| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| VMS Sublingual Products Market Size 2024 |

USD 12,932.0 Million |

| VMS Sublingual Products Market, CAGR |

8.40% |

| VMS Sublingual Products Market Size 2032 |

USD 24,654.7 Million |

Market Overview

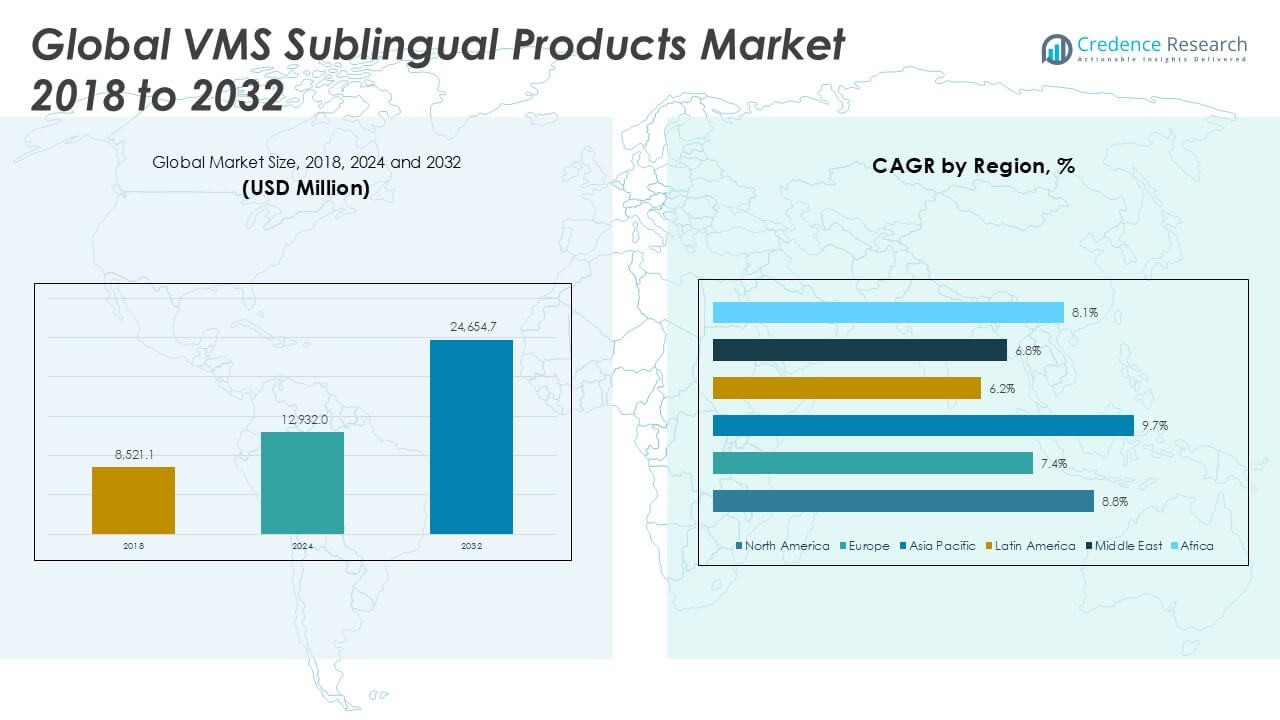

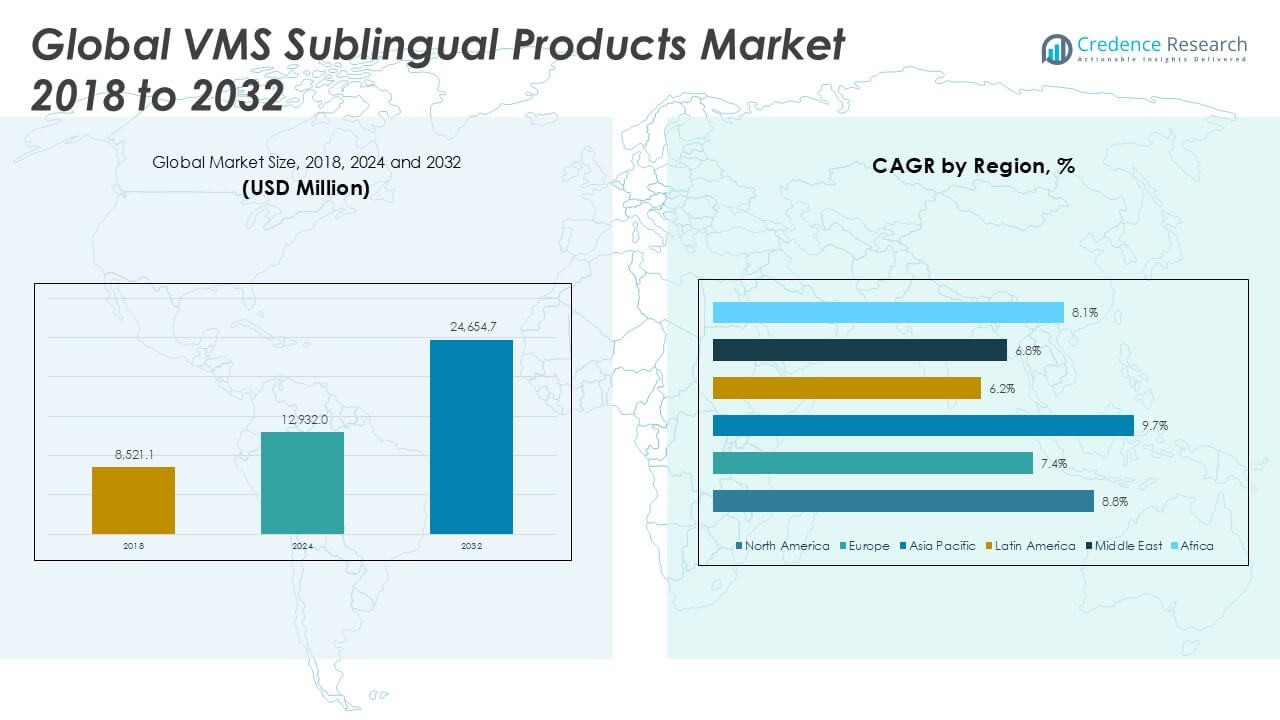

The Global VMS Sublingual Products Market is projected to grow from USD 12,932.0 million in 2024 to an estimated USD 24,654.7 million Based on 2032, with a compound annual growth rate (CAGR) 8.40% from 2025 to 2032

Health-conscious lifestyles, growing awareness of nutrient deficiencies and an aging population drive demand for convenient and effective delivery systems. Consumers seek personalized nutrition solutions, prompting firms to develop tailored sublingual blends. Technological advances in film-forming agents and permeation enhancers optimize absorption rates. Regulatory agencies increasingly recognize sublingual dosage forms, which stimulates new product launches. Specialty pharmacies and DTC brands leverage digital platforms to engage end users, reinforcing the trend toward direct-to-consumer sublingual offerings.

North America leads the VMS sublingual space with over 35% market share, supported by robust healthcare infrastructure and high consumer health awareness. Europe follows closely, where stringent quality standards and strong nutraceutical regulations foster market maturity. Asia Pacific exhibits the fastest growth, led by China and India, as rising middle-class populations prioritize wellness and preventive care. Key players shaping the competitive landscape include Bayer AG, Pfizer Inc., Abbott Laboratories, GlaxoSmithKline plc, Nestlé Health Science, Nature’s Sunshine Products, Life Extension and VitaHealth International. These companies drive innovation through strategic partnerships, targeted R\&D investments and regional expansion initiatives, reinforcing their market leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global VMS Sublingual Products Market is projected to reach USD 24,654.7 million by 2032 from USD 12,932.0 million in 2024, growing at a CAGR of 8.40% between 2025 and 2032.

