Market Overview:

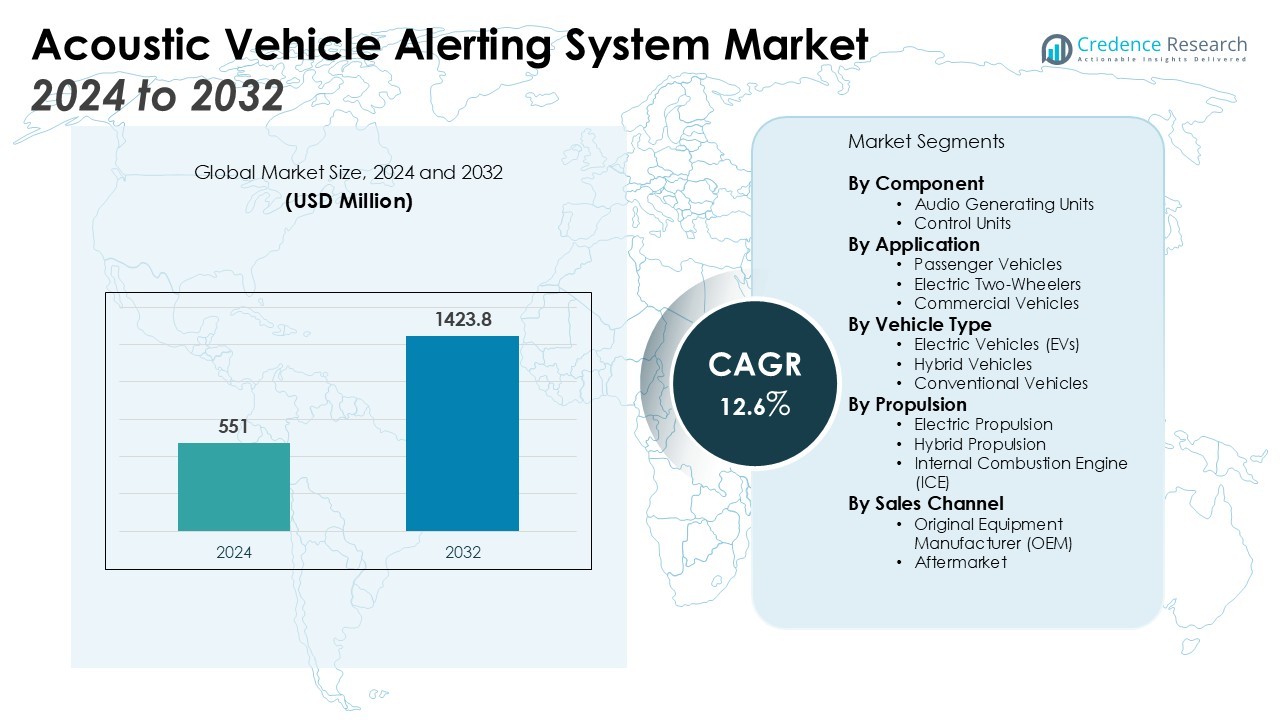

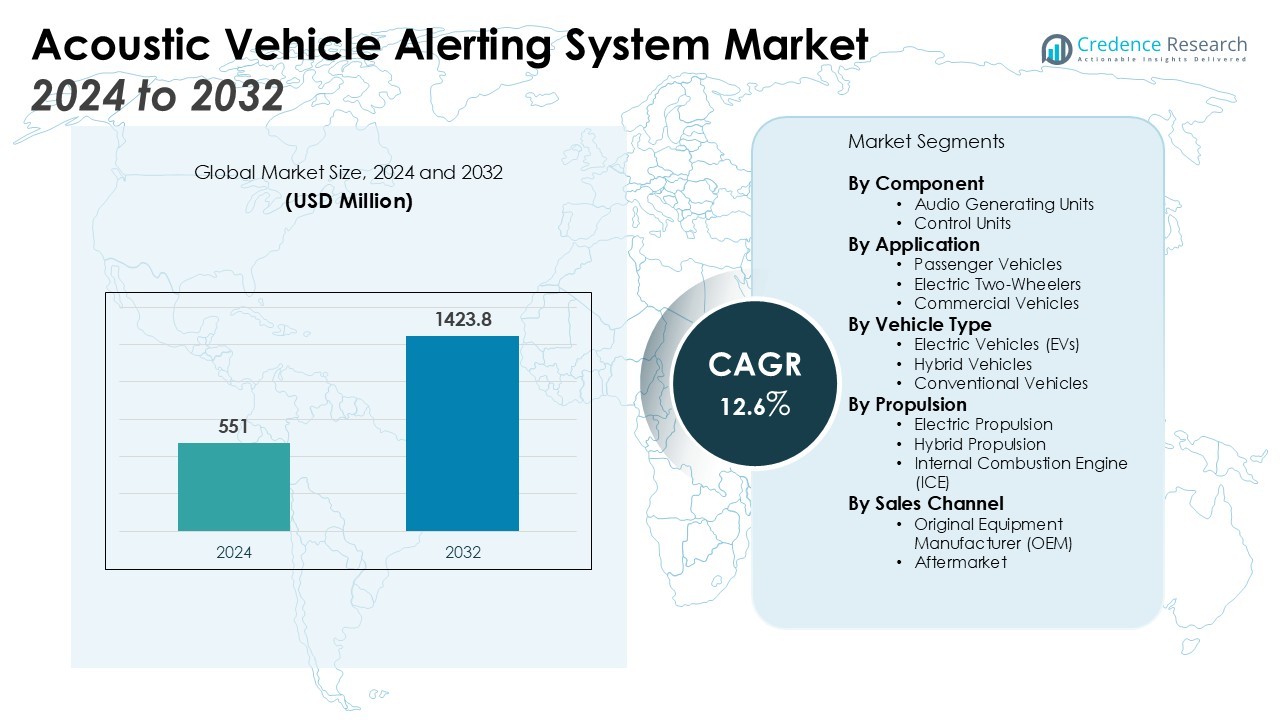

The Acoustic Vehicle Alerting System Market size was valued at USD 551 million in 2024 and is anticipated to reach USD 1423.8 million by 2032, at a CAGR of 12.6% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acoustic Vehicle Alerting System Market Size 2024 |

USD 551 Million |

| Acoustic Vehicle Alerting System Market, CAGR |

12.6% |

| Acoustic Vehicle Alerting System Market Size 2032 |

USD 1423.8 Million |

Key drivers of the AVAS market include stringent regulations requiring EVs to emit artificial sounds at low speeds to enhance pedestrian safety. This regulatory push, coupled with the growing adoption of electric two-wheelers and the development of autonomous vehicles, has accelerated the deployment of AVAS technologies. Additionally, advancements in sensor technologies and vehicle-to-everything (V2X) communication are enabling more sophisticated and context-aware alert systems. The increasing emphasis on sustainable transportation and government incentives for EV adoption further supports the market’s expansion.

Regionally, Asia Pacific holds the highest market share, attributed to the rapid penetration of EVs in countries like China and Japan. The region’s focus on smart-city initiatives and the integration of AVAS with V2X infrastructure further bolster its dominance. North America and Europe also exhibit substantial growth, driven by regulatory frameworks and increasing consumer demand for enhanced vehicle safety features. Additionally, strong investments in EV infrastructure in these regions are contributing to the increased adoption of AVAS technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Acoustic Vehicle Alerting System (AVAS) Market was valued at USD 551 million in 2024 and is expected to reach USD 1,423.8 million by 2032, growing at a CAGR of 12.6%.

