Market Overview

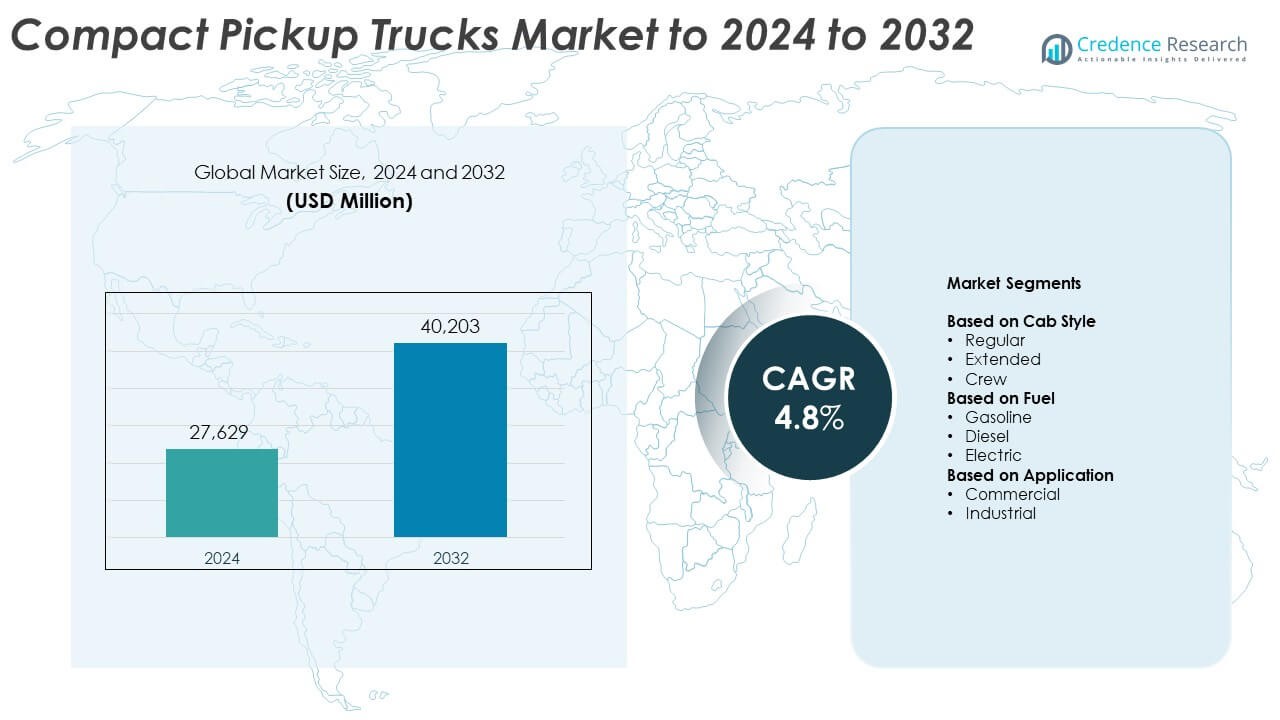

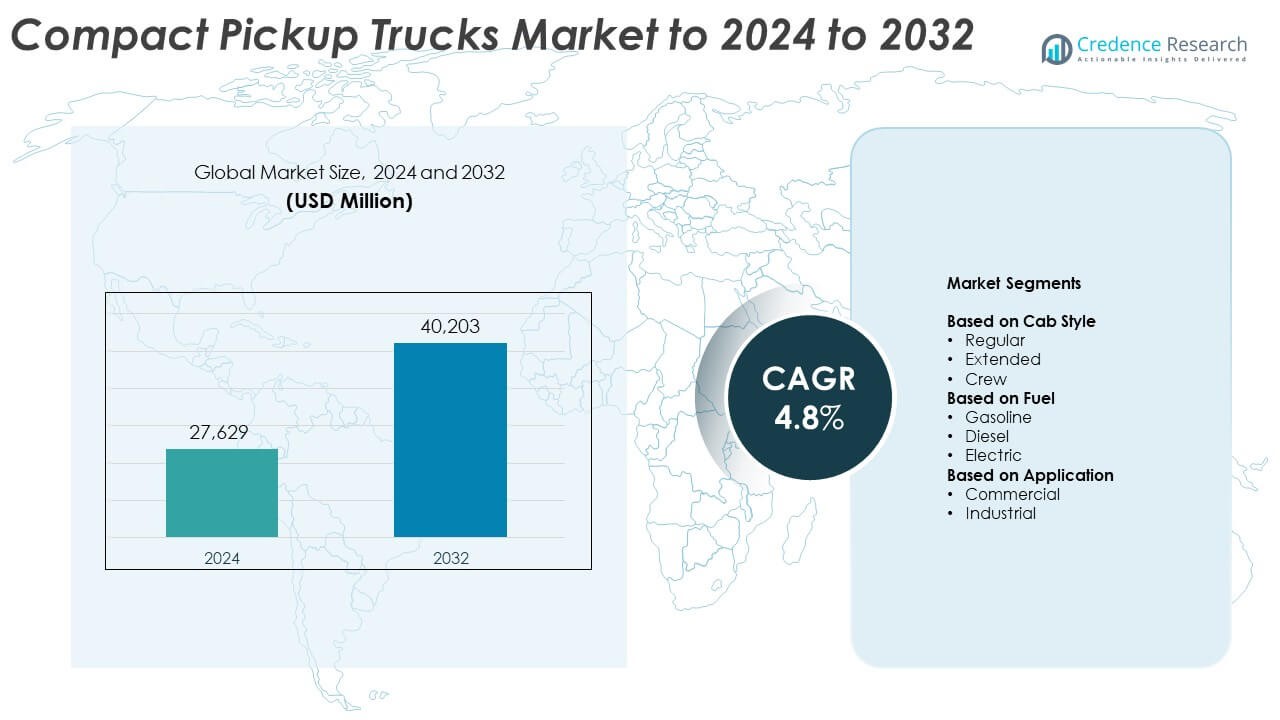

The Compact Pickup Trucks Market size was valued at USD 27,629 million in 2024 and is anticipated to reach USD 40,203 million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compact Pickup Trucks Market Size 2024 |

USD 27,629 Million |

| Compact Pickup Trucks Market, CAGR |

4.8% |

| Compact Pickup Trucks Market Size 2032 |

USD 40,203 Million |

The compact pickup trucks market is led by major players such as Ford Motor Company, Toyota Motor Corporation, General Motors Company, Hyundai Motor Corporation, and Tata Motors. These companies maintain a strong presence through extensive product portfolios, technological innovation, and global distribution networks. North America emerged as the leading region with a 55% market share in 2024, driven by high consumer demand and strong fleet adoption. Asia Pacific followed with a 22% share, supported by expanding urban infrastructure and growing small-business operations. Europe accounted for 18%, fueled by hybrid adoption and emission-compliant models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The compact pickup trucks market was valued at USD 27,629 million in 2024 and is projected to reach USD 40,203 million by 2032, growing at a CAGR of 4.8% during the forecast period.

- Rising demand for versatile, fuel-efficient vehicles for both personal and commercial use is a key driver of market growth.

- Electrification, advanced safety systems, and connectivity integration are emerging trends reshaping the design and performance of compact pickups.

