Market Overview

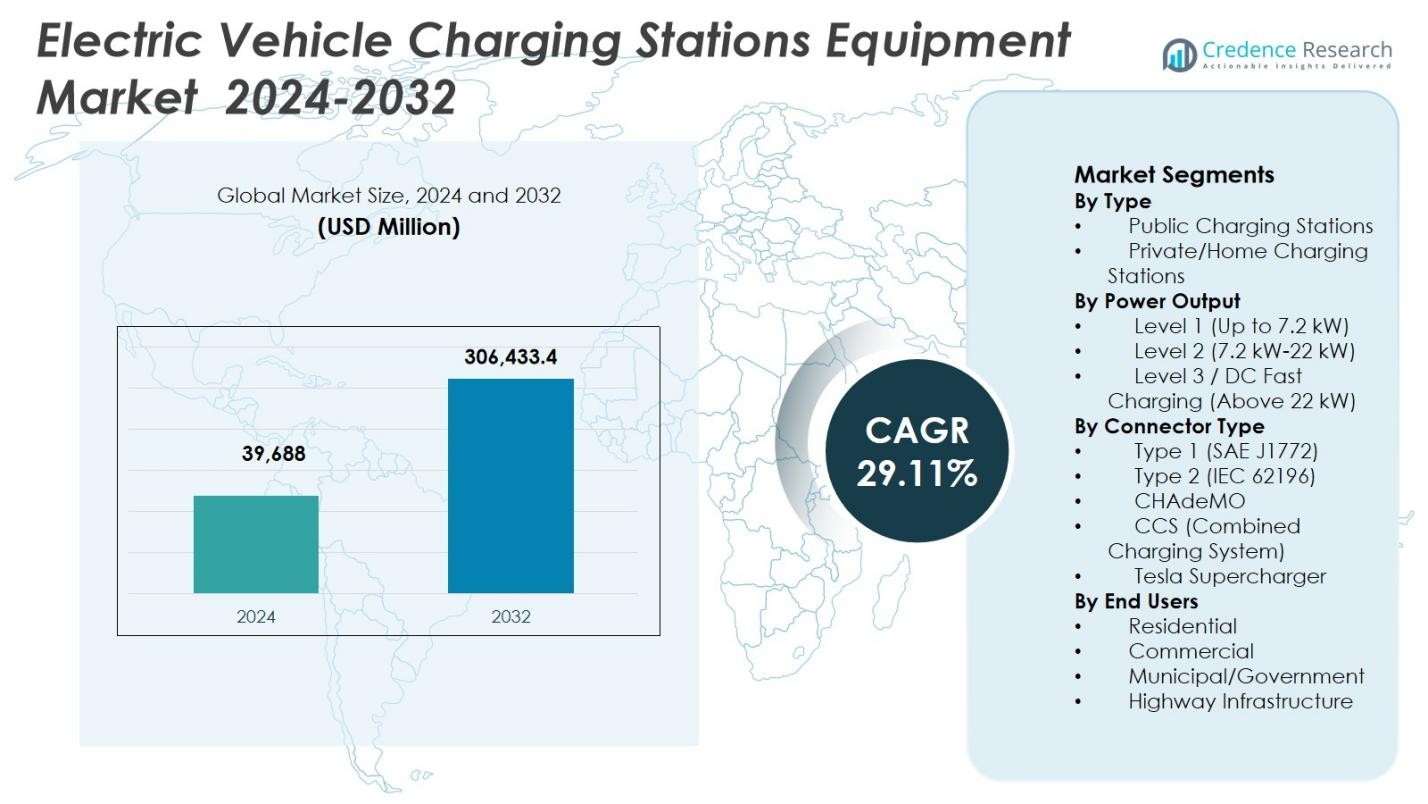

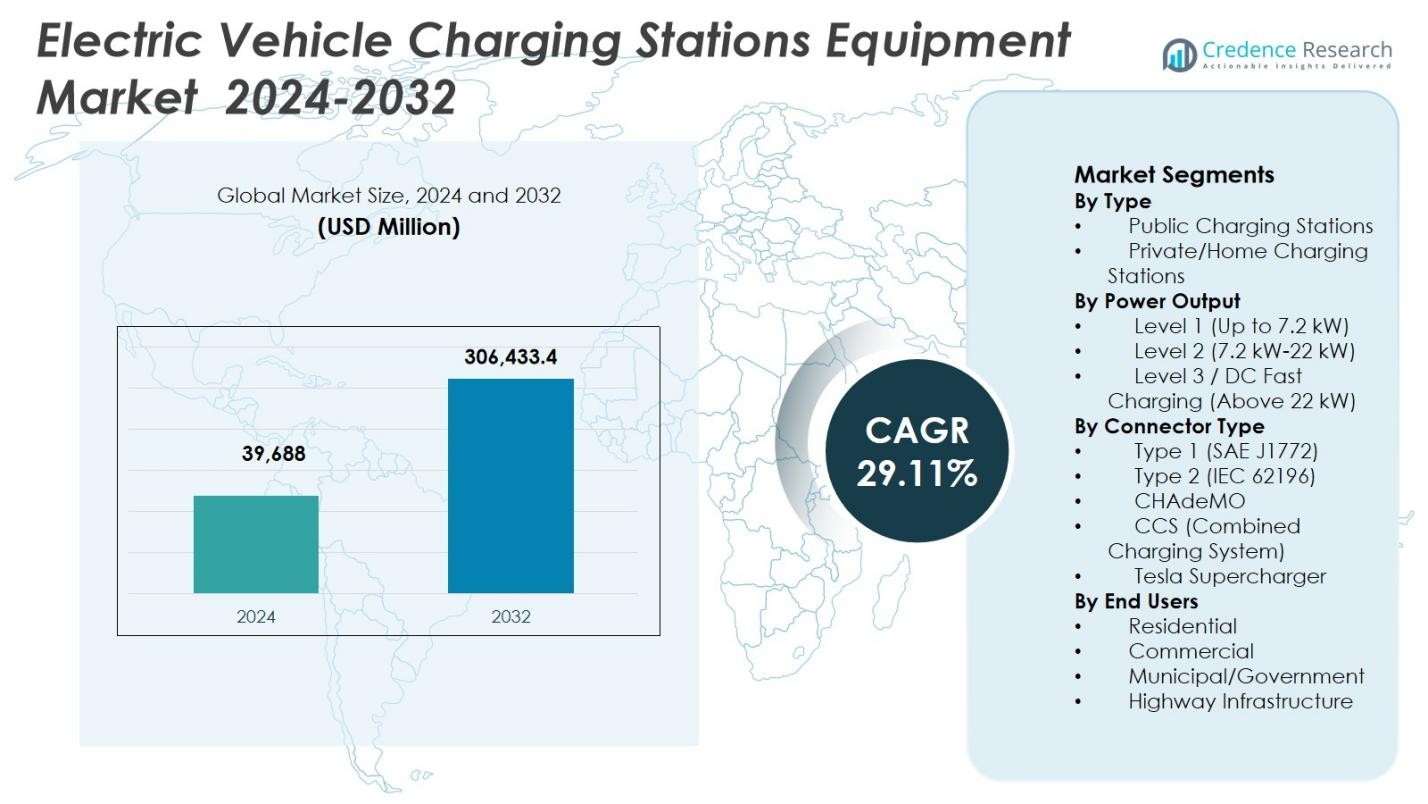

Electric Vehicle Charging Stations Equipment Market size was valued at USD 39,688 million in 2024 and is anticipated to reach USD 306,433.4 million by 2032, at a CAGR of 29.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Charging Stations Equipment Market Size 2024 |

USD 39,688 Million |

| Electric Vehicle Charging Stations Equipment Market, CAGR |

29.11% |

| Electric Vehicle Charging Stations Equipment Market Size 2032 |

USD 306,433.4 Million |

Electric Vehicle Charging Stations Equipment Market is shaped by leading players such as ABB, Siemens, Schneider Electric, ChargePoint, Tesla, Eaton, EVBox, BYD, Tritium, and Star Charge, which focus on expanding high-power charging portfolios, smart charging capabilities, and scalable equipment designs. These companies invest in DC fast charging technology, software-driven energy management, and interoperability to support public, commercial, and fleet charging requirements. Regionally, Asia-Pacific leads the Electric Vehicle Charging Stations Equipment Market with a 34.8% market share, supported by extensive infrastructure deployment and strong EV adoption in China, Japan, and South Korea. North America follows with a 32.6% share, driven by highway fast-charging expansion and fleet electrification, while Europe holds a 29.4% share, supported by regulatory mandates and cross-border charging networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Electric Vehicle Charging Stations Equipment Market was valued at USD 39,688 million in 2024 and is projected to grow at a CAGR of 29.11% through 2032, supported by rapid expansion of global charging infrastructure and accelerating electric vehicle penetration.

