Market Overview:

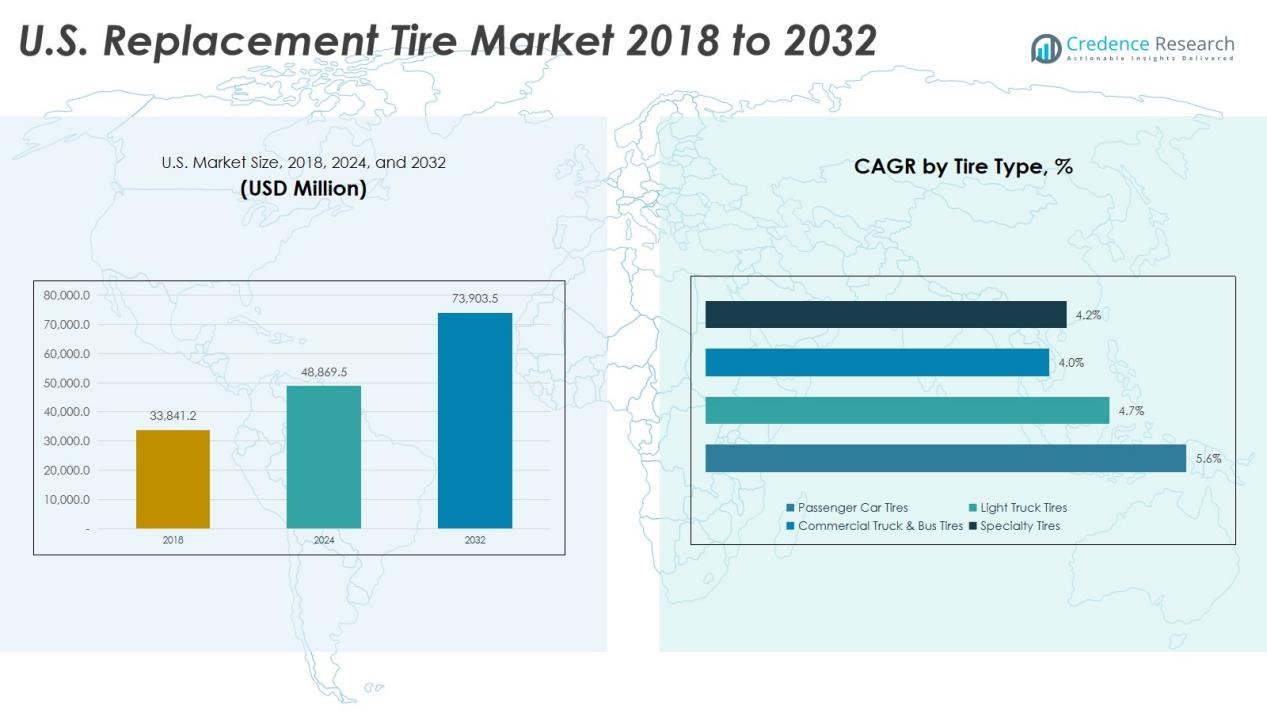

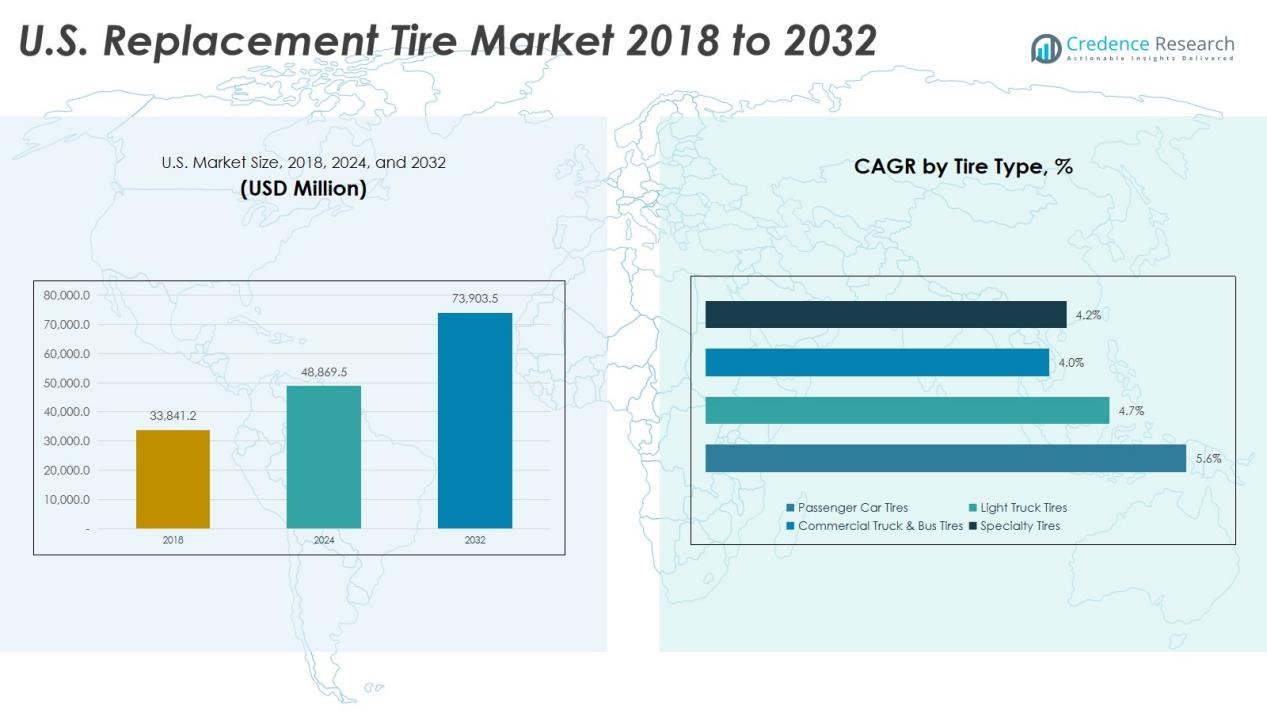

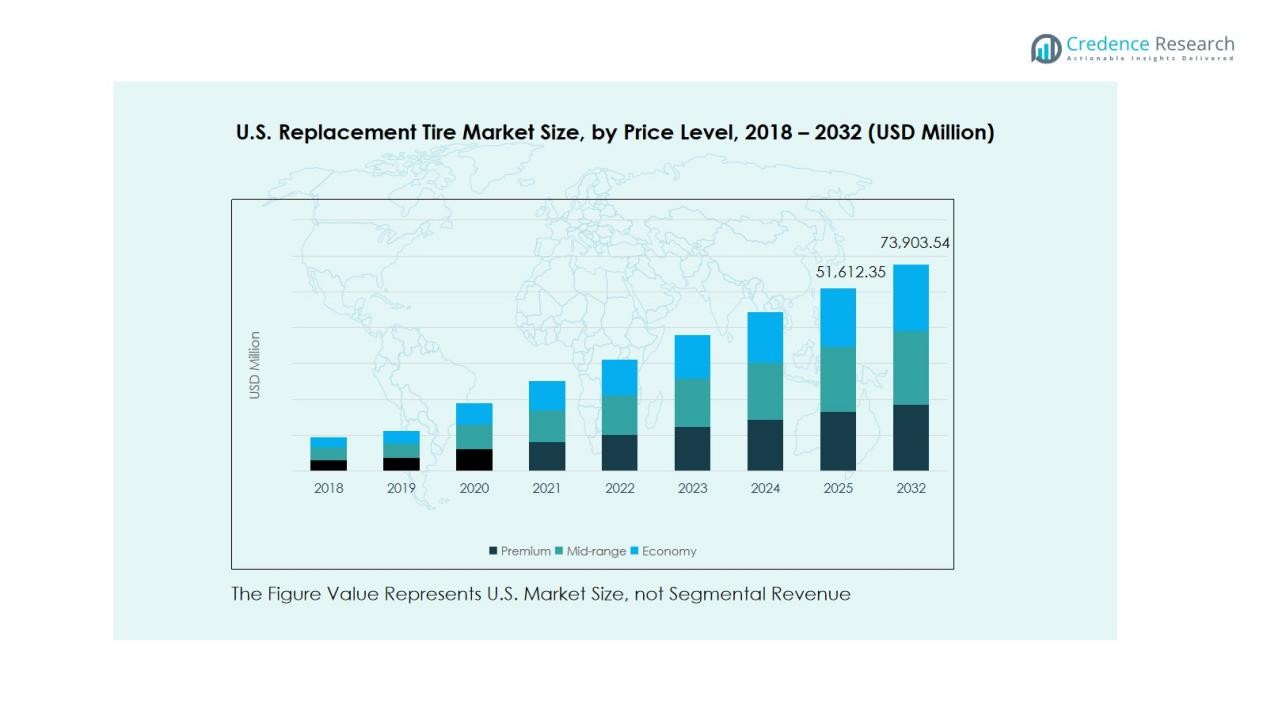

The U.S. Replacement Tire Market size was valued at USD 33,841.2 million in 2018 to USD 48,869.5 million in 2024 and is anticipated to reach USD 73,903.5 million by 2032, at a CAGR of 5.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Replacement Tire Market Size 2024 |

USD 48,869.5 Million |

| U.S. Replacement Tire Market, CAGR |

5.26% |

| U.S. Replacement Tire Market Size 2032 |

USD 73,903.5 Million |

Key drivers underpinning this growth include an ageing vehicle fleet—raising replacement frequency—and rising demand for tires tailored to electric vehicles (EVs) with higher load and durability requirements. Technological innovations such as low-rolling resistance compounds and smart sensors also propel the market as consumer expectations shift toward longer-life, higher-performance replacement tires.

Regionally, the U.S. dominates the North American replacement tire sector, supported by a mature aftermarket and high vehicle ownership levels. While growth in Canada and Mexico is emerging, incremental demand in the U.S. remains central as OEM markets saturate and replacement channels expand