Market Overview

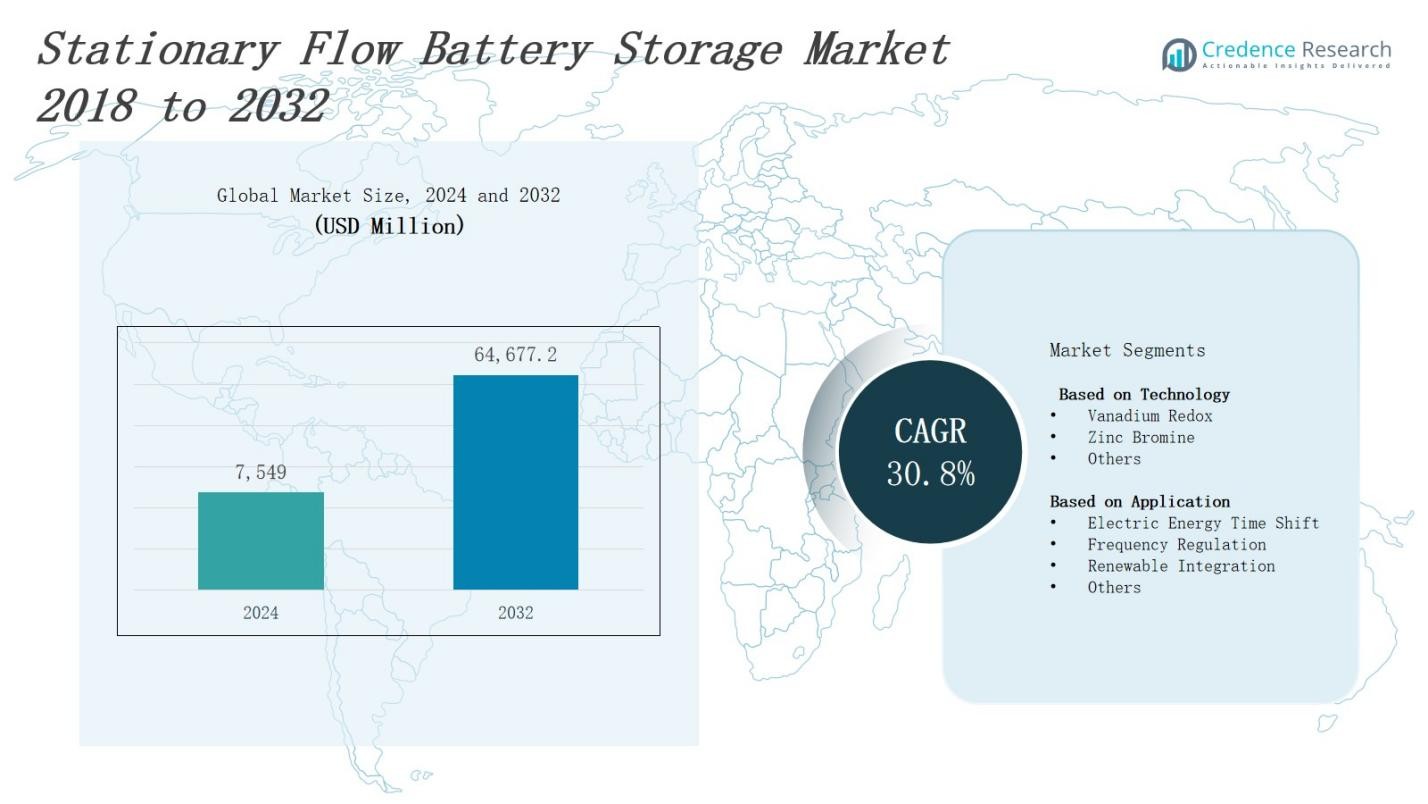

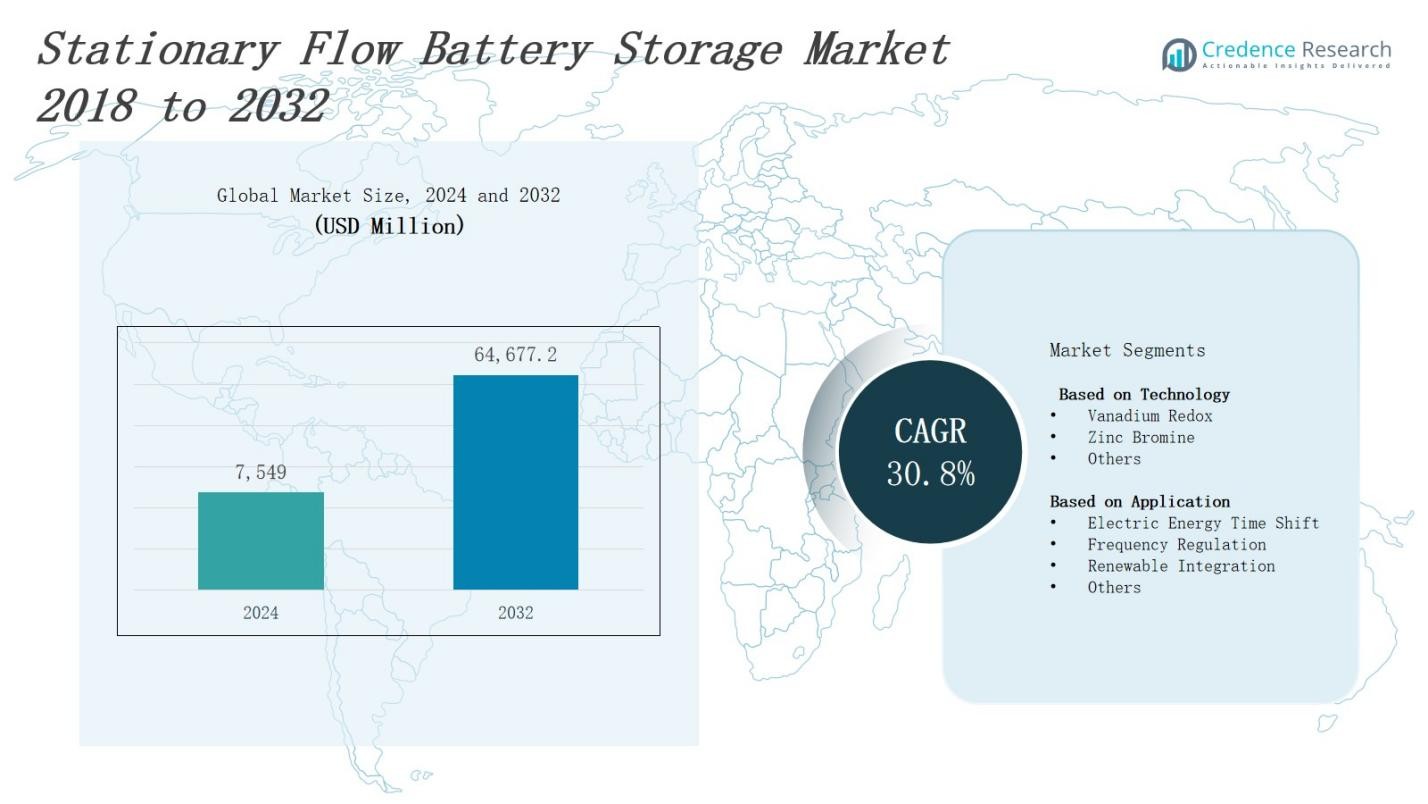

The Stationary Flow Battery Storage Market is projected to grow from USD 7,549 million in 2024 to USD 64,677.2 million by 2032, expanding at a CAGR of 30.8%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stationary Flow Battery Storage Market Size 2024 |

USD 7,549 Million |

| Stationary Flow Battery Storage Market, CAGR |

30.8% |

| Stationary Flow Battery Storage Market Size 2032 |

USD 64,677.2 Million |

The stationary flow battery storage market grows driven by increasing demand for reliable and scalable energy storage solutions to support renewable energy integration and grid stability. Rising investments in clean energy infrastructure and government incentives accelerate adoption. Technological advancements improve battery efficiency, lifespan, and safety, reducing total cost of ownership. Market trends include the development of advanced electrolyte materials and modular designs that enable flexible capacity expansion. Growing focus on decarbonization and energy resilience across industries further fuels market momentum. The market also benefits from partnerships between technology providers and utilities to deploy large-scale storage projects worldwide.

The stationary flow battery storage market spans key regions including North America, Asia-Pacific, Europe, and the Rest of the World. North America and Europe focus on grid stability and renewable integration, while Asia-Pacific leads with rapid industrialization and large renewable capacity. Emerging markets in Latin America, the Middle East, and Africa drive growth in the Rest of the World segment. Leading players such as Voltstorage, Largo, Invinity Energy Systems, and Primus Power actively expand their presence across these regions through technological innovation and strategic partnerships to meet rising global demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The stationary flow battery storage market is projected to grow from USD 7,549 million in 2024 to USD 64,677.2 million by 2032, expanding at a CAGR of 30.8%.

- Demand rises for reliable, scalable energy storage to support renewable energy integration and grid stability, driven by investments and government incentives.

