| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Theodolite Market Size 2024 |

USD 346.94 million |

| Theodolite Market, CAGR |

5.81% |

| Theodolite Market Size 2032 |

USD 542.07 million |

Market Overview:

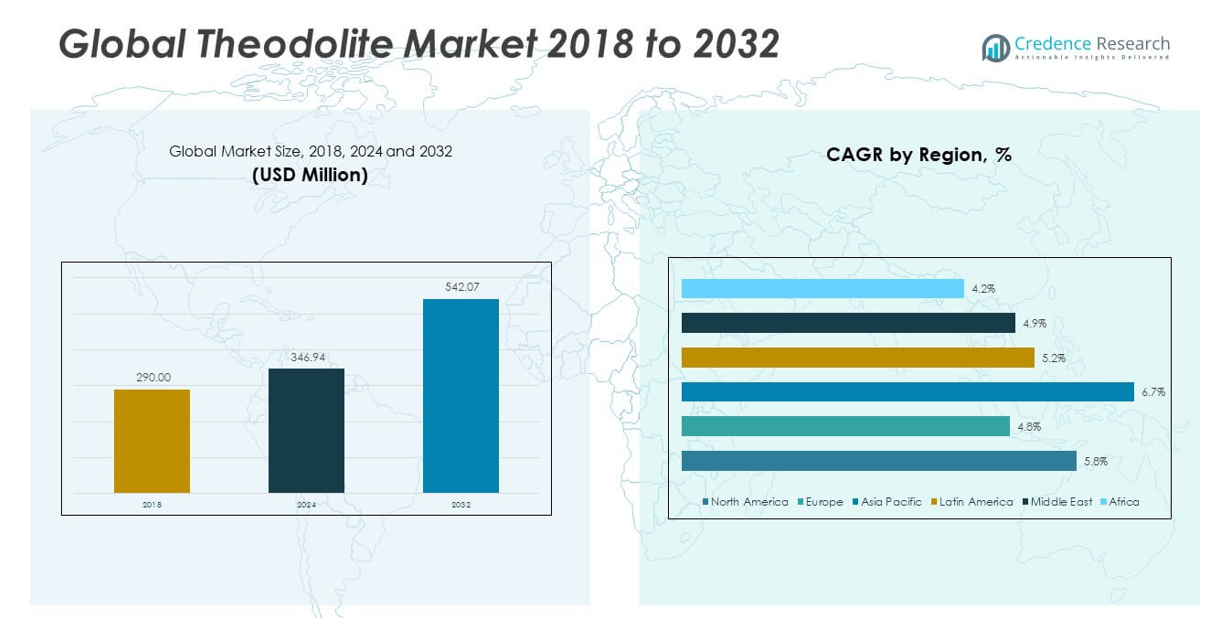

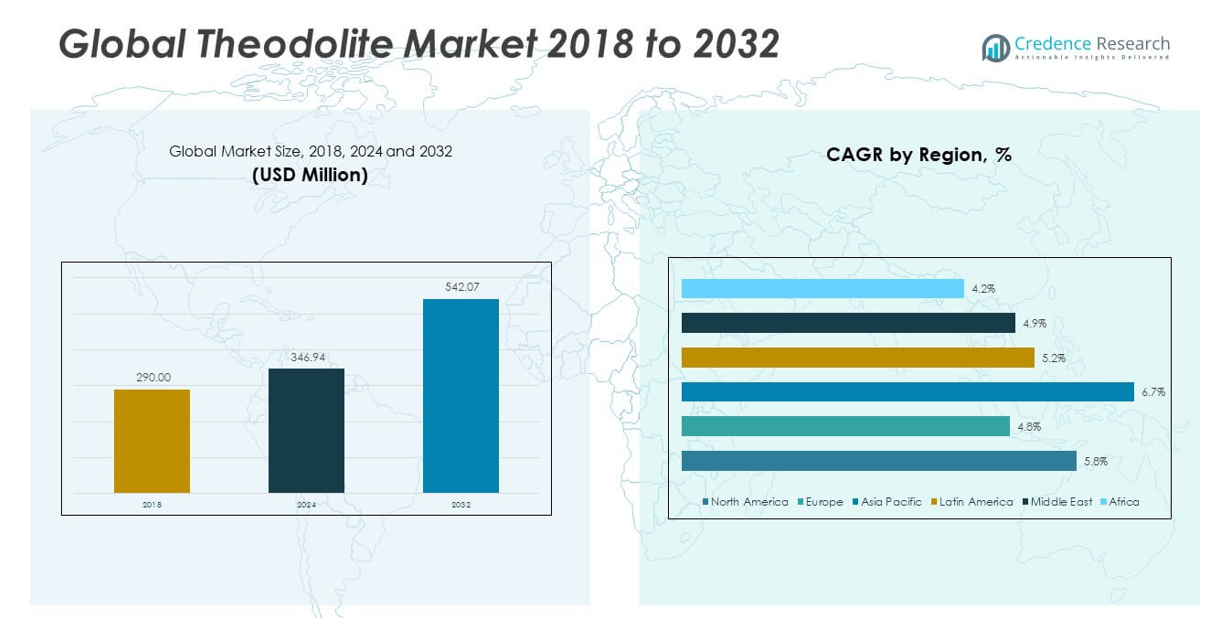

The Global Theodolite Market size was valued at USD 290.00 million in 2018 to USD 346.94 million in 2024 and is anticipated to reach USD 542.07 million by 2032, at a CAGR of 5.81% during the forecast period.

The Global Theodolite Market is primarily fueled by the growing volume of infrastructure development activities worldwide, including smart city projects, transportation networks, and renewable energy installations. The need for high-precision instruments in geodetic and cadastral surveying tasks contributes to sustained demand. Construction companies, civil engineers, and land surveyors are increasingly relying on digital and electronic theodolites for their high efficiency, fast measurement capabilities, and integration with geographic information systems (GIS). The market is also influenced by technological innovations such as automated data logging, Bluetooth connectivity, and enhanced angular resolution. These advancements improve user productivity while minimizing manual errors. Moreover, government initiatives for modernizing public infrastructure and expanding urban footprints further boost market prospects. The integration of theodolites into automated surveying systems and their use in unmanned aerial vehicles (UAVs) for topographic data capture are emerging trends expanding application scope.

Regionally, Asia Pacific dominates the global theodolite market, accounting for the largest revenue share in 2024. The region benefits from large-scale infrastructure programs in countries such as China, India, Japan, and South Korea. China’s Belt and Road Initiative and India’s Smart Cities Mission are key projects driving demand for geospatial instruments. In North America, strong adoption is observed across construction and transportation sectors, particularly in the United States where technological integration and automation are prevalent in surveying practices. Europe maintains a significant market share owing to strict compliance standards for land development and the presence of established engineering firms. Countries like Germany, France, and the UK are leading users of advanced surveying tools. The Middle East is emerging as a promising region, supported by large-scale urban developments and smart city investments in the Gulf Cooperation Council (GCC) countries. Latin America and Africa are also witnessing gradual adoption, primarily driven by investments in mining, road development, and agricultural modernization. The global expansion of the construction sector and the need for efficient land management across all regions will continue to support the growth of the theodolite market over the coming years.

Market Insights:

- The Global Theodolite Market has strong growth opportunities through integration with technologies such as drones, GNSS, LiDAR, and cloud-based platforms, enabling real-time data collection and seamless collaboration across surveying applications.

- It can capitalize on rising demand for smart infrastructure monitoring by offering products that support automation, wireless connectivity, and compatibility with GIS and BIM systems used in large-scale construction and civil planning projects.

- Surveying firms increasingly seek advanced theodolites with remote access, data logging, and high-precision capabilities, creating space for product innovation and differentiation in competitive markets.

- There is untapped potential in developing regions such as Southeast Asia, Africa, and Latin America, where infrastructure development, land reforms, and rural electrification projects are gaining momentum.

- Niche applications in fields such as archaeology, environmental monitoring, and coastal surveying offer new revenue streams for companies that deliver compact, rugged, and field-ready solutions.

- Cost-effective, user-friendly theodolites can appeal to governments, SMEs, and academic institutions in emerging economies that face skill and budget limitations.

- Strategic alliances with regional distributors and public sector agencies can accelerate market penetration in underdeveloped areas and strengthen brand presence in localized markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expanding Infrastructure Projects Worldwide Fuel Market Growth:

The Global Theodolite Market continues to benefit from the unprecedented rise in infrastructure development projects across both developed and emerging markets. Governments are aggressively pursuing large-scale projects including highways, railways, dams, ports, and bridges, which require precise ground measurements and layout markings. Theodolites, known for their ability to deliver highly accurate angular readings, are widely deployed in initial surveying and site preparation activities. These devices help ensure alignment and accuracy in construction, reducing rework and delays.

- For instance, Topcon’s DT-309 digital theodolite is a precision instrument used in large-scale infrastructure projects. This theodolite provides a verified angular accuracy of 9 seconds, supported by advanced optics with 26x magnification and features such as an optical plummet and tilt sensor with ±3-minute angle correction.

Growing Emphasis on Precision in Engineering and Surveying Applications:

Surveyors and engineers are increasingly relying on advanced surveying tools to meet the rising standards in modern construction and civil planning. Theodolites provide dependable results in topographic surveys, boundary assessments, and elevation mapping. As urban environments become denser and more regulated, the need for precise land demarcation and angle measurement grows stronger. This need drives consistent demand for reliable and easy-to-operate theodolite systems.

- For instance, Leica Geosystems’ TS16 total station—theodolitic surveying instrument—offers automated angle measurement with precision up to 1″ and was utilized in the Crossrail project in London to map underground alignments with accuracy within 2 millimeters.

Technological Advancement in Digital and Robotic Theodolites:

Theodolites have evolved significantly with the integration of digital features, laser plummets, internal data logging, and wireless connectivity. These innovations simplify field operations, improve data accuracy, and reduce human error. Digital displays, automatic horizontal and vertical readings, and compatibility with CAD and GIS platforms enhance productivity. The Global Theodolite Market is gaining traction from construction companies and surveyors shifting towards digital transformation in their operational processes.

Strategic Government Investment in Smart Cities and Defense Infrastructure:

Government-led initiatives such as smart city programs, industrial corridors, and national defense infrastructure development are creating sustained demand for high-performance theodolites. These instruments are vital for establishing project baselines, boundary layouts, and vertical assessments in complex urban and defense environments. The Global Theodolite Market benefits from budget allocations in sectors including border security, urban development, and transportation networks where theodolites are essential for layout accuracy.

Market Trends:

Integration of GIS and GNSS Elevates Theodolite Utility:

The Global Theodolite Market is seeing increased convergence between theodolites and geospatial technologies like GNSS (Global Navigation Satellite Systems) and GIS (Geographic Information Systems). The integration improves positional accuracy, expands the scope of field applications, and enables real-time data access and synchronization. Surveyors are using these tools in larger, more complex projects involving multiple stakeholders, ensuring high accuracy and seamless data transfer.

- For instance, Trimble’s S7 Total Station integrates GNSS, robotic theodolite functions, and 3D scanning, enabling surveyors for the California High-Speed Rail project to achieve positioning accuracy better than 5 millimeters, with automated geospatial data capture and real-time cloud transmission.

Cloud-Based Data Sharing and Workflow Optimization:

Surveying professionals and construction managers are adopting cloud-based data storage and project management systems. Theodolites equipped with wireless capabilities and mobile app compatibility allow real-time upload of measurement data to centralized databases. This trend helps enhance transparency, minimize duplication of efforts, and promote collaboration across dispersed teams. It reduces the reliance on paper documentation and improves project efficiency.

- For instance, Sokkia iX series robotic total stations enable real-time data transmission and project collaboration. The iX-1200 model offers angular accuracy as precise as 1”, 10 Hz update rates for efficient stacking, and is 30% smaller and lighter than older models.

Focus on Ergonomic, Compact, and Modular Equipment Design:

Manufacturers in the Global Theodolite Market are focusing on developing compact, modular, and lightweight designs that cater to users in rugged terrains and remote locations. Instruments are being designed with intuitive user interfaces, long battery life, and rugged casings. The trend toward portability and usability is making theodolites more accessible to independent surveyors and field workers in developing markets.

Rise in Equipment Leasing and Rental Business Models:

A growing number of contractors and engineering firms are opting to lease or rent surveying equipment to minimize capital expenditure. This trend is particularly pronounced in cost-sensitive economies and project-based operations. Leasing companies are building strategic partnerships with manufacturers to offer advanced theodolite models on short-term or subscription-based terms. This model allows smaller firms to access modern tools without incurring heavy upfront costs.

Market Challenges Analysis:

High Capital Cost and Technical Training Requirements:

Despite technological advancements, theodolites—particularly digital and robotic models—carry high upfront costs. Budget-conscious SMEs and government departments in developing regions often face difficulty justifying the investment. In addition to procurement costs, training personnel to effectively operate and maintain these devices remains a key hurdle, especially in areas lacking technical institutions and support infrastructure. Limited access to after-sales service and calibration facilities further discourages adoption. The lack of multilingual technical manuals and region-specific training programs adds complexity for non-English-speaking users. These barriers can delay implementation timelines and reduce operational efficiency in resource-constrained environments.

Growing Competition from Integrated Surveying Technologies:

The Global Theodolite Market faces strong competition from total stations, laser scanners, and drone-based surveying systems. These alternatives provide a broader set of functionalities, such as simultaneous distance and angle measurements, 3D mapping, and automated data processing. Their ability to combine functions that traditionally required multiple devices puts downward pressure on standalone theodolite demand. Many contractors and engineering firms prefer multi-purpose systems to streamline operations and reduce equipment loads. Faster data acquisition and visualization capabilities offered by integrated technologies appeal to time-sensitive projects. Continuous innovation in these competing tools limits the adoption of conventional theodolite systems in advanced surveying applications.

Market Opportunities:

Technology Integration Unlocks Advanced Application Potential:

The Global Theodolite Market can unlock significant growth by aligning with digital transformation trends in the construction and geospatial sectors. It stands to benefit from the increasing adoption of automation, real-time data integration, and remote surveying solutions. Theodolites with built-in connectivity to cloud platforms, GIS software, and mobile applications will meet rising demand for precision and operational efficiency. Industry players have the opportunity to develop compact, battery-efficient, and smart-enabled devices that cater to evolving field requirements. Companies that offer seamless integration with drones, GNSS receivers, and LiDAR systems can serve high-value applications such as terrain mapping and infrastructure inspection. Expanding digital infrastructure and smart city programs globally will further elevate the role of advanced theodolite systems.

Emerging Economies Offer Untapped Commercial Opportunities:

The Global Theodolite Market also holds strong potential in emerging economies where infrastructure modernization is accelerating. Governments in Latin America, Southeast Asia, and Africa are increasing public investment in road construction, urban planning, and rural development, creating demand for accessible and durable surveying instruments. It can address regional gaps by offering cost-effective and easy-to-use products tailored for resource-limited environments. Opportunities exist in agriculture, mining, and renewable energy projects that require accurate land assessment and boundary demarcation. Market participants that collaborate with local agencies and build distribution partnerships can strengthen their footprint. Broadening product portfolios to serve specialized use cases will support long-term competitiveness.

Market Segmentation Analysis:

By Product

The Global Theodolite Market is segmented into optical theodolites, electronic theodolites, and vernier theodolites. Electronic theodolites dominate the segment due to their enhanced accuracy, digital readouts, and seamless integration with geospatial technologies. They are widely adopted in professional surveying applications requiring precision and efficiency. Optical theodolites continue to find use in regions where affordability and simplicity take precedence over advanced functionality. Vernier theodolites represent the most traditional form, often used in training environments or low-intensity field tasks. While their market share is limited, they remain relevant in educational and small-scale surveying applications.

