Market Overview

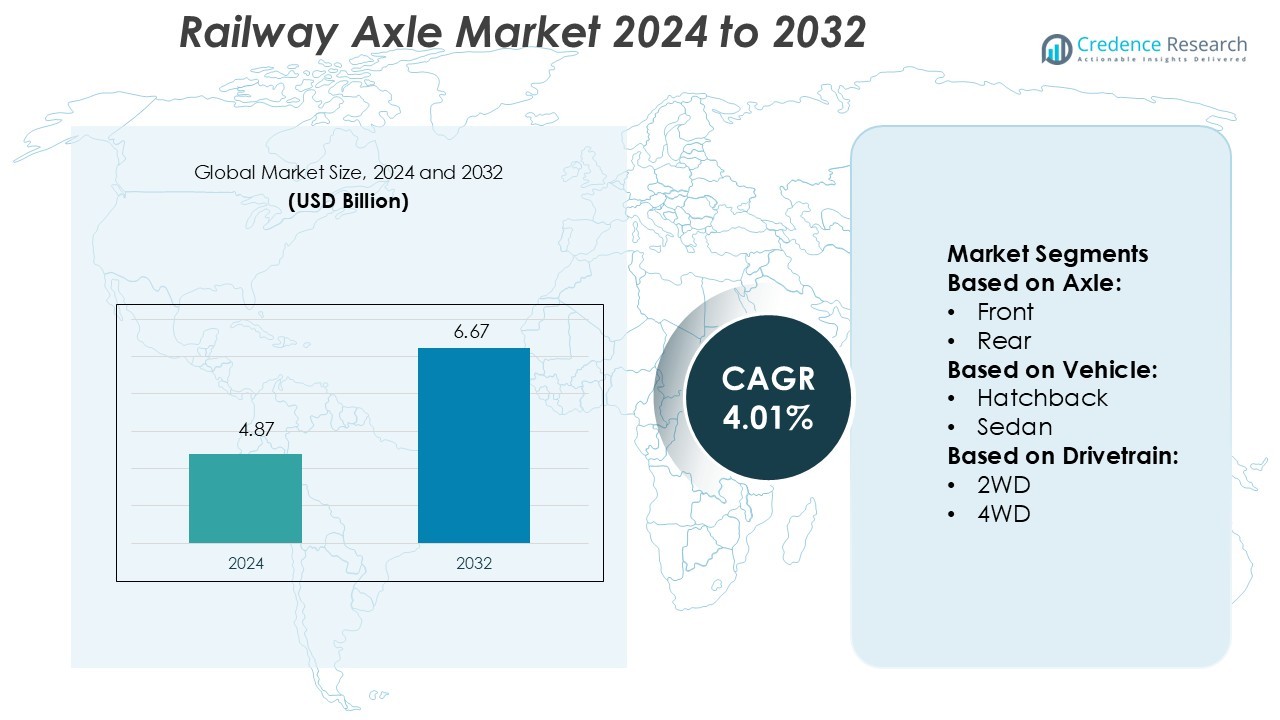

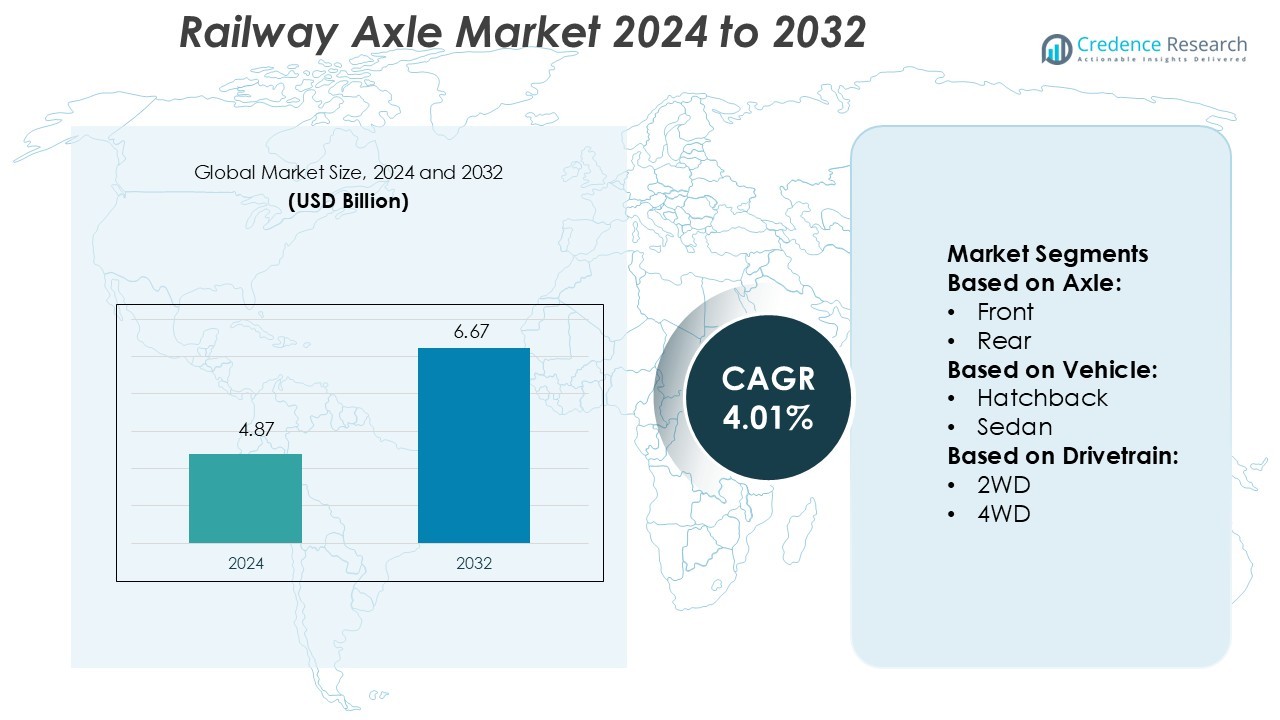

Railway Axle Market size was valued USD 4.87 billion in 2024 and is anticipated to reach USD 6.67 billion by 2032, at a CAGR of 4.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Railway Axle Market Size 2024 |

USD 4.87 Billion |

| Railway Axle Market, CAGR |

4.01% |

| Railway Axle Market Size 2032 |

USD 6.67 Billion |

The Railway Axle Market is driven by prominent players such as Mando, ZF Friedrichshafen, Benteler International, Meritor, Hyundai Transys, Schaeffler, GKN Automotive, Daimler, Dana, and AMA. These companies focus on developing lightweight, durable, and energy-efficient axle systems for passenger and freight applications. They emphasize digital diagnostics, precision engineering, and sustainable materials to enhance performance and reduce maintenance costs. Strategic collaborations with rail manufacturers and infrastructure developers strengthen their market positions globally. Asia-Pacific leads the market with a 36.2% share, supported by rapid rail expansion in China, India, and Japan, along with significant investments in high-speed and metro train projects that drive regional axle demand.Top of Form

Market Insights

- The Railway Axle Market was valued at USD 4.87 billion in 2024 and is projected to reach USD 6.67 billion by 2032, growing at a CAGR of 4.01% during the forecast period.

- Rising demand for high-speed and electric trains is driving the market, supported by investments in durable, lightweight axle systems designed to enhance fuel efficiency and operational reliability.

- Increasing adoption of smart technologies, including sensor-based axle monitoring and predictive maintenance, is transforming rail operations and reducing downtime across major fleets.

- The market is highly competitive, with key players focusing on advanced materials, digital diagnostics, and strategic partnerships to expand global reach and product performance.