- Technological advancements enhance battery efficiency, lifespan, and safety, lowering total ownership costs and enabling modular, flexible capacity expansion.

- The market benefits from growing focus on decarbonization and energy resilience across industries and partnerships between technology providers and utilities worldwide.

- North America holds 30% market share, emphasizing grid stability and renewable integration; Asia-Pacific leads with 40%, driven by rapid industrialization and renewable capacity growth.

- Europe commands 20% share with strong environmental regulations and renewable targets, while the Rest of the World accounts for 10%, driven by emerging markets in Latin America, Middle East, and Africa.

- Challenges include high initial capital costs, complex system design, limited awareness, and competition from lower-cost, shorter-duration storage technologies like lithium-ion batteries.

Market Drivers

Rising Demand for Renewable Energy Integration and Grid Stability

The stationary flow battery storage market benefits from the increasing adoption of renewable energy sources such as solar and wind. These sources require efficient energy storage to manage their intermittent generation and maintain grid reliability. It supports peak load management and smoothens energy supply fluctuations. Utilities and independent power producers invest in flow battery systems to enhance grid stability, reduce curtailment, and optimize renewable energy use, accelerating market growth worldwide.

- For instance, U.S. utilities utilize vanadium redox flow batteries to store excess solar and wind energy during off-peak periods, releasing it to balance demand and stabilize the grid, supported by federal incentives for energy storage.

Government Policies and Incentives Supporting Clean Energy

Strong regulatory frameworks and government incentives promoting clean energy deployment drive the stationary flow battery storage market. Subsidies, tax credits, and favorable policies encourage utilities and industries to adopt flow battery technology. It helps meet national renewable energy targets and carbon reduction commitments. Countries with ambitious decarbonization goals actively support energy storage projects, expanding demand for advanced, long-duration storage solutions such as flow batteries.

Technological Advancements Enhancing Performance and Cost Efficiency

The stationary flow battery storage market expands due to continuous technological improvements that enhance battery efficiency, lifespan, and safety. Innovations in electrolyte chemistry and membrane technology improve energy density and reduce maintenance costs. It lowers the total cost of ownership and increases competitiveness against conventional storage options. Manufacturers focus on modular and scalable designs, enabling customized solutions tailored to diverse application requirements, which attract more customers.

- For instance, zinc-bromine flow batteries have seen improvements in electrolyte chemistry that raise energy density and reduce degradation, making them more cost-effective for long-duration renewable energy storage.

Growing Industrial and Commercial Adoption for Energy Resilience

Industries and commercial sectors increasingly deploy stationary flow battery systems to ensure energy resilience and reduce reliance on fossil fuels. It provides backup power, load shifting, and demand charge management, optimizing operational costs. Rising awareness about sustainability and energy security prompts companies to integrate flow batteries into their energy strategies. This trend fosters broader market acceptance beyond traditional utility-scale applications, contributing significantly to market expansion.

Market Trends

Advancements in Electrolyte and Membrane Technologies

The stationary flow battery storage market experiences significant innovation in electrolyte formulations and membrane materials. These advancements increase energy density and improve ion selectivity, enhancing overall battery efficiency. It reduces degradation rates and extends operational life. Companies focus on developing cost-effective, sustainable electrolyte chemistries that also minimize environmental impact. Enhanced materials enable more reliable, scalable solutions suited for a variety of grid and off-grid applications, driving wider adoption.

- For instance, IMDEA Energy developed a patented membrane-free redox flow battery using immiscible aqueous and non-aqueous electrolytes that eliminates the need for costly ion-selective membranes, thereby reducing costs while improving sustainability and performance in real flow conditions.

Modular and Scalable System Designs for Flexibility

The stationary flow battery storage market trends toward modular, scalable system architectures that allow flexible capacity expansion. It enables users to tailor storage capacity according to changing energy demands without complete system replacement. Modular designs simplify installation and maintenance, lowering operational expenses. This flexibility attracts utilities, commercial enterprises, and microgrid operators seeking adaptable, long-duration energy storage solutions to optimize grid performance and operational efficiency.

- For instance, CMBlu’s Organic SolidFlow battery features a modular design where power and storage capacity can be independently scaled, allowing customization from small microgrids to large industrial facilities with long-duration energy storage capabilities.

Integration with Renewable Energy and Smart Grid Technologies

The stationary flow battery storage market increasingly integrates with renewable energy systems and smart grid platforms. It facilitates efficient energy management, demand response, and peak shaving, improving grid reliability. Battery systems connect with digital monitoring and control tools to optimize performance and predict maintenance needs. This integration supports the transition to decentralized energy architectures and promotes sustainable energy use across sectors, reinforcing market growth globally.

