Market Overview

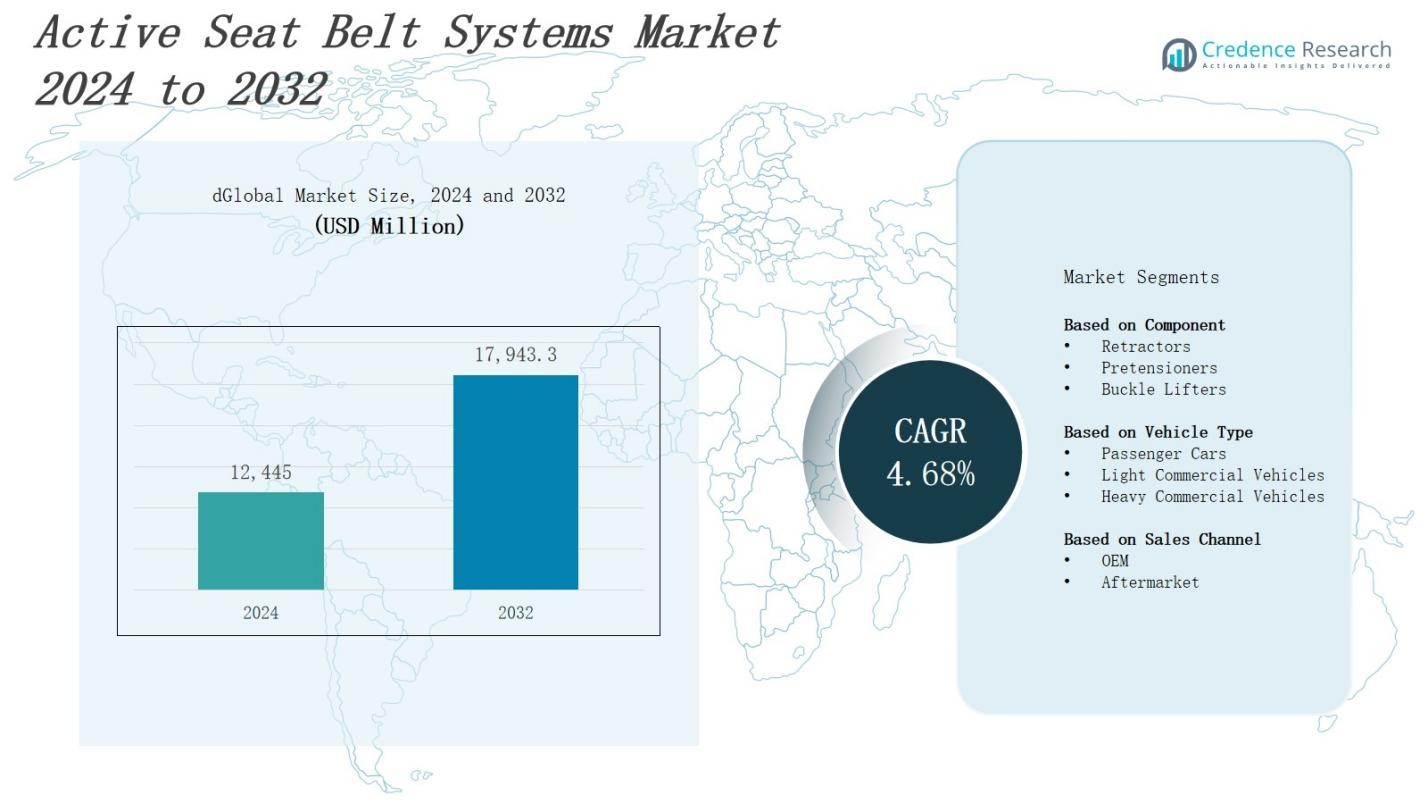

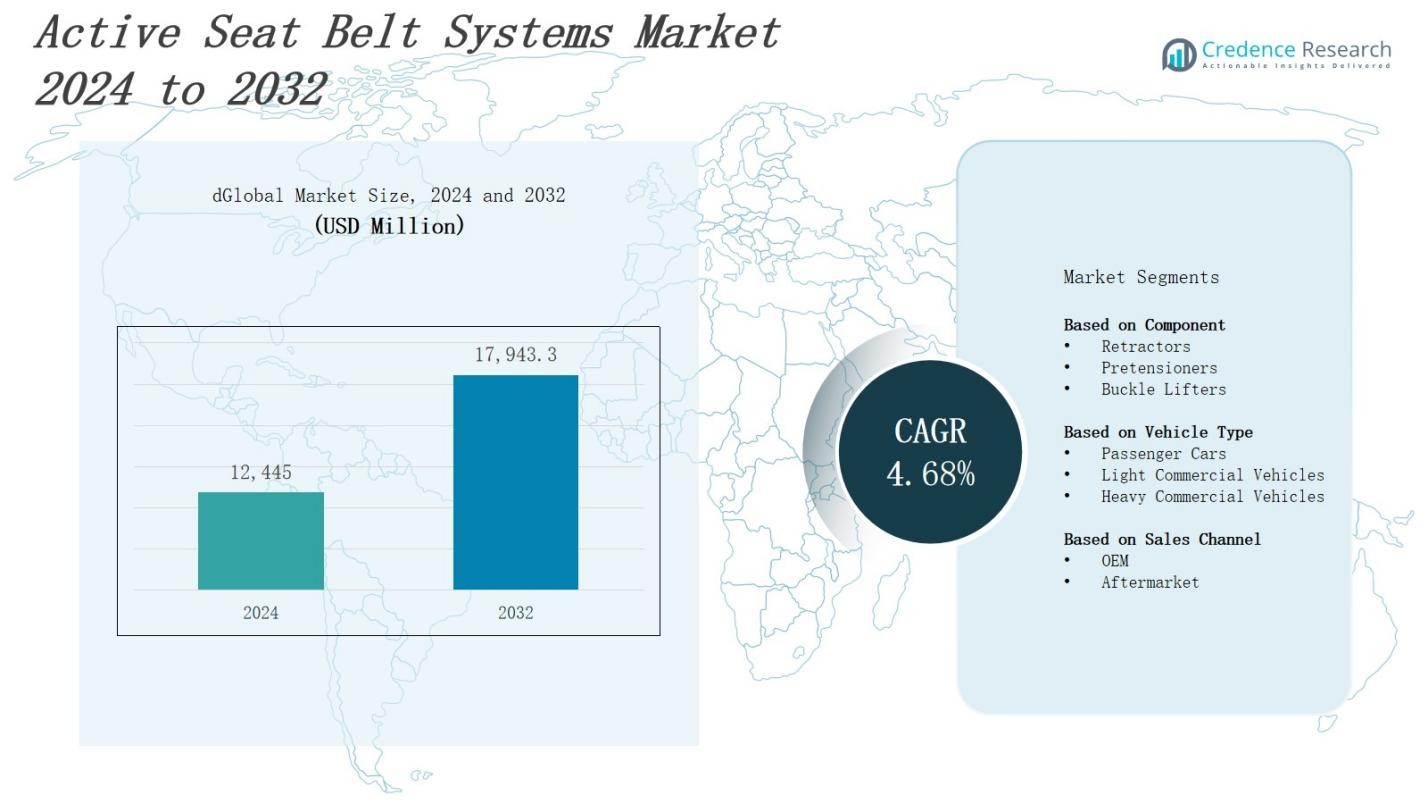

The active seat belt systems market is projected to grow from USD 12,445 million in 2024 to USD 17,943.3 million by 2032, registering a compound annual growth rate (CAGR) of 4.68%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Active Seat Belt Systems Market Size 2024 |

USD 12,445 Million |

| Active Seat Belt Systems Market, CAGR |

4.68% |

| Active Seat Belt Systems Market Size 2032 |

USD 17,943.3 Million |

The active seat belt systems market grows driven by increasing vehicle safety regulations and rising consumer awareness about occupant protection. Automakers prioritize integrating advanced safety technologies to reduce fatalities and injuries in accidents. Innovations such as pre-tensioners and adaptive load limiters enhance belt performance, boosting demand. The trend toward connected and autonomous vehicles further accelerates adoption, as these systems integrate with broader safety networks. Additionally, growing demand for premium and luxury vehicles supports market expansion. Regional emphasis on stringent safety standards and government initiatives to promote automotive safety also propel market growth globally.