through online and specialized retail networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market was valued at USD 33,841.2 million in 2018, reached USD 48,869.5 million in 2024, and is projected to attain USD 73,903.5 million by 2032, growing at a CAGR of 5.26% during the forecast period.

- The U.S. holds around 75% of the North American tire market, supported by mature vehicle ownership and a strong aftermarket system. Canada follows with roughly 12%, and Mexico with about 13%, both showing steady growth from increasing automotive activity.

- Mexico represents the fastest-growing region with a share of about 13%, driven by expanding vehicle production, ownership, and a rising replacement cycle as the national automotive fleet grows.

- The replacement tire segment commands the larger share of the U.S. tire market, supported by an aging vehicle fleet and frequent replacement needs that sustain aftermarket demand.

- By vehicle category, the passenger car and light-truck segment dominates, accounting for the largest share, reflecting high ownership rates and continuous tire wear across commuting and logistics applications.

Market Drivers:

Aging Vehicle Fleet and Rising Replacement Demand

The U.S. Replacement Tire Market benefits from an expanding fleet of older vehicles that require frequent tire changes. The average vehicle age in the country surpassed 12.6 years in 2024, creating steady aftermarket demand. It reflects strong consumer preference for maintaining existing vehicles rather than purchasing new ones. The growth of used car sales further supports the replacement cycle, sustaining consistent tire consumption across light and heavy-duty categories.

- For Instance, Discount Tire acquired Suburban Tire Auto Repair Centers, adding six new retail locations in the Chicago area to expand its footprint and offer more auto maintenance services. This move was part of a broader strategy of targeted acquisitions and general organic growth, bringing their nationwide store count to over 1,200 locations.

Growing Penetration of Electric and Hybrid Vehicles

The rising number of electric vehicles (EVs) is reshaping tire performance requirements. It drives demand for specialized low-noise, high-grip, and durable tires capable of supporting heavier battery weights. Manufacturers such as Michelin and Bridgestone have expanded EV-specific tire lines to meet this shift. The trend also encourages innovation in tread design and rubber compounds to enhance energy efficiency and reduce wear.