- Rising consumer demand for fast-absorbing and convenient supplement formats fuels growth in the sublingual delivery segment.

- Increasing awareness of nutritional deficiencies and aging-related health issues supports strong adoption across developed and emerging economies.

- Growth in direct-to-consumer models and expansion of online retail channels enhances market penetration and consumer access.

- Limited awareness about sublingual benefits and lack of standardized regulations across regions hinder wider market adoption.

- North America leads the market with over 35% share, driven by robust infrastructure and advanced healthcare awareness.

- Asia Pacific shows the highest growth rate (CAGR 9.7%), supported by rising disposable incomes and increasing focus on preventive health.

Market Drivers

Rising Demand for Rapid Nutrient Absorption and High Bioavailability

Consumers seek efficient supplement solutions that deliver nutrients faster than oral tablets. The Global VMS Sublingual Products Market leverages sublingual delivery to bypass digestive barriers. It shortens absorption time and boosts bioavailability. Patients report quicker effects when they place tablets under the tongue. Clinicians recommend sublingual forms to address immediate nutrient needs. Manufacturers respond with tailored VMS blends to meet this requirement.

- For instance, a 2024 survey by the Council for Responsible Nutrition found that over 9 million adults in the United States regularly used sublingual vitamin B12 supplements, citing faster onset of effects compared to traditional oral forms.

Expanding Geriatric Population and Awareness of Nutrient Gaps

An aging demographic increases demand for convenient supplement formats. It addresses swallowing challenges common among older adults. Rising awareness of micronutrient deficiencies fuels interest in targeted therapies. The Global VMS Sublingual Products Market offers precise dosing that supports nutrient management. Healthcare providers endorse sublingual VMS for patients with malabsorption conditions. Industry participants fund education campaigns that highlight nutrient gaps.

- For instance, in 2023, the National Institutes of Health reported that more than 2,200 long-term care facilities in the U.S. incorporated sublingual vitamin and mineral supplements into their standard nutrition protocols for residents with swallowing difficulties.

Advances in Formulation Technologies Enhance Patient Compliance

Innovations in taste-masking improve patient acceptance of sublingual tablets. It uses film coatings that dissolve quickly under the tongue. Manufacturers integrate micronization to boost solubility and stability. Research teams optimize permeation enhancers to maximize uptake. The Global VMS Sublingual Products Market benefits from these breakthroughs. Developers invest in portable packaging that preserves product integrity.

Strengthening E-Commerce Platforms and Direct-to-Consumer Outreach

Digital channels simplify access to sublingual VMS products. It allows brands to collect user feedback and tailor offerings. Subscription models ensure consistent supply for loyal customers. The Global VMS Sublingual Products Market gains traction through online marketing. Companies partner with e-commerce platforms to expand global reach. Social media campaigns educate consumers about product benefits.

Market Trends

Increased Focus on Personalized Nutrition and Functional Formulations

Consumers demand products that align with individual health goals and genetic profiles. Brands now offer sublingual VMS products tailored for immunity, energy, cognitive health, and stress relief. The Global VMS Sublingual Products Market reflects this shift through customizable dosing and ingredient selection. It supports targeted wellness by incorporating adaptogens, nootropics, and functional botanicals. Diagnostic tools like DNA tests and health trackers guide supplement choices. Companies use consumer data to refine product development and improve personalization.

- For instance, Nestlé Health Science reported analyzing over 120,000 individual DNA test kits in 2024 to guide the development and recommendation of personalized sublingual supplements for targeted health outcomes.

Growing Adoption of Clean Label and Plant-Based Ingredients

Transparency influences purchasing decisions in the supplement industry. Consumers prefer clean-label VMS sublinguals free from artificial additives, colors, and preservatives. The Global VMS Sublingual Products Market responds with organic, non-GMO, and vegan-certified formulations. It highlights plant-based nutrients sourced from sustainable farming. Natural sweeteners and flavoring agents improve palatability without compromising efficacy. Regulatory scrutiny encourages consistent labeling and traceable sourcing practices.

- For instance, the Council for Responsible Nutrition’s 2024 survey found that 54,000 supplement products registered for voluntary clean-label certification in the United States, with a significant portion representing plant-based and sublingual delivery formats.

Proliferation of Innovative Dosage Formats and Delivery Mechanisms

The market moves beyond standard tablets to films, sprays, and melt-in-mouth strips. These innovations improve user convenience and broaden consumer appeal. The Global VMS Sublingual Products Market introduces products that dissolve rapidly and offer portable use. It supports compliance among busy professionals, travelers, and older adults. Developers invest in compact, single-use packaging for precise dosing. Multilayer film technologies also enable multi-ingredient integration in a single strip.

Stronger Integration of Digital Health and Telewellness Ecosystems

Consumers access supplements through digital platforms linked to telehealth services. The integration of health monitoring apps with supplement subscriptions gains popularity. The Global VMS Sublingual Products Market adapts by embedding digital tools into consumer journeys. It uses AI-driven chatbots and virtual consultations to guide supplement selection. Platforms offer reminders, intake tracking, and health progress reports. This trend bridges preventive care with on-demand wellness support.

Market Challenges

Limited Consumer Awareness and Misconceptions About Sublingual Delivery

Many consumers remain unfamiliar with the benefits of sublingual supplementation compared to traditional oral formats. Misconceptions about taste, efficacy, and safety reduce product adoption rates. The Global VMS Sublingual Products Market must overcome skepticism through education and transparent communication. It faces resistance in regions where supplement awareness remains low. Health professionals often lack detailed guidance on recommending sublingual VMS, which further limits outreach. Bridging this knowledge gap requires coordinated efforts across brands, practitioners, and retailers.

- For instance, a survey by the Consumer Healthcare Products Association (CHPA) in 2025 found that among 1,169 U.S. adults, only 22% had heard of the Dietary Supplement Health and Education Act (DSHEA), and 52% were unsure or believed supplements were unregulated, illustrating widespread gaps in supplement knowledge and regulatory awareness among consumers

Regulatory Variability and Product Standardization Issues Across Regions

The sublingual supplement category lacks harmonized global regulations, creating challenges in formulation, labeling, and distribution. Varying classification of products—whether as dietary supplements or therapeutic agents—complicates market entry. The Global VMS Sublingual Products Market must navigate differing import policies and ingredient restrictions. It also faces hurdles in standardizing dosing protocols across regions. Smaller firms struggle with compliance due to high certification costs and fragmented oversight. These regulatory inconsistencies hinder scalability and delay new product launches.

Market Opportunities

Expansion into Emerging Markets with Growing Middle-Class Health Consciousness

Emerging economies present strong growth potential due to rising disposable incomes and expanding access to wellness products. A growing middle class increasingly prioritizes preventive healthcare and seeks convenient supplement formats. The Global VMS Sublingual Products Market can capitalize on this demand by localizing formulations and establishing regional partnerships. It benefits from the rise of online pharmacies and direct-to-consumer channels in Asia, Latin America, and the Middle East. Cultural acceptance of natural remedies also aligns well with sublingual VMS offerings. Companies that invest early in distribution and education can secure long-term market positioning.

Innovation in Multi-Functional and Fast-Acting Supplement Blends

Consumers look for supplements that deliver multiple health benefits in a single dose. Demand rises for formulations that combine vitamins, minerals, adaptogens, and herbal extracts in sublingual formats. The Global VMS Sublingual Products Market gains momentum through R\&D focused on multi-functional, fast-acting blends. It supports development of products for energy, sleep, stress, and immunity without increasing pill burden. Taste and format innovations enhance product appeal across diverse age groups. Companies can attract broader demographics by offering solutions tailored to specific lifestyles and health concerns.