- Asia-Pacific leads with a 36.2% market share, followed by Europe at 32.4%, while the rear axle segment dominates with a 52.7% share, driven by strong demand from freight and heavy-duty rail applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Axle

The rear axle segment held the dominant market share of 52.7% in 2024, driven by its critical role in supporting vehicle load and transmitting power from the differential to the wheels. Rear axles are commonly used in heavy-duty and commercial vehicles where strength and torque handling are essential. Increasing demand for high-performance axles with improved fatigue strength and wear resistance supports this dominance. Advancements in forged steel and composite materials enhance axle durability, boosting adoption in trucks, buses, and rail freight vehicles requiring high load-bearing capacity.

- For instance, ZF Friedrichshafen introduced the AxTrax 2 dual electric axle platform, designed for heavy-duty Class 8 trucks. This model uses two e-motors to deliver a continuous output of 380 kW and a peak torque of up to 54,800 Nm.

By Vehicle

The heavy commercial vehicle segment accounted for the largest market share of 41.3% in 2024 due to its extensive use in freight transport and logistics. High load capacity, long-distance durability, and increasing infrastructure investments drive this segment. Manufacturers are focusing on lightweight yet strong axle systems to improve fuel efficiency without compromising performance. Electric and hybrid truck models are also fueling innovation in axle designs optimized for high torque transfer. Continuous fleet modernization across developed and emerging economies further supports the segment’s growth.

- For instance, Meritor’s 14Xe™ is a fully integrated, all-electric drive system designed for medium- and heavy-duty commercial vehicles, consolidating the electric motor and transmission within the axle’s carrier.

By Drivetrain

In drivetrain type, the 2WD segment led the market with a 58.6% share in 2024, favored for its lower maintenance cost, simpler design, and suitability for passenger and light commercial vehicles. However, AWD and 4WD systems are gaining traction in SUVs and off-road applications for better traction and stability. By sales channel, the OEM segment dominated with a 64.9% share, supported by growing production of electric and heavy-duty vehicles. Automakers’ emphasis on integrating advanced axle assemblies during production continues to drive OEM-led growth, ensuring system compatibility and quality assurance.

Key Growth Drivers

Rising Investments in Rail Infrastructure

Growing public and private investments in rail infrastructure projects drive demand for railway axles. Countries are expanding metro networks, high-speed trains, and freight corridors to improve connectivity and reduce congestion. These projects require durable and high-performance axles capable of handling heavy loads and high speeds. Governments in Asia-Pacific and Europe are allocating significant budgets for rail modernization. This expansion directly fuels the demand for advanced axle systems that meet stringent safety and efficiency standards across both passenger and freight rail applications.

- For instance, GKN Automotive’s modular eDrive system for large electric vehicle applications is capable of generating up to 5,300 Nm of torque in a single unit.

Increasing Adoption of Electric and Hybrid Locomotives

The global transition toward sustainable transport is encouraging the adoption of electric and hybrid locomotives. These locomotives require optimized axle systems that support higher torque and efficient power transmission. Manufacturers are developing lightweight, high-strength axle materials to enhance performance while minimizing energy loss. For instance, axle designs compatible with regenerative braking systems are gaining traction. As electrification expands across rail networks, demand for specialized axles engineered for electric propulsion and low maintenance will continue to grow, driving overall market expansion.

- For instance, CRRC Corporation has supplied thousands of high-speed trainsets for China’s railway network, including the Fuxing series, which is capable of operating at speeds up to 350 km/h.

Advancements in Material and Manufacturing Technologies

Technological innovation in materials and production methods significantly boosts axle performance and reliability. Manufacturers are integrating forged steel and composite alloys to reduce axle weight while improving fatigue strength. Automation and precision machining enhance production efficiency and consistency. The adoption of additive manufacturing and non-destructive testing ensures product quality and cost-effectiveness. These innovations enable axles to withstand harsh operational conditions with longer service life. The continuous evolution of manufacturing technologies supports the production of efficient, sustainable, and high-performance axle systems.