The active seat belt systems market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World. North America and Europe lead with strong regulatory frameworks and high consumer demand, holding the largest market shares. Asia-Pacific shows rapid growth due to expanding automotive production and rising safety awareness. The Rest of the World, including Latin America, the Middle East, and Africa, presents emerging opportunities. Leading key players such as Autoliv Inc., Continental AG, Robert Bosch GmbH, Hyundai Mobis, and Joyson Safety Systems dominate the market through innovation and extensive regional presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The active seat belt systems market is projected to grow from USD 12,445 million in 2024 to USD 17,943.3 million by 2032, registering a CAGR of 4.68%.

- Increasing vehicle safety regulations and rising consumer awareness about occupant protection drive market growth, with automakers prioritizing advanced safety technologies to reduce fatalities and injuries.

- Innovations such as pre-tensioners and adaptive load limiters enhance belt performance, boosting demand across various vehicle segments.

- The trend toward connected and autonomous vehicles accelerates adoption as active seat belt systems integrate with broader safety networks.

- Growing demand for premium and luxury vehicles supports market expansion, complemented by regional emphasis on stringent safety standards and government safety initiatives.

- North America and Europe lead the market with strong regulatory frameworks and high consumer demand, holding 30% and 28% market shares, respectively.

- Asia-Pacific shows the fastest growth, capturing 27% market share due to expanding automotive production and rising safety awareness, while the Rest of the World holds 15%, driven by emerging opportunities in Latin America, the Middle East, and Africa.

Market Drivers

Stringent Vehicle Safety Regulations Propel Market Growth

Government authorities worldwide enforce strict vehicle safety standards to reduce road fatalities and injuries, driving demand for advanced restraint systems. The active seat belt systems market benefits from mandates requiring automakers to incorporate features like pre-tensioners and load limiters. Regulators continually update safety protocols to address emerging risks, compelling manufacturers to innovate. It ensures compliance and boosts consumer confidence in vehicle safety. Increasingly rigorous crash-test requirements further stimulate market adoption globally.

- For instance, Autoliv introduced a new generation of active seat belt technology in 2020 featuring enhanced pre-tensioning capabilities to meet evolving safety regulations.

Rising Consumer Awareness Enhances Adoption Rates

Growing awareness about vehicle safety and occupant protection motivates consumers to prioritize cars equipped with advanced safety technologies. The active seat belt systems market experiences increased demand as buyers seek enhanced protection during collisions. Consumers recognize the importance of adaptive restraint features that improve comfort and reduce injury severity. Automakers respond by integrating sophisticated belt systems to meet these expectations. It encourages innovation and expands market penetration, particularly in developed regions with safety-conscious buyers.

- For instance, Continental partnered with a major automaker in 2022 to integrate its active seat belt system in a luxury vehicle model, featuring pre-tensioning mechanisms that reduce injury risk in collisions by tightening the belts before impact.

Technological Advancements Drive Product Innovation

Continuous innovation in sensor technology and belt mechanism design advances the capabilities of active seat belt systems. Automakers incorporate smart features like occupant weight detection, tension adjustment, and integration with airbag control systems to improve effectiveness. The market benefits from enhanced reliability, comfort, and real-time responsiveness. It aligns with the broader trend of vehicle electrification and connectivity, which demands seamless safety integration. These technological improvements attract both OEMs and aftermarket sectors, fueling sustained market expansion.

Increasing Vehicle Production and Premium Segment Growth

The expansion of global vehicle production, especially in emerging markets, fuels demand for advanced safety components. The active seat belt systems market capitalizes on rising sales of passenger vehicles, including premium and luxury models that often come equipped with state-of-the-art restraint systems. It meets consumer expectations for comfort and safety features. OEMs prioritize incorporating these systems to differentiate products and comply with safety regulations. Growth in urbanization and disposable income supports the proliferation of vehicles with advanced safety solutions worldwide.