Market Segmentation Analysis

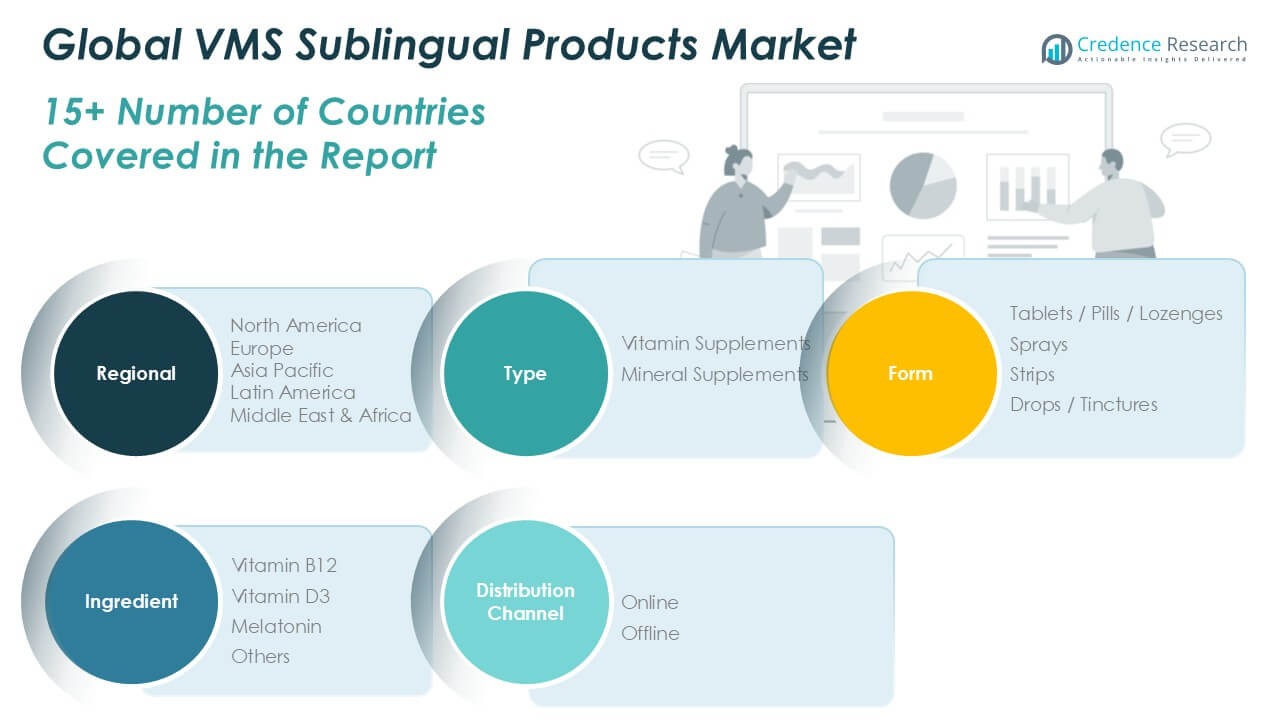

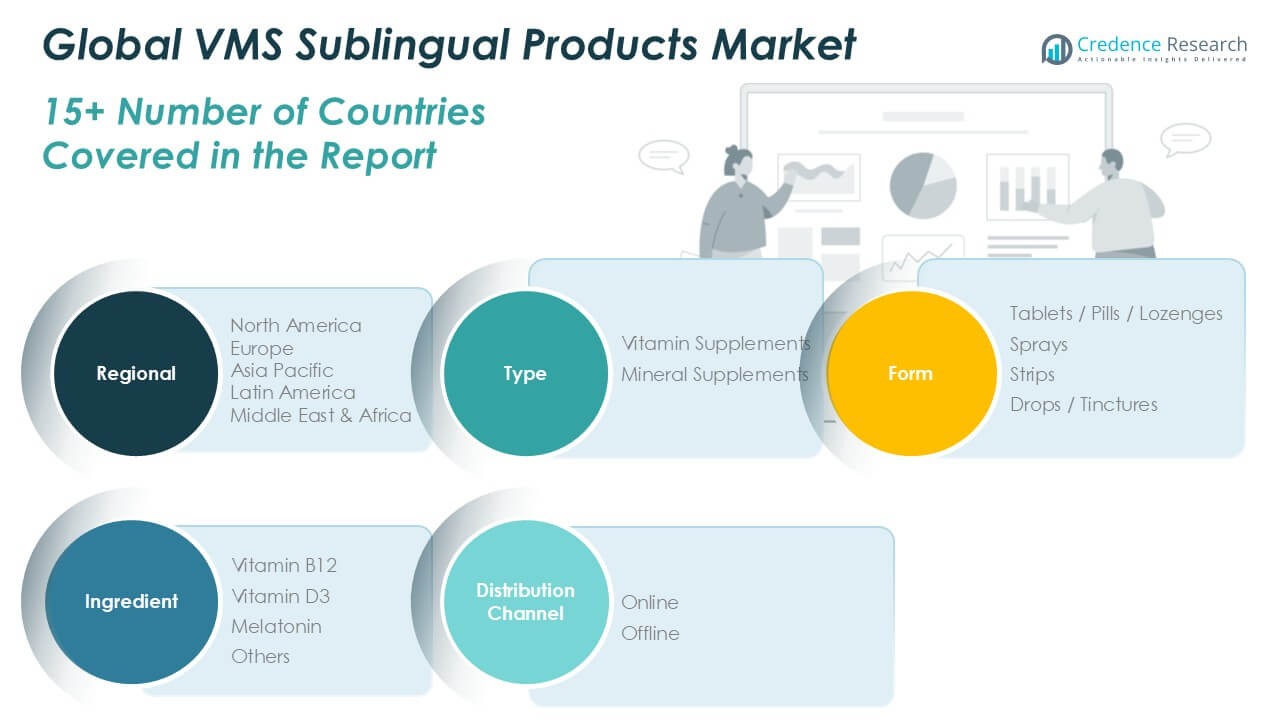

By Type

The Global VMS Sublingual Products Market segments by type into vitamin supplements and mineral supplements. Vitamin supplements account for a major share due to widespread consumer focus on immune support, energy enhancement, and wellness. Mineral supplements follow, driven by rising awareness of trace mineral deficiencies such as magnesium and zinc. It sees strong adoption across preventive care and therapeutic nutrition. Vitamin subtypes, especially B-complex and D3, dominate sublingual formats for their faster absorption and high demand. Market players develop blended solutions to combine multiple nutrients in single-dose formats.

- For instance, company sales data from 2024 indicate that over 350 million units of sublingual vitamin supplements were sold worldwide, compared to approximately 120 million units of sublingual mineral supplements.

By Form

The market divides by form into tablets/pills/lozenges, sprays, strips, and drops/tinctures. Tablets and lozenges lead due to ease of production and consumer familiarity. It gains momentum with growing demand for melt-in-mouth experiences and precision dosing. Sprays and strips emerge as preferred options among younger demographics and on-the-go users. Drops and tinctures serve both general consumers and specialized health needs. Form innovation remains a key differentiator, influencing both volume and revenue share across regions.

- For instance, industry surveys in 2024 reported that more than 270 million sublingual VMS products were sold in tablet, pill, or lozenge form globally, while sprays, strips, and drops/tinctures collectively accounted for around 110 million units.

By Ingredient

The ingredient segmentation includes Vitamin B12, Vitamin D3, Melatonin, and Others. Vitamin B12 dominates due to its widespread use in energy, metabolism, and cognitive function support. Vitamin D3 follows with increased demand linked to immunity and bone health. The Global VMS Sublingual Products Market uses melatonin for sleep aid applications, gaining popularity in wellness-focused routines. The “Others” category includes botanicals, adaptogens, and niche micronutrients. Ingredient innovation enables product diversification and targeted health outcomes.