Key Trends & Opportunities

Shift Toward Lightweight and High-Durability Axles

The demand for lightweight yet strong axle systems is increasing as rail operators seek to enhance fuel efficiency and reduce maintenance costs. Composite and alloy-based axles provide superior load-bearing capacity with reduced overall weight. Manufacturers are focusing on hybrid material axles that combine steel and carbon fiber for improved durability. These designs also support faster train speeds and longer service intervals. The shift toward weight-optimized axles creates new opportunities for suppliers specializing in high-performance materials and advanced engineering solutions.

- For instance, Honeywell’s ground transportation solutions include the HGuide n580 inertial navigation system, which provides robust and continuous positioning, particularly in challenging environments like tunnels and urban canyons where GNSS signals may be denied or blocked.

Growing Digitalization and Predictive Maintenance

Digital transformation is reshaping axle performance monitoring and maintenance strategies. The integration of IoT sensors and predictive analytics enables real-time axle condition tracking. Rail operators can detect stress, vibration, or temperature anomalies before failures occur, reducing downtime and repair costs. Companies are investing in smart axle systems embedded with telemetry and diagnostic features. This data-driven approach enhances safety and extends component lifespan. As predictive maintenance becomes standard practice, demand for connected and intelligent axle solutions continues to rise globally.

- For instance, Hitachi Rail’s HMAX platform is fitted to over 2,000 trains and more than 200,000 asset-systems, processing real-time and batch data from sensors monitoring bogie and wheelset health, track vibration, overhead line condition, and train-vehicle subsystems to enable condition-based maintenance rather than fixed schedules.

Key Challenges

High Production and Maintenance Costs

The manufacturing of railway axles involves high-grade materials and precision engineering, which increase production costs. The need for advanced testing and certification adds further expenses. Maintenance costs are also significant, particularly for freight and high-speed applications exposed to heavy loads. Smaller manufacturers struggle to balance quality and affordability, limiting market competitiveness. Price-sensitive regions often delay fleet upgrades due to budget constraints. These factors collectively restrict market expansion, especially among developing economies with limited rail modernization funding.

Stringent Regulatory and Safety Standards

Railway axle manufacturers must comply with strict global standards covering fatigue life, load performance, and safety certification. Meeting these requirements demands advanced testing equipment, rigorous quality control, and documentation. Regulatory variations across regions further complicate compliance for exporters. Non-compliance can lead to costly recalls or operational restrictions. These challenges increase production complexity and hinder small players’ participation. Continuous adaptation to evolving international standards remains a critical challenge for manufacturers aiming to ensure reliability, interoperability, and long-term certification.

Regional Analysis

North America

North America held a 28.6% share of the global railway axle market in 2024, driven by the modernization of freight and passenger rail systems. The United States and Canada are investing heavily in rail infrastructure upgrades, focusing on fuel-efficient and durable axle technologies. Growth in intercity passenger services and cross-border freight operations supports steady demand. Key manufacturers are emphasizing lightweight axle materials and predictive maintenance systems. Additionally, government funding for sustainable rail mobility and high-speed train projects strengthens regional production and adoption of advanced axle assemblies.

Europe

Europe accounted for 32.4% of the global market share in 2024, leading due to extensive railway networks and strict safety standards. The region’s focus on electrification and sustainable mobility boosts demand for high-performance axles. Countries such as Germany, France, and the United Kingdom invest in advanced axle materials for high-speed and metro trains. Ongoing projects under the EU Green Deal promote efficient and eco-friendly rail systems. Leading companies collaborate with technology providers to enhance axle monitoring and reduce lifecycle costs, further reinforcing Europe’s dominance in the global railway axle industry.

Asia-Pacific

Asia-Pacific dominated the market with a 36.2% share in 2024, supported by rapid urbanization and large-scale rail expansion in China, India, and Japan. Governments are investing heavily in high-speed rail and metro systems to improve urban connectivity. Rising manufacturing capabilities and cost-effective labor strengthen regional production capacity. Demand for freight rail axles is also growing due to expanding trade and industrial activity. Innovations in axle durability and high-load capacity materials drive growth. Local manufacturers increasingly export to Europe and the Middle East, making Asia-Pacific the fastest-growing market for railway axles.