- The growing adoption of electric vehicles, driven by environmental concerns and government incentives, significantly boosts the demand for AVAS technologies.

- Advancements in sensor technologies and vehicle-to-everything (V2X) communication enable more dynamic, context-sensitive alerts, enhancing safety without noise pollution.

- The rise of autonomous vehicles amplifies the need for AVAS integration, ensuring pedestrian safety in the absence of human drivers.

- Variations in regional sound emission standards pose challenges to global AVAS standardization, increasing costs for automakers.

- High implementation costs and technical complexities, such as AI integration, limit adoption, especially for smaller manufacturers in emerging markets.

- Asia Pacific leads the market with a 35% share, while North America and Europe see significant growth driven by regulatory frameworks and consumer demand for enhanced safety.

Market Drivers:

Stringent Regulatory Requirements for Pedestrian Safety

The Acoustic Vehicle Alerting System (AVAS) market is significantly driven by strict regulations that mandate electric vehicles (EVs) to generate artificial sounds at low speeds. These regulations are enforced to ensure pedestrian safety, especially in urban environments where quieter EVs can go unnoticed. Authorities across the globe, including the European Union, the United States, and Japan, have introduced guidelines requiring the implementation of AVAS in EVs, particularly at speeds below 30 km/h. This push is crucial in preventing accidents and enhancing public awareness of the presence of silent vehicles on the road.

- For instance, Brigade Electronics has developed its Quiet Vehicle Sounder AVAS to operate within the legally mandated sound level, which according to UN Regulation 138 must not exceed 75 decibels.

Rise in Electric Vehicle Adoption

The increasing adoption of electric vehicles (EVs) directly contributes to the growing demand for AVAS technologies. EV sales have surged globally due to heightened environmental concerns, stricter emission regulations, and government incentives. The rapid penetration of electric two-wheelers and passenger vehicles, especially in regions like Asia Pacific, further accelerates the need for AVAS systems. These vehicles, often too quiet for pedestrians to hear, necessitate artificial sound systems for safety, creating a robust demand for AVAS solutions in the automotive market.

- For instance, BYD’s Super e-Platform technology, launched on new models in 2025, enables its vehicles to add 400 kilometers of range with just a 5-minute charge.

Technological Advancements in Sensor and Communication Systems

Advancements in sensor technologies and vehicle-to-everything (V2X) communication have propelled the evolution of Acoustic Vehicle Alerting Systems. These technologies enable AVAS to generate more dynamic and context-sensitive alerts that respond to real-time environmental conditions, such as traffic density and pedestrian presence. With sensors becoming increasingly more accurate and efficient, AVAS can now provide tailored alerts, improving safety without causing noise pollution, further expanding its market adoption.

Expansion of Autonomous and Connected Vehicle Markets

The rise of autonomous vehicles (AVs) and connected car technologies is another major driver for the AVAS market. As AVs lack traditional human drivers, the need for systems that ensure pedestrian safety is amplified. AVAS solutions are integrated into these vehicles to provide audio cues that signify vehicle movement, alerting nearby pedestrians of potential hazards. The convergence of autonomous driving technology and AVAS not only enhances safety but also opens up new opportunities for growth within the market.

Market Trends:

Integration of Smart Technologies in Acoustic Vehicle Alerting Systems

The Acoustic Vehicle Alerting System (AVAS) market is witnessing a significant trend toward the integration of smart technologies. The incorporation of sensors, artificial intelligence (AI), and vehicle-to-everything (V2X) communication is enhancing the effectiveness of AVAS. These technologies enable the system to produce sound alerts based on real-time environmental factors, such as traffic conditions, pedestrian movement, and vehicle speed. By utilizing AI, AVAS can generate tailored and context-specific sounds, offering a more personalized safety experience. This trend is gaining traction, particularly in advanced markets such as North America and Europe, where the focus is on increasing vehicle safety and reducing road accidents. The integration of smart technologies not only improves pedestrian safety but also contributes to the development of autonomous and connected vehicle ecosystems.

- For instance, the ROHM group company LAPIS Technology has developed the ML22120xx series of speech synthesis ICs specifically for AVAS, which use a hardware-based configuration.

Rising Consumer Demand for Customizable and Aesthetic Sound Options

Another key trend in the Acoustic Vehicle Alerting System market is the growing consumer demand for customizable and aesthetically pleasing sound options. As electric vehicles (EVs) become more mainstream, manufacturers are moving beyond basic alert sounds and offering consumers the option to personalize the auditory experience. This shift reflects a desire for more human-centric, pleasant, and brand-specific sounds that align with a vehicle’s overall design and driving experience. Car manufacturers are increasingly investing in R&D to create sounds that are not only effective in ensuring pedestrian safety but also enhance the vehicle’s appeal. With a focus on enhancing the driving experience and aligning with eco-friendly innovations, AVAS is evolving to cater to a more personalized market segment.

- For instance, Audi’s sound engineers composed the unique e-sound for the e-tron GT by layering and mixing 32 separate acoustic sound elements to create a distinctive and high-quality driving sound.

Market Challenges Analysis:

Challenges in Standardizing Acoustic Vehicle Alerting Systems

The Acoustic Vehicle Alerting System (AVAS) market faces challenges in establishing global standards for sound emission requirements. While several regions have implemented regulations, such as the European Union’s requirement for AVAS in electric vehicles (EVs), inconsistencies in sound level standards and sound types still exist across different markets. These variations can lead to difficulties for automakers trying to develop systems that comply with multiple regulations while maintaining a consistent user experience. The lack of uniformity also complicates the global supply chain and increases costs for manufacturers, who must tailor systems to meet specific local requirements. This challenge is amplified as the market moves towards more autonomous and connected vehicles, which demand even stricter and more specific regulations.

Cost Constraints and Technical Limitations

The cost of implementing high-quality AVAS solutions remains a significant challenge for manufacturers. Advanced technologies, such as AI integration and real-time sensor data processing, increase the overall cost of acoustic systems. Smaller manufacturers, especially in emerging markets, may find it difficult to adopt these advanced technologies, leading to slower market penetration. Technical limitations also exist in balancing the effectiveness of sound alerts with noise pollution concerns. Striking the right balance between safety and minimizing sound disturbance is complex, and improving this aspect of AVAS requires continuous innovation and investment in research.

Market Opportunities:

Expansion of Electric Vehicle Market Presents Growth Opportunities

The rapid expansion of the electric vehicle (EV) market presents significant opportunities for the Acoustic Vehicle Alerting System (AVAS) market. As the global shift towards electric mobility accelerates, the need for safety features like AVAS becomes more pronounced. With increasing government regulations around EVs, such as mandatory sound emission standards for low-speed operation, automakers are investing in AVAS technologies to comply with these rules. This trend creates a growing market for advanced, customizable AVAS solutions, providing opportunities for manufacturers to innovate and offer tailored products that align with different market preferences. Furthermore, the proliferation of EVs in regions like Asia-Pacific and North America opens up substantial growth potential for AVAS deployment.

Integration with Autonomous Vehicle Technologies

The rise of autonomous vehicles (AVs) also presents a unique opportunity for the AVAS market. As self-driving vehicles continue to gain traction, there is a need for systems that ensure pedestrian awareness and vehicle presence. AVAS technology, integrated into AVs, will help bridge the safety gap in environments where traditional sound cues from human-driven vehicles are absent. The demand for AVAS in autonomous vehicles is expected to increase as these vehicles move towards mainstream adoption. This integration not only supports pedestrian safety but also aligns with the ongoing advancements in smart transportation ecosystems.

Market Segmentation Analysis:

By Component:

The market is divided into two main components: audio generating units and control units. Audio generating units hold the largest market share, driven by their role in emitting sound to alert pedestrians and cyclists of a vehicle’s presence. Control units, responsible for managing the sound output, are expected to grow steadily as vehicle manufacturers increasingly incorporate advanced control systems to meet regulatory requirements.

- For instance, the NTI Audio FX100 Audio Analyzer, used for comprehensive audio analysis in research and quality control, offers a wide level measurement range starting from 1 µV.

By Application:

The primary applications of AVAS include passenger vehicles, electric two-wheelers, and commercial vehicles. Passenger vehicles dominate the market due to the increasing number of electric and hybrid vehicles. The electric two-wheeler segment is growing rapidly, especially in regions with high EV adoption, such as Asia Pacific. Commercial vehicles also present significant growth potential as regulations extend to larger electric vehicles.

- For instance, a 2024 scientific study on the perceptual evaluation of AVAS conducted detailed measurements and auralizations on the specific warning sounds from 3 different models of electric passenger cars: a Tesla Model Y, a Volkswagen ID.3, and a Nissan Leaf.

By Vehicle Type:

The AVAS market is segmented into electric vehicles (EVs), hybrid vehicles, and conventional vehicles. EVs account for the largest share, driven by stringent regulations in regions like North America and Europe requiring artificial sound emission at low speeds. Hybrid vehicles follow closely, as they combine electric and internal combustion engine systems. Conventional vehicles, while not a major focus for AVAS, continue to contribute to the market as manufacturers adopt electric technologies in their fleets.

Segmentations:

- By Component:

- Audio Generating Units

- Control Units

- By Application:

- Passenger Vehicles

- Electric Two-Wheelers

- Commercial Vehicles

- By Vehicle Type:

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Conventional Vehicles

- By Propulsion:

- Electric Propulsion

- Hybrid Propulsion

- Internal Combustion Engine (ICE)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World

Regional Analysis:

North America: Leading the Acoustic Vehicle Alerting System Market

North America dominates the Acoustic Vehicle Alerting System (AVAS) Market with a market share of 35%, driven by stringent regulatory standards and growing concerns about pedestrian safety. The U.S. leads the market, with the National Highway Traffic Safety Administration (NHTSA) mandating the use of AVAS in electric and hybrid vehicles to improve their detectability in low-speed environments. The increasing number of electric vehicles (EVs) in the region further supports the demand for these systems. The market’s growth is further fueled by substantial automotive industry investments in advanced technologies and the region’s focus on enhancing vehicle safety features.