By Distribution Channel

Distribution splits between offline and online channels. Offline remains dominant through pharmacies, health stores, and supermarkets, offering strong visibility and consumer trust. Online platforms grow rapidly, supported by digital marketing, product variety, and convenience. It enables personalized shopping and subscription models. Brands use e-commerce to expand global reach and collect consumer insights. Online sales continue to reshape buyer behavior and market accessibility.

Segments

Based on Type

- Vitamin Supplements

- Mineral Supplements

Based on Form

- Tablets / Pills / Lozenges

- Sprays

- Strips

- Drops / Tinctures

Based on Ingredient

- Vitamin B12

- Vitamin D3

- Melatonin

- Others

Based on Distribution Channel

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America VMS Sublingual Products Market

North America holds the largest share in the Global VMS Sublingual Products Market, accounting for 37.4% in 2024 with a market size of USD 4,836.6 million, projected to reach USD 8,185.4 million by 2032 at a CAGR of 8.8%. The region benefits from high consumer health awareness, a robust dietary supplement industry, and advanced distribution networks. It drives strong demand through direct-to-consumer brands, retail pharmacy chains, and online wellness platforms. The United States leads regional sales, supported by regulatory clarity and product innovation. Consumer preference for fast-acting, non-invasive formats strengthens the appeal of sublingual options. It continues to expand through functional blends targeting immunity, energy, and sleep support.

Europe VMS Sublingual Products Market

Europe contributes 26.7% to the global market in 2024 with a value of USD 3,452.8 million, growing to USD 6,139.0 million by 2032 at a CAGR of 7.4%. The region shows strong demand in Germany, France, and the UK, where aging populations and preventive health strategies drive supplement usage. It benefits from established healthcare systems and consumer trust in over-the-counter formulations. Regulatory frameworks support sublingual VMS innovation with quality and safety standards. Sustainability and clean-label trends influence buyer behavior, pushing brands to invest in organic and vegan formulations. Regional brands build customer loyalty through transparent labeling and science-backed claims.

Asia Pacific VMS Sublingual Products Market

Asia Pacific holds a 22.8% market share in 2024, valued at USD 2,948.5 million, and is forecasted to reach USD 7,001.9 million by 2032, reflecting the highest CAGR of 9.7%. China, Japan, India, and South Korea drive this growth through rising disposable incomes and expanding health awareness. The VMS Sublingual Products Market in this region gains momentum from younger demographics and growing adoption of natural health products. It benefits from strong e-commerce penetration and increasing demand for convenient wellness formats. Regional players and global brands focus on localizing flavors and dosage forms. Government initiatives to promote nutritional health further boost demand.

Latin America VMS Sublingual Products Market

Latin America represents 5.3% of the global market in 2024 with a size of USD 685.4 million, projected to reach USD 1,503.9 million by 2032 at a CAGR of 6.2%. Brazil and Mexico lead regional demand, supported by a growing middle class and increasing retail penetration. It experiences a gradual shift from traditional supplements to sublingual formats due to convenience and perceived absorption benefits. Health-focused campaigns and influencer marketing raise awareness among urban consumers. Local production and flexible distribution networks enhance accessibility in emerging cities. Companies invest in affordable sublingual offerings tailored to regional purchasing power.

Middle East VMS Sublingual Products Market

The Middle East accounts for 4.1% of the global market in 2024, with a value of USD 530.2 million, expected to grow to USD 1,060.2 million by 2032 at a CAGR of 6.8%. The market benefits from rising interest in health and wellness across the Gulf Cooperation Council (GCC) countries. It attracts demand from both local populations and expatriates seeking quality nutritional support. Pharmacies and health stores remain primary sales channels, while online platforms gain traction in urban centers. The VMS Sublingual Products Market shows potential in sleep aids, immunity boosters, and energy-enhancing formulas. Regional governments promote preventive healthcare, creating favorable conditions for supplement growth.