- For instance, Michelin launched the Pilot Sport EV in April 2021, featuring ElectricGrip Compound technology with a hard compound center tread designed to handle high torque characteristics of electric sports cars, extending vehicle range by up to 37 miles.

Technological Innovations in Tire Design and Manufacturing

The U.S. Replacement Tire Market is advancing with rapid adoption of smart tire technologies and sustainable materials. It includes sensors for tire pressure monitoring, wear tracking, and predictive maintenance. Leading producers invest in automation and AI-driven production to ensure precision and cost efficiency. The focus on recyclable materials and reduced rolling resistance aligns with evolving environmental standards and consumer expectations.

Expanding E-Commerce and Aftermarket Distribution Networks

The aftermarket distribution ecosystem is transforming through digital sales platforms and logistics integration. It allows consumers and fleet operators to access a wide range of products online with transparent pricing. Retailers and service providers collaborate with tire manufacturers to streamline delivery and installation services. Expanding online presence enhances accessibility and strengthens competitive advantage across both urban and rural markets.

Market Trends:

Shift Toward Smart and Sustainable Tire Technologies

The U.S. Replacement Tire Market is experiencing a strong movement toward connected and eco-friendly solutions. Manufacturers integrate RFID tags and smart sensors that monitor real-time tire pressure, temperature, and wear patterns. It enables predictive maintenance and supports fleet operators in improving vehicle uptime. Tire makers are also investing in bio-based rubber, silica compounds, and recycled materials to reduce environmental impact. Brands such as Goodyear and Continental are advancing self-sealing and airless tire concepts that enhance durability and reduce waste. The focus on technology-driven sustainability is becoming a major factor influencing product differentiation and consumer preference.

- For Instance, Continental’s ContiSeal technology, introduced in 2008 and available globally, enables tires to self-seal punctures up to 5 mm in the tread area. While commercially available since 2008, it was introduced in specific markets like India in early 2025.

Rising Influence of E-Commerce and Direct-to-Consumer Models

Online sales are transforming the distribution landscape of replacement tires in the United States. It reflects changing consumer habits, where buyers seek convenience, transparent pricing, and wider product access through digital channels. Major tire retailers and OEMs now operate hybrid distribution models combining online ordering with local installation partners. Subscription-based maintenance services and doorstep fitment options are gaining traction among urban consumers. The trend supports market penetration across smaller cities where traditional service centers are limited. This digital transformation enhances competitiveness and reshapes how tire brands connect with end users nationwide.

- For instance, Treadsy operates the largest tire installation network in the United States, partnering with 18,000 tire shops nationwide to deliver tires directly to local installers for customer convenience.

Market Challenges Analysis:

Volatile Raw Material Costs and Supply Chain Constraints

The U.S. Replacement Tire Market faces persistent pressure from fluctuating prices of natural rubber, synthetic compounds, and steel cords. It increases production costs and compresses profit margins for manufacturers and distributors. Global supply chain disruptions and transportation delays further strain inventory management. Tire producers must balance pricing strategies to maintain competitiveness without affecting customer loyalty. Import dependency on Asian markets for raw materials also heightens exposure to geopolitical risks and freight fluctuations. These challenges demand stronger domestic sourcing and flexible procurement strategies to stabilize operations.

Rising Competition and Price Sensitivity in Aftermarket Sales

The aftermarket tire segment faces intense price competition among global and regional brands. It leads to margin erosion, especially for small retailers and independent workshops. Consumers often prioritize discounts and online deals over brand reputation, creating downward pricing pressure. Premium tire makers must justify higher costs through performance, safety, and sustainability features. Market fragmentation complicates distribution efficiency and reduces supplier bargaining power. Companies must adopt differentiated service models and loyalty programs to retain customers in a highly competitive environment.

Market Opportunities:

Expansion of Electric and Hybrid Vehicle Aftermarket

The U.S. Replacement Tire Market offers significant growth potential through the expanding electric and hybrid vehicle segment. It creates demand for tires with low rolling resistance, higher load-bearing capacity, and enhanced grip to support EV performance. Manufacturers investing in specialized tire lines for EVs can capture an emerging customer base seeking safety and efficiency. Partnerships with automakers and fleet operators further open opportunities for exclusive supply agreements. The growing focus on sustainable mobility encourages continuous innovation in tire compounds and tread design. This evolution strengthens brand positioning within the rapidly transforming automotive landscape.

