity networks, requiring grid reinforcement and energy management solutions. Inadequate infrastructure can lead to load congestion and operational inefficiencies. Coordination between utilities, charging operators, and regulators remains critical. Addressing power availability, reliability, and peak-load management is essential to ensure uninterrupted charging services and long-term market sustainability.

Regional Analysis

North America

North America held a 34.6% market share in 2024 in the Electric Vehicle Charging Networks Market, driven by strong EV adoption, federal infrastructure funding, and widespread deployment of public fast-charging stations. The United States leads regional growth through large-scale highway corridor charging projects and incentives supporting residential and commercial installations. Canada contributes through national zero-emission vehicle targets and public–private charging partnerships. High penetration of Level 2 and DC fast chargers, combined with strong participation from utilities and energy companies, continues to strengthen network density and long-term regional expansion.

Europe

Europe accounted for a 29.8% market share in 2024, supported by stringent emission regulations and aggressive electrification policies across the region. Countries such as Germany, the Netherlands, France, and the Nordics maintain dense public charging networks integrated with urban mobility plans. Strong focus on renewable-powered charging infrastructure and standardized connectors enhances cross-border interoperability. Government mandates for charging installations in residential and commercial buildings further support growth. Expansion of ultra-fast charging corridors along trans-European transport networks continues to reinforce Europe’s strong market position.

Asia-Pacific

Asia-Pacific captured a 27.4% market share in 2024, driven by rapid urbanization, high EV production, and large-scale infrastructure investments. China dominates the region with extensive public charging deployment supported by government planning and utility participation. Japan and South Korea focus on fast and wireless charging innovation, while India accelerates network expansion through public incentives and fleet electrification programs. High population density and growing electric two-wheeler and passenger EV adoption significantly increase charging demand, positioning Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America held a 5.1% market share in 2024, supported by emerging EV adoption and early-stage charging infrastructure development. Countries including Brazil, Mexico, and Chile are investing in public charging networks across major urban centers and highways. Government-backed sustainability initiatives and pilot programs for electric buses and fleets drive infrastructure deployment. Private-sector participation and international partnerships further support market development. Although network density remains limited compared to mature regions, rising environmental awareness and policy support continue to strengthen long-term growth prospects.

Middle East & Africa

The Middle East & Africa region accounted for a 3.1% market share in 2024, reflecting early-stage adoption with growing momentum. Gulf countries are leading regional deployment through smart city initiatives and investments in premium public charging infrastructure. The United Arab Emirates and Saudi Arabia prioritize EV charging as part of broader energy transition strategies. In Africa, pilot projects and donor-supported programs are expanding urban charging access. Increasing focus on sustainability and diversification of transport energy sources supports gradual regional market expansion.

Market Segmentations:

By Charging Type

- AC Charging

- DC Fast Charging

- Wireless Charging

By Charger Level

- Level 1

- Level 2

- Level 3 (DC Fast Chargers)

By Application

- Public Charging

- Private / Residential Charging

- Fleet & Commercial Charging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Tesla, ChargePoint, EVgo, Blink Charging, ABB, Siemens, Schneider Electric, Eaton, Shell Recharge, and BP Pulse form the core structure of the Electric Vehicle Charging Networks Market. The market reflects strong strategic focus on network expansion, technology upgrades, and interoperability to improve charger availability and user experience. Leading players invest in high-power DC fast chargers, software-driven network management platforms, and integrated payment solutions to strengthen utilization rates. Partnerships with automakers, utilities, and commercial property owners support large-scale deployment across urban centers and highway corridors. Companies also emphasize geographic expansion, particularly in high-growth regions, through acquisitions and joint ventures. Continuous innovation in smart charging, energy management, and grid integration enables differentiation while addressing power constraints. Competitive intensity remains high as players prioritize reliability, coverage density, and scalability to secure long-term network leadership.

Key Player Analysis

- Tesla, Inc.

- ChargePoint, Inc.

- EVgo, Inc.

- Blink Charging Co.

- ABB Ltd.

- Siemens AG

- Schneider Electric

- Eaton Corporation

- BP Pulse

- Shell Recharge

Recent Developments

- In December 2025, Nayax acquired Lynkwell, an AI-enabled EV charging platform, for $25.9 million to enhance its commerce and payment solutions in EV infrastructure.

- In November 2025, JOLT agreed to acquire a significant portion of Volta Media Network from Shell, adding thousands of EV charging and digital advertising sites across the United States and accelerating its global charging network footprint.

- In August 2025, Virta acquired NORTHE Fleet Management, establishing a comprehensive EV fleet charging and energy solutions platform in Europe to broaden its service offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Charging Type, Charger Level, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric vehicle adoption across passenger, commercial, and fleet segments will continue to accelerate charging network expansion.

- Public and ultra-fast charging infrastructure will grow rapidly to support long-distance travel and high-utilization vehicles.

- Integration of smart charging, AI-based load management, and digital payment platforms will enhance network efficiency.

- Grid-connected energy storage and renewable integration will become standard features at charging sites.

- Fleet and commercial charging demand will rise with electrification of logistics, ride-hailing, and public transport.

- Interoperability and standardized charging protocols will improve user experience across regions.

- Private investment and public–private partnerships will strengthen large-scale network deployment.

- Urban charging density will increase through installations in residential complexes and workplaces.

- Wireless and automated charging technologies will gain gradual adoption in controlled environments.

- Focus on reliability, uptime, and predictive maintenance will define long-term network competitiveness.

Market Segmentation Analysis:

Market Segmentation Analysis: