Market Overview:

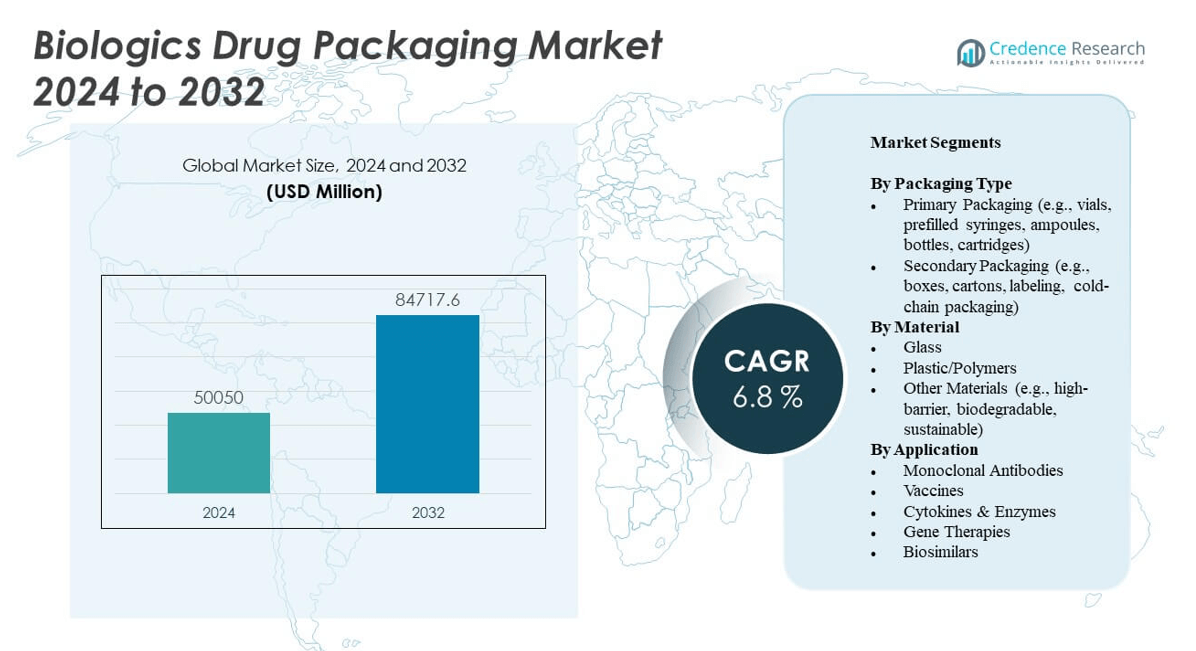

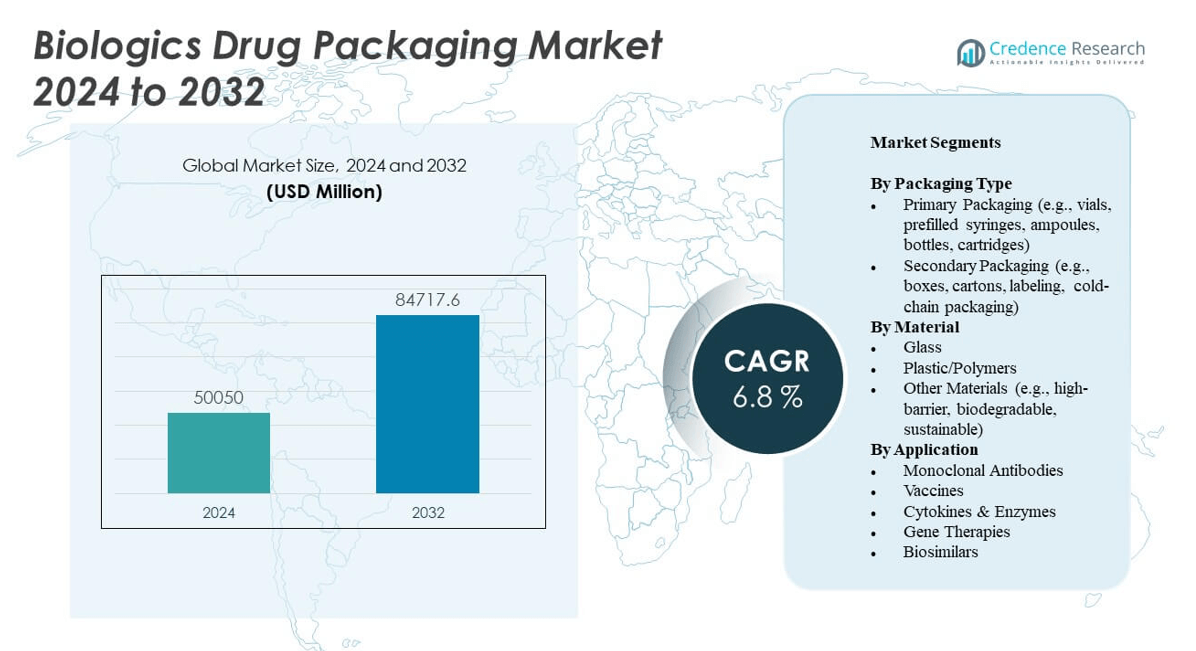

The Biologics Drug Packaging Market is projected to grow from USD 50,050 million in 2024 to an estimated USD 84,717.6 million by 2032, with a compound annual growth rate (CAGR) of 6.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biologics Drug Packaging Market Size 2024 |

USD 50,050 million |

| Biologics Drug Packaging Market, CAGR |

6.8% |

| Biologics Drug Packaging Market Size 2032 |

USD 84,717.6 million |

The market is driven by the increasing global demand for biologics due to rising chronic disease prevalence, an aging population, and the expansion of personalized medicine. Pharmaceutical companies are investing in advanced packaging technologies to preserve the integrity and stability of sensitive biologic formulations, including monoclonal antibodies, vaccines, and gene therapies. Regulatory focus on product safety and compliance has further spurred innovation in tamper-evident, traceable, and cold-chain compatible packaging solutions. The shift toward self-administered therapies is also fueling demand for user-friendly, prefilled syringes and auto-injectors.

North America leads the Biologics Drug Packaging Market due to strong biopharmaceutical production, a highly developed regulatory framework, and robust healthcare infrastructure. Europe follows, supported by growing investments in biologics R&D and sustainable packaging innovations. Meanwhile, Asia Pacific is emerging as a high-growth region, driven by expanding healthcare access, contract manufacturing growth, and increasing domestic biologics development in countries such as China, India, and South Korea. These trends reflect a global shift toward specialized packaging to meet the complex requirements of biologic therapies.

Market Insights:

- The Biologics Drug Packaging Market is projected to grow from USD 50,050 million in 2024 to USD 84,717.6 million by 2032, at a CAGR of 6.8%.

- Rising demand for monoclonal antibodies and vaccines is accelerating the need for specialized, sterile, and tamper-evident packaging formats.

- Increasing focus on patient self-administration supports the adoption of prefilled syringes, cartridges, and auto-injector packaging.

- High material and compliance costs pose a challenge, especially for small and mid-sized biologics manufacturers.

- Glass remains dominant in primary packaging, while polymers gain ground in flexible and user-friendly delivery systems.

- North America holds 41% of the market share, driven by strong biologics R&D and advanced packaging infrastructure.

- Asia Pacific is the fastest-growing region due to biopharma expansion, government support, and local CDMO partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Biologics Due to Chronic Diseases and Personalized Therapies

The growing global burden of chronic diseases such as cancer, autoimmune disorders, and diabetes is directly increasing the demand for biologic therapies. Biologics offer targeted treatment approaches, making them essential in modern personalized medicine. This demand drives the need for specialized packaging solutions that ensure stability, safety, and patient compliance. The Biologics Drug Packaging Market is expanding in response to the precision and care required for these sensitive drug formulations. Pharmaceutical firms are scaling biologics production, and packaging innovation is central to protecting drug efficacy. High investment in research and biologics pipeline development accelerates packaging demand. Prevalence of lifestyle-related conditions further reinforces the market’s growth trajectory. Government support for biologics access increases packaging volumes, especially in emerging economies.

Advancement in Prefilled Syringes and Self-Administered Devices

The rise of patient-centric drug delivery methods has increased the use of prefilled syringes, cartridges, and auto-injectors. These formats offer convenience, safety, and reduced dosing errors, especially in outpatient and home settings. The Biologics Drug Packaging Market benefits from this shift, as packaging must adapt to integrated delivery devices. Packaging companies are investing in sterile fill-finish capabilities and tamper-proof systems. Growth in biosimilars and self-injection therapies supports rapid scaling of device-packaging solutions. Regulations support ease-of-use in chronic therapy packaging, ensuring widespread adoption. Companies focus on ergonomic designs for arthritis and elderly patients, enhancing accessibility. Increased chronic care outside hospitals fuels steady demand for self-administered packaging.

- For example, Gerresheimer AG’s new Gx Elite® borosilicate syringe, launched in December 2023, demonstrated extractables/leachables below 2 ppb (parts-per-billion) and over 99.9% cosmetic acceptance rate in 100% automated inspection, according to the company’s release.

Stringent Regulatory Environment for Drug Safety and Integrity

Global health agencies enforce rigorous packaging standards to ensure drug integrity throughout the supply chain. The Biologics Drug Packaging Market is shaped by regulatory requirements for traceability, serialization, and cold chain compliance. Biologics are sensitive to temperature, moisture, and light, requiring advanced materials and controlled logistics. Regulatory pressure pushes packaging providers to adopt high-barrier laminates, tamper-evident seals, and RFID technologies. Compliance with FDA, EMA, and WHO guidelines compels manufacturers to upgrade packaging systems. Automation and inspection systems are being adopted to meet audit readiness. The push for sustainable packaging must still align with strict safety mandates. Global harmonization of packaging rules ensures consistent product quality across borders.

- For example, West Pharmaceutical Services has developed Daikyo Crystal Zenith® (CZ) vials made from high-purity cyclic olefin polymer (COP), offering superior resistance to breakage and temperature fluctuations. These vials exhibit extremely low levels of extractables and leachables, support container-closure integrity in cold-chain and cryogenic conditions, and eliminate concerns associated with glass, such as delamination and particulate contamination.

Biopharmaceutical Expansion and CDMO Growth Boosting Demand

The expansion of biopharmaceutical manufacturing facilities and the rise of Contract Development and Manufacturing Organizations (CDMOs) drive packaging needs. The Biologics Drug Packaging Market aligns with these trends by supporting high-volume, compliant packaging operations. CDMOs increasingly offer packaging as an integrated service, meeting customer timelines and reducing supply chain complexity. Biotech firms outsource packaging to focus on R&D and reduce capital investments. Rapid scale-up in response to therapeutic breakthroughs demands agile packaging partners. CDMOs invest in flexible filling lines and modular packaging systems. Geographic expansion of biologics production into Asia and Latin America boosts local packaging demand. Collaborative innovation between CDMOs and packaging firms enhances design, sustainability, and compliance.

Market Trends:

Adoption of Smart Packaging Technologies for Enhanced Monitoring

Pharmaceutical companies are integrating smart packaging to track and monitor biologic products throughout the supply chain. The Biologics Drug Packaging Market is seeing growth in technologies such as temperature indicators, data loggers, and NFC-enabled labels. These solutions improve real-time visibility and help maintain cold chain compliance. Smart packaging supports traceability and enhances anti-counterfeiting capabilities. Hospitals and pharmacies adopt these tools to reduce product wastage and improve patient outcomes. It benefits biologics that require stringent storage and handling conditions. Sensor-embedded packaging is becoming standard in high-value biologics and specialty drugs. Technological integration drives collaboration between pharma, packaging, and IoT firms.

- For example, AstraZeneca uses Loftware’s Smartflow platform to manage over 10,000 artwork changes annually, integrating NFC-enabled labels and RFID tags for real-time product tracking and anti-counterfeiting.

Sustainable and Eco-Friendly Packaging Becoming a Priority

Sustainability is gaining traction as a key differentiator in biologics packaging. Companies are developing recyclable, biodegradable, and bio-based packaging options that meet performance requirements. The Biologics Drug Packaging Market is influenced by both regulatory guidelines and corporate ESG goals. Stakeholders seek packaging that balances patient safety with minimal environmental impact. Adoption of mono-material films, paper-based trays, and recyclable blister packs is increasing. Brands are working to reduce secondary packaging and optimize material use. It is driving R&D investments into alternative polymers and green manufacturing practices. Packaging firms gain competitive edge by offering sustainable solutions certified by global standards.

Customization and Modular Packaging Solutions for Niche Therapies

The rise in orphan drugs and niche biologic therapies is shifting packaging strategies toward smaller, tailored batches. The Biologics Drug Packaging Market is adopting modular packaging systems that allow flexibility for varied batch sizes. Personalized therapies require adaptive packaging formats that align with unique storage and administration protocols. Manufacturers deploy modular fill-finish lines and versatile labeling systems to manage product diversity. High-mix, low-volume production models are shaping packaging configurations. It supports speed-to-market for new biologic launches. Advanced serialization and unique patient codes are becoming standard for customized treatments. This trend promotes packaging agility and reduces inventory burden.

Digital Transformation Across Packaging Operations

Digital tools are streamlining biologic packaging operations, from design to final distribution. The Biologics Drug Packaging Market is embracing automation, digital twins, and AI-based quality control. Packaging lines are being connected to MES and ERP systems for real-time performance tracking. Digital design platforms allow rapid prototyping and compliance testing. Remote monitoring of packaging environments ensures regulatory adherence and minimizes deviations. It is enhancing traceability and enabling better audit readiness. Digital records support end-to-end documentation for complex biologics supply chains. Cloud-based platforms foster collaboration across global packaging networks and stakeholders.

- For example, Samsung Biologics uses digital twin technology and AI-based predictive models to optimize biologics packaging, integrating MES and ERP systems for real-time monitoring

Market Challenges Analysis:

Maintaining Cold Chain Integrity Throughout Global Distribution

Ensuring cold chain compliance remains a core challenge in the Biologics Drug Packaging Market. Biologics require narrow temperature ranges to maintain stability, often between 2°C and 8°C. Disruptions during storage, transport, or handling can degrade efficacy and safety. Packaging must offer reliable thermal insulation while accommodating diverse global logistics infrastructures. Limited cold chain capabilities in emerging markets complicate last-mile delivery. High cost of temperature-controlled packaging adds to operational burden. It is difficult to balance thermal performance, cost, and sustainability in long-haul transport. Validation and monitoring protocols must be standardized to reduce cold chain failures.

High Material Costs and Complex Manufacturing Processes

Biologics packaging involves high-performance materials, sterile conditions, and advanced filling technologies. These requirements increase cost and complexity, especially for start-ups and small manufacturers. The Biologics Drug Packaging Market must balance functional performance with economic feasibility. Specialized polymers, multi-layer laminates, and barrier coatings are expensive and difficult to scale. Regulatory compliance adds to operational costs through quality testing and documentation. Automation investments are essential yet capital intensive. It becomes challenging to deliver cost-effective solutions while meeting global quality benchmarks. Supply chain disruptions and raw material shortages further strain cost structures.

Market Opportunities:

Emergence of Biologics in Emerging Economies Fuels Localized Packaging Growth

The increasing development and consumption of biologics in countries like India, Brazil, and China create opportunities for localized packaging operations. The Biologics Drug Packaging Market can expand by supporting regional production with cost-effective, regulation-compliant packaging solutions. Growth in domestic biopharma and government health initiatives supports volume demand. Packaging firms can partner with local CDMOs and logistics providers to streamline services. It helps reduce transit risks and packaging delays across borders.

Integration of AI and Automation in Biologics Packaging Solutions

There is significant potential in leveraging AI, robotics, and machine vision for efficient packaging of biologics. The Biologics Drug Packaging Market can benefit from digitized quality control, predictive maintenance, and automated batch tracking. These technologies improve line speed and reduce human error, ensuring regulatory compliance. AI enables predictive insights to optimize packaging material use and storage. It supports scalable, smart packaging systems across multiple therapy platforms.

Market Segmentation Analysis:

The Biologics Drug Packaging Market is segmented

By packaging type into primary and secondary packaging. Primary packaging dominates the market due to its critical role in protecting sensitive biologics. Vials and prefilled syringes are widely used for monoclonal antibodies and vaccines, while cartridges and ampoules support emerging therapies and self-injection devices. Secondary packaging such as cartons, labeling, and insulated cold-chain formats ensures product safety during storage and distribution.

- For example, SCHOTT offers syriQ BioPure® glass syringes for biologics, designed to minimize extractables and leachables, with validated low-tungsten and silicone oil-free formats for monoclonal antibodies.

By material, glass remains the preferred choice for high-purity biologics, especially for injectable formats like vials and ampoules. Plastic and polymer-based materials are gaining traction in prefilled syringes and auto-injectors due to their design flexibility and durability. Other materials, including high-barrier films and biodegradable packaging, are emerging to meet sustainability goals and extended shelf-life needs.

- For example, TempAid provides cold-chain packaging for vaccines and gene therapies, including ISTA-certified insulated shippers and real-time temperature monitoring for biologics like mRNA and monoclonal antibodies.

By application, monoclonal antibodies lead due to their widespread use in oncology and immunotherapy. Vaccines follow closely, driven by global immunization programs. The Biologics Drug Packaging Market also sees rising demand from gene therapies, cytokines, enzymes, and biosimilars, each requiring highly tailored packaging solutions.

Segmentation:

By Packaging Type

- Primary Packaging (e.g., vials, prefilled syringes, ampoules, bottles, cartridges)

- Secondary Packaging (e.g., boxes, cartons, labeling, cold-chain packaging)

By Material

- Glass

- Plastic/Polymers

- Other Materials (e.g., high-barrier, biodegradable, sustainable)

By Application

- Monoclonal Antibodies

- Vaccines

- Cytokines & Enzymes

- Gene Therapies

- Biosimilars

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share of the Biologics Drug Packaging Market, accounting for 41% of the global revenue. The United States leads this region due to its established biopharmaceutical industry, strong R&D capabilities, and stringent regulatory landscape. High adoption of advanced drug delivery formats and investments in cold chain logistics strengthen packaging innovation. The presence of major biologic drug developers and packaging companies accelerates demand for high-integrity packaging solutions. Canada supports regional growth through its expanding biosimilars sector and regulatory alignment with global standards. The market remains highly competitive, with a strong focus on sustainability and digital traceability solutions. It continues to evolve with increasing demand for patient-centric packaging systems.

Europe captures 29% of the global Biologics Drug Packaging Market share, driven by robust biologics production, advanced healthcare infrastructure, and regulatory emphasis on pharmaceutical packaging standards. Countries such as Germany, Switzerland, and France play a central role due to their pharmaceutical manufacturing strength. The European Medicines Agency (EMA) drives harmonization of packaging protocols, influencing the market’s progression. Cold chain investments and demand for eco-friendly packaging materials are shaping packaging innovation across the region. The market is also witnessing growth in contract packaging services, particularly for clinical trial supplies. It reflects Europe’s focus on safety, sustainability, and compliance across the biologics packaging lifecycle.

Asia Pacific holds 21% of the market share and represents the fastest-growing region in the Biologics Drug Packaging Market. Countries like China, India, Japan, and South Korea are expanding their biopharma production capabilities, supporting increased packaging demand. Government investments in healthcare infrastructure and support for biosimilar development drive packaging scale-up. Domestic CDMOs are partnering with international firms to localize biologics packaging and meet export requirements. Growth in chronic disease burden and biologics adoption fuels strong uptake of temperature-controlled and tamper-evident packaging formats. It benefits from improving regulatory environments and rising demand for high-quality, cost-effective packaging solutions. Emerging players in this region continue to build capacity across sterile fill-finish and secondary packaging services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Gerresheimer AG

- West Pharmaceutical Services

- Becton, Dickinson & Co.

- Amcor Plc

- Berry Global

- AptarGroup Inc.

- PCI Pharma Services

- Sharp Packaging

- Catalent

- WestRock

- CCL Industries

- Körber Pharma

- Almac Group

- Origin Pharma Packaging

Competitive Analysis:

The Biologics Drug Packaging Market features a mix of global packaging giants and specialized biotech packaging providers. Leading players such as West Pharmaceutical Services, Gerresheimer AG, Schott AG, and Catalent Inc. dominate with advanced capabilities in sterile packaging, prefilled systems, and integrated drug delivery solutions. These companies invest heavily in automation, material innovation, and regulatory compliance to retain market share. Mid-sized firms and CDMOs compete by offering flexible services and localized manufacturing. Strategic collaborations between packaging suppliers and biologic drug manufacturers are increasing, enabling custom solutions for evolving drug formulations. It remains competitive with new entrants targeting niche applications, such as temperature-sensitive packaging and smart labeling technologies. Intellectual property, strong supply networks, and regulatory expertise are key differentiators in the market.

Recent Developments:

- In July 2025, Becton, Dickinson & Co. announced a major partnership with Waters Corporation to merge their diagnostic divisions. This initiative is expected to create a diagnostics powerhouse capable of generating $9 billion in revenue by 2030, with a strong focus on standardized, scalable, high-volume testing processes for precision medicine and biologic diagnostics.

- In June 2025, PCI Pharma Services unveiled a new, state-of-the-art, 50,000-square-foot sterile fill/finish manufacturing facility at its Bedford, New Hampshire campus. This expansion enhances PCI’s ability to serve large-scale biologic drug production, featuring cutting-edge isolated vial-filling lines and lyophilization technologies fully compliant with Annex 1 standards.

- In March 2025, Amcor Plc introduced a 2oz retort bottle for nutritional shots with proprietary StormPanel technology, engineered in partnership with Insymmetry. This innovation provides durable, shelf-stable packaging for low-acid beverages such as coffee and dairy products, aligning with the rigorous needs of today’s biologics and food packaging sectors.

- In February 2024, AptarGroup Inc. entered a multi-year enterprise agreement with Biogen to operate and develop digital health solutions, initially targeting neurology and immunology across 15 countries.

Market Concentration & Characteristics:

The Biologics Drug Packaging Market is moderately concentrated, with a handful of global firms holding significant market share. It is characterized by high regulatory oversight, capital-intensive infrastructure, and technical complexity due to the sensitive nature of biologic drugs. The market demands precision, traceability, and cold chain integrity, which shapes packaging design and operations. Growth in biosimilars, self-administered therapies, and sustainability initiatives is influencing packaging formats. It favors companies that offer scalable, compliant, and patient-friendly solutions supported by robust global supply chains.

Report Coverage:

The research report offers an in-depth analysis based on Packaging Type, Material and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising global demand for biologics will sustain the need for advanced packaging solutions tailored to complex formulations.

- Increased focus on patient-centric delivery will drive innovations in prefilled syringes and auto-injector packaging.

- Cold chain packaging technologies will advance to ensure drug integrity across diverse geographies.

- Sustainability goals will accelerate the development of recyclable and bio-based packaging materials.

- Digital packaging features such as smart labels and traceability tools will gain wider adoption.

- Expansion of biologics manufacturing in emerging markets will boost regional packaging capabilities.

- Regulatory harmonization will standardize packaging practices across global supply chains.

- Strategic partnerships between pharma companies and packaging providers will shape innovation.

- AI and automation will optimize packaging processes and reduce production inefficiencies.

- Personalized medicine and smaller batch production will demand agile and modular packaging formats.