Market Trends

Integration of Advanced Safety Technologies Enhances System Effectiveness

The active seat belt systems market increasingly incorporates advanced technologies such as sensor-based pre-tensioners, adaptive load limiters, and occupant detection systems. These features optimize restraint force based on crash severity and occupant characteristics, improving protection and comfort. Integration with vehicle safety networks, including airbags and collision avoidance systems, strengthens overall occupant safety. It supports manufacturers’ efforts to meet evolving safety regulations and consumer demands for smarter, more responsive safety solutions in modern vehicles.

- For instance, ZF’s Multi-Stage Load Limiter system adjusts belt force according to occupant size and weight, reducing accident impacts while aligning with upcoming NCAP Roadmap 2030 safety standards.

Rising Adoption of Connected and Autonomous Vehicles Drives Market Evolution

Connected and autonomous vehicle technologies require sophisticated safety systems to ensure occupant protection in diverse driving scenarios. The active seat belt systems market adapts by offering smart restraint solutions that communicate with vehicle control units and external sensors. It enables real-time adjustment of belt tension and deployment timing, enhancing crash response. This trend aligns with broader automotive innovations, pushing manufacturers to develop intelligent seat belt systems that complement autonomous driving features and improve overall vehicle safety.

- For instance, Bosch is developing integrated safety systems capable of earlier collision detection that triggers multi-sensor coordinated responses including seatbelt pretensioners to enhance occupant protection in autonomous scenarios.

Focus on Lightweight Materials Supports Vehicle Efficiency Goals

The push for fuel efficiency and reduced emissions prompts automakers to use lightweight materials in safety components without compromising performance. The active seat belt systems market responds by incorporating high-strength, lightweight fabrics and components. It helps manufacturers reduce vehicle weight and improve fuel economy while maintaining occupant protection standards. This trend aligns with regulatory pressures on environmental impact and supports the broader shift toward sustainable automotive design practices.

Expansion of Premium and Luxury Vehicle Segments Fuels Demand

Increasing consumer preference for premium and luxury vehicles drives demand for advanced safety features, including sophisticated active seat belt systems. The market benefits from higher adoption rates in these segments due to the emphasis on comfort, customization, and cutting-edge technology. It encourages automakers to innovate and differentiate their offerings with enhanced restraint systems. Growth in disposable income and urbanization worldwide further supports the penetration of premium vehicles equipped with state-of-the-art safety technologies.

Market Challenges Analysis

High Production and Integration Costs Limit Market Expansion

The active seat belt systems market faces challenges due to the high costs associated with advanced sensor technologies and sophisticated belt mechanisms. Manufacturers encounter increased expenses during the design, testing, and integration phases, which can impact vehicle pricing and profitability. It restricts adoption, particularly in price-sensitive markets and entry-level vehicle segments. Suppliers must balance innovation with cost efficiency to maintain competitive pricing. The complexity of integrating these systems with existing vehicle safety networks also raises development costs and timelines.

Stringent Regulatory Compliance and Technical Standardization Pose Barriers

Compliance with diverse and evolving safety regulations across different regions presents challenges for the active seat belt systems market. Manufacturers must ensure systems meet multiple standards, requiring extensive validation and certification processes. It complicates product development and delays market entry. The lack of unified global technical standards hinders streamlined manufacturing and increases logistical complexities. Coordinating with various automotive safety authorities demands ongoing investment in research and adaptation, which can slow down innovation and scaling effort.

Market Opportunities

Expansion into Emerging Markets with Growing Automotive Production

The active seat belt systems market holds significant opportunity in emerging regions where automotive production and vehicle ownership are rapidly increasing. Rising urbanization and improving economic conditions boost demand for safer vehicles equipped with advanced restraint systems. It enables manufacturers to capture new customer bases by offering cost-effective, region-specific safety solutions. Collaborations with local OEMs and suppliers can accelerate market penetration. Growing government focus on road safety in these regions further supports the adoption of advanced seat belt technologies.