Growth of Digital Retail and Fleet Service Networks

The transition toward online tire sales and digital service models provides new revenue channels for manufacturers and retailers. It enables better consumer reach, transparent pricing, and direct engagement through e-commerce platforms. Fleet operators are adopting predictive tire maintenance and data-driven management systems to optimize operations. The integration of mobile installation and subscription-based tire replacement programs enhances convenience and customer retention. Expanding these digital and service ecosystems allows companies to diversify revenue streams. The trend supports long-term competitiveness in a market driven by technology and service innovation.

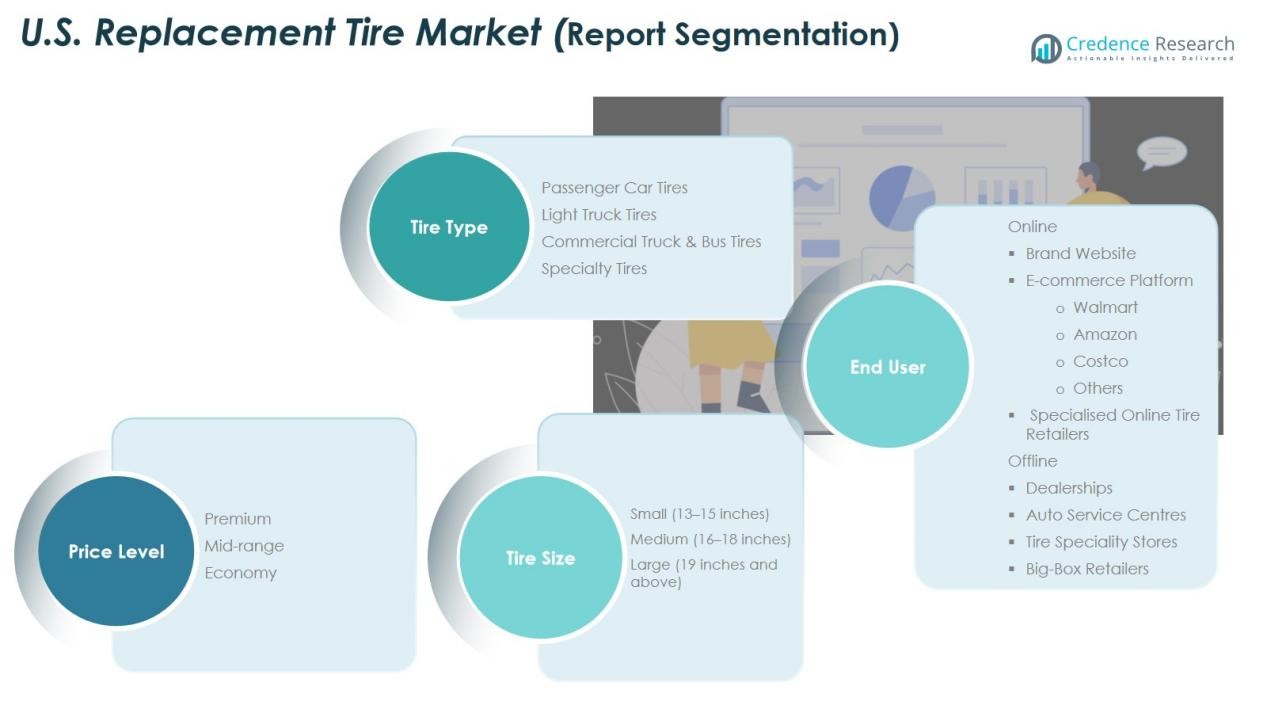

Market Segmentation Analysis:

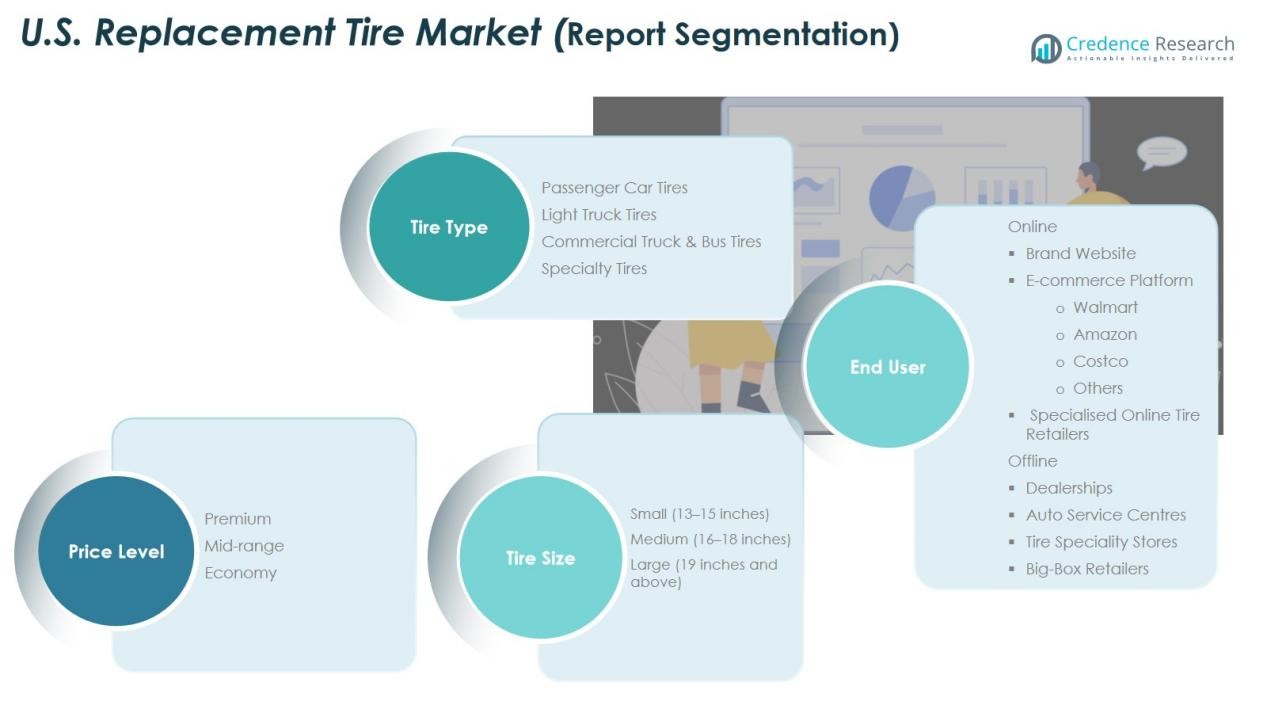

By Tire Type

The U.S. Replacement Tire Market includes passenger car tires, light truck tires, commercial truck and bus tires, and specialty tires. Passenger car tires hold the largest share, driven by the high volume of personal vehicle ownership and frequent replacement cycles. It benefits from advancements in all-season and fuel-efficient tire technologies that enhance road performance and longevity. Light truck and commercial tires maintain steady demand from logistics and last-mile delivery fleets. Specialty tires cater to niche sectors such as agriculture, motorsports, and off-road applications, expanding the product diversity within the market.

- For instance, in September 2022, Michelin introduced the MICHELIN Defender 2 all-season passenger tire in the U.S., engineered to provide up to 25,000 more miles of tread life than leading competitors, addressing the demand for longer-lasting performance tires.