- Rising electric vehicle adoption, supportive government incentives, public–private partnerships, and large-scale investments in highway and urban charging networks are key drivers strengthening demand for advanced charging station equipment.

- The market is witnessing strong trends toward DC fast charging, smart charging systems, software-enabled energy management, and integration of renewable energy and storage solutions to enhance efficiency and grid stability.

- Leading players focus on high-power chargers, modular designs, and interoperability standards, while Public Charging Stations dominate with a 64.3% segment share and Level 3/DC fast charging leads with 48.6% share, reflecting demand for rapid charging.

- Regionally, Asia-Pacific leads with a 34.8% market share, followed by North America at 32.6% and Europe at 29.4%, while Latin America and the Middle East & Africa show gradual but steady infrastructure development.

Market Segmentation Analysis:

By Type:

By type, the Public Charging Stations segment dominated the Electric Vehicle Charging Stations Equipment Market with a 64.3% market share in 2024. This leadership is driven by rapid expansion of public charging infrastructure across highways, urban centers, and commercial locations to support rising EV adoption. Government funding programs, utility-led deployments, and partnerships between automakers and charging network operators strongly support this segment. Public chargers address range anxiety and enable long-distance travel, making them essential for mass-market EV penetration. In contrast, private and home charging stations remain secondary due to space constraints and lower installation scalability.

- For instance, General Motors partnered with ChargePoint to deploy up to 500 ultra-fast charging ports across the U.S., branded under GM Energy. Many sites feature ChargePoint’s Omni Port system for seamless CCS and NACS compatibility, plus Express Plus chargers reaching 500kW speeds. Locations open to the public by end of 2025.

By Power Output:

By power output, Level 3 / DC Fast Charging (Above 22 kW) held the largest share of the Electric Vehicle Charging Stations Equipment Market at 48.6% in 2024. This dominance is supported by strong demand for rapid charging solutions in public corridors, fleet depots, and commercial hubs. DC fast chargers significantly reduce charging time, improving vehicle utilization and user convenience. Increasing deployment along highways, growing adoption by ride-hailing and logistics fleets, and advancements in high-power charging technology continue to accelerate growth, positioning this segment as the backbone of fast-expanding EV infrastructure.

- For instance, EVgo and Toyota launched co-branded DC fast charging stations featuring 350 kW chargers in Baldwin Park and Sacramento, California, in March 2025. Each site serves up to eight vehicles simultaneously near amenities like stores and restaurants.

By Connector Type:

By connector type, CCS (Combined Charging System) accounted for the leading 41.8% market share in 2024 within the Electric Vehicle Charging Stations Equipment Market. Its dominance is driven by broad adoption across Europe and North America, compatibility with both AC and DC charging, and strong support from major automakers. CCS enables higher power delivery and faster charging, aligning well with next-generation EV platforms. Regulatory standardization efforts and interoperability requirements further strengthen CCS adoption, while expanding fast-charging networks reinforce its role as the preferred connector for public and high-power charging applications.

Key Growth Drivers

Rapid Expansion of Electric Vehicle Adoption

Rapid growth in electric vehicle adoption remains a primary driver of the Electric Vehicle Charging Stations Equipment Market. Rising sales of passenger EVs, commercial electric fleets, and electric buses are directly increasing demand for reliable and scalable charging infrastructure. Automaker electrification strategies, declining battery costs, and expanding model availability across price segments are accelerating market penetration. As EV ownership rises across urban and semi-urban regions, governments and private operators continue to invest in charging station equipment to ensure accessibility, reduce range anxiety, and support sustained electrification momentum.

- For instance, BYD delivered 10 K9S battery-electric buses to Link Transit in Washington, each with up to 215 miles range and wireless charging for extended routes. These 35-foot buses, fitted with Momentum Dynamics receivers, enable perpetual on-route usage.

Strong Government Policies and Infrastructure Investments

Supportive government policies and large-scale infrastructure investments significantly drive the Electric Vehicle Charging Stations Equipment Market. National and regional programs promote public charging deployment through subsidies, tax incentives, and public-private partnerships. Regulatory mandates encouraging zero-emission transportation and carbon reduction targets further accelerate charging infrastructure expansion. Utility involvement and grid modernization initiatives also support equipment deployment. These policy frameworks reduce financial barriers for operators, stimulate private investment, and enable rapid rollout of charging stations across highways, commercial hubs, and residential developments.

- For instance, ChargePoint, through partners, secured over $19 million from California’s NEVI program allocation to deploy 248 DC fast charging ports at 45 highway sites. This supports reliable fast charging along key routes like I-5, addressing congestion in high-traffic areas.