Advancements in Smart and Connected Vehicle Technologies Open New Avenues

The increasing adoption of connected and autonomous vehicles creates opportunities for the active seat belt systems market to develop integrated, intelligent restraint solutions. It can leverage real-time data and vehicle communication systems to optimize occupant protection dynamically. This trend encourages innovation in adaptive seat belt technologies that respond to various crash scenarios and occupant conditions. Partnerships with technology providers and investments in R&D can strengthen product portfolios. Growing consumer preference for vehicles with advanced safety features also drives demand for such smart systems.

Market Segmentation Analysis:

By Component

The active seat belt systems market segments into retractors, pretensioners, and buckle lifters based on components. Retractors dominate due to their critical role in controlling belt tension and ensuring occupant restraint during collisions. Pretensioners follow closely, enhancing safety by tightening the belt instantly upon impact detection. Buckle lifters, though less prominent, improve user convenience and comfort by adjusting belt positioning. Manufacturers invest in innovation across all components to enhance performance and comply with safety regulations.

- For instance, Autoliv Inc. unveiled a zero-gravity seat with integrated airbags and seatbelt systems in 2023, designed specifically for comfort and safety during autonomous vehicle operation, emphasizing occupant posture and restraint during extended drives.

By Vehicle Type

Passenger cars represent the largest segment within the active seat belt systems market owing to their high production volume and stringent safety standards. Light commercial vehicles also contribute significantly due to rising demand for enhanced safety in goods transport and passenger services. Heavy commercial vehicles show steady growth driven by regulatory enforcement in freight and public transport sectors. It enables manufacturers to tailor seat belt solutions according to vehicle size and application requirements.

By Sales Channel

The active seat belt systems market divides sales channels into original equipment manufacturers (OEM) and aftermarket. OEM holds the majority share as seat belts are standard safety features installed during vehicle manufacturing. Aftermarket sales grow steadily, driven by vehicle servicing, replacements, and upgrades in older models. It supports ongoing demand for safety enhancements and maintenance, particularly in regions with extended vehicle usage periods. Both channels remain crucial for sustained market growth.

- For instance, aftermarket demand is supported by companies like UNOMINDA in India, which is expanding its manufacturing capacity to supply advanced seat belt components for replacements and upgrades.

Segments:

Based on Component

- Retractors

- Pretensioners

- Buckle Lifters

Based on Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Based on Sales Channel

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of the active seat belt systems market, accounting for 30% of the global revenue. The region benefits from stringent vehicle safety regulations enforced by authorities such as the NHTSA. High consumer awareness and demand for advanced automotive safety features drive adoption across passenger and commercial vehicles. Leading automakers in the region continuously integrate innovative seat belt technologies to meet regulatory and market expectations. It maintains a strong aftermarket due to the large vehicle fleet requiring replacements and upgrades. The focus on connected and autonomous vehicle development further strengthens market growth in North America.

Europe

Europe represents 28% of the active seat belt systems market, supported by strict safety standards from regulatory bodies like UNECE and Euro NCAP. Governments impose rigorous crash test requirements, prompting manufacturers to equip vehicles with sophisticated restraint systems. It enjoys strong demand across passenger cars and commercial vehicles, fueled by safety-conscious consumers and advanced automotive manufacturing. The region leads in adopting lightweight and smart materials for seat belts to improve performance and vehicle efficiency. Expansion in electric and autonomous vehicles also creates opportunities for integrated active seat belt solutions.

Asia-Pacific

The Asia-Pacific region captures 27% of the active seat belt systems market and exhibits the fastest growth due to rising vehicle production and increasing road safety initiatives. Rapid urbanization and expanding middle-class populations increase vehicle ownership, driving demand for enhanced safety features. It benefits from growing automotive manufacturing hubs in China, India, Japan, and South Korea. Regional governments strengthen safety regulations to reduce traffic fatalities, encouraging seat belt system adoption. OEMs focus on cost-effective yet advanced solutions to meet diverse market needs across emerging and developed countries.