Africa VMS Sublingual Products Market

Africa holds 3.7% of the global market in 2024 with a market size of USD 478.5 million, estimated to reach USD 764.3 million by 2032 at a CAGR of 8.1%. South Africa, Nigeria, and Kenya lead regional adoption of sublingual VMS products, driven by increasing urbanization and growing healthcare awareness. The VMS Sublingual Products Market in Africa faces challenges related to distribution infrastructure but sees opportunity through mobile health initiatives and telehealth partnerships. It benefits from rising demand for affordable wellness products with clear health claims. Global brands collaborate with regional distributors to strengthen supply chains. Product education and low-cost sublingual formats are key to unlocking long-term potential.

Key players

- Superior Source

- Natrol

- NOW Foods

- Nature’s Bounty

- Jarrow Formulas

- Pure Encapsulations

- Life Extension

- GNC

- Solgar

- Swanson Health

- Dissolve-It

- QuickStrip

- MaryRuth Organics

- EZ Melts

Competitive Analysis

The Global VMS Sublingual Products Market features a blend of established supplement brands and emerging innovators focused on fast-acting delivery formats. Companies like Superior Source, NOW Foods, and GNC lead the space with broad product portfolios and strong retail presence. Emerging players such as QuickStrip and EZ Melts introduce disruptive technologies centered on rapid dissolution and targeted benefits. It thrives on differentiation through flavor profiles, clean-label certifications, and unique ingredient combinations. Strategic moves include direct-to-consumer expansion, digital marketing, and partnerships with healthcare professionals. Market leaders invest in R\&D to enhance absorption efficiency and build consumer trust through clinical validation. Competitive intensity continues to rise as companies target specific health functions and regional opportunities.

Recent Developments

- In 2025, Rapid Dose Therapeutics expanded its QuickStrip product line with consumer-focused oral thin-film strips, including QuickStrip Energy (caffeine) and QuickStrip Sleep (melatonin). These strips utilize sublingual and buccal absorption for rapid and convenient delivery of active ingredients.

Market Concentration and Characteristics

The Global VMS Sublingual Products Market shows moderate concentration, with a mix of dominant players and niche brands competing across specialized segments. It features a diverse landscape shaped by product innovation, brand recognition, and direct-to-consumer strategies. Leading companies maintain a strong presence through extensive distribution networks, while smaller firms differentiate through unique delivery technologies and clean-label offerings. The market emphasizes rapid absorption, personalized nutrition, and convenience, driving demand for alternative dosage forms like strips, sprays, and melts. Regulatory compliance, taste optimization, and ingredient transparency define core industry characteristics. Consumer trust and health outcomes remain central to brand loyalty and long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Ingredient, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Brands will tailor sublingual blends based on consumer genetics, lifestyle, and micro-nutrient deficiencies. They will rely on consumer data and diagnostic partnerships.

- Expect surge in certified organic, vegan-friendly sublingual supplements without artificial additives. Consumers will demand full ingredient transparency and ethical sourcing.

- Products combining immunity support, cognitive enhancement, and energy maintenance will become mainstream. Companies will optimize dosage profiles for synergistic benefits.

- Innovations such as multi-layer films, nano-emulsion sprays, and single‑use strips will gain traction. Manufacturers will optimize rapid dissolution and ease of use.

- Apps and telehealth platforms will offer personalized supplement guidance, automated reorder reminders, and health tracking. Brands will leverage data-driven feedback loops.

- Asia Pacific and Latin America will see accelerated demand due to shifting lifestyles and rising wellness awareness. Local partnerships will facilitate product adaptation and distribution.

- Brands will deepen relationships with nutritionists, pharmacists, and integrative medicine providers. They will launch clinically validated sublingual products backed by practitioner endorsements.

- Harmonized guidelines across markets will support cross-border innovation and product launches. Industry bodies will work toward uniform labeling and dosage norms.

- Personalized monthly supply bundles will gain popularity among health‑conscious consumers. Brands will use loyalty incentives and data analytics to strengthen retention.

- Pressure on brands to adopt recyclable films and minimal plastic will intensify. Consumers will favor companies that embed circular economy practices into their value chain.