Expansion of Commercial and Industrial Energy Storage Applications

The stationary flow battery storage market witnesses growth in commercial and industrial sectors leveraging it for energy cost management and resilience. Organizations adopt flow batteries for backup power, load leveling, and demand charge reduction. It improves energy security while supporting sustainability goals. Rising corporate commitments to carbon neutrality accelerate investments in flow battery storage projects, broadening the market beyond utility-scale installations and fostering diversified application opportunities worldwide.

Market Challenges Analysis

High Initial Capital Costs and Complex System Design

The stationary flow battery storage market faces challenges related to high upfront capital investment, which limits adoption, especially among small and medium-sized enterprises. It requires significant expenditure for system components such as electrolyte materials, membranes, and balance-of-plant infrastructure. Complex system design and integration add to installation and commissioning costs. These factors create barriers to entry and slow deployment despite long-term operational benefits. Market players must focus on cost reduction through manufacturing scale and technological innovation to improve accessibility.

Limited Awareness and Competition from Alternative Technologies

The stationary flow battery storage market encounters challenges from limited awareness and understanding of flow battery advantages compared to other storage technologies like lithium-ion batteries. It competes with well-established, lower-capital-cost solutions that offer higher energy density but shorter duration. Perceptions regarding flow battery complexity and maintenance requirements also hinder wider acceptance. Overcoming these challenges requires educating stakeholders about long-duration capabilities and lifecycle cost benefits to drive broader market penetration and long-term growth.

Market Opportunities

Expansion into Emerging Markets and Renewable Energy Projects

The stationary flow battery storage market holds significant opportunities in emerging economies investing heavily in renewable energy infrastructure. It can support large-scale solar and wind projects by providing reliable, long-duration storage that stabilizes grid fluctuations. Growing electrification and modernization of power grids in regions such as Asia-Pacific, Latin America, and Africa create demand for advanced energy storage solutions. Market players can capitalize on government initiatives and international funding aimed at sustainable energy deployment to expand their geographic footprint.

Development of Hybrid and Integrated Energy Storage Systems

The stationary flow battery storage market can benefit from growing interest in hybrid energy storage systems that combine flow batteries with other technologies like lithium-ion and supercapacitors. It offers complementary advantages by addressing duration and scalability challenges. Integrating flow batteries into microgrids and smart grid frameworks enables enhanced energy management, resilience, and cost optimization. Collaborations between technology providers, utilities, and industrial users foster innovation and create new business models, expanding market opportunities across various sectors.

Market Segmentation Analysis:

By Technology

The stationary flow battery storage market segments include vanadium redox, zinc bromine, and other emerging technologies. Vanadium redox batteries dominate due to their high efficiency, long cycle life, and scalability for large applications. It offers reliable performance with low environmental impact. Zinc bromine technology attracts attention for its lower cost and higher energy density, suitable for commercial and industrial uses. Other technologies, such as organic and iron-based flow batteries, gain traction through ongoing research and development, expanding technological diversity and market reach.

- For instance, Stryten Energy’s vanadium redox flow batteries support long-duration renewable energy storage with scalable solutions suitable for microgrids and utility-scale applications.

By Application

The stationary flow battery storage market serves various applications, including electric energy time shift, frequency regulation, renewable integration, and others. It plays a critical role in electric energy time shift by storing excess energy during off-peak hours for use during peak demand. Frequency regulation benefits from flow batteries’ rapid response and stable power output. Renewable integration remains a major driver, enabling smoother incorporation of intermittent solar and wind energy into the grid. Other applications include backup power and microgrid support, broadening deployment opportunities across industries.

- For instance, for renewable integration, Redox One, a Cypriot company, is commercializing iron-chromium flow batteries using cost-effective chromium and iron electrolytes sourced from South Africa, targeting large-scale renewable projects like wind farms with long-duration, low-cost energy storage.

Segments:

Based on Technology

- Vanadium Redox

- Zinc Bromine

- Others

Based on Application

- Electric Energy Time Shift

- Frequency Regulation

- Renewable Integration

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of 30% in the stationary flow battery storage market due to its advanced energy infrastructure and supportive regulatory environment. It benefits from strong government incentives and investments in clean energy technologies. Utilities in the region increasingly deploy flow battery systems for grid stabilization and renewable energy integration. It also gains traction in commercial and industrial sectors aiming to improve energy resilience and reduce costs. Technological innovation hubs and established market players further drive adoption and growth across the United States and Canada.