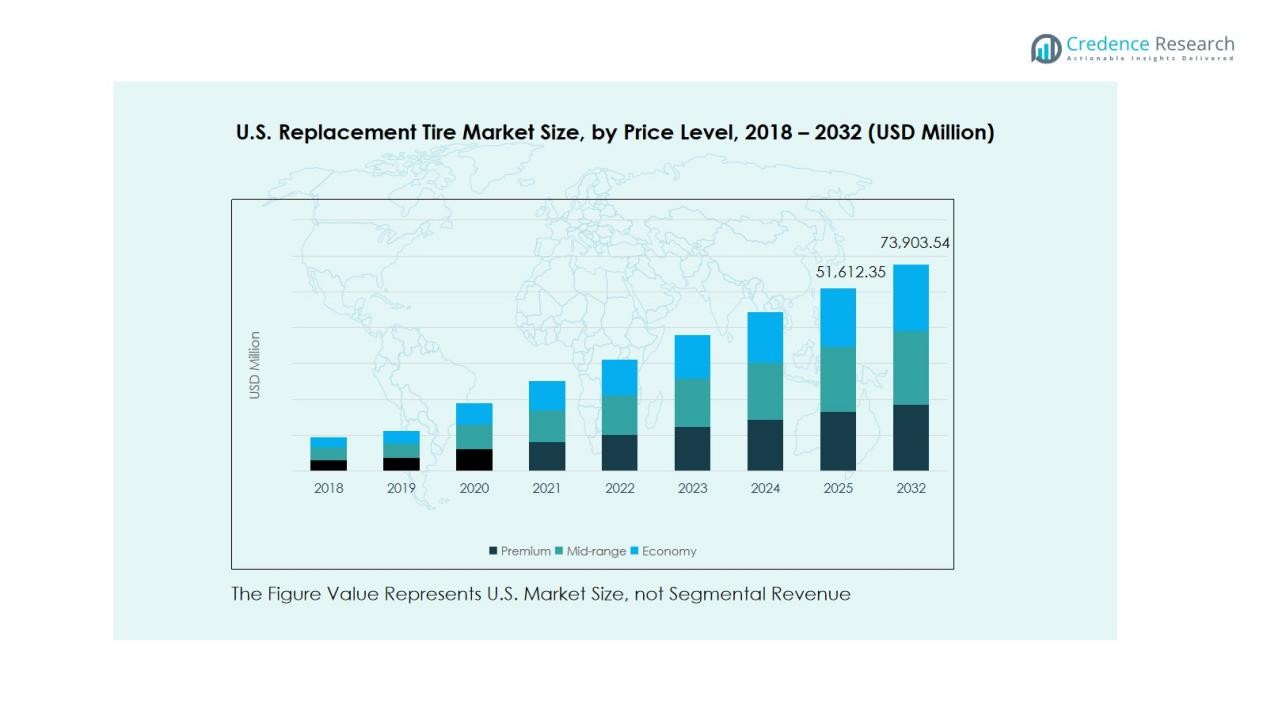

By Price Level

The market is segmented into premium, mid-range, and economy tires. Premium tires dominate due to their superior durability, grip, and safety performance. It gains traction among consumers seeking long-term value and reliability for daily or high-speed travel. Mid-range tires show strong adoption in the replacement segment, balancing affordability with quality. Economy tires serve price-sensitive customers, particularly in rural areas and independent workshops. The growing variety of budget-friendly options enhances accessibility and competition among brands.

- For Instance, Michelin Pilot Sport 5 tire outperformed competitors in wet braking. The test, performed by the TÜV SÜD product service, showed the Pilot Sport 5 generally stopped shorter on wet roads, both when new and worn to the legal limit.

By Tire Size

Tire size segmentation includes small (13–15 inches), medium (16–18 inches), and large (19 inches and above). Medium-sized tires lead due to widespread use in sedans, SUVs, and light trucks. It reflects the growing preference for crossover and utility vehicles across U.S. households. Large tires are expanding with premium and electric vehicle adoption requiring higher load capacities. Small tires retain relevance in compact and economy cars, though growth remains moderate compared to larger formats.

Segmentations:

By Tire Type

- Passenger Car Tires

- Light Truck Tires

- Commercial Truck & Bus Tires

- Specialty Tires

By Price Level

- Premium

- Mid-range

- Economy

By Tire Size

- Small (13–15 inches)

- Medium (16–18 inches)

- Large (19 inches and above)

By End User

Online

- Brand Website

- E-commerce Platform

- Walmart

- Amazon

- Costco

- Others

Offline

- Dealers

- Auto Service Centres

- Tire Specialty Stores

- Big-Box Retailers

Regional Analysis:

Strong Demand Concentration in the Southern and Western States

The U.S. Replacement Tire Market experiences the highest demand across southern and western regions due to extensive vehicle ownership and diverse terrain conditions. States such as Texas, California, and Florida represent major consumption hubs driven by passenger car and light truck usage. It benefits from favorable climate conditions that require frequent tire replacements due to heat-related wear. Expanding logistics operations and higher commercial fleet density in these states also contribute to strong aftermarket activity. The presence of well-developed distribution channels and service networks supports continuous product availability and market penetration.