Technological Advancements in Charging Equipment

Continuous technological innovation strongly supports growth in the Electric Vehicle Charging Stations Equipment Market. Advancements in high-power DC fast charging, smart charging systems, and energy management software improve charging efficiency and user experience. Integration of IoT, remote monitoring, and load balancing enhances operational reliability and grid compatibility. Improved power electronics, cooling systems, and modular designs reduce downtime and maintenance costs. These innovations enable higher utilization rates and support scalable infrastructure deployment, encouraging widespread adoption by commercial operators and fleet managers.

Key Trends & Opportunities

Growth of Ultra-Fast and High-Power Charging Networks

The expansion of ultra-fast and high-power charging networks represents a major trend and opportunity in the Electric Vehicle Charging Stations Equipment Market. Increasing deployment of chargers above 150 kW supports long-distance travel and commercial fleet operations. Automakers and charging providers are aligning vehicle architectures with high-power charging standards, driving demand for advanced equipment. This trend creates opportunities for manufacturers to develop next-generation fast chargers, cooling technologies, and grid-integrated solutions that address growing expectations for rapid and convenient charging.

- For instance, Servotech Renewable is installing 10 units of 240 kW DC EV chargers at Kempegowda International Airport in Bengaluru for airside operations, forming a 2.4 MW hub for electric buses between terminals. This setup enhances 24/7 efficiency and reduces emissions.

Integration of Renewable Energy and Smart Grid Solutions

Integration of renewable energy and smart grid technologies is emerging as a key opportunity in the Electric Vehicle Charging Stations Equipment Market. Charging stations increasingly incorporate solar power, energy storage systems, and intelligent energy management to reduce grid strain and operating costs. Smart charging enables demand response, peak load management, and dynamic pricing models. These capabilities enhance sustainability, improve grid resilience, and support large-scale EV adoption, creating new revenue opportunities for equipment providers offering integrated and energy-efficient charging solutions.

- For instance, AlphaESS EV Charger integrates with SMILE-G3 energy storage systems, offering 7 kW single-phase and 11 kW three-phase models with automatic mode switching to maximize PV usage.

Key Challenges

High Installation and Infrastructure Costs

High installation and infrastructure costs present a major challenge for the Electric Vehicle Charging Stations Equipment Market. Deployment of fast and ultra-fast chargers requires significant capital investment in equipment, grid upgrades, transformers, and civil works. Land acquisition, permitting processes, and utility connection delays further increase project costs. These financial barriers can slow infrastructure rollout, particularly in developing regions and low-traffic areas, limiting charging network density and affecting the pace of market expansion.

Grid Capacity Constraints and Interoperability Issues

Grid capacity constraints and interoperability challenges continue to impact the Electric Vehicle Charging Stations Equipment Market. High-power charging stations place substantial load on local grids, requiring upgrades to ensure stable power supply. Inconsistent charging standards, connector compatibility issues, and fragmented software platforms create complexity for operators and users. Addressing these challenges requires coordinated efforts among utilities, equipment manufacturers, and regulators to improve grid readiness, standardization, and seamless user experience across charging networks.

Regional Analysis

North America

North America accounted for a 32.6% market share in 2024 in the Electric Vehicle Charging Stations Equipment Market, driven by strong EV adoption across the United States and Canada. Federal and state-level incentives supporting EV infrastructure, along with large-scale investments in public and highway fast-charging networks, continue to accelerate equipment demand. Automaker-led charging alliances, expanding commercial fleet electrification, and rising installation of DC fast chargers strengthen regional growth. Advanced grid infrastructure and early adoption of smart charging technologies further support deployment, positioning North America as a mature and technology-driven market.

Europe

Europe held a 29.4% market share in 2024 in the Electric Vehicle Charging Stations Equipment Market, supported by aggressive emission reduction targets and strong regulatory mandates. Countries such as Germany, the Netherlands, France, and the Nordic region lead in public charging density and cross-border charging networks. EU-backed funding programs and harmonized charging standards accelerate infrastructure rollout. High penetration of Type 2 and CCS connectors, combined with growing demand for high-power charging along highways and urban corridors, continues to drive equipment installations across residential, commercial, and public applications.