- For instance, South Surveying & Mapping Technology’s ET-02A offers digital readout accuracy of 2” with advanced absolute encoding, dual-side LCDs, and fast, reliable field measurements.

By End-use Industry

The Global Theodolite Market serves a wide range of industries including construction, transportation, oil & gas, mining, agriculture, and others. Construction is the leading end-use segment, driven by increasing global demand for accurate site planning and infrastructure development. Transportation follows, supported by investments in rail, road, and bridge projects requiring precise land alignment. The oil & gas and mining sectors use theodolites for site surveying, equipment placement, and terrain evaluation. Agriculture is emerging as a promising application area, especially in land mapping and irrigation system layout. Other segments include utilities and environmental studies, where accurate land measurement supports operational and compliance requirements.

- For instance, Construction, Transportation, Oil & Gas, Mining, and Agriculture utilize high-precision total stations and theodolites for critical applications. For example, the Leica Viva TS15 offers angle measurements of 1”, 2”, 3”, and 5” with distance measurement accuracy of 1 mm + 1.5 ppm (prism) and modern grid scanning functions, supporting demanding environments like oil field development and complex land layouts.

Segmentation:

By Product

- Optical Theodolite

- Electronic Theodolite

- Vernier Theodolite

By End-use Industry

- Construction

- Transportation

- Oil & Gas

- Mining

- Agriculture

- Others

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Theodolite Market size was valued at USD 64.73 million in 2018 to USD 75.91 million in 2024 and is anticipated to reach USD 118.33 million by 2032, at a CAGR of 5.8% during the forecast period. The Global Theodolite Market in North America is fueled by the adoption of digital surveying instruments in construction, transportation, and defense infrastructure. The U.S. dominates regional revenue due to extensive infrastructure upgrades and use of automated land measurement tools. High levels of R&D investment and a skilled technical workforce support technological innovation and drive demand for high-precision instruments.

Europe

The Europe Theodolite Market size was valued at USD 59.31 million in 2018 to USD 67.40 million in 2024 and is anticipated to reach USD 97.71 million by 2032, at a CAGR of 4.8%. The Global Theodolite Market in Europe is supported by strong regulatory standards, urban restoration projects, and cross-border transportation infrastructure development. Countries such as Germany, France, and the UK have maintained steady demand for theodolites, particularly electronic variants, in construction and industrial layout applications. The focus on energy efficiency and modular urban planning is encouraging adoption of digital surveying tools.

Asia Pacific

The Asia Pacific Theodolite Market size was valued at USD 112.29 million in 2018 to USD 138.10 million in 2024 and is anticipated to reach USD 230.11 million by 2032, at a CAGR of 6.7%. The region dominates the Global Theodolite Market due to rapid urbanization, smart city initiatives, and massive public infrastructure spending in China and India. Local governments are increasing budgets for road, rail, and commercial development, which boosts demand for advanced surveying instruments. Competitive pricing from regional manufacturers is also encouraging widespread adoption of digital theodolites.

Latin America

The Latin America Theodolite Market size was valued at USD 28.19 million in 2018 to USD 33.51 million in 2024 and is anticipated to reach USD 49.91 million by 2032, at a CAGR of 5.2%. The Global Theodolite Market in Latin America is supported by ongoing residential construction, mining, and transportation initiatives. Brazil and Mexico lead market demand due to increased investment in public infrastructure and expansion of private construction projects. Regional uptake of electronic surveying tools is growing steadily, though constrained by budget and skill gaps.

Middle East

The Middle East Theodolite Market size was valued at USD 15.75 million in 2018 to USD 18.00 million in 2024 and is anticipated to reach USD 26.24 million by 2032, at a CAGR of 4.9%. The Global Theodolite Market in this region benefits from large-scale infrastructure development in UAE, Saudi Arabia, and Qatar. Construction of airports, commercial hubs, and energy projects are key drivers. The region is gradually shifting from manual to digital surveying techniques, creating demand for advanced theodolite systems.