Asia-Pacific

Asia-Pacific leads the stationary flow battery storage market with a 40% share, driven by rapid industrialization and massive renewable energy capacity additions. Countries like China, India, Japan, and South Korea invest heavily in energy storage to support grid modernization and decarbonization goals. It benefits from government policies promoting sustainable energy and international collaborations for technology transfer. The expanding manufacturing base and increasing focus on electrification accelerate flow battery deployments across the region’s diverse markets. Rising electricity demand further strengthens market potential in this area.

Europe

Europe commands a 20% share in the stationary flow battery storage market, supported by stringent environmental regulations and aggressive renewable energy targets. It focuses on integrating flow batteries with wind and solar power projects to enhance grid flexibility and reliability. It also gains momentum from government-funded research and pilot projects emphasizing sustainable and circular economy principles. Countries like Germany, the UK, France, and the Netherlands actively implement energy storage solutions to achieve energy transition objectives. Collaborative initiatives among stakeholders foster technological advancement and commercial adoption.

Rest of the World

The Rest of the World accounts for 10% of the stationary flow battery storage market, driven by emerging economies in Latin America, the Middle East, and Africa. It benefits from growing electrification efforts and renewable energy installations in these regions. Governments seek to improve energy access and grid stability using advanced storage solutions. It faces challenges related to infrastructure development and capital investment but shows promising potential through international funding and partnerships. The market outlook remains positive due to increasing awareness and demand for clean energy technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Voltstorage

- Largo

- Everflow

- VRB Energy

- Primus Power

- Invinity Energy Systems

- Elestor

- Redflow

- ESS

Competitive Analysis

The stationary flow battery storage market features a competitive landscape dominated by established players and innovative startups. Key companies focus on technological advancements, product reliability, and strategic partnerships to strengthen their market position. It emphasizes research and development to improve energy density, reduce costs, and extend battery lifespan. Collaborations with utilities and industrial clients enable customized solutions that meet diverse application needs. Companies such as Voltstorage, Largo, and Invinity Energy Systems actively expand their global footprint through pilot projects and commercial deployments. Market participants also invest in scaling manufacturing capabilities to meet growing demand. Competitive differentiation relies on efficiency improvements, safety enhancements, and flexible system designs, which drive customer adoption and long-term contracts. Overall, it remains a dynamic market where innovation and strategic alliances determine leadership.

Recent Developments

- On May 21, 2025, Indian battery technology firm Pure partnered with Canadian energy storage solutions company Charge Power to offer energy storage products in North America, including residential, commercial, and grid-scale systems.

- In April 2025, XL Batteries launched its first grid-scale organic flow battery system in partnership with Stolthaven Terminals at their Houston facility, marking its commercial debut in long-duration energy storage.

- In 2025, Singapore-based VFlowTech secured $20.5 million to scale production and enhance digital features of its modular Powercube systems designed for long-duration storage.

- In June 2024, BASF Stationary Energy Storage GmbH and NGK Insulators, Ltd. introduced the NAS MODEL L24 sodium-sulfur battery, featuring reduced degradation and improved thermal management for extended storage applications.

Market Concentration & Characteristics

The stationary flow battery storage market exhibits moderate concentration with a mix of established firms and emerging innovators competing for market share. It features key players focusing on technological advancements, cost reduction, and strategic collaborations to strengthen their positions. The market remains fragmented due to ongoing research in various flow battery chemistries and regional differences in adoption rates. It benefits from partnerships between technology providers, utilities, and industrial customers that facilitate large-scale deployments. Companies invest heavily in scaling manufacturing capacity to meet increasing demand and improve economies of scale. The competitive environment encourages continuous innovation in efficiency, safety, and modularity. Customer requirements for long-duration, reliable energy storage solutions drive differentiation. Overall, the market’s dynamic nature reflects evolving technology and expanding applications, positioning it for significant growth while maintaining competitive intensity among participants.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The stationary flow battery storage market will expand due to rising renewable energy integration.

- It will benefit from increasing government support and clean energy policies globally.

- Technological innovations will enhance battery efficiency and reduce operational costs.

- Modular and scalable system designs will attract a broader customer base.

- Industries will adopt flow batteries to improve energy resilience and reduce emissions.

- The market will see growth in emerging economies with expanding electrification.

- Collaborations between technology providers and utilities will accelerate large-scale deployments.

- Awareness about long-duration energy storage benefits will drive wider market acceptance.

- Competition will intensify, encouraging continuous product improvements.

- Integration with smart grids and hybrid energy systems will create new opportunities.