Asia-Pacific

Asia-Pacific dominated with a 34.8% market share in 2024 in the Electric Vehicle Charging Stations Equipment Market, supported by rapid EV adoption in China, Japan, South Korea, and emerging Southeast Asian economies. China remains the largest contributor due to extensive government-backed charging infrastructure programs and strong domestic manufacturing of charging equipment. Urbanization, rising electric two-wheeler and passenger EV sales, and large-scale public charging deployments drive demand. Expansion of DC fast charging and increasing integration of smart grid solutions further reinforce Asia-Pacific’s leadership in volume-driven growth.

Latin America

Latin America accounted for a 2.1% market share in 2024 in the Electric Vehicle Charging Stations Equipment Market, reflecting an emerging but steadily developing landscape. Countries such as Brazil, Mexico, and Chile are investing in public charging infrastructure supported by clean mobility initiatives and pilot EV programs. Growing urban EV adoption, fleet electrification in public transport, and gradual policy support are stimulating equipment demand. While infrastructure density remains limited, increasing private-sector participation and regional sustainability goals are expected to support consistent expansion of charging station equipment deployment.

Middle East & Africa

The Middle East & Africa region captured a 1.1% market share in 2024 in the Electric Vehicle Charging Stations Equipment Market. Growth is driven by early-stage EV adoption, government-led sustainability strategies, and smart city initiatives in countries such as the UAE and Saudi Arabia. Investments focus on public and commercial charging installations in urban centers and premium developments. Limited grid infrastructure and lower EV penetration constrain rapid expansion, but rising awareness of clean mobility and long-term diversification plans continue to create opportunities for gradual market development.

Market Segmentations:

By Type

- Public Charging Stations

- Private/Home Charging Stations

By Power Output

- Level 1 (Up to 7.2 kW)

- Level 2 (7.2 kW-22 kW)

- Level 3 / DC Fast Charging (Above 22 kW)

By Connector Type

- Type 1 (SAE J1772)

- Type 2 (IEC 62196)

- CHAdeMO

- CCS (Combined Charging System)

- Tesla Supercharger

By End Users

- Residential

- Commercial

- Municipal/Government

- Highway Infrastructure

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Electric Vehicle Charging Stations Equipment Market includes key players such as ABB, Siemens, Schneider Electric, ChargePoint, Tesla, Eaton, EVBox, BYD, Tritium, and Star Charge. The market is characterized by strong focus on expanding DC fast charging portfolios, enhancing power efficiency, and integrating smart charging and energy management capabilities. Leading companies prioritize modular and scalable charger designs to address diverse public, commercial, and fleet requirements. Strategic partnerships with automakers, utilities, and governments support network expansion and accelerate infrastructure deployment. Continuous investments in high-power charging technology, interoperability standards, and software-driven platforms strengthen market positioning. Manufacturers also emphasize regional expansion, localized manufacturing, and compliance with evolving charging standards to enhance competitiveness and address growing demand across mature and emerging electric vehicle markets.

Key Player Analysis

Recent Developments

- In December 2025, Nayax acquired Lynkwell, an AI-enabled EV charging platform, for $25.9 million to enhance its software and payment solutions in the EV ecosystem.

- In May 2025, Eaton and ChargePoint announced a partnership to integrate EV charging solutions with power infrastructure, advancing bidirectional power flow and V2X capabilities across the U.S., Canada, and Europe.

- In April 2025, ChargePoint unveiled a new AC Level 2 charging architecture featuring bidirectional charging and speeds up to double typical rates, targeting commercial, residential, and fleet use in North America and Europe.

- In January 2025, SOLUM introduced next-generation 50kW liquid-cooled bidirectional EV charger power modules at CES 2025, aimed at improving grid stability and reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Power Output, Connector Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electric Vehicle Charging Stations Equipment Market will witness sustained expansion driven by accelerating global electric vehicle adoption across passenger and commercial segments.

- Deployment of high-power and ultra-fast charging equipment will increase to support long-distance travel and fleet electrification needs.

- Public charging infrastructure will continue to expand rapidly across highways, urban centers, and commercial locations to reduce range anxiety.

- Smart charging technologies integrating software, connectivity, and energy management will become standard across new installations.

- Grid-integrated charging solutions with load balancing and demand response capabilities will gain stronger adoption.

- Standardization of connectors and interoperability protocols will improve user experience and network efficiency.

- Integration of renewable energy sources and energy storage systems will strengthen sustainability and grid resilience.

- Private investment and public-private partnerships will play a growing role in accelerating infrastructure deployment.

- Emerging markets will experience faster infrastructure development supported by government electrification policies.

- Continuous innovation in power electronics and charger design will improve reliability, scalability, and operational efficiency.