Africa

The Africa Theodolite Market size was valued at USD 9.74 million in 2018 to USD 14.02 million in 2024 and is anticipated to reach USD 19.77 million by 2032, at a CAGR of 4.2%. The Global Theodolite Market in Africa is emerging as governments increase spending on basic infrastructure and land development. Countries like South Africa, Nigeria, and Kenya are witnessing rising adoption of surveying tools for land reform, road building, and rural electrification. Growth remains steady but dependent on foreign aid, investment, and equipment affordability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Changzhou Dadi Surveying Science & Technology Co., Ltd.

- eSurvey GNSS

- Geo-Fennel GmbH

- GeoMax AG

- Gottlieb Nestle GmbH

- Hi-Target Surveying Instrument Co., Ltd.

- Leica Geosystems AG

- Metrica S.p.A.

- NEDO GmbH

- Nikon-Trimble Co., Ltd.

- Pentax Precision Co., Ltd.

- PREXISO AG

- SatLab Geosolutions AB

- Sokkia Co., Ltd.

- South Surveying & Mapping Instrument Co., Ltd.

- Spectra Precision

- Suzhou FOIF Co., Ltd.

- Theis Feinwerktechnik GmbH

- Tianjin Xing Ou Surveying Instrument Manufacture Co., Ltd.

- Topcon Corporation

Competitive Analysis:

The Global Theodolite Market features a moderately fragmented competitive landscape, with several multinational and regional players competing on product quality, innovation, and pricing. Established brands such as Leica Geosystems, Topcon Corporation, Nikon-Trimble, and Sokkia dominate through broad product portfolios, strong distribution networks, and robust after-sales services. These companies invest heavily in R&D to integrate AI, automation, and GNSS features into their offerings. Mid-tier and emerging players, especially from Asia, are gaining ground by offering cost-effective digital theodolites targeted at price-sensitive markets.

Recent Developments:

- In May 2025, Leica Geosystems AG, a Hexagon subsidiary, strengthened its reality capture technology offering by acquiring Scasa, the developer of PinPoint 3D modeling software. This acquisition integrated PinPoint with Leica’s BLK360 SE Essentials solution, facilitating seamless workflows for point cloud processing, 3D modeling, and construction layout applications.

- In May 2025, GeoMax AG introduced the Zenith06 Pro GNSS smart antenna, equipped with tilt compensation to improve field productivity. The new product is targeted at professional surveyors and was rolled out alongside software packages enhancing user experience and data accuracy.

Market Concentration & Characteristics:

The Global Theodolite Market is moderately concentrated, with a mix of established international players and regional manufacturers competing on product innovation, accuracy, and pricing. It features strong brand loyalty among professional users who prioritize precision and durability. The market is characterized by steady demand from construction, infrastructure, and surveying industries, with electronic and digital models gaining traction. It remains driven by long product life cycles and high capital investments, making replacement cycles relatively slow. Companies differentiate through integration of advanced technologies such as wireless connectivity, data logging, and compatibility with GIS platforms. It continues to evolve with the growing need for automated and remote surveying solutions.

Report Coverage:

The research report offers an in-depth analysis based on product and end user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising global infrastructure investment will sustain demand for high-precision theodolites across construction and transportation sectors.

- Growing adoption of digital surveying tools will accelerate the shift toward electronic and robotic theodolites.

- Integration with GIS, BIM, and cloud platforms will create new application opportunities in smart city planning.

- Emerging economies will offer strong growth potential due to increased spending on urban development and land reform.

- Technological innovations will drive the development of compact, wireless, and battery-efficient theodolite systems.

- Demand from agriculture, mining, and renewable energy projects will expand the market’s industrial footprint.

- Educational institutions will continue to use basic models, supporting steady demand for vernier and optical theodolites.

- Competition from total stations and drone-based systems will encourage product differentiation and specialization.

- Manufacturers will focus on automation and real-time data capabilities to meet evolving field requirements.

- Strategic partnerships with local distributors will play a key role in penetrating underdeveloped and rural markets.