Europe: Strong Regulatory Frameworks and Advancements in Technology

Europe accounts for 30% of the Acoustic Vehicle Alerting System Market, driven by robust regulations such as the European Union’s mandate for AVAS in electric and hybrid vehicles. These regulations ensure that vehicles produce sufficient noise to alert pedestrians and cyclists, addressing safety concerns in urban areas. Additionally, the automotive industry in Europe is actively integrating innovative technologies, such as artificial intelligence and machine learning, to enhance AVAS functionality. This technological advancement contributes to improving the system’s effectiveness, leading to increased adoption across European countries.

Asia-Pacific: Rapid Urbanization and Growing EV Adoption

The Asia-Pacific region holds 25% of the Acoustic Vehicle Alerting System Market, driven by rapid urbanization, industrialization, and the rise of electric vehicle adoption. Countries like China, Japan, and South Korea are witnessing significant advancements in the EV sector, with government incentives and policies further promoting electric mobility. As the number of electric vehicles on the road increases, the need for AVAS becomes more pronounced, particularly in densely populated urban areas. The region’s growing awareness of pedestrian safety and environmental concerns also drives the adoption of AVAS technology.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kendrion NV

- Mercedes-Benz AG

- Kufatec GmbH & Co. Kg

- Texas Instruments

- Hella Gmbh & Co. KGaA

- Harman International

- Honda Motor Company

- Brigade Electronics

- Continental Engineering Services GmbH

- Soundracer AB

Competitive Analysis:

The Acoustic Vehicle Alerting System (AVAS) Market is highly competitive, with several key players focusing on technological advancements and regulatory compliance to gain market share. Leading companies include Continental AG, Bosch, Delphi Technologies, and Denso Corporation. These players are investing heavily in R&D to develop advanced AVAS solutions that offer dynamic sound generation, integration with vehicle-to-everything (V2X) systems, and improved pedestrian safety features. The market is also witnessing collaborations between automotive manufacturers and AVAS solution providers to meet stringent regulatory standards for electric and hybrid vehicles. Companies are expanding their product portfolios by introducing systems tailored to specific vehicle types, such as electric two-wheelers and commercial vehicles. The competitive landscape is further shaped by the growing emphasis on autonomous vehicle integration, with players focusing on seamless AVAS technology integration in these advanced systems.

Recent Developments:

- In July 2025, Hella launched its first series production of the 48V Flatpack energy management solution in China.

- In February 2025, Hella formed a strategic partnership with BrightView Technologies, Inc. to advance automotive lighting technologies.

- In May 2025, Harman announced an agreement to acquire the audio brands Bowers & Wilkins, Denon, Polk, and Marantz from Masimo.

Market Concentration & Characteristics:

The Acoustic Vehicle Alerting System (AVAS) Market is moderately concentrated, with a few dominant players controlling the majority of market share. Leading companies such as Continental AG, Bosch, and Delphi Technologies have established strong positions through extensive R&D and strategic partnerships with automotive manufacturers. These players focus on developing advanced technologies that comply with stringent regulations and address the growing demand for pedestrian safety in electric and hybrid vehicles. The market is characterized by high competition in innovation, with companies striving to enhance sound clarity, integration with vehicle-to-everything (V2X) systems, and customization for various vehicle types. New entrants face challenges in competing with established players due to the high capital investment required for R&D and compliance with regulatory standards. Despite this, the market continues to evolve with increasing demand for safer and smarter AVAS solutions in both urban and autonomous vehicle settings.

Report Coverage:

The research report offers an in-depth analysis based on Component, Application, Vehicle Type, Propulsion, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Acoustic Vehicle Alerting System (AVAS) Market is set to expand significantly, driven by increasing adoption of electric and hybrid vehicles.

- Regulatory mandates worldwide are enforcing the integration of AVAS in electric vehicles to enhance pedestrian safety.

- Technological advancements are leading to the development of more efficient and context-aware alert systems.

- The rise of autonomous vehicles is creating new opportunities for AVAS integration to ensure pedestrian awareness.

- Consumer awareness regarding pedestrian safety is prompting demand for vehicles equipped with AVAS.

- Advancements in sensor technologies are improving the effectiveness of AVAS in various environmental conditions.

- The expansion of electric vehicle infrastructure is facilitating the widespread adoption of AVAS.

- Collaborations between automotive manufacturers and technology providers are accelerating AVAS development.

- The focus on sustainable transportation is indirectly promoting the growth of the AVAS market.

- Investments in research and development are leading to innovative solutions in AVAS technology.

- The global push towards smart cities is integrating AVAS with vehicle-to-everything (V2X) communication systems.