Rest of the World

The Rest of the World accounts for 15% of the active seat belt systems market, driven by increasing vehicle production in Latin America, the Middle East, and Africa. Growing awareness about vehicle safety and regulatory improvements contribute to gradual market penetration. It faces challenges due to varying safety standards and lower consumer purchasing power but shows steady progress. Collaborations between global manufacturers and local suppliers facilitate technology transfer and system integration. The market benefits from rising demand in commercial vehicles used for transportation and logistics in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Takata Corporation

- Robert Bosch GmbH

- Hyundai Mobis Co., Ltd.

- Continental AG

- Tokai Rika Co., Ltd.

- Goradia Industries

- Joyson Safety Systems

- Schrader International Inc.

- Denso Corporation

- Autoliv Inc.

- Far Europe Inc.

- Key Safety Systems

Competitive Analysis

The active seat belt systems market experiences intense competition among leading players such as Autoliv Inc., Continental AG, and Robert Bosch GmbH, who invest heavily in research and development to enhance safety features and system integration. It drives innovation through advanced sensor technologies, lightweight materials, and smart connectivity, meeting stringent regulatory requirements and evolving consumer demands. Market participants pursue mergers, acquisitions, and strategic partnerships to expand product portfolios and geographic reach. Competitors focus on competitive pricing, manufacturing efficiency, and aftersales services across OEM and aftermarket channels. Continuous technological advancements, emphasis on sustainability, and growing demand for connected and autonomous vehicles further strengthen their positions in the global market, driving long-term growth and increased market penetration. Companies also invest in localized manufacturing and supply chain optimization to reduce costs and respond swiftly to regional market needs, reinforcing their competitive advantage in a rapidly evolving automotive safety landscape.

Recent Developments

- In May 2023, Autoliv Inc. introduced a zero-gravity seat concept at Auto Shanghai, featuring an integrated adaptive seatbelt and airbags designed to optimize occupant safety in autonomous vehicles.

- In September 2024, Continental AG expanded its product portfolio at Automechanika by showcasing advanced sensors for driver assistance and improved seatbelt technologies to enhance vehicle safety.

- In June 2025, Hyundai Mobis unveiled a defensive driving system that detects and reacts to rear vehicles, working in tandem with active seatbelt systems to prevent collisions.

- In August 2023, ZF Friedrichshafen AG introduced the ACR8 electromechanical belt tensioner, which adjusts tension based on crash severity to improve occupant protection during impacts.

Market Concentration & Characteristics

The active seat belt systems market exhibits a moderately concentrated competitive landscape dominated by a few key players such as Autoliv Inc., Continental AG, and Robert Bosch GmbH. These companies command significant market share due to their advanced technological capabilities, extensive product portfolios, and strong relationships with leading automakers. It maintains high entry barriers driven by stringent regulatory requirements, substantial R&D investments, and the need for sophisticated manufacturing processes. The market also features continuous innovation in sensor technology and system integration to meet evolving safety standards and consumer expectations. Regional diversification and strategic partnerships enhance market reach and operational efficiency. Smaller players focus on niche segments or emerging markets to carve out specialized opportunities. The market’s characteristics include a balance between OEM and aftermarket sales channels, emphasizing product reliability, compliance, and cost-effectiveness. This structure supports steady growth while encouraging ongoing technological advancements and competitive differentiation.

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced safety features will drive widespread adoption of active seat belt systems.

- Integration with connected and autonomous vehicle technologies will enhance system functionality.

- Manufacturers will focus on lightweight materials to improve fuel efficiency without compromising safety.

- Growing regulations worldwide will push automakers to equip vehicles with sophisticated restraint systems.

- Expansion in emerging markets will create new growth opportunities for seat belt system providers.

- Innovation in sensor accuracy and responsiveness will improve occupant protection during crashes.

- Aftermarket sales will grow due to increased vehicle maintenance and safety upgrades.

- Collaboration between technology firms and automotive OEMs will accelerate product development.

- Consumer preference for premium and luxury vehicles will support demand for advanced seat belts.

- Sustainability initiatives will influence design and manufacturing processes in the active seat belt systems market.