Steady Growth Across the Midwest Driven by Agriculture and Logistics

Midwestern states play a significant role in supporting the replacement tire market through agricultural, construction, and freight operations. It records consistent sales of specialty and heavy-duty tires for farming and transport applications. The region’s mix of rural and industrial activity fosters stable demand for both economy and mid-range tire categories. Manufacturers are strengthening dealership networks to meet rising replacement cycles for tractors, trucks, and utility vehicles. Harsh winters and road salt exposure also accelerate tire wear, stimulating higher replacement frequency across the region.

Expanding Aftermarket Presence in the Northeast and Mountain Regions

The northeastern and mountain regions are witnessing growing aftermarket activity supported by aging vehicles and urban mobility patterns. It is driven by increased adoption of all-season and winter tires to adapt to variable road conditions. Consumers in states such as New York, Pennsylvania, and Colorado prefer premium tire models for safety and performance. The surge in e-commerce logistics across metropolitan areas is amplifying fleet tire replacement needs. Rising digital retail adoption and regional distribution centers are further strengthening aftermarket accessibility and service efficiency.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Michelin

- Bridgestone Americas, Inc.

- Cooper Tire & Rubber Company

- Kumho Tire

- Firestone Tire & Rubber Company

- Toyo Tire U.S.A. Corp.

- Vogue Tyre and Rubber Co.

- Yokohama Tire Corporation

- Other Key Players

Competitive Analysis:

The U.S. Replacement Tire Market is highly competitive, with leading players focusing on innovation, performance, and distribution strength. Major companies include The Goodyear Tire & Rubber Company, Michelin, Bridgestone Americas, Inc., Cooper Tire & Rubber Company, Kumho Tire, Firestone Tire & Rubber Company, and Toyo Tire U.S.A. Corp. It demonstrates strong market rivalry driven by technological advancements and product diversification across passenger and commercial segments. Companies invest in sustainable materials, advanced tread designs, and EV-compatible models to enhance efficiency and durability. Strategic partnerships with dealers, retailers, and online platforms expand their market reach and improve customer engagement. It maintains competitiveness through continuous R&D investment and strong brand positioning, ensuring alignment with evolving consumer needs and regulatory standards

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments:

- In May 2025, Goodyear agreed to sell its Goodyear Chemical business to Gemspring Capital Management LLC as part of a strategic portfolio optimization.

- In October 2025, Michelin consolidated its acquired data science companies under the Michelin Connected Fleet brand, strengthening offerings in smart mobility and predictive tire solutions.

Report Coverage:

The research report offers an in-depth analysis based on Tire Type, Price Level, Tire Size and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Replacement Tire Market is expected to witness sustained demand driven by an aging vehicle fleet and consistent ownership trends.

- It will experience higher adoption of EV-compatible tires designed for enhanced load capacity and lower rolling resistance.

- Smart tire technology will gain momentum, integrating sensors for real-time monitoring and predictive maintenance.

- Sustainability will shape product development through recyclable materials and eco-friendly manufacturing practices.

- E-commerce platforms will continue to expand their role in tire distribution and consumer engagement.

- Premium tire demand will rise due to greater awareness of safety, performance, and fuel efficiency.

- Fleet operators will increase investments in tire management systems to improve operational uptime and cost control.

- Regional and local retailers will collaborate with major manufacturers to strengthen distribution efficiency.

- Hybrid and electric SUVs will drive larger tire segment growth due to rising popularity among U.S. consumers.

- It will continue evolving toward digital service integration, enabling seamless online purchasing and on-site installation experiences.