Latin America

Latin America captured a 1.8% share of the railway axle market in 2024, supported by gradual infrastructure development in Brazil, Mexico, and Argentina. Efforts to upgrade freight corridors and metro systems are creating moderate demand for durable and cost-efficient axles. Governments are encouraging public-private partnerships to modernize outdated fleets. Suppliers are focusing on axle refurbishment and low-maintenance designs to meet regional needs. Although growth remains slower compared to other regions, expanding mining and logistics sectors present potential opportunities for future axle demand across heavy-duty rail applications.

Middle East & Africa

The Middle East & Africa region held a 1.0% share in 2024, with emerging opportunities in rail connectivity and freight infrastructure. Countries such as Saudi Arabia, the UAE, and South Africa are investing in long-distance and urban rail projects. The GCC’s focus on smart and integrated transport systems drives axle modernization initiatives. African nations are gradually adopting rail as a key logistics mode, supported by international funding. Demand for robust, heat-resistant axle systems is rising due to harsh operating conditions. Strategic collaborations with global manufacturers are strengthening regional technological capabilities.

Market Segmentations:

By Axle:

By Vehicle:

By Drivetrain:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Railway Axle Market features strong competition among key players such as Mando, ZF Friedrichshafen, Benteler International, Meritor, Hyundai Transys, Schaeffler, GKN Automotive, Daimler, Dana, and AMA. The railway axle market is highly competitive, characterized by continuous technological advancements and product innovation. Manufacturers are investing in lightweight materials, such as forged steel and composite alloys, to enhance performance, durability, and energy efficiency. Automation and precision machining technologies are being adopted to improve axle accuracy and reduce production costs. The growing use of digital monitoring systems for real-time performance tracking and predictive maintenance further strengthens competitiveness. Additionally, global rail modernization initiatives and electrification projects are prompting suppliers to focus on sustainable designs that align with regulatory standards and evolving customer expectations.

Key Player Analysis

- Mando

- ZF Friedrichshafen

- Benteler International

- Meritor

- Hyundai Transys

- Schaeffler

- GKN Automotive

- Daimler

- Dana

- AMA

Recent Developments

- In June 2025, AAM announced a supply agreement with Scout Motors to provide front electric drive units (EDUs) and rear e-Beam axles for the all-new electric Scout Traveller SUV and Scout Terra pickup truck.

- In April 2025, ZF Commercial Vehicle Solutions (CVS) secured a multi-year contract to supply several thousand units of its AxTrax 2 electric axle to a leading Indian manufacturer.

- In December 2024, Dana Incorporated fitted the AdvanTEK 40 Pro axle system into 40,000-pound 6×4 tandem axle system. Their design improvements in the tandem axle class now enable fleets to have a more sophisticated 6×4 system which enhances vehicle durability and performance.

- In October 2024, MOOG announced the launch of its new line of Constant Velocity (CV) axles, engineered for high performance and durability. The CV axles are constructed with premium materials, feature heat-treated components for enhanced strength, neoprene boots to prevent contamination, and high-quality grease for optimal lubrication.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Axle, Vehicle, Drivetrain and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for lightweight and high-strength axle materials will continue to rise across regions.

- Electrification of rail networks will drive adoption of specialized axles for electric locomotives.

- Integration of smart sensors will enhance axle monitoring and predictive maintenance efficiency.

- Manufacturers will expand use of automation and robotics to improve production precision.

- Increasing focus on sustainable manufacturing will lead to the development of recyclable axle materials.

- Growth in high-speed rail projects will create demand for advanced fatigue-resistant axle systems.

- Emerging economies will invest heavily in rail infrastructure, boosting regional axle production.

- Digitalization and data analytics will optimize maintenance cycles and extend axle lifespan.

- Strategic collaborations between OEMs and component suppliers will accelerate innovation.

- Continuous regulatory alignment will ensure global standardization and enhance product reliability.