- The market remains highly competitive, with global automakers focusing on hybrid and electric models to meet emission standards and consumer preferences.

- North America led with a 55% share in 2024, followed by Asia Pacific with 22% and Europe with 18%; among segments, the crew cab and gasoline categories dominated due to comfort, practicality, and wide infrastructure availability.

Market Segmentation Analysis:

By Cab Style

The crew cab segment dominated the compact pickup trucks market with a 47.2% share in 2024. Crew cabs are favored for their spacious interiors, four full-sized doors, and enhanced comfort for family and business use. The growing preference for lifestyle-oriented vehicles and multi-purpose usage in both personal and commercial settings supports this dominance. Automakers are expanding crew cab variants with advanced infotainment, driver-assistance systems, and ergonomic designs to attract younger buyers seeking performance and utility balance.

- For instance, the Hyundai Santa Cruz is available exclusively in a crew-cab configuration with four doors and a five-passenger seating capacity. The truck has an overall length of 195.7 inches and a curb-to-curb turning diameter of 39.6 feet.

By Fuel

The gasoline segment held the largest share of 61.5% in 2024, driven by the broad availability of fueling infrastructure and lower initial vehicle costs. Gasoline-powered compact pickups offer strong performance and are more suited for light-duty applications compared to diesel variants. Manufacturers are improving fuel efficiency with turbocharged engines and hybrid gasoline systems. However, the electric segment is gaining momentum as governments promote zero-emission vehicles and brands like Ford and Rivian launch compact EV pickups.

- For instance, the Chevrolet Montana’s 1.2-turbo engine returns an INMETRO-rated 12.3 km/L in the city and 13.7 km/L on the highway when running on gasoline (with an automatic transmission), which highlights its competitive fuel efficiency.

By Application

The commercial segment led the compact pickup trucks market with a 58.4% share in 2024. Businesses prefer compact pickups for their affordability, fuel efficiency, and ease of maneuverability in urban areas. They are widely used for small-scale logistics, service fleets, and utility operations. Growth in e-commerce deliveries and last-mile transportation has increased demand for compact pickups. Companies are introducing customizable cargo solutions and telematics to enhance fleet performance and reduce operational costs.

Key Growth Drivers

Rising Urban Demand for Versatile Vehicles

Compact pickup trucks are gaining popularity among urban consumers seeking multipurpose vehicles for both personal and light commercial use. Their smaller dimensions and improved fuel efficiency make them ideal for navigating congested city environments. Automakers are introducing flexible seating and storage designs to appeal to users who need daily commuting convenience and cargo capability. The growing adoption among small businesses and individual contractors continues to strengthen the segment’s expansion globally.

- For instance, Ford Maverick’s length is 199.7 inches. Its turning circle is 40.0 feet. Compact size eases urban parking and deliveries.

Technological Advancements and Electrification

Manufacturers are increasingly focusing on integrating advanced technology and electrification into compact pickup models. Features like adaptive cruise control, lane-keeping systems, and connected infotainment platforms enhance safety and comfort. The transition toward hybrid and fully electric models aligns with global emission-reduction goals, boosting consumer interest. Government incentives and expanding charging networks further support adoption, creating a favorable environment for long-term growth.

- For instance, Toyota Tacoma i-FORCE MAX produces 326 horsepower. Peak torque reaches 465 lb-ft. The hybrid pairs a 2.4-liter turbo with a 48-hp motor.

Expanding Small Business and E-commerce Operations

The rise of e-commerce and small-scale delivery services drives strong demand for compact pickups due to their cost efficiency and maneuverability. Businesses prefer these vehicles for urban logistics, maintenance, and transportation of light goods. Their lower ownership costs and improved payload capacity make them attractive for fleet operators. As delivery networks expand in emerging economies, compact pickups continue to play a critical role in last-mile logistics growth.

Key Trends and Opportunities

Growing Adoption of Electric Compact Pickups

Electric compact pickup models are becoming a significant opportunity area as automakers diversify powertrain portfolios. The adoption is supported by stricter emission standards and advancements in battery technology, extending range and performance. Companies are developing lightweight platforms optimized for electric propulsion, enhancing energy efficiency. Expanding government incentives and consumer interest in sustainable mobility are expected to further accelerate the shift toward electric variants.

- For instance, the 2025 Rivian R1T Dual-Motor with the Max battery pack offers an EPA-rated range of up to 410 miles (with 21-inch wheels), reflecting updated specifications for the vehicle.

Increased Customization and Premiumization

Consumers are showing a growing interest in customized and premium compact pickup models equipped with advanced interiors and connectivity features. Automakers are offering luxury-oriented trims, smart infotainment, and off-road packages to attract lifestyle buyers. This trend supports higher profitability while catering to diverse consumer needs. As customers prioritize comfort and design alongside utility, premium compact pickups are emerging as a key growth segment in developed markets.

- For instance, the GMC Canyon AT4X AEV has a 1.5-inch additional lift compared to the standard AT4X (resulting in a total 4.5-inch factory lift over the base model). With its 35-inch tires, ground clearance reaches 12.2 inches. It uses Multimatic DSSV dampers and boron-steel skid plates.

Key Challenges

High Production and Maintenance Costs

The integration of advanced electronics, emission systems, and lightweight materials increases production costs for compact pickup trucks. Manufacturers face challenges in maintaining competitive pricing while ensuring high performance and safety standards. Maintenance expenses also rise with the addition of complex onboard systems, impacting overall ownership costs. These factors can limit adoption, especially in price-sensitive regions.

Competition from SUVs and Mid-size Trucks

Compact pickups face strong competition from compact SUVs and mid-size trucks offering similar features with added comfort or capacity. Consumers often view SUVs as more versatile family vehicles, reducing the appeal of compact trucks. Additionally, automakers are prioritizing mid-size models for higher margins and broader market presence. This competition pressures compact pickup manufacturers to differentiate through design innovation and efficiency improvements.

Regional Analysis

North America

North America held approximately 55% share of the compact pickup trucks market in 2024. Demand stayed strong from retail buyers and small fleets. Urban delivery and lifestyle use supported steady orders. Localized manufacturing and wide dealer networks improved availability and service. Feature-rich crew cabs and gasoline powertrains remained popular choices. Hybrids gained traction in city fleets. Regulatory stability and healthy financing aided renewals and new purchases. Telematics adoption improved fleet uptime and cost control.

Europe

Europe accounted for about 18% share in 2024. Buyers favored efficient, multi-purpose models for mixed personal and business use. Emission rules encouraged lighter platforms and electrified variants. OEMs tailored trims, safety tech, and ride comfort to regional roads. Expansion of light commercial services in major cities lifted demand. Dealer incentives supported small-business purchases. Hybrid options entered municipal and utility fleets. Supply chain normalization improved delivery times across core markets.

Asia Pacific

Asia Pacific captured roughly 22% share in 2024. Rapid urbanization and growing SMEs boosted light-duty haulage needs. Thailand, Indonesia, and India showed solid retail and fleet uptake. Local production and component sourcing improved price competitiveness. Governments promoted cleaner powertrains, aiding hybrid introductions. E-commerce growth increased last-mile requirements. Road upgrades supported intercity operations for compact beds. New model launches targeted value buyers with connected features.

Latin America

Latin America represented about 3% share in 2024. Buyers valued low running costs and agility on mixed roads. Agriculture, utilities, and small traders drove steady orders. New entrants added competitive trims and safety bundles. Financing programs and improved parts logistics supported retention. Hybrid introductions started in a few metros. Regional assembly and imports balanced availability. Currency swings moderated pricing strategies and promotions.

Middle East & Africa

Middle East & Africa accounted for around 2% share in 2024. Demand came from construction, mining services, and municipal fleets. Compact models appealed as cost-effective alternatives to larger trucks. Growth concentrated in South Africa, UAE, and Saudi Arabia. Dealers expanded service packages for harsh environments. Emerging assembly projects improved supply resilience. Fleet buyers emphasized durability and payload within city limits. Electrified offerings began pilot deployments in select fleets.

Market Segmentations:

By Cab Style

By Fuel

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The compact pickup trucks market features strong competition among major automakers such as Ford Motor Company, Tata Motors, Hyundai Motor Corporation, Nissan Motor Co. Ltd., Ashok Leyland, Toyota Motor Corporation, General Motors Company, Dongfeng Motor Corporation, Honda Motor Co., Ltd., and China FAW Group Corp., Ltd. Market participants are focusing on introducing fuel-efficient and hybrid variants to meet tightening emission norms. Continuous investments in advanced safety systems, connectivity features, and lightweight chassis are reshaping product offerings. Manufacturers are expanding production capacity in emerging markets to reduce costs and address growing regional demand. Partnerships with battery suppliers and technology firms are strengthening the shift toward electric models. Companies are also diversifying product lines with premium trims, customizable interiors, and enhanced off-road performance. This competitive environment encourages consistent innovation, with firms leveraging digital marketing and fleet services to capture both commercial and lifestyle-driven consumer segments globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Ashok Leyland continued its strategic focus on the Light Commercial Vehicle (LCV) segment, which includes compact trucks like the Dost, Bada Dost, and the new Saathi.

- In August 2025, Ford announced plans to produce a new line of affordable electric vehicles on a “Universal EV Platform”.

- In 2023, Toyota unveiled the EPU concept (Electric PickUp) at the Japan Mobility Show.

Report Coverage

The research report offers an in-depth analysis based on Cab Style, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising urban demand for multipurpose vehicles.

- Automakers will focus on expanding electric and hybrid compact pickup lineups.

- Integration of advanced driver-assistance and connectivity features will become standard.

- Lightweight materials and modular platforms will improve efficiency and performance.

- Fleet electrification and government emission goals will boost adoption across logistics sectors.

- Customization options and premium variants will attract lifestyle and adventure users.

- Emerging economies in Asia-Pacific will continue to lead global production and sales.

- Partnerships between automakers and tech firms will enhance telematics and smart fleet management.

- Aftermarket services and digital platforms will expand for maintenance and tracking.

- Increasing competition from compact SUVs will push manufacturers toward